Nov 18, 2025

Nov 18, 2025

Top Carbon Credit Certification Standards 2025

Sustainability Strategy

Sustainability Strategy

In This Article

Explore the leading carbon credit certification standards of 2025, their unique strengths, and how they align with corporate sustainability goals.

Top Carbon Credit Certification Standards 2025

Carbon credit certification has become a cornerstone of corporate sustainability in 2025, helping businesses meet net-zero goals by ensuring emission reductions are real, measurable, and verified. The four leading standards - Verra VCS, Gold Standard, American Carbon Registry (ACR), and Climate Action Reserve (CAR) - each cater to different project needs and market requirements. Here's what you need to know:

Verra VCS: The largest global program, certifying diverse projects like forestry, agriculture, and renewable energy. Widely used by Fortune 500 companies.

Gold Standard: Focuses on projects with social and environmental benefits, such as clean energy and community-driven initiatives. Popular for ESG-focused buyers.

ACR: U.S.-based with a strong compliance focus, including California's cap-and-trade program. Known for forestry and agricultural projects.

CAR: Primarily U.S.-focused, excelling in regulatory compliance with protocols for methane capture, forestry, and waste management.

Key Takeaways:

Choose Verra VCS for global scalability and broad project types.

Opt for Gold Standard if co-benefits like health or biodiversity are priorities.

Use ACR or CAR for U.S.-specific compliance needs, especially in regulated markets.

Each standard offers unique strengths, and selecting the right one depends on your project's goals, budget, and target market. Below, explore their features and relevance in detail to find the best fit for your sustainability efforts.

1. Verra Verified Carbon Standard (VCS)

Year Established and Global Reach

Since its launch in 2005, the Verra Verified Carbon Standard has become the largest voluntary carbon credit program worldwide. By 2025, it had certified over 2,000 projects spanning more than 80 countries, issuing 1 billion Verified Carbon Units (VCUs). Each VCU corresponds to one metric ton of CO₂ equivalent either reduced or removed [10]. This expansive reach highlights its ability to certify a wide variety of emission reduction activities, from REDD+ forest conservation in tropical areas to renewable energy initiatives in the American Midwest. Its broad global presence allows for diverse project types and contributions.

Eligible Project Types

The VCS accommodates a wide array of project categories. These include well-established sectors like REDD+ forest conservation, renewable energy development, energy efficiency upgrades, and methane capture from landfills. It also certifies newer approaches, such as carbon capture in concrete production. Additional eligible areas include projects focused on agriculture, waste management, and land-use changes, providing U.S. organizations with multiple pathways to generate certified carbon credits [8][9].

Core Certification Requirements

For a project to earn VCS certification, it must deliver greenhouse gas reductions that are real, measurable, and go beyond what would have occurred without the project. Compliance with local laws and the protection of community interests are also mandatory. Each project undergoes a rigorous process, including independent third-party validation and verification, registration, ongoing monitoring, periodic reviews, and final approval before VCUs are issued. In 2025, the program introduced a Methodology Change and Requantification Procedure, allowing developers to update their quantification methods retroactively to reflect the latest scientific and market standards [2][3].

Market Recognition and U.S. Relevance

VCS credits are recognized under international frameworks such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), provided they meet specific criteria. This makes them particularly useful for U.S.-based airlines and organizations with substantial travel-related emissions. The program's transparent registry system and strict measures against double counting enhance its credibility, making VCS a reliable option for companies committed to meaningful climate action [7].

2. Gold Standard

Year Established and Global Reach

Launched in 2003 as a collaborative effort between the World Wide Fund for Nature (WWF) and other international NGOs, Gold Standard has grown into a globally recognized certification body. By 2024, it has certified more than 2,000 projects across 80+ countries, generating over 200 million carbon credits and contributing upwards of $30 billion in shared value for climate action and sustainable development efforts worldwide [4].

Eligible Project Types

Gold Standard certification applies to a wide range of projects, including renewable energy initiatives like wind, solar, and hydro, as well as energy efficiency, waste management, clean cooking solutions, water purification, reforestation, and sustainable agriculture. Each certified project aligns with at least three United Nations Sustainable Development Goals, ensuring a broader impact that goes beyond reducing carbon emissions [4][6].

Core Certification Requirements

To earn certification, projects must meet stringent criteria. This includes demonstrating emissions reductions that are real, measurable, and additional - meaning they wouldn't occur without carbon finance. Projects must also engage local stakeholders, undergo thorough third-party validation, and maintain transparent documentation. Continuous monitoring and periodic third-party verification are essential, alongside comprehensive risk assessments and buffer reserves to ensure permanence. Adherence to standardized methodologies and independent verification processes is non-negotiable [4][6].

Market Recognition and U.S. Relevance

Gold Standard stands out by combining carbon reduction with sustainable development benefits, setting it apart from frameworks like the Verified Carbon Standard (VCS). In the voluntary carbon market, Gold Standard credits are highly regarded, often commanding premium status due to their additional focus on development co-benefits. In the United States, these credits are among the top three most purchased by corporations seeking credible and impactful offsets [4].

The increasing U.S. demand for carbon credits with added social and environmental benefits makes Gold Standard particularly appealing to organizations with strong environmental, social, and governance (ESG) objectives. Companies leveraging these credits can align with best practices in sustainability reporting and meet stakeholder expectations for impactful climate action. Gold Standard is frequently cited in U.S. corporate sustainability reports and is a favored choice for meeting Science Based Targets initiative (SBTi) requirements [4].

For U.S.-based organizations, Gold Standard certification offers additional value when purchasing international offset credits. These projects not only achieve meaningful carbon reductions but also deliver significant community benefits, particularly in emerging markets. This dual impact allows companies to demonstrate global leadership in climate action while supporting sustainable development worldwide.

What are the carbon standards? (Verra, Gold Standard, American Carbon Registry, etc) - Abatable

3. American Carbon Registry (ACR)

The American Carbon Registry (ACR) provides a carbon certification framework that is deeply rooted in U.S. standards while maintaining a global presence.

Year Established and Global Reach

Established in 1996 and operated by Winrock International, ACR stands as one of the longest-running voluntary carbon offset programs in the United States. While its primary focus is domestic, its influence spans over 30 countries, including regions in North America, Latin America, Asia, and Africa. Despite this international reach, the majority of its projects remain U.S.-based, reflecting its deep expertise in navigating U.S. regulatory systems. Over the years, ACR has issued more than 200 million metric tons of verified emission reductions, a testament to its impact and credibility in the carbon market[1].

Eligible Project Types

ACR certifies a wide range of projects, with forestry and land use initiatives forming a significant portion of its portfolio. These include efforts like reforestation, avoided deforestation, and improved forest management. The registry also supports agricultural projects aimed at soil carbon sequestration and reducing methane emissions from livestock. Beyond these, ACR certifies renewable energy projects, industrial gas destruction, and methane capture from landfills and dairy operations. With over 40 approved methodologies, ACR continues to adapt to advancements in carbon reduction, including emerging technologies like direct air capture and enhanced rock weathering. For example, in June 2024, The Nature Conservancy registered a 5,000-acre reforestation project in Mississippi through ACR, generating 1.2 million metric tons of credits and $18 million in revenue for local landowners[1].

Core Certification Requirements

ACR’s certification process is grounded in rigorous standards to ensure the integrity of the credits it issues. Projects must undergo independent third-party validation, adhere to strict monitoring, reporting, and verification (MRV) protocols, and follow approved methodologies. Developers are required to prove additionality, demonstrating that the emission reductions would not have occurred without the project. Additionally, permanence is a key criterion, particularly for forestry projects, which must include buffer pools to address risks like fire, disease, or other natural disruptions. To enhance transparency and trust, all project data is publicly accessible, and measures are in place to prevent double counting. This meticulous approach has earned ACR respect from both regulatory authorities and corporate stakeholders.

Market Recognition and U.S. Relevance

ACR holds a distinctive position as the only U.S.-based registry approved for California’s cap-and-trade program. This regulatory endorsement significantly boosts its value for companies with compliance obligations. In 2024, ACR credits accounted for roughly 35% of all offset credits retired within California’s compliance market[1]. Voluntary credits under ACR typically trade between $8 and $18 per metric ton of CO₂e, while compliance credits range from $15 to $25. For instance, in September 2023, Chevron retired 500,000 ACR credits to meet regulatory requirements. These credits supported a methane capture project at a Texas landfill managed by Waste Management Inc., which achieved a 40% reduction in annual methane emissions[1]. The alignment of ACR with U.S. regulatory frameworks and its transparent registry system makes it a trusted choice for organizations, particularly in sectors like energy, water infrastructure, and resource management. For sustainability consultancies such as Council Fire, ACR offers a dependable solution for clients needing compliance-grade offsets and detailed impact reporting[1].

