Jan 20, 2026

Ultimate Guide to ESG in Emerging Markets 2026

ESG Strategy

In This Article

Guide to ESG in emerging markets: 2026 rules, reporting deadlines, investor trends, climate finance and practical steps for compliance and growth.

Ultimate Guide to ESG in Emerging Markets 2026

Emerging markets are central to global ESG efforts, contributing 85% of global CO₂ emissions while facing substantial economic risks like potential GDP losses in regions such as South Asia by 2050. These markets also hold immense potential for sustainability progress, with rising ESG regulations, investor interest, and consumer demand driving change. Key developments in 2026 include:

Mandatory ESG reporting: Brazil and Hong Kong now require ESG disclosures for listed companies.

EU regulations impacting supply chains: The Corporate Sustainability Due Diligence Directive (CSDDD) and Deforestation Regulation require stricter compliance for businesses tied to EU markets.

Global frameworks: Over 36 jurisdictions, covering more than half of global GDP, are aligning with ISSB standards.

Consumer shifts: 77% of consumers in these regions prioritize sustainable products, outpacing developed markets.

Emerging markets are also advancing renewable energy, biodiversity preservation, and climate adaptation finance to meet global goals. However, challenges like income bias in ESG scores and regulatory complexity remain. Strategic planning, robust data systems, and partnerships are critical for businesses to navigate these shifts while unlocking opportunities for growth and compliance.

ESG 2.0 in Emerging Markets: Why Proof Now Beats Promises

Major ESG Regulations Affecting Emerging Markets in 2026

As we move into 2026, the focus on Environmental, Social, and Governance (ESG) policies has shifted from drafting frameworks to enforcing them. Pulsora aptly describes this shift:

"Q4 2025 marked a pivot from ESG expansion to ESG execution" [6].

This change brings a new level of urgency for businesses in emerging markets, as they now face specific compliance demands. Three major regulatory frameworks - the EU's Corporate Sustainability Due Diligence Directive, the EU Deforestation Regulation, and a growing array of regional reporting requirements - are redefining how these companies operate.

EU Corporate Sustainability Due Diligence Directive (CSDDD)

The CSDDD (Directive 2024/1760) mandates that companies address human rights and environmental impacts across their global value chains, including their relationships with business partners in emerging markets [5]. Following the Omnibus I reform in December 2025, the directive now applies to firms with more than 5,000 employees and €1.5 billion in turnover, with compliance deadlines set for July 2029 [6].

Although smaller businesses are exempt, suppliers in emerging markets are indirectly affected. For instance, companies in Brazil or Kenya may need to provide detailed sustainability data to their EU-based partners who fall under the directive. The European Commission has emphasized:

"the Directive will steer businesses towards responsible behaviour and could become a new global standard with regard to mandatory environmental and human rights due diligence" [5].

In support of this transition, the EU has committed resources to help value chain companies in developing countries meet these international standards. Notably, 70% of respondents in an EU public consultation agreed that action on corporate sustainability due diligence was necessary [5].

EU Deforestation Regulation (EUDR)

Nature-related disclosures are becoming a critical focus in 2026, with biodiversity and land-use impacts increasingly influencing financial decisions [6]. The EUDR enforces strict traceability requirements for high-risk commodities, particularly impacting agricultural and forestry supply chains in emerging markets.

By 2025, companies such as Holcim and GSK had already set ambitious targets for water and ecosystem impacts through the Science Based Targets Network framework. Meanwhile, over 150 organizations began preparing for nature-related disclosures [6]. As the Taskforce on Nature-related Financial Disclosures (TNFD) gains traction, producers in developing economies will need to demonstrate commitments to biodiversity preservation, sustainable land use, and carbon neutrality to maintain access to EU markets.

Regional ESG Reporting Requirements

Emerging markets are also advancing their own ESG reporting standards, many of which align with the International Sustainability Standards Board (ISSB). Currently, 16 emerging markets have mandatory ESG disclosure regulations, and 71 stock exchanges worldwide provide specific ESG guidance [9]. For example:

Brazil has mandated ESG reporting for publicly traded companies starting January 1, 2026.

Hong Kong introduced similar requirements for large-cap firms on the same date [6].

ISSB adoption is accelerating across developing economies, with countries like Bangladesh, Chile, Ghana, and Kenya finalizing compliance strategies [7]. Elsewhere, Japan plans to phase in its J-IFRS S1/S2 standards for large companies in fiscal year 2027, while Singapore has postponed its mandate for large unlisted firms to FY 2030 [6].

In the United States, state-level initiatives are stepping in where federal regulations are absent. California and New York have introduced mandatory greenhouse gas reporting requirements that also affect suppliers in emerging markets [6]. Meanwhile, the UAE's Sustainable Finance Working Group released "Climate Transition Planning Principles" in December 2025, requiring large corporations and financial institutions to disclose credible decarbonization strategies [6].

The EU has also simplified its European Sustainability Reporting Standards (ESRS), reducing required data points by 61% as of 2025 [6]. However, emerging market firms serving EU clients must still comply with these standards, even as simplified versions for non-EU companies are expected by 2029 [8][9].

ESG Trends Shaping Emerging Markets in 2026

Emerging markets are witnessing a dramatic evolution in ESG priorities, driven by their distinct challenges and opportunities. These shifts highlight not just the vulnerabilities of developing economies but their ability to leapfrog traditional development models. As BCG aptly puts it:

"The sustainability imperative is transforming the very nature of global competition" [4].

The interplay of financial and ecological factors is paving the way for impactful ESG strategies in these regions.

Climate Adaptation Finance

The urgency for climate adaptation in developing economies is staggering, with annual funding needs projected to hit $300 billion by 2030 to safeguard infrastructure, agriculture, and water systems from climate impacts [10]. If global emission reductions fall short, these numbers could balloon to between $520 billion and $1.75 trillion annually after 2050 [10]. Notably, emerging markets (excluding China) are responsible for 34% of sustainable bond issuances, channeling resources into resilient infrastructure projects [10]. This financial activity underscores the growing recognition of adaptation as a cornerstone of sustainable development.

Biodiversity and Physical Climate Risk

Emerging markets are at the epicenter of climate risks, with regions like Africa, South Asia, Central and South America, and small island states facing the brunt of environmental hazards [10]. These areas, home to many of the world’s most biodiverse ecosystems, are increasingly vulnerable to degradation. As the IMF warns:

"The loss of ecosystems strongly contributes to the impairment of carbon sinks, necessary to achieve global temperature objectives" [10].

Flooding and water scarcity are creating systemic challenges, with global insurance losses from natural disasters expected to surpass $135 billion in 2024 [11]. On the flip side, the carbon dioxide removal industry - tied to biodiversity and nature-based solutions - could grow to $1.2 trillion by 2050 [11]. Leveraging tools like satellite imagery and advanced climate data, companies are closing information gaps and identifying promising investments in climate adaptation [10].

Renewable Energy and Energy Efficiency

Achieving net-zero targets in emerging markets demands a massive scale-up in renewable energy investments, estimated at $1 trillion per year by 2030 [10]. Adding to this urgency, the EU's Carbon Border Adjustment Mechanism (CBAM) and stricter greenhouse gas regulations are pressuring exporters in these regions to embrace decarbonization [4]. This regulatory push aligns with industry-led efforts to reduce emissions. In response, trailblazing companies in sectors like steel, cement, and chemicals are adopting low-carbon business models. Additionally, regional taxonomy frameworks in ASEAN, Malaysia, and Singapore are offering clearer signals for private investment, highlighting climate benefits even in traditionally carbon-intensive industries [10].

Council Fire's Approach to ESG in Emerging Markets

Council Fire takes the complexities of emerging regulatory frameworks and turns them into practical, integrated ESG strategies. Their approach helps organizations shift from merely meeting reporting obligations to actively creating value through three core pillars.

