Jan 3, 2026

Jan 3, 2026

How to Meet ESG Rules in Energy Transmission

ESG Strategy

ESG Strategy

In This Article

Practical guidance for transmission companies on measuring Scope 1–3 emissions, aligning with TCFD/ISSB, upgrading lines, and building governance for ESG compliance.

How to Meet ESG Rules in Energy Transmission

Energy transmission companies face increasing pressure to comply with ESG (Environmental, Social, and Governance) standards, driven by stricter global regulations and stakeholder demands. These rules aim to reduce greenhouse gas emissions, improve social accountability, and ensure ethical governance. Here's a quick breakdown of the challenges and solutions:

Key Challenges:

Complex data tracking for emissions, particularly Scope 3 (80%-95% of carbon footprint).

Navigating overlapping state, federal, and global regulations like California's SB 253 and the EU's CSRD.

Aging infrastructure (70% of U.S. transmission lines are over 25 years old).

Solutions:

Use frameworks like TCFD and ISSB to streamline reporting.

Upgrade infrastructure with advanced conductors to double capacity cost-effectively.

Develop detailed governance and reporting systems to ensure compliance and build trust.

Partner with experts to address regulatory and technical requirements.

Meeting ESG standards isn't just about compliance - it positions companies to reduce risks, attract investment, and integrate renewable energy into the grid for long-term growth.