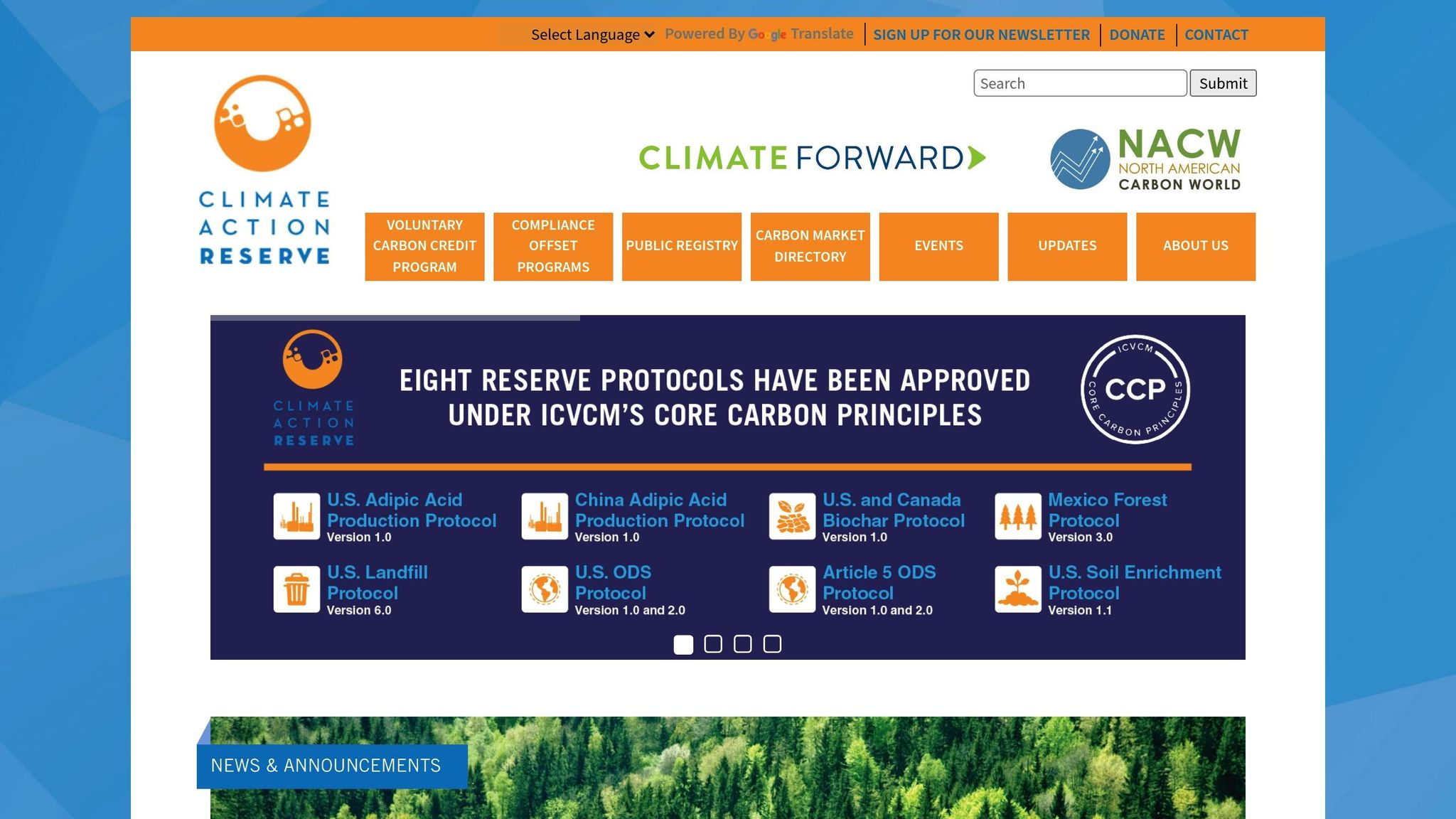

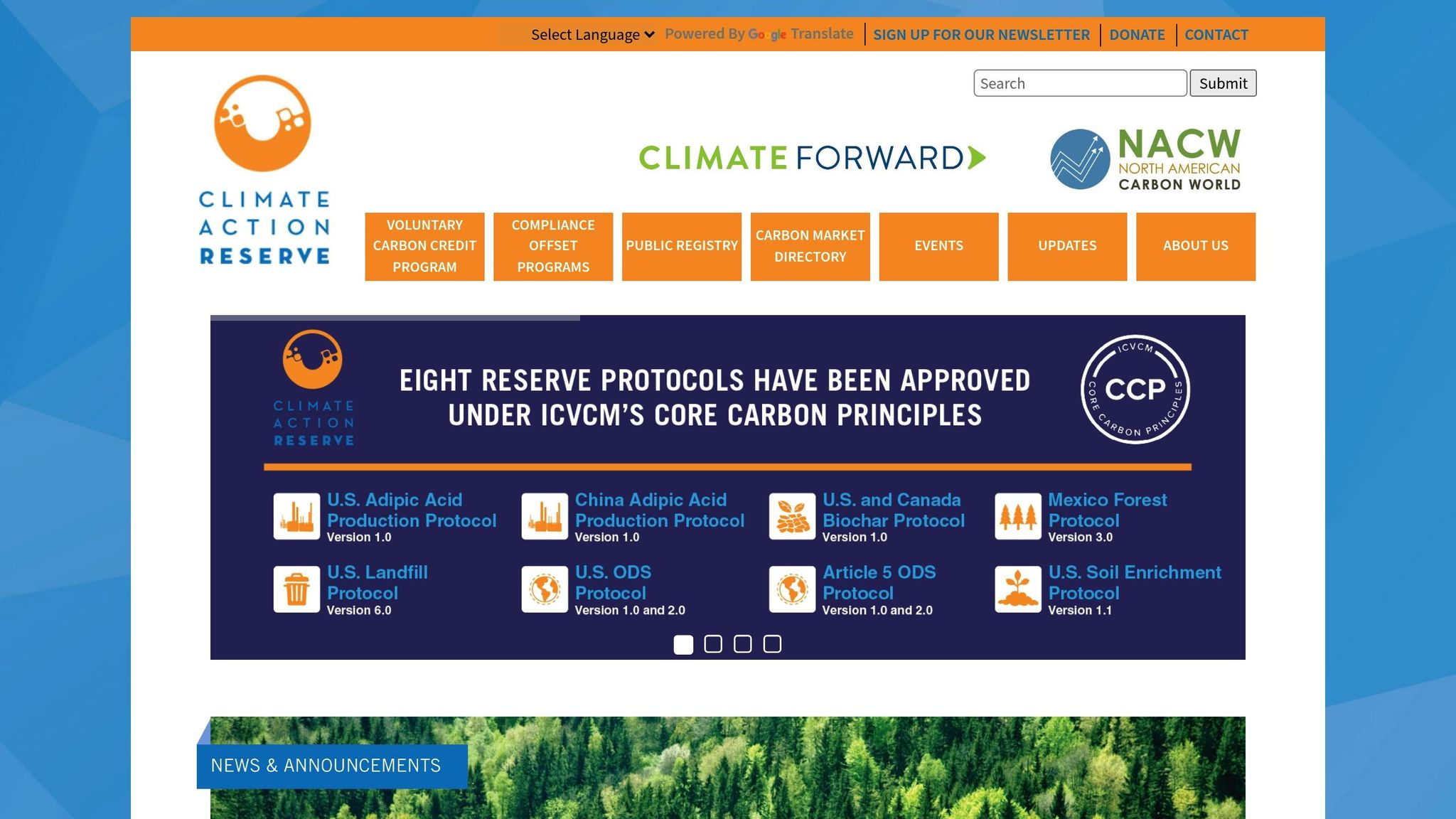

4. Climate Action Reserve (CAR)

The Climate Action Reserve (CAR) is a U.S.-based carbon credit certification standard, deeply aligned with American regulatory frameworks and state-level compliance programs.