Systems Thinking for ESG Integration

Council Fire employs a systems-based approach to ESG, mapping out how physical risks, operational challenges, and regulatory changes intersect with evolving reporting requirements. Instead of treating environmental, social, and governance issues as separate concerns, they focus on the connections between them. For instance, water scarcity in a manufacturing hub doesn’t just threaten production - it can also disrupt workforce stability, strain community relationships, and jeopardize long-term operations. By engaging stakeholders early on, Council Fire identifies root causes and crafts strategies to address these foundational issues.

Decarbonization and Circular Economy Solutions

To help organizations meet climate goals without compromising economic performance, Council Fire develops detailed decarbonization plans. These plans outline governance structures, financial impacts, and realistic timelines, offering more than just net-zero promises - they provide actionable roadmaps. Additionally, their focus on circular economy models reduces reliance on finite resources while opening up new revenue opportunities. By designing resilient infrastructure projects that meet investor standards, Council Fire also facilitates access to climate finance. Leveraging digital ESG platforms, they streamline data collection across regions, ensuring compliance with frameworks like ISSB and CSRD [13].

Stakeholder-Centered Planning

Trust and collaboration are at the heart of effective ESG strategies. Council Fire builds stakeholder engagement around material priorities, aligning the interests of investors, suppliers, and communities. This is especially critical in emerging markets, which are forecasted to achieve around 14% earnings growth by 2026 [14]. As Global Alpha Capital Management Ltd. highlights:

"ESG has always been about financial risk mitigation and long-term value creation – doing what is right for our clients by identifying material risks and opportunities in a rapidly changing world" [12].