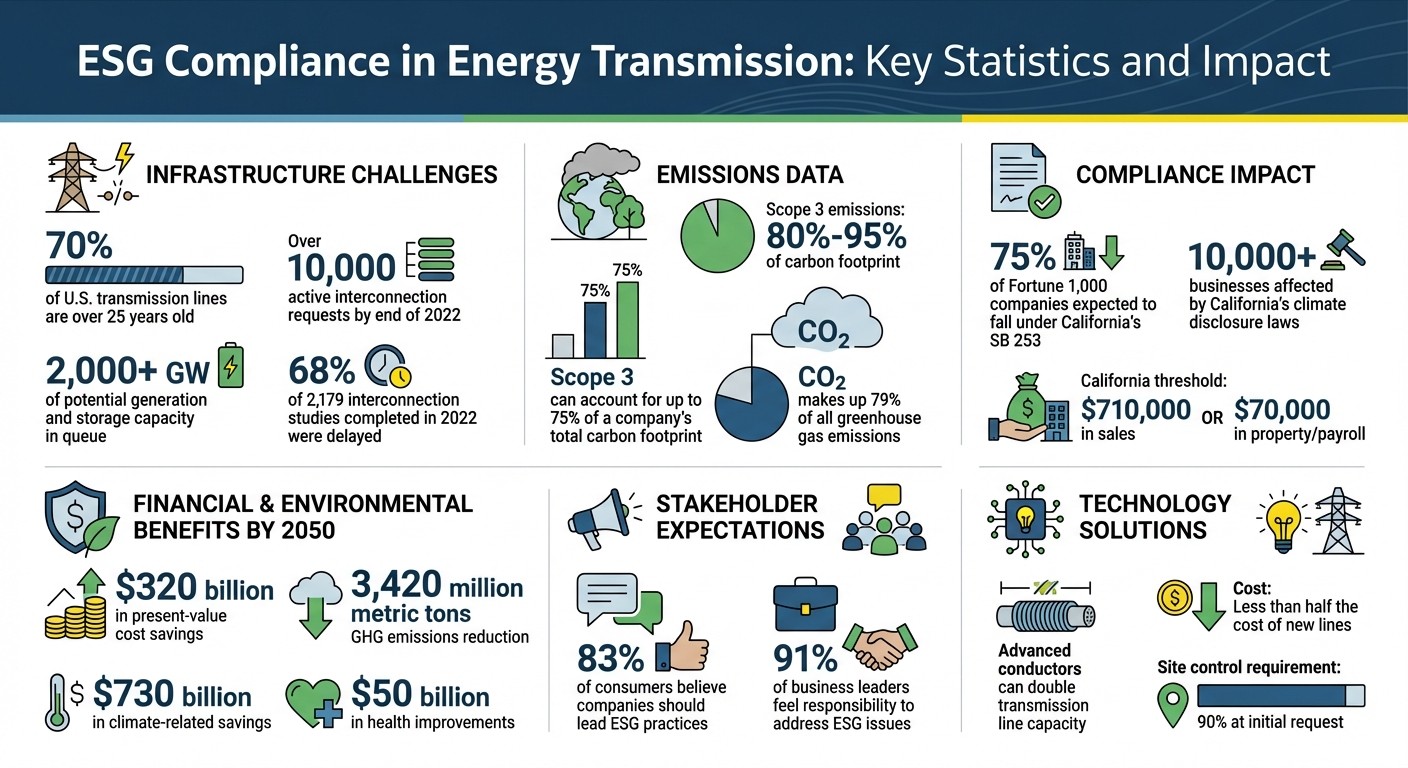

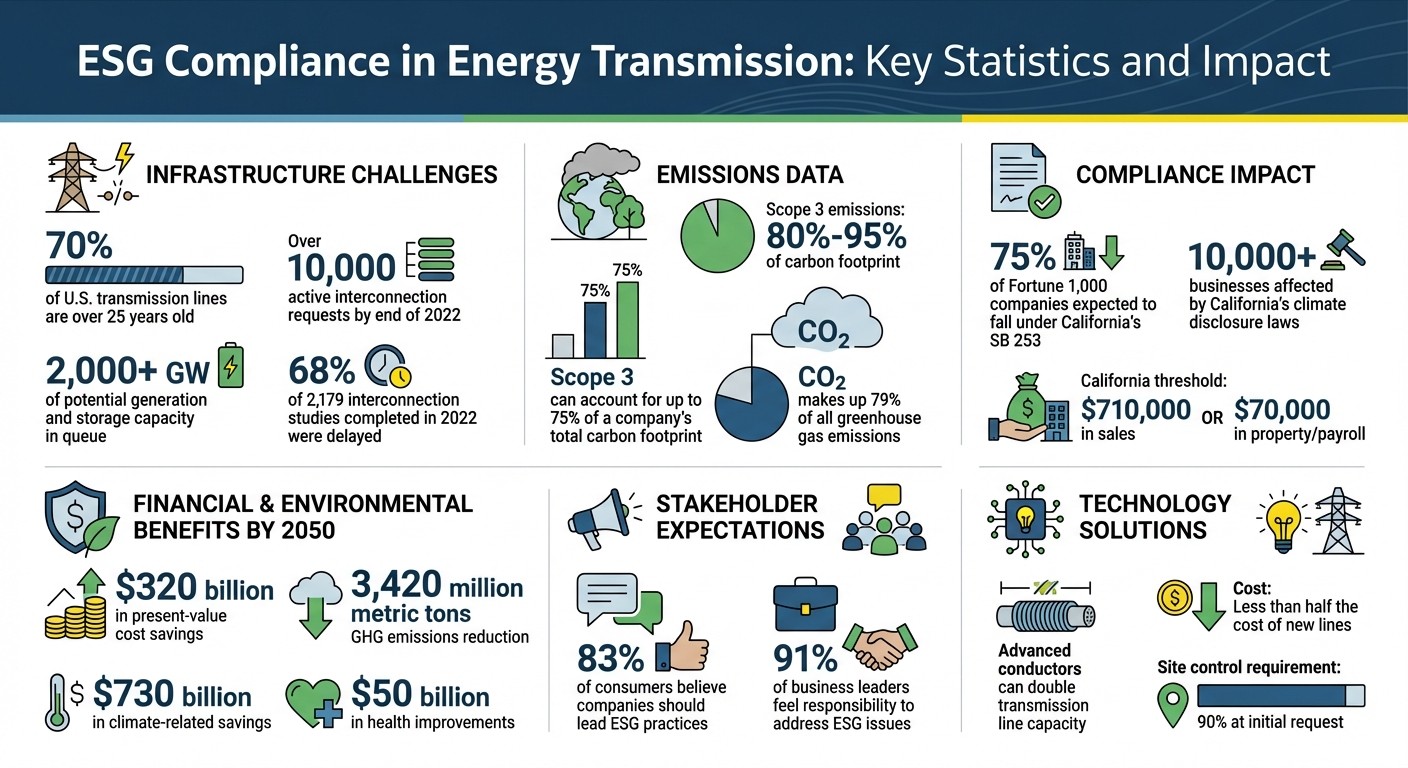

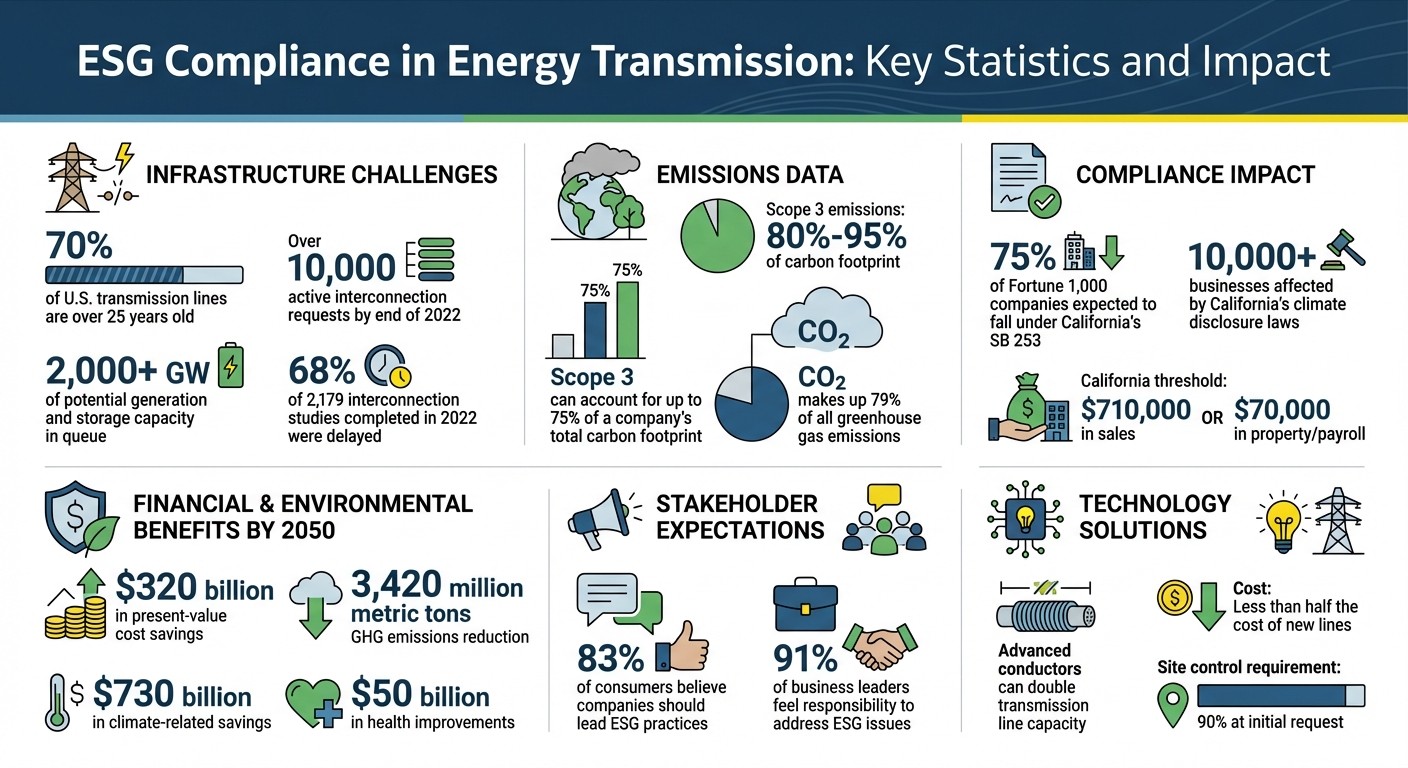

ESG Compliance in Energy Transmission: Key Statistics and Impact

Key ESG Regulations and Standards

ESG Standards for Energy Transmission

Energy transmission reporting is shaped by three primary standards. The Task Force on Climate-related Financial Disclosures (TCFD) forms the basis of many major regulations, including California’s climate laws and proposed SEC rules. The International Sustainability Standards Board (ISSB) issues IFRS Sustainability Reporting Standards, which require companies to incorporate Sustainability Accounting Standards Board (SASB) industry-specific guidelines. For businesses operating in Europe, the EU Corporate Sustainability Reporting Directive (CSRD) enforces detailed reporting in line with European Sustainability Reporting Standards (ESRS).

The TCFD's principles enable companies to repurpose data across various frameworks, minimizing redundant reporting efforts. However, each framework retains unique requirements. For example, California's SB 261 mandates TCFD-based disclosures of climate-related financial risks for companies with annual revenues exceeding $500 million. SB 253, on the other hand, requires comprehensive Scope 1, 2, and 3 greenhouse gas emissions reporting for entities generating over $1 billion annually. Notably, approximately 75% of Fortune 1,000 companies are expected to fall under SB 253, with over 10,000 businesses affected by California’s broader climate disclosure laws [3][5].

For 2023, any entity "doing business" in California is subject to these laws if it has sales exceeding $710,000 or property and payroll surpassing $70,000 [5]. PwC emphasizes that California’s low thresholds mean that even minimal financial activity in the state qualifies a business as active [5].

Let’s now explore how federal and state policies further influence these reporting obligations.

U.S. Federal and State Policy Requirements

Federal and state policies play a critical role in shaping compliance for energy transmission projects, influencing both operational practices and permitting processes alongside reporting standards.

FERC Order No. 2023 addresses the extensive interconnection backlogs by replacing the "first-come, first-served" approach with a "first-ready, first-served" cluster study model. By the end of 2022, U.S. interconnection queues had over 10,000 active requests, representing more than 2,000 gigawatts (GW) of potential generation and storage capacity. In the same year, 68% of the 2,179 interconnection studies completed were delayed, prompting FERC to implement firm deadlines and financial penalties for transmission providers [2].

The Coordinated Interagency Transmission Authorizations and Permits (CITAP) Program, established under 10 CFR Part 900, streamlines federal authorizations for siting electric transmission facilities. As stated by the Department of Energy:

This part seeks to ensure that these projects are developed consistent with the nation's environmental laws, including laws that address endangered and threatened species, critical habitats, and cultural and historic properties [4].

Looking ahead, FERC Order No. 1977, effective May 2024, will modernize transmission siting by requiring applicants to submit an "Environmental Justice Public Engagement Plan" and a "Tribal Consultation Policy" [6].

On the governance front, FERC Standards of Conduct (18 CFR Part 358) ensure transparency and prevent discrimination in energy markets by regulating the relationship between transmission providers and their marketing affiliates. These standards underpin the "Governance" pillar for transmission companies and align with environmental and social obligations. Additionally, interconnection customers are now required to demonstrate 90% site control when submitting their initial requests and achieve full site control by the facilities study stage to avoid penalties and delays in the queue [2].

