Jan 25, 2026

Jan 25, 2026

How to Conduct Vulnerability Assessment & Equity Mapping for Corporations

ESG Strategy

ESG Strategy

In This Article

Step-by-step guide to combining vulnerability assessments and equity mapping for corporations: scope, asset inventory, stakeholder impacts, integrated mitigation, and monitoring.

How to Conduct Vulnerability Assessment & Equity Mapping for Corporations

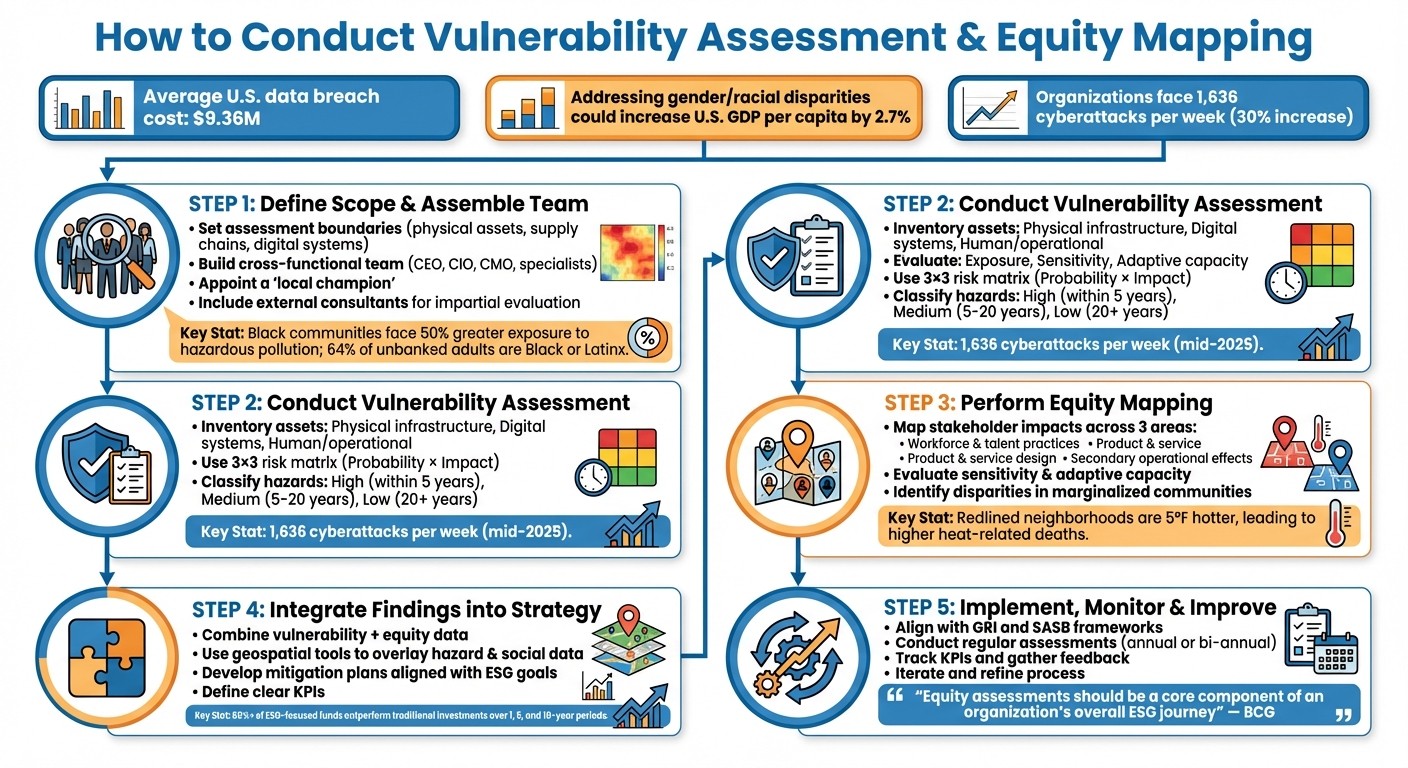

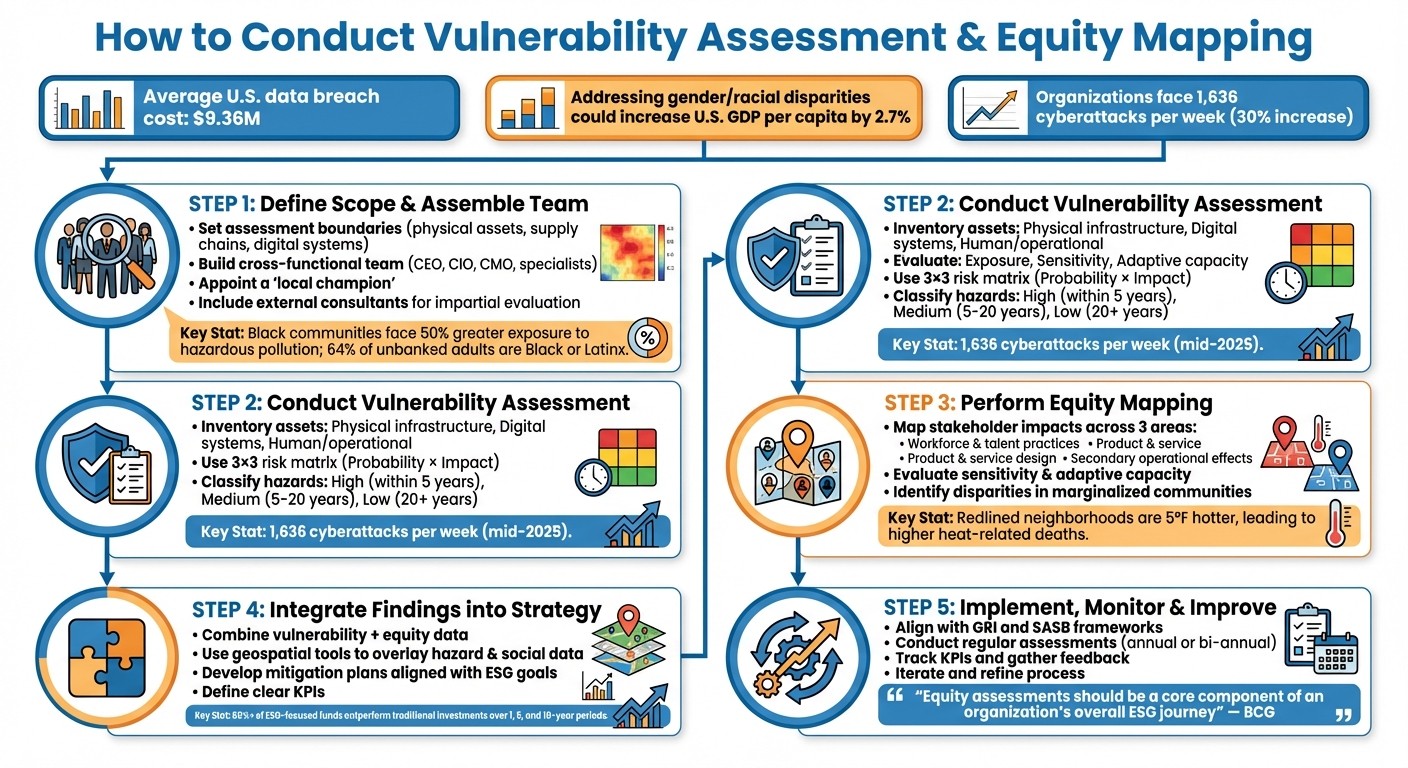

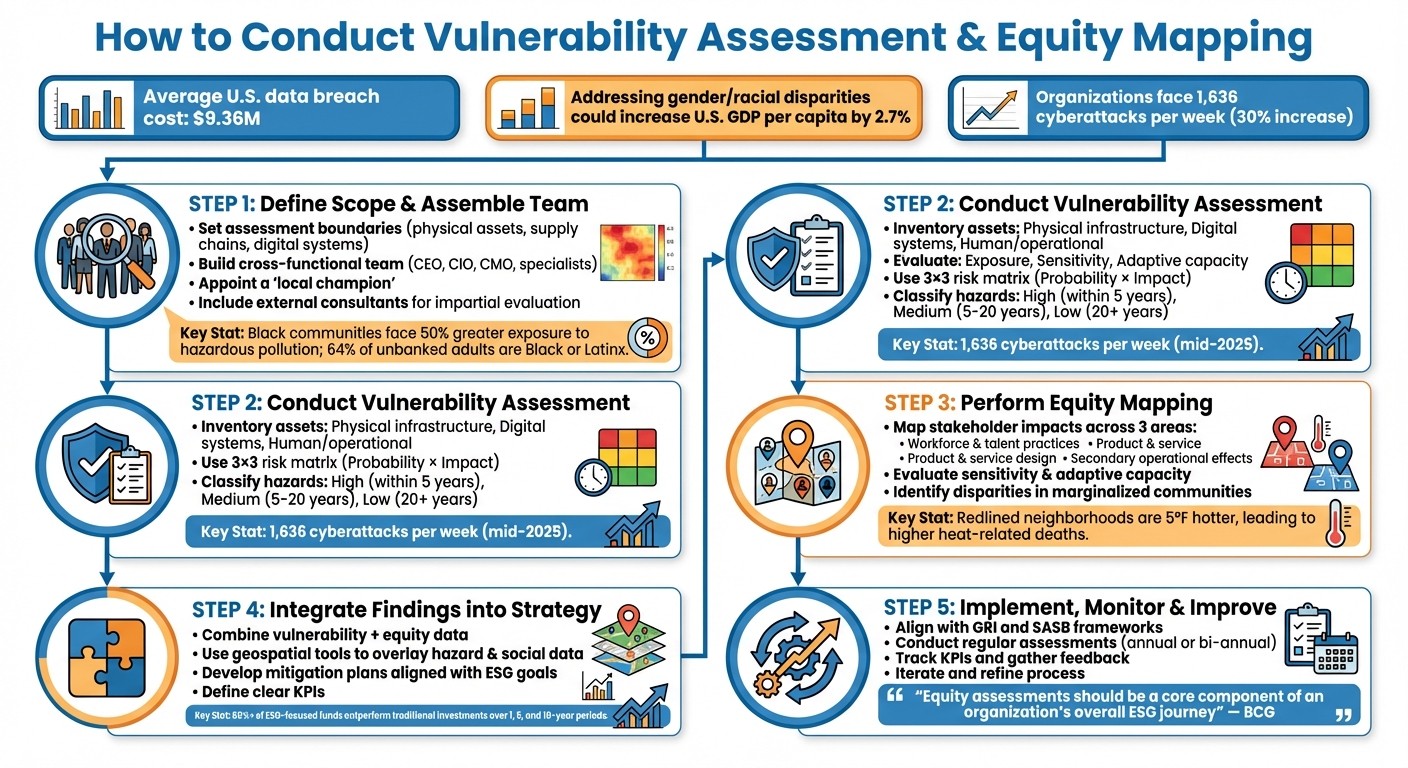

Corporations today face numerous risks, from cybersecurity threats to social inequities. Two tools - vulnerability assessments and equity mapping - help organizations identify weaknesses and understand how their decisions impact diverse communities. These tools not only reduce risks but also build trust with stakeholders and align with ESG goals. Here's a quick overview:

Vulnerability Assessment: Identifies and prioritizes risks in IT systems, supply chains, and operations. For example, U.S. companies face an average data breach cost of $9.36M.

Equity Mapping: Examines how decisions affect different demographic groups, addressing inequities in hiring, product access, and environmental impacts. Addressing gender and racial disparities alone could increase U.S. GDP per capita by 2.7%.

5-Step Process for Corporate Vulnerability Assessment and Equity Mapping

Shifting from Equality to Equity through Responsible Data Use

Step 1: Define the Scope and Assemble Your Team

Establish clear priorities and gather a well-rounded team to generate actionable insights.

Set Your Assessment Boundaries

Begin by pinpointing the physical assets, supply chains, and digital systems that are most vital to your operations and most at risk from potential hazards [3][5]. Use a prioritization matrix to evaluate asset-hazard pairs based on likelihood and impact, focusing your efforts on the highest-risk areas [3][5]. Your scope should also encompass external stakeholders, including investors, customers, suppliers, regulators, and local communities, particularly those that have historically faced marginalization [2][4].

When setting boundaries, consider a range of factors. Assess whether your products and services are accessible to diverse communities and whether your facilities disproportionately affect low-income or immigrant neighborhoods [2]. For example, Black communities in the U.S. face 50% greater exposure to hazardous pollution compared to other groups, and 64% of unbanked or underbanked adults are Black or Latinx [2]. Establish clear KPIs to ensure all essential components are captured [2].

Build Your Assessment Team

Bring together a cross-functional team that includes key leadership - such as the CEO, Chief Information Officer, Chief Investment Officer, and Chief Marketing Officer - alongside specialists in change management, corporate responsibility, sustainability, and data analysis [2]. Many organizations also work with third-party consultants or adaptation experts to ensure impartial evaluations and to address complex technical issues [3][2][5]. For instance, in March 2022, JP Morgan Chase commissioned an external firm to assess its $30 billion, five-year racial equity initiative aimed at reducing wealth disparities in Black, Hispanic, and Latinx communities [2].

Appoint a "local champion" - an internal leader who understands your organization's culture and ensures that the work of external consultants aligns with your specific values and operational goals [3][5]. Strive for a team that balances technical expertise with social understanding, as data alone cannot fully capture risks unique to specific communities [3][5].

Melissa Dudek, Kedra Newsom Reeves, and Sossina Gutema of BCG emphasize, "Equity assessments should be a core component of an organization's overall ESG journey, particularly given that investors recognize DEI activism as a signal of ESG impact" [2].

With your scope clarified and your team assembled, the next step is to collect and analyze data for the vulnerability assessment.

Step 2: Conduct the Vulnerability Assessment

Take a structured approach to catalog your assets and assess their exposure to potential risks.

Inventory Assets and Identify Vulnerabilities

Start by creating a comprehensive inventory of all critical assets, organizing them into three main categories: physical infrastructure (such as buildings, manufacturing plants, and distribution centers), digital and telecommunications systems (including cloud platforms, networks, and devices), and human and operational assets (like supply chain partners, employees, and essential services) [3][5][6]. A simple spreadsheet can help keep this information clear and accessible [3][5].

For each asset, evaluate its exposure, sensitivity, and adaptive capacity [3][5][6]. For instance, a warehouse located in a coastal flood zone may be highly exposed to sea-level rise, while a data center that relies on a single power grid is vulnerable to outages. Assets with backup systems, such as generators, are better equipped to handle disruptions, demonstrating greater adaptive capacity.

"Think about the things your community truly depends upon to function, and use that knowledge to set your priorities."

Pay special attention to critical nodes - those assets whose failure could lead to widespread disruptions. Examples include a primary telecommunications hub or your largest supplier. These should take precedence over less essential facilities. To guide your assessment, classify hazards by their likelihood: "High Probability" for events expected within 5 years, "Medium Probability" for those likely in 5–20 years, and "Low Probability" for risks beyond 20 years [3][5].

Once your assets and their vulnerabilities are cataloged, you can move on to a systematic evaluation of risks.

Evaluate and Prioritize Risks

Risk is determined by two factors: the likelihood of a hazard occurring and the severity of its consequences [3][5]. Use a 3x3 matrix to map these factors, with probability on one axis and impact - whether financial, operational, or social - on the other [3][5]. Assets that fall into the High-High or High-Medium risk categories should be addressed first.

"Risk is a compound concept that describes the chance of sustaining a substantial loss. The first element of risk is the probability of a hazard occurring. The second element is the magnitude of consequences from the event."

U.S. Climate Resilience Toolkit [3]

While qualitative labels like Low, Medium, and High are a helpful starting point, more complex systems benefit from quantitative data. Incorporate property values, hazard frequencies, and geospatial information to refine your priorities and reduce uncertainty [3][5]. For example, as of mid-2025, organizations faced an average of 1,636 cyberattacks per week - a 30% increase from the previous year - highlighting the urgency of addressing digital vulnerabilities [8].

Finally, conduct a gap analysis to compare your current risk management practices against industry benchmarks. This will help you identify areas for improvement and ensure your approach aligns with established standards [7].

Step 3: Perform Equity Mapping

Once vulnerabilities are identified, the next step is to determine who is affected and in what ways across various communities.

Map Stakeholder Impacts

Equity mapping involves examining operations through three key areas: workforce and talent practices (such as recruitment and promotion pathways), product and service design (ensuring fair access across diverse demographics), and secondary operational effects (like environmental or data privacy impacts on nearby communities) [2]. The challenges differ by industry - for instance, financial services need to address gaps in banking access, while energy companies must assess how clean technology is distributed across different groups.

Each stakeholder group should be evaluated for two critical factors: sensitivity - their vulnerability to specific impacts - and adaptive capacity, or their ability to recover from those impacts [3][5]. For example, a low-income neighborhood near a manufacturing facility might have high sensitivity to air pollution but low adaptive capacity due to limited access to healthcare. A simple screening matrix can help categorize each group as High, Medium, or Low for both factors [3][5].

In 2020, some financial institutions responded to these challenges by introducing alternative products designed with inclusive features like cash-flow management tools and digital interfaces tailored for various languages and smartphone capabilities. These efforts reached underserved stakeholders through neighborhood-focused branches and partnerships with local community development financial institutions [2]. Such initiatives highlight the importance of analyzing impacts to uncover and address systemic inequities.

Identify Disparities and Inequities

To uncover systemic disparities, go beyond surface-level metrics. For instance, Black communities in the U.S. are exposed to 50% more hazardous pollution than other groups, and historically redlined neighborhoods are often five degrees Fahrenheit hotter than non-redlined areas, leading to higher rates of heat-related deaths [2]. These often-overlooked impacts - whether tied to facility locations, barriers in product design, or risks associated with data protection - tend to disproportionately affect marginalized populations.

"When racial equity is not consciously addressed, racial inequality is often unconsciously replicated."

To prevent perpetuating inequality, assessments should be conducted before implementing new policies [1]. As industry standards for equity mapping are still evolving, it’s wise to collaborate with third-party experts in corporate responsibility and change management. These partners can help establish meaningful KPIs and ensure critical components aren’t overlooked [2]. Addressing inequities isn’t just a moral obligation - it’s an economic opportunity. For example, eliminating gender and racial discrimination in innovation could boost U.S. GDP per capita by 2.7% [2]. Equity mapping, therefore, is essential for creating both social and economic progress.

Step 4: Integrate Findings into Your Strategy

Once you’ve gathered vulnerability and equity data, the next step is to put these insights into action. This is where raw information evolves into strategic decisions that protect both your corporate assets and the well-being of the communities impacted by your operations.

Combine Vulnerability and Equity Data

To create a comprehensive risk profile, merge your vulnerability and equity findings. Incorporate social and equity costs into your risk assessments, ensuring they are evaluated alongside physical threats. For instance, when using a 3×3 risk matrix - where the y-axis represents probability and the x-axis captures the magnitude of consequences (including social impacts) - you can ensure risks affecting marginalized communities are given equal consideration as those impacting physical assets.

Geospatial tools can take this analysis further. By overlaying physical hazard data with social vulnerability information, you can identify areas where resilience-building efforts will have the most significant impact. For example, a manufacturing plant located in a historically redlined neighborhood with high flood risk could emerge as a critical focus area. The facility’s value, combined with the limited ability of nearby residents to adapt, highlights the urgency of intervention. Additionally, pay attention to potential cascading failures, such as disruptions in telecommunications or supply chains, which could amplify the effects of these risks [3][5]. This integrated perspective sets the stage for targeted and effective mitigation strategies.

Develop Mitigation and Action Plans

Action plans should address immediate risks while also aligning with long-term goals. Independent third-party assessments can validate your equity initiatives, ensuring transparency and accountability to stakeholders. Incorporating equity assessments into your broader ESG strategy is essential, especially given the growing recognition of their importance. Research shows that more than 80% of ESG-focused funds outperform traditional investments over one-, five-, and ten-year periods [2].

"Equity assessments should be a core component of an organization's overall ESG journey, particularly given that investors recognize DEI activism as a signal of ESG impact"

BCG researchers [2]

Define clear KPIs to measure success. These could include metrics like reductions in pollution exposure for nearby communities or increased accessibility of products across diverse demographic groups. Evaluate whether your facility locations or data protection policies unintentionally create barriers for marginalized populations. Addressing these issues not only fulfills social responsibilities but also provides measurable economic benefits.

Step 5: Implement, Monitor, and Improve

With your integrated risk and equity insights in hand, it's time to put your strategies into action and refine them over time.

Deploy Your Mitigation Strategies

Focus on addressing the most critical risks first. High-High and High-Medium risk pairs from your risk matrix should take precedence. Standardize risk categories by defining clear probability intervals to ensure consistency in evaluation.

Pay special attention to critical infrastructure or nodes whose failure could trigger widespread disruptions. For instance, a telecommunications hub or a vital supply chain facility might not have the highest individual risk score, but their importance in the larger system should elevate their priority [3]. Conduct materiality assessments to weigh financial impacts against stakeholder priorities, ensuring that resilience investments align with long-term goals [9]. Align your plans with established frameworks like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) to meet ESG compliance requirements [9].

Bringing in expertise can make a big difference. Consider hiring specialized consultants, such as Architecture and Engineering (A&E) firms or climate adaptation professionals, to help tackle technical challenges and document key issues [3]. Start small by benchmarking against market trends and analyzing how competitors are investing in resilience. This phased approach allows you to gather insights before committing to large-scale capital projects [9].

Once your strategies are in motion, maintaining momentum through continuous monitoring becomes essential.

Monitor Progress and Adjust Plans

After implementing your mitigation measures, track their effectiveness and adapt as needed. Use established KPIs and baseline metrics to measure progress [2]. Regular assessments, conducted annually or bi-annually, provide a consistent way to evaluate outcomes [2]. Research shows that more than 80% of studies on ESG impact reveal that ESG-focused funds outperform traditional ones over one-, five-, and ten-year periods, reinforcing the value of ongoing monitoring [2].

"Assessments shouldn't be so rigid that they aren't improved iteratively based on lessons from the prior cycle. Make sure to track feedback and refine the process with each iteration."

BCG [2]

Gather feedback from individual sites and stay alert to emerging trends to capture real-time impacts [10]. If new vulnerabilities arise, reassess and determine whether they should be elevated to higher-priority status [3][5]. Regularly communicate your progress to both internal and external stakeholders, fostering transparency and accountability [7].

Conclusion

Vulnerability assessments and equity mapping offer powerful ways to build companies that are not only resilient but also inclusive, enabling them to navigate an increasingly complex business landscape. By pinpointing assets most at risk of disruption and evaluating how operations affect diverse communities, businesses lay the groundwork for smarter decisions that safeguard both their financial health and the well-being of those they impact.

The advantages of incorporating these assessments extend beyond risk management - they also contribute to creating long-term value and strengthening competitive positioning.

"The economy can reach its full potential only when all people are able to fully participate."

BCG [2]

Shifting from promises to tangible action requires a deliberate approach: systematic evaluations, clear priorities, and continuous monitoring. Whether tackling cascading infrastructure vulnerabilities or addressing disparities in how products serve various communities, these processes uncover hidden issues and open doors to meaningful progress.

The link between assessment and action is what turns insights into strategic results.

At Council Fire, we specialize in turning these assessments into measurable outcomes. By leveraging systems thinking and focusing on stakeholder-driven planning, we help organizations transform vulnerability and equity insights into actionable strategies. These strategies not only enhance climate resilience but also promote circular economies and generate lasting environmental, social, and economic benefits. We go beyond identifying risks and inequities - we create pathways to address them effectively.

FAQs

What is the difference between vulnerability assessments and equity mapping?

Vulnerability assessments and equity mapping serve as two interconnected tools that help organizations and communities address risks and disparities effectively.

Vulnerability assessments aim to pinpoint and evaluate potential risks - whether they stem from climate change, cybersecurity threats, or public health issues. By analyzing factors like exposure, underlying trends, and existing conditions, these assessments highlight areas or operations most at risk. This insight helps organizations decide where to focus their mitigation efforts.

Equity mapping, in contrast, looks at how resources, opportunities, and risks are distributed across various communities. By uncovering systemic disparities - such as unequal access to resources or concentrated environmental hazards - it provides a foundation for decisions that prioritize fairness and inclusion.

When used together, these approaches offer a comprehensive view of both the severity of risks and the reasons certain groups are more vulnerable. This integrated perspective supports the development of solutions that are not only effective but also equitable.

How can companies use vulnerability and equity assessments to improve their strategic planning?

Companies can strengthen their strategic planning by leveraging insights from vulnerability and equity assessments to pinpoint and address critical risks and disparities. A good starting point is to assess potential social, environmental, and economic vulnerabilities within their operations. Understanding how these factors affect various stakeholder groups, particularly underrepresented communities, can help uncover areas that need attention and drive meaningful action.

To bring these insights into practice, integrate them into existing structures like enterprise risk management (ERM) or broader sustainability strategies. Use the data gathered to establish clear, measurable objectives aimed at minimizing risks and advancing inclusivity. Involving leadership, employees, and community representatives in the process ensures that these insights lead to concrete actions, ultimately fostering resilience, equity, and long-term sustainability across the organization.

What is the role of third-party consultants in vulnerability assessments and equity mapping?

Third-party consultants play an important role in conducting vulnerability assessments and equity mapping, offering an impartial and specialized perspective that organizations might lack internally. Their involvement ensures a detailed and unbiased approach, especially when dealing with intricate challenges such as social equity, environmental risks, or economic vulnerabilities.

By applying established frameworks and data-driven techniques, these consultants pinpoint risks, inequities, and opportunities for improvement across a company's operations, policies, and community engagement. They often identify overlooked biases or gaps that internal teams might miss, helping businesses make decisions that are more inclusive and well-informed. Additionally, their objective insights foster transparency and strengthen trust with stakeholders, making them a critical asset for organizations striving to incorporate sustainability and inclusivity into their long-term strategies.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 25, 2026

How to Conduct Vulnerability Assessment & Equity Mapping for Corporations

ESG Strategy

In This Article

Step-by-step guide to combining vulnerability assessments and equity mapping for corporations: scope, asset inventory, stakeholder impacts, integrated mitigation, and monitoring.

How to Conduct Vulnerability Assessment & Equity Mapping for Corporations

Corporations today face numerous risks, from cybersecurity threats to social inequities. Two tools - vulnerability assessments and equity mapping - help organizations identify weaknesses and understand how their decisions impact diverse communities. These tools not only reduce risks but also build trust with stakeholders and align with ESG goals. Here's a quick overview:

Vulnerability Assessment: Identifies and prioritizes risks in IT systems, supply chains, and operations. For example, U.S. companies face an average data breach cost of $9.36M.

Equity Mapping: Examines how decisions affect different demographic groups, addressing inequities in hiring, product access, and environmental impacts. Addressing gender and racial disparities alone could increase U.S. GDP per capita by 2.7%.

5-Step Process for Corporate Vulnerability Assessment and Equity Mapping

Shifting from Equality to Equity through Responsible Data Use

Step 1: Define the Scope and Assemble Your Team

Establish clear priorities and gather a well-rounded team to generate actionable insights.

Set Your Assessment Boundaries

Begin by pinpointing the physical assets, supply chains, and digital systems that are most vital to your operations and most at risk from potential hazards [3][5]. Use a prioritization matrix to evaluate asset-hazard pairs based on likelihood and impact, focusing your efforts on the highest-risk areas [3][5]. Your scope should also encompass external stakeholders, including investors, customers, suppliers, regulators, and local communities, particularly those that have historically faced marginalization [2][4].

When setting boundaries, consider a range of factors. Assess whether your products and services are accessible to diverse communities and whether your facilities disproportionately affect low-income or immigrant neighborhoods [2]. For example, Black communities in the U.S. face 50% greater exposure to hazardous pollution compared to other groups, and 64% of unbanked or underbanked adults are Black or Latinx [2]. Establish clear KPIs to ensure all essential components are captured [2].

Build Your Assessment Team

Bring together a cross-functional team that includes key leadership - such as the CEO, Chief Information Officer, Chief Investment Officer, and Chief Marketing Officer - alongside specialists in change management, corporate responsibility, sustainability, and data analysis [2]. Many organizations also work with third-party consultants or adaptation experts to ensure impartial evaluations and to address complex technical issues [3][2][5]. For instance, in March 2022, JP Morgan Chase commissioned an external firm to assess its $30 billion, five-year racial equity initiative aimed at reducing wealth disparities in Black, Hispanic, and Latinx communities [2].

Appoint a "local champion" - an internal leader who understands your organization's culture and ensures that the work of external consultants aligns with your specific values and operational goals [3][5]. Strive for a team that balances technical expertise with social understanding, as data alone cannot fully capture risks unique to specific communities [3][5].

Melissa Dudek, Kedra Newsom Reeves, and Sossina Gutema of BCG emphasize, "Equity assessments should be a core component of an organization's overall ESG journey, particularly given that investors recognize DEI activism as a signal of ESG impact" [2].

With your scope clarified and your team assembled, the next step is to collect and analyze data for the vulnerability assessment.

Step 2: Conduct the Vulnerability Assessment

Take a structured approach to catalog your assets and assess their exposure to potential risks.

Inventory Assets and Identify Vulnerabilities

Start by creating a comprehensive inventory of all critical assets, organizing them into three main categories: physical infrastructure (such as buildings, manufacturing plants, and distribution centers), digital and telecommunications systems (including cloud platforms, networks, and devices), and human and operational assets (like supply chain partners, employees, and essential services) [3][5][6]. A simple spreadsheet can help keep this information clear and accessible [3][5].

For each asset, evaluate its exposure, sensitivity, and adaptive capacity [3][5][6]. For instance, a warehouse located in a coastal flood zone may be highly exposed to sea-level rise, while a data center that relies on a single power grid is vulnerable to outages. Assets with backup systems, such as generators, are better equipped to handle disruptions, demonstrating greater adaptive capacity.

"Think about the things your community truly depends upon to function, and use that knowledge to set your priorities."

Pay special attention to critical nodes - those assets whose failure could lead to widespread disruptions. Examples include a primary telecommunications hub or your largest supplier. These should take precedence over less essential facilities. To guide your assessment, classify hazards by their likelihood: "High Probability" for events expected within 5 years, "Medium Probability" for those likely in 5–20 years, and "Low Probability" for risks beyond 20 years [3][5].

Once your assets and their vulnerabilities are cataloged, you can move on to a systematic evaluation of risks.

Evaluate and Prioritize Risks

Risk is determined by two factors: the likelihood of a hazard occurring and the severity of its consequences [3][5]. Use a 3x3 matrix to map these factors, with probability on one axis and impact - whether financial, operational, or social - on the other [3][5]. Assets that fall into the High-High or High-Medium risk categories should be addressed first.

"Risk is a compound concept that describes the chance of sustaining a substantial loss. The first element of risk is the probability of a hazard occurring. The second element is the magnitude of consequences from the event."

U.S. Climate Resilience Toolkit [3]

While qualitative labels like Low, Medium, and High are a helpful starting point, more complex systems benefit from quantitative data. Incorporate property values, hazard frequencies, and geospatial information to refine your priorities and reduce uncertainty [3][5]. For example, as of mid-2025, organizations faced an average of 1,636 cyberattacks per week - a 30% increase from the previous year - highlighting the urgency of addressing digital vulnerabilities [8].

Finally, conduct a gap analysis to compare your current risk management practices against industry benchmarks. This will help you identify areas for improvement and ensure your approach aligns with established standards [7].

Step 3: Perform Equity Mapping

Once vulnerabilities are identified, the next step is to determine who is affected and in what ways across various communities.

Map Stakeholder Impacts

Equity mapping involves examining operations through three key areas: workforce and talent practices (such as recruitment and promotion pathways), product and service design (ensuring fair access across diverse demographics), and secondary operational effects (like environmental or data privacy impacts on nearby communities) [2]. The challenges differ by industry - for instance, financial services need to address gaps in banking access, while energy companies must assess how clean technology is distributed across different groups.

Each stakeholder group should be evaluated for two critical factors: sensitivity - their vulnerability to specific impacts - and adaptive capacity, or their ability to recover from those impacts [3][5]. For example, a low-income neighborhood near a manufacturing facility might have high sensitivity to air pollution but low adaptive capacity due to limited access to healthcare. A simple screening matrix can help categorize each group as High, Medium, or Low for both factors [3][5].

In 2020, some financial institutions responded to these challenges by introducing alternative products designed with inclusive features like cash-flow management tools and digital interfaces tailored for various languages and smartphone capabilities. These efforts reached underserved stakeholders through neighborhood-focused branches and partnerships with local community development financial institutions [2]. Such initiatives highlight the importance of analyzing impacts to uncover and address systemic inequities.

Identify Disparities and Inequities

To uncover systemic disparities, go beyond surface-level metrics. For instance, Black communities in the U.S. are exposed to 50% more hazardous pollution than other groups, and historically redlined neighborhoods are often five degrees Fahrenheit hotter than non-redlined areas, leading to higher rates of heat-related deaths [2]. These often-overlooked impacts - whether tied to facility locations, barriers in product design, or risks associated with data protection - tend to disproportionately affect marginalized populations.

"When racial equity is not consciously addressed, racial inequality is often unconsciously replicated."

To prevent perpetuating inequality, assessments should be conducted before implementing new policies [1]. As industry standards for equity mapping are still evolving, it’s wise to collaborate with third-party experts in corporate responsibility and change management. These partners can help establish meaningful KPIs and ensure critical components aren’t overlooked [2]. Addressing inequities isn’t just a moral obligation - it’s an economic opportunity. For example, eliminating gender and racial discrimination in innovation could boost U.S. GDP per capita by 2.7% [2]. Equity mapping, therefore, is essential for creating both social and economic progress.

Step 4: Integrate Findings into Your Strategy

Once you’ve gathered vulnerability and equity data, the next step is to put these insights into action. This is where raw information evolves into strategic decisions that protect both your corporate assets and the well-being of the communities impacted by your operations.

Combine Vulnerability and Equity Data

To create a comprehensive risk profile, merge your vulnerability and equity findings. Incorporate social and equity costs into your risk assessments, ensuring they are evaluated alongside physical threats. For instance, when using a 3×3 risk matrix - where the y-axis represents probability and the x-axis captures the magnitude of consequences (including social impacts) - you can ensure risks affecting marginalized communities are given equal consideration as those impacting physical assets.

Geospatial tools can take this analysis further. By overlaying physical hazard data with social vulnerability information, you can identify areas where resilience-building efforts will have the most significant impact. For example, a manufacturing plant located in a historically redlined neighborhood with high flood risk could emerge as a critical focus area. The facility’s value, combined with the limited ability of nearby residents to adapt, highlights the urgency of intervention. Additionally, pay attention to potential cascading failures, such as disruptions in telecommunications or supply chains, which could amplify the effects of these risks [3][5]. This integrated perspective sets the stage for targeted and effective mitigation strategies.

Develop Mitigation and Action Plans

Action plans should address immediate risks while also aligning with long-term goals. Independent third-party assessments can validate your equity initiatives, ensuring transparency and accountability to stakeholders. Incorporating equity assessments into your broader ESG strategy is essential, especially given the growing recognition of their importance. Research shows that more than 80% of ESG-focused funds outperform traditional investments over one-, five-, and ten-year periods [2].

"Equity assessments should be a core component of an organization's overall ESG journey, particularly given that investors recognize DEI activism as a signal of ESG impact"

BCG researchers [2]

Define clear KPIs to measure success. These could include metrics like reductions in pollution exposure for nearby communities or increased accessibility of products across diverse demographic groups. Evaluate whether your facility locations or data protection policies unintentionally create barriers for marginalized populations. Addressing these issues not only fulfills social responsibilities but also provides measurable economic benefits.

Step 5: Implement, Monitor, and Improve

With your integrated risk and equity insights in hand, it's time to put your strategies into action and refine them over time.

Deploy Your Mitigation Strategies

Focus on addressing the most critical risks first. High-High and High-Medium risk pairs from your risk matrix should take precedence. Standardize risk categories by defining clear probability intervals to ensure consistency in evaluation.

Pay special attention to critical infrastructure or nodes whose failure could trigger widespread disruptions. For instance, a telecommunications hub or a vital supply chain facility might not have the highest individual risk score, but their importance in the larger system should elevate their priority [3]. Conduct materiality assessments to weigh financial impacts against stakeholder priorities, ensuring that resilience investments align with long-term goals [9]. Align your plans with established frameworks like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) to meet ESG compliance requirements [9].

Bringing in expertise can make a big difference. Consider hiring specialized consultants, such as Architecture and Engineering (A&E) firms or climate adaptation professionals, to help tackle technical challenges and document key issues [3]. Start small by benchmarking against market trends and analyzing how competitors are investing in resilience. This phased approach allows you to gather insights before committing to large-scale capital projects [9].

Once your strategies are in motion, maintaining momentum through continuous monitoring becomes essential.

Monitor Progress and Adjust Plans

After implementing your mitigation measures, track their effectiveness and adapt as needed. Use established KPIs and baseline metrics to measure progress [2]. Regular assessments, conducted annually or bi-annually, provide a consistent way to evaluate outcomes [2]. Research shows that more than 80% of studies on ESG impact reveal that ESG-focused funds outperform traditional ones over one-, five-, and ten-year periods, reinforcing the value of ongoing monitoring [2].

"Assessments shouldn't be so rigid that they aren't improved iteratively based on lessons from the prior cycle. Make sure to track feedback and refine the process with each iteration."

BCG [2]

Gather feedback from individual sites and stay alert to emerging trends to capture real-time impacts [10]. If new vulnerabilities arise, reassess and determine whether they should be elevated to higher-priority status [3][5]. Regularly communicate your progress to both internal and external stakeholders, fostering transparency and accountability [7].

Conclusion

Vulnerability assessments and equity mapping offer powerful ways to build companies that are not only resilient but also inclusive, enabling them to navigate an increasingly complex business landscape. By pinpointing assets most at risk of disruption and evaluating how operations affect diverse communities, businesses lay the groundwork for smarter decisions that safeguard both their financial health and the well-being of those they impact.

The advantages of incorporating these assessments extend beyond risk management - they also contribute to creating long-term value and strengthening competitive positioning.

"The economy can reach its full potential only when all people are able to fully participate."

BCG [2]

Shifting from promises to tangible action requires a deliberate approach: systematic evaluations, clear priorities, and continuous monitoring. Whether tackling cascading infrastructure vulnerabilities or addressing disparities in how products serve various communities, these processes uncover hidden issues and open doors to meaningful progress.

The link between assessment and action is what turns insights into strategic results.

At Council Fire, we specialize in turning these assessments into measurable outcomes. By leveraging systems thinking and focusing on stakeholder-driven planning, we help organizations transform vulnerability and equity insights into actionable strategies. These strategies not only enhance climate resilience but also promote circular economies and generate lasting environmental, social, and economic benefits. We go beyond identifying risks and inequities - we create pathways to address them effectively.

FAQs

What is the difference between vulnerability assessments and equity mapping?

Vulnerability assessments and equity mapping serve as two interconnected tools that help organizations and communities address risks and disparities effectively.

Vulnerability assessments aim to pinpoint and evaluate potential risks - whether they stem from climate change, cybersecurity threats, or public health issues. By analyzing factors like exposure, underlying trends, and existing conditions, these assessments highlight areas or operations most at risk. This insight helps organizations decide where to focus their mitigation efforts.

Equity mapping, in contrast, looks at how resources, opportunities, and risks are distributed across various communities. By uncovering systemic disparities - such as unequal access to resources or concentrated environmental hazards - it provides a foundation for decisions that prioritize fairness and inclusion.

When used together, these approaches offer a comprehensive view of both the severity of risks and the reasons certain groups are more vulnerable. This integrated perspective supports the development of solutions that are not only effective but also equitable.

How can companies use vulnerability and equity assessments to improve their strategic planning?

Companies can strengthen their strategic planning by leveraging insights from vulnerability and equity assessments to pinpoint and address critical risks and disparities. A good starting point is to assess potential social, environmental, and economic vulnerabilities within their operations. Understanding how these factors affect various stakeholder groups, particularly underrepresented communities, can help uncover areas that need attention and drive meaningful action.

To bring these insights into practice, integrate them into existing structures like enterprise risk management (ERM) or broader sustainability strategies. Use the data gathered to establish clear, measurable objectives aimed at minimizing risks and advancing inclusivity. Involving leadership, employees, and community representatives in the process ensures that these insights lead to concrete actions, ultimately fostering resilience, equity, and long-term sustainability across the organization.

What is the role of third-party consultants in vulnerability assessments and equity mapping?

Third-party consultants play an important role in conducting vulnerability assessments and equity mapping, offering an impartial and specialized perspective that organizations might lack internally. Their involvement ensures a detailed and unbiased approach, especially when dealing with intricate challenges such as social equity, environmental risks, or economic vulnerabilities.

By applying established frameworks and data-driven techniques, these consultants pinpoint risks, inequities, and opportunities for improvement across a company's operations, policies, and community engagement. They often identify overlooked biases or gaps that internal teams might miss, helping businesses make decisions that are more inclusive and well-informed. Additionally, their objective insights foster transparency and strengthen trust with stakeholders, making them a critical asset for organizations striving to incorporate sustainability and inclusivity into their long-term strategies.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 25, 2026

How to Conduct Vulnerability Assessment & Equity Mapping for Corporations

ESG Strategy

In This Article

Step-by-step guide to combining vulnerability assessments and equity mapping for corporations: scope, asset inventory, stakeholder impacts, integrated mitigation, and monitoring.

How to Conduct Vulnerability Assessment & Equity Mapping for Corporations

Corporations today face numerous risks, from cybersecurity threats to social inequities. Two tools - vulnerability assessments and equity mapping - help organizations identify weaknesses and understand how their decisions impact diverse communities. These tools not only reduce risks but also build trust with stakeholders and align with ESG goals. Here's a quick overview:

Vulnerability Assessment: Identifies and prioritizes risks in IT systems, supply chains, and operations. For example, U.S. companies face an average data breach cost of $9.36M.

Equity Mapping: Examines how decisions affect different demographic groups, addressing inequities in hiring, product access, and environmental impacts. Addressing gender and racial disparities alone could increase U.S. GDP per capita by 2.7%.

5-Step Process for Corporate Vulnerability Assessment and Equity Mapping

Shifting from Equality to Equity through Responsible Data Use

Step 1: Define the Scope and Assemble Your Team

Establish clear priorities and gather a well-rounded team to generate actionable insights.

Set Your Assessment Boundaries

Begin by pinpointing the physical assets, supply chains, and digital systems that are most vital to your operations and most at risk from potential hazards [3][5]. Use a prioritization matrix to evaluate asset-hazard pairs based on likelihood and impact, focusing your efforts on the highest-risk areas [3][5]. Your scope should also encompass external stakeholders, including investors, customers, suppliers, regulators, and local communities, particularly those that have historically faced marginalization [2][4].

When setting boundaries, consider a range of factors. Assess whether your products and services are accessible to diverse communities and whether your facilities disproportionately affect low-income or immigrant neighborhoods [2]. For example, Black communities in the U.S. face 50% greater exposure to hazardous pollution compared to other groups, and 64% of unbanked or underbanked adults are Black or Latinx [2]. Establish clear KPIs to ensure all essential components are captured [2].

Build Your Assessment Team

Bring together a cross-functional team that includes key leadership - such as the CEO, Chief Information Officer, Chief Investment Officer, and Chief Marketing Officer - alongside specialists in change management, corporate responsibility, sustainability, and data analysis [2]. Many organizations also work with third-party consultants or adaptation experts to ensure impartial evaluations and to address complex technical issues [3][2][5]. For instance, in March 2022, JP Morgan Chase commissioned an external firm to assess its $30 billion, five-year racial equity initiative aimed at reducing wealth disparities in Black, Hispanic, and Latinx communities [2].

Appoint a "local champion" - an internal leader who understands your organization's culture and ensures that the work of external consultants aligns with your specific values and operational goals [3][5]. Strive for a team that balances technical expertise with social understanding, as data alone cannot fully capture risks unique to specific communities [3][5].

Melissa Dudek, Kedra Newsom Reeves, and Sossina Gutema of BCG emphasize, "Equity assessments should be a core component of an organization's overall ESG journey, particularly given that investors recognize DEI activism as a signal of ESG impact" [2].

With your scope clarified and your team assembled, the next step is to collect and analyze data for the vulnerability assessment.

Step 2: Conduct the Vulnerability Assessment

Take a structured approach to catalog your assets and assess their exposure to potential risks.

Inventory Assets and Identify Vulnerabilities

Start by creating a comprehensive inventory of all critical assets, organizing them into three main categories: physical infrastructure (such as buildings, manufacturing plants, and distribution centers), digital and telecommunications systems (including cloud platforms, networks, and devices), and human and operational assets (like supply chain partners, employees, and essential services) [3][5][6]. A simple spreadsheet can help keep this information clear and accessible [3][5].

For each asset, evaluate its exposure, sensitivity, and adaptive capacity [3][5][6]. For instance, a warehouse located in a coastal flood zone may be highly exposed to sea-level rise, while a data center that relies on a single power grid is vulnerable to outages. Assets with backup systems, such as generators, are better equipped to handle disruptions, demonstrating greater adaptive capacity.

"Think about the things your community truly depends upon to function, and use that knowledge to set your priorities."

Pay special attention to critical nodes - those assets whose failure could lead to widespread disruptions. Examples include a primary telecommunications hub or your largest supplier. These should take precedence over less essential facilities. To guide your assessment, classify hazards by their likelihood: "High Probability" for events expected within 5 years, "Medium Probability" for those likely in 5–20 years, and "Low Probability" for risks beyond 20 years [3][5].

Once your assets and their vulnerabilities are cataloged, you can move on to a systematic evaluation of risks.

Evaluate and Prioritize Risks

Risk is determined by two factors: the likelihood of a hazard occurring and the severity of its consequences [3][5]. Use a 3x3 matrix to map these factors, with probability on one axis and impact - whether financial, operational, or social - on the other [3][5]. Assets that fall into the High-High or High-Medium risk categories should be addressed first.

"Risk is a compound concept that describes the chance of sustaining a substantial loss. The first element of risk is the probability of a hazard occurring. The second element is the magnitude of consequences from the event."

U.S. Climate Resilience Toolkit [3]

While qualitative labels like Low, Medium, and High are a helpful starting point, more complex systems benefit from quantitative data. Incorporate property values, hazard frequencies, and geospatial information to refine your priorities and reduce uncertainty [3][5]. For example, as of mid-2025, organizations faced an average of 1,636 cyberattacks per week - a 30% increase from the previous year - highlighting the urgency of addressing digital vulnerabilities [8].

Finally, conduct a gap analysis to compare your current risk management practices against industry benchmarks. This will help you identify areas for improvement and ensure your approach aligns with established standards [7].

Step 3: Perform Equity Mapping

Once vulnerabilities are identified, the next step is to determine who is affected and in what ways across various communities.

Map Stakeholder Impacts

Equity mapping involves examining operations through three key areas: workforce and talent practices (such as recruitment and promotion pathways), product and service design (ensuring fair access across diverse demographics), and secondary operational effects (like environmental or data privacy impacts on nearby communities) [2]. The challenges differ by industry - for instance, financial services need to address gaps in banking access, while energy companies must assess how clean technology is distributed across different groups.

Each stakeholder group should be evaluated for two critical factors: sensitivity - their vulnerability to specific impacts - and adaptive capacity, or their ability to recover from those impacts [3][5]. For example, a low-income neighborhood near a manufacturing facility might have high sensitivity to air pollution but low adaptive capacity due to limited access to healthcare. A simple screening matrix can help categorize each group as High, Medium, or Low for both factors [3][5].

In 2020, some financial institutions responded to these challenges by introducing alternative products designed with inclusive features like cash-flow management tools and digital interfaces tailored for various languages and smartphone capabilities. These efforts reached underserved stakeholders through neighborhood-focused branches and partnerships with local community development financial institutions [2]. Such initiatives highlight the importance of analyzing impacts to uncover and address systemic inequities.

Identify Disparities and Inequities

To uncover systemic disparities, go beyond surface-level metrics. For instance, Black communities in the U.S. are exposed to 50% more hazardous pollution than other groups, and historically redlined neighborhoods are often five degrees Fahrenheit hotter than non-redlined areas, leading to higher rates of heat-related deaths [2]. These often-overlooked impacts - whether tied to facility locations, barriers in product design, or risks associated with data protection - tend to disproportionately affect marginalized populations.

"When racial equity is not consciously addressed, racial inequality is often unconsciously replicated."

To prevent perpetuating inequality, assessments should be conducted before implementing new policies [1]. As industry standards for equity mapping are still evolving, it’s wise to collaborate with third-party experts in corporate responsibility and change management. These partners can help establish meaningful KPIs and ensure critical components aren’t overlooked [2]. Addressing inequities isn’t just a moral obligation - it’s an economic opportunity. For example, eliminating gender and racial discrimination in innovation could boost U.S. GDP per capita by 2.7% [2]. Equity mapping, therefore, is essential for creating both social and economic progress.

Step 4: Integrate Findings into Your Strategy

Once you’ve gathered vulnerability and equity data, the next step is to put these insights into action. This is where raw information evolves into strategic decisions that protect both your corporate assets and the well-being of the communities impacted by your operations.

Combine Vulnerability and Equity Data

To create a comprehensive risk profile, merge your vulnerability and equity findings. Incorporate social and equity costs into your risk assessments, ensuring they are evaluated alongside physical threats. For instance, when using a 3×3 risk matrix - where the y-axis represents probability and the x-axis captures the magnitude of consequences (including social impacts) - you can ensure risks affecting marginalized communities are given equal consideration as those impacting physical assets.

Geospatial tools can take this analysis further. By overlaying physical hazard data with social vulnerability information, you can identify areas where resilience-building efforts will have the most significant impact. For example, a manufacturing plant located in a historically redlined neighborhood with high flood risk could emerge as a critical focus area. The facility’s value, combined with the limited ability of nearby residents to adapt, highlights the urgency of intervention. Additionally, pay attention to potential cascading failures, such as disruptions in telecommunications or supply chains, which could amplify the effects of these risks [3][5]. This integrated perspective sets the stage for targeted and effective mitigation strategies.

Develop Mitigation and Action Plans

Action plans should address immediate risks while also aligning with long-term goals. Independent third-party assessments can validate your equity initiatives, ensuring transparency and accountability to stakeholders. Incorporating equity assessments into your broader ESG strategy is essential, especially given the growing recognition of their importance. Research shows that more than 80% of ESG-focused funds outperform traditional investments over one-, five-, and ten-year periods [2].

"Equity assessments should be a core component of an organization's overall ESG journey, particularly given that investors recognize DEI activism as a signal of ESG impact"

BCG researchers [2]

Define clear KPIs to measure success. These could include metrics like reductions in pollution exposure for nearby communities or increased accessibility of products across diverse demographic groups. Evaluate whether your facility locations or data protection policies unintentionally create barriers for marginalized populations. Addressing these issues not only fulfills social responsibilities but also provides measurable economic benefits.

Step 5: Implement, Monitor, and Improve

With your integrated risk and equity insights in hand, it's time to put your strategies into action and refine them over time.

Deploy Your Mitigation Strategies

Focus on addressing the most critical risks first. High-High and High-Medium risk pairs from your risk matrix should take precedence. Standardize risk categories by defining clear probability intervals to ensure consistency in evaluation.

Pay special attention to critical infrastructure or nodes whose failure could trigger widespread disruptions. For instance, a telecommunications hub or a vital supply chain facility might not have the highest individual risk score, but their importance in the larger system should elevate their priority [3]. Conduct materiality assessments to weigh financial impacts against stakeholder priorities, ensuring that resilience investments align with long-term goals [9]. Align your plans with established frameworks like the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) to meet ESG compliance requirements [9].

Bringing in expertise can make a big difference. Consider hiring specialized consultants, such as Architecture and Engineering (A&E) firms or climate adaptation professionals, to help tackle technical challenges and document key issues [3]. Start small by benchmarking against market trends and analyzing how competitors are investing in resilience. This phased approach allows you to gather insights before committing to large-scale capital projects [9].

Once your strategies are in motion, maintaining momentum through continuous monitoring becomes essential.

Monitor Progress and Adjust Plans

After implementing your mitigation measures, track their effectiveness and adapt as needed. Use established KPIs and baseline metrics to measure progress [2]. Regular assessments, conducted annually or bi-annually, provide a consistent way to evaluate outcomes [2]. Research shows that more than 80% of studies on ESG impact reveal that ESG-focused funds outperform traditional ones over one-, five-, and ten-year periods, reinforcing the value of ongoing monitoring [2].

"Assessments shouldn't be so rigid that they aren't improved iteratively based on lessons from the prior cycle. Make sure to track feedback and refine the process with each iteration."

BCG [2]

Gather feedback from individual sites and stay alert to emerging trends to capture real-time impacts [10]. If new vulnerabilities arise, reassess and determine whether they should be elevated to higher-priority status [3][5]. Regularly communicate your progress to both internal and external stakeholders, fostering transparency and accountability [7].

Conclusion

Vulnerability assessments and equity mapping offer powerful ways to build companies that are not only resilient but also inclusive, enabling them to navigate an increasingly complex business landscape. By pinpointing assets most at risk of disruption and evaluating how operations affect diverse communities, businesses lay the groundwork for smarter decisions that safeguard both their financial health and the well-being of those they impact.

The advantages of incorporating these assessments extend beyond risk management - they also contribute to creating long-term value and strengthening competitive positioning.

"The economy can reach its full potential only when all people are able to fully participate."

BCG [2]

Shifting from promises to tangible action requires a deliberate approach: systematic evaluations, clear priorities, and continuous monitoring. Whether tackling cascading infrastructure vulnerabilities or addressing disparities in how products serve various communities, these processes uncover hidden issues and open doors to meaningful progress.

The link between assessment and action is what turns insights into strategic results.

At Council Fire, we specialize in turning these assessments into measurable outcomes. By leveraging systems thinking and focusing on stakeholder-driven planning, we help organizations transform vulnerability and equity insights into actionable strategies. These strategies not only enhance climate resilience but also promote circular economies and generate lasting environmental, social, and economic benefits. We go beyond identifying risks and inequities - we create pathways to address them effectively.

FAQs

What is the difference between vulnerability assessments and equity mapping?

Vulnerability assessments and equity mapping serve as two interconnected tools that help organizations and communities address risks and disparities effectively.

Vulnerability assessments aim to pinpoint and evaluate potential risks - whether they stem from climate change, cybersecurity threats, or public health issues. By analyzing factors like exposure, underlying trends, and existing conditions, these assessments highlight areas or operations most at risk. This insight helps organizations decide where to focus their mitigation efforts.

Equity mapping, in contrast, looks at how resources, opportunities, and risks are distributed across various communities. By uncovering systemic disparities - such as unequal access to resources or concentrated environmental hazards - it provides a foundation for decisions that prioritize fairness and inclusion.

When used together, these approaches offer a comprehensive view of both the severity of risks and the reasons certain groups are more vulnerable. This integrated perspective supports the development of solutions that are not only effective but also equitable.

How can companies use vulnerability and equity assessments to improve their strategic planning?

Companies can strengthen their strategic planning by leveraging insights from vulnerability and equity assessments to pinpoint and address critical risks and disparities. A good starting point is to assess potential social, environmental, and economic vulnerabilities within their operations. Understanding how these factors affect various stakeholder groups, particularly underrepresented communities, can help uncover areas that need attention and drive meaningful action.

To bring these insights into practice, integrate them into existing structures like enterprise risk management (ERM) or broader sustainability strategies. Use the data gathered to establish clear, measurable objectives aimed at minimizing risks and advancing inclusivity. Involving leadership, employees, and community representatives in the process ensures that these insights lead to concrete actions, ultimately fostering resilience, equity, and long-term sustainability across the organization.

What is the role of third-party consultants in vulnerability assessments and equity mapping?

Third-party consultants play an important role in conducting vulnerability assessments and equity mapping, offering an impartial and specialized perspective that organizations might lack internally. Their involvement ensures a detailed and unbiased approach, especially when dealing with intricate challenges such as social equity, environmental risks, or economic vulnerabilities.

By applying established frameworks and data-driven techniques, these consultants pinpoint risks, inequities, and opportunities for improvement across a company's operations, policies, and community engagement. They often identify overlooked biases or gaps that internal teams might miss, helping businesses make decisions that are more inclusive and well-informed. Additionally, their objective insights foster transparency and strengthen trust with stakeholders, making them a critical asset for organizations striving to incorporate sustainability and inclusivity into their long-term strategies.

Related Blog Posts

FAQ

What does it really mean to “redefine profit”?

What makes Council Fire different?

Who does Council Fire you work with?

What does working with Council Fire actually look like?

How does Council Fire help organizations turn big goals into action?

How does Council Fire define and measure success?