Dec 21, 2025

Dec 21, 2025

Private Capital for Decentralized Water Systems

Sustainability Strategy

Sustainability Strategy

In This Article

Private capital and hybrid public-private models help close the water infrastructure gap using decentralized systems, AI-enabled management, and regional collaboration.

Private Capital for Decentralized Water Systems

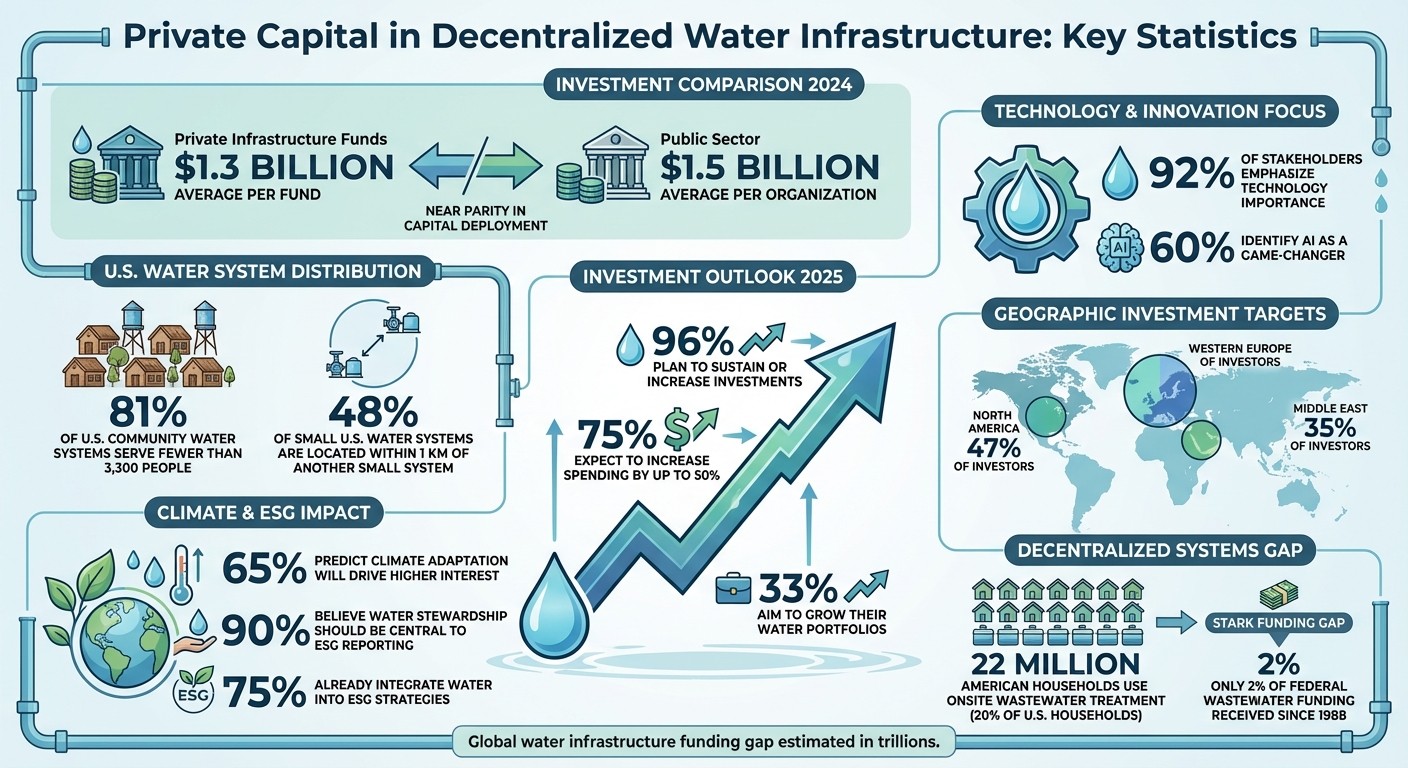

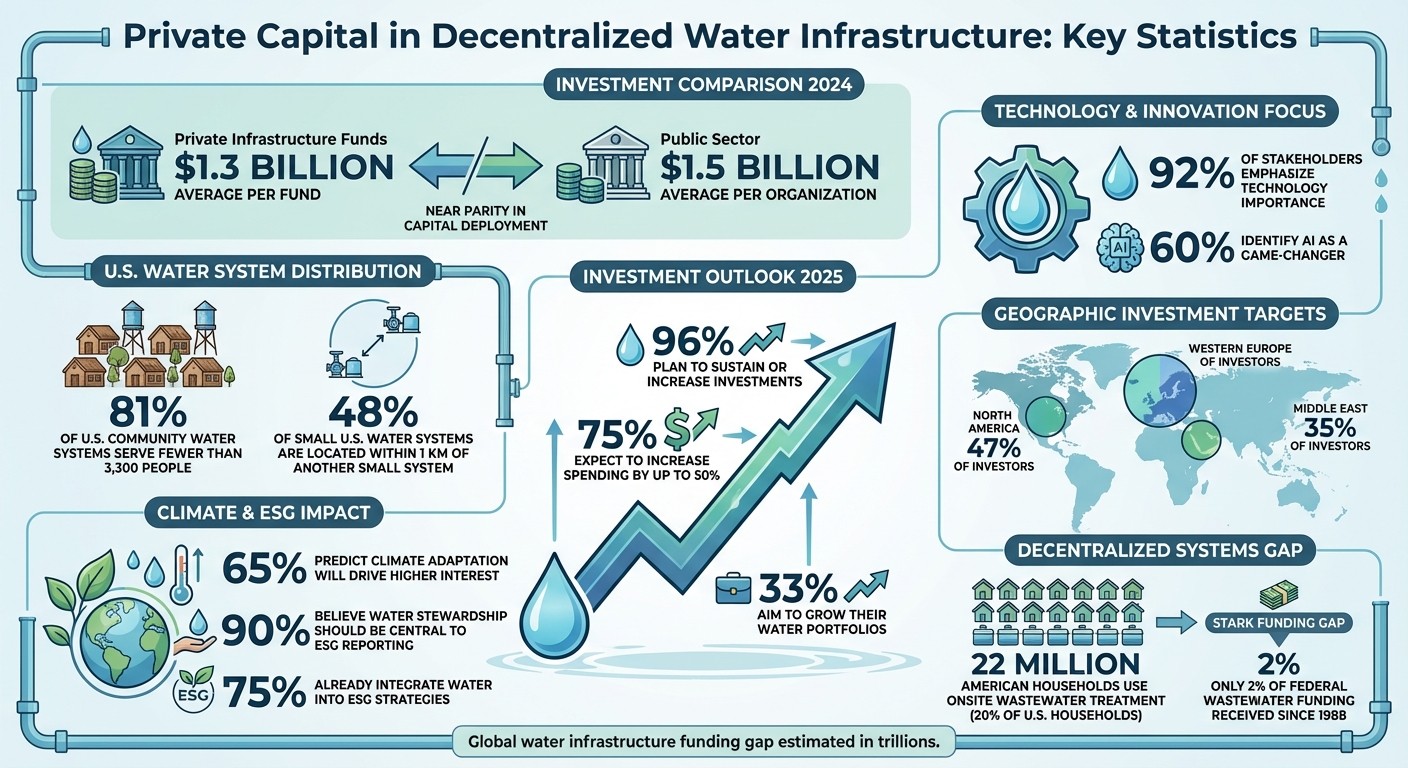

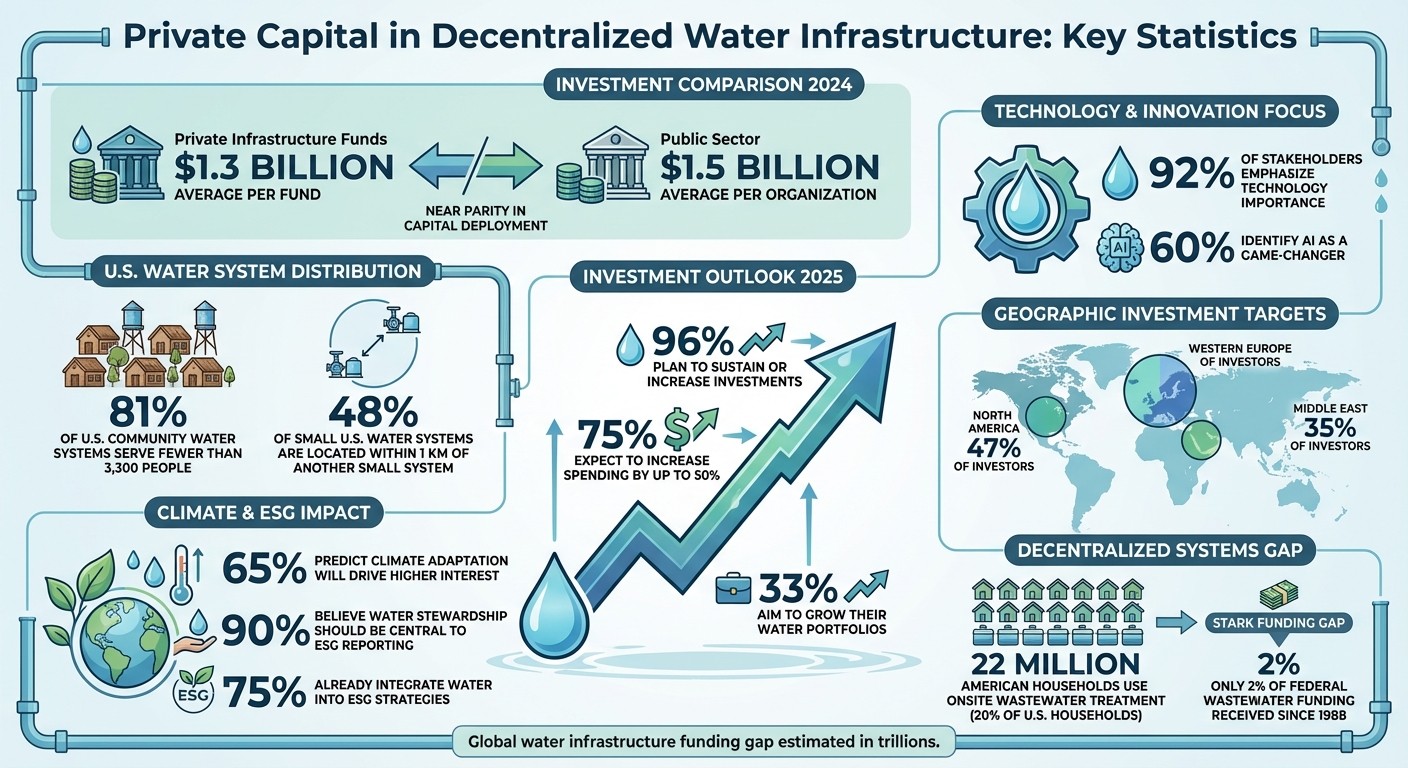

The global water infrastructure funding gap, estimated in the trillions, is driving a shift toward decentralized water systems and private investment. These localized systems, which treat water closer to its source, are gaining traction, particularly in rural areas where 81% of U.S. community water systems serve fewer than 3,300 people. In 2024, private infrastructure funds invested an average of $1.3 billion in water projects, nearly matching the public sector's $1.5 billion. This marks a growing collaboration between public and private sectors, with 96% of stakeholders planning to sustain or increase investments in 2025.

Key insights:

Decentralized systems address regulatory and infrastructure challenges for smaller communities.

Private funding is filling gaps left by traditional municipal models, with hybrid public-private models gaining popularity.

Technology like AI and smart water management is seen as transformative, with 92% of stakeholders emphasizing its importance.

Barriers include market fragmentation, regulatory hurdles, and affordability concerns, but regional collaboration and blended financing models offer solutions.

The future of water infrastructure lies in combining private capital and public oversight to address systemic challenges while ensuring equitable access.

Private vs Public Investment in Decentralized Water Infrastructure 2024-2025

Private Investment Trends in Decentralized Water Infrastructure

Where Private Investors Are Focusing

Private investment in decentralized water infrastructure has surged in recent years. In 2024 alone, private infrastructure funds allocated an average of $1.3 billion each to water projects, closely rivaling the public sector's average of $1.5 billion per organization [3]. This shift signals a departure from traditional financing methods, such as municipal bonds, toward partnerships that unite utilities and private investors.

The focus of these investments spans several critical areas. Smart water management and AI-powered solutions are leading the way, with 92% of stakeholders highlighting the importance of technological advancements and over 60% identifying AI as a game-changer [2]. Decentralized onsite wastewater treatment systems, which serve around 22 million American households (nearly 20% of all U.S. households), represent another significant area of opportunity. Despite their prevalence, these systems have historically received only about 2% of federal wastewater funding since 1988 [8]. This funding gap presents a ripe opportunity for private capital to step in.