How to Achieve ESG Compliance in 2026

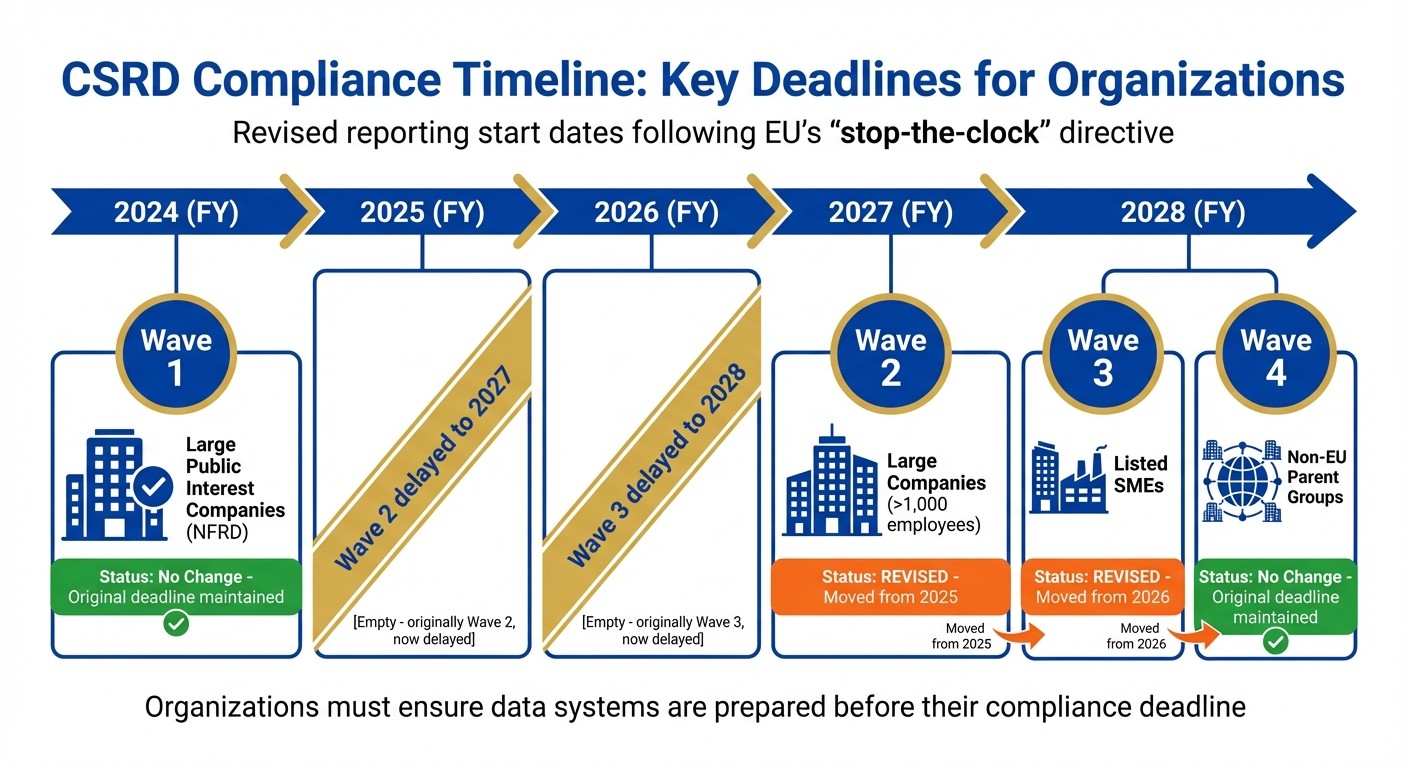

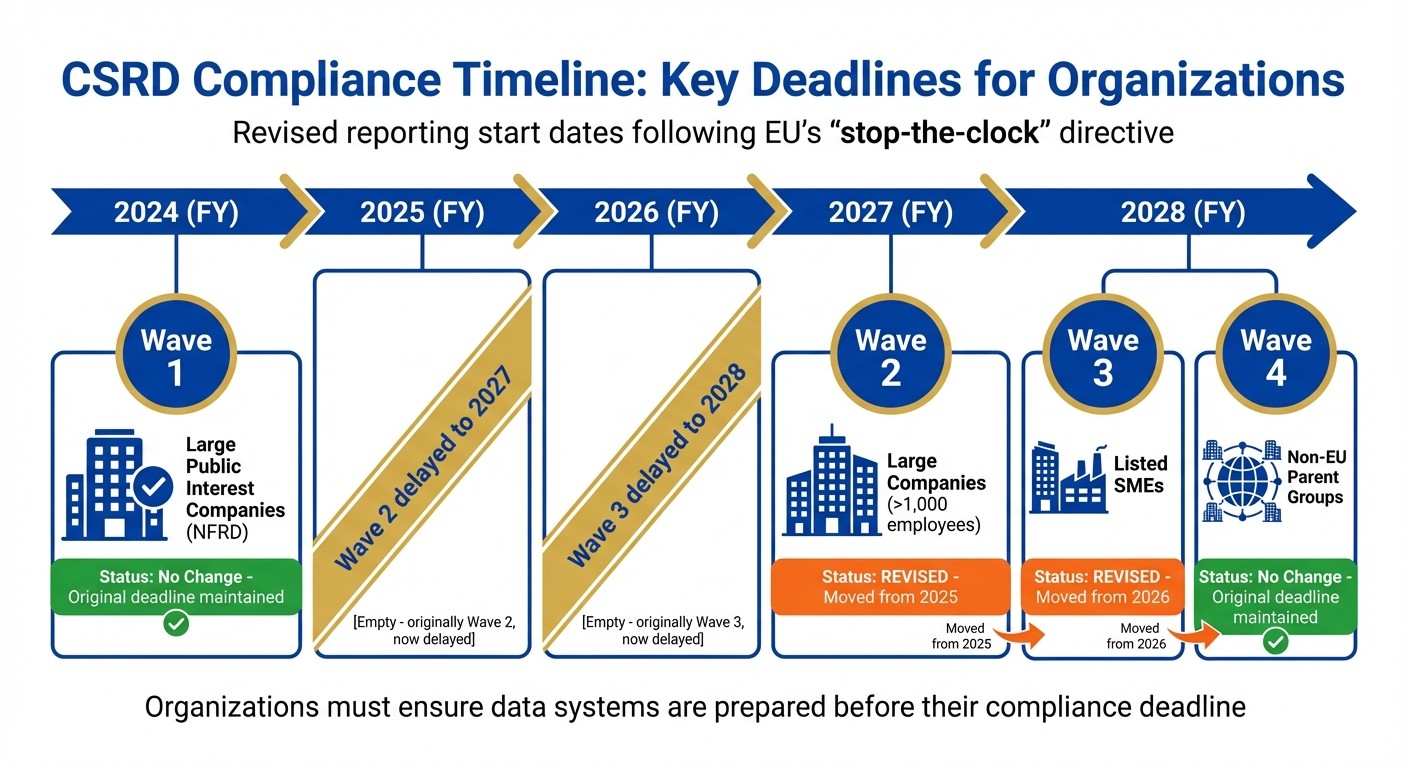

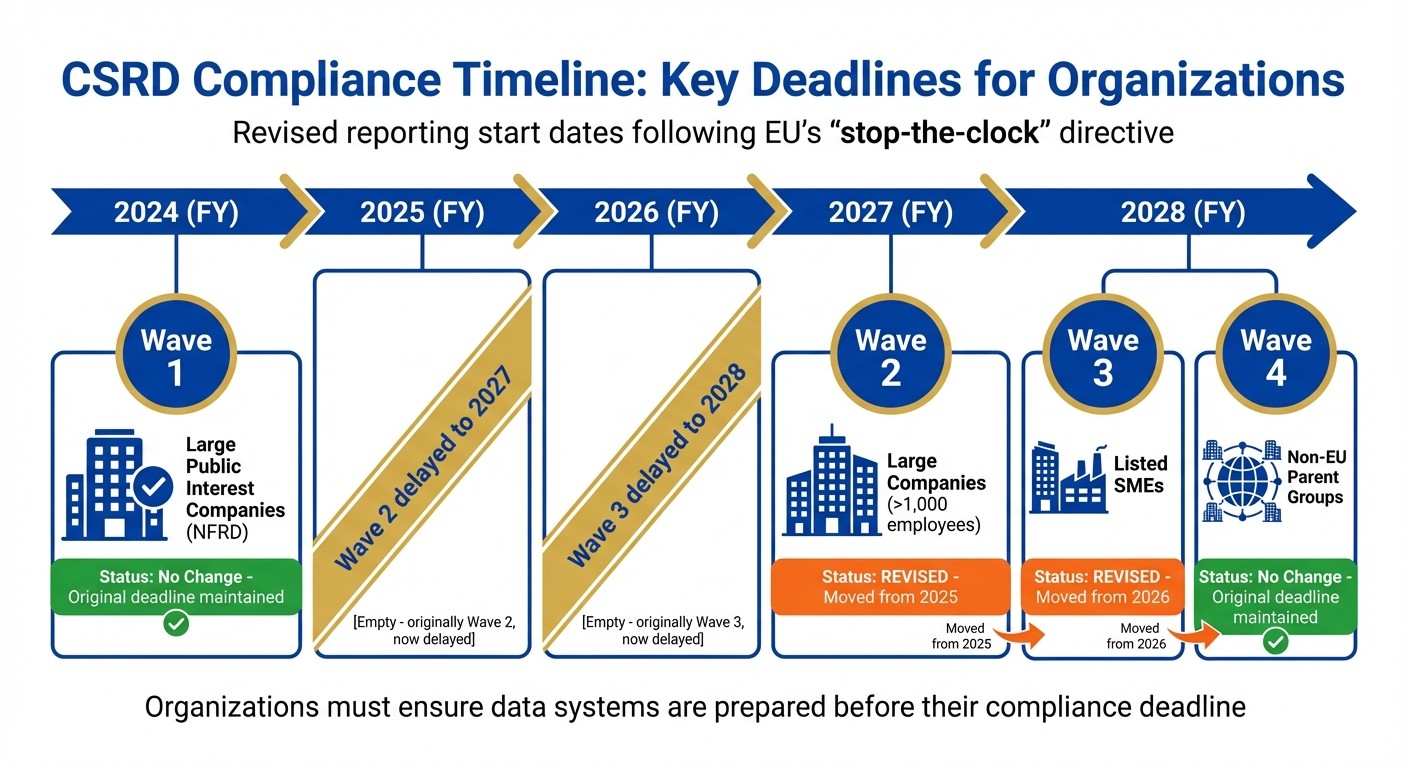

CSRD Compliance Timeline for Emerging Market Companies 2024-2028

Achieving ESG compliance requires aligning with regulatory deadlines, upgrading data systems, and forming strategic partnerships. While regulatory delays provide additional preparation time, they also increase risks for organizations that fail to act promptly.

Regulatory Timelines and Key Milestones

The EU's "stop-the-clock" directive has adjusted several Corporate Sustainability Reporting Directive (CSRD) timelines. For instance, Wave 2, which applies to large companies with over 1,000 employees, has been pushed from the 2025 financial year to 2027. Similarly, listed small and medium enterprises (SMEs) will now begin reporting in 2028 instead of 2026. On the other hand, Wave 1 entities - large public interest companies already reporting under the Non-Financial Reporting Directive (NFRD) - will stick to their original 2024 schedule. Non-EU parent groups also remain on track for a 2028 reporting start.

Wave | Entity Type | Original Start (FY) | Revised Start (FY) |

|---|---|---|---|

Wave 1 | Large Public Interest (NFRD) | 2024 | 2024 (No Change) |

Wave 2 | Large Companies (>1,000 employees) | 2025 | 2027 |

Wave 3 | Listed SMEs | 2026 | 2028 |

Wave 4 | Non-EU Parent Groups | 2028 | 2028 (No Change) |

As these deadlines approach, organizations must ensure their data systems are prepared to meet the increasing demands for transparency and accuracy.

Data Collection and Risk Prioritization

Manual spreadsheets are no longer sufficient for managing ESG data. Automated platforms that centralize data and include built-in audit trails are becoming essential. Additionally, with rating agencies now using AI tools to analyze publicly available information, managing your organization’s digital footprint has taken on new urgency. A well-structured risk matrix can help prioritize the most critical ESG data for targeted action.

For companies in emerging markets, the International Finance Corporation's (IFC) ESG Performance Indicators provide a practical framework. These indicators rely on publicly available information and globally recognized standards, easing the reporting burden while maintaining credibility with international investors. Furthermore, under IFRS S2 guidelines, organizations can use climate-related scenario analysis to assess how their business models hold up against physical and transition risks. This approach relies on "reasonable and supportable" data that can be gathered without excessive costs [1] [15] [16].

Partnerships for ESG Implementation

Upgraded data systems and regulatory clarity lay the groundwork, but strong partnerships are crucial for translating compliance into actionable strategies.

Collaboration across departments is key to ensuring data accuracy and consistency. As Tyler Thomas, Sustainability Lead at AArete, explains:

"ESG data usually lives across numerous departments... standardizing the ESG data capture is crucial for having consistent insights" [18].

To achieve this, organizations can establish centralized ESG teams that coordinate data collection and analysis across all departments.

External partnerships are equally important. Collaborating with specialized organizations like Council Fire can help convert regulatory requirements into practical strategies. Additionally, resources such as the IFC's Disclosure & Transparency Toolkit and the World Bank's Sovereign ESG Data Portal provide valuable tools for bridging information gaps, particularly for companies in emerging markets [1] [17].

Conclusion: Moving Forward with ESG in Emerging Markets

Organizations in emerging markets are at a turning point. While they face a gap in sustainability compared to developed economies, this challenge also offers an opportunity to lead the way in balancing financial goals with environmental responsibility. The financial benefits of embracing ESG practices make a strong case for prioritizing these strategies.

With mandatory ESG reporting already implemented in key emerging markets and the EU's updated CSRD deadlines approaching in 2027, the need for decisive action is more pressing than ever. Adopting proactive ESG strategies has become essential for maintaining a foothold in global markets [3][4]. Emerging markets, which contribute about 85% of global CO₂ equivalent emissions, play a key role in addressing climate challenges [4].

