Jan 1, 2026

Jan 1, 2026

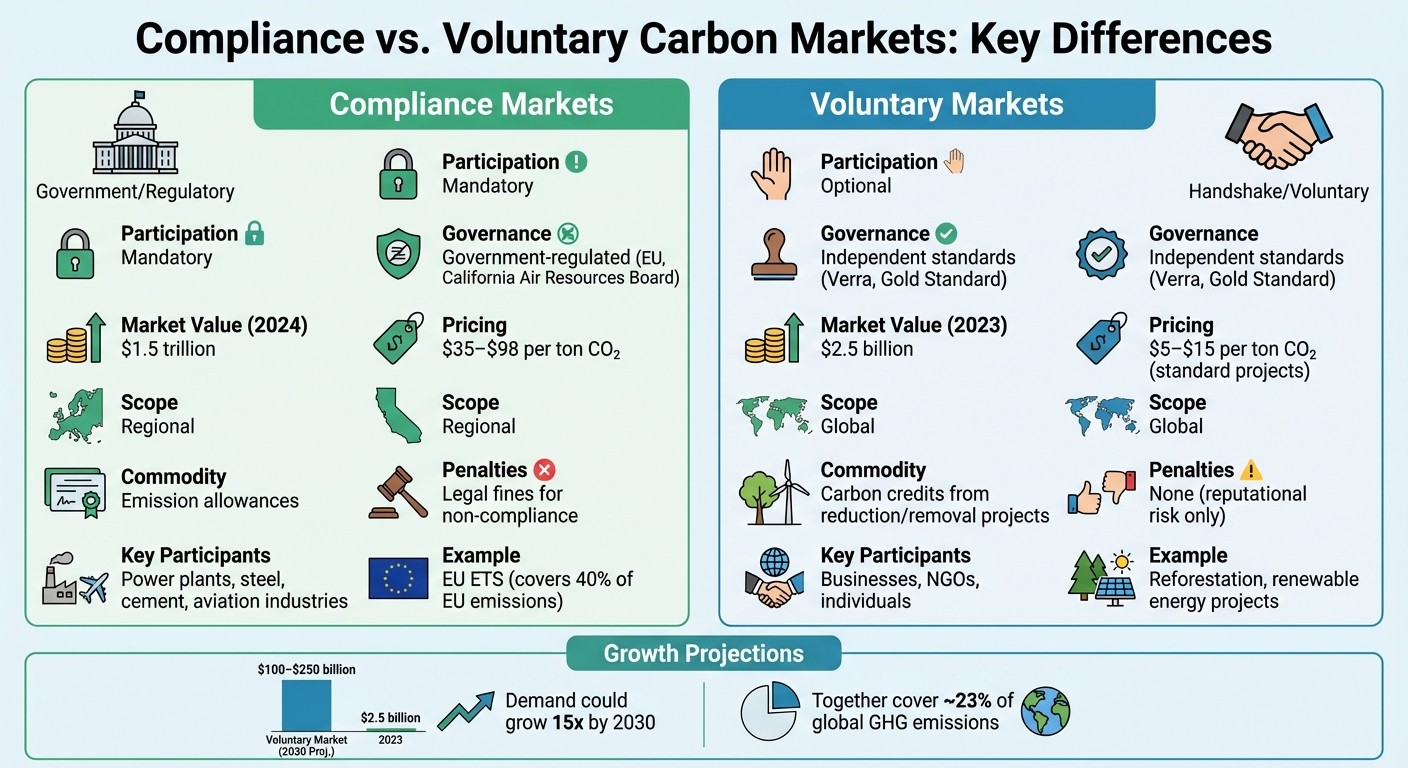

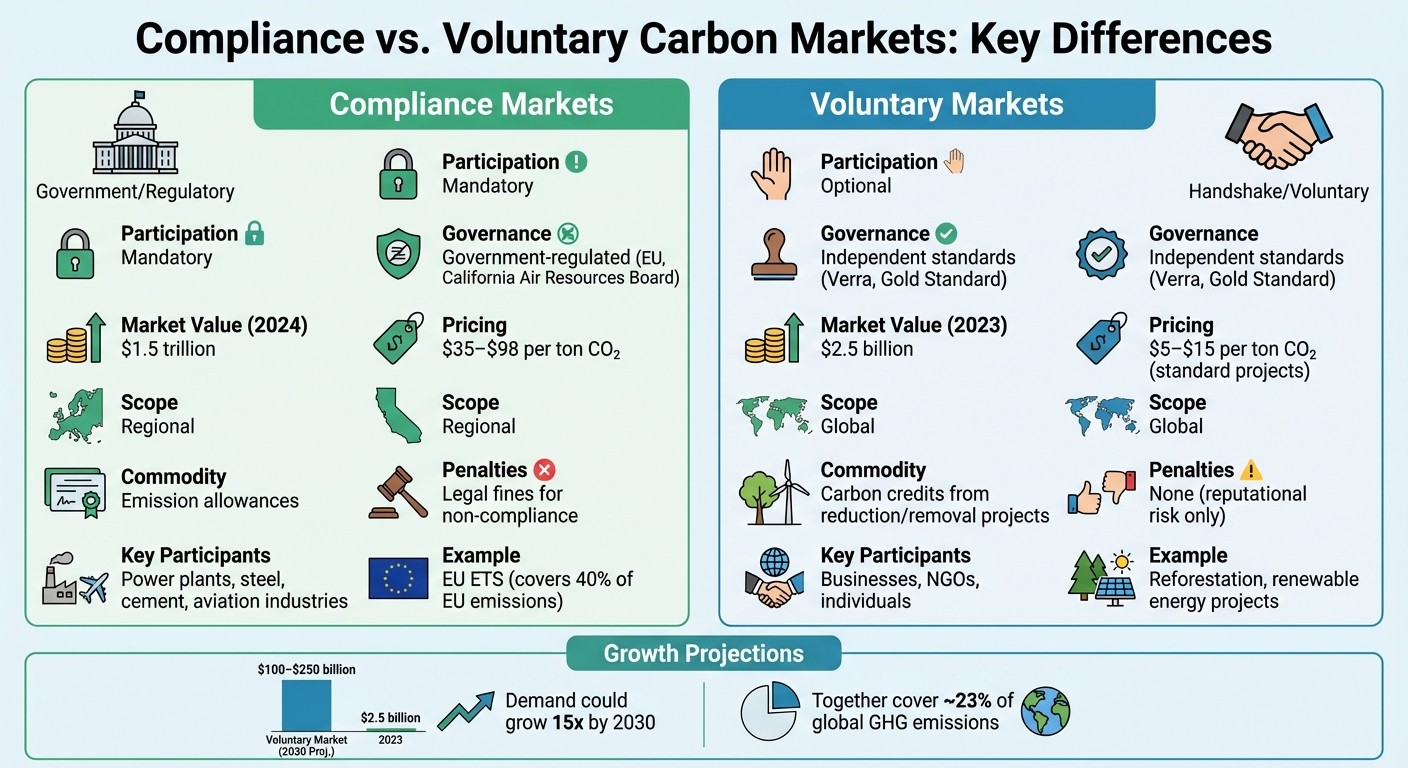

Voluntary vs. Compliance Carbon Markets: Key Differences

ESG Strategy

ESG Strategy

In This Article

Compliance markets force mandatory cuts; voluntary markets fund innovation and extra emissions reductions.