Geographically, investment patterns are becoming more diverse. Western Europe is seen as the top growth region by 60% of investors, while 47% are targeting North America [4]. The Middle East is also emerging as a key focus area, with 35% of infrastructure funds identifying it as a primary growth target. Meanwhile, organizations from East Asia - particularly in China, Singapore, Japan, and South Korea - are expanding into Western markets to tap into advanced water management technologies [4].

"The water sector is experiencing a fundamental shift in how capital flows into critical infrastructure. Even investor-owned utilities are now actively seeking partnerships with infrastructure funds because their capital demands have become so extensive."

Michael Albrecht, Managing Partner, Ridgewood Infrastructure[3]

Investment strategies are evolving based on regional needs. In developed markets like the U.S. and Europe, the focus is on upgrading aging infrastructure and improving efficiency. In contrast, emerging markets in Asia and the Middle East are prioritizing large-scale projects and implementing new technologies [6]. Notably, 25% of Asian organizations invested over $1 billion in water projects in 2024, surpassing the investment volumes of both the U.S. and the UK [3].

These targeted investments reflect a market primed for growth.

Market Size and Growth Forecasts

The future of private investment in decentralized water systems looks promising. Ninety-six percent of stakeholders in the sector plan to maintain or increase their investments in 2025 compared to 2024 [3][7]. About 75% of respondents expect to increase their spending by up to 50% [3]. This growing commitment underscores the shift of water infrastructure from a niche concern to a strategic priority for institutional investors.

This favorable investment climate is driving a transition from maintenance-focused strategies to aggressive portfolio expansion. In 2025, 33% of organizations aim to grow their water portfolios [3], and nearly 47% of water utilities now rank private equity funds among their top three sources of financial support [3]. The collaboration between public and private capital is becoming more common, with 40% of stakeholders identifying new investment opportunities as their primary focus for the year ahead [3][2].

Climate resilience is emerging as a key motivator for these investments. Sixty-five percent of stakeholders predict that a growing emphasis on climate adaptation will drive higher interest in water-related projects, while 55% foresee increased capital flow as a direct result [2]. Furthermore, 90% of stakeholders believe water stewardship should be a central component of ESG reporting, with 75% already integrating water considerations into their ESG strategies [2].

"As more organizations experience water scarcity or flooding events, it is clear that a water footprint is just as crucial as carbon in terms of strategic decision-making."

What Drives Private Sector Investment

Water Scarcity and Infrastructure Gaps

Water is no longer just a basic necessity - it has become a strategic focus for institutional investors. With a global funding gap for water infrastructure running into the trillions of dollars, there’s an urgent need for private capital to step in and scale solutions effectively [1]. In regions like North America and Western Europe, years of underinvestment in infrastructure have created a backlog too large for traditional public funding to handle alone.