This evolving landscape calls for strategies that go beyond mere compliance. Shifting consumer demands and workforce expectations are pushing companies to embed ESG into their core operations. This shift not only mitigates risks but also opens doors to growth, including access to nearly $200 billion in sustainable debt issued in emerging markets in 2021 [2][4]. As BCG aptly states:

"The sustainability imperative is transforming the very nature of global competition" [4].

Council Fire works with organizations to turn compliance requirements into opportunities for meaningful impact. By applying systems thinking and stakeholder-focused planning, they help businesses chart actionable paths toward decarbonization, circular economy practices, and climate resilience. Their approach blends technical know-how with strategic execution, ensuring that ESG efforts deliver tangible environmental, social, and economic outcomes.

Looking ahead, success in these markets will require enhanced data systems, partnerships with Development Finance Institutions, and a commitment to openness and accountability. Companies that act decisively now will not only meet regulatory demands but also gain a competitive edge, turning environmental hurdles into drivers of innovation and growth.

FAQs

What are the key challenges for ESG compliance in emerging markets by 2026?

Emerging markets are grappling with notable challenges as they strive to meet ESG compliance targets by 2026. One of the primary obstacles is the fragmented regulatory environment. In regions like Asia, Africa, and Latin America, governments have adopted diverse standards, often drawing inspiration from frameworks such as TCFD or the EU. However, these standards remain inconsistent and, in many cases, optional. This lack of uniformity complicates efforts for companies trying to establish scalable reporting systems, increasing the likelihood of non-compliance.

Another pressing concern is the inconsistent quality of ESG data. Across these markets, the availability and reliability of data vary significantly, making it challenging for investors to gauge risks and for companies to deliver trustworthy disclosures. Compounding this issue is the shortage of internal expertise within many firms, which can lead to exaggerated sustainability claims, commonly referred to as "greenwashing." Adding to the strain, limited access to cost-effective sustainable financing makes it even harder for companies to invest in the tools and third-party verifications needed to improve their compliance efforts.

Council Fire works closely with organizations to address these barriers, offering tailored, data-driven ESG strategies. Their approach helps align businesses with global frameworks, boosts reporting accuracy, and lays the groundwork for sustainable, long-term growth.

How do EU regulations like CSDDD and EUDR impact businesses in emerging markets?

The European Union’s latest sustainability regulations, including the Corporate Sustainability Due Diligence Directive (CSDDD) and the EU Deforestation Regulation (EUDR), are setting new global standards for businesses, extending their reach even into emerging markets. These regulations demand that companies evaluate the impact of their operations and supply chains on both people and the environment. Additionally, businesses must establish due diligence systems and publicly disclose their sustainability efforts.

For companies in emerging markets, compliance comes with significant challenges. They face increased costs to meet these requirements, the need to invest in supply chain transparency, and the adoption of advanced monitoring tools. The EUDR, for instance, places strict demands on exporters of commodities like coffee, cocoa, and palm oil. These exporters must provide evidence that their products are not tied to deforestation, often necessitating third-party certifications and revised procurement contracts. Failure to comply could lead to trade restrictions, financial penalties, or even exclusion from EU markets.

Despite the hurdles, these regulations bring potential benefits. Companies that adapt quickly can position themselves as leaders, build stronger partnerships with EU buyers, and appeal to ESG-conscious investors by showcasing their commitment to responsible sourcing and sustainable business practices.

Why is climate adaptation financing essential for ESG success in emerging markets?

Climate adaptation financing plays a pivotal role in supporting ESG strategies across emerging markets, which are particularly vulnerable to climate-related challenges such as floods, heatwaves, and rising sea levels. Without adequate financial resources, these risks can severely impact assets, disrupt supply chains, and undermine governance structures. This, in turn, makes it more difficult for companies to achieve their ESG objectives or appeal to responsible investors.

Emerging markets often operate under tight budgetary constraints, a situation exacerbated by global disruptions like the COVID-19 pandemic. As a result, private capital becomes indispensable in closing the funding gap. Financial tools such as green bonds, blended-finance facilities, and outcome-based debt are instrumental in transforming sustainable projects into viable investments. These mechanisms also enhance climate-risk transparency and strengthen ESG outcomes.

For businesses and investors, securing adaptation financing delivers practical advantages, including improved resilience, lower insurance premiums, and the ability to generate long-term value. This approach aligns seamlessly with Council Fire’s mission to turn sustainability strategies into actionable, measurable results.

Related Blog Posts

Latest Articles

©2025

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 20, 2026

Ultimate Guide to ESG in Emerging Markets 2026

ESG Strategy

In This Article

Guide to ESG in emerging markets: 2026 rules, reporting deadlines, investor trends, climate finance and practical steps for compliance and growth.

Ultimate Guide to ESG in Emerging Markets 2026

Emerging markets are central to global ESG efforts, contributing 85% of global CO₂ emissions while facing substantial economic risks like potential GDP losses in regions such as South Asia by 2050. These markets also hold immense potential for sustainability progress, with rising ESG regulations, investor interest, and consumer demand driving change. Key developments in 2026 include:

Mandatory ESG reporting: Brazil and Hong Kong now require ESG disclosures for listed companies.

EU regulations impacting supply chains: The Corporate Sustainability Due Diligence Directive (CSDDD) and Deforestation Regulation require stricter compliance for businesses tied to EU markets.

Global frameworks: Over 36 jurisdictions, covering more than half of global GDP, are aligning with ISSB standards.

Consumer shifts: 77% of consumers in these regions prioritize sustainable products, outpacing developed markets.

Emerging markets are also advancing renewable energy, biodiversity preservation, and climate adaptation finance to meet global goals. However, challenges like income bias in ESG scores and regulatory complexity remain. Strategic planning, robust data systems, and partnerships are critical for businesses to navigate these shifts while unlocking opportunities for growth and compliance.

ESG 2.0 in Emerging Markets: Why Proof Now Beats Promises

Major ESG Regulations Affecting Emerging Markets in 2026

As we move into 2026, the focus on Environmental, Social, and Governance (ESG) policies has shifted from drafting frameworks to enforcing them. Pulsora aptly describes this shift:

"Q4 2025 marked a pivot from ESG expansion to ESG execution" [6].

This change brings a new level of urgency for businesses in emerging markets, as they now face specific compliance demands. Three major regulatory frameworks - the EU's Corporate Sustainability Due Diligence Directive, the EU Deforestation Regulation, and a growing array of regional reporting requirements - are redefining how these companies operate.

EU Corporate Sustainability Due Diligence Directive (CSDDD)

The CSDDD (Directive 2024/1760) mandates that companies address human rights and environmental impacts across their global value chains, including their relationships with business partners in emerging markets [5]. Following the Omnibus I reform in December 2025, the directive now applies to firms with more than 5,000 employees and €1.5 billion in turnover, with compliance deadlines set for July 2029 [6].

Although smaller businesses are exempt, suppliers in emerging markets are indirectly affected. For instance, companies in Brazil or Kenya may need to provide detailed sustainability data to their EU-based partners who fall under the directive. The European Commission has emphasized:

"the Directive will steer businesses towards responsible behaviour and could become a new global standard with regard to mandatory environmental and human rights due diligence" [5].

In support of this transition, the EU has committed resources to help value chain companies in developing countries meet these international standards. Notably, 70% of respondents in an EU public consultation agreed that action on corporate sustainability due diligence was necessary [5].

EU Deforestation Regulation (EUDR)

Nature-related disclosures are becoming a critical focus in 2026, with biodiversity and land-use impacts increasingly influencing financial decisions [6]. The EUDR enforces strict traceability requirements for high-risk commodities, particularly impacting agricultural and forestry supply chains in emerging markets.

By 2025, companies such as Holcim and GSK had already set ambitious targets for water and ecosystem impacts through the Science Based Targets Network framework. Meanwhile, over 150 organizations began preparing for nature-related disclosures [6]. As the Taskforce on Nature-related Financial Disclosures (TNFD) gains traction, producers in developing economies will need to demonstrate commitments to biodiversity preservation, sustainable land use, and carbon neutrality to maintain access to EU markets.