Voluntary vs. Compliance Carbon Markets: Key Differences

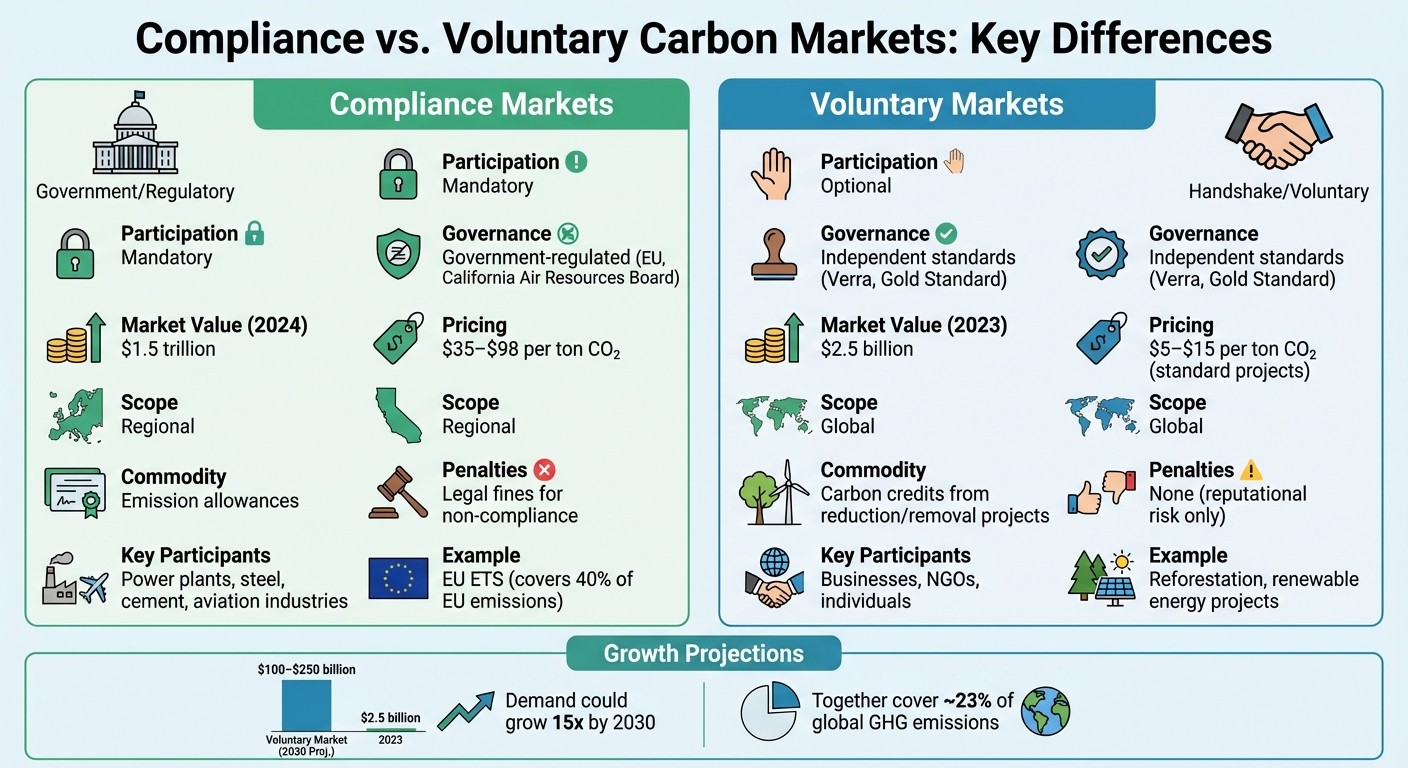

Carbon markets are systems where organizations trade carbon credits to reduce greenhouse gas emissions. These markets fall into two categories:

Compliance Markets: Government-regulated, mandatory for high-emission industries (e.g., power, steel, aviation). Participants must meet legal emission caps or face penalties. In 2024, this market was valued at $1.5 trillion.

Voluntary Markets: Open to businesses, nonprofits, and individuals. Participation is optional, often driven by sustainability goals or public perception. In 2023, this market was valued at $2.5 billion.

Key Differences:

Participation: Compliance is mandatory; voluntary is optional.

Governance: Compliance is overseen by governments; voluntary relies on independent standards (e.g., Verra, Gold Standard).

Cost: Compliance credits are pricier ($35–$98/ton); voluntary credits range from $5–$15/ton.

Scope: Compliance markets are regional; voluntary markets are global.

Both markets serve different purposes but complement each other in reducing emissions and funding climate projects.

Quick Comparison

Aspect | Compliance Markets | Voluntary Markets |

|---|---|---|

Participation | Mandatory | Optional |

Governance | Government-regulated | Independent standards |

Market Value (2024) | $1.5 trillion | $2.5 billion |

Pricing | $35–$98/ton | $5–$15/ton |

Scope | Regional | Global |

This dual-market system allows organizations to meet legal requirements while supporting broader emission reduction goals.

Compliance vs Voluntary Carbon Markets: Key Differences Comparison

Compliance Carbon Markets Explained

Purpose and Scope

Compliance carbon markets are regulatory systems designed to enforce greenhouse gas emission reductions, helping nations meet their legal commitments under agreements like the Paris Agreement and the Kyoto Protocol [3]. These markets function by setting a cap on total emissions allowed within specific sectors. Companies must stay within these limits or face penalties.

The European Union Emissions Trading System (EU ETS), launched in 2005, is the largest compliance market globally. It covers power plants and industrial facilities, with annual reductions in the cap to ensure continuous progress in cutting emissions [6]. Similarly, California's Cap-and-Trade Program, initiated in 2013, applies to major industries, utilities, and fuel distributors [8]. Germany's National Emissions Trading System (nEHS) targets sectors like buildings and transportation - areas not included under the EU ETS - by implementing a fixed carbon price that rises incrementally [3].

As of 2024, carbon pricing initiatives are active in 46 national and 37 subnational jurisdictions, collectively covering about 23% of global greenhouse gas emissions. Emerging markets in Asia are also stepping up, with Indonesia launching a system in late 2023, Vietnam piloting one in 2024, and Malaysia planning to roll out its program by early 2025 [6].

Who Participates

Compliance markets are designed to regulate high-emission sectors. Key participants include power generation companies, heavy industries such as cement, steel, and aluminum producers, and aviation companies. These entities must adhere to government-set emission thresholds. Regulatory bodies like the European Commission and the California Air Resources Board oversee these markets, setting caps and issuing or auctioning allowances [3].

In 2023, Tesla, Inc. reported $1.78 billion in revenue from selling regulatory carbon credits [6]. Market intermediaries, such as brokers and exchanges, play a critical role in facilitating the trade of surplus allowances. Furthermore, mechanisms like the EU's Carbon Border Adjustment Mechanism (CBAM), starting in 2026, will require foreign producers of carbon-intensive goods to account for the carbon costs embedded in their products [3].

How the Market Works

Compliance markets typically operate through two main systems: cap-and-trade and baseline-and-credit. In a cap-and-trade system, companies emitting less than their allocated allowances can sell the surplus [3].

Australia's Safeguard Mechanism exemplifies the baseline-and-credit approach, where companies exceeding a government-defined emission baseline must purchase Australian Carbon Credit Units (ACCUs) to offset the excess [5]. Globally, compliance markets handled approximately $1.5 trillion in trades in 2024, with considerable CO₂ volumes exchanged [6]. Prices in these markets tend to be higher than those in voluntary markets due to regulatory costs and the legal requirement to comply. However, they can be volatile, influenced by factors like geopolitical events, policy shifts, and renewable energy trends [3][4].

"For companies that are not covered by the European regulations, but are covered by the nEHS, there is likely to be a lack of understanding of the complexity and potential financial liability of a carbon compliance scheme."

– Vanessa Kükenthal, nEHS Specialist, CFP Energy [3]

To meet compliance, companies can adopt various strategies, such as installing emission-reduction technologies, switching to cleaner fuels, improving operational efficiency, or purchasing surplus allowances. The Northern Lights project, a collaboration between Equinor, Shell, and TotalEnergies, illustrates such efforts. This initiative stores 1.5 million metric tons of CO₂ annually for industrial emitters, showcasing the infrastructure needed to meet decarbonization goals [6]. Unlike the flexibility seen in voluntary carbon markets, compliance markets operate within a tightly controlled framework, ensuring adherence to mandated emission targets.

Voluntary Carbon Markets Explained

Purpose and Flexibility

Voluntary carbon markets (VCMs) stand apart from compliance markets in a key way: participation is entirely optional. Here, private individuals and organizations choose to buy and sell carbon credits, not because regulations require it, but to meet their own goals [9]. In this system, credits represent measurable amounts of CO₂e that have been either avoided or removed from the atmosphere.

The motivations for engaging in VCMs are diverse. Many companies aim to fulfill corporate social responsibility (CSR) commitments, distinguish their brands, or achieve "carbon neutral" or "net-zero" targets [5] [9]. By purchasing credits, businesses can align with consumer demand for sustainability, improve their public image, and even prepare for potential future regulations [2] [4].

"Voluntary carbon markets provide a flexible approach for entities looking to enhance their corporate image, meet consumer demand for greener products, or prepare for future regulatory requirements." – montel.energy [4]

Unlike compliance markets, which follow strict cap-and-trade rules with government-issued allowances, VCMs are project-driven. These projects often focus on initiatives like reforestation, renewable energy, or community-based programs [2] [10]. This flexibility allows participants to choose projects that align with their priorities, such as biodiversity conservation or local community support [4] [10].

Who Participates

Private companies dominate the demand side of voluntary markets. By 2023, over one-third of the largest publicly traded companies worldwide had committed to net-zero targets. Many of these businesses rely on carbon credits to offset emissions from their operations, supply chains, or activities like business travel [8].

Participation isn’t limited to corporations. NGOs, individuals, and public agencies also engage in VCMs to offset emissions from events, travel, or other activities [9]. On the supply side, project developers - including local communities, private landowners, and regional governments - use VCMs to fund environmental projects [5] [9]. Governments, too, leverage these markets to attract foreign investment and exceed their climate goals [9] [11]. For example, Japan’s GX League involves over 600 companies, representing roughly 40% of the country’s emissions [11]. Globally, countries like India, China, Brazil, the United States, and Indonesia lead in supplying carbon credits, with Southern Asia excelling overall and Latin America specializing in nature-based solutions [9].

This broad participation supports a variety of projects, all guided by established standards to ensure credibility.

Project Types and Standards

Voluntary carbon markets back a wide array of projects aimed at reducing or removing emissions. Popular initiatives include reforestation, afforestation, renewable energy installations (like solar and wind farms), methane capture from landfills or farms, and community-focused efforts such as clean cookstove programs [4] [9]. For instance, the Virunga National Park Hydropower project in the Democratic Republic of Congo delivers sustainable energy to about 4 million people while safeguarding local ecosystems [13].