"The water sector faces unprecedented challenges: escalating water scarcity, deteriorating infrastructure and increasing demand. These pressures have elevated water from a niche concern to a strategic priority for governments, corporations and institutional investors."

Bill Malarkey, Partner, Roland Berger[7]

The limitations of traditional financing methods have driven a search for innovative approaches, with investors increasingly aiming for both financial and social returns.

Economic and Social Returns

Private investors are particularly drawn to decentralized water systems, which deliver clear economic benefits while also addressing pressing social needs. Public-private partnerships (P3s) have emerged as a popular model, allowing public entities to shift financial and operational risks to private firms. These private players bring specialized expertise and alternative financing strategies, enabling long-term investments and operational efficiencies that public sector monopolies often struggle to achieve [5].

The financial appeal of water infrastructure is growing. Sixty-five percent of stakeholders believe that climate resiliency efforts will increase interest in water projects, while 40% expect higher profitability as more investment flows into climate-resilient infrastructure [2]. Additionally, water stewardship is becoming a key part of ESG reporting, with many organizations integrating water-related goals into their broader sustainability plans.

Smaller, rural water systems stand to benefit significantly from private sector involvement. These communities often lack the resources or scale to attract technical expertise. P3s help bridge this gap by enabling multiple small systems to collaborate and contract with a single private firm, creating economies of scale that would otherwise be unattainable [5].

Technology and Financing Models

To realize both economic and social gains, investors are leveraging advanced technologies and innovative financing frameworks. Tools like smart water management systems, microfiltration, and AI-powered solutions are helping deliver measurable outcomes. These technologies not only enhance operational efficiency but also boost project profitability, aligning well with performance-based investment models [2][5][6].

New financing structures are also making it easier for private investors to participate. Blended finance models, which use public funds to offset private risks, are enabling projects in financially constrained regions [5]. Rather than full privatization, many investors prefer hybrid approaches - 33% favor mixed ownership structures, while 24% lean toward concession models that balance private sector efficiency with public oversight [1].

The shift in investment dynamics is striking. In 2024, infrastructure funds deployed around $1.3 billion each, nearly matching the $1.5 billion deployed by the public sector [3]. This growing parity underscores a significant transformation: private capital is no longer a secondary player - it’s becoming indispensable in addressing large-scale water infrastructure challenges.

Barriers to Private Capital Investment

Market Fragmentation and Financial Risks

The fragmented nature of the water sector presents a significant hurdle for private investors aiming to deploy capital on a large scale. In the U.S., most water systems serve relatively small populations, which limits opportunities to achieve economies of scale [5]. As a result, investors face higher costs per customer, making it difficult to fund projects that are financially appealing.

Decentralized systems also come with their own set of challenges. They often incur higher energy and maintenance costs, and older infrastructure - frequently plagued by unforeseen issues - drives up inspection and repair expenses [5].

Adding to these obstacles are revenue limitations. Political and social pressures often keep water rates lower than necessary, preventing systems from implementing full-cost pricing [5]. For investors who prioritize consistent returns, the prospect of raising rates to cover costs can lead to public backlash and "sticker shock" among consumers [5].

"Addressing these challenges requires new financing models beyond traditional municipal bonds or share issuances."

Michael Albrecht, Managing Partner, Ridgewood Infrastructure [3]

Fragmented markets, combined with inconsistent policies, only deepen the complexity for potential investors.

Regulatory and Policy Obstacles

Navigating the regulatory environment is another major challenge. Regulations vary widely across states and municipalities, creating a confusing and time-consuming process for investors [2][6]. The situation is even more complicated in rural areas, where many communities lack formal government structures to organize utilities or negotiate partnerships with private entities [5]. In cases where local governments have the authority to act, they often lack the expertise or resources to manage complex agreements, making it difficult to oversee long-term private sector contracts [5]. State-level policies can further hinder efforts by discouraging the regional cooperation necessary to attract private capital.

"Regulatory uncertainty can result in delayed investment decisions and project timelines, while the fragmentation of the water markets complicates efforts to scale solutions."

White & Case [2]

The dual role of water - as both a public necessity and an economic resource - adds another layer of complexity. Existing regulatory frameworks have not fully adapted to this dual role, further amplifying the financial risks tied to market fragmentation [2].

Equity and Access Issues

Balancing the need for profitability with affordability poses a significant challenge, particularly in low-income and rural communities. Private investors typically require returns that small or decentralized systems cannot provide without increasing water rates. However, such rate hikes could place a heavy burden on residents who earn below the national average [5]. This raises critical concerns about whether private capital can support decentralized systems without exacerbating existing inequities.

Public skepticism also plays a key role in deterring investment. Many view the idea of profiting from water - a resource considered a human right - as ethically troubling. This skepticism often translates into political resistance, preventing projects from moving forward [5]. Interestingly, 48% of small U.S. water systems are located within just 1 km of another small system [5], highlighting opportunities for regional collaboration. However, realizing this potential will require overcoming both regulatory barriers and local opposition to consolidation.

Risk Factor | Impact on Private Investment | Potential Mitigation Solution |

|---|---|---|

Market Fragmentation | Limits scaling and results in smaller, less efficient deals | Promote regional collaboration and system consolidation |

Regulatory Uncertainty | Extends project timelines and delays decisions | Build constructive relationships with regulatory bodies |

Low Water Rates | Creates insufficient revenue for service costs | Use blended financing and improve billing systems |

Aging Infrastructure | Increases risks of unforeseen maintenance expenses | Focus on developing new assets |

Lack of Scale | Leads to higher per-customer costs in rural areas | Implement regionalized public-private partnership models |

Project Examples and Success Stories

Mauritius' Decentralized Water Projects

Mauritius has embraced decentralized water systems to tackle its growing water scarcity issues. Projections indicate a 13% decline in water availability by 2050, compounded by leakage rates of 48%-60%. To address these challenges, the Development Bank of Mauritius (DBM) has introduced a Rainwater Harvesting System Loan Scheme for households. This program offers loans of up to MUR 50,000 (approximately $1,200) at a 3% interest rate with a five-year repayment term. On the commercial side, similar systems have demonstrated impressive returns, with internal rates of return exceeding 25%.

For small and medium enterprises, the Technology and Innovation Scheme (TINNS) provides significant support, covering 80% of water treatment system costs, up to MUR 150,000 (around $3,400). Companies such as Aqua Science and Technology, Pure Aqua Inc., and Veolia Recycling have joined forces with multilateral institutions like the African Development Bank and UNDP to enhance capacity. These combined efforts are projected to save approximately MUR 858 million (about $20 million) over 15 years by reducing water losses. This initiative is particularly critical for drought-prone areas like Rodrigues [10]. Similarly, in the United States, public-private partnerships are addressing rural infrastructure challenges with innovative approaches.

U.S. Public-Private Projects

In the United States, public-private partnerships (P3s) are proving to be effective in addressing rural water infrastructure gaps. By fostering regional collaboration, these partnerships enable small, neighboring systems to pool resources, creating opportunities for economies of scale. Private capital is increasingly directed toward developing modern water treatment plants, which offer clearer outcomes and reduced risks [5].

Regional P3 models allow several small water systems to collectively contract with a single private firm for operations and maintenance, streamlining processes and cutting costs. Unlike traditional municipal financing, these projects transfer performance risks to private partners and rely on a mix of private equity and commercial debt rather than public bonds [9]. Research shows that small water systems are finding it harder to secure capital than in previous years, further driving interest in P3 models [5]. Historically, water-related P3s accounted for just 1%-3% of projects since the early 1990s, but they are gaining momentum as communities recognize the value of specialized expertise and alternative financing options [9].

The Path Forward for Private Capital

Opportunities for Public-Private Partnerships

In the water sector, public and private capital are increasingly joining forces, with private infrastructure funds now rivaling public sector investments [3]. This shift highlights the reality that trillion-dollar funding gaps in water infrastructure cannot be bridged by public funding alone [1].