Regional ESG Reporting Requirements

Emerging markets are also advancing their own ESG reporting standards, many of which align with the International Sustainability Standards Board (ISSB). Currently, 16 emerging markets have mandatory ESG disclosure regulations, and 71 stock exchanges worldwide provide specific ESG guidance [9]. For example:

Brazil has mandated ESG reporting for publicly traded companies starting January 1, 2026.

Hong Kong introduced similar requirements for large-cap firms on the same date [6].

ISSB adoption is accelerating across developing economies, with countries like Bangladesh, Chile, Ghana, and Kenya finalizing compliance strategies [7]. Elsewhere, Japan plans to phase in its J-IFRS S1/S2 standards for large companies in fiscal year 2027, while Singapore has postponed its mandate for large unlisted firms to FY 2030 [6].

In the United States, state-level initiatives are stepping in where federal regulations are absent. California and New York have introduced mandatory greenhouse gas reporting requirements that also affect suppliers in emerging markets [6]. Meanwhile, the UAE's Sustainable Finance Working Group released "Climate Transition Planning Principles" in December 2025, requiring large corporations and financial institutions to disclose credible decarbonization strategies [6].

The EU has also simplified its European Sustainability Reporting Standards (ESRS), reducing required data points by 61% as of 2025 [6]. However, emerging market firms serving EU clients must still comply with these standards, even as simplified versions for non-EU companies are expected by 2029 [8][9].

ESG Trends Shaping Emerging Markets in 2026

Emerging markets are witnessing a dramatic evolution in ESG priorities, driven by their distinct challenges and opportunities. These shifts highlight not just the vulnerabilities of developing economies but their ability to leapfrog traditional development models. As BCG aptly puts it:

"The sustainability imperative is transforming the very nature of global competition" [4].

The interplay of financial and ecological factors is paving the way for impactful ESG strategies in these regions.

Climate Adaptation Finance

The urgency for climate adaptation in developing economies is staggering, with annual funding needs projected to hit $300 billion by 2030 to safeguard infrastructure, agriculture, and water systems from climate impacts [10]. If global emission reductions fall short, these numbers could balloon to between $520 billion and $1.75 trillion annually after 2050 [10]. Notably, emerging markets (excluding China) are responsible for 34% of sustainable bond issuances, channeling resources into resilient infrastructure projects [10]. This financial activity underscores the growing recognition of adaptation as a cornerstone of sustainable development.

Biodiversity and Physical Climate Risk

Emerging markets are at the epicenter of climate risks, with regions like Africa, South Asia, Central and South America, and small island states facing the brunt of environmental hazards [10]. These areas, home to many of the world’s most biodiverse ecosystems, are increasingly vulnerable to degradation. As the IMF warns:

"The loss of ecosystems strongly contributes to the impairment of carbon sinks, necessary to achieve global temperature objectives" [10].

Flooding and water scarcity are creating systemic challenges, with global insurance losses from natural disasters expected to surpass $135 billion in 2024 [11]. On the flip side, the carbon dioxide removal industry - tied to biodiversity and nature-based solutions - could grow to $1.2 trillion by 2050 [11]. Leveraging tools like satellite imagery and advanced climate data, companies are closing information gaps and identifying promising investments in climate adaptation [10].

Renewable Energy and Energy Efficiency

Achieving net-zero targets in emerging markets demands a massive scale-up in renewable energy investments, estimated at $1 trillion per year by 2030 [10]. Adding to this urgency, the EU's Carbon Border Adjustment Mechanism (CBAM) and stricter greenhouse gas regulations are pressuring exporters in these regions to embrace decarbonization [4]. This regulatory push aligns with industry-led efforts to reduce emissions. In response, trailblazing companies in sectors like steel, cement, and chemicals are adopting low-carbon business models. Additionally, regional taxonomy frameworks in ASEAN, Malaysia, and Singapore are offering clearer signals for private investment, highlighting climate benefits even in traditionally carbon-intensive industries [10].

Council Fire's Approach to ESG in Emerging Markets

Council Fire takes the complexities of emerging regulatory frameworks and turns them into practical, integrated ESG strategies. Their approach helps organizations shift from merely meeting reporting obligations to actively creating value through three core pillars.

Systems Thinking for ESG Integration

Council Fire employs a systems-based approach to ESG, mapping out how physical risks, operational challenges, and regulatory changes intersect with evolving reporting requirements. Instead of treating environmental, social, and governance issues as separate concerns, they focus on the connections between them. For instance, water scarcity in a manufacturing hub doesn’t just threaten production - it can also disrupt workforce stability, strain community relationships, and jeopardize long-term operations. By engaging stakeholders early on, Council Fire identifies root causes and crafts strategies to address these foundational issues.

Decarbonization and Circular Economy Solutions

To help organizations meet climate goals without compromising economic performance, Council Fire develops detailed decarbonization plans. These plans outline governance structures, financial impacts, and realistic timelines, offering more than just net-zero promises - they provide actionable roadmaps. Additionally, their focus on circular economy models reduces reliance on finite resources while opening up new revenue opportunities. By designing resilient infrastructure projects that meet investor standards, Council Fire also facilitates access to climate finance. Leveraging digital ESG platforms, they streamline data collection across regions, ensuring compliance with frameworks like ISSB and CSRD [13].

Stakeholder-Centered Planning

Trust and collaboration are at the heart of effective ESG strategies. Council Fire builds stakeholder engagement around material priorities, aligning the interests of investors, suppliers, and communities. This is especially critical in emerging markets, which are forecasted to achieve around 14% earnings growth by 2026 [14]. As Global Alpha Capital Management Ltd. highlights:

"ESG has always been about financial risk mitigation and long-term value creation – doing what is right for our clients by identifying material risks and opportunities in a rapidly changing world" [12].

How to Achieve ESG Compliance in 2026

CSRD Compliance Timeline for Emerging Market Companies 2024-2028

Achieving ESG compliance requires aligning with regulatory deadlines, upgrading data systems, and forming strategic partnerships. While regulatory delays provide additional preparation time, they also increase risks for organizations that fail to act promptly.

Regulatory Timelines and Key Milestones

The EU's "stop-the-clock" directive has adjusted several Corporate Sustainability Reporting Directive (CSRD) timelines. For instance, Wave 2, which applies to large companies with over 1,000 employees, has been pushed from the 2025 financial year to 2027. Similarly, listed small and medium enterprises (SMEs) will now begin reporting in 2028 instead of 2026. On the other hand, Wave 1 entities - large public interest companies already reporting under the Non-Financial Reporting Directive (NFRD) - will stick to their original 2024 schedule. Non-EU parent groups also remain on track for a 2028 reporting start.

Wave | Entity Type | Original Start (FY) | Revised Start (FY) |

|---|---|---|---|

Wave 1 | Large Public Interest (NFRD) | 2024 | 2024 (No Change) |

Wave 2 | Large Companies (>1,000 employees) | 2025 | 2027 |

Wave 3 | Listed SMEs | 2026 | 2028 |

Wave 4 | Non-EU Parent Groups | 2028 | 2028 (No Change) |

As these deadlines approach, organizations must ensure their data systems are prepared to meet the increasing demands for transparency and accuracy.

Data Collection and Risk Prioritization

Manual spreadsheets are no longer sufficient for managing ESG data. Automated platforms that centralize data and include built-in audit trails are becoming essential. Additionally, with rating agencies now using AI tools to analyze publicly available information, managing your organization’s digital footprint has taken on new urgency. A well-structured risk matrix can help prioritize the most critical ESG data for targeted action.

For companies in emerging markets, the International Finance Corporation's (IFC) ESG Performance Indicators provide a practical framework. These indicators rely on publicly available information and globally recognized standards, easing the reporting burden while maintaining credibility with international investors. Furthermore, under IFRS S2 guidelines, organizations can use climate-related scenario analysis to assess how their business models hold up against physical and transition risks. This approach relies on "reasonable and supportable" data that can be gathered without excessive costs [1] [15] [16].