Year Established and Scope

Established in 2001 in Los Angeles, California, CAR focuses primarily on North America, though some of its protocols are recognized internationally. This regional emphasis allows CAR to effectively navigate U.S. regulatory systems, making it a trusted choice for domestic organizations. By November 2025, CAR had registered over 500 projects and issued more than 180 million metric tons of CO₂ equivalent credits, known as Climate Reserve Tonnes (CRTs). These numbers highlight its significant role in the carbon offset market.

Types of Eligible Projects

CAR certifies a variety of project types, including:

Forestry projects like reforestation and improved forest management

Landfill methane capture

Livestock methane management

Organic waste composting

Destruction of ozone-depleting substances

Recent updates have expanded its scope to include soil carbon sequestration, dairy digesters, and urban forestry. For example, in April 2025, Dairyland Power Cooperative registered a manure digester project under CAR’s Livestock Protocol. This initiative, which captured methane emissions from three dairy farms in Wisconsin, generated 45,000 CRTs after undergoing third-party verification. The project also contributed to local air quality improvements.

Certification Process and Requirements

CAR's certification process is rigorous, ensuring that all projects deliver real, additional, and verifiable greenhouse gas reductions. Projects must follow CAR’s published protocols, which detail eligibility criteria, quantification methods, monitoring, and reporting requirements. Accredited third-party verification is mandatory before any credits are issued.

Transparency is a cornerstone of CAR’s approach. All projects are listed in a publicly accessible registry, allowing anyone to review project details, credit issuance, and retirement records. This openness builds trust and ensures traceability. Additionally, all projects must comply with U.S. laws and regulations and address stakeholder feedback during the certification process.

Market Relevance in the U.S.

CAR is one of the few standards accepted for compliance in California’s cap-and-trade program, overseen by the California Air Resources Board (CARB). This recognition elevates CAR credits to a premium level, particularly for organizations with regulatory obligations.

In June 2025, Pacific Gas & Electric (PG&E) retired 250,000 CRTs from CAR-certified forest management projects to meet California’s cap-and-trade requirements. Verified by SCS Global Services, these credits supported the preservation of 12,000 acres of mixed hardwood forest, sequestering an estimated 1.2 million metric tons of CO₂e over a decade.

As U.S. climate regulations become stricter, the demand for compliance-grade offsets like CAR credits continues to grow. For consultancies such as Council Fire, CAR provides a reliable framework for clients in industries like natural resource management, energy infrastructure, and sustainable community development. Its detailed reporting and compliance-grade standards make it a valuable tool for navigating evolving environmental regulations.

Advantages and Disadvantages

Each certification standard comes with its own set of strengths and challenges. By understanding these trade-offs, organizations can better align their sustainability goals with the practical demands of implementation and market expectations.

Verra VCS holds a dominant position in the global market. Its broad project eligibility - spanning forestry, agriculture, renewable energy, and technology - provides organizations with considerable flexibility. Additionally, its rigorous third-party validation and transparent registry system have earned the trust of 80% of Fortune 500 companies[8]. However, its primary focus on greenhouse gas reductions, without requiring additional social or environmental benefits, might not appeal to organizations seeking a more rounded sustainability impact[2].

Gold Standard stands out by requiring verified co-benefits, such as improved health, gender equality, or biodiversity protection. This emphasis on sustainable development makes its credits highly sought after by buyers who value a more comprehensive impact. On the downside, its restrictive project eligibility - mainly limited to renewable energy, energy efficiency, and community-driven initiatives - can limit its applicability for projects outside these areas.

American Carbon Registry (ACR) is tailored for U.S.-based projects, offering streamlined certification processes and methodologies suited to North American conditions. However, ACR’s international recognition is relatively limited compared to Verra VCS or Gold Standard, which could pose challenges for organizations aiming for global market credibility.

Climate Action Reserve (CAR) excels in regulatory acceptance, particularly within California’s cap-and-trade program, often commanding premium credit pricing. Its prescriptive methodologies help reduce uncertainty during project development. However, its limited international recognition and focus on specific project categories may restrict its appeal for innovative or less conventional offset initiatives.

Standard | Certification Costs (USD) | Project Eligibility | Co-Benefits | Market Recognition (U.S.) |

|---|---|---|---|---|

Verra VCS | $30,000–$150,000+ | Broad (e.g., forestry, agriculture, tech) | Optional (CCB add-on available) | Very High (global and U.S.) |

Gold Standard | $40,000–$200,000+ | More restrictive (renewables, community) | Required (core to standard) | High (especially for co-benefits) |

ACR | $30,000–$150,000+ | Broad (U.S. focus, innovative methods) | Optional | High (U.S. compliance and voluntary) |

CAR | $30,000–$150,000+ | Broad (U.S. focus, regulatory alignment) | Optional | High (U.S. compliance and voluntary) |

Certification costs vary widely depending on the size, complexity, and monitoring requirements of a project. Gold Standard projects often carry the highest expenses due to the additional verification needed for sustainable development co-benefits[4]. All standards mandate independent third-party validation, but the level of scrutiny depends on the standard’s specific requirements and methodology.

The choice of standard ultimately hinges on an organization’s strategic goals. For those aiming for broad market access and strong buyer recognition, Verra VCS is a preferred option. Organizations prioritizing measurable social and environmental impacts alongside carbon reduction often gravitate toward Gold Standard. Meanwhile, projects focused on U.S. compliance or regulatory alignment typically benefit from ACR or CAR.

Market recognition is a key factor in determining credit pricing and buyer demand. Verra VCS and Gold Standard maintain the strongest international presence, while CAR excels in U.S.-specific compliance markets.

For consultancies like Council Fire, navigating these trade-offs is crucial for effective project planning. The challenge lies in matching an organization’s objectives with the unique requirements of each standard while keeping an eye on long-term market trends and regulatory developments. These considerations provide the foundation for a tailored selection guide aimed at U.S.-based organizations.

Selection Guide for U.S. Organizations

Choosing the right carbon credit certification standard is a critical step that can shape your project's costs, market acceptance, and regulatory compliance. Here's a closer look at what U.S. organizations should consider when navigating this process.

Start by assessing your project's scale and scope. Large-scale, multi-site projects often benefit from the Verra VCS standard due to its extensive methodology options and global scalability. Companies like Microsoft and Unilever have successfully used Verra VCS for major forestry and technology-based initiatives[8]. On the other hand, smaller, community-focused projects - such as local solar energy programs - may find Gold Standard more supportive, especially when the goal is to deliver both carbon reduction and community benefits[4][5]. This initial evaluation helps align certification choices with your project's unique needs.

Next, focus on regulatory alignment. For projects aiming to comply with international frameworks, ensure the standard you choose meets those specific requirements. For example, Verra VCS is approved for the pilot and first phases of CORSIA, making it a strong choice for organizations in international aviation or those seeking global compliance[7].

Budget carefully for certification costs. Expenses can range from $30,000 to over $200,000, depending on the project's complexity and the chosen standard[4]. Gold Standard certifications often come with higher costs due to additional verification for co-benefits like social or environmental improvements. However, these added investments can lead to premium pricing in voluntary carbon markets.

Match your goals with certification requirements. If your organization values measurable social or environmental benefits alongside carbon reduction, Gold Standard is a compelling option. It mandates verified co-benefits, such as improved health outcomes, gender equality, or biodiversity protection. For projects focused primarily on reducing greenhouse gas emissions, Verra VCS offers a cost-effective alternative with optional co-benefits.

Understand your target market and buyer preferences. Corporate buyers increasingly value standards with strong third-party validation and transparent impact reporting[8][10]. For example, agricultural methane reduction projects in California often rely on CAR or ACR for state compliance, while organizations aiming for broader market appeal often choose Verra VCS or Gold Standard due to their international recognition.

Be mindful of timelines. Certification can take months or even over a year, depending on the project's complexity and the standard's requirements. Verra VCS, for instance, involves detailed third-party validation and verification, which can extend the timeline but ensures a high level of market credibility. Additionally, factor in potential delays for methodology updates, such as Verra's planned requantification procedure in 2025[3].

Consider sector-specific needs. Different standards suit different types of projects. For instance, technology-based solutions like CO₂ capture in concrete often align well with Verra VCS methodologies. Renewable energy and energy efficiency projects, however, may find a better fit with Gold Standard. Forest conservation (REDD+) projects can work under multiple standards, but preferences in regulatory and market contexts may steer you toward specific options[8].

Integrate certification into your broader sustainability strategy. Early engagement with certification bodies and stakeholders is crucial. Firms like Council Fire can provide valuable guidance, helping to align certification choices with your organization's goals while navigating the complexities of regulatory compliance and natural resource management.