How to Achieve ESG Compliance in Energy Transmission

Calculate and Report GHG Emissions

To meet ESG standards, energy transmission companies must start by accurately calculating their carbon footprint with the help of sustainability consulting. The first step involves defining organizational boundaries using one of three approaches: Operational Control (covering 100% of emissions from controlled assets), Financial Control (based on policy-directing ability), or Equity Share (proportional to ownership percentage) [9][10]. This decision ensures clarity on which assets to include in reports and prevents double counting.

Once boundaries are set, emissions should be categorized into three scopes:

Scope 1: Direct emissions from company-owned sources.

Scope 2: Indirect emissions from purchased energy.

Scope 3: Other indirect emissions across the value chain [9][10].

For electrical transmission equipment, apply the mass-balance method to track fluorinated greenhouse gases. This involves calculating inventory reductions, adding acquisitions, subtracting disbursements, and adjusting for changes in nameplate capacity [8].

Precision is key. For equipment rated above 38 kV, use tools like flow meters (±1%), pressure gauges (±0.5%), temperature gauges (±1°F), and scales with 1% accuracy [8]. If measured nameplate capacity deviates by 2% or more from the manufacturer’s specifications, use the measured value for reporting [8].

Monica Dorsey from Stok highlights the importance of standardized frameworks:

"The Greenhouse Gas Protocol (GHG Protocol)... establishes comprehensive global standardized frameworks to measure and manage greenhouse gas (GHG) emissions from private and public sector operations" [9].

To formalize these efforts, develop an Inventory Management Plan (IMP) that documents methodologies, maintains detailed records, and supports third-party verification [10]. Additionally, tools like the EPA's GHG Emission Factors Hub can help convert activity data into carbon dioxide equivalents (CO2e) [10].

Adopt Renewable Energy and Decarbonization Plans

After establishing an emissions baseline, focus on integrating renewable energy and upgrading infrastructure. One effective approach is reconductoring existing transmission lines with advanced conductors. According to GridLab:

"Advanced conductors can double existing transmission line capacity at less than half the cost and a fraction of the time as new lines" [11].

This is particularly relevant as nearly 70% of U.S. transmission lines are over 25 years old, nearing the end of their typical 50–80-year lifespan [12]. Upgrading transmission systems could cut greenhouse gas emissions by 3,420 million metric tons by 2050, while saving $320 billion in present-value costs [1]. The additional benefits include $730 billion in climate-related savings and $50 billion in health improvements by 2050 [1].

Improving interregional connectivity is another critical step. This allows for sharing reliability resources and accessing cost-effective renewable energy across larger areas. The Department of Energy (DOE) emphasizes:

"A robust transmission system is required to meet grid needs and support increased activity and load growth associated with data centers, new manufacturing facilities, and electrification" [1].

In October 2023, the DOE allocated $3.5 billion through its GRIP program to fund 58 projects across 44 states, focusing on boosting grid resilience and clean energy integration [12].

Additional strategies include implementing microgrids to enhance local power reliability during outages and developing offshore wind transmission networks to connect renewable energy sources to both coastal and inland regions. Use frameworks like the GHG Protocol and reporting platforms such as GRESB, CDP, or ISSB to ensure transparency and accountability [9].

Strengthen Grid Resilience and Resource Use

Grid resilience is a cornerstone of decarbonization. Expanding regional and interregional transmission lines helps share resources across wider areas, reducing outage risks during high-demand periods [1]. This shift from isolated upgrades to comprehensive solutions balances reliability with growing energy needs.

To meet EPA Subpart DD requirements, establish standardized protocols for gas recovery, particularly for SF6, and maintain detailed logs [8]. While carbon dioxide makes up about 79% of all greenhouse gas emissions, managing fluorinated gases is equally critical for transmission companies [13]. Tools like ReEDS can assist in identifying cost-effective and environmentally balanced investments in the power sector [1].

Build Governance and Reporting Systems

Strong governance ensures data accuracy and builds trust with stakeholders. Begin by consistently defining organizational boundaries - whether using operational control, financial control, or equity share - to clarify which assets are included in ESG reports [9]. This consistency improves transparency and simplifies audits.

As regulations tighten, such as California's SB 253 and the SEC Climate Disclosure Rule, thorough documentation is becoming increasingly important [9]. Scope 3 emissions, which can account for up to 75% of a company's carbon footprint, require particular attention [13]. Leveraging ESG and GHG emissions software can streamline data collection, minimize errors, and align with global frameworks like TCFD and ISSB [9][13].

Reporting through recognized platforms such as CDP, GRESB, or ISSB (IFRS S1 and S2) enhances credibility. Regular third-party verification further strengthens stakeholder confidence, ensuring compliance with evolving standards.

Working with Consultants for ESG Compliance

How Council Fire Supports ESG Implementation

Turning sustainability ambitions into actionable outcomes can be a complex journey, especially when navigating the intricate requirements of ESG compliance. Council Fire steps in with a systems-thinking approach and a focus on stakeholder-driven planning, helping businesses integrate sustainability into their operations while achieving measurable environmental and social outcomes.

The process starts with a materiality assessment, pinpointing the ESG factors that hold the most significance for your operations and stakeholders [14]. Following this, Council Fire helps establish robust governance frameworks by clearly defining roles and responsibilities for ESG oversight. This ensures accountability throughout the organization and prepares companies for regulatory requirements, such as the SEC’s mandate to disclose climate-related risks, management processes, and impacts exceeding 1% of a related financial statement line item [7][14]. By laying this strategic foundation, businesses are better positioned to meet technical compliance needs while aligning operations with sustainability goals.

Council Fire’s approach blends regulatory precision with forward-thinking strategy. For instance, they streamline transitions like those required under FERC Order No. 2023, which adopts a "first-ready" model to address procedural delays and meet evolving interconnection standards [2]. They also assess advanced technologies, such as innovative conductors and power flow controls, to facilitate the integration of renewable energy sources like wind, solar, and battery storage [2]. This combination of technical expertise and strategic planning ensures businesses stay ahead of regulatory requirements while advancing their sustainability objectives.

Benefits of Partnering with Council Fire

Council Fire offers more than just regulatory guidance - it delivers long-term strategic value by turning compliance challenges into opportunities for growth and excellence. Their specialized services include carbon footprint analysis, environmental audits, and the development of social responsibility programs [14]. These efforts help companies proactively address ESG-related risks, avoiding potential fines, reputational harm, or financial losses [14].

Transmission upgrades, for example, not only reduce emissions but also generate significant cost savings [1]. Council Fire’s data-driven methods ensure these benefits are fully realized by enhancing grid reliability and integrating affordable renewable energy sources [1].

Additionally, Council Fire emphasizes the importance of stakeholder engagement. By combining technical knowledge with effective communication strategies, they foster trust and drive meaningful progress. Their work spans natural resource management, energy infrastructure, and community development, ensuring every initiative delivers lasting impact. Instead of creating reports that merely sit on shelves, Council Fire transforms ambitious sustainability goals into actionable strategies that give companies a competitive edge.

Rob Gramlich from Grid Strategies on Transmission Reform and Clean Energy Access | Net Zero Compare

Conclusion

Meeting ESG requirements in energy transmission calls for thoughtful planning, clear reporting, and strong governance. Companies must prioritize building robust governance structures, monitor key performance metrics through standardized tools like FERC Form No. 715, and address the challenges posed by aging infrastructure. With nearly 70% of U.S. transmission lines exceeding 25 years in age [12], the urgency for action cannot be overstated.