Partnerships for ESG Implementation

Upgraded data systems and regulatory clarity lay the groundwork, but strong partnerships are crucial for translating compliance into actionable strategies.

Collaboration across departments is key to ensuring data accuracy and consistency. As Tyler Thomas, Sustainability Lead at AArete, explains:

"ESG data usually lives across numerous departments... standardizing the ESG data capture is crucial for having consistent insights" [18].

To achieve this, organizations can establish centralized ESG teams that coordinate data collection and analysis across all departments.

External partnerships are equally important. Collaborating with specialized organizations like Council Fire can help convert regulatory requirements into practical strategies. Additionally, resources such as the IFC's Disclosure & Transparency Toolkit and the World Bank's Sovereign ESG Data Portal provide valuable tools for bridging information gaps, particularly for companies in emerging markets [1] [17].

Conclusion: Moving Forward with ESG in Emerging Markets

Organizations in emerging markets are at a turning point. While they face a gap in sustainability compared to developed economies, this challenge also offers an opportunity to lead the way in balancing financial goals with environmental responsibility. The financial benefits of embracing ESG practices make a strong case for prioritizing these strategies.

With mandatory ESG reporting already implemented in key emerging markets and the EU's updated CSRD deadlines approaching in 2027, the need for decisive action is more pressing than ever. Adopting proactive ESG strategies has become essential for maintaining a foothold in global markets [3][4]. Emerging markets, which contribute about 85% of global CO₂ equivalent emissions, play a key role in addressing climate challenges [4].

This evolving landscape calls for strategies that go beyond mere compliance. Shifting consumer demands and workforce expectations are pushing companies to embed ESG into their core operations. This shift not only mitigates risks but also opens doors to growth, including access to nearly $200 billion in sustainable debt issued in emerging markets in 2021 [2][4]. As BCG aptly states:

"The sustainability imperative is transforming the very nature of global competition" [4].

Council Fire works with organizations to turn compliance requirements into opportunities for meaningful impact. By applying systems thinking and stakeholder-focused planning, they help businesses chart actionable paths toward decarbonization, circular economy practices, and climate resilience. Their approach blends technical know-how with strategic execution, ensuring that ESG efforts deliver tangible environmental, social, and economic outcomes.

Looking ahead, success in these markets will require enhanced data systems, partnerships with Development Finance Institutions, and a commitment to openness and accountability. Companies that act decisively now will not only meet regulatory demands but also gain a competitive edge, turning environmental hurdles into drivers of innovation and growth.

FAQs

What are the key challenges for ESG compliance in emerging markets by 2026?

Emerging markets are grappling with notable challenges as they strive to meet ESG compliance targets by 2026. One of the primary obstacles is the fragmented regulatory environment. In regions like Asia, Africa, and Latin America, governments have adopted diverse standards, often drawing inspiration from frameworks such as TCFD or the EU. However, these standards remain inconsistent and, in many cases, optional. This lack of uniformity complicates efforts for companies trying to establish scalable reporting systems, increasing the likelihood of non-compliance.

Another pressing concern is the inconsistent quality of ESG data. Across these markets, the availability and reliability of data vary significantly, making it challenging for investors to gauge risks and for companies to deliver trustworthy disclosures. Compounding this issue is the shortage of internal expertise within many firms, which can lead to exaggerated sustainability claims, commonly referred to as "greenwashing." Adding to the strain, limited access to cost-effective sustainable financing makes it even harder for companies to invest in the tools and third-party verifications needed to improve their compliance efforts.

Council Fire works closely with organizations to address these barriers, offering tailored, data-driven ESG strategies. Their approach helps align businesses with global frameworks, boosts reporting accuracy, and lays the groundwork for sustainable, long-term growth.

How do EU regulations like CSDDD and EUDR impact businesses in emerging markets?

The European Union’s latest sustainability regulations, including the Corporate Sustainability Due Diligence Directive (CSDDD) and the EU Deforestation Regulation (EUDR), are setting new global standards for businesses, extending their reach even into emerging markets. These regulations demand that companies evaluate the impact of their operations and supply chains on both people and the environment. Additionally, businesses must establish due diligence systems and publicly disclose their sustainability efforts.

For companies in emerging markets, compliance comes with significant challenges. They face increased costs to meet these requirements, the need to invest in supply chain transparency, and the adoption of advanced monitoring tools. The EUDR, for instance, places strict demands on exporters of commodities like coffee, cocoa, and palm oil. These exporters must provide evidence that their products are not tied to deforestation, often necessitating third-party certifications and revised procurement contracts. Failure to comply could lead to trade restrictions, financial penalties, or even exclusion from EU markets.

Despite the hurdles, these regulations bring potential benefits. Companies that adapt quickly can position themselves as leaders, build stronger partnerships with EU buyers, and appeal to ESG-conscious investors by showcasing their commitment to responsible sourcing and sustainable business practices.

Why is climate adaptation financing essential for ESG success in emerging markets?

Climate adaptation financing plays a pivotal role in supporting ESG strategies across emerging markets, which are particularly vulnerable to climate-related challenges such as floods, heatwaves, and rising sea levels. Without adequate financial resources, these risks can severely impact assets, disrupt supply chains, and undermine governance structures. This, in turn, makes it more difficult for companies to achieve their ESG objectives or appeal to responsible investors.

Emerging markets often operate under tight budgetary constraints, a situation exacerbated by global disruptions like the COVID-19 pandemic. As a result, private capital becomes indispensable in closing the funding gap. Financial tools such as green bonds, blended-finance facilities, and outcome-based debt are instrumental in transforming sustainable projects into viable investments. These mechanisms also enhance climate-risk transparency and strengthen ESG outcomes.

For businesses and investors, securing adaptation financing delivers practical advantages, including improved resilience, lower insurance premiums, and the ability to generate long-term value. This approach aligns seamlessly with Council Fire’s mission to turn sustainability strategies into actionable, measurable results.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 20, 2026

Ultimate Guide to ESG in Emerging Markets 2026

ESG Strategy

In This Article

Guide to ESG in emerging markets: 2026 rules, reporting deadlines, investor trends, climate finance and practical steps for compliance and growth.

Ultimate Guide to ESG in Emerging Markets 2026

Emerging markets are central to global ESG efforts, contributing 85% of global CO₂ emissions while facing substantial economic risks like potential GDP losses in regions such as South Asia by 2050. These markets also hold immense potential for sustainability progress, with rising ESG regulations, investor interest, and consumer demand driving change. Key developments in 2026 include:

Mandatory ESG reporting: Brazil and Hong Kong now require ESG disclosures for listed companies.

EU regulations impacting supply chains: The Corporate Sustainability Due Diligence Directive (CSDDD) and Deforestation Regulation require stricter compliance for businesses tied to EU markets.

Global frameworks: Over 36 jurisdictions, covering more than half of global GDP, are aligning with ISSB standards.

Consumer shifts: 77% of consumers in these regions prioritize sustainable products, outpacing developed markets.

Emerging markets are also advancing renewable energy, biodiversity preservation, and climate adaptation finance to meet global goals. However, challenges like income bias in ESG scores and regulatory complexity remain. Strategic planning, robust data systems, and partnerships are critical for businesses to navigate these shifts while unlocking opportunities for growth and compliance.

ESG 2.0 in Emerging Markets: Why Proof Now Beats Promises

Major ESG Regulations Affecting Emerging Markets in 2026

As we move into 2026, the focus on Environmental, Social, and Governance (ESG) policies has shifted from drafting frameworks to enforcing them. Pulsora aptly describes this shift:

"Q4 2025 marked a pivot from ESG expansion to ESG execution" [6].

This change brings a new level of urgency for businesses in emerging markets, as they now face specific compliance demands. Three major regulatory frameworks - the EU's Corporate Sustainability Due Diligence Directive, the EU Deforestation Regulation, and a growing array of regional reporting requirements - are redefining how these companies operate.