Stay updated on evolving requirements. Regularly monitor changes in methodologies and market standards to ensure your project remains competitive and compliant. This proactive approach helps organizations adapt to shifting regulatory landscapes and evolving buyer expectations.

Balancing these factors - project goals, regulatory needs, market preferences, and available resources - can help your organization make informed decisions that align with its sustainability objectives and long-term strategy.

Conclusion

As we look at the carbon credit certification landscape in 2025, U.S. organizations have a range of clear options to help achieve their sustainability goals. Each certification standard offers distinct strengths, catering to different project types and strategic priorities. Verra VCS remains the leading standard, enjoying widespread market trust and adoption by 80% of Fortune 500 companies, including major players like Microsoft and Unilever. Its broad acceptance is bolstered by its alignment with cutting-edge scientific methodologies, offering comprehensive options for diverse projects[8].

While Verra holds the top spot, other standards provide unique benefits worth considering. Gold Standard is particularly appealing for organizations aiming to achieve additional social and environmental impacts alongside carbon reduction. Its rigorous monitoring and regular audits ensure high levels of accountability, making it a strong choice for projects where broader community and environmental outcomes are key priorities - even if this comes with higher certification costs[11].

For projects with a domestic focus, ACR and CAR provide U.S.-centric solutions that are streamlined and practical. While they might not carry the same international recognition as Verra or Gold Standard, they are well-suited for organizations concentrating on domestic markets or aiming to meet specific compliance needs[1][4]. These options highlight the importance of tailoring your choice to your project's unique goals and requirements.

Selecting the right certification standard requires careful consideration of factors like project scale, budget, timeline, and sustainability objectives. Staying ahead of evolving standards is crucial. Developments such as the introduction of Core Carbon Principles (CCP) labels and CORSIA eligibility requirements reflect the shifting demands of the market[3][7]. Organizations that remain informed and work with experienced consultants - whether through firms like Council Fire or directly with certification bodies - are better positioned to navigate these changes and achieve long-term success in the carbon credit market.

Ultimately, the best certification standard will align with your organization's specific needs. By prioritizing rigorous validation, transparent processes, and alignment with your overall sustainability strategy, you can ensure your efforts deliver meaningful results, no matter which path you choose.

FAQs

What’s the best way to choose a carbon credit certification standard for my organization’s sustainability goals?

Choosing a carbon credit certification standard begins with identifying what matters most to your organization. Does your focus lie in cutting emissions, preserving ecosystems, or empowering local communities? Aligning the certification standard with these goals is crucial. Widely respected options like Verra VCS and Gold Standard are known for their reliability and meaningful outcomes.

It's also essential to match the certification to the type of projects you’re pursuing, whether that's renewable energy initiatives, forestry efforts, or other sustainability ventures. Prioritize standards that emphasize measurable results, transparency, and additionality - ensuring your actions create an impact that wouldn’t occur otherwise. For more specific guidance, consulting with sustainability professionals can help you evaluate your options and choose the path that best supports your objectives.

What are the key differences between Verra VCS and Gold Standard in terms of project eligibility and market reputation?

Verra's Verified Carbon Standard (VCS) and the Gold Standard are two of the most recognized systems for certifying carbon credits, though their priorities and eligibility criteria set them apart. Verra VCS accommodates a wide variety of project types, ranging from energy and forestry to agriculture, with a focus on scalability and integration into global markets. Meanwhile, the Gold Standard is centered on projects that deliver both environmental and social benefits, such as renewable energy or community-driven initiatives, often requiring more rigorous stakeholder involvement.

When it comes to reputation, both standards hold a strong standing in the market. However, Gold Standard credits are frequently seen as premium due to their added emphasis on social impact. Verra VCS, by contrast, is appreciated for its adaptability and broad acceptance across both voluntary and compliance markets, making it a go-to option for larger-scale efforts.

Why might U.S.-based organizations choose ACR or CAR for carbon credit certification?

U.S.-based organizations often gravitate toward the American Carbon Registry (ACR) or the Climate Action Reserve (CAR) because these standards are specifically designed to align with the regulatory and market conditions in the United States. This alignment makes them a practical choice for projects targeting both domestic compliance requirements and voluntary carbon markets.

What sets ACR and CAR apart is their focus on delivering high-quality methodologies. These standards prioritize transparency and enforce rigorous verification processes, ensuring that the carbon credits generated are both reliable and measurable. For organizations, this means greater confidence in the environmental integrity of their credits. By leveraging ACR or CAR, U.S. organizations can align their sustainability initiatives with local market expectations while achieving meaningful environmental outcomes.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Nov 18, 2025

Top Carbon Credit Certification Standards 2025

Sustainability Strategy

In This Article

Explore the leading carbon credit certification standards of 2025, their unique strengths, and how they align with corporate sustainability goals.

Top Carbon Credit Certification Standards 2025

Carbon credit certification has become a cornerstone of corporate sustainability in 2025, helping businesses meet net-zero goals by ensuring emission reductions are real, measurable, and verified. The four leading standards - Verra VCS, Gold Standard, American Carbon Registry (ACR), and Climate Action Reserve (CAR) - each cater to different project needs and market requirements. Here's what you need to know:

Verra VCS: The largest global program, certifying diverse projects like forestry, agriculture, and renewable energy. Widely used by Fortune 500 companies.

Gold Standard: Focuses on projects with social and environmental benefits, such as clean energy and community-driven initiatives. Popular for ESG-focused buyers.

ACR: U.S.-based with a strong compliance focus, including California's cap-and-trade program. Known for forestry and agricultural projects.

CAR: Primarily U.S.-focused, excelling in regulatory compliance with protocols for methane capture, forestry, and waste management.

Key Takeaways:

Choose Verra VCS for global scalability and broad project types.

Opt for Gold Standard if co-benefits like health or biodiversity are priorities.

Use ACR or CAR for U.S.-specific compliance needs, especially in regulated markets.

Each standard offers unique strengths, and selecting the right one depends on your project's goals, budget, and target market. Below, explore their features and relevance in detail to find the best fit for your sustainability efforts.

1. Verra Verified Carbon Standard (VCS)

Year Established and Global Reach

Since its launch in 2005, the Verra Verified Carbon Standard has become the largest voluntary carbon credit program worldwide. By 2025, it had certified over 2,000 projects spanning more than 80 countries, issuing 1 billion Verified Carbon Units (VCUs). Each VCU corresponds to one metric ton of CO₂ equivalent either reduced or removed [10]. This expansive reach highlights its ability to certify a wide variety of emission reduction activities, from REDD+ forest conservation in tropical areas to renewable energy initiatives in the American Midwest. Its broad global presence allows for diverse project types and contributions.

Eligible Project Types

The VCS accommodates a wide array of project categories. These include well-established sectors like REDD+ forest conservation, renewable energy development, energy efficiency upgrades, and methane capture from landfills. It also certifies newer approaches, such as carbon capture in concrete production. Additional eligible areas include projects focused on agriculture, waste management, and land-use changes, providing U.S. organizations with multiple pathways to generate certified carbon credits [8][9].

Core Certification Requirements

For a project to earn VCS certification, it must deliver greenhouse gas reductions that are real, measurable, and go beyond what would have occurred without the project. Compliance with local laws and the protection of community interests are also mandatory. Each project undergoes a rigorous process, including independent third-party validation and verification, registration, ongoing monitoring, periodic reviews, and final approval before VCUs are issued. In 2025, the program introduced a Methodology Change and Requantification Procedure, allowing developers to update their quantification methods retroactively to reflect the latest scientific and market standards [2][3].

Market Recognition and U.S. Relevance

VCS credits are recognized under international frameworks such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), provided they meet specific criteria. This makes them particularly useful for U.S.-based airlines and organizations with substantial travel-related emissions. The program's transparent registry system and strict measures against double counting enhance its credibility, making VCS a reliable option for companies committed to meaningful climate action [7].

2. Gold Standard

Year Established and Global Reach

Launched in 2003 as a collaborative effort between the World Wide Fund for Nature (WWF) and other international NGOs, Gold Standard has grown into a globally recognized certification body. By 2024, it has certified more than 2,000 projects across 80+ countries, generating over 200 million carbon credits and contributing upwards of $30 billion in shared value for climate action and sustainable development efforts worldwide [4].

Eligible Project Types

Gold Standard certification applies to a wide range of projects, including renewable energy initiatives like wind, solar, and hydro, as well as energy efficiency, waste management, clean cooking solutions, water purification, reforestation, and sustainable agriculture. Each certified project aligns with at least three United Nations Sustainable Development Goals, ensuring a broader impact that goes beyond reducing carbon emissions [4][6].

Core Certification Requirements

To earn certification, projects must meet stringent criteria. This includes demonstrating emissions reductions that are real, measurable, and additional - meaning they wouldn't occur without carbon finance. Projects must also engage local stakeholders, undergo thorough third-party validation, and maintain transparent documentation. Continuous monitoring and periodic third-party verification are essential, alongside comprehensive risk assessments and buffer reserves to ensure permanence. Adherence to standardized methodologies and independent verification processes is non-negotiable [4][6].

Market Recognition and U.S. Relevance

Gold Standard stands out by combining carbon reduction with sustainable development benefits, setting it apart from frameworks like the Verified Carbon Standard (VCS). In the voluntary carbon market, Gold Standard credits are highly regarded, often commanding premium status due to their additional focus on development co-benefits. In the United States, these credits are among the top three most purchased by corporations seeking credible and impactful offsets [4].

The increasing U.S. demand for carbon credits with added social and environmental benefits makes Gold Standard particularly appealing to organizations with strong environmental, social, and governance (ESG) objectives. Companies leveraging these credits can align with best practices in sustainability reporting and meet stakeholder expectations for impactful climate action. Gold Standard is frequently cited in U.S. corporate sustainability reports and is a favored choice for meeting Science Based Targets initiative (SBTi) requirements [4].

For U.S.-based organizations, Gold Standard certification offers additional value when purchasing international offset credits. These projects not only achieve meaningful carbon reductions but also deliver significant community benefits, particularly in emerging markets. This dual impact allows companies to demonstrate global leadership in climate action while supporting sustainable development worldwide.

What are the carbon standards? (Verra, Gold Standard, American Carbon Registry, etc) - Abatable

3. American Carbon Registry (ACR)

The American Carbon Registry (ACR) provides a carbon certification framework that is deeply rooted in U.S. standards while maintaining a global presence.

Year Established and Global Reach

Established in 1996 and operated by Winrock International, ACR stands as one of the longest-running voluntary carbon offset programs in the United States. While its primary focus is domestic, its influence spans over 30 countries, including regions in North America, Latin America, Asia, and Africa. Despite this international reach, the majority of its projects remain U.S.-based, reflecting its deep expertise in navigating U.S. regulatory systems. Over the years, ACR has issued more than 200 million metric tons of verified emission reductions, a testament to its impact and credibility in the carbon market[1].

Eligible Project Types

ACR certifies a wide range of projects, with forestry and land use initiatives forming a significant portion of its portfolio. These include efforts like reforestation, avoided deforestation, and improved forest management. The registry also supports agricultural projects aimed at soil carbon sequestration and reducing methane emissions from livestock. Beyond these, ACR certifies renewable energy projects, industrial gas destruction, and methane capture from landfills and dairy operations. With over 40 approved methodologies, ACR continues to adapt to advancements in carbon reduction, including emerging technologies like direct air capture and enhanced rock weathering. For example, in June 2024, The Nature Conservancy registered a 5,000-acre reforestation project in Mississippi through ACR, generating 1.2 million metric tons of credits and $18 million in revenue for local landowners[1].

Core Certification Requirements

ACR’s certification process is grounded in rigorous standards to ensure the integrity of the credits it issues. Projects must undergo independent third-party validation, adhere to strict monitoring, reporting, and verification (MRV) protocols, and follow approved methodologies. Developers are required to prove additionality, demonstrating that the emission reductions would not have occurred without the project. Additionally, permanence is a key criterion, particularly for forestry projects, which must include buffer pools to address risks like fire, disease, or other natural disruptions. To enhance transparency and trust, all project data is publicly accessible, and measures are in place to prevent double counting. This meticulous approach has earned ACR respect from both regulatory authorities and corporate stakeholders.

Market Recognition and U.S. Relevance

ACR holds a distinctive position as the only U.S.-based registry approved for California’s cap-and-trade program. This regulatory endorsement significantly boosts its value for companies with compliance obligations. In 2024, ACR credits accounted for roughly 35% of all offset credits retired within California’s compliance market[1]. Voluntary credits under ACR typically trade between $8 and $18 per metric ton of CO₂e, while compliance credits range from $15 to $25. For instance, in September 2023, Chevron retired 500,000 ACR credits to meet regulatory requirements. These credits supported a methane capture project at a Texas landfill managed by Waste Management Inc., which achieved a 40% reduction in annual methane emissions[1]. The alignment of ACR with U.S. regulatory frameworks and its transparent registry system makes it a trusted choice for organizations, particularly in sectors like energy, water infrastructure, and resource management. For sustainability consultancies such as Council Fire, ACR offers a dependable solution for clients needing compliance-grade offsets and detailed impact reporting[1].

4. Climate Action Reserve (CAR)

The Climate Action Reserve (CAR) is a U.S.-based carbon credit certification standard, deeply aligned with American regulatory frameworks and state-level compliance programs.

Year Established and Scope

Established in 2001 in Los Angeles, California, CAR focuses primarily on North America, though some of its protocols are recognized internationally. This regional emphasis allows CAR to effectively navigate U.S. regulatory systems, making it a trusted choice for domestic organizations. By November 2025, CAR had registered over 500 projects and issued more than 180 million metric tons of CO₂ equivalent credits, known as Climate Reserve Tonnes (CRTs). These numbers highlight its significant role in the carbon offset market.

Types of Eligible Projects

CAR certifies a variety of project types, including:

Forestry projects like reforestation and improved forest management

Landfill methane capture

Livestock methane management

Organic waste composting

Destruction of ozone-depleting substances

Recent updates have expanded its scope to include soil carbon sequestration, dairy digesters, and urban forestry. For example, in April 2025, Dairyland Power Cooperative registered a manure digester project under CAR’s Livestock Protocol. This initiative, which captured methane emissions from three dairy farms in Wisconsin, generated 45,000 CRTs after undergoing third-party verification. The project also contributed to local air quality improvements.

Certification Process and Requirements

CAR's certification process is rigorous, ensuring that all projects deliver real, additional, and verifiable greenhouse gas reductions. Projects must follow CAR’s published protocols, which detail eligibility criteria, quantification methods, monitoring, and reporting requirements. Accredited third-party verification is mandatory before any credits are issued.

Transparency is a cornerstone of CAR’s approach. All projects are listed in a publicly accessible registry, allowing anyone to review project details, credit issuance, and retirement records. This openness builds trust and ensures traceability. Additionally, all projects must comply with U.S. laws and regulations and address stakeholder feedback during the certification process.

Market Relevance in the U.S.

CAR is one of the few standards accepted for compliance in California’s cap-and-trade program, overseen by the California Air Resources Board (CARB). This recognition elevates CAR credits to a premium level, particularly for organizations with regulatory obligations.

In June 2025, Pacific Gas & Electric (PG&E) retired 250,000 CRTs from CAR-certified forest management projects to meet California’s cap-and-trade requirements. Verified by SCS Global Services, these credits supported the preservation of 12,000 acres of mixed hardwood forest, sequestering an estimated 1.2 million metric tons of CO₂e over a decade.

As U.S. climate regulations become stricter, the demand for compliance-grade offsets like CAR credits continues to grow. For consultancies such as Council Fire, CAR provides a reliable framework for clients in industries like natural resource management, energy infrastructure, and sustainable community development. Its detailed reporting and compliance-grade standards make it a valuable tool for navigating evolving environmental regulations.

Advantages and Disadvantages

Each certification standard comes with its own set of strengths and challenges. By understanding these trade-offs, organizations can better align their sustainability goals with the practical demands of implementation and market expectations.

Verra VCS holds a dominant position in the global market. Its broad project eligibility - spanning forestry, agriculture, renewable energy, and technology - provides organizations with considerable flexibility. Additionally, its rigorous third-party validation and transparent registry system have earned the trust of 80% of Fortune 500 companies[8]. However, its primary focus on greenhouse gas reductions, without requiring additional social or environmental benefits, might not appeal to organizations seeking a more rounded sustainability impact[2].

Gold Standard stands out by requiring verified co-benefits, such as improved health, gender equality, or biodiversity protection. This emphasis on sustainable development makes its credits highly sought after by buyers who value a more comprehensive impact. On the downside, its restrictive project eligibility - mainly limited to renewable energy, energy efficiency, and community-driven initiatives - can limit its applicability for projects outside these areas.