To ensure the quality of credits, independent NGOs establish rigorous standards [12]. The Verified Carbon Standard (VCS), managed by Verra, leads the market, accounting for 71.3% of all credits issued as of June 2023 [9]. The Gold Standard follows with a 16.7% market share, particularly favored by European buyers [9] [12]. In North America, the American Carbon Registry (ACR) and the Climate Action Reserve (CAR) hold shares of 6.3% and 5.1%, respectively [9] [12].

Verification involves several steps: preparing a Project Design Document, undergoing independent validation, monitoring progress periodically, and conducting onsite audits. This process ensures that projects meet key criteria like additionality, permanence, and avoiding double counting [12] [13].

Beyond carbon reduction, many projects provide additional benefits, such as advancing the UN Sustainable Development Goals. Standards like SD VISta (Verra) and GS4GG (Gold Standard) certify contributions to goals like clean water, gender equality, and biodiversity protection [10] [12]. Projects with verified co-benefits or nature-based solutions often command higher prices in the market [4] [5].

These well-defined standards and verification processes form the foundation for comparing voluntary and compliance markets.

Key Differences Between the Two Markets

Regulation and Governance

The most notable distinction lies in who oversees and enforces participation. Compliance markets are mandatory systems governed by official entities such as national governments, regional authorities, or international organizations like the EU or California's Air Resources Board. Businesses in regulated sectors must participate, and failure to comply can result in financial penalties [1][4].

On the other hand, voluntary markets operate without government mandates. Instead, organizations like Verra, which manages the Verified Carbon Standard, and the Gold Standard establish rules and verify projects [4][5]. Participation is open to businesses, nonprofits, or individuals who choose to buy credits. These markets rely on third-party audits and public registries to ensure credibility rather than governmental enforcement [3][5].

These differences in governance significantly influence market size and who can participate.

Market Size and Accessibility

Building on these governance distinctions, the scale and reach of the two markets differ dramatically. In 2024, compliance markets reached a trading value of approximately $1.5 trillion, covering about 23% of global greenhouse gas emissions [6]. By comparison, the voluntary market was valued at $2.5 billion in 2023, though it is growing quickly, with projections suggesting it could reach $100 billion to $250 billion by 2030 [6].

Geographic scope is another key difference. Compliance markets are typically region-specific, such as the EU ETS in Europe, China's national ETS, or California's state-level system [1][3]. Voluntary markets, however, operate globally, enabling a company in New York to support projects like reforestation in Brazil or renewable energy initiatives in India [5]. This global flexibility makes voluntary markets accessible to organizations of any size or location, while compliance markets are restricted to entities within specific jurisdictions that meet predefined emission thresholds [2].

Cost and Flexibility

The pricing structures of these markets reflect their unique dynamics. Compliance costs are generally higher, driven by regulatory caps and legal mandates. For instance, in 2024, prices in the EU ETS ranged between €80 and €90 per ton (approximately $87–$98), with the average carbon price across compliance markets in 2020 at $34.99 [14][16].

In voluntary markets, pricing varies widely, from less than $1 per ton to $119 per ton of CO₂e, depending on factors like project type, location, and quality [14]. Most high-quality offsets in voluntary markets are priced between $5 and $15 per ton [16]. Projects that actively remove carbon, such as direct air capture, often command premium prices compared to those that prevent emissions, like clean cookstove initiatives [15]. Additionally, nature-based projects with added benefits, such as biodiversity protection or community development, tend to fetch higher prices [5].

The table below highlights the key differences between the two markets:

Aspect | Compliance Markets | Voluntary Markets |

|---|---|---|

Participation | Mandatory for regulated sectors | Optional for any entity |

Governance | Managed by government authorities (e.g., EU, California) | Based on independent standards (e.g., Verra, Gold Standard) |

Commodity | Allowances (permission to emit) | Offsets (proof of reduction or removal) |

Geographic Scope | Regional or national | Global |

Market Value (2023-2024) | ~$1.5 trillion [6] | ~$2.5 billion [6] |

Typical Price Range | $5–$15/ton [16] | |

Flexibility | Low; strict caps and penalties | High; choice of projects and timing |

"The distinction between compliance and voluntary carbon markets isn't just a technicality - it shapes how businesses and entire industries approach carbon reduction." – CarbonUnits.com [1]

Effectiveness and Standards

Verification and Transparency

Compliance carbon markets maintain their credibility through rigorous government oversight. Centralized registries are used to track allowances and ensure there’s no double-counting of emissions, as demonstrated by the EU Emissions Trading System (EU ETS), which oversees nearly 40% of the European Union's emissions [3][11].

Voluntary carbon markets, on the other hand, rely on independent third-party standards for project verification. Standards like Verra's Verified Carbon Standard and the Gold Standard play a pivotal role in maintaining integrity. While voluntary markets were once fragmented due to over-the-counter trades [11], efforts like the Integrity Council for the Voluntary Carbon Market (ICVCM) have stepped in to establish global benchmarks for credit quality [5]. Adding to this momentum, the Biden-Harris Administration announced a $35 million Carbon Dioxide Removal Purchase Pilot Prize in May 2024 to support the development of a trustworthy voluntary carbon market [18].

The enforcement mechanisms differ significantly between the two markets. Compliance markets impose financial penalties for violations - for instance, the EU ETS charges €100 per ton of CO₂ for non-compliance [10]. In contrast, voluntary markets depend on market reputation and adherence to evolving standards [5]. These distinct approaches not only influence accountability but also shape the broader impact of each system.

Long-Term Impact

Compliance markets are designed to drive systemic change by enforcing mandatory emission reductions. Through cap-and-trade systems, they gradually lower the number of allowances available, creating a regulatory baseline that supports national and international climate goals [3][10].

Voluntary markets, however, excel in fostering innovation and channeling climate finance into projects that might otherwise go unfunded. These projects often include nature-based solutions like reforestation and cutting-edge technologies such as direct air capture. Projections suggest that demand for voluntary carbon credits could grow by 15 times or more by 2030, potentially offsetting 1.5 to 2.0 gigatons of CO₂ annually [17][5]. This expansion not only helps companies mitigate their residual emissions but also contributes to broader climate resilience through benefits like biodiversity conservation and community support [10][5].

"The voluntary carbon market directs private financing to climate-action projects that would not otherwise get off the ground." – McKinsey & Company [17]

Both markets play distinct yet complementary roles in addressing climate challenges, with compliance markets setting mandatory limits and voluntary markets driving innovation and additional funding for impactful projects.

Comparison Table

Side-by-Side Comparison

Voluntary and compliance carbon markets share the common goal of reducing greenhouse gas emissions, but their structures, participants, and objectives differ significantly. These differences influence how organizations engage with each market, from regulatory frameworks to pricing and verification processes.

Below is a detailed comparison that outlines the key aspects of these two markets. This table provides a clear view of their unique characteristics, helping businesses and individuals evaluate which market aligns best with their climate strategies and obligations.

Aspect | Compliance Carbon Markets | Voluntary Carbon Markets |

|---|---|---|

Regulation | Mandatory, overseen by government or international authorities | Voluntary, guided by independent third-party standards |

Participants | Dominated by high-emission industries like power, manufacturing, aviation, and heavy industry | Open to businesses, NGOs, and individuals |

Objective | Fulfill legally binding emission reduction targets to avoid penalties | Offset emissions to meet CSR goals, enhance brand reputation, and achieve Net Zero ambitions |

Commodity | Emission allowances (permits to emit specific amounts) | Carbon credits from emission reduction or removal projects |

Flexibility | Limited, with strict regulatory caps and guidelines | High, allowing participants to choose projects and set personalized targets |

Market Size | Larger in financial value and emissions scope | Valued at roughly $2 billion in 2022, with projections of $10–$40 billion by 2030 [5][14] |

Pricing | Typically higher, with prices around €80–€90 per ton in the EU ETS for 2024 and a weighted global average of $34.99 per ton [14][16] | Generally lower, ranging from $5–$15 per ton for standard projects, though prices can vary from under $1 to over $119 per ton [14][16] |

Verification | Conducted by regulatory bodies using centralized registries | Managed by independent third-party organizations like Verra, Gold Standard, and Plan Vivo |

Penalties | Legal fines and financial sanctions for non-compliance | No legal penalties, though reputational risks may arise |

Environmental Impact | Promotes systematic reductions through mandatory caps | Supports diverse projects like reforestation, clean energy, and direct air capture, often delivering additional benefits such as biodiversity and community support [5] |

This side-by-side comparison highlights how these markets complement each other, offering distinct yet interconnected pathways to drive decarbonization efforts effectively.

Using Both Markets for Decarbonization

Combining Voluntary and Compliance Approaches

Organizations can take advantage of both compliance and voluntary carbon markets to meet their decarbonization goals. By adopting a hybrid approach, companies can fulfill mandatory obligations through compliance markets while also using voluntary credits to tackle emissions not covered by regulations or to showcase leadership in reducing carbon footprints beyond legal requirements [3][4].