EU Corporate Sustainability Due Diligence Directive (CSDDD)

The CSDDD (Directive 2024/1760) mandates that companies address human rights and environmental impacts across their global value chains, including their relationships with business partners in emerging markets [5]. Following the Omnibus I reform in December 2025, the directive now applies to firms with more than 5,000 employees and €1.5 billion in turnover, with compliance deadlines set for July 2029 [6].

Although smaller businesses are exempt, suppliers in emerging markets are indirectly affected. For instance, companies in Brazil or Kenya may need to provide detailed sustainability data to their EU-based partners who fall under the directive. The European Commission has emphasized:

"the Directive will steer businesses towards responsible behaviour and could become a new global standard with regard to mandatory environmental and human rights due diligence" [5].

In support of this transition, the EU has committed resources to help value chain companies in developing countries meet these international standards. Notably, 70% of respondents in an EU public consultation agreed that action on corporate sustainability due diligence was necessary [5].

EU Deforestation Regulation (EUDR)

Nature-related disclosures are becoming a critical focus in 2026, with biodiversity and land-use impacts increasingly influencing financial decisions [6]. The EUDR enforces strict traceability requirements for high-risk commodities, particularly impacting agricultural and forestry supply chains in emerging markets.

By 2025, companies such as Holcim and GSK had already set ambitious targets for water and ecosystem impacts through the Science Based Targets Network framework. Meanwhile, over 150 organizations began preparing for nature-related disclosures [6]. As the Taskforce on Nature-related Financial Disclosures (TNFD) gains traction, producers in developing economies will need to demonstrate commitments to biodiversity preservation, sustainable land use, and carbon neutrality to maintain access to EU markets.

Regional ESG Reporting Requirements

Emerging markets are also advancing their own ESG reporting standards, many of which align with the International Sustainability Standards Board (ISSB). Currently, 16 emerging markets have mandatory ESG disclosure regulations, and 71 stock exchanges worldwide provide specific ESG guidance [9]. For example:

Brazil has mandated ESG reporting for publicly traded companies starting January 1, 2026.

Hong Kong introduced similar requirements for large-cap firms on the same date [6].

ISSB adoption is accelerating across developing economies, with countries like Bangladesh, Chile, Ghana, and Kenya finalizing compliance strategies [7]. Elsewhere, Japan plans to phase in its J-IFRS S1/S2 standards for large companies in fiscal year 2027, while Singapore has postponed its mandate for large unlisted firms to FY 2030 [6].

In the United States, state-level initiatives are stepping in where federal regulations are absent. California and New York have introduced mandatory greenhouse gas reporting requirements that also affect suppliers in emerging markets [6]. Meanwhile, the UAE's Sustainable Finance Working Group released "Climate Transition Planning Principles" in December 2025, requiring large corporations and financial institutions to disclose credible decarbonization strategies [6].

The EU has also simplified its European Sustainability Reporting Standards (ESRS), reducing required data points by 61% as of 2025 [6]. However, emerging market firms serving EU clients must still comply with these standards, even as simplified versions for non-EU companies are expected by 2029 [8][9].

ESG Trends Shaping Emerging Markets in 2026

Emerging markets are witnessing a dramatic evolution in ESG priorities, driven by their distinct challenges and opportunities. These shifts highlight not just the vulnerabilities of developing economies but their ability to leapfrog traditional development models. As BCG aptly puts it:

"The sustainability imperative is transforming the very nature of global competition" [4].

The interplay of financial and ecological factors is paving the way for impactful ESG strategies in these regions.

Climate Adaptation Finance

The urgency for climate adaptation in developing economies is staggering, with annual funding needs projected to hit $300 billion by 2030 to safeguard infrastructure, agriculture, and water systems from climate impacts [10]. If global emission reductions fall short, these numbers could balloon to between $520 billion and $1.75 trillion annually after 2050 [10]. Notably, emerging markets (excluding China) are responsible for 34% of sustainable bond issuances, channeling resources into resilient infrastructure projects [10]. This financial activity underscores the growing recognition of adaptation as a cornerstone of sustainable development.

Biodiversity and Physical Climate Risk

Emerging markets are at the epicenter of climate risks, with regions like Africa, South Asia, Central and South America, and small island states facing the brunt of environmental hazards [10]. These areas, home to many of the world’s most biodiverse ecosystems, are increasingly vulnerable to degradation. As the IMF warns:

"The loss of ecosystems strongly contributes to the impairment of carbon sinks, necessary to achieve global temperature objectives" [10].

Flooding and water scarcity are creating systemic challenges, with global insurance losses from natural disasters expected to surpass $135 billion in 2024 [11]. On the flip side, the carbon dioxide removal industry - tied to biodiversity and nature-based solutions - could grow to $1.2 trillion by 2050 [11]. Leveraging tools like satellite imagery and advanced climate data, companies are closing information gaps and identifying promising investments in climate adaptation [10].

Renewable Energy and Energy Efficiency

Achieving net-zero targets in emerging markets demands a massive scale-up in renewable energy investments, estimated at $1 trillion per year by 2030 [10]. Adding to this urgency, the EU's Carbon Border Adjustment Mechanism (CBAM) and stricter greenhouse gas regulations are pressuring exporters in these regions to embrace decarbonization [4]. This regulatory push aligns with industry-led efforts to reduce emissions. In response, trailblazing companies in sectors like steel, cement, and chemicals are adopting low-carbon business models. Additionally, regional taxonomy frameworks in ASEAN, Malaysia, and Singapore are offering clearer signals for private investment, highlighting climate benefits even in traditionally carbon-intensive industries [10].

Council Fire's Approach to ESG in Emerging Markets

Council Fire takes the complexities of emerging regulatory frameworks and turns them into practical, integrated ESG strategies. Their approach helps organizations shift from merely meeting reporting obligations to actively creating value through three core pillars.

Systems Thinking for ESG Integration

Council Fire employs a systems-based approach to ESG, mapping out how physical risks, operational challenges, and regulatory changes intersect with evolving reporting requirements. Instead of treating environmental, social, and governance issues as separate concerns, they focus on the connections between them. For instance, water scarcity in a manufacturing hub doesn’t just threaten production - it can also disrupt workforce stability, strain community relationships, and jeopardize long-term operations. By engaging stakeholders early on, Council Fire identifies root causes and crafts strategies to address these foundational issues.

Decarbonization and Circular Economy Solutions

To help organizations meet climate goals without compromising economic performance, Council Fire develops detailed decarbonization plans. These plans outline governance structures, financial impacts, and realistic timelines, offering more than just net-zero promises - they provide actionable roadmaps. Additionally, their focus on circular economy models reduces reliance on finite resources while opening up new revenue opportunities. By designing resilient infrastructure projects that meet investor standards, Council Fire also facilitates access to climate finance. Leveraging digital ESG platforms, they streamline data collection across regions, ensuring compliance with frameworks like ISSB and CSRD [13].

Stakeholder-Centered Planning

Trust and collaboration are at the heart of effective ESG strategies. Council Fire builds stakeholder engagement around material priorities, aligning the interests of investors, suppliers, and communities. This is especially critical in emerging markets, which are forecasted to achieve around 14% earnings growth by 2026 [14]. As Global Alpha Capital Management Ltd. highlights:

"ESG has always been about financial risk mitigation and long-term value creation – doing what is right for our clients by identifying material risks and opportunities in a rapidly changing world" [12].

How to Achieve ESG Compliance in 2026

CSRD Compliance Timeline for Emerging Market Companies 2024-2028

Achieving ESG compliance requires aligning with regulatory deadlines, upgrading data systems, and forming strategic partnerships. While regulatory delays provide additional preparation time, they also increase risks for organizations that fail to act promptly.