American Carbon Registry (ACR) is tailored for U.S.-based projects, offering streamlined certification processes and methodologies suited to North American conditions. However, ACR’s international recognition is relatively limited compared to Verra VCS or Gold Standard, which could pose challenges for organizations aiming for global market credibility.

Climate Action Reserve (CAR) excels in regulatory acceptance, particularly within California’s cap-and-trade program, often commanding premium credit pricing. Its prescriptive methodologies help reduce uncertainty during project development. However, its limited international recognition and focus on specific project categories may restrict its appeal for innovative or less conventional offset initiatives.

Standard | Certification Costs (USD) | Project Eligibility | Co-Benefits | Market Recognition (U.S.) |

|---|---|---|---|---|

Verra VCS | $30,000–$150,000+ | Broad (e.g., forestry, agriculture, tech) | Optional (CCB add-on available) | Very High (global and U.S.) |

Gold Standard | $40,000–$200,000+ | More restrictive (renewables, community) | Required (core to standard) | High (especially for co-benefits) |

ACR | $30,000–$150,000+ | Broad (U.S. focus, innovative methods) | Optional | High (U.S. compliance and voluntary) |

CAR | $30,000–$150,000+ | Broad (U.S. focus, regulatory alignment) | Optional | High (U.S. compliance and voluntary) |

Certification costs vary widely depending on the size, complexity, and monitoring requirements of a project. Gold Standard projects often carry the highest expenses due to the additional verification needed for sustainable development co-benefits[4]. All standards mandate independent third-party validation, but the level of scrutiny depends on the standard’s specific requirements and methodology.

The choice of standard ultimately hinges on an organization’s strategic goals. For those aiming for broad market access and strong buyer recognition, Verra VCS is a preferred option. Organizations prioritizing measurable social and environmental impacts alongside carbon reduction often gravitate toward Gold Standard. Meanwhile, projects focused on U.S. compliance or regulatory alignment typically benefit from ACR or CAR.

Market recognition is a key factor in determining credit pricing and buyer demand. Verra VCS and Gold Standard maintain the strongest international presence, while CAR excels in U.S.-specific compliance markets.

For consultancies like Council Fire, navigating these trade-offs is crucial for effective project planning. The challenge lies in matching an organization’s objectives with the unique requirements of each standard while keeping an eye on long-term market trends and regulatory developments. These considerations provide the foundation for a tailored selection guide aimed at U.S.-based organizations.

Selection Guide for U.S. Organizations

Choosing the right carbon credit certification standard is a critical step that can shape your project's costs, market acceptance, and regulatory compliance. Here's a closer look at what U.S. organizations should consider when navigating this process.

Start by assessing your project's scale and scope. Large-scale, multi-site projects often benefit from the Verra VCS standard due to its extensive methodology options and global scalability. Companies like Microsoft and Unilever have successfully used Verra VCS for major forestry and technology-based initiatives[8]. On the other hand, smaller, community-focused projects - such as local solar energy programs - may find Gold Standard more supportive, especially when the goal is to deliver both carbon reduction and community benefits[4][5]. This initial evaluation helps align certification choices with your project's unique needs.

Next, focus on regulatory alignment. For projects aiming to comply with international frameworks, ensure the standard you choose meets those specific requirements. For example, Verra VCS is approved for the pilot and first phases of CORSIA, making it a strong choice for organizations in international aviation or those seeking global compliance[7].

Budget carefully for certification costs. Expenses can range from $30,000 to over $200,000, depending on the project's complexity and the chosen standard[4]. Gold Standard certifications often come with higher costs due to additional verification for co-benefits like social or environmental improvements. However, these added investments can lead to premium pricing in voluntary carbon markets.

Match your goals with certification requirements. If your organization values measurable social or environmental benefits alongside carbon reduction, Gold Standard is a compelling option. It mandates verified co-benefits, such as improved health outcomes, gender equality, or biodiversity protection. For projects focused primarily on reducing greenhouse gas emissions, Verra VCS offers a cost-effective alternative with optional co-benefits.

Understand your target market and buyer preferences. Corporate buyers increasingly value standards with strong third-party validation and transparent impact reporting[8][10]. For example, agricultural methane reduction projects in California often rely on CAR or ACR for state compliance, while organizations aiming for broader market appeal often choose Verra VCS or Gold Standard due to their international recognition.

Be mindful of timelines. Certification can take months or even over a year, depending on the project's complexity and the standard's requirements. Verra VCS, for instance, involves detailed third-party validation and verification, which can extend the timeline but ensures a high level of market credibility. Additionally, factor in potential delays for methodology updates, such as Verra's planned requantification procedure in 2025[3].

Consider sector-specific needs. Different standards suit different types of projects. For instance, technology-based solutions like CO₂ capture in concrete often align well with Verra VCS methodologies. Renewable energy and energy efficiency projects, however, may find a better fit with Gold Standard. Forest conservation (REDD+) projects can work under multiple standards, but preferences in regulatory and market contexts may steer you toward specific options[8].

Integrate certification into your broader sustainability strategy. Early engagement with certification bodies and stakeholders is crucial. Firms like Council Fire can provide valuable guidance, helping to align certification choices with your organization's goals while navigating the complexities of regulatory compliance and natural resource management.

Stay updated on evolving requirements. Regularly monitor changes in methodologies and market standards to ensure your project remains competitive and compliant. This proactive approach helps organizations adapt to shifting regulatory landscapes and evolving buyer expectations.

Balancing these factors - project goals, regulatory needs, market preferences, and available resources - can help your organization make informed decisions that align with its sustainability objectives and long-term strategy.

Conclusion

As we look at the carbon credit certification landscape in 2025, U.S. organizations have a range of clear options to help achieve their sustainability goals. Each certification standard offers distinct strengths, catering to different project types and strategic priorities. Verra VCS remains the leading standard, enjoying widespread market trust and adoption by 80% of Fortune 500 companies, including major players like Microsoft and Unilever. Its broad acceptance is bolstered by its alignment with cutting-edge scientific methodologies, offering comprehensive options for diverse projects[8].

While Verra holds the top spot, other standards provide unique benefits worth considering. Gold Standard is particularly appealing for organizations aiming to achieve additional social and environmental impacts alongside carbon reduction. Its rigorous monitoring and regular audits ensure high levels of accountability, making it a strong choice for projects where broader community and environmental outcomes are key priorities - even if this comes with higher certification costs[11].

For projects with a domestic focus, ACR and CAR provide U.S.-centric solutions that are streamlined and practical. While they might not carry the same international recognition as Verra or Gold Standard, they are well-suited for organizations concentrating on domestic markets or aiming to meet specific compliance needs[1][4]. These options highlight the importance of tailoring your choice to your project's unique goals and requirements.

Selecting the right certification standard requires careful consideration of factors like project scale, budget, timeline, and sustainability objectives. Staying ahead of evolving standards is crucial. Developments such as the introduction of Core Carbon Principles (CCP) labels and CORSIA eligibility requirements reflect the shifting demands of the market[3][7]. Organizations that remain informed and work with experienced consultants - whether through firms like Council Fire or directly with certification bodies - are better positioned to navigate these changes and achieve long-term success in the carbon credit market.

Ultimately, the best certification standard will align with your organization's specific needs. By prioritizing rigorous validation, transparent processes, and alignment with your overall sustainability strategy, you can ensure your efforts deliver meaningful results, no matter which path you choose.

FAQs

What’s the best way to choose a carbon credit certification standard for my organization’s sustainability goals?

Choosing a carbon credit certification standard begins with identifying what matters most to your organization. Does your focus lie in cutting emissions, preserving ecosystems, or empowering local communities? Aligning the certification standard with these goals is crucial. Widely respected options like Verra VCS and Gold Standard are known for their reliability and meaningful outcomes.

It's also essential to match the certification to the type of projects you’re pursuing, whether that's renewable energy initiatives, forestry efforts, or other sustainability ventures. Prioritize standards that emphasize measurable results, transparency, and additionality - ensuring your actions create an impact that wouldn’t occur otherwise. For more specific guidance, consulting with sustainability professionals can help you evaluate your options and choose the path that best supports your objectives.

What are the key differences between Verra VCS and Gold Standard in terms of project eligibility and market reputation?

Verra's Verified Carbon Standard (VCS) and the Gold Standard are two of the most recognized systems for certifying carbon credits, though their priorities and eligibility criteria set them apart. Verra VCS accommodates a wide variety of project types, ranging from energy and forestry to agriculture, with a focus on scalability and integration into global markets. Meanwhile, the Gold Standard is centered on projects that deliver both environmental and social benefits, such as renewable energy or community-driven initiatives, often requiring more rigorous stakeholder involvement.

When it comes to reputation, both standards hold a strong standing in the market. However, Gold Standard credits are frequently seen as premium due to their added emphasis on social impact. Verra VCS, by contrast, is appreciated for its adaptability and broad acceptance across both voluntary and compliance markets, making it a go-to option for larger-scale efforts.

Why might U.S.-based organizations choose ACR or CAR for carbon credit certification?

U.S.-based organizations often gravitate toward the American Carbon Registry (ACR) or the Climate Action Reserve (CAR) because these standards are specifically designed to align with the regulatory and market conditions in the United States. This alignment makes them a practical choice for projects targeting both domestic compliance requirements and voluntary carbon markets.

What sets ACR and CAR apart is their focus on delivering high-quality methodologies. These standards prioritize transparency and enforce rigorous verification processes, ensuring that the carbon credits generated are both reliable and measurable. For organizations, this means greater confidence in the environmental integrity of their credits. By leveraging ACR or CAR, U.S. organizations can align their sustainability initiatives with local market expectations while achieving meaningful environmental outcomes.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Nov 18, 2025

Top Carbon Credit Certification Standards 2025

Sustainability Strategy

In This Article

Explore the leading carbon credit certification standards of 2025, their unique strengths, and how they align with corporate sustainability goals.

Top Carbon Credit Certification Standards 2025

Carbon credit certification has become a cornerstone of corporate sustainability in 2025, helping businesses meet net-zero goals by ensuring emission reductions are real, measurable, and verified. The four leading standards - Verra VCS, Gold Standard, American Carbon Registry (ACR), and Climate Action Reserve (CAR) - each cater to different project needs and market requirements. Here's what you need to know:

Verra VCS: The largest global program, certifying diverse projects like forestry, agriculture, and renewable energy. Widely used by Fortune 500 companies.

Gold Standard: Focuses on projects with social and environmental benefits, such as clean energy and community-driven initiatives. Popular for ESG-focused buyers.

ACR: U.S.-based with a strong compliance focus, including California's cap-and-trade program. Known for forestry and agricultural projects.

CAR: Primarily U.S.-focused, excelling in regulatory compliance with protocols for methane capture, forestry, and waste management.

Key Takeaways:

Choose Verra VCS for global scalability and broad project types.

Opt for Gold Standard if co-benefits like health or biodiversity are priorities.

Use ACR or CAR for U.S.-specific compliance needs, especially in regulated markets.

Each standard offers unique strengths, and selecting the right one depends on your project's goals, budget, and target market. Below, explore their features and relevance in detail to find the best fit for your sustainability efforts.

1. Verra Verified Carbon Standard (VCS)

Year Established and Global Reach

Since its launch in 2005, the Verra Verified Carbon Standard has become the largest voluntary carbon credit program worldwide. By 2025, it had certified over 2,000 projects spanning more than 80 countries, issuing 1 billion Verified Carbon Units (VCUs). Each VCU corresponds to one metric ton of CO₂ equivalent either reduced or removed [10]. This expansive reach highlights its ability to certify a wide variety of emission reduction activities, from REDD+ forest conservation in tropical areas to renewable energy initiatives in the American Midwest. Its broad global presence allows for diverse project types and contributions.

Eligible Project Types

The VCS accommodates a wide array of project categories. These include well-established sectors like REDD+ forest conservation, renewable energy development, energy efficiency upgrades, and methane capture from landfills. It also certifies newer approaches, such as carbon capture in concrete production. Additional eligible areas include projects focused on agriculture, waste management, and land-use changes, providing U.S. organizations with multiple pathways to generate certified carbon credits [8][9].

Core Certification Requirements

For a project to earn VCS certification, it must deliver greenhouse gas reductions that are real, measurable, and go beyond what would have occurred without the project. Compliance with local laws and the protection of community interests are also mandatory. Each project undergoes a rigorous process, including independent third-party validation and verification, registration, ongoing monitoring, periodic reviews, and final approval before VCUs are issued. In 2025, the program introduced a Methodology Change and Requantification Procedure, allowing developers to update their quantification methods retroactively to reflect the latest scientific and market standards [2][3].

Market Recognition and U.S. Relevance

VCS credits are recognized under international frameworks such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), provided they meet specific criteria. This makes them particularly useful for U.S.-based airlines and organizations with substantial travel-related emissions. The program's transparent registry system and strict measures against double counting enhance its credibility, making VCS a reliable option for companies committed to meaningful climate action [7].

2. Gold Standard

Year Established and Global Reach

Launched in 2003 as a collaborative effort between the World Wide Fund for Nature (WWF) and other international NGOs, Gold Standard has grown into a globally recognized certification body. By 2024, it has certified more than 2,000 projects across 80+ countries, generating over 200 million carbon credits and contributing upwards of $30 billion in shared value for climate action and sustainable development efforts worldwide [4].

Eligible Project Types

Gold Standard certification applies to a wide range of projects, including renewable energy initiatives like wind, solar, and hydro, as well as energy efficiency, waste management, clean cooking solutions, water purification, reforestation, and sustainable agriculture. Each certified project aligns with at least three United Nations Sustainable Development Goals, ensuring a broader impact that goes beyond reducing carbon emissions [4][6].

Core Certification Requirements

To earn certification, projects must meet stringent criteria. This includes demonstrating emissions reductions that are real, measurable, and additional - meaning they wouldn't occur without carbon finance. Projects must also engage local stakeholders, undergo thorough third-party validation, and maintain transparent documentation. Continuous monitoring and periodic third-party verification are essential, alongside comprehensive risk assessments and buffer reserves to ensure permanence. Adherence to standardized methodologies and independent verification processes is non-negotiable [4][6].

Market Recognition and U.S. Relevance

Gold Standard stands out by combining carbon reduction with sustainable development benefits, setting it apart from frameworks like the Verified Carbon Standard (VCS). In the voluntary carbon market, Gold Standard credits are highly regarded, often commanding premium status due to their additional focus on development co-benefits. In the United States, these credits are among the top three most purchased by corporations seeking credible and impactful offsets [4].

The increasing U.S. demand for carbon credits with added social and environmental benefits makes Gold Standard particularly appealing to organizations with strong environmental, social, and governance (ESG) objectives. Companies leveraging these credits can align with best practices in sustainability reporting and meet stakeholder expectations for impactful climate action. Gold Standard is frequently cited in U.S. corporate sustainability reports and is a favored choice for meeting Science Based Targets initiative (SBTi) requirements [4].

For U.S.-based organizations, Gold Standard certification offers additional value when purchasing international offset credits. These projects not only achieve meaningful carbon reductions but also deliver significant community benefits, particularly in emerging markets. This dual impact allows companies to demonstrate global leadership in climate action while supporting sustainable development worldwide.

What are the carbon standards? (Verra, Gold Standard, American Carbon Registry, etc) - Abatable

3. American Carbon Registry (ACR)

The American Carbon Registry (ACR) provides a carbon certification framework that is deeply rooted in U.S. standards while maintaining a global presence.

Year Established and Global Reach

Established in 1996 and operated by Winrock International, ACR stands as one of the longest-running voluntary carbon offset programs in the United States. While its primary focus is domestic, its influence spans over 30 countries, including regions in North America, Latin America, Asia, and Africa. Despite this international reach, the majority of its projects remain U.S.-based, reflecting its deep expertise in navigating U.S. regulatory systems. Over the years, ACR has issued more than 200 million metric tons of verified emission reductions, a testament to its impact and credibility in the carbon market[1].

Eligible Project Types

ACR certifies a wide range of projects, with forestry and land use initiatives forming a significant portion of its portfolio. These include efforts like reforestation, avoided deforestation, and improved forest management. The registry also supports agricultural projects aimed at soil carbon sequestration and reducing methane emissions from livestock. Beyond these, ACR certifies renewable energy projects, industrial gas destruction, and methane capture from landfills and dairy operations. With over 40 approved methodologies, ACR continues to adapt to advancements in carbon reduction, including emerging technologies like direct air capture and enhanced rock weathering. For example, in June 2024, The Nature Conservancy registered a 5,000-acre reforestation project in Mississippi through ACR, generating 1.2 million metric tons of credits and $18 million in revenue for local landowners[1].

Core Certification Requirements

ACR’s certification process is grounded in rigorous standards to ensure the integrity of the credits it issues. Projects must undergo independent third-party validation, adhere to strict monitoring, reporting, and verification (MRV) protocols, and follow approved methodologies. Developers are required to prove additionality, demonstrating that the emission reductions would not have occurred without the project. Additionally, permanence is a key criterion, particularly for forestry projects, which must include buffer pools to address risks like fire, disease, or other natural disruptions. To enhance transparency and trust, all project data is publicly accessible, and measures are in place to prevent double counting. This meticulous approach has earned ACR respect from both regulatory authorities and corporate stakeholders.

Market Recognition and U.S. Relevance

ACR holds a distinctive position as the only U.S.-based registry approved for California’s cap-and-trade program. This regulatory endorsement significantly boosts its value for companies with compliance obligations. In 2024, ACR credits accounted for roughly 35% of all offset credits retired within California’s compliance market[1]. Voluntary credits under ACR typically trade between $8 and $18 per metric ton of CO₂e, while compliance credits range from $15 to $25. For instance, in September 2023, Chevron retired 500,000 ACR credits to meet regulatory requirements. These credits supported a methane capture project at a Texas landfill managed by Waste Management Inc., which achieved a 40% reduction in annual methane emissions[1]. The alignment of ACR with U.S. regulatory frameworks and its transparent registry system makes it a trusted choice for organizations, particularly in sectors like energy, water infrastructure, and resource management. For sustainability consultancies such as Council Fire, ACR offers a dependable solution for clients needing compliance-grade offsets and detailed impact reporting[1].

4. Climate Action Reserve (CAR)

The Climate Action Reserve (CAR) is a U.S.-based carbon credit certification standard, deeply aligned with American regulatory frameworks and state-level compliance programs.

Year Established and Scope

Established in 2001 in Los Angeles, California, CAR focuses primarily on North America, though some of its protocols are recognized internationally. This regional emphasis allows CAR to effectively navigate U.S. regulatory systems, making it a trusted choice for domestic organizations. By November 2025, CAR had registered over 500 projects and issued more than 180 million metric tons of CO₂ equivalent credits, known as Climate Reserve Tonnes (CRTs). These numbers highlight its significant role in the carbon offset market.

Types of Eligible Projects

CAR certifies a variety of project types, including:

Forestry projects like reforestation and improved forest management

Landfill methane capture

Livestock methane management

Organic waste composting

Destruction of ozone-depleting substances

Recent updates have expanded its scope to include soil carbon sequestration, dairy digesters, and urban forestry. For example, in April 2025, Dairyland Power Cooperative registered a manure digester project under CAR’s Livestock Protocol. This initiative, which captured methane emissions from three dairy farms in Wisconsin, generated 45,000 CRTs after undergoing third-party verification. The project also contributed to local air quality improvements.

Certification Process and Requirements

CAR's certification process is rigorous, ensuring that all projects deliver real, additional, and verifiable greenhouse gas reductions. Projects must follow CAR’s published protocols, which detail eligibility criteria, quantification methods, monitoring, and reporting requirements. Accredited third-party verification is mandatory before any credits are issued.

Transparency is a cornerstone of CAR’s approach. All projects are listed in a publicly accessible registry, allowing anyone to review project details, credit issuance, and retirement records. This openness builds trust and ensures traceability. Additionally, all projects must comply with U.S. laws and regulations and address stakeholder feedback during the certification process.

Market Relevance in the U.S.

CAR is one of the few standards accepted for compliance in California’s cap-and-trade program, overseen by the California Air Resources Board (CARB). This recognition elevates CAR credits to a premium level, particularly for organizations with regulatory obligations.

In June 2025, Pacific Gas & Electric (PG&E) retired 250,000 CRTs from CAR-certified forest management projects to meet California’s cap-and-trade requirements. Verified by SCS Global Services, these credits supported the preservation of 12,000 acres of mixed hardwood forest, sequestering an estimated 1.2 million metric tons of CO₂e over a decade.

As U.S. climate regulations become stricter, the demand for compliance-grade offsets like CAR credits continues to grow. For consultancies such as Council Fire, CAR provides a reliable framework for clients in industries like natural resource management, energy infrastructure, and sustainable community development. Its detailed reporting and compliance-grade standards make it a valuable tool for navigating evolving environmental regulations.

Advantages and Disadvantages

Each certification standard comes with its own set of strengths and challenges. By understanding these trade-offs, organizations can better align their sustainability goals with the practical demands of implementation and market expectations.

Verra VCS holds a dominant position in the global market. Its broad project eligibility - spanning forestry, agriculture, renewable energy, and technology - provides organizations with considerable flexibility. Additionally, its rigorous third-party validation and transparent registry system have earned the trust of 80% of Fortune 500 companies[8]. However, its primary focus on greenhouse gas reductions, without requiring additional social or environmental benefits, might not appeal to organizations seeking a more rounded sustainability impact[2].

Gold Standard stands out by requiring verified co-benefits, such as improved health, gender equality, or biodiversity protection. This emphasis on sustainable development makes its credits highly sought after by buyers who value a more comprehensive impact. On the downside, its restrictive project eligibility - mainly limited to renewable energy, energy efficiency, and community-driven initiatives - can limit its applicability for projects outside these areas.

American Carbon Registry (ACR) is tailored for U.S.-based projects, offering streamlined certification processes and methodologies suited to North American conditions. However, ACR’s international recognition is relatively limited compared to Verra VCS or Gold Standard, which could pose challenges for organizations aiming for global market credibility.

Climate Action Reserve (CAR) excels in regulatory acceptance, particularly within California’s cap-and-trade program, often commanding premium credit pricing. Its prescriptive methodologies help reduce uncertainty during project development. However, its limited international recognition and focus on specific project categories may restrict its appeal for innovative or less conventional offset initiatives.

Standard | Certification Costs (USD) | Project Eligibility | Co-Benefits | Market Recognition (U.S.) |

|---|---|---|---|---|

Verra VCS | $30,000–$150,000+ | Broad (e.g., forestry, agriculture, tech) | Optional (CCB add-on available) | Very High (global and U.S.) |

Gold Standard | $40,000–$200,000+ | More restrictive (renewables, community) | Required (core to standard) | High (especially for co-benefits) |

ACR | $30,000–$150,000+ | Broad (U.S. focus, innovative methods) | Optional | High (U.S. compliance and voluntary) |

CAR | $30,000–$150,000+ | Broad (U.S. focus, regulatory alignment) | Optional | High (U.S. compliance and voluntary) |

Certification costs vary widely depending on the size, complexity, and monitoring requirements of a project. Gold Standard projects often carry the highest expenses due to the additional verification needed for sustainable development co-benefits[4]. All standards mandate independent third-party validation, but the level of scrutiny depends on the standard’s specific requirements and methodology.

The choice of standard ultimately hinges on an organization’s strategic goals. For those aiming for broad market access and strong buyer recognition, Verra VCS is a preferred option. Organizations prioritizing measurable social and environmental impacts alongside carbon reduction often gravitate toward Gold Standard. Meanwhile, projects focused on U.S. compliance or regulatory alignment typically benefit from ACR or CAR.

Market recognition is a key factor in determining credit pricing and buyer demand. Verra VCS and Gold Standard maintain the strongest international presence, while CAR excels in U.S.-specific compliance markets.

For consultancies like Council Fire, navigating these trade-offs is crucial for effective project planning. The challenge lies in matching an organization’s objectives with the unique requirements of each standard while keeping an eye on long-term market trends and regulatory developments. These considerations provide the foundation for a tailored selection guide aimed at U.S.-based organizations.

Selection Guide for U.S. Organizations

Choosing the right carbon credit certification standard is a critical step that can shape your project's costs, market acceptance, and regulatory compliance. Here's a closer look at what U.S. organizations should consider when navigating this process.

Start by assessing your project's scale and scope. Large-scale, multi-site projects often benefit from the Verra VCS standard due to its extensive methodology options and global scalability. Companies like Microsoft and Unilever have successfully used Verra VCS for major forestry and technology-based initiatives[8]. On the other hand, smaller, community-focused projects - such as local solar energy programs - may find Gold Standard more supportive, especially when the goal is to deliver both carbon reduction and community benefits[4][5]. This initial evaluation helps align certification choices with your project's unique needs.