Jan 1, 2026

Jan 1, 2026

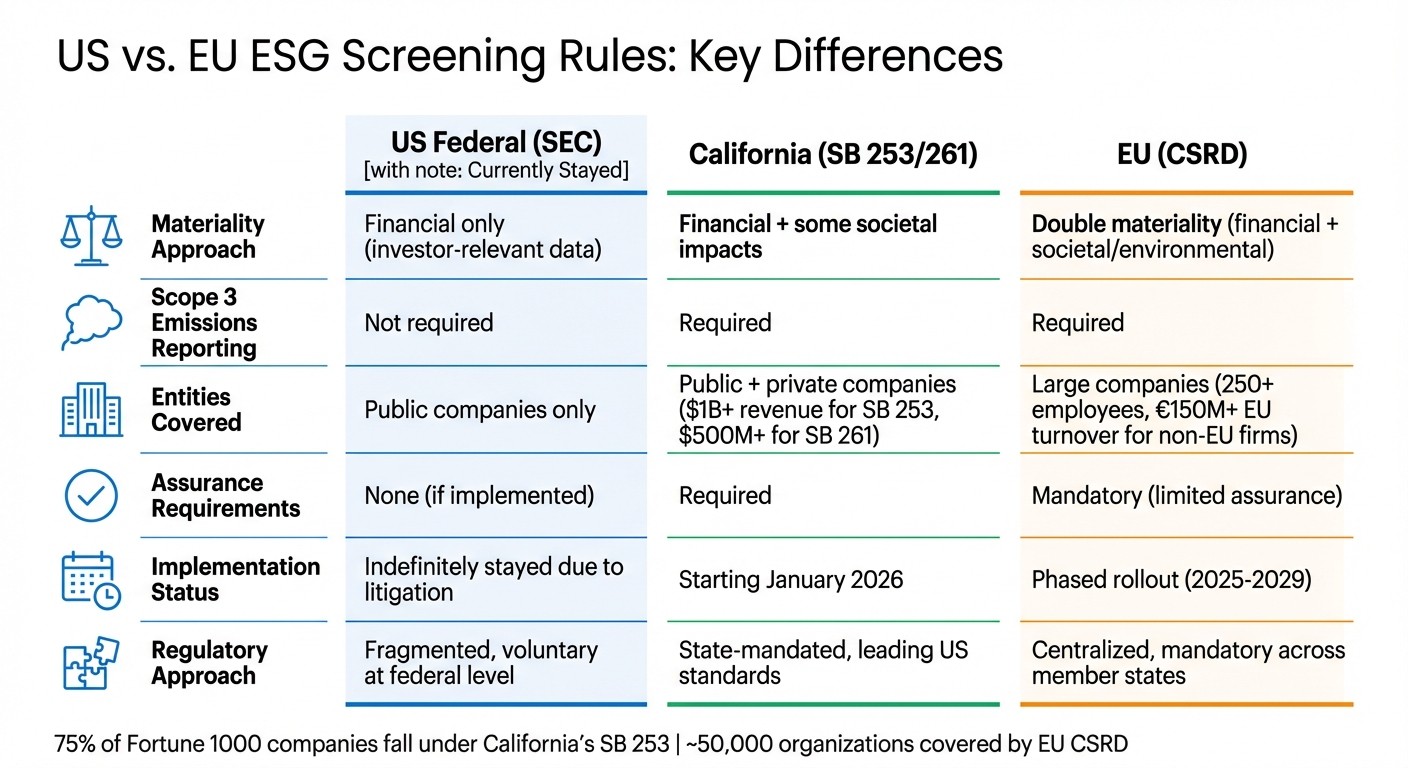

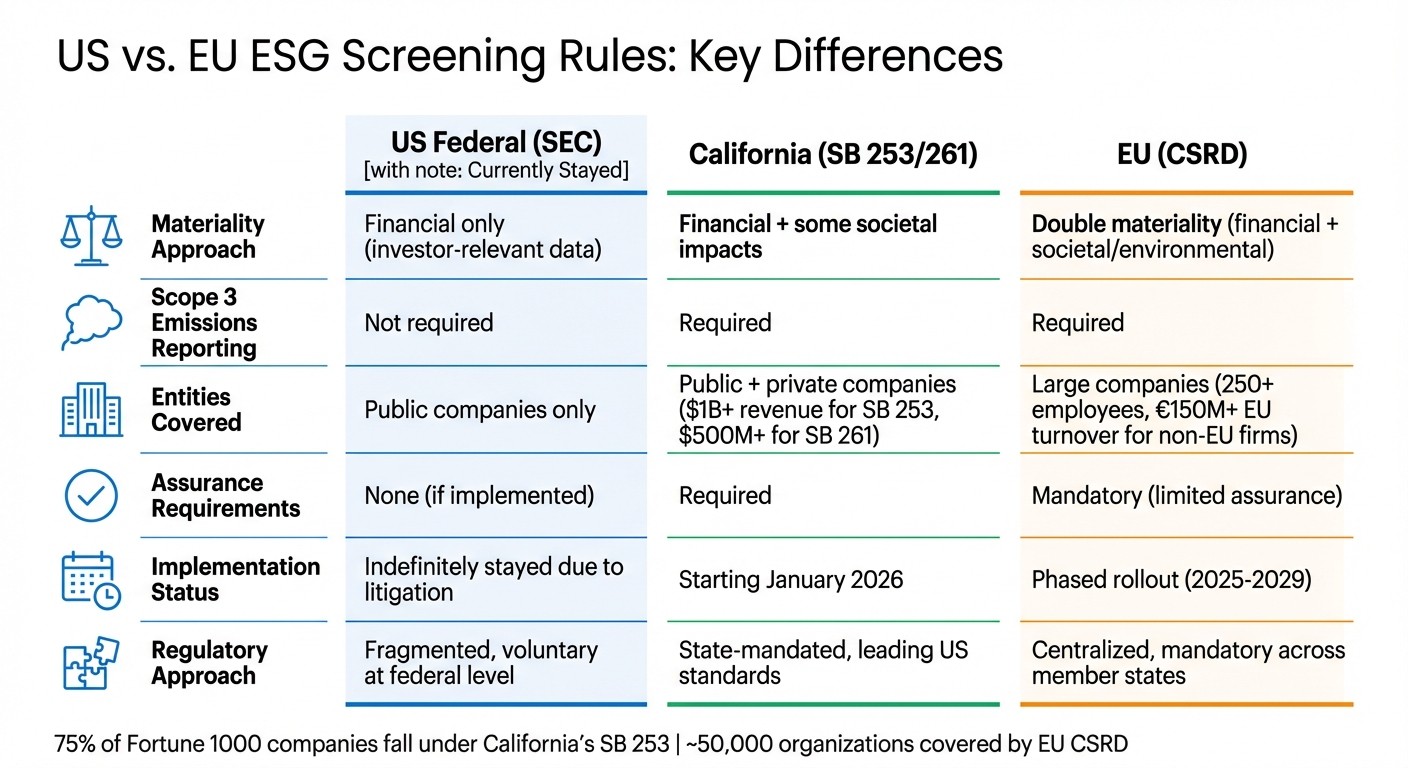

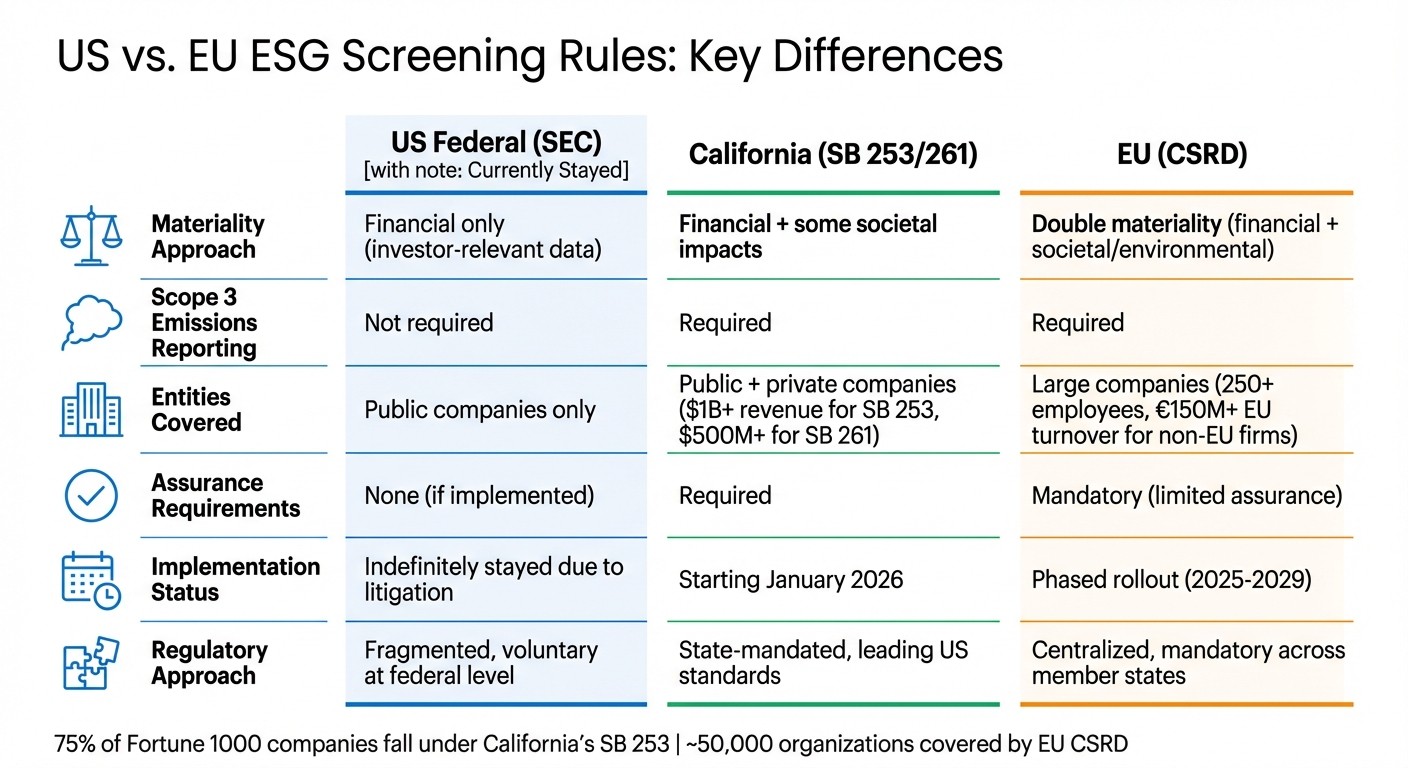

US vs. EU ESG Screening Rules: Key Differences

ESG Strategy

ESG Strategy

In This Article

Compare US and EU ESG screening rules — materiality, Scope 3, entity coverage, assurance, enforcement, and cross-border compliance implications for multinationals.

US vs. EU ESG Screening Rules: Key Differences

Navigating ESG Rules: US vs. EU

The US and EU take very different paths in how companies must report on environmental, social, and governance (ESG) factors, often requiring specialized sustainability consulting to navigate the complexities. Here's what you need to know:

US Approach: Fragmented, with no federal mandate. California leads with laws like SB 253, requiring large companies to report emissions starting January 2026. Federal rules, like the SEC's climate disclosure, remain stalled due to legal challenges.

EU Approach: Centralized with mandatory frameworks like the Corporate Sustainability Reporting Directive (CSRD). Companies must report both financial impacts and their societal/environmental effects (double materiality). Non-EU companies earning €150M+ in the EU must comply.

Materiality: US focuses on financial materiality (investor-relevant data), while the EU requires double materiality (financial + societal/environmental impacts).

Scope 3 Emissions: California and the EU require disclosure, but US federal rules do not.

Quick Comparison

Feature | US Federal (SEC) | California (SB 253/261) | EU (CSRD) |

|---|---|---|---|

Materiality | Financial only | Financial + some societal | Double (financial + societal/environmental) |

Scope 3 Reporting | Not required | Required | Required |

Entities Covered | Public companies | Public + private ($1B+ revenue) | Large companies (250+ employees, €150M+ EU turnover for non-EU firms) |

Assurance | None (if implemented) | Required | Mandatory (limited assurance) |

Key Takeaway: Companies operating in both regions face challenges aligning with these differing frameworks. The US leans on voluntary and state-specific rules, while the EU enforces stricter, unified standards. Understanding these differences is critical for compliance and global business planning.

US vs EU ESG Screening Rules Comparison Chart

Update on Key ESG Reporting Developments in the U.S. and EU: November 2025

US ESG Screening Rules

In the United States, there is no single, unified framework for ESG (Environmental, Social, and Governance) screening. Unlike the EU's centralized approach, the U.S. regulatory landscape is fragmented, with federal rules stalled and state-level mandates varying widely. This patchwork of requirements often creates conflicting obligations for businesses operating across multiple jurisdictions.

Main Regulations and Frameworks

In March 2024, the Securities and Exchange Commission (SEC) introduced new climate disclosure rules. These require publicly traded companies to report material climate risks, including Scope 1 and Scope 2 emissions, as well as severe weather-related losses exceeding 1% of their assets. However, these rules are currently on hold due to ongoing litigation, specifically the Iowa v. SEC case [8].

California has stepped in to fill part of the regulatory gap with two new laws. Senate Bill 253 (SB 253) mandates that companies with annual revenues exceeding $1 billion disclose their Scope 1, 2, and 3 emissions starting January 1, 2026. Senate Bill 261 (SB 261) requires companies with over $500 million in revenue to submit biennial climate risk reports, following the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations [7].

Matteo Tonello, Head of Benchmarking and Analytics at The Conference Board, remarked:

emerging as the standard for US climate disclosure [7].

Both California laws align with the Greenhouse Gas Protocol and TCFD framework, offering a degree of consistency for companies already using these standards. However, the situation is complicated by over 40 anti-ESG laws enacted across 21 states, creating additional compliance challenges for businesses operating nationwide [7].

This ever-changing regulatory environment has heightened the risk of litigation and liability for companies.

Litigation and Liability Risks

Litigation has become a key driver of ESG enforcement in the U.S. The SEC voluntarily stayed its climate disclosure rules due to a "flurry of lawsuits" brought by states, trade associations, and interest groups [1]. This reliance on legal challenges creates uncertainty and greatly influences how companies approach ESG disclosures.