The case for ESG compliance goes well beyond meeting regulations. Modernizing transmission infrastructure has the potential to save $320 billion by 2050 while reducing greenhouse gas emissions by 3,420 million metric tons [1]. These outcomes represent not only environmental progress but also critical financial opportunities. Upgrades strengthen grid reliability, enable broader integration of renewable energy, and position companies for success in an evolving energy sector.

Stakeholder expectations are also driving the need for action. According to research, 83% of consumers believe companies should lead in shaping ESG practices, and 91% of business leaders feel a responsibility to address ESG issues [15]. This alignment between public demand and corporate responsibility presents both a challenge and a chance for energy transmission companies to take the lead.

Navigating the complexities of ESG compliance often requires expert guidance. Specialized consultants offer the technical expertise, stakeholder engagement strategies, and systems-based approaches necessary to turn sustainability goals into measurable outcomes. They help organizations avoid pitfalls like greenwashing, identify key ESG factors, and establish governance models that ensure accountability. Firms such as Council Fire play a critical role in translating these challenges into actionable strategies, enabling companies to achieve meaningful results.

Achieving success in this space requires bold action. By adopting science-driven targets, investing in modern grid technologies, and fostering community partnerships through well-rounded benefits plans, energy transmission companies can transform ESG compliance into a competitive edge. Combining rigorous governance with forward-looking investments ensures not only compliance but also sustainable growth, delivering environmental, social, and economic benefits that resonate far into the future.

FAQs

What challenges do energy transmission companies face in meeting ESG requirements?

Energy transmission companies encounter several hurdles in meeting ESG requirements. One significant area is environmental compliance, which demands a thorough evaluation of the direct, indirect, and cumulative impacts of their projects. The process becomes even more intricate when navigating federal and state permitting systems, often involving multiple agencies with overlapping jurisdictions. These complexities can result in delays and longer project timelines.

Another challenge lies in governance and reporting. Companies must comply with stringent regulations, such as FERC's Standards of Conduct, while keeping up with evolving ESG reporting standards. This requires implementing accurate and auditable data systems alongside strong internal controls to ensure the credibility of their ESG reports.

On top of these, there are physical and social challenges to address. Designing infrastructure capable of withstanding extreme weather is crucial, as is fostering meaningful engagement with local communities and Indigenous tribes. Transparent communication and fair distribution of project benefits are key to earning trust and advancing sustainability goals. Expert consultation, such as that offered by Council Fire, can provide valuable support in navigating these intricate issues.

How can energy transmission companies track and report Scope 3 emissions effectively?

To effectively track and report Scope 3 emissions, energy transmission companies can adopt a systematic process that ensures accuracy and transparency:

Set clear boundaries: Begin by identifying the relevant areas of your value chain. This includes suppliers, contractors, and electricity users. Determine which Scope 3 categories are applicable to your operations to create a focused and manageable framework.

Gather necessary data: Collaborate with partners to collect key activity data, such as fuel consumption, material usage, and emissions reported by suppliers. When direct information isn’t available, rely on trusted emission factors to fill in the gaps.

Calculate and disclose emissions: Use established methods to calculate emissions, converting the results into metric tons of CO₂-equivalent (t CO₂e). Provide detailed and transparent disclosures, including the methodologies, data sources, and breakdowns of emissions by category.

For those seeking additional guidance, Council Fire, a consultancy specializing in sustainability initiatives, offers valuable support. They can help simplify data management, enhance collaboration across stakeholders, and ensure alignment with reporting standards.

How do federal and state policies impact ESG compliance for energy transmission projects?

Federal and state policies are key in defining the ESG compliance landscape for energy transmission projects, establishing the rules and standards that developers must adhere to. At the federal level, the Federal Energy Regulatory Commission (FERC) plays a central role, managing permitting and environmental reviews to ensure projects meet criteria for safety, transparency, and environmental stewardship. Notable updates, such as the 2023 Interconnection Final Rule, aim to simplify grid connection processes while maintaining a focus on reliability and environmental responsibility. Federal guidelines also emphasize collaboration with states and Tribes to uphold environmental and social protections.

On the state level, policies introduce additional ESG requirements, including stricter environmental impact assessments, land-use planning, and renewable energy targets. These regulations shape decisions on project locations, permitting schedules, and community involvement, often incorporating goals to address climate challenges and promote equitable access to clean energy. Together, these federal and state frameworks create a complex regulatory environment that energy companies must carefully navigate.

Council Fire offers expertise to help energy companies interpret these intricate regulations, align their projects with ESG objectives, and foster meaningful stakeholder engagement to support sustainable energy solutions.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 3, 2026

How to Meet ESG Rules in Energy Transmission

ESG Strategy

In This Article

Practical guidance for transmission companies on measuring Scope 1–3 emissions, aligning with TCFD/ISSB, upgrading lines, and building governance for ESG compliance.

How to Meet ESG Rules in Energy Transmission

Energy transmission companies face increasing pressure to comply with ESG (Environmental, Social, and Governance) standards, driven by stricter global regulations and stakeholder demands. These rules aim to reduce greenhouse gas emissions, improve social accountability, and ensure ethical governance. Here's a quick breakdown of the challenges and solutions:

Key Challenges:

Complex data tracking for emissions, particularly Scope 3 (80%-95% of carbon footprint).

Navigating overlapping state, federal, and global regulations like California's SB 253 and the EU's CSRD.

Aging infrastructure (70% of U.S. transmission lines are over 25 years old).

Solutions:

Use frameworks like TCFD and ISSB to streamline reporting.

Upgrade infrastructure with advanced conductors to double capacity cost-effectively.

Develop detailed governance and reporting systems to ensure compliance and build trust.

Partner with experts to address regulatory and technical requirements.

Meeting ESG standards isn't just about compliance - it positions companies to reduce risks, attract investment, and integrate renewable energy into the grid for long-term growth.

ESG Compliance in Energy Transmission: Key Statistics and Impact

Key ESG Regulations and Standards

ESG Standards for Energy Transmission

Energy transmission reporting is shaped by three primary standards. The Task Force on Climate-related Financial Disclosures (TCFD) forms the basis of many major regulations, including California’s climate laws and proposed SEC rules. The International Sustainability Standards Board (ISSB) issues IFRS Sustainability Reporting Standards, which require companies to incorporate Sustainability Accounting Standards Board (SASB) industry-specific guidelines. For businesses operating in Europe, the EU Corporate Sustainability Reporting Directive (CSRD) enforces detailed reporting in line with European Sustainability Reporting Standards (ESRS).

The TCFD's principles enable companies to repurpose data across various frameworks, minimizing redundant reporting efforts. However, each framework retains unique requirements. For example, California's SB 261 mandates TCFD-based disclosures of climate-related financial risks for companies with annual revenues exceeding $500 million. SB 253, on the other hand, requires comprehensive Scope 1, 2, and 3 greenhouse gas emissions reporting for entities generating over $1 billion annually. Notably, approximately 75% of Fortune 1,000 companies are expected to fall under SB 253, with over 10,000 businesses affected by California’s broader climate disclosure laws [3][5].

For 2023, any entity "doing business" in California is subject to these laws if it has sales exceeding $710,000 or property and payroll surpassing $70,000 [5]. PwC emphasizes that California’s low thresholds mean that even minimal financial activity in the state qualifies a business as active [5].

Let’s now explore how federal and state policies further influence these reporting obligations.

U.S. Federal and State Policy Requirements

Federal and state policies play a critical role in shaping compliance for energy transmission projects, influencing both operational practices and permitting processes alongside reporting standards.

FERC Order No. 2023 addresses the extensive interconnection backlogs by replacing the "first-come, first-served" approach with a "first-ready, first-served" cluster study model. By the end of 2022, U.S. interconnection queues had over 10,000 active requests, representing more than 2,000 gigawatts (GW) of potential generation and storage capacity. In the same year, 68% of the 2,179 interconnection studies completed were delayed, prompting FERC to implement firm deadlines and financial penalties for transmission providers [2].

The Coordinated Interagency Transmission Authorizations and Permits (CITAP) Program, established under 10 CFR Part 900, streamlines federal authorizations for siting electric transmission facilities. As stated by the Department of Energy:

This part seeks to ensure that these projects are developed consistent with the nation's environmental laws, including laws that address endangered and threatened species, critical habitats, and cultural and historic properties [4].

Looking ahead, FERC Order No. 1977, effective May 2024, will modernize transmission siting by requiring applicants to submit an "Environmental Justice Public Engagement Plan" and a "Tribal Consultation Policy" [6].

On the governance front, FERC Standards of Conduct (18 CFR Part 358) ensure transparency and prevent discrimination in energy markets by regulating the relationship between transmission providers and their marketing affiliates. These standards underpin the "Governance" pillar for transmission companies and align with environmental and social obligations. Additionally, interconnection customers are now required to demonstrate 90% site control when submitting their initial requests and achieve full site control by the facilities study stage to avoid penalties and delays in the queue [2].

How to Achieve ESG Compliance in Energy Transmission

Calculate and Report GHG Emissions

To meet ESG standards, energy transmission companies must start by accurately calculating their carbon footprint with the help of sustainability consulting. The first step involves defining organizational boundaries using one of three approaches: Operational Control (covering 100% of emissions from controlled assets), Financial Control (based on policy-directing ability), or Equity Share (proportional to ownership percentage) [9][10]. This decision ensures clarity on which assets to include in reports and prevents double counting.

Once boundaries are set, emissions should be categorized into three scopes:

Scope 1: Direct emissions from company-owned sources.

Scope 2: Indirect emissions from purchased energy.

Scope 3: Other indirect emissions across the value chain [9][10].

For electrical transmission equipment, apply the mass-balance method to track fluorinated greenhouse gases. This involves calculating inventory reductions, adding acquisitions, subtracting disbursements, and adjusting for changes in nameplate capacity [8].

Precision is key. For equipment rated above 38 kV, use tools like flow meters (±1%), pressure gauges (±0.5%), temperature gauges (±1°F), and scales with 1% accuracy [8]. If measured nameplate capacity deviates by 2% or more from the manufacturer’s specifications, use the measured value for reporting [8].

Monica Dorsey from Stok highlights the importance of standardized frameworks:

"The Greenhouse Gas Protocol (GHG Protocol)... establishes comprehensive global standardized frameworks to measure and manage greenhouse gas (GHG) emissions from private and public sector operations" [9].

To formalize these efforts, develop an Inventory Management Plan (IMP) that documents methodologies, maintains detailed records, and supports third-party verification [10]. Additionally, tools like the EPA's GHG Emission Factors Hub can help convert activity data into carbon dioxide equivalents (CO2e) [10].

Adopt Renewable Energy and Decarbonization Plans

After establishing an emissions baseline, focus on integrating renewable energy and upgrading infrastructure. One effective approach is reconductoring existing transmission lines with advanced conductors. According to GridLab:

"Advanced conductors can double existing transmission line capacity at less than half the cost and a fraction of the time as new lines" [11].

This is particularly relevant as nearly 70% of U.S. transmission lines are over 25 years old, nearing the end of their typical 50–80-year lifespan [12]. Upgrading transmission systems could cut greenhouse gas emissions by 3,420 million metric tons by 2050, while saving $320 billion in present-value costs [1]. The additional benefits include $730 billion in climate-related savings and $50 billion in health improvements by 2050 [1].

Improving interregional connectivity is another critical step. This allows for sharing reliability resources and accessing cost-effective renewable energy across larger areas. The Department of Energy (DOE) emphasizes:

"A robust transmission system is required to meet grid needs and support increased activity and load growth associated with data centers, new manufacturing facilities, and electrification" [1].

In October 2023, the DOE allocated $3.5 billion through its GRIP program to fund 58 projects across 44 states, focusing on boosting grid resilience and clean energy integration [12].

Additional strategies include implementing microgrids to enhance local power reliability during outages and developing offshore wind transmission networks to connect renewable energy sources to both coastal and inland regions. Use frameworks like the GHG Protocol and reporting platforms such as GRESB, CDP, or ISSB to ensure transparency and accountability [9].

Strengthen Grid Resilience and Resource Use

Grid resilience is a cornerstone of decarbonization. Expanding regional and interregional transmission lines helps share resources across wider areas, reducing outage risks during high-demand periods [1]. This shift from isolated upgrades to comprehensive solutions balances reliability with growing energy needs.

To meet EPA Subpart DD requirements, establish standardized protocols for gas recovery, particularly for SF6, and maintain detailed logs [8]. While carbon dioxide makes up about 79% of all greenhouse gas emissions, managing fluorinated gases is equally critical for transmission companies [13]. Tools like ReEDS can assist in identifying cost-effective and environmentally balanced investments in the power sector [1].

Build Governance and Reporting Systems

Strong governance ensures data accuracy and builds trust with stakeholders. Begin by consistently defining organizational boundaries - whether using operational control, financial control, or equity share - to clarify which assets are included in ESG reports [9]. This consistency improves transparency and simplifies audits.

As regulations tighten, such as California's SB 253 and the SEC Climate Disclosure Rule, thorough documentation is becoming increasingly important [9]. Scope 3 emissions, which can account for up to 75% of a company's carbon footprint, require particular attention [13]. Leveraging ESG and GHG emissions software can streamline data collection, minimize errors, and align with global frameworks like TCFD and ISSB [9][13].

Reporting through recognized platforms such as CDP, GRESB, or ISSB (IFRS S1 and S2) enhances credibility. Regular third-party verification further strengthens stakeholder confidence, ensuring compliance with evolving standards.

Working with Consultants for ESG Compliance

How Council Fire Supports ESG Implementation

Turning sustainability ambitions into actionable outcomes can be a complex journey, especially when navigating the intricate requirements of ESG compliance. Council Fire steps in with a systems-thinking approach and a focus on stakeholder-driven planning, helping businesses integrate sustainability into their operations while achieving measurable environmental and social outcomes.

The process starts with a materiality assessment, pinpointing the ESG factors that hold the most significance for your operations and stakeholders [14]. Following this, Council Fire helps establish robust governance frameworks by clearly defining roles and responsibilities for ESG oversight. This ensures accountability throughout the organization and prepares companies for regulatory requirements, such as the SEC’s mandate to disclose climate-related risks, management processes, and impacts exceeding 1% of a related financial statement line item [7][14]. By laying this strategic foundation, businesses are better positioned to meet technical compliance needs while aligning operations with sustainability goals.

Council Fire’s approach blends regulatory precision with forward-thinking strategy. For instance, they streamline transitions like those required under FERC Order No. 2023, which adopts a "first-ready" model to address procedural delays and meet evolving interconnection standards [2]. They also assess advanced technologies, such as innovative conductors and power flow controls, to facilitate the integration of renewable energy sources like wind, solar, and battery storage [2]. This combination of technical expertise and strategic planning ensures businesses stay ahead of regulatory requirements while advancing their sustainability objectives.

Benefits of Partnering with Council Fire

Council Fire offers more than just regulatory guidance - it delivers long-term strategic value by turning compliance challenges into opportunities for growth and excellence. Their specialized services include carbon footprint analysis, environmental audits, and the development of social responsibility programs [14]. These efforts help companies proactively address ESG-related risks, avoiding potential fines, reputational harm, or financial losses [14].

Transmission upgrades, for example, not only reduce emissions but also generate significant cost savings [1]. Council Fire’s data-driven methods ensure these benefits are fully realized by enhancing grid reliability and integrating affordable renewable energy sources [1].

Additionally, Council Fire emphasizes the importance of stakeholder engagement. By combining technical knowledge with effective communication strategies, they foster trust and drive meaningful progress. Their work spans natural resource management, energy infrastructure, and community development, ensuring every initiative delivers lasting impact. Instead of creating reports that merely sit on shelves, Council Fire transforms ambitious sustainability goals into actionable strategies that give companies a competitive edge.

Rob Gramlich from Grid Strategies on Transmission Reform and Clean Energy Access | Net Zero Compare

Conclusion

Meeting ESG requirements in energy transmission calls for thoughtful planning, clear reporting, and strong governance. Companies must prioritize building robust governance structures, monitor key performance metrics through standardized tools like FERC Form No. 715, and address the challenges posed by aging infrastructure. With nearly 70% of U.S. transmission lines exceeding 25 years in age [12], the urgency for action cannot be overstated.

The case for ESG compliance goes well beyond meeting regulations. Modernizing transmission infrastructure has the potential to save $320 billion by 2050 while reducing greenhouse gas emissions by 3,420 million metric tons [1]. These outcomes represent not only environmental progress but also critical financial opportunities. Upgrades strengthen grid reliability, enable broader integration of renewable energy, and position companies for success in an evolving energy sector.

Stakeholder expectations are also driving the need for action. According to research, 83% of consumers believe companies should lead in shaping ESG practices, and 91% of business leaders feel a responsibility to address ESG issues [15]. This alignment between public demand and corporate responsibility presents both a challenge and a chance for energy transmission companies to take the lead.

Navigating the complexities of ESG compliance often requires expert guidance. Specialized consultants offer the technical expertise, stakeholder engagement strategies, and systems-based approaches necessary to turn sustainability goals into measurable outcomes. They help organizations avoid pitfalls like greenwashing, identify key ESG factors, and establish governance models that ensure accountability. Firms such as Council Fire play a critical role in translating these challenges into actionable strategies, enabling companies to achieve meaningful results.

Achieving success in this space requires bold action. By adopting science-driven targets, investing in modern grid technologies, and fostering community partnerships through well-rounded benefits plans, energy transmission companies can transform ESG compliance into a competitive edge. Combining rigorous governance with forward-looking investments ensures not only compliance but also sustainable growth, delivering environmental, social, and economic benefits that resonate far into the future.

FAQs

What challenges do energy transmission companies face in meeting ESG requirements?

Energy transmission companies encounter several hurdles in meeting ESG requirements. One significant area is environmental compliance, which demands a thorough evaluation of the direct, indirect, and cumulative impacts of their projects. The process becomes even more intricate when navigating federal and state permitting systems, often involving multiple agencies with overlapping jurisdictions. These complexities can result in delays and longer project timelines.

Another challenge lies in governance and reporting. Companies must comply with stringent regulations, such as FERC's Standards of Conduct, while keeping up with evolving ESG reporting standards. This requires implementing accurate and auditable data systems alongside strong internal controls to ensure the credibility of their ESG reports.

On top of these, there are physical and social challenges to address. Designing infrastructure capable of withstanding extreme weather is crucial, as is fostering meaningful engagement with local communities and Indigenous tribes. Transparent communication and fair distribution of project benefits are key to earning trust and advancing sustainability goals. Expert consultation, such as that offered by Council Fire, can provide valuable support in navigating these intricate issues.

How can energy transmission companies track and report Scope 3 emissions effectively?

To effectively track and report Scope 3 emissions, energy transmission companies can adopt a systematic process that ensures accuracy and transparency:

Set clear boundaries: Begin by identifying the relevant areas of your value chain. This includes suppliers, contractors, and electricity users. Determine which Scope 3 categories are applicable to your operations to create a focused and manageable framework.

Gather necessary data: Collaborate with partners to collect key activity data, such as fuel consumption, material usage, and emissions reported by suppliers. When direct information isn’t available, rely on trusted emission factors to fill in the gaps.

Calculate and disclose emissions: Use established methods to calculate emissions, converting the results into metric tons of CO₂-equivalent (t CO₂e). Provide detailed and transparent disclosures, including the methodologies, data sources, and breakdowns of emissions by category.

For those seeking additional guidance, Council Fire, a consultancy specializing in sustainability initiatives, offers valuable support. They can help simplify data management, enhance collaboration across stakeholders, and ensure alignment with reporting standards.

How do federal and state policies impact ESG compliance for energy transmission projects?

Federal and state policies are key in defining the ESG compliance landscape for energy transmission projects, establishing the rules and standards that developers must adhere to. At the federal level, the Federal Energy Regulatory Commission (FERC) plays a central role, managing permitting and environmental reviews to ensure projects meet criteria for safety, transparency, and environmental stewardship. Notable updates, such as the 2023 Interconnection Final Rule, aim to simplify grid connection processes while maintaining a focus on reliability and environmental responsibility. Federal guidelines also emphasize collaboration with states and Tribes to uphold environmental and social protections.

On the state level, policies introduce additional ESG requirements, including stricter environmental impact assessments, land-use planning, and renewable energy targets. These regulations shape decisions on project locations, permitting schedules, and community involvement, often incorporating goals to address climate challenges and promote equitable access to clean energy. Together, these federal and state frameworks create a complex regulatory environment that energy companies must carefully navigate.

Council Fire offers expertise to help energy companies interpret these intricate regulations, align their projects with ESG objectives, and foster meaningful stakeholder engagement to support sustainable energy solutions.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 3, 2026

How to Meet ESG Rules in Energy Transmission

ESG Strategy

In This Article

Practical guidance for transmission companies on measuring Scope 1–3 emissions, aligning with TCFD/ISSB, upgrading lines, and building governance for ESG compliance.

How to Meet ESG Rules in Energy Transmission

Energy transmission companies face increasing pressure to comply with ESG (Environmental, Social, and Governance) standards, driven by stricter global regulations and stakeholder demands. These rules aim to reduce greenhouse gas emissions, improve social accountability, and ensure ethical governance. Here's a quick breakdown of the challenges and solutions:

Key Challenges:

Complex data tracking for emissions, particularly Scope 3 (80%-95% of carbon footprint).

Navigating overlapping state, federal, and global regulations like California's SB 253 and the EU's CSRD.

Aging infrastructure (70% of U.S. transmission lines are over 25 years old).

Solutions:

Use frameworks like TCFD and ISSB to streamline reporting.

Upgrade infrastructure with advanced conductors to double capacity cost-effectively.

Develop detailed governance and reporting systems to ensure compliance and build trust.

Partner with experts to address regulatory and technical requirements.

Meeting ESG standards isn't just about compliance - it positions companies to reduce risks, attract investment, and integrate renewable energy into the grid for long-term growth.

ESG Compliance in Energy Transmission: Key Statistics and Impact

Key ESG Regulations and Standards

ESG Standards for Energy Transmission

Energy transmission reporting is shaped by three primary standards. The Task Force on Climate-related Financial Disclosures (TCFD) forms the basis of many major regulations, including California’s climate laws and proposed SEC rules. The International Sustainability Standards Board (ISSB) issues IFRS Sustainability Reporting Standards, which require companies to incorporate Sustainability Accounting Standards Board (SASB) industry-specific guidelines. For businesses operating in Europe, the EU Corporate Sustainability Reporting Directive (CSRD) enforces detailed reporting in line with European Sustainability Reporting Standards (ESRS).

The TCFD's principles enable companies to repurpose data across various frameworks, minimizing redundant reporting efforts. However, each framework retains unique requirements. For example, California's SB 261 mandates TCFD-based disclosures of climate-related financial risks for companies with annual revenues exceeding $500 million. SB 253, on the other hand, requires comprehensive Scope 1, 2, and 3 greenhouse gas emissions reporting for entities generating over $1 billion annually. Notably, approximately 75% of Fortune 1,000 companies are expected to fall under SB 253, with over 10,000 businesses affected by California’s broader climate disclosure laws [3][5].

For 2023, any entity "doing business" in California is subject to these laws if it has sales exceeding $710,000 or property and payroll surpassing $70,000 [5]. PwC emphasizes that California’s low thresholds mean that even minimal financial activity in the state qualifies a business as active [5].

Let’s now explore how federal and state policies further influence these reporting obligations.

U.S. Federal and State Policy Requirements

Federal and state policies play a critical role in shaping compliance for energy transmission projects, influencing both operational practices and permitting processes alongside reporting standards.

FERC Order No. 2023 addresses the extensive interconnection backlogs by replacing the "first-come, first-served" approach with a "first-ready, first-served" cluster study model. By the end of 2022, U.S. interconnection queues had over 10,000 active requests, representing more than 2,000 gigawatts (GW) of potential generation and storage capacity. In the same year, 68% of the 2,179 interconnection studies completed were delayed, prompting FERC to implement firm deadlines and financial penalties for transmission providers [2].

The Coordinated Interagency Transmission Authorizations and Permits (CITAP) Program, established under 10 CFR Part 900, streamlines federal authorizations for siting electric transmission facilities. As stated by the Department of Energy:

This part seeks to ensure that these projects are developed consistent with the nation's environmental laws, including laws that address endangered and threatened species, critical habitats, and cultural and historic properties [4].

Looking ahead, FERC Order No. 1977, effective May 2024, will modernize transmission siting by requiring applicants to submit an "Environmental Justice Public Engagement Plan" and a "Tribal Consultation Policy" [6].

On the governance front, FERC Standards of Conduct (18 CFR Part 358) ensure transparency and prevent discrimination in energy markets by regulating the relationship between transmission providers and their marketing affiliates. These standards underpin the "Governance" pillar for transmission companies and align with environmental and social obligations. Additionally, interconnection customers are now required to demonstrate 90% site control when submitting their initial requests and achieve full site control by the facilities study stage to avoid penalties and delays in the queue [2].

How to Achieve ESG Compliance in Energy Transmission

Calculate and Report GHG Emissions

To meet ESG standards, energy transmission companies must start by accurately calculating their carbon footprint with the help of sustainability consulting. The first step involves defining organizational boundaries using one of three approaches: Operational Control (covering 100% of emissions from controlled assets), Financial Control (based on policy-directing ability), or Equity Share (proportional to ownership percentage) [9][10]. This decision ensures clarity on which assets to include in reports and prevents double counting.

Once boundaries are set, emissions should be categorized into three scopes:

Scope 1: Direct emissions from company-owned sources.

Scope 2: Indirect emissions from purchased energy.

Scope 3: Other indirect emissions across the value chain [9][10].

For electrical transmission equipment, apply the mass-balance method to track fluorinated greenhouse gases. This involves calculating inventory reductions, adding acquisitions, subtracting disbursements, and adjusting for changes in nameplate capacity [8].

Precision is key. For equipment rated above 38 kV, use tools like flow meters (±1%), pressure gauges (±0.5%), temperature gauges (±1°F), and scales with 1% accuracy [8]. If measured nameplate capacity deviates by 2% or more from the manufacturer’s specifications, use the measured value for reporting [8].

Monica Dorsey from Stok highlights the importance of standardized frameworks:

"The Greenhouse Gas Protocol (GHG Protocol)... establishes comprehensive global standardized frameworks to measure and manage greenhouse gas (GHG) emissions from private and public sector operations" [9].

To formalize these efforts, develop an Inventory Management Plan (IMP) that documents methodologies, maintains detailed records, and supports third-party verification [10]. Additionally, tools like the EPA's GHG Emission Factors Hub can help convert activity data into carbon dioxide equivalents (CO2e) [10].

Adopt Renewable Energy and Decarbonization Plans

After establishing an emissions baseline, focus on integrating renewable energy and upgrading infrastructure. One effective approach is reconductoring existing transmission lines with advanced conductors. According to GridLab:

"Advanced conductors can double existing transmission line capacity at less than half the cost and a fraction of the time as new lines" [11].

This is particularly relevant as nearly 70% of U.S. transmission lines are over 25 years old, nearing the end of their typical 50–80-year lifespan [12]. Upgrading transmission systems could cut greenhouse gas emissions by 3,420 million metric tons by 2050, while saving $320 billion in present-value costs [1]. The additional benefits include $730 billion in climate-related savings and $50 billion in health improvements by 2050 [1].

Improving interregional connectivity is another critical step. This allows for sharing reliability resources and accessing cost-effective renewable energy across larger areas. The Department of Energy (DOE) emphasizes:

"A robust transmission system is required to meet grid needs and support increased activity and load growth associated with data centers, new manufacturing facilities, and electrification" [1].

In October 2023, the DOE allocated $3.5 billion through its GRIP program to fund 58 projects across 44 states, focusing on boosting grid resilience and clean energy integration [12].

Additional strategies include implementing microgrids to enhance local power reliability during outages and developing offshore wind transmission networks to connect renewable energy sources to both coastal and inland regions. Use frameworks like the GHG Protocol and reporting platforms such as GRESB, CDP, or ISSB to ensure transparency and accountability [9].

Strengthen Grid Resilience and Resource Use

Grid resilience is a cornerstone of decarbonization. Expanding regional and interregional transmission lines helps share resources across wider areas, reducing outage risks during high-demand periods [1]. This shift from isolated upgrades to comprehensive solutions balances reliability with growing energy needs.

To meet EPA Subpart DD requirements, establish standardized protocols for gas recovery, particularly for SF6, and maintain detailed logs [8]. While carbon dioxide makes up about 79% of all greenhouse gas emissions, managing fluorinated gases is equally critical for transmission companies [13]. Tools like ReEDS can assist in identifying cost-effective and environmentally balanced investments in the power sector [1].

Build Governance and Reporting Systems

Strong governance ensures data accuracy and builds trust with stakeholders. Begin by consistently defining organizational boundaries - whether using operational control, financial control, or equity share - to clarify which assets are included in ESG reports [9]. This consistency improves transparency and simplifies audits.

As regulations tighten, such as California's SB 253 and the SEC Climate Disclosure Rule, thorough documentation is becoming increasingly important [9]. Scope 3 emissions, which can account for up to 75% of a company's carbon footprint, require particular attention [13]. Leveraging ESG and GHG emissions software can streamline data collection, minimize errors, and align with global frameworks like TCFD and ISSB [9][13].

Reporting through recognized platforms such as CDP, GRESB, or ISSB (IFRS S1 and S2) enhances credibility. Regular third-party verification further strengthens stakeholder confidence, ensuring compliance with evolving standards.

Working with Consultants for ESG Compliance

How Council Fire Supports ESG Implementation

Turning sustainability ambitions into actionable outcomes can be a complex journey, especially when navigating the intricate requirements of ESG compliance. Council Fire steps in with a systems-thinking approach and a focus on stakeholder-driven planning, helping businesses integrate sustainability into their operations while achieving measurable environmental and social outcomes.

The process starts with a materiality assessment, pinpointing the ESG factors that hold the most significance for your operations and stakeholders [14]. Following this, Council Fire helps establish robust governance frameworks by clearly defining roles and responsibilities for ESG oversight. This ensures accountability throughout the organization and prepares companies for regulatory requirements, such as the SEC’s mandate to disclose climate-related risks, management processes, and impacts exceeding 1% of a related financial statement line item [7][14]. By laying this strategic foundation, businesses are better positioned to meet technical compliance needs while aligning operations with sustainability goals.

Council Fire’s approach blends regulatory precision with forward-thinking strategy. For instance, they streamline transitions like those required under FERC Order No. 2023, which adopts a "first-ready" model to address procedural delays and meet evolving interconnection standards [2]. They also assess advanced technologies, such as innovative conductors and power flow controls, to facilitate the integration of renewable energy sources like wind, solar, and battery storage [2]. This combination of technical expertise and strategic planning ensures businesses stay ahead of regulatory requirements while advancing their sustainability objectives.

Benefits of Partnering with Council Fire

Council Fire offers more than just regulatory guidance - it delivers long-term strategic value by turning compliance challenges into opportunities for growth and excellence. Their specialized services include carbon footprint analysis, environmental audits, and the development of social responsibility programs [14]. These efforts help companies proactively address ESG-related risks, avoiding potential fines, reputational harm, or financial losses [14].

Transmission upgrades, for example, not only reduce emissions but also generate significant cost savings [1]. Council Fire’s data-driven methods ensure these benefits are fully realized by enhancing grid reliability and integrating affordable renewable energy sources [1].

Additionally, Council Fire emphasizes the importance of stakeholder engagement. By combining technical knowledge with effective communication strategies, they foster trust and drive meaningful progress. Their work spans natural resource management, energy infrastructure, and community development, ensuring every initiative delivers lasting impact. Instead of creating reports that merely sit on shelves, Council Fire transforms ambitious sustainability goals into actionable strategies that give companies a competitive edge.

Rob Gramlich from Grid Strategies on Transmission Reform and Clean Energy Access | Net Zero Compare

Conclusion

Meeting ESG requirements in energy transmission calls for thoughtful planning, clear reporting, and strong governance. Companies must prioritize building robust governance structures, monitor key performance metrics through standardized tools like FERC Form No. 715, and address the challenges posed by aging infrastructure. With nearly 70% of U.S. transmission lines exceeding 25 years in age [12], the urgency for action cannot be overstated.

The case for ESG compliance goes well beyond meeting regulations. Modernizing transmission infrastructure has the potential to save $320 billion by 2050 while reducing greenhouse gas emissions by 3,420 million metric tons [1]. These outcomes represent not only environmental progress but also critical financial opportunities. Upgrades strengthen grid reliability, enable broader integration of renewable energy, and position companies for success in an evolving energy sector.

Stakeholder expectations are also driving the need for action. According to research, 83% of consumers believe companies should lead in shaping ESG practices, and 91% of business leaders feel a responsibility to address ESG issues [15]. This alignment between public demand and corporate responsibility presents both a challenge and a chance for energy transmission companies to take the lead.

Navigating the complexities of ESG compliance often requires expert guidance. Specialized consultants offer the technical expertise, stakeholder engagement strategies, and systems-based approaches necessary to turn sustainability goals into measurable outcomes. They help organizations avoid pitfalls like greenwashing, identify key ESG factors, and establish governance models that ensure accountability. Firms such as Council Fire play a critical role in translating these challenges into actionable strategies, enabling companies to achieve meaningful results.

Achieving success in this space requires bold action. By adopting science-driven targets, investing in modern grid technologies, and fostering community partnerships through well-rounded benefits plans, energy transmission companies can transform ESG compliance into a competitive edge. Combining rigorous governance with forward-looking investments ensures not only compliance but also sustainable growth, delivering environmental, social, and economic benefits that resonate far into the future.

FAQs

What challenges do energy transmission companies face in meeting ESG requirements?

Energy transmission companies encounter several hurdles in meeting ESG requirements. One significant area is environmental compliance, which demands a thorough evaluation of the direct, indirect, and cumulative impacts of their projects. The process becomes even more intricate when navigating federal and state permitting systems, often involving multiple agencies with overlapping jurisdictions. These complexities can result in delays and longer project timelines.

Another challenge lies in governance and reporting. Companies must comply with stringent regulations, such as FERC's Standards of Conduct, while keeping up with evolving ESG reporting standards. This requires implementing accurate and auditable data systems alongside strong internal controls to ensure the credibility of their ESG reports.

On top of these, there are physical and social challenges to address. Designing infrastructure capable of withstanding extreme weather is crucial, as is fostering meaningful engagement with local communities and Indigenous tribes. Transparent communication and fair distribution of project benefits are key to earning trust and advancing sustainability goals. Expert consultation, such as that offered by Council Fire, can provide valuable support in navigating these intricate issues.

How can energy transmission companies track and report Scope 3 emissions effectively?

To effectively track and report Scope 3 emissions, energy transmission companies can adopt a systematic process that ensures accuracy and transparency:

Set clear boundaries: Begin by identifying the relevant areas of your value chain. This includes suppliers, contractors, and electricity users. Determine which Scope 3 categories are applicable to your operations to create a focused and manageable framework.

Gather necessary data: Collaborate with partners to collect key activity data, such as fuel consumption, material usage, and emissions reported by suppliers. When direct information isn’t available, rely on trusted emission factors to fill in the gaps.

Calculate and disclose emissions: Use established methods to calculate emissions, converting the results into metric tons of CO₂-equivalent (t CO₂e). Provide detailed and transparent disclosures, including the methodologies, data sources, and breakdowns of emissions by category.

For those seeking additional guidance, Council Fire, a consultancy specializing in sustainability initiatives, offers valuable support. They can help simplify data management, enhance collaboration across stakeholders, and ensure alignment with reporting standards.

How do federal and state policies impact ESG compliance for energy transmission projects?

Federal and state policies are key in defining the ESG compliance landscape for energy transmission projects, establishing the rules and standards that developers must adhere to. At the federal level, the Federal Energy Regulatory Commission (FERC) plays a central role, managing permitting and environmental reviews to ensure projects meet criteria for safety, transparency, and environmental stewardship. Notable updates, such as the 2023 Interconnection Final Rule, aim to simplify grid connection processes while maintaining a focus on reliability and environmental responsibility. Federal guidelines also emphasize collaboration with states and Tribes to uphold environmental and social protections.

On the state level, policies introduce additional ESG requirements, including stricter environmental impact assessments, land-use planning, and renewable energy targets. These regulations shape decisions on project locations, permitting schedules, and community involvement, often incorporating goals to address climate challenges and promote equitable access to clean energy. Together, these federal and state frameworks create a complex regulatory environment that energy companies must carefully navigate.

Council Fire offers expertise to help energy companies interpret these intricate regulations, align their projects with ESG objectives, and foster meaningful stakeholder engagement to support sustainable energy solutions.

Related Blog Posts

FAQ

What does it really mean to “redefine profit”?

What makes Council Fire different?

Who does Council Fire you work with?

What does working with Council Fire actually look like?

How does Council Fire help organizations turn big goals into action?

How does Council Fire define and measure success?