This strategy is particularly useful for addressing emissions that are harder to eliminate. It allows companies to support impactful projects like reforestation or direct air capture while they work on longer-term decarbonization plans [5]. For example, the aviation industry has embraced this dual approach through CORSIA, a program requiring airlines to offset emissions using approved carbon credits to maintain net emissions at 2020 levels [3][7].

Some carbon credits add an extra layer of adaptability by functioning in both markets. Australian Carbon Credit Units (ACCUs), for instance, can be traded in compliance or voluntary markets. This dual-use capability gives organizations the flexibility to adjust their strategies as regulations and market dynamics evolve [5]. Such adaptability becomes increasingly important as compliance schemes grow. The EU's Carbon Border Adjustment Mechanism (CBAM), for example, will be phased in starting in 2026, initially targeting high-carbon industries like cement, steel, and aluminum [3]. Additionally, the Science Based Targets initiative (SBTi) is moving toward allowing carbon offsets to count for Scope 3 emissions, offering a clearer role for voluntary credits in achieving broader net-zero goals [7].

Given the complexities of managing this dual-market approach, specialized expertise is critical.

Working with Expert Consultancies

Effectively navigating the interplay between voluntary and compliance carbon markets requires a deep understanding of pricing trends, evolving regulations, and the quality of carbon credits.

"For companies that are not covered by the European regulations, but are covered by the nEHS, there is likely to be a lack of understanding of the complexity and potential financial liability of a carbon compliance scheme" [3].

Expert consultancies like Council Fire play a vital role in helping organizations integrate both markets into their decarbonization strategies. These firms prioritize reducing internal emissions first and then guide companies in selecting high-quality voluntary credits that align with corporate values and the UN Sustainable Development Goals. They also help secure long-term offtake agreements - similar to power purchase agreements - that lock in a set volume of credits at fixed prices over several years. This approach provides financial predictability in volatile markets [5].

Conclusion

Key Takeaways

This discussion has shed light on the distinct purposes of compliance and voluntary carbon markets in addressing climate change. Compliance markets focus on enforcing mandatory emission reductions, compelling high-emission industries to meet legally binding targets or face penalties. A notable example is the EU ETS, which has achieved a 41% reduction in covered emissions since 2005 [20]. On the other hand, voluntary carbon markets offer a flexible mechanism for businesses, NGOs, and individuals to offset emissions beyond regulatory requirements, funding diverse initiatives like reforestation and direct air capture.

Together, these markets play complementary roles in advancing decarbonization. Compliance markets drive systemic industrial shifts by imposing progressively tighter emission caps, while voluntary markets provide funding for innovative climate projects that might not otherwise gain regulatory support. Currently, compliance markets account for approximately 20% of global greenhouse gas emissions, whereas voluntary markets represent less than 1% [20].

Many organizations find value in adopting a hybrid approach - using compliance markets to fulfill mandatory obligations while leveraging voluntary credits to address residual emissions and demonstrate leadership in climate action. Projections indicate that demand for voluntary credits could grow 15-fold by 2030 and 100-fold by 2050 [19].

To maximize impact, prioritize cutting internal emissions before addressing residual emissions through high-quality carbon credits. Collaborating with experienced partners, such as Council Fire (https://councilfire.org), can help align your strategy with regulatory requirements and broader sustainability goals to achieve meaningful decarbonization.

Carbon Markets 101: A Beginners Guide to Carbon Markets | Dr. Roger Cohen, PhD

FAQs

What are the benefits for companies participating in voluntary carbon markets?

Participating in voluntary carbon markets allows companies to address their climate goals in a flexible and cost-efficient manner while strengthening their competitive edge. By purchasing verified carbon credits, businesses can offset emissions that are difficult or expensive to reduce within their operations, contributing to progress toward net-zero targets. Additionally, these investments channel resources into projects that actively reduce or prevent greenhouse gas emissions, amplifying global efforts to tackle climate change.

The benefits go beyond environmental impact. Voluntary carbon markets offer businesses the opportunity to showcase their dedication to sustainability, enhancing their brand image and meeting the rising expectations of investors, customers, and other stakeholders. This engagement not only helps companies differentiate themselves but also builds goodwill and aligns them with broader societal and environmental goals.

Council Fire assists organizations in navigating these markets with strategic support. From selecting high-quality carbon credits to effectively communicating climate initiatives, they provide the tools needed to maximize both reputational value and financial outcomes.

What’s the difference between compliance and voluntary carbon markets, and how do they work together to reduce emissions?

Compliance carbon markets operate under mandatory government regulations, setting strict emission caps for industries like power plants, airlines, and heavy manufacturing. Companies within these sectors must either cut their emissions or purchase allowances, effectively assigning a financial cost to carbon emissions. This approach has proven effective in driving meaningful reductions in high-emission industries.

In contrast, voluntary carbon markets provide an optional platform for businesses and individuals to purchase carbon credits. These credits fund projects aimed at reducing or avoiding emissions, such as reforestation efforts or renewable energy ventures. Unlike compliance markets, voluntary markets often support smaller or innovative projects that may not yet be included in regulatory programs.

Together, these two types of markets create a powerful synergy. Compliance markets enforce large-scale emission reductions through regulation, while voluntary markets support additional initiatives, enabling organizations to meet broader sustainability targets. This dual approach plays a critical role in advancing progress toward net-zero emissions by blending strict oversight with adaptable, market-based solutions.

What drives the price differences between compliance and voluntary carbon credits?

The price gap between compliance carbon credits and voluntary carbon credits stems from differences in regulation, market dynamics, and the specifics of individual projects. Compliance credits are directly tied to government policies, such as carbon caps or taxes, which create a legally mandated demand. This enforced demand, coupled with rigorous verification processes and penalties for non-compliance, tends to keep their prices higher and more consistent.

On the other hand, voluntary credits are shaped by corporate environmental goals and operate in a less regulated space. Their pricing often hinges on factors like the credibility and transparency of the project, as well as any additional benefits it provides, such as supporting local communities or preserving biodiversity. While buyers in the voluntary market may negotiate lower prices, high-quality projects - those with robust monitoring systems or extra social contributions - frequently fetch a premium. Other elements, including the size of the market, transaction costs, and the reputation of the certifying body, also influence pricing. Council Fire assists organizations in navigating these variables, helping them craft carbon credit strategies that align with their objectives and financial plans.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 1, 2026

Voluntary vs. Compliance Carbon Markets: Key Differences

ESG Strategy

In This Article

Compliance markets force mandatory cuts; voluntary markets fund innovation and extra emissions reductions.

Voluntary vs. Compliance Carbon Markets: Key Differences

Carbon markets are systems where organizations trade carbon credits to reduce greenhouse gas emissions. These markets fall into two categories:

Compliance Markets: Government-regulated, mandatory for high-emission industries (e.g., power, steel, aviation). Participants must meet legal emission caps or face penalties. In 2024, this market was valued at $1.5 trillion.

Voluntary Markets: Open to businesses, nonprofits, and individuals. Participation is optional, often driven by sustainability goals or public perception. In 2023, this market was valued at $2.5 billion.

Key Differences:

Participation: Compliance is mandatory; voluntary is optional.

Governance: Compliance is overseen by governments; voluntary relies on independent standards (e.g., Verra, Gold Standard).

Cost: Compliance credits are pricier ($35–$98/ton); voluntary credits range from $5–$15/ton.

Scope: Compliance markets are regional; voluntary markets are global.

Both markets serve different purposes but complement each other in reducing emissions and funding climate projects.

Quick Comparison

Aspect | Compliance Markets | Voluntary Markets |

|---|---|---|

Participation | Mandatory | Optional |

Governance | Government-regulated | Independent standards |

Market Value (2024) | $1.5 trillion | $2.5 billion |

Pricing | $35–$98/ton | $5–$15/ton |

Scope | Regional | Global |

This dual-market system allows organizations to meet legal requirements while supporting broader emission reduction goals.

Compliance vs Voluntary Carbon Markets: Key Differences Comparison

Compliance Carbon Markets Explained

Purpose and Scope

Compliance carbon markets are regulatory systems designed to enforce greenhouse gas emission reductions, helping nations meet their legal commitments under agreements like the Paris Agreement and the Kyoto Protocol [3]. These markets function by setting a cap on total emissions allowed within specific sectors. Companies must stay within these limits or face penalties.

The European Union Emissions Trading System (EU ETS), launched in 2005, is the largest compliance market globally. It covers power plants and industrial facilities, with annual reductions in the cap to ensure continuous progress in cutting emissions [6]. Similarly, California's Cap-and-Trade Program, initiated in 2013, applies to major industries, utilities, and fuel distributors [8]. Germany's National Emissions Trading System (nEHS) targets sectors like buildings and transportation - areas not included under the EU ETS - by implementing a fixed carbon price that rises incrementally [3].

As of 2024, carbon pricing initiatives are active in 46 national and 37 subnational jurisdictions, collectively covering about 23% of global greenhouse gas emissions. Emerging markets in Asia are also stepping up, with Indonesia launching a system in late 2023, Vietnam piloting one in 2024, and Malaysia planning to roll out its program by early 2025 [6].

Who Participates

Compliance markets are designed to regulate high-emission sectors. Key participants include power generation companies, heavy industries such as cement, steel, and aluminum producers, and aviation companies. These entities must adhere to government-set emission thresholds. Regulatory bodies like the European Commission and the California Air Resources Board oversee these markets, setting caps and issuing or auctioning allowances [3].

In 2023, Tesla, Inc. reported $1.78 billion in revenue from selling regulatory carbon credits [6]. Market intermediaries, such as brokers and exchanges, play a critical role in facilitating the trade of surplus allowances. Furthermore, mechanisms like the EU's Carbon Border Adjustment Mechanism (CBAM), starting in 2026, will require foreign producers of carbon-intensive goods to account for the carbon costs embedded in their products [3].

How the Market Works

Compliance markets typically operate through two main systems: cap-and-trade and baseline-and-credit. In a cap-and-trade system, companies emitting less than their allocated allowances can sell the surplus [3].

Australia's Safeguard Mechanism exemplifies the baseline-and-credit approach, where companies exceeding a government-defined emission baseline must purchase Australian Carbon Credit Units (ACCUs) to offset the excess [5]. Globally, compliance markets handled approximately $1.5 trillion in trades in 2024, with considerable CO₂ volumes exchanged [6]. Prices in these markets tend to be higher than those in voluntary markets due to regulatory costs and the legal requirement to comply. However, they can be volatile, influenced by factors like geopolitical events, policy shifts, and renewable energy trends [3][4].

"For companies that are not covered by the European regulations, but are covered by the nEHS, there is likely to be a lack of understanding of the complexity and potential financial liability of a carbon compliance scheme."

– Vanessa Kükenthal, nEHS Specialist, CFP Energy [3]

To meet compliance, companies can adopt various strategies, such as installing emission-reduction technologies, switching to cleaner fuels, improving operational efficiency, or purchasing surplus allowances. The Northern Lights project, a collaboration between Equinor, Shell, and TotalEnergies, illustrates such efforts. This initiative stores 1.5 million metric tons of CO₂ annually for industrial emitters, showcasing the infrastructure needed to meet decarbonization goals [6]. Unlike the flexibility seen in voluntary carbon markets, compliance markets operate within a tightly controlled framework, ensuring adherence to mandated emission targets.

Voluntary Carbon Markets Explained

Purpose and Flexibility

Voluntary carbon markets (VCMs) stand apart from compliance markets in a key way: participation is entirely optional. Here, private individuals and organizations choose to buy and sell carbon credits, not because regulations require it, but to meet their own goals [9]. In this system, credits represent measurable amounts of CO₂e that have been either avoided or removed from the atmosphere.

The motivations for engaging in VCMs are diverse. Many companies aim to fulfill corporate social responsibility (CSR) commitments, distinguish their brands, or achieve "carbon neutral" or "net-zero" targets [5] [9]. By purchasing credits, businesses can align with consumer demand for sustainability, improve their public image, and even prepare for potential future regulations [2] [4].

"Voluntary carbon markets provide a flexible approach for entities looking to enhance their corporate image, meet consumer demand for greener products, or prepare for future regulatory requirements." – montel.energy [4]

Unlike compliance markets, which follow strict cap-and-trade rules with government-issued allowances, VCMs are project-driven. These projects often focus on initiatives like reforestation, renewable energy, or community-based programs [2] [10]. This flexibility allows participants to choose projects that align with their priorities, such as biodiversity conservation or local community support [4] [10].

Who Participates

Private companies dominate the demand side of voluntary markets. By 2023, over one-third of the largest publicly traded companies worldwide had committed to net-zero targets. Many of these businesses rely on carbon credits to offset emissions from their operations, supply chains, or activities like business travel [8].

Participation isn’t limited to corporations. NGOs, individuals, and public agencies also engage in VCMs to offset emissions from events, travel, or other activities [9]. On the supply side, project developers - including local communities, private landowners, and regional governments - use VCMs to fund environmental projects [5] [9]. Governments, too, leverage these markets to attract foreign investment and exceed their climate goals [9] [11]. For example, Japan’s GX League involves over 600 companies, representing roughly 40% of the country’s emissions [11]. Globally, countries like India, China, Brazil, the United States, and Indonesia lead in supplying carbon credits, with Southern Asia excelling overall and Latin America specializing in nature-based solutions [9].

This broad participation supports a variety of projects, all guided by established standards to ensure credibility.

Project Types and Standards

Voluntary carbon markets back a wide array of projects aimed at reducing or removing emissions. Popular initiatives include reforestation, afforestation, renewable energy installations (like solar and wind farms), methane capture from landfills or farms, and community-focused efforts such as clean cookstove programs [4] [9]. For instance, the Virunga National Park Hydropower project in the Democratic Republic of Congo delivers sustainable energy to about 4 million people while safeguarding local ecosystems [13].

To ensure the quality of credits, independent NGOs establish rigorous standards [12]. The Verified Carbon Standard (VCS), managed by Verra, leads the market, accounting for 71.3% of all credits issued as of June 2023 [9]. The Gold Standard follows with a 16.7% market share, particularly favored by European buyers [9] [12]. In North America, the American Carbon Registry (ACR) and the Climate Action Reserve (CAR) hold shares of 6.3% and 5.1%, respectively [9] [12].

Verification involves several steps: preparing a Project Design Document, undergoing independent validation, monitoring progress periodically, and conducting onsite audits. This process ensures that projects meet key criteria like additionality, permanence, and avoiding double counting [12] [13].

Beyond carbon reduction, many projects provide additional benefits, such as advancing the UN Sustainable Development Goals. Standards like SD VISta (Verra) and GS4GG (Gold Standard) certify contributions to goals like clean water, gender equality, and biodiversity protection [10] [12]. Projects with verified co-benefits or nature-based solutions often command higher prices in the market [4] [5].

These well-defined standards and verification processes form the foundation for comparing voluntary and compliance markets.

Key Differences Between the Two Markets

Regulation and Governance

The most notable distinction lies in who oversees and enforces participation. Compliance markets are mandatory systems governed by official entities such as national governments, regional authorities, or international organizations like the EU or California's Air Resources Board. Businesses in regulated sectors must participate, and failure to comply can result in financial penalties [1][4].

On the other hand, voluntary markets operate without government mandates. Instead, organizations like Verra, which manages the Verified Carbon Standard, and the Gold Standard establish rules and verify projects [4][5]. Participation is open to businesses, nonprofits, or individuals who choose to buy credits. These markets rely on third-party audits and public registries to ensure credibility rather than governmental enforcement [3][5].

These differences in governance significantly influence market size and who can participate.

Market Size and Accessibility

Building on these governance distinctions, the scale and reach of the two markets differ dramatically. In 2024, compliance markets reached a trading value of approximately $1.5 trillion, covering about 23% of global greenhouse gas emissions [6]. By comparison, the voluntary market was valued at $2.5 billion in 2023, though it is growing quickly, with projections suggesting it could reach $100 billion to $250 billion by 2030 [6].

Geographic scope is another key difference. Compliance markets are typically region-specific, such as the EU ETS in Europe, China's national ETS, or California's state-level system [1][3]. Voluntary markets, however, operate globally, enabling a company in New York to support projects like reforestation in Brazil or renewable energy initiatives in India [5]. This global flexibility makes voluntary markets accessible to organizations of any size or location, while compliance markets are restricted to entities within specific jurisdictions that meet predefined emission thresholds [2].

Cost and Flexibility

The pricing structures of these markets reflect their unique dynamics. Compliance costs are generally higher, driven by regulatory caps and legal mandates. For instance, in 2024, prices in the EU ETS ranged between €80 and €90 per ton (approximately $87–$98), with the average carbon price across compliance markets in 2020 at $34.99 [14][16].

In voluntary markets, pricing varies widely, from less than $1 per ton to $119 per ton of CO₂e, depending on factors like project type, location, and quality [14]. Most high-quality offsets in voluntary markets are priced between $5 and $15 per ton [16]. Projects that actively remove carbon, such as direct air capture, often command premium prices compared to those that prevent emissions, like clean cookstove initiatives [15]. Additionally, nature-based projects with added benefits, such as biodiversity protection or community development, tend to fetch higher prices [5].

The table below highlights the key differences between the two markets:

Aspect | Compliance Markets | Voluntary Markets |

|---|---|---|

Participation | Mandatory for regulated sectors | Optional for any entity |

Governance | Managed by government authorities (e.g., EU, California) | Based on independent standards (e.g., Verra, Gold Standard) |

Commodity | Allowances (permission to emit) | Offsets (proof of reduction or removal) |

Geographic Scope | Regional or national | Global |

Market Value (2023-2024) | ~$1.5 trillion [6] | ~$2.5 billion [6] |

Typical Price Range | $5–$15/ton [16] | |

Flexibility | Low; strict caps and penalties | High; choice of projects and timing |

"The distinction between compliance and voluntary carbon markets isn't just a technicality - it shapes how businesses and entire industries approach carbon reduction." – CarbonUnits.com [1]

Effectiveness and Standards

Verification and Transparency

Compliance carbon markets maintain their credibility through rigorous government oversight. Centralized registries are used to track allowances and ensure there’s no double-counting of emissions, as demonstrated by the EU Emissions Trading System (EU ETS), which oversees nearly 40% of the European Union's emissions [3][11].

Voluntary carbon markets, on the other hand, rely on independent third-party standards for project verification. Standards like Verra's Verified Carbon Standard and the Gold Standard play a pivotal role in maintaining integrity. While voluntary markets were once fragmented due to over-the-counter trades [11], efforts like the Integrity Council for the Voluntary Carbon Market (ICVCM) have stepped in to establish global benchmarks for credit quality [5]. Adding to this momentum, the Biden-Harris Administration announced a $35 million Carbon Dioxide Removal Purchase Pilot Prize in May 2024 to support the development of a trustworthy voluntary carbon market [18].

The enforcement mechanisms differ significantly between the two markets. Compliance markets impose financial penalties for violations - for instance, the EU ETS charges €100 per ton of CO₂ for non-compliance [10]. In contrast, voluntary markets depend on market reputation and adherence to evolving standards [5]. These distinct approaches not only influence accountability but also shape the broader impact of each system.

Long-Term Impact

Compliance markets are designed to drive systemic change by enforcing mandatory emission reductions. Through cap-and-trade systems, they gradually lower the number of allowances available, creating a regulatory baseline that supports national and international climate goals [3][10].

Voluntary markets, however, excel in fostering innovation and channeling climate finance into projects that might otherwise go unfunded. These projects often include nature-based solutions like reforestation and cutting-edge technologies such as direct air capture. Projections suggest that demand for voluntary carbon credits could grow by 15 times or more by 2030, potentially offsetting 1.5 to 2.0 gigatons of CO₂ annually [17][5]. This expansion not only helps companies mitigate their residual emissions but also contributes to broader climate resilience through benefits like biodiversity conservation and community support [10][5].

"The voluntary carbon market directs private financing to climate-action projects that would not otherwise get off the ground." – McKinsey & Company [17]

Both markets play distinct yet complementary roles in addressing climate challenges, with compliance markets setting mandatory limits and voluntary markets driving innovation and additional funding for impactful projects.

Comparison Table

Side-by-Side Comparison

Voluntary and compliance carbon markets share the common goal of reducing greenhouse gas emissions, but their structures, participants, and objectives differ significantly. These differences influence how organizations engage with each market, from regulatory frameworks to pricing and verification processes.

Below is a detailed comparison that outlines the key aspects of these two markets. This table provides a clear view of their unique characteristics, helping businesses and individuals evaluate which market aligns best with their climate strategies and obligations.

Aspect | Compliance Carbon Markets | Voluntary Carbon Markets |

|---|---|---|

Regulation | Mandatory, overseen by government or international authorities | Voluntary, guided by independent third-party standards |

Participants | Dominated by high-emission industries like power, manufacturing, aviation, and heavy industry | Open to businesses, NGOs, and individuals |

Objective | Fulfill legally binding emission reduction targets to avoid penalties | Offset emissions to meet CSR goals, enhance brand reputation, and achieve Net Zero ambitions |

Commodity | Emission allowances (permits to emit specific amounts) | Carbon credits from emission reduction or removal projects |

Flexibility | Limited, with strict regulatory caps and guidelines | High, allowing participants to choose projects and set personalized targets |

Market Size | Larger in financial value and emissions scope | Valued at roughly $2 billion in 2022, with projections of $10–$40 billion by 2030 [5][14] |

Pricing | Typically higher, with prices around €80–€90 per ton in the EU ETS for 2024 and a weighted global average of $34.99 per ton [14][16] | Generally lower, ranging from $5–$15 per ton for standard projects, though prices can vary from under $1 to over $119 per ton [14][16] |

Verification | Conducted by regulatory bodies using centralized registries | Managed by independent third-party organizations like Verra, Gold Standard, and Plan Vivo |

Penalties | Legal fines and financial sanctions for non-compliance | No legal penalties, though reputational risks may arise |

Environmental Impact | Promotes systematic reductions through mandatory caps | Supports diverse projects like reforestation, clean energy, and direct air capture, often delivering additional benefits such as biodiversity and community support [5] |

This side-by-side comparison highlights how these markets complement each other, offering distinct yet interconnected pathways to drive decarbonization efforts effectively.

Using Both Markets for Decarbonization

Combining Voluntary and Compliance Approaches

Organizations can take advantage of both compliance and voluntary carbon markets to meet their decarbonization goals. By adopting a hybrid approach, companies can fulfill mandatory obligations through compliance markets while also using voluntary credits to tackle emissions not covered by regulations or to showcase leadership in reducing carbon footprints beyond legal requirements [3][4].

This strategy is particularly useful for addressing emissions that are harder to eliminate. It allows companies to support impactful projects like reforestation or direct air capture while they work on longer-term decarbonization plans [5]. For example, the aviation industry has embraced this dual approach through CORSIA, a program requiring airlines to offset emissions using approved carbon credits to maintain net emissions at 2020 levels [3][7].

Some carbon credits add an extra layer of adaptability by functioning in both markets. Australian Carbon Credit Units (ACCUs), for instance, can be traded in compliance or voluntary markets. This dual-use capability gives organizations the flexibility to adjust their strategies as regulations and market dynamics evolve [5]. Such adaptability becomes increasingly important as compliance schemes grow. The EU's Carbon Border Adjustment Mechanism (CBAM), for example, will be phased in starting in 2026, initially targeting high-carbon industries like cement, steel, and aluminum [3]. Additionally, the Science Based Targets initiative (SBTi) is moving toward allowing carbon offsets to count for Scope 3 emissions, offering a clearer role for voluntary credits in achieving broader net-zero goals [7].

Given the complexities of managing this dual-market approach, specialized expertise is critical.

Working with Expert Consultancies

Effectively navigating the interplay between voluntary and compliance carbon markets requires a deep understanding of pricing trends, evolving regulations, and the quality of carbon credits.

"For companies that are not covered by the European regulations, but are covered by the nEHS, there is likely to be a lack of understanding of the complexity and potential financial liability of a carbon compliance scheme" [3].

Expert consultancies like Council Fire play a vital role in helping organizations integrate both markets into their decarbonization strategies. These firms prioritize reducing internal emissions first and then guide companies in selecting high-quality voluntary credits that align with corporate values and the UN Sustainable Development Goals. They also help secure long-term offtake agreements - similar to power purchase agreements - that lock in a set volume of credits at fixed prices over several years. This approach provides financial predictability in volatile markets [5].

Conclusion

Key Takeaways

This discussion has shed light on the distinct purposes of compliance and voluntary carbon markets in addressing climate change. Compliance markets focus on enforcing mandatory emission reductions, compelling high-emission industries to meet legally binding targets or face penalties. A notable example is the EU ETS, which has achieved a 41% reduction in covered emissions since 2005 [20]. On the other hand, voluntary carbon markets offer a flexible mechanism for businesses, NGOs, and individuals to offset emissions beyond regulatory requirements, funding diverse initiatives like reforestation and direct air capture.

Together, these markets play complementary roles in advancing decarbonization. Compliance markets drive systemic industrial shifts by imposing progressively tighter emission caps, while voluntary markets provide funding for innovative climate projects that might not otherwise gain regulatory support. Currently, compliance markets account for approximately 20% of global greenhouse gas emissions, whereas voluntary markets represent less than 1% [20].

Many organizations find value in adopting a hybrid approach - using compliance markets to fulfill mandatory obligations while leveraging voluntary credits to address residual emissions and demonstrate leadership in climate action. Projections indicate that demand for voluntary credits could grow 15-fold by 2030 and 100-fold by 2050 [19].

To maximize impact, prioritize cutting internal emissions before addressing residual emissions through high-quality carbon credits. Collaborating with experienced partners, such as Council Fire (https://councilfire.org), can help align your strategy with regulatory requirements and broader sustainability goals to achieve meaningful decarbonization.

Carbon Markets 101: A Beginners Guide to Carbon Markets | Dr. Roger Cohen, PhD

FAQs

What are the benefits for companies participating in voluntary carbon markets?

Participating in voluntary carbon markets allows companies to address their climate goals in a flexible and cost-efficient manner while strengthening their competitive edge. By purchasing verified carbon credits, businesses can offset emissions that are difficult or expensive to reduce within their operations, contributing to progress toward net-zero targets. Additionally, these investments channel resources into projects that actively reduce or prevent greenhouse gas emissions, amplifying global efforts to tackle climate change.

The benefits go beyond environmental impact. Voluntary carbon markets offer businesses the opportunity to showcase their dedication to sustainability, enhancing their brand image and meeting the rising expectations of investors, customers, and other stakeholders. This engagement not only helps companies differentiate themselves but also builds goodwill and aligns them with broader societal and environmental goals.

Council Fire assists organizations in navigating these markets with strategic support. From selecting high-quality carbon credits to effectively communicating climate initiatives, they provide the tools needed to maximize both reputational value and financial outcomes.

What’s the difference between compliance and voluntary carbon markets, and how do they work together to reduce emissions?

Compliance carbon markets operate under mandatory government regulations, setting strict emission caps for industries like power plants, airlines, and heavy manufacturing. Companies within these sectors must either cut their emissions or purchase allowances, effectively assigning a financial cost to carbon emissions. This approach has proven effective in driving meaningful reductions in high-emission industries.

In contrast, voluntary carbon markets provide an optional platform for businesses and individuals to purchase carbon credits. These credits fund projects aimed at reducing or avoiding emissions, such as reforestation efforts or renewable energy ventures. Unlike compliance markets, voluntary markets often support smaller or innovative projects that may not yet be included in regulatory programs.

Together, these two types of markets create a powerful synergy. Compliance markets enforce large-scale emission reductions through regulation, while voluntary markets support additional initiatives, enabling organizations to meet broader sustainability targets. This dual approach plays a critical role in advancing progress toward net-zero emissions by blending strict oversight with adaptable, market-based solutions.

What drives the price differences between compliance and voluntary carbon credits?

The price gap between compliance carbon credits and voluntary carbon credits stems from differences in regulation, market dynamics, and the specifics of individual projects. Compliance credits are directly tied to government policies, such as carbon caps or taxes, which create a legally mandated demand. This enforced demand, coupled with rigorous verification processes and penalties for non-compliance, tends to keep their prices higher and more consistent.

On the other hand, voluntary credits are shaped by corporate environmental goals and operate in a less regulated space. Their pricing often hinges on factors like the credibility and transparency of the project, as well as any additional benefits it provides, such as supporting local communities or preserving biodiversity. While buyers in the voluntary market may negotiate lower prices, high-quality projects - those with robust monitoring systems or extra social contributions - frequently fetch a premium. Other elements, including the size of the market, transaction costs, and the reputation of the certifying body, also influence pricing. Council Fire assists organizations in navigating these variables, helping them craft carbon credit strategies that align with their objectives and financial plans.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Jan 1, 2026

Voluntary vs. Compliance Carbon Markets: Key Differences

ESG Strategy

In This Article

Compliance markets force mandatory cuts; voluntary markets fund innovation and extra emissions reductions.

Voluntary vs. Compliance Carbon Markets: Key Differences

Carbon markets are systems where organizations trade carbon credits to reduce greenhouse gas emissions. These markets fall into two categories:

Compliance Markets: Government-regulated, mandatory for high-emission industries (e.g., power, steel, aviation). Participants must meet legal emission caps or face penalties. In 2024, this market was valued at $1.5 trillion.

Voluntary Markets: Open to businesses, nonprofits, and individuals. Participation is optional, often driven by sustainability goals or public perception. In 2023, this market was valued at $2.5 billion.

Key Differences:

Participation: Compliance is mandatory; voluntary is optional.

Governance: Compliance is overseen by governments; voluntary relies on independent standards (e.g., Verra, Gold Standard).

Cost: Compliance credits are pricier ($35–$98/ton); voluntary credits range from $5–$15/ton.

Scope: Compliance markets are regional; voluntary markets are global.

Both markets serve different purposes but complement each other in reducing emissions and funding climate projects.

Quick Comparison

Aspect | Compliance Markets | Voluntary Markets |

|---|---|---|

Participation | Mandatory | Optional |

Governance | Government-regulated | Independent standards |

Market Value (2024) | $1.5 trillion | $2.5 billion |

Pricing | $35–$98/ton | $5–$15/ton |

Scope | Regional | Global |

This dual-market system allows organizations to meet legal requirements while supporting broader emission reduction goals.

Compliance vs Voluntary Carbon Markets: Key Differences Comparison

Compliance Carbon Markets Explained

Purpose and Scope

Compliance carbon markets are regulatory systems designed to enforce greenhouse gas emission reductions, helping nations meet their legal commitments under agreements like the Paris Agreement and the Kyoto Protocol [3]. These markets function by setting a cap on total emissions allowed within specific sectors. Companies must stay within these limits or face penalties.

The European Union Emissions Trading System (EU ETS), launched in 2005, is the largest compliance market globally. It covers power plants and industrial facilities, with annual reductions in the cap to ensure continuous progress in cutting emissions [6]. Similarly, California's Cap-and-Trade Program, initiated in 2013, applies to major industries, utilities, and fuel distributors [8]. Germany's National Emissions Trading System (nEHS) targets sectors like buildings and transportation - areas not included under the EU ETS - by implementing a fixed carbon price that rises incrementally [3].

As of 2024, carbon pricing initiatives are active in 46 national and 37 subnational jurisdictions, collectively covering about 23% of global greenhouse gas emissions. Emerging markets in Asia are also stepping up, with Indonesia launching a system in late 2023, Vietnam piloting one in 2024, and Malaysia planning to roll out its program by early 2025 [6].

Who Participates

Compliance markets are designed to regulate high-emission sectors. Key participants include power generation companies, heavy industries such as cement, steel, and aluminum producers, and aviation companies. These entities must adhere to government-set emission thresholds. Regulatory bodies like the European Commission and the California Air Resources Board oversee these markets, setting caps and issuing or auctioning allowances [3].

In 2023, Tesla, Inc. reported $1.78 billion in revenue from selling regulatory carbon credits [6]. Market intermediaries, such as brokers and exchanges, play a critical role in facilitating the trade of surplus allowances. Furthermore, mechanisms like the EU's Carbon Border Adjustment Mechanism (CBAM), starting in 2026, will require foreign producers of carbon-intensive goods to account for the carbon costs embedded in their products [3].

How the Market Works

Compliance markets typically operate through two main systems: cap-and-trade and baseline-and-credit. In a cap-and-trade system, companies emitting less than their allocated allowances can sell the surplus [3].

Australia's Safeguard Mechanism exemplifies the baseline-and-credit approach, where companies exceeding a government-defined emission baseline must purchase Australian Carbon Credit Units (ACCUs) to offset the excess [5]. Globally, compliance markets handled approximately $1.5 trillion in trades in 2024, with considerable CO₂ volumes exchanged [6]. Prices in these markets tend to be higher than those in voluntary markets due to regulatory costs and the legal requirement to comply. However, they can be volatile, influenced by factors like geopolitical events, policy shifts, and renewable energy trends [3][4].

"For companies that are not covered by the European regulations, but are covered by the nEHS, there is likely to be a lack of understanding of the complexity and potential financial liability of a carbon compliance scheme."

– Vanessa Kükenthal, nEHS Specialist, CFP Energy [3]

To meet compliance, companies can adopt various strategies, such as installing emission-reduction technologies, switching to cleaner fuels, improving operational efficiency, or purchasing surplus allowances. The Northern Lights project, a collaboration between Equinor, Shell, and TotalEnergies, illustrates such efforts. This initiative stores 1.5 million metric tons of CO₂ annually for industrial emitters, showcasing the infrastructure needed to meet decarbonization goals [6]. Unlike the flexibility seen in voluntary carbon markets, compliance markets operate within a tightly controlled framework, ensuring adherence to mandated emission targets.

Voluntary Carbon Markets Explained

Purpose and Flexibility

Voluntary carbon markets (VCMs) stand apart from compliance markets in a key way: participation is entirely optional. Here, private individuals and organizations choose to buy and sell carbon credits, not because regulations require it, but to meet their own goals [9]. In this system, credits represent measurable amounts of CO₂e that have been either avoided or removed from the atmosphere.

The motivations for engaging in VCMs are diverse. Many companies aim to fulfill corporate social responsibility (CSR) commitments, distinguish their brands, or achieve "carbon neutral" or "net-zero" targets [5] [9]. By purchasing credits, businesses can align with consumer demand for sustainability, improve their public image, and even prepare for potential future regulations [2] [4].

"Voluntary carbon markets provide a flexible approach for entities looking to enhance their corporate image, meet consumer demand for greener products, or prepare for future regulatory requirements." – montel.energy [4]

Unlike compliance markets, which follow strict cap-and-trade rules with government-issued allowances, VCMs are project-driven. These projects often focus on initiatives like reforestation, renewable energy, or community-based programs [2] [10]. This flexibility allows participants to choose projects that align with their priorities, such as biodiversity conservation or local community support [4] [10].

Who Participates

Private companies dominate the demand side of voluntary markets. By 2023, over one-third of the largest publicly traded companies worldwide had committed to net-zero targets. Many of these businesses rely on carbon credits to offset emissions from their operations, supply chains, or activities like business travel [8].

Participation isn’t limited to corporations. NGOs, individuals, and public agencies also engage in VCMs to offset emissions from events, travel, or other activities [9]. On the supply side, project developers - including local communities, private landowners, and regional governments - use VCMs to fund environmental projects [5] [9]. Governments, too, leverage these markets to attract foreign investment and exceed their climate goals [9] [11]. For example, Japan’s GX League involves over 600 companies, representing roughly 40% of the country’s emissions [11]. Globally, countries like India, China, Brazil, the United States, and Indonesia lead in supplying carbon credits, with Southern Asia excelling overall and Latin America specializing in nature-based solutions [9].

This broad participation supports a variety of projects, all guided by established standards to ensure credibility.

Project Types and Standards

Voluntary carbon markets back a wide array of projects aimed at reducing or removing emissions. Popular initiatives include reforestation, afforestation, renewable energy installations (like solar and wind farms), methane capture from landfills or farms, and community-focused efforts such as clean cookstove programs [4] [9]. For instance, the Virunga National Park Hydropower project in the Democratic Republic of Congo delivers sustainable energy to about 4 million people while safeguarding local ecosystems [13].

To ensure the quality of credits, independent NGOs establish rigorous standards [12]. The Verified Carbon Standard (VCS), managed by Verra, leads the market, accounting for 71.3% of all credits issued as of June 2023 [9]. The Gold Standard follows with a 16.7% market share, particularly favored by European buyers [9] [12]. In North America, the American Carbon Registry (ACR) and the Climate Action Reserve (CAR) hold shares of 6.3% and 5.1%, respectively [9] [12].

Verification involves several steps: preparing a Project Design Document, undergoing independent validation, monitoring progress periodically, and conducting onsite audits. This process ensures that projects meet key criteria like additionality, permanence, and avoiding double counting [12] [13].

Beyond carbon reduction, many projects provide additional benefits, such as advancing the UN Sustainable Development Goals. Standards like SD VISta (Verra) and GS4GG (Gold Standard) certify contributions to goals like clean water, gender equality, and biodiversity protection [10] [12]. Projects with verified co-benefits or nature-based solutions often command higher prices in the market [4] [5].

These well-defined standards and verification processes form the foundation for comparing voluntary and compliance markets.

Key Differences Between the Two Markets

Regulation and Governance

The most notable distinction lies in who oversees and enforces participation. Compliance markets are mandatory systems governed by official entities such as national governments, regional authorities, or international organizations like the EU or California's Air Resources Board. Businesses in regulated sectors must participate, and failure to comply can result in financial penalties [1][4].

On the other hand, voluntary markets operate without government mandates. Instead, organizations like Verra, which manages the Verified Carbon Standard, and the Gold Standard establish rules and verify projects [4][5]. Participation is open to businesses, nonprofits, or individuals who choose to buy credits. These markets rely on third-party audits and public registries to ensure credibility rather than governmental enforcement [3][5].

These differences in governance significantly influence market size and who can participate.

Market Size and Accessibility

Building on these governance distinctions, the scale and reach of the two markets differ dramatically. In 2024, compliance markets reached a trading value of approximately $1.5 trillion, covering about 23% of global greenhouse gas emissions [6]. By comparison, the voluntary market was valued at $2.5 billion in 2023, though it is growing quickly, with projections suggesting it could reach $100 billion to $250 billion by 2030 [6].

Geographic scope is another key difference. Compliance markets are typically region-specific, such as the EU ETS in Europe, China's national ETS, or California's state-level system [1][3]. Voluntary markets, however, operate globally, enabling a company in New York to support projects like reforestation in Brazil or renewable energy initiatives in India [5]. This global flexibility makes voluntary markets accessible to organizations of any size or location, while compliance markets are restricted to entities within specific jurisdictions that meet predefined emission thresholds [2].

Cost and Flexibility

The pricing structures of these markets reflect their unique dynamics. Compliance costs are generally higher, driven by regulatory caps and legal mandates. For instance, in 2024, prices in the EU ETS ranged between €80 and €90 per ton (approximately $87–$98), with the average carbon price across compliance markets in 2020 at $34.99 [14][16].

In voluntary markets, pricing varies widely, from less than $1 per ton to $119 per ton of CO₂e, depending on factors like project type, location, and quality [14]. Most high-quality offsets in voluntary markets are priced between $5 and $15 per ton [16]. Projects that actively remove carbon, such as direct air capture, often command premium prices compared to those that prevent emissions, like clean cookstove initiatives [15]. Additionally, nature-based projects with added benefits, such as biodiversity protection or community development, tend to fetch higher prices [5].

The table below highlights the key differences between the two markets:

Aspect | Compliance Markets | Voluntary Markets |

|---|---|---|

Participation | Mandatory for regulated sectors | Optional for any entity |

Governance | Managed by government authorities (e.g., EU, California) | Based on independent standards (e.g., Verra, Gold Standard) |

Commodity | Allowances (permission to emit) | Offsets (proof of reduction or removal) |

Geographic Scope | Regional or national | Global |

Market Value (2023-2024) | ~$1.5 trillion [6] | ~$2.5 billion [6] |

Typical Price Range | $5–$15/ton [16] | |

Flexibility | Low; strict caps and penalties | High; choice of projects and timing |

"The distinction between compliance and voluntary carbon markets isn't just a technicality - it shapes how businesses and entire industries approach carbon reduction." – CarbonUnits.com [1]

Effectiveness and Standards

Verification and Transparency

Compliance carbon markets maintain their credibility through rigorous government oversight. Centralized registries are used to track allowances and ensure there’s no double-counting of emissions, as demonstrated by the EU Emissions Trading System (EU ETS), which oversees nearly 40% of the European Union's emissions [3][11].

Voluntary carbon markets, on the other hand, rely on independent third-party standards for project verification. Standards like Verra's Verified Carbon Standard and the Gold Standard play a pivotal role in maintaining integrity. While voluntary markets were once fragmented due to over-the-counter trades [11], efforts like the Integrity Council for the Voluntary Carbon Market (ICVCM) have stepped in to establish global benchmarks for credit quality [5]. Adding to this momentum, the Biden-Harris Administration announced a $35 million Carbon Dioxide Removal Purchase Pilot Prize in May 2024 to support the development of a trustworthy voluntary carbon market [18].

The enforcement mechanisms differ significantly between the two markets. Compliance markets impose financial penalties for violations - for instance, the EU ETS charges €100 per ton of CO₂ for non-compliance [10]. In contrast, voluntary markets depend on market reputation and adherence to evolving standards [5]. These distinct approaches not only influence accountability but also shape the broader impact of each system.

Long-Term Impact

Compliance markets are designed to drive systemic change by enforcing mandatory emission reductions. Through cap-and-trade systems, they gradually lower the number of allowances available, creating a regulatory baseline that supports national and international climate goals [3][10].

Voluntary markets, however, excel in fostering innovation and channeling climate finance into projects that might otherwise go unfunded. These projects often include nature-based solutions like reforestation and cutting-edge technologies such as direct air capture. Projections suggest that demand for voluntary carbon credits could grow by 15 times or more by 2030, potentially offsetting 1.5 to 2.0 gigatons of CO₂ annually [17][5]. This expansion not only helps companies mitigate their residual emissions but also contributes to broader climate resilience through benefits like biodiversity conservation and community support [10][5].

"The voluntary carbon market directs private financing to climate-action projects that would not otherwise get off the ground." – McKinsey & Company [17]

Both markets play distinct yet complementary roles in addressing climate challenges, with compliance markets setting mandatory limits and voluntary markets driving innovation and additional funding for impactful projects.

Comparison Table

Side-by-Side Comparison

Voluntary and compliance carbon markets share the common goal of reducing greenhouse gas emissions, but their structures, participants, and objectives differ significantly. These differences influence how organizations engage with each market, from regulatory frameworks to pricing and verification processes.

Below is a detailed comparison that outlines the key aspects of these two markets. This table provides a clear view of their unique characteristics, helping businesses and individuals evaluate which market aligns best with their climate strategies and obligations.

Aspect | Compliance Carbon Markets | Voluntary Carbon Markets |

|---|---|---|

Regulation | Mandatory, overseen by government or international authorities | Voluntary, guided by independent third-party standards |

Participants | Dominated by high-emission industries like power, manufacturing, aviation, and heavy industry | Open to businesses, NGOs, and individuals |

Objective | Fulfill legally binding emission reduction targets to avoid penalties | Offset emissions to meet CSR goals, enhance brand reputation, and achieve Net Zero ambitions |

Commodity | Emission allowances (permits to emit specific amounts) | Carbon credits from emission reduction or removal projects |

Flexibility | Limited, with strict regulatory caps and guidelines | High, allowing participants to choose projects and set personalized targets |

Market Size | Larger in financial value and emissions scope | Valued at roughly $2 billion in 2022, with projections of $10–$40 billion by 2030 [5][14] |

Pricing | Typically higher, with prices around €80–€90 per ton in the EU ETS for 2024 and a weighted global average of $34.99 per ton [14][16] | Generally lower, ranging from $5–$15 per ton for standard projects, though prices can vary from under $1 to over $119 per ton [14][16] |

Verification | Conducted by regulatory bodies using centralized registries | Managed by independent third-party organizations like Verra, Gold Standard, and Plan Vivo |

Penalties | Legal fines and financial sanctions for non-compliance | No legal penalties, though reputational risks may arise |

Environmental Impact | Promotes systematic reductions through mandatory caps | Supports diverse projects like reforestation, clean energy, and direct air capture, often delivering additional benefits such as biodiversity and community support [5] |

This side-by-side comparison highlights how these markets complement each other, offering distinct yet interconnected pathways to drive decarbonization efforts effectively.

Using Both Markets for Decarbonization

Combining Voluntary and Compliance Approaches