Businesses also face potential shareholder lawsuits for misleading ESG statements or greenwashing claims under state consumer protection laws [8]. For example, in May 2023, the SEC reached a $56 million settlement with Vale S.A., an iron ore producer, for making false claims about dam safety in its sustainability reports prior to the 2019 Brumadinho disaster [8]. Additionally, in 2024, the SEC charged Keurig Dr Pepper for inaccurate claims about the recyclability of its K-Cup pods [8]. Despite disbanding its Climate and ESG Task Force in 2024, the SEC continues to pursue these cases through its general Division of Enforcement [8].

Certain legal protections exist for companies, such as the Private Securities Litigation Reform Act (PSLRA), which provides a safe harbor for forward-looking ESG statements. The "bespeaks caution" doctrine also offers protection if disclosures include meaningful cautionary language [8]. To navigate these risks, companies are advised to integrate climate-related metrics into their internal controls and establish cross-functional ESG committees to ensure consistent and accurate disclosures [7].

EU ESG Screening Rules

The European Union has adopted a centralized and mandatory ESG screening framework, setting it apart from the more fragmented approach seen in the United States. Instead of relying on state-specific rules or voluntary guidelines, the EU has established a uniform regulatory system that applies across all member states and even impacts many non-EU companies operating within Europe.

Main Regulations Driving ESG Screening

Four key regulations form the backbone of the EU’s ESG screening framework. The Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants to use standardized sustainability labels, aiming to enhance transparency and combat greenwashing [11]. By November 2025, proposed amendments will mandate that at least 70% of a product’s portfolio aligns with its stated sustainability strategy [13].

The Corporate Sustainability Reporting Directive (CSRD), which replaced the older Non-Financial Reporting Directive, elevates the importance of sustainability data by demanding it be treated with the same level of scrutiny as financial information. Dan Byrne of The Corporate Governance Institute explains:

Sustainability information will be treated with the same rigour and suspicion as financial information [10].

This directive applies to roughly 50,000 organizations across the EU [10].

The EU Taxonomy Regulation provides a clear classification system to identify which economic activities qualify as "environmentally sustainable", creating a benchmark for ESG screening [11]. Additionally, the ESG Rating Regulation (EU 2024/3005) requires ESG rating agencies to obtain authorization from the European Securities and Markets Authority (ESMA) and disclose their methodologies to ensure transparency and independence [9].

A standout feature of the EU framework is the double materiality requirement under the CSRD. Companies must report not only how sustainability issues affect their financial performance but also how their operations impact the environment and society [11].

Together, these regulations establish a robust foundation for consistent and reliable ESG reporting.

Reporting Standards and Assurance Requirements

To support these regulations, the EU enforces detailed reporting and verification protocols. The European Sustainability Reporting Standards (ESRS) provide mandatory templates covering 12 key areas, such as climate, pollution, workforce, and business conduct [12]. These templates promote consistency and comparability across companies, a contrast to the more flexible practices often seen in the U.S.

The CSRD introduces a phased implementation based on company size and type. Companies already subject to the earlier reporting directive began reporting in 2025 for their 2024 data. Other large companies meeting at least two of three criteria - balance sheet assets exceeding €20 million, turnover above €40 million, or more than 250 employees - will begin reporting in 2026 for their 2025 data. Listed small and medium-sized enterprises (SMEs) and smaller credit institutions follow in 2027, while non-EU companies with over €150 million in EU turnover must comply starting in 2029, covering their 2028 financial year [11].

Another critical element is mandatory assurance. Unlike voluntary frameworks, the CSRD requires sustainability data to undergo "limited assurance" from either a statutory auditor or an independent provider [12]. Additionally, reports must be digitally tagged for machine-readability through the European Single Access Point [11].

This rigorous approach ensures that ESG reporting in the EU is both trustworthy and accessible.

Main Differences Between US and EU ESG Screening Rules

Scope and Coverage Comparison

The United States and European Union take notably different approaches to ESG (Environmental, Social, and Governance) screening, particularly in terms of scope and coverage. In the US, the focus is on financial materiality, meaning companies are required to report only on factors that directly impact investor returns. On the other hand, the EU employs a double materiality framework, mandating disclosures that address not only financial impacts but also societal and environmental effects [1].

One key difference lies in the treatment of Scope 3 emissions - those generated across a company's value chain. Under the EU's Corporate Sustainability Reporting Directive (CSRD), companies must disclose material value-chain emissions. California's SB 253 also mandates Scope 3 reporting for companies with revenues exceeding $1 billion. By contrast, the federal SEC climate rule, which initially excluded Scope 3 reporting, has been indefinitely stayed [7].

The scope of entities covered also varies. Federal rules in the US apply only to public issuers, whereas California's laws extend to both public and private companies. For instance, SB 253 applies to entities with revenues over $1 billion, while SB 261 covers those with revenues above $500 million. Approximately 75% of Fortune 1000 companies fall under SB 253's jurisdiction [7]. Meanwhile, the EU's CSRD currently applies to large companies with 250 or more employees. However, a proposed February 2025 Omnibus package could raise this threshold to companies with over 1,000 employees, potentially reducing the number of affected businesses by 80% [7].

Feature | US Federal (SEC – Stayed) | US California (SB 253/261) | EU (CSRD) |

|---|---|---|---|

Primary Materiality | Financial Materiality | Disclosure required regardless of financial materiality | Double Materiality |

Scope 3 Reporting | Not Required | Required | Required |

Entity Type | Public issuers | Public and Private entities | Large companies (including non-EU parents) |

Revenue/Size Threshold | N/A | $1B+ (SB 253) / $500M+ (SB 261) | 250+ employees (proposed increase to 1,000+) |

Assurance | Conditional (if implemented) | Required | Mandatory (Limited Assurance) |

Michael Watson, Head of Climate and Sustainability Advisory at Pinsent Masons, highlights the challenge for US companies:

For US businesses, the lack of interoperability across regimes means thought will likely need to be given to adapting their processes for the different requirements we are seeing emerge across jurisdictions [14].

These structural differences don’t just influence compliance strategies - they also play a role in shaping global investment decisions and regulatory enforcement.

Enforcement and Compliance Approaches

The way ESG rules are enforced further underscores the divide between the US and EU. In the US, enforcement relies heavily on litigation. For example, the SEC climate rule has been indefinitely delayed due to legal challenges. Additionally, more than 40 anti-ESG bills introduced across 21 states have added layers of complexity to compliance [7].

By contrast, the EU employs standardized, mandatory frameworks that include third-party assurance. The CSRD requires "limited assurance" for ESG disclosures to ensure they are free from material misstatements. While this creates a more unified compliance environment across member states, challenges remain. As of early 2025, ten EU countries had yet to fully incorporate the CSRD into their national laws [7].

In the absence of federal mandates, California has become the de facto leader in ESG disclosure standards within the US. The California Air Resources Board announced in December 2024 that it would exercise enforcement discretion during the initial 2026 reporting cycle for SB 253, provided companies make "good faith efforts" to comply [7]. Matteo Tonello observes:

In the absence of federal mandates and disclosure rules, state-level regulations will instead likely shape the future of corporate sustainability disclosures in the US [7].

Meanwhile, the EU is signaling a shift toward simplification. The proposed 2025 Omnibus package includes measures to delay reporting deadlines and reduce the number of companies subject to the CSRD. This stands in stark contrast to the fragmented regulatory landscape in the US, where state-level rules dominate. For multinational organizations, navigating these divergent systems presents significant challenges for achieving consistent ESG integration.

Cross-Border Compliance Challenges

Managing Dual Compliance Requirements

For multinational companies, juggling both US and EU ESG regulations presents a maze of obstacles. The global reach of EU rules, for instance, requires non-EU parent companies generating over €150 million in the EU to report on a whole-group basis under the CSRD. This forces US multinationals to adopt EU standards across their operations, even as US federal rules remain comparatively lenient [1]. The clash between the EU’s “double materiality” approach and the US focus on financial materiality creates additional enforcement headaches across jurisdictions [1].

Timing misalignments add another layer of complexity. California mandates Scope 1 and 2 emissions reporting by January 1, 2026, while the EU's Omnibus proposal suggests delaying certain CSRD reporting for large companies until 2028 [1]. These disparities in timelines and requirements leave companies vulnerable to compliance gaps. Moreover, the detailed disclosures demanded by EU regulations could spark securities litigation in the US if the information is inconsistent with US filings or appears misleading under anti-fraud laws. As Skadden, Arps, Slate, Meagher & Flom LLP points out:

The granular information required by the EU could feed litigation in the U.S. if the disclosures appear false or misleading, or are inconsistent with disclosures in other jurisdictions [15].

Data reliability further complicates matters. Companies often depend on unregulated third-party ESG data providers or estimations to fill reporting gaps, increasing the risk of greenwashing accusations [1]. With 99% of S&P 500 companies already disclosing ESG-related information outside their SEC filings as of 2021, the pressure to ensure consistent, accurate data across diverse reporting frameworks has reached unprecedented levels [15]. These regulatory misalignments not only make compliance more difficult but also expose companies to heightened legal and reputational risks.

Using Expert Guidance for ESG Integration

To navigate these challenges, businesses need to move beyond piecemeal solutions and adopt comprehensive, expert-led strategies. Many organizations are embracing systems thinking to align their sustainability goals with varying regulatory frameworks. DLA Piper emphasizes the importance of balance:

ESG strategies must remain true to identified objectives and not be overly calibrated to the regulatory requirements of any one jurisdiction or they risk non-compliance with the requirements of other jurisdictions [4].

Practical steps include forming cross-functional teams that align legal, financial, and sustainability data for seamless reporting [1]. Implementing robust disclosure controls is equally critical, along with engaging external experts to review and validate disclosures. This ensures consistency across SEC filings, CSRD-based reports, and voluntary disclosures [1].

Organizations like Council Fire offer the strategic support needed to create unified reporting systems that meet rigorous ESG mandates, including Scope 3 emissions reporting required by both California's SB 253 and the EU's CSRD [1]. By adopting such integrated approaches, companies can ensure their sustainability initiatives deliver environmental, social, and economic benefits while meeting diverse regulatory demands.

Starting early is essential. As Norton Rose Fulbright cautions:

Noncompliance with the reporting requirements in the applicable jurisdiction(s) may be fatal to potential ventures, investment opportunities, and the public perception of involved parties [1].

Companies that establish strong ESG frameworks today will be better equipped to adapt to evolving regulations and maintain a competitive edge in the long run.

Effects on Global Investment and Business Strategies

How ESG Rules Affect Screening and Exclusion Policies

The differing regulatory approaches between the US and EU are reshaping how assets are screened and how capital is allocated globally. By 2024, global ESG fund assets reached an impressive $3.2 trillion, but investment patterns varied significantly by region [6]. For example, European investors added $8.6 billion to ESG funds in Q2 2025, while the US marked its eleventh straight quarter of withdrawals from such funds [6]. This regional split reflects not only differing investor attitudes but also fundamental contrasts in how sustainability standards are defined and enforced.

Shareholder behavior further highlights these differences. In 2024, UK and European asset managers supported 81% of shareholder ESG proposals on average, whereas their US counterparts backed only 25% [6]. Political dynamics amplify this divide - 47% of North American investors express concerns about potential legal or political backlash tied to ESG strategies, compared to just 30% of European investors [3]. Additionally, 54% of North American investors anticipate growing domestic opposition to ESG practices [3].

These challenges extend to fund managers, who must carefully navigate regulatory expectations when designing ESG-related products. In the US, the SEC’s “Names Rule” mandates that funds using ESG-related terminology allocate at least 80% of their assets to align with those claims [5][4]. Meanwhile, in the EU, many asset managers have reclassified funds from "Article 9" (dark green) to "Article 8" (light green) under the SFDR framework to avoid accusations of greenwashing [3]. These pressures push global investors to adopt region-specific disclosures while striving to uphold their broader ESG commitments.

Navigating these regulatory complexities often requires expert guidance, particularly in balancing compliance with strategic goals.

Working with Consultancies to Navigate ESG Complexity

Given these investment hurdles, consultancies play a crucial role in simplifying ESG integration and helping businesses maintain their competitive edge. Viewing ESG purely as a compliance task risks missing out on its strategic potential. Standardized ESG disclosures not only help businesses manage risks and identify opportunities but also provide a marketing edge in regions where sustainability awareness is high [3][2].

Organizations like Council Fire specialize in turning sustainability efforts into measurable business value. They tackle areas such as carbon footprint analysis, circular supply chain development, stakeholder-focused planning, and climate resilience strategies. This comprehensive approach equips companies to navigate the EU’s stringent regulatory environment while addressing the fragmented policies in the US. By adopting unified ESG practices, businesses can meet diverse regulatory requirements while staying true to their sustainability goals - a critical strategy for maintaining operational and strategic consistency across international markets.

Conclusion

Examining the regulatory frameworks in the US and EU reveals a growing divide that is reshaping how global businesses handle ESG screening. In the EU, the Corporate Sustainability Reporting Directive (CSRD) enforces a "double materiality" standard. This means companies must assess not only the financial impact of sustainability issues but also their broader societal and environmental effects, with phased requirements guiding implementation. Meanwhile, ESG disclosure in the US remains mostly voluntary at the federal level due to ongoing legal uncertainties. However, California's SB 253 and SB 261 have emerged as benchmarks, influencing approximately 75% of Fortune 1000 companies [7]. This divergence compels businesses to navigate the US's focus on financial materiality alongside the EU's broader double materiality, creating a challenging landscape for cross-border compliance.

The differences in regional timelines and regulatory scope add another layer of complexity. For example, the EU’s February 2025 Omnibus proposal is expected to streamline reporting requirements by cutting obligations by at least 25% [6]. Yet, businesses still face a fragmented system of conflicting standards across jurisdictions, which heightens compliance risks.

Notably, 97% of C-Suite executives recognize that sustainability reporting delivers benefits beyond mere compliance [7]. This underscores the importance of getting it right - not just for managing risks, but also for maintaining a competitive edge.

To achieve effective ESG integration, companies need a comprehensive and strategic approach. Council Fire offers solutions designed to turn regulatory challenges into opportunities. Their systems-thinking methodology helps businesses meet varied regulatory requirements while maintaining operational alignment and delivering measurable sustainability outcomes.

FAQs

What are the main differences between ESG screening rules in the US and EU?

The key distinction comes down to how regulations are handled. The European Union (EU) mandates strict ESG regulations, backed by legal requirements and penalties for non-compliance. On the other hand, the United States (US) leans toward a voluntary, market-driven approach, offering companies more freedom in how they implement ESG practices.

This regulatory gap creates challenges for global businesses that operate across both regions. Companies must juggle varying expectations and compliance standards, making it essential to tailor their sustainability strategies to meet the specific demands of each region.

How do ESG reporting rules in the US and EU affect multinational companies?

ESG reporting requirements in the US and EU pose considerable hurdles for multinational corporations due to their differing approaches. The EU enforces stringent regulations such as the Corporate Sustainability Reporting Directive (CSRD), which mandates detailed, standardized disclosures for companies with significant operations within Europe, regardless of where they are headquartered. In contrast, the US leans more toward voluntary, materiality-based disclosures, with relatively fewer mandatory rules. These differences can result in increased compliance costs and the risk of legal complications when disclosures don't align across jurisdictions.

To navigate these challenges, companies often rely on advanced data systems capable of harmonizing reporting efforts across regions. These systems help address varying materiality standards and manage differing timelines. Collaborating with consultancies like Council Fire, which specialize in sustainability, can simplify data collection, ensure adherence to both US and EU requirements, and strengthen relationships with stakeholders - all while supporting long-term organizational goals.

What makes the concept of 'double materiality' important in EU regulations?

The idea of double materiality plays a key role in EU regulations, especially within the framework of the Corporate Sustainability Reporting Directive (CSRD). This principle compels companies to assess two critical dimensions: how sustainability issues influence their financial outcomes and how their activities impact the environment and society.

By adopting this twofold perspective, businesses are encouraged to integrate sustainability more thoroughly into their strategies. This approach not only supports broader societal and environmental objectives but also helps organizations identify and manage risks that could affect their long-term viability.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 1, 2026

US vs. EU ESG Screening Rules: Key Differences

ESG Strategy

In This Article

Compare US and EU ESG screening rules — materiality, Scope 3, entity coverage, assurance, enforcement, and cross-border compliance implications for multinationals.

US vs. EU ESG Screening Rules: Key Differences

Navigating ESG Rules: US vs. EU

The US and EU take very different paths in how companies must report on environmental, social, and governance (ESG) factors, often requiring specialized sustainability consulting to navigate the complexities. Here's what you need to know:

US Approach: Fragmented, with no federal mandate. California leads with laws like SB 253, requiring large companies to report emissions starting January 2026. Federal rules, like the SEC's climate disclosure, remain stalled due to legal challenges.

EU Approach: Centralized with mandatory frameworks like the Corporate Sustainability Reporting Directive (CSRD). Companies must report both financial impacts and their societal/environmental effects (double materiality). Non-EU companies earning €150M+ in the EU must comply.

Materiality: US focuses on financial materiality (investor-relevant data), while the EU requires double materiality (financial + societal/environmental impacts).

Scope 3 Emissions: California and the EU require disclosure, but US federal rules do not.

Quick Comparison

Feature | US Federal (SEC) | California (SB 253/261) | EU (CSRD) |

|---|---|---|---|

Materiality | Financial only | Financial + some societal | Double (financial + societal/environmental) |

Scope 3 Reporting | Not required | Required | Required |

Entities Covered | Public companies | Public + private ($1B+ revenue) | Large companies (250+ employees, €150M+ EU turnover for non-EU firms) |

Assurance | None (if implemented) | Required | Mandatory (limited assurance) |

Key Takeaway: Companies operating in both regions face challenges aligning with these differing frameworks. The US leans on voluntary and state-specific rules, while the EU enforces stricter, unified standards. Understanding these differences is critical for compliance and global business planning.

US vs EU ESG Screening Rules Comparison Chart

Update on Key ESG Reporting Developments in the U.S. and EU: November 2025

US ESG Screening Rules

In the United States, there is no single, unified framework for ESG (Environmental, Social, and Governance) screening. Unlike the EU's centralized approach, the U.S. regulatory landscape is fragmented, with federal rules stalled and state-level mandates varying widely. This patchwork of requirements often creates conflicting obligations for businesses operating across multiple jurisdictions.

Main Regulations and Frameworks

In March 2024, the Securities and Exchange Commission (SEC) introduced new climate disclosure rules. These require publicly traded companies to report material climate risks, including Scope 1 and Scope 2 emissions, as well as severe weather-related losses exceeding 1% of their assets. However, these rules are currently on hold due to ongoing litigation, specifically the Iowa v. SEC case [8].

California has stepped in to fill part of the regulatory gap with two new laws. Senate Bill 253 (SB 253) mandates that companies with annual revenues exceeding $1 billion disclose their Scope 1, 2, and 3 emissions starting January 1, 2026. Senate Bill 261 (SB 261) requires companies with over $500 million in revenue to submit biennial climate risk reports, following the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations [7].

Matteo Tonello, Head of Benchmarking and Analytics at The Conference Board, remarked:

emerging as the standard for US climate disclosure [7].

Both California laws align with the Greenhouse Gas Protocol and TCFD framework, offering a degree of consistency for companies already using these standards. However, the situation is complicated by over 40 anti-ESG laws enacted across 21 states, creating additional compliance challenges for businesses operating nationwide [7].

This ever-changing regulatory environment has heightened the risk of litigation and liability for companies.

Litigation and Liability Risks

Litigation has become a key driver of ESG enforcement in the U.S. The SEC voluntarily stayed its climate disclosure rules due to a "flurry of lawsuits" brought by states, trade associations, and interest groups [1]. This reliance on legal challenges creates uncertainty and greatly influences how companies approach ESG disclosures.

Businesses also face potential shareholder lawsuits for misleading ESG statements or greenwashing claims under state consumer protection laws [8]. For example, in May 2023, the SEC reached a $56 million settlement with Vale S.A., an iron ore producer, for making false claims about dam safety in its sustainability reports prior to the 2019 Brumadinho disaster [8]. Additionally, in 2024, the SEC charged Keurig Dr Pepper for inaccurate claims about the recyclability of its K-Cup pods [8]. Despite disbanding its Climate and ESG Task Force in 2024, the SEC continues to pursue these cases through its general Division of Enforcement [8].

Certain legal protections exist for companies, such as the Private Securities Litigation Reform Act (PSLRA), which provides a safe harbor for forward-looking ESG statements. The "bespeaks caution" doctrine also offers protection if disclosures include meaningful cautionary language [8]. To navigate these risks, companies are advised to integrate climate-related metrics into their internal controls and establish cross-functional ESG committees to ensure consistent and accurate disclosures [7].

EU ESG Screening Rules

The European Union has adopted a centralized and mandatory ESG screening framework, setting it apart from the more fragmented approach seen in the United States. Instead of relying on state-specific rules or voluntary guidelines, the EU has established a uniform regulatory system that applies across all member states and even impacts many non-EU companies operating within Europe.

Main Regulations Driving ESG Screening

Four key regulations form the backbone of the EU’s ESG screening framework. The Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants to use standardized sustainability labels, aiming to enhance transparency and combat greenwashing [11]. By November 2025, proposed amendments will mandate that at least 70% of a product’s portfolio aligns with its stated sustainability strategy [13].

The Corporate Sustainability Reporting Directive (CSRD), which replaced the older Non-Financial Reporting Directive, elevates the importance of sustainability data by demanding it be treated with the same level of scrutiny as financial information. Dan Byrne of The Corporate Governance Institute explains:

Sustainability information will be treated with the same rigour and suspicion as financial information [10].

This directive applies to roughly 50,000 organizations across the EU [10].

The EU Taxonomy Regulation provides a clear classification system to identify which economic activities qualify as "environmentally sustainable", creating a benchmark for ESG screening [11]. Additionally, the ESG Rating Regulation (EU 2024/3005) requires ESG rating agencies to obtain authorization from the European Securities and Markets Authority (ESMA) and disclose their methodologies to ensure transparency and independence [9].

A standout feature of the EU framework is the double materiality requirement under the CSRD. Companies must report not only how sustainability issues affect their financial performance but also how their operations impact the environment and society [11].

Together, these regulations establish a robust foundation for consistent and reliable ESG reporting.

Reporting Standards and Assurance Requirements

To support these regulations, the EU enforces detailed reporting and verification protocols. The European Sustainability Reporting Standards (ESRS) provide mandatory templates covering 12 key areas, such as climate, pollution, workforce, and business conduct [12]. These templates promote consistency and comparability across companies, a contrast to the more flexible practices often seen in the U.S.

The CSRD introduces a phased implementation based on company size and type. Companies already subject to the earlier reporting directive began reporting in 2025 for their 2024 data. Other large companies meeting at least two of three criteria - balance sheet assets exceeding €20 million, turnover above €40 million, or more than 250 employees - will begin reporting in 2026 for their 2025 data. Listed small and medium-sized enterprises (SMEs) and smaller credit institutions follow in 2027, while non-EU companies with over €150 million in EU turnover must comply starting in 2029, covering their 2028 financial year [11].

Another critical element is mandatory assurance. Unlike voluntary frameworks, the CSRD requires sustainability data to undergo "limited assurance" from either a statutory auditor or an independent provider [12]. Additionally, reports must be digitally tagged for machine-readability through the European Single Access Point [11].

This rigorous approach ensures that ESG reporting in the EU is both trustworthy and accessible.

Main Differences Between US and EU ESG Screening Rules

Scope and Coverage Comparison

The United States and European Union take notably different approaches to ESG (Environmental, Social, and Governance) screening, particularly in terms of scope and coverage. In the US, the focus is on financial materiality, meaning companies are required to report only on factors that directly impact investor returns. On the other hand, the EU employs a double materiality framework, mandating disclosures that address not only financial impacts but also societal and environmental effects [1].

One key difference lies in the treatment of Scope 3 emissions - those generated across a company's value chain. Under the EU's Corporate Sustainability Reporting Directive (CSRD), companies must disclose material value-chain emissions. California's SB 253 also mandates Scope 3 reporting for companies with revenues exceeding $1 billion. By contrast, the federal SEC climate rule, which initially excluded Scope 3 reporting, has been indefinitely stayed [7].

The scope of entities covered also varies. Federal rules in the US apply only to public issuers, whereas California's laws extend to both public and private companies. For instance, SB 253 applies to entities with revenues over $1 billion, while SB 261 covers those with revenues above $500 million. Approximately 75% of Fortune 1000 companies fall under SB 253's jurisdiction [7]. Meanwhile, the EU's CSRD currently applies to large companies with 250 or more employees. However, a proposed February 2025 Omnibus package could raise this threshold to companies with over 1,000 employees, potentially reducing the number of affected businesses by 80% [7].

Feature | US Federal (SEC – Stayed) | US California (SB 253/261) | EU (CSRD) |

|---|---|---|---|

Primary Materiality | Financial Materiality | Disclosure required regardless of financial materiality | Double Materiality |

Scope 3 Reporting | Not Required | Required | Required |

Entity Type | Public issuers | Public and Private entities | Large companies (including non-EU parents) |

Revenue/Size Threshold | N/A | $1B+ (SB 253) / $500M+ (SB 261) | 250+ employees (proposed increase to 1,000+) |

Assurance | Conditional (if implemented) | Required | Mandatory (Limited Assurance) |

Michael Watson, Head of Climate and Sustainability Advisory at Pinsent Masons, highlights the challenge for US companies:

For US businesses, the lack of interoperability across regimes means thought will likely need to be given to adapting their processes for the different requirements we are seeing emerge across jurisdictions [14].

These structural differences don’t just influence compliance strategies - they also play a role in shaping global investment decisions and regulatory enforcement.

Enforcement and Compliance Approaches

The way ESG rules are enforced further underscores the divide between the US and EU. In the US, enforcement relies heavily on litigation. For example, the SEC climate rule has been indefinitely delayed due to legal challenges. Additionally, more than 40 anti-ESG bills introduced across 21 states have added layers of complexity to compliance [7].

By contrast, the EU employs standardized, mandatory frameworks that include third-party assurance. The CSRD requires "limited assurance" for ESG disclosures to ensure they are free from material misstatements. While this creates a more unified compliance environment across member states, challenges remain. As of early 2025, ten EU countries had yet to fully incorporate the CSRD into their national laws [7].

In the absence of federal mandates, California has become the de facto leader in ESG disclosure standards within the US. The California Air Resources Board announced in December 2024 that it would exercise enforcement discretion during the initial 2026 reporting cycle for SB 253, provided companies make "good faith efforts" to comply [7]. Matteo Tonello observes:

In the absence of federal mandates and disclosure rules, state-level regulations will instead likely shape the future of corporate sustainability disclosures in the US [7].

Meanwhile, the EU is signaling a shift toward simplification. The proposed 2025 Omnibus package includes measures to delay reporting deadlines and reduce the number of companies subject to the CSRD. This stands in stark contrast to the fragmented regulatory landscape in the US, where state-level rules dominate. For multinational organizations, navigating these divergent systems presents significant challenges for achieving consistent ESG integration.

Cross-Border Compliance Challenges

Managing Dual Compliance Requirements

For multinational companies, juggling both US and EU ESG regulations presents a maze of obstacles. The global reach of EU rules, for instance, requires non-EU parent companies generating over €150 million in the EU to report on a whole-group basis under the CSRD. This forces US multinationals to adopt EU standards across their operations, even as US federal rules remain comparatively lenient [1]. The clash between the EU’s “double materiality” approach and the US focus on financial materiality creates additional enforcement headaches across jurisdictions [1].

Timing misalignments add another layer of complexity. California mandates Scope 1 and 2 emissions reporting by January 1, 2026, while the EU's Omnibus proposal suggests delaying certain CSRD reporting for large companies until 2028 [1]. These disparities in timelines and requirements leave companies vulnerable to compliance gaps. Moreover, the detailed disclosures demanded by EU regulations could spark securities litigation in the US if the information is inconsistent with US filings or appears misleading under anti-fraud laws. As Skadden, Arps, Slate, Meagher & Flom LLP points out:

The granular information required by the EU could feed litigation in the U.S. if the disclosures appear false or misleading, or are inconsistent with disclosures in other jurisdictions [15].

Data reliability further complicates matters. Companies often depend on unregulated third-party ESG data providers or estimations to fill reporting gaps, increasing the risk of greenwashing accusations [1]. With 99% of S&P 500 companies already disclosing ESG-related information outside their SEC filings as of 2021, the pressure to ensure consistent, accurate data across diverse reporting frameworks has reached unprecedented levels [15]. These regulatory misalignments not only make compliance more difficult but also expose companies to heightened legal and reputational risks.

Using Expert Guidance for ESG Integration

To navigate these challenges, businesses need to move beyond piecemeal solutions and adopt comprehensive, expert-led strategies. Many organizations are embracing systems thinking to align their sustainability goals with varying regulatory frameworks. DLA Piper emphasizes the importance of balance:

ESG strategies must remain true to identified objectives and not be overly calibrated to the regulatory requirements of any one jurisdiction or they risk non-compliance with the requirements of other jurisdictions [4].

Practical steps include forming cross-functional teams that align legal, financial, and sustainability data for seamless reporting [1]. Implementing robust disclosure controls is equally critical, along with engaging external experts to review and validate disclosures. This ensures consistency across SEC filings, CSRD-based reports, and voluntary disclosures [1].

Organizations like Council Fire offer the strategic support needed to create unified reporting systems that meet rigorous ESG mandates, including Scope 3 emissions reporting required by both California's SB 253 and the EU's CSRD [1]. By adopting such integrated approaches, companies can ensure their sustainability initiatives deliver environmental, social, and economic benefits while meeting diverse regulatory demands.

Starting early is essential. As Norton Rose Fulbright cautions:

Noncompliance with the reporting requirements in the applicable jurisdiction(s) may be fatal to potential ventures, investment opportunities, and the public perception of involved parties [1].

Companies that establish strong ESG frameworks today will be better equipped to adapt to evolving regulations and maintain a competitive edge in the long run.

Effects on Global Investment and Business Strategies

How ESG Rules Affect Screening and Exclusion Policies

The differing regulatory approaches between the US and EU are reshaping how assets are screened and how capital is allocated globally. By 2024, global ESG fund assets reached an impressive $3.2 trillion, but investment patterns varied significantly by region [6]. For example, European investors added $8.6 billion to ESG funds in Q2 2025, while the US marked its eleventh straight quarter of withdrawals from such funds [6]. This regional split reflects not only differing investor attitudes but also fundamental contrasts in how sustainability standards are defined and enforced.

Shareholder behavior further highlights these differences. In 2024, UK and European asset managers supported 81% of shareholder ESG proposals on average, whereas their US counterparts backed only 25% [6]. Political dynamics amplify this divide - 47% of North American investors express concerns about potential legal or political backlash tied to ESG strategies, compared to just 30% of European investors [3]. Additionally, 54% of North American investors anticipate growing domestic opposition to ESG practices [3].

These challenges extend to fund managers, who must carefully navigate regulatory expectations when designing ESG-related products. In the US, the SEC’s “Names Rule” mandates that funds using ESG-related terminology allocate at least 80% of their assets to align with those claims [5][4]. Meanwhile, in the EU, many asset managers have reclassified funds from "Article 9" (dark green) to "Article 8" (light green) under the SFDR framework to avoid accusations of greenwashing [3]. These pressures push global investors to adopt region-specific disclosures while striving to uphold their broader ESG commitments.

Navigating these regulatory complexities often requires expert guidance, particularly in balancing compliance with strategic goals.

Working with Consultancies to Navigate ESG Complexity

Given these investment hurdles, consultancies play a crucial role in simplifying ESG integration and helping businesses maintain their competitive edge. Viewing ESG purely as a compliance task risks missing out on its strategic potential. Standardized ESG disclosures not only help businesses manage risks and identify opportunities but also provide a marketing edge in regions where sustainability awareness is high [3][2].

Organizations like Council Fire specialize in turning sustainability efforts into measurable business value. They tackle areas such as carbon footprint analysis, circular supply chain development, stakeholder-focused planning, and climate resilience strategies. This comprehensive approach equips companies to navigate the EU’s stringent regulatory environment while addressing the fragmented policies in the US. By adopting unified ESG practices, businesses can meet diverse regulatory requirements while staying true to their sustainability goals - a critical strategy for maintaining operational and strategic consistency across international markets.

Conclusion

Examining the regulatory frameworks in the US and EU reveals a growing divide that is reshaping how global businesses handle ESG screening. In the EU, the Corporate Sustainability Reporting Directive (CSRD) enforces a "double materiality" standard. This means companies must assess not only the financial impact of sustainability issues but also their broader societal and environmental effects, with phased requirements guiding implementation. Meanwhile, ESG disclosure in the US remains mostly voluntary at the federal level due to ongoing legal uncertainties. However, California's SB 253 and SB 261 have emerged as benchmarks, influencing approximately 75% of Fortune 1000 companies [7]. This divergence compels businesses to navigate the US's focus on financial materiality alongside the EU's broader double materiality, creating a challenging landscape for cross-border compliance.

The differences in regional timelines and regulatory scope add another layer of complexity. For example, the EU’s February 2025 Omnibus proposal is expected to streamline reporting requirements by cutting obligations by at least 25% [6]. Yet, businesses still face a fragmented system of conflicting standards across jurisdictions, which heightens compliance risks.

Notably, 97% of C-Suite executives recognize that sustainability reporting delivers benefits beyond mere compliance [7]. This underscores the importance of getting it right - not just for managing risks, but also for maintaining a competitive edge.

To achieve effective ESG integration, companies need a comprehensive and strategic approach. Council Fire offers solutions designed to turn regulatory challenges into opportunities. Their systems-thinking methodology helps businesses meet varied regulatory requirements while maintaining operational alignment and delivering measurable sustainability outcomes.

FAQs

What are the main differences between ESG screening rules in the US and EU?

The key distinction comes down to how regulations are handled. The European Union (EU) mandates strict ESG regulations, backed by legal requirements and penalties for non-compliance. On the other hand, the United States (US) leans toward a voluntary, market-driven approach, offering companies more freedom in how they implement ESG practices.

This regulatory gap creates challenges for global businesses that operate across both regions. Companies must juggle varying expectations and compliance standards, making it essential to tailor their sustainability strategies to meet the specific demands of each region.

How do ESG reporting rules in the US and EU affect multinational companies?

ESG reporting requirements in the US and EU pose considerable hurdles for multinational corporations due to their differing approaches. The EU enforces stringent regulations such as the Corporate Sustainability Reporting Directive (CSRD), which mandates detailed, standardized disclosures for companies with significant operations within Europe, regardless of where they are headquartered. In contrast, the US leans more toward voluntary, materiality-based disclosures, with relatively fewer mandatory rules. These differences can result in increased compliance costs and the risk of legal complications when disclosures don't align across jurisdictions.

To navigate these challenges, companies often rely on advanced data systems capable of harmonizing reporting efforts across regions. These systems help address varying materiality standards and manage differing timelines. Collaborating with consultancies like Council Fire, which specialize in sustainability, can simplify data collection, ensure adherence to both US and EU requirements, and strengthen relationships with stakeholders - all while supporting long-term organizational goals.

What makes the concept of 'double materiality' important in EU regulations?

The idea of double materiality plays a key role in EU regulations, especially within the framework of the Corporate Sustainability Reporting Directive (CSRD). This principle compels companies to assess two critical dimensions: how sustainability issues influence their financial outcomes and how their activities impact the environment and society.

By adopting this twofold perspective, businesses are encouraged to integrate sustainability more thoroughly into their strategies. This approach not only supports broader societal and environmental objectives but also helps organizations identify and manage risks that could affect their long-term viability.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 1, 2026

US vs. EU ESG Screening Rules: Key Differences

ESG Strategy

In This Article

Compare US and EU ESG screening rules — materiality, Scope 3, entity coverage, assurance, enforcement, and cross-border compliance implications for multinationals.

US vs. EU ESG Screening Rules: Key Differences

Navigating ESG Rules: US vs. EU

The US and EU take very different paths in how companies must report on environmental, social, and governance (ESG) factors, often requiring specialized sustainability consulting to navigate the complexities. Here's what you need to know:

US Approach: Fragmented, with no federal mandate. California leads with laws like SB 253, requiring large companies to report emissions starting January 2026. Federal rules, like the SEC's climate disclosure, remain stalled due to legal challenges.

EU Approach: Centralized with mandatory frameworks like the Corporate Sustainability Reporting Directive (CSRD). Companies must report both financial impacts and their societal/environmental effects (double materiality). Non-EU companies earning €150M+ in the EU must comply.

Materiality: US focuses on financial materiality (investor-relevant data), while the EU requires double materiality (financial + societal/environmental impacts).

Scope 3 Emissions: California and the EU require disclosure, but US federal rules do not.

Quick Comparison

Feature | US Federal (SEC) | California (SB 253/261) | EU (CSRD) |

|---|---|---|---|

Materiality | Financial only | Financial + some societal | Double (financial + societal/environmental) |

Scope 3 Reporting | Not required | Required | Required |

Entities Covered | Public companies | Public + private ($1B+ revenue) | Large companies (250+ employees, €150M+ EU turnover for non-EU firms) |

Assurance | None (if implemented) | Required | Mandatory (limited assurance) |

Key Takeaway: Companies operating in both regions face challenges aligning with these differing frameworks. The US leans on voluntary and state-specific rules, while the EU enforces stricter, unified standards. Understanding these differences is critical for compliance and global business planning.

US vs EU ESG Screening Rules Comparison Chart

Update on Key ESG Reporting Developments in the U.S. and EU: November 2025

US ESG Screening Rules

In the United States, there is no single, unified framework for ESG (Environmental, Social, and Governance) screening. Unlike the EU's centralized approach, the U.S. regulatory landscape is fragmented, with federal rules stalled and state-level mandates varying widely. This patchwork of requirements often creates conflicting obligations for businesses operating across multiple jurisdictions.

Main Regulations and Frameworks

In March 2024, the Securities and Exchange Commission (SEC) introduced new climate disclosure rules. These require publicly traded companies to report material climate risks, including Scope 1 and Scope 2 emissions, as well as severe weather-related losses exceeding 1% of their assets. However, these rules are currently on hold due to ongoing litigation, specifically the Iowa v. SEC case [8].

California has stepped in to fill part of the regulatory gap with two new laws. Senate Bill 253 (SB 253) mandates that companies with annual revenues exceeding $1 billion disclose their Scope 1, 2, and 3 emissions starting January 1, 2026. Senate Bill 261 (SB 261) requires companies with over $500 million in revenue to submit biennial climate risk reports, following the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations [7].

Matteo Tonello, Head of Benchmarking and Analytics at The Conference Board, remarked:

emerging as the standard for US climate disclosure [7].

Both California laws align with the Greenhouse Gas Protocol and TCFD framework, offering a degree of consistency for companies already using these standards. However, the situation is complicated by over 40 anti-ESG laws enacted across 21 states, creating additional compliance challenges for businesses operating nationwide [7].

This ever-changing regulatory environment has heightened the risk of litigation and liability for companies.

Litigation and Liability Risks

Litigation has become a key driver of ESG enforcement in the U.S. The SEC voluntarily stayed its climate disclosure rules due to a "flurry of lawsuits" brought by states, trade associations, and interest groups [1]. This reliance on legal challenges creates uncertainty and greatly influences how companies approach ESG disclosures.

Businesses also face potential shareholder lawsuits for misleading ESG statements or greenwashing claims under state consumer protection laws [8]. For example, in May 2023, the SEC reached a $56 million settlement with Vale S.A., an iron ore producer, for making false claims about dam safety in its sustainability reports prior to the 2019 Brumadinho disaster [8]. Additionally, in 2024, the SEC charged Keurig Dr Pepper for inaccurate claims about the recyclability of its K-Cup pods [8]. Despite disbanding its Climate and ESG Task Force in 2024, the SEC continues to pursue these cases through its general Division of Enforcement [8].

Certain legal protections exist for companies, such as the Private Securities Litigation Reform Act (PSLRA), which provides a safe harbor for forward-looking ESG statements. The "bespeaks caution" doctrine also offers protection if disclosures include meaningful cautionary language [8]. To navigate these risks, companies are advised to integrate climate-related metrics into their internal controls and establish cross-functional ESG committees to ensure consistent and accurate disclosures [7].

EU ESG Screening Rules

The European Union has adopted a centralized and mandatory ESG screening framework, setting it apart from the more fragmented approach seen in the United States. Instead of relying on state-specific rules or voluntary guidelines, the EU has established a uniform regulatory system that applies across all member states and even impacts many non-EU companies operating within Europe.

Main Regulations Driving ESG Screening

Four key regulations form the backbone of the EU’s ESG screening framework. The Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants to use standardized sustainability labels, aiming to enhance transparency and combat greenwashing [11]. By November 2025, proposed amendments will mandate that at least 70% of a product’s portfolio aligns with its stated sustainability strategy [13].

The Corporate Sustainability Reporting Directive (CSRD), which replaced the older Non-Financial Reporting Directive, elevates the importance of sustainability data by demanding it be treated with the same level of scrutiny as financial information. Dan Byrne of The Corporate Governance Institute explains:

Sustainability information will be treated with the same rigour and suspicion as financial information [10].

This directive applies to roughly 50,000 organizations across the EU [10].

The EU Taxonomy Regulation provides a clear classification system to identify which economic activities qualify as "environmentally sustainable", creating a benchmark for ESG screening [11]. Additionally, the ESG Rating Regulation (EU 2024/3005) requires ESG rating agencies to obtain authorization from the European Securities and Markets Authority (ESMA) and disclose their methodologies to ensure transparency and independence [9].

A standout feature of the EU framework is the double materiality requirement under the CSRD. Companies must report not only how sustainability issues affect their financial performance but also how their operations impact the environment and society [11].

Together, these regulations establish a robust foundation for consistent and reliable ESG reporting.

Reporting Standards and Assurance Requirements

To support these regulations, the EU enforces detailed reporting and verification protocols. The European Sustainability Reporting Standards (ESRS) provide mandatory templates covering 12 key areas, such as climate, pollution, workforce, and business conduct [12]. These templates promote consistency and comparability across companies, a contrast to the more flexible practices often seen in the U.S.

The CSRD introduces a phased implementation based on company size and type. Companies already subject to the earlier reporting directive began reporting in 2025 for their 2024 data. Other large companies meeting at least two of three criteria - balance sheet assets exceeding €20 million, turnover above €40 million, or more than 250 employees - will begin reporting in 2026 for their 2025 data. Listed small and medium-sized enterprises (SMEs) and smaller credit institutions follow in 2027, while non-EU companies with over €150 million in EU turnover must comply starting in 2029, covering their 2028 financial year [11].

Another critical element is mandatory assurance. Unlike voluntary frameworks, the CSRD requires sustainability data to undergo "limited assurance" from either a statutory auditor or an independent provider [12]. Additionally, reports must be digitally tagged for machine-readability through the European Single Access Point [11].

This rigorous approach ensures that ESG reporting in the EU is both trustworthy and accessible.

Main Differences Between US and EU ESG Screening Rules

Scope and Coverage Comparison

The United States and European Union take notably different approaches to ESG (Environmental, Social, and Governance) screening, particularly in terms of scope and coverage. In the US, the focus is on financial materiality, meaning companies are required to report only on factors that directly impact investor returns. On the other hand, the EU employs a double materiality framework, mandating disclosures that address not only financial impacts but also societal and environmental effects [1].

One key difference lies in the treatment of Scope 3 emissions - those generated across a company's value chain. Under the EU's Corporate Sustainability Reporting Directive (CSRD), companies must disclose material value-chain emissions. California's SB 253 also mandates Scope 3 reporting for companies with revenues exceeding $1 billion. By contrast, the federal SEC climate rule, which initially excluded Scope 3 reporting, has been indefinitely stayed [7].

The scope of entities covered also varies. Federal rules in the US apply only to public issuers, whereas California's laws extend to both public and private companies. For instance, SB 253 applies to entities with revenues over $1 billion, while SB 261 covers those with revenues above $500 million. Approximately 75% of Fortune 1000 companies fall under SB 253's jurisdiction [7]. Meanwhile, the EU's CSRD currently applies to large companies with 250 or more employees. However, a proposed February 2025 Omnibus package could raise this threshold to companies with over 1,000 employees, potentially reducing the number of affected businesses by 80% [7].

Feature | US Federal (SEC – Stayed) | US California (SB 253/261) | EU (CSRD) |

|---|---|---|---|

Primary Materiality | Financial Materiality | Disclosure required regardless of financial materiality | Double Materiality |

Scope 3 Reporting | Not Required | Required | Required |

Entity Type | Public issuers | Public and Private entities | Large companies (including non-EU parents) |

Revenue/Size Threshold | N/A | $1B+ (SB 253) / $500M+ (SB 261) | 250+ employees (proposed increase to 1,000+) |

Assurance | Conditional (if implemented) | Required | Mandatory (Limited Assurance) |

Michael Watson, Head of Climate and Sustainability Advisory at Pinsent Masons, highlights the challenge for US companies:

For US businesses, the lack of interoperability across regimes means thought will likely need to be given to adapting their processes for the different requirements we are seeing emerge across jurisdictions [14].

These structural differences don’t just influence compliance strategies - they also play a role in shaping global investment decisions and regulatory enforcement.

Enforcement and Compliance Approaches

The way ESG rules are enforced further underscores the divide between the US and EU. In the US, enforcement relies heavily on litigation. For example, the SEC climate rule has been indefinitely delayed due to legal challenges. Additionally, more than 40 anti-ESG bills introduced across 21 states have added layers of complexity to compliance [7].

By contrast, the EU employs standardized, mandatory frameworks that include third-party assurance. The CSRD requires "limited assurance" for ESG disclosures to ensure they are free from material misstatements. While this creates a more unified compliance environment across member states, challenges remain. As of early 2025, ten EU countries had yet to fully incorporate the CSRD into their national laws [7].

In the absence of federal mandates, California has become the de facto leader in ESG disclosure standards within the US. The California Air Resources Board announced in December 2024 that it would exercise enforcement discretion during the initial 2026 reporting cycle for SB 253, provided companies make "good faith efforts" to comply [7]. Matteo Tonello observes:

In the absence of federal mandates and disclosure rules, state-level regulations will instead likely shape the future of corporate sustainability disclosures in the US [7].

Meanwhile, the EU is signaling a shift toward simplification. The proposed 2025 Omnibus package includes measures to delay reporting deadlines and reduce the number of companies subject to the CSRD. This stands in stark contrast to the fragmented regulatory landscape in the US, where state-level rules dominate. For multinational organizations, navigating these divergent systems presents significant challenges for achieving consistent ESG integration.

Cross-Border Compliance Challenges

Managing Dual Compliance Requirements

For multinational companies, juggling both US and EU ESG regulations presents a maze of obstacles. The global reach of EU rules, for instance, requires non-EU parent companies generating over €150 million in the EU to report on a whole-group basis under the CSRD. This forces US multinationals to adopt EU standards across their operations, even as US federal rules remain comparatively lenient [1]. The clash between the EU’s “double materiality” approach and the US focus on financial materiality creates additional enforcement headaches across jurisdictions [1].

Timing misalignments add another layer of complexity. California mandates Scope 1 and 2 emissions reporting by January 1, 2026, while the EU's Omnibus proposal suggests delaying certain CSRD reporting for large companies until 2028 [1]. These disparities in timelines and requirements leave companies vulnerable to compliance gaps. Moreover, the detailed disclosures demanded by EU regulations could spark securities litigation in the US if the information is inconsistent with US filings or appears misleading under anti-fraud laws. As Skadden, Arps, Slate, Meagher & Flom LLP points out:

The granular information required by the EU could feed litigation in the U.S. if the disclosures appear false or misleading, or are inconsistent with disclosures in other jurisdictions [15].

Data reliability further complicates matters. Companies often depend on unregulated third-party ESG data providers or estimations to fill reporting gaps, increasing the risk of greenwashing accusations [1]. With 99% of S&P 500 companies already disclosing ESG-related information outside their SEC filings as of 2021, the pressure to ensure consistent, accurate data across diverse reporting frameworks has reached unprecedented levels [15]. These regulatory misalignments not only make compliance more difficult but also expose companies to heightened legal and reputational risks.

Using Expert Guidance for ESG Integration

To navigate these challenges, businesses need to move beyond piecemeal solutions and adopt comprehensive, expert-led strategies. Many organizations are embracing systems thinking to align their sustainability goals with varying regulatory frameworks. DLA Piper emphasizes the importance of balance:

ESG strategies must remain true to identified objectives and not be overly calibrated to the regulatory requirements of any one jurisdiction or they risk non-compliance with the requirements of other jurisdictions [4].

Practical steps include forming cross-functional teams that align legal, financial, and sustainability data for seamless reporting [1]. Implementing robust disclosure controls is equally critical, along with engaging external experts to review and validate disclosures. This ensures consistency across SEC filings, CSRD-based reports, and voluntary disclosures [1].

Organizations like Council Fire offer the strategic support needed to create unified reporting systems that meet rigorous ESG mandates, including Scope 3 emissions reporting required by both California's SB 253 and the EU's CSRD [1]. By adopting such integrated approaches, companies can ensure their sustainability initiatives deliver environmental, social, and economic benefits while meeting diverse regulatory demands.

Starting early is essential. As Norton Rose Fulbright cautions:

Noncompliance with the reporting requirements in the applicable jurisdiction(s) may be fatal to potential ventures, investment opportunities, and the public perception of involved parties [1].

Companies that establish strong ESG frameworks today will be better equipped to adapt to evolving regulations and maintain a competitive edge in the long run.

Effects on Global Investment and Business Strategies

How ESG Rules Affect Screening and Exclusion Policies

The differing regulatory approaches between the US and EU are reshaping how assets are screened and how capital is allocated globally. By 2024, global ESG fund assets reached an impressive $3.2 trillion, but investment patterns varied significantly by region [6]. For example, European investors added $8.6 billion to ESG funds in Q2 2025, while the US marked its eleventh straight quarter of withdrawals from such funds [6]. This regional split reflects not only differing investor attitudes but also fundamental contrasts in how sustainability standards are defined and enforced.

Shareholder behavior further highlights these differences. In 2024, UK and European asset managers supported 81% of shareholder ESG proposals on average, whereas their US counterparts backed only 25% [6]. Political dynamics amplify this divide - 47% of North American investors express concerns about potential legal or political backlash tied to ESG strategies, compared to just 30% of European investors [3]. Additionally, 54% of North American investors anticipate growing domestic opposition to ESG practices [3].

These challenges extend to fund managers, who must carefully navigate regulatory expectations when designing ESG-related products. In the US, the SEC’s “Names Rule” mandates that funds using ESG-related terminology allocate at least 80% of their assets to align with those claims [5][4]. Meanwhile, in the EU, many asset managers have reclassified funds from "Article 9" (dark green) to "Article 8" (light green) under the SFDR framework to avoid accusations of greenwashing [3]. These pressures push global investors to adopt region-specific disclosures while striving to uphold their broader ESG commitments.

Navigating these regulatory complexities often requires expert guidance, particularly in balancing compliance with strategic goals.

Working with Consultancies to Navigate ESG Complexity

Given these investment hurdles, consultancies play a crucial role in simplifying ESG integration and helping businesses maintain their competitive edge. Viewing ESG purely as a compliance task risks missing out on its strategic potential. Standardized ESG disclosures not only help businesses manage risks and identify opportunities but also provide a marketing edge in regions where sustainability awareness is high [3][2].

Organizations like Council Fire specialize in turning sustainability efforts into measurable business value. They tackle areas such as carbon footprint analysis, circular supply chain development, stakeholder-focused planning, and climate resilience strategies. This comprehensive approach equips companies to navigate the EU’s stringent regulatory environment while addressing the fragmented policies in the US. By adopting unified ESG practices, businesses can meet diverse regulatory requirements while staying true to their sustainability goals - a critical strategy for maintaining operational and strategic consistency across international markets.

Conclusion

Examining the regulatory frameworks in the US and EU reveals a growing divide that is reshaping how global businesses handle ESG screening. In the EU, the Corporate Sustainability Reporting Directive (CSRD) enforces a "double materiality" standard. This means companies must assess not only the financial impact of sustainability issues but also their broader societal and environmental effects, with phased requirements guiding implementation. Meanwhile, ESG disclosure in the US remains mostly voluntary at the federal level due to ongoing legal uncertainties. However, California's SB 253 and SB 261 have emerged as benchmarks, influencing approximately 75% of Fortune 1000 companies [7]. This divergence compels businesses to navigate the US's focus on financial materiality alongside the EU's broader double materiality, creating a challenging landscape for cross-border compliance.

The differences in regional timelines and regulatory scope add another layer of complexity. For example, the EU’s February 2025 Omnibus proposal is expected to streamline reporting requirements by cutting obligations by at least 25% [6]. Yet, businesses still face a fragmented system of conflicting standards across jurisdictions, which heightens compliance risks.

Notably, 97% of C-Suite executives recognize that sustainability reporting delivers benefits beyond mere compliance [7]. This underscores the importance of getting it right - not just for managing risks, but also for maintaining a competitive edge.

To achieve effective ESG integration, companies need a comprehensive and strategic approach. Council Fire offers solutions designed to turn regulatory challenges into opportunities. Their systems-thinking methodology helps businesses meet varied regulatory requirements while maintaining operational alignment and delivering measurable sustainability outcomes.

FAQs

What are the main differences between ESG screening rules in the US and EU?

The key distinction comes down to how regulations are handled. The European Union (EU) mandates strict ESG regulations, backed by legal requirements and penalties for non-compliance. On the other hand, the United States (US) leans toward a voluntary, market-driven approach, offering companies more freedom in how they implement ESG practices.

This regulatory gap creates challenges for global businesses that operate across both regions. Companies must juggle varying expectations and compliance standards, making it essential to tailor their sustainability strategies to meet the specific demands of each region.

How do ESG reporting rules in the US and EU affect multinational companies?

ESG reporting requirements in the US and EU pose considerable hurdles for multinational corporations due to their differing approaches. The EU enforces stringent regulations such as the Corporate Sustainability Reporting Directive (CSRD), which mandates detailed, standardized disclosures for companies with significant operations within Europe, regardless of where they are headquartered. In contrast, the US leans more toward voluntary, materiality-based disclosures, with relatively fewer mandatory rules. These differences can result in increased compliance costs and the risk of legal complications when disclosures don't align across jurisdictions.

To navigate these challenges, companies often rely on advanced data systems capable of harmonizing reporting efforts across regions. These systems help address varying materiality standards and manage differing timelines. Collaborating with consultancies like Council Fire, which specialize in sustainability, can simplify data collection, ensure adherence to both US and EU requirements, and strengthen relationships with stakeholders - all while supporting long-term organizational goals.

What makes the concept of 'double materiality' important in EU regulations?

The idea of double materiality plays a key role in EU regulations, especially within the framework of the Corporate Sustainability Reporting Directive (CSRD). This principle compels companies to assess two critical dimensions: how sustainability issues influence their financial outcomes and how their activities impact the environment and society.

By adopting this twofold perspective, businesses are encouraged to integrate sustainability more thoroughly into their strategies. This approach not only supports broader societal and environmental objectives but also helps organizations identify and manage risks that could affect their long-term viability.

Related Blog Posts

FAQ

What does it really mean to “redefine profit”?

What makes Council Fire different?

Who does Council Fire you work with?

What does working with Council Fire actually look like?

How does Council Fire help organizations turn big goals into action?

How does Council Fire define and measure success?