A balanced approach is gaining traction among decision-makers, with many favoring hybrid models that combine the efficiency of private investment with the accountability of public oversight. In fact, two-thirds of stakeholders prefer minority private investment over complete privatization, with 33% supporting mixed ownership and 24% backing concession models [1]. Michael Albrecht, Managing Partner at Ridgewood Infrastructure, captures this sentiment:

"This isn't just about fixing individual assets - it's about addressing systemic challenges at scale, which requires new financing models that go beyond traditional municipal bonds or share issuances." [3]

Regional collaboration offers another promising avenue. Many smaller water systems in the United States are located near one another, making it feasible to consolidate them under single private contracts. This approach can create economies of scale that individual communities, especially the 81% of U.S. community water systems serving fewer than 3,300 people, would struggle to achieve independently [5].

Looking ahead, the momentum in the sector is clear - 96% of water sector decision-makers plan to sustain or increase their investments by 2025 [1]. Much of this is driven by the urgency of climate resiliency, with 65% of stakeholders anticipating a rise in water-related projects as businesses increasingly recognize that water footprints are as critical as carbon footprints for ensuring long-term operations [2]. This evolving landscape is paving the way for more integrated and collaborative approaches.

Scaling Impact Through Partnerships

Expanding on hybrid models, achieving scale requires both financial resources and strategic partnerships. Organizations like Council Fire play a pivotal role in this space, merging profitability with sustainability. Their expertise in water infrastructure and resource management helps public and private entities implement sustainability initiatives and form effective partnerships.

The future lies in blended financing approaches, which combine public funds, grants, and loan guarantees to reduce risks for private investors in underserved areas [5]. Success also hinges on engaging proactively with regulators to foster an environment that encourages innovation and collaboration.

Technology is another critical piece of the puzzle. Over 60% of respondents identify artificial intelligence as a key driver of transformation, enabling water systems to operate more efficiently [2]. With 92% of stakeholders acknowledging the potential of technology [2], partnerships that integrate both capital and cutting-edge solutions are poised to drive significant advancements in the sector.

Public and Private Finance for Rethinking Water Infrastructure - Rethinking Water West 2025 at ASU

Conclusion

The global water infrastructure crisis, with funding gaps running into trillions of dollars, cannot rely solely on public funding to bridge the divide [1]. Private capital is stepping in as a critical force for progress. In 2024, infrastructure funds are expected to deploy an average of $1.3 billion each - an amount that rivals public sector contributions [3]. This shift highlights the growing importance of collaborative models that unite public oversight with the efficiency of private investment.

The solution lies not in choosing between public or private approaches but in blending their strengths. Joanne Emerson Taqi, Partner at White & Case, emphasizes this balanced perspective:

"Closing the water investment gap will require something other than full privatization or exclusively public funding. It will require thoughtful collaboration that leverages the strengths of both sectors." [1]

As market conditions change, hybrid partnerships are becoming indispensable. Achieving success requires embracing these models, working with regulators to eliminate barriers, and fostering partnerships that balance financial stability with fair access to water resources. This is especially vital for small, decentralized systems, which often face the greatest challenges in securing funding.

With mounting water scarcity and the intensifying effects of climate change, the need for integrated investment solutions is urgent. Organizations like Council Fire play a key role in guiding both public and private sectors to develop water infrastructure projects that benefit communities while delivering returns for investors. The future of decentralized water systems depends on building balanced partnerships and making smart investments today.

FAQs

What advantages do decentralized water systems offer compared to traditional municipal models?

Decentralized water systems process water or wastewater near the source, bypassing the need for extensive pipelines to centralized treatment plants. By treating water locally, these systems significantly cut down infrastructure expenses, use less energy, and reduce water loss. This makes them an efficient and practical option, especially for rural or remote areas where building large-scale plants may not be feasible.

Beyond cost efficiency, decentralized systems bring added flexibility and resilience. They enable communities to respond more effectively to climate-related challenges or shifts in population, as maintenance and upgrades are confined to smaller, localized units. Their modular design encourages regional collaboration and can draw private investment through public-private partnerships, opening doors for sustained development. Organizations like Council Fire play a key role in guiding stakeholders to align financial objectives with environmental and social priorities in decentralized water projects.

How do public-private partnerships improve decentralized water infrastructure?

Public-private partnerships (PPPs) bring together government oversight with private-sector resources, expertise, and shared risk to tackle the immense investment demands of U.S. water systems. These collaborations are particularly beneficial for rural and small-community utilities, which often face challenges in maintaining outdated infrastructure. Through PPPs, these utilities can modernize decentralized treatment and distribution systems without imposing heavy financial burdens on local residents.

One of the key advantages of PPPs is their ability to provide upfront funding, which allows construction to move forward more quickly and minimizes delays between project planning and implementation. Private-sector partners also bring specialized capabilities, such as advanced engineering solutions and digital monitoring technologies, that boost efficiency and help extend the lifespan of water infrastructure. Furthermore, these partnerships balance risks - like construction challenges or fluctuating demand - by assigning them to the parties best equipped to handle them, ensuring projects remain both financially stable and operationally effective.

Council Fire, a consultancy focused on sustainability, plays a vital role in shaping these partnerships. By encouraging collaboration, developing clear financing models, and emphasizing the lasting importance of resilient water systems, Council Fire helps communities secure private investment while safeguarding public health and preserving ecosystems.

How does technology enhance decentralized water systems?

Technology plays a pivotal role in enhancing the efficiency and scalability of decentralized water systems. Modern on-site treatment solutions, such as advanced filtration systems and membrane bioreactor technologies, can be deployed in a matter of months, providing safe and clean water exactly where it’s needed. These systems are often equipped with digital monitoring tools that deliver real-time data on water quality, flow rates, and energy consumption. This data helps operators fine-tune performance, anticipate maintenance needs, and comply with regulatory standards.

Cutting-edge advancements like compact reverse osmosis, AI-powered controls, and electrocoagulation broaden the range of contaminants that can be effectively treated. These technologies also support water reuse and closed-loop systems, making them ideal for schools, small communities, and businesses. By lowering initial costs and accelerating implementation timelines, these innovations make decentralized water systems an attractive option for private investors. Council Fire works with organizations to integrate these technologies, ensuring projects deliver both financial returns and positive environmental impacts.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 21, 2025

Private Capital for Decentralized Water Systems

Sustainability Strategy

In This Article

Private capital and hybrid public-private models help close the water infrastructure gap using decentralized systems, AI-enabled management, and regional collaboration.

Private Capital for Decentralized Water Systems

The global water infrastructure funding gap, estimated in the trillions, is driving a shift toward decentralized water systems and private investment. These localized systems, which treat water closer to its source, are gaining traction, particularly in rural areas where 81% of U.S. community water systems serve fewer than 3,300 people. In 2024, private infrastructure funds invested an average of $1.3 billion in water projects, nearly matching the public sector's $1.5 billion. This marks a growing collaboration between public and private sectors, with 96% of stakeholders planning to sustain or increase investments in 2025.

Key insights:

Decentralized systems address regulatory and infrastructure challenges for smaller communities.

Private funding is filling gaps left by traditional municipal models, with hybrid public-private models gaining popularity.

Technology like AI and smart water management is seen as transformative, with 92% of stakeholders emphasizing its importance.

Barriers include market fragmentation, regulatory hurdles, and affordability concerns, but regional collaboration and blended financing models offer solutions.

The future of water infrastructure lies in combining private capital and public oversight to address systemic challenges while ensuring equitable access.

Private vs Public Investment in Decentralized Water Infrastructure 2024-2025

Private Investment Trends in Decentralized Water Infrastructure

Where Private Investors Are Focusing

Private investment in decentralized water infrastructure has surged in recent years. In 2024 alone, private infrastructure funds allocated an average of $1.3 billion each to water projects, closely rivaling the public sector's average of $1.5 billion per organization [3]. This shift signals a departure from traditional financing methods, such as municipal bonds, toward partnerships that unite utilities and private investors.