Regulatory Timelines and Key Milestones

The EU's "stop-the-clock" directive has adjusted several Corporate Sustainability Reporting Directive (CSRD) timelines. For instance, Wave 2, which applies to large companies with over 1,000 employees, has been pushed from the 2025 financial year to 2027. Similarly, listed small and medium enterprises (SMEs) will now begin reporting in 2028 instead of 2026. On the other hand, Wave 1 entities - large public interest companies already reporting under the Non-Financial Reporting Directive (NFRD) - will stick to their original 2024 schedule. Non-EU parent groups also remain on track for a 2028 reporting start.

Wave | Entity Type | Original Start (FY) | Revised Start (FY) |

|---|---|---|---|

Wave 1 | Large Public Interest (NFRD) | 2024 | 2024 (No Change) |

Wave 2 | Large Companies (>1,000 employees) | 2025 | 2027 |

Wave 3 | Listed SMEs | 2026 | 2028 |

Wave 4 | Non-EU Parent Groups | 2028 | 2028 (No Change) |

As these deadlines approach, organizations must ensure their data systems are prepared to meet the increasing demands for transparency and accuracy.

Data Collection and Risk Prioritization

Manual spreadsheets are no longer sufficient for managing ESG data. Automated platforms that centralize data and include built-in audit trails are becoming essential. Additionally, with rating agencies now using AI tools to analyze publicly available information, managing your organization’s digital footprint has taken on new urgency. A well-structured risk matrix can help prioritize the most critical ESG data for targeted action.

For companies in emerging markets, the International Finance Corporation's (IFC) ESG Performance Indicators provide a practical framework. These indicators rely on publicly available information and globally recognized standards, easing the reporting burden while maintaining credibility with international investors. Furthermore, under IFRS S2 guidelines, organizations can use climate-related scenario analysis to assess how their business models hold up against physical and transition risks. This approach relies on "reasonable and supportable" data that can be gathered without excessive costs [1] [15] [16].

Partnerships for ESG Implementation

Upgraded data systems and regulatory clarity lay the groundwork, but strong partnerships are crucial for translating compliance into actionable strategies.

Collaboration across departments is key to ensuring data accuracy and consistency. As Tyler Thomas, Sustainability Lead at AArete, explains:

"ESG data usually lives across numerous departments... standardizing the ESG data capture is crucial for having consistent insights" [18].

To achieve this, organizations can establish centralized ESG teams that coordinate data collection and analysis across all departments.

External partnerships are equally important. Collaborating with specialized organizations like Council Fire can help convert regulatory requirements into practical strategies. Additionally, resources such as the IFC's Disclosure & Transparency Toolkit and the World Bank's Sovereign ESG Data Portal provide valuable tools for bridging information gaps, particularly for companies in emerging markets [1] [17].

Conclusion: Moving Forward with ESG in Emerging Markets

Organizations in emerging markets are at a turning point. While they face a gap in sustainability compared to developed economies, this challenge also offers an opportunity to lead the way in balancing financial goals with environmental responsibility. The financial benefits of embracing ESG practices make a strong case for prioritizing these strategies.

With mandatory ESG reporting already implemented in key emerging markets and the EU's updated CSRD deadlines approaching in 2027, the need for decisive action is more pressing than ever. Adopting proactive ESG strategies has become essential for maintaining a foothold in global markets [3][4]. Emerging markets, which contribute about 85% of global CO₂ equivalent emissions, play a key role in addressing climate challenges [4].

This evolving landscape calls for strategies that go beyond mere compliance. Shifting consumer demands and workforce expectations are pushing companies to embed ESG into their core operations. This shift not only mitigates risks but also opens doors to growth, including access to nearly $200 billion in sustainable debt issued in emerging markets in 2021 [2][4]. As BCG aptly states:

"The sustainability imperative is transforming the very nature of global competition" [4].

Council Fire works with organizations to turn compliance requirements into opportunities for meaningful impact. By applying systems thinking and stakeholder-focused planning, they help businesses chart actionable paths toward decarbonization, circular economy practices, and climate resilience. Their approach blends technical know-how with strategic execution, ensuring that ESG efforts deliver tangible environmental, social, and economic outcomes.

Looking ahead, success in these markets will require enhanced data systems, partnerships with Development Finance Institutions, and a commitment to openness and accountability. Companies that act decisively now will not only meet regulatory demands but also gain a competitive edge, turning environmental hurdles into drivers of innovation and growth.

FAQs

What are the key challenges for ESG compliance in emerging markets by 2026?

Emerging markets are grappling with notable challenges as they strive to meet ESG compliance targets by 2026. One of the primary obstacles is the fragmented regulatory environment. In regions like Asia, Africa, and Latin America, governments have adopted diverse standards, often drawing inspiration from frameworks such as TCFD or the EU. However, these standards remain inconsistent and, in many cases, optional. This lack of uniformity complicates efforts for companies trying to establish scalable reporting systems, increasing the likelihood of non-compliance.

Another pressing concern is the inconsistent quality of ESG data. Across these markets, the availability and reliability of data vary significantly, making it challenging for investors to gauge risks and for companies to deliver trustworthy disclosures. Compounding this issue is the shortage of internal expertise within many firms, which can lead to exaggerated sustainability claims, commonly referred to as "greenwashing." Adding to the strain, limited access to cost-effective sustainable financing makes it even harder for companies to invest in the tools and third-party verifications needed to improve their compliance efforts.

Council Fire works closely with organizations to address these barriers, offering tailored, data-driven ESG strategies. Their approach helps align businesses with global frameworks, boosts reporting accuracy, and lays the groundwork for sustainable, long-term growth.

How do EU regulations like CSDDD and EUDR impact businesses in emerging markets?

The European Union’s latest sustainability regulations, including the Corporate Sustainability Due Diligence Directive (CSDDD) and the EU Deforestation Regulation (EUDR), are setting new global standards for businesses, extending their reach even into emerging markets. These regulations demand that companies evaluate the impact of their operations and supply chains on both people and the environment. Additionally, businesses must establish due diligence systems and publicly disclose their sustainability efforts.

For companies in emerging markets, compliance comes with significant challenges. They face increased costs to meet these requirements, the need to invest in supply chain transparency, and the adoption of advanced monitoring tools. The EUDR, for instance, places strict demands on exporters of commodities like coffee, cocoa, and palm oil. These exporters must provide evidence that their products are not tied to deforestation, often necessitating third-party certifications and revised procurement contracts. Failure to comply could lead to trade restrictions, financial penalties, or even exclusion from EU markets.

Despite the hurdles, these regulations bring potential benefits. Companies that adapt quickly can position themselves as leaders, build stronger partnerships with EU buyers, and appeal to ESG-conscious investors by showcasing their commitment to responsible sourcing and sustainable business practices.

Why is climate adaptation financing essential for ESG success in emerging markets?

Climate adaptation financing plays a pivotal role in supporting ESG strategies across emerging markets, which are particularly vulnerable to climate-related challenges such as floods, heatwaves, and rising sea levels. Without adequate financial resources, these risks can severely impact assets, disrupt supply chains, and undermine governance structures. This, in turn, makes it more difficult for companies to achieve their ESG objectives or appeal to responsible investors.

Emerging markets often operate under tight budgetary constraints, a situation exacerbated by global disruptions like the COVID-19 pandemic. As a result, private capital becomes indispensable in closing the funding gap. Financial tools such as green bonds, blended-finance facilities, and outcome-based debt are instrumental in transforming sustainable projects into viable investments. These mechanisms also enhance climate-risk transparency and strengthen ESG outcomes.

For businesses and investors, securing adaptation financing delivers practical advantages, including improved resilience, lower insurance premiums, and the ability to generate long-term value. This approach aligns seamlessly with Council Fire’s mission to turn sustainability strategies into actionable, measurable results.

Related Blog Posts

FAQ

What does it really mean to “redefine profit”?

What makes Council Fire different?

Who does Council Fire you work with?

What does working with Council Fire actually look like?

How does Council Fire help organizations turn big goals into action?

How does Council Fire define and measure success?