The focus of these investments spans several critical areas. Smart water management and AI-powered solutions are leading the way, with 92% of stakeholders highlighting the importance of technological advancements and over 60% identifying AI as a game-changer [2]. Decentralized onsite wastewater treatment systems, which serve around 22 million American households (nearly 20% of all U.S. households), represent another significant area of opportunity. Despite their prevalence, these systems have historically received only about 2% of federal wastewater funding since 1988 [8]. This funding gap presents a ripe opportunity for private capital to step in.

Geographically, investment patterns are becoming more diverse. Western Europe is seen as the top growth region by 60% of investors, while 47% are targeting North America [4]. The Middle East is also emerging as a key focus area, with 35% of infrastructure funds identifying it as a primary growth target. Meanwhile, organizations from East Asia - particularly in China, Singapore, Japan, and South Korea - are expanding into Western markets to tap into advanced water management technologies [4].

"The water sector is experiencing a fundamental shift in how capital flows into critical infrastructure. Even investor-owned utilities are now actively seeking partnerships with infrastructure funds because their capital demands have become so extensive."

Michael Albrecht, Managing Partner, Ridgewood Infrastructure[3]

Investment strategies are evolving based on regional needs. In developed markets like the U.S. and Europe, the focus is on upgrading aging infrastructure and improving efficiency. In contrast, emerging markets in Asia and the Middle East are prioritizing large-scale projects and implementing new technologies [6]. Notably, 25% of Asian organizations invested over $1 billion in water projects in 2024, surpassing the investment volumes of both the U.S. and the UK [3].

These targeted investments reflect a market primed for growth.

Market Size and Growth Forecasts

The future of private investment in decentralized water systems looks promising. Ninety-six percent of stakeholders in the sector plan to maintain or increase their investments in 2025 compared to 2024 [3][7]. About 75% of respondents expect to increase their spending by up to 50% [3]. This growing commitment underscores the shift of water infrastructure from a niche concern to a strategic priority for institutional investors.

This favorable investment climate is driving a transition from maintenance-focused strategies to aggressive portfolio expansion. In 2025, 33% of organizations aim to grow their water portfolios [3], and nearly 47% of water utilities now rank private equity funds among their top three sources of financial support [3]. The collaboration between public and private capital is becoming more common, with 40% of stakeholders identifying new investment opportunities as their primary focus for the year ahead [3][2].

Climate resilience is emerging as a key motivator for these investments. Sixty-five percent of stakeholders predict that a growing emphasis on climate adaptation will drive higher interest in water-related projects, while 55% foresee increased capital flow as a direct result [2]. Furthermore, 90% of stakeholders believe water stewardship should be a central component of ESG reporting, with 75% already integrating water considerations into their ESG strategies [2].

"As more organizations experience water scarcity or flooding events, it is clear that a water footprint is just as crucial as carbon in terms of strategic decision-making."

What Drives Private Sector Investment

Water Scarcity and Infrastructure Gaps

Water is no longer just a basic necessity - it has become a strategic focus for institutional investors. With a global funding gap for water infrastructure running into the trillions of dollars, there’s an urgent need for private capital to step in and scale solutions effectively [1]. In regions like North America and Western Europe, years of underinvestment in infrastructure have created a backlog too large for traditional public funding to handle alone.

"The water sector faces unprecedented challenges: escalating water scarcity, deteriorating infrastructure and increasing demand. These pressures have elevated water from a niche concern to a strategic priority for governments, corporations and institutional investors."

Bill Malarkey, Partner, Roland Berger[7]

The limitations of traditional financing methods have driven a search for innovative approaches, with investors increasingly aiming for both financial and social returns.

Economic and Social Returns

Private investors are particularly drawn to decentralized water systems, which deliver clear economic benefits while also addressing pressing social needs. Public-private partnerships (P3s) have emerged as a popular model, allowing public entities to shift financial and operational risks to private firms. These private players bring specialized expertise and alternative financing strategies, enabling long-term investments and operational efficiencies that public sector monopolies often struggle to achieve [5].

The financial appeal of water infrastructure is growing. Sixty-five percent of stakeholders believe that climate resiliency efforts will increase interest in water projects, while 40% expect higher profitability as more investment flows into climate-resilient infrastructure [2]. Additionally, water stewardship is becoming a key part of ESG reporting, with many organizations integrating water-related goals into their broader sustainability plans.

Smaller, rural water systems stand to benefit significantly from private sector involvement. These communities often lack the resources or scale to attract technical expertise. P3s help bridge this gap by enabling multiple small systems to collaborate and contract with a single private firm, creating economies of scale that would otherwise be unattainable [5].

Technology and Financing Models

To realize both economic and social gains, investors are leveraging advanced technologies and innovative financing frameworks. Tools like smart water management systems, microfiltration, and AI-powered solutions are helping deliver measurable outcomes. These technologies not only enhance operational efficiency but also boost project profitability, aligning well with performance-based investment models [2][5][6].

New financing structures are also making it easier for private investors to participate. Blended finance models, which use public funds to offset private risks, are enabling projects in financially constrained regions [5]. Rather than full privatization, many investors prefer hybrid approaches - 33% favor mixed ownership structures, while 24% lean toward concession models that balance private sector efficiency with public oversight [1].

The shift in investment dynamics is striking. In 2024, infrastructure funds deployed around $1.3 billion each, nearly matching the $1.5 billion deployed by the public sector [3]. This growing parity underscores a significant transformation: private capital is no longer a secondary player - it’s becoming indispensable in addressing large-scale water infrastructure challenges.

Barriers to Private Capital Investment

Market Fragmentation and Financial Risks

The fragmented nature of the water sector presents a significant hurdle for private investors aiming to deploy capital on a large scale. In the U.S., most water systems serve relatively small populations, which limits opportunities to achieve economies of scale [5]. As a result, investors face higher costs per customer, making it difficult to fund projects that are financially appealing.

Decentralized systems also come with their own set of challenges. They often incur higher energy and maintenance costs, and older infrastructure - frequently plagued by unforeseen issues - drives up inspection and repair expenses [5].

Adding to these obstacles are revenue limitations. Political and social pressures often keep water rates lower than necessary, preventing systems from implementing full-cost pricing [5]. For investors who prioritize consistent returns, the prospect of raising rates to cover costs can lead to public backlash and "sticker shock" among consumers [5].

"Addressing these challenges requires new financing models beyond traditional municipal bonds or share issuances."

Michael Albrecht, Managing Partner, Ridgewood Infrastructure [3]

Fragmented markets, combined with inconsistent policies, only deepen the complexity for potential investors.

Regulatory and Policy Obstacles

Navigating the regulatory environment is another major challenge. Regulations vary widely across states and municipalities, creating a confusing and time-consuming process for investors [2][6]. The situation is even more complicated in rural areas, where many communities lack formal government structures to organize utilities or negotiate partnerships with private entities [5]. In cases where local governments have the authority to act, they often lack the expertise or resources to manage complex agreements, making it difficult to oversee long-term private sector contracts [5]. State-level policies can further hinder efforts by discouraging the regional cooperation necessary to attract private capital.

"Regulatory uncertainty can result in delayed investment decisions and project timelines, while the fragmentation of the water markets complicates efforts to scale solutions."

White & Case [2]

The dual role of water - as both a public necessity and an economic resource - adds another layer of complexity. Existing regulatory frameworks have not fully adapted to this dual role, further amplifying the financial risks tied to market fragmentation [2].

Equity and Access Issues

Balancing the need for profitability with affordability poses a significant challenge, particularly in low-income and rural communities. Private investors typically require returns that small or decentralized systems cannot provide without increasing water rates. However, such rate hikes could place a heavy burden on residents who earn below the national average [5]. This raises critical concerns about whether private capital can support decentralized systems without exacerbating existing inequities.

Public skepticism also plays a key role in deterring investment. Many view the idea of profiting from water - a resource considered a human right - as ethically troubling. This skepticism often translates into political resistance, preventing projects from moving forward [5]. Interestingly, 48% of small U.S. water systems are located within just 1 km of another small system [5], highlighting opportunities for regional collaboration. However, realizing this potential will require overcoming both regulatory barriers and local opposition to consolidation.

Risk Factor | Impact on Private Investment | Potential Mitigation Solution |

|---|---|---|

Market Fragmentation | Limits scaling and results in smaller, less efficient deals | Promote regional collaboration and system consolidation |

Regulatory Uncertainty | Extends project timelines and delays decisions | Build constructive relationships with regulatory bodies |

Low Water Rates | Creates insufficient revenue for service costs | Use blended financing and improve billing systems |

Aging Infrastructure | Increases risks of unforeseen maintenance expenses | Focus on developing new assets |

Lack of Scale | Leads to higher per-customer costs in rural areas | Implement regionalized public-private partnership models |

Project Examples and Success Stories

Mauritius' Decentralized Water Projects

Mauritius has embraced decentralized water systems to tackle its growing water scarcity issues. Projections indicate a 13% decline in water availability by 2050, compounded by leakage rates of 48%-60%. To address these challenges, the Development Bank of Mauritius (DBM) has introduced a Rainwater Harvesting System Loan Scheme for households. This program offers loans of up to MUR 50,000 (approximately $1,200) at a 3% interest rate with a five-year repayment term. On the commercial side, similar systems have demonstrated impressive returns, with internal rates of return exceeding 25%.

For small and medium enterprises, the Technology and Innovation Scheme (TINNS) provides significant support, covering 80% of water treatment system costs, up to MUR 150,000 (around $3,400). Companies such as Aqua Science and Technology, Pure Aqua Inc., and Veolia Recycling have joined forces with multilateral institutions like the African Development Bank and UNDP to enhance capacity. These combined efforts are projected to save approximately MUR 858 million (about $20 million) over 15 years by reducing water losses. This initiative is particularly critical for drought-prone areas like Rodrigues [10]. Similarly, in the United States, public-private partnerships are addressing rural infrastructure challenges with innovative approaches.

U.S. Public-Private Projects

In the United States, public-private partnerships (P3s) are proving to be effective in addressing rural water infrastructure gaps. By fostering regional collaboration, these partnerships enable small, neighboring systems to pool resources, creating opportunities for economies of scale. Private capital is increasingly directed toward developing modern water treatment plants, which offer clearer outcomes and reduced risks [5].

Regional P3 models allow several small water systems to collectively contract with a single private firm for operations and maintenance, streamlining processes and cutting costs. Unlike traditional municipal financing, these projects transfer performance risks to private partners and rely on a mix of private equity and commercial debt rather than public bonds [9]. Research shows that small water systems are finding it harder to secure capital than in previous years, further driving interest in P3 models [5]. Historically, water-related P3s accounted for just 1%-3% of projects since the early 1990s, but they are gaining momentum as communities recognize the value of specialized expertise and alternative financing options [9].

The Path Forward for Private Capital

Opportunities for Public-Private Partnerships

In the water sector, public and private capital are increasingly joining forces, with private infrastructure funds now rivaling public sector investments [3]. This shift highlights the reality that trillion-dollar funding gaps in water infrastructure cannot be bridged by public funding alone [1].

A balanced approach is gaining traction among decision-makers, with many favoring hybrid models that combine the efficiency of private investment with the accountability of public oversight. In fact, two-thirds of stakeholders prefer minority private investment over complete privatization, with 33% supporting mixed ownership and 24% backing concession models [1]. Michael Albrecht, Managing Partner at Ridgewood Infrastructure, captures this sentiment:

"This isn't just about fixing individual assets - it's about addressing systemic challenges at scale, which requires new financing models that go beyond traditional municipal bonds or share issuances." [3]

Regional collaboration offers another promising avenue. Many smaller water systems in the United States are located near one another, making it feasible to consolidate them under single private contracts. This approach can create economies of scale that individual communities, especially the 81% of U.S. community water systems serving fewer than 3,300 people, would struggle to achieve independently [5].

Looking ahead, the momentum in the sector is clear - 96% of water sector decision-makers plan to sustain or increase their investments by 2025 [1]. Much of this is driven by the urgency of climate resiliency, with 65% of stakeholders anticipating a rise in water-related projects as businesses increasingly recognize that water footprints are as critical as carbon footprints for ensuring long-term operations [2]. This evolving landscape is paving the way for more integrated and collaborative approaches.

Scaling Impact Through Partnerships

Expanding on hybrid models, achieving scale requires both financial resources and strategic partnerships. Organizations like Council Fire play a pivotal role in this space, merging profitability with sustainability. Their expertise in water infrastructure and resource management helps public and private entities implement sustainability initiatives and form effective partnerships.

The future lies in blended financing approaches, which combine public funds, grants, and loan guarantees to reduce risks for private investors in underserved areas [5]. Success also hinges on engaging proactively with regulators to foster an environment that encourages innovation and collaboration.

Technology is another critical piece of the puzzle. Over 60% of respondents identify artificial intelligence as a key driver of transformation, enabling water systems to operate more efficiently [2]. With 92% of stakeholders acknowledging the potential of technology [2], partnerships that integrate both capital and cutting-edge solutions are poised to drive significant advancements in the sector.

Public and Private Finance for Rethinking Water Infrastructure - Rethinking Water West 2025 at ASU

Conclusion

The global water infrastructure crisis, with funding gaps running into trillions of dollars, cannot rely solely on public funding to bridge the divide [1]. Private capital is stepping in as a critical force for progress. In 2024, infrastructure funds are expected to deploy an average of $1.3 billion each - an amount that rivals public sector contributions [3]. This shift highlights the growing importance of collaborative models that unite public oversight with the efficiency of private investment.

The solution lies not in choosing between public or private approaches but in blending their strengths. Joanne Emerson Taqi, Partner at White & Case, emphasizes this balanced perspective:

"Closing the water investment gap will require something other than full privatization or exclusively public funding. It will require thoughtful collaboration that leverages the strengths of both sectors." [1]

As market conditions change, hybrid partnerships are becoming indispensable. Achieving success requires embracing these models, working with regulators to eliminate barriers, and fostering partnerships that balance financial stability with fair access to water resources. This is especially vital for small, decentralized systems, which often face the greatest challenges in securing funding.

With mounting water scarcity and the intensifying effects of climate change, the need for integrated investment solutions is urgent. Organizations like Council Fire play a key role in guiding both public and private sectors to develop water infrastructure projects that benefit communities while delivering returns for investors. The future of decentralized water systems depends on building balanced partnerships and making smart investments today.

FAQs

What advantages do decentralized water systems offer compared to traditional municipal models?

Decentralized water systems process water or wastewater near the source, bypassing the need for extensive pipelines to centralized treatment plants. By treating water locally, these systems significantly cut down infrastructure expenses, use less energy, and reduce water loss. This makes them an efficient and practical option, especially for rural or remote areas where building large-scale plants may not be feasible.

Beyond cost efficiency, decentralized systems bring added flexibility and resilience. They enable communities to respond more effectively to climate-related challenges or shifts in population, as maintenance and upgrades are confined to smaller, localized units. Their modular design encourages regional collaboration and can draw private investment through public-private partnerships, opening doors for sustained development. Organizations like Council Fire play a key role in guiding stakeholders to align financial objectives with environmental and social priorities in decentralized water projects.

How do public-private partnerships improve decentralized water infrastructure?

Public-private partnerships (PPPs) bring together government oversight with private-sector resources, expertise, and shared risk to tackle the immense investment demands of U.S. water systems. These collaborations are particularly beneficial for rural and small-community utilities, which often face challenges in maintaining outdated infrastructure. Through PPPs, these utilities can modernize decentralized treatment and distribution systems without imposing heavy financial burdens on local residents.

One of the key advantages of PPPs is their ability to provide upfront funding, which allows construction to move forward more quickly and minimizes delays between project planning and implementation. Private-sector partners also bring specialized capabilities, such as advanced engineering solutions and digital monitoring technologies, that boost efficiency and help extend the lifespan of water infrastructure. Furthermore, these partnerships balance risks - like construction challenges or fluctuating demand - by assigning them to the parties best equipped to handle them, ensuring projects remain both financially stable and operationally effective.

Council Fire, a consultancy focused on sustainability, plays a vital role in shaping these partnerships. By encouraging collaboration, developing clear financing models, and emphasizing the lasting importance of resilient water systems, Council Fire helps communities secure private investment while safeguarding public health and preserving ecosystems.

How does technology enhance decentralized water systems?

Technology plays a pivotal role in enhancing the efficiency and scalability of decentralized water systems. Modern on-site treatment solutions, such as advanced filtration systems and membrane bioreactor technologies, can be deployed in a matter of months, providing safe and clean water exactly where it’s needed. These systems are often equipped with digital monitoring tools that deliver real-time data on water quality, flow rates, and energy consumption. This data helps operators fine-tune performance, anticipate maintenance needs, and comply with regulatory standards.

Cutting-edge advancements like compact reverse osmosis, AI-powered controls, and electrocoagulation broaden the range of contaminants that can be effectively treated. These technologies also support water reuse and closed-loop systems, making them ideal for schools, small communities, and businesses. By lowering initial costs and accelerating implementation timelines, these innovations make decentralized water systems an attractive option for private investors. Council Fire works with organizations to integrate these technologies, ensuring projects deliver both financial returns and positive environmental impacts.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 21, 2025

Private Capital for Decentralized Water Systems

Sustainability Strategy

In This Article

Private capital and hybrid public-private models help close the water infrastructure gap using decentralized systems, AI-enabled management, and regional collaboration.

Private Capital for Decentralized Water Systems

The global water infrastructure funding gap, estimated in the trillions, is driving a shift toward decentralized water systems and private investment. These localized systems, which treat water closer to its source, are gaining traction, particularly in rural areas where 81% of U.S. community water systems serve fewer than 3,300 people. In 2024, private infrastructure funds invested an average of $1.3 billion in water projects, nearly matching the public sector's $1.5 billion. This marks a growing collaboration between public and private sectors, with 96% of stakeholders planning to sustain or increase investments in 2025.

Key insights:

Decentralized systems address regulatory and infrastructure challenges for smaller communities.

Private funding is filling gaps left by traditional municipal models, with hybrid public-private models gaining popularity.

Technology like AI and smart water management is seen as transformative, with 92% of stakeholders emphasizing its importance.

Barriers include market fragmentation, regulatory hurdles, and affordability concerns, but regional collaboration and blended financing models offer solutions.

The future of water infrastructure lies in combining private capital and public oversight to address systemic challenges while ensuring equitable access.

Private vs Public Investment in Decentralized Water Infrastructure 2024-2025

Private Investment Trends in Decentralized Water Infrastructure

Where Private Investors Are Focusing

Private investment in decentralized water infrastructure has surged in recent years. In 2024 alone, private infrastructure funds allocated an average of $1.3 billion each to water projects, closely rivaling the public sector's average of $1.5 billion per organization [3]. This shift signals a departure from traditional financing methods, such as municipal bonds, toward partnerships that unite utilities and private investors.

The focus of these investments spans several critical areas. Smart water management and AI-powered solutions are leading the way, with 92% of stakeholders highlighting the importance of technological advancements and over 60% identifying AI as a game-changer [2]. Decentralized onsite wastewater treatment systems, which serve around 22 million American households (nearly 20% of all U.S. households), represent another significant area of opportunity. Despite their prevalence, these systems have historically received only about 2% of federal wastewater funding since 1988 [8]. This funding gap presents a ripe opportunity for private capital to step in.

Geographically, investment patterns are becoming more diverse. Western Europe is seen as the top growth region by 60% of investors, while 47% are targeting North America [4]. The Middle East is also emerging as a key focus area, with 35% of infrastructure funds identifying it as a primary growth target. Meanwhile, organizations from East Asia - particularly in China, Singapore, Japan, and South Korea - are expanding into Western markets to tap into advanced water management technologies [4].

"The water sector is experiencing a fundamental shift in how capital flows into critical infrastructure. Even investor-owned utilities are now actively seeking partnerships with infrastructure funds because their capital demands have become so extensive."

Michael Albrecht, Managing Partner, Ridgewood Infrastructure[3]

Investment strategies are evolving based on regional needs. In developed markets like the U.S. and Europe, the focus is on upgrading aging infrastructure and improving efficiency. In contrast, emerging markets in Asia and the Middle East are prioritizing large-scale projects and implementing new technologies [6]. Notably, 25% of Asian organizations invested over $1 billion in water projects in 2024, surpassing the investment volumes of both the U.S. and the UK [3].

These targeted investments reflect a market primed for growth.

Market Size and Growth Forecasts

The future of private investment in decentralized water systems looks promising. Ninety-six percent of stakeholders in the sector plan to maintain or increase their investments in 2025 compared to 2024 [3][7]. About 75% of respondents expect to increase their spending by up to 50% [3]. This growing commitment underscores the shift of water infrastructure from a niche concern to a strategic priority for institutional investors.

This favorable investment climate is driving a transition from maintenance-focused strategies to aggressive portfolio expansion. In 2025, 33% of organizations aim to grow their water portfolios [3], and nearly 47% of water utilities now rank private equity funds among their top three sources of financial support [3]. The collaboration between public and private capital is becoming more common, with 40% of stakeholders identifying new investment opportunities as their primary focus for the year ahead [3][2].

Climate resilience is emerging as a key motivator for these investments. Sixty-five percent of stakeholders predict that a growing emphasis on climate adaptation will drive higher interest in water-related projects, while 55% foresee increased capital flow as a direct result [2]. Furthermore, 90% of stakeholders believe water stewardship should be a central component of ESG reporting, with 75% already integrating water considerations into their ESG strategies [2].

"As more organizations experience water scarcity or flooding events, it is clear that a water footprint is just as crucial as carbon in terms of strategic decision-making."

What Drives Private Sector Investment

Water Scarcity and Infrastructure Gaps

Water is no longer just a basic necessity - it has become a strategic focus for institutional investors. With a global funding gap for water infrastructure running into the trillions of dollars, there’s an urgent need for private capital to step in and scale solutions effectively [1]. In regions like North America and Western Europe, years of underinvestment in infrastructure have created a backlog too large for traditional public funding to handle alone.

"The water sector faces unprecedented challenges: escalating water scarcity, deteriorating infrastructure and increasing demand. These pressures have elevated water from a niche concern to a strategic priority for governments, corporations and institutional investors."

Bill Malarkey, Partner, Roland Berger[7]

The limitations of traditional financing methods have driven a search for innovative approaches, with investors increasingly aiming for both financial and social returns.

Economic and Social Returns

Private investors are particularly drawn to decentralized water systems, which deliver clear economic benefits while also addressing pressing social needs. Public-private partnerships (P3s) have emerged as a popular model, allowing public entities to shift financial and operational risks to private firms. These private players bring specialized expertise and alternative financing strategies, enabling long-term investments and operational efficiencies that public sector monopolies often struggle to achieve [5].

The financial appeal of water infrastructure is growing. Sixty-five percent of stakeholders believe that climate resiliency efforts will increase interest in water projects, while 40% expect higher profitability as more investment flows into climate-resilient infrastructure [2]. Additionally, water stewardship is becoming a key part of ESG reporting, with many organizations integrating water-related goals into their broader sustainability plans.

Smaller, rural water systems stand to benefit significantly from private sector involvement. These communities often lack the resources or scale to attract technical expertise. P3s help bridge this gap by enabling multiple small systems to collaborate and contract with a single private firm, creating economies of scale that would otherwise be unattainable [5].

Technology and Financing Models

To realize both economic and social gains, investors are leveraging advanced technologies and innovative financing frameworks. Tools like smart water management systems, microfiltration, and AI-powered solutions are helping deliver measurable outcomes. These technologies not only enhance operational efficiency but also boost project profitability, aligning well with performance-based investment models [2][5][6].

New financing structures are also making it easier for private investors to participate. Blended finance models, which use public funds to offset private risks, are enabling projects in financially constrained regions [5]. Rather than full privatization, many investors prefer hybrid approaches - 33% favor mixed ownership structures, while 24% lean toward concession models that balance private sector efficiency with public oversight [1].

The shift in investment dynamics is striking. In 2024, infrastructure funds deployed around $1.3 billion each, nearly matching the $1.5 billion deployed by the public sector [3]. This growing parity underscores a significant transformation: private capital is no longer a secondary player - it’s becoming indispensable in addressing large-scale water infrastructure challenges.

Barriers to Private Capital Investment

Market Fragmentation and Financial Risks

The fragmented nature of the water sector presents a significant hurdle for private investors aiming to deploy capital on a large scale. In the U.S., most water systems serve relatively small populations, which limits opportunities to achieve economies of scale [5]. As a result, investors face higher costs per customer, making it difficult to fund projects that are financially appealing.

Decentralized systems also come with their own set of challenges. They often incur higher energy and maintenance costs, and older infrastructure - frequently plagued by unforeseen issues - drives up inspection and repair expenses [5].

Adding to these obstacles are revenue limitations. Political and social pressures often keep water rates lower than necessary, preventing systems from implementing full-cost pricing [5]. For investors who prioritize consistent returns, the prospect of raising rates to cover costs can lead to public backlash and "sticker shock" among consumers [5].

"Addressing these challenges requires new financing models beyond traditional municipal bonds or share issuances."

Michael Albrecht, Managing Partner, Ridgewood Infrastructure [3]

Fragmented markets, combined with inconsistent policies, only deepen the complexity for potential investors.

Regulatory and Policy Obstacles

Navigating the regulatory environment is another major challenge. Regulations vary widely across states and municipalities, creating a confusing and time-consuming process for investors [2][6]. The situation is even more complicated in rural areas, where many communities lack formal government structures to organize utilities or negotiate partnerships with private entities [5]. In cases where local governments have the authority to act, they often lack the expertise or resources to manage complex agreements, making it difficult to oversee long-term private sector contracts [5]. State-level policies can further hinder efforts by discouraging the regional cooperation necessary to attract private capital.

"Regulatory uncertainty can result in delayed investment decisions and project timelines, while the fragmentation of the water markets complicates efforts to scale solutions."

White & Case [2]

The dual role of water - as both a public necessity and an economic resource - adds another layer of complexity. Existing regulatory frameworks have not fully adapted to this dual role, further amplifying the financial risks tied to market fragmentation [2].

Equity and Access Issues

Balancing the need for profitability with affordability poses a significant challenge, particularly in low-income and rural communities. Private investors typically require returns that small or decentralized systems cannot provide without increasing water rates. However, such rate hikes could place a heavy burden on residents who earn below the national average [5]. This raises critical concerns about whether private capital can support decentralized systems without exacerbating existing inequities.

Public skepticism also plays a key role in deterring investment. Many view the idea of profiting from water - a resource considered a human right - as ethically troubling. This skepticism often translates into political resistance, preventing projects from moving forward [5]. Interestingly, 48% of small U.S. water systems are located within just 1 km of another small system [5], highlighting opportunities for regional collaboration. However, realizing this potential will require overcoming both regulatory barriers and local opposition to consolidation.

Risk Factor | Impact on Private Investment | Potential Mitigation Solution |

|---|---|---|

Market Fragmentation | Limits scaling and results in smaller, less efficient deals | Promote regional collaboration and system consolidation |

Regulatory Uncertainty | Extends project timelines and delays decisions | Build constructive relationships with regulatory bodies |

Low Water Rates | Creates insufficient revenue for service costs | Use blended financing and improve billing systems |

Aging Infrastructure | Increases risks of unforeseen maintenance expenses | Focus on developing new assets |

Lack of Scale | Leads to higher per-customer costs in rural areas | Implement regionalized public-private partnership models |

Project Examples and Success Stories

Mauritius' Decentralized Water Projects

Mauritius has embraced decentralized water systems to tackle its growing water scarcity issues. Projections indicate a 13% decline in water availability by 2050, compounded by leakage rates of 48%-60%. To address these challenges, the Development Bank of Mauritius (DBM) has introduced a Rainwater Harvesting System Loan Scheme for households. This program offers loans of up to MUR 50,000 (approximately $1,200) at a 3% interest rate with a five-year repayment term. On the commercial side, similar systems have demonstrated impressive returns, with internal rates of return exceeding 25%.

For small and medium enterprises, the Technology and Innovation Scheme (TINNS) provides significant support, covering 80% of water treatment system costs, up to MUR 150,000 (around $3,400). Companies such as Aqua Science and Technology, Pure Aqua Inc., and Veolia Recycling have joined forces with multilateral institutions like the African Development Bank and UNDP to enhance capacity. These combined efforts are projected to save approximately MUR 858 million (about $20 million) over 15 years by reducing water losses. This initiative is particularly critical for drought-prone areas like Rodrigues [10]. Similarly, in the United States, public-private partnerships are addressing rural infrastructure challenges with innovative approaches.

U.S. Public-Private Projects

In the United States, public-private partnerships (P3s) are proving to be effective in addressing rural water infrastructure gaps. By fostering regional collaboration, these partnerships enable small, neighboring systems to pool resources, creating opportunities for economies of scale. Private capital is increasingly directed toward developing modern water treatment plants, which offer clearer outcomes and reduced risks [5].

Regional P3 models allow several small water systems to collectively contract with a single private firm for operations and maintenance, streamlining processes and cutting costs. Unlike traditional municipal financing, these projects transfer performance risks to private partners and rely on a mix of private equity and commercial debt rather than public bonds [9]. Research shows that small water systems are finding it harder to secure capital than in previous years, further driving interest in P3 models [5]. Historically, water-related P3s accounted for just 1%-3% of projects since the early 1990s, but they are gaining momentum as communities recognize the value of specialized expertise and alternative financing options [9].

The Path Forward for Private Capital

Opportunities for Public-Private Partnerships

In the water sector, public and private capital are increasingly joining forces, with private infrastructure funds now rivaling public sector investments [3]. This shift highlights the reality that trillion-dollar funding gaps in water infrastructure cannot be bridged by public funding alone [1].

A balanced approach is gaining traction among decision-makers, with many favoring hybrid models that combine the efficiency of private investment with the accountability of public oversight. In fact, two-thirds of stakeholders prefer minority private investment over complete privatization, with 33% supporting mixed ownership and 24% backing concession models [1]. Michael Albrecht, Managing Partner at Ridgewood Infrastructure, captures this sentiment:

"This isn't just about fixing individual assets - it's about addressing systemic challenges at scale, which requires new financing models that go beyond traditional municipal bonds or share issuances." [3]

Regional collaboration offers another promising avenue. Many smaller water systems in the United States are located near one another, making it feasible to consolidate them under single private contracts. This approach can create economies of scale that individual communities, especially the 81% of U.S. community water systems serving fewer than 3,300 people, would struggle to achieve independently [5].

Looking ahead, the momentum in the sector is clear - 96% of water sector decision-makers plan to sustain or increase their investments by 2025 [1]. Much of this is driven by the urgency of climate resiliency, with 65% of stakeholders anticipating a rise in water-related projects as businesses increasingly recognize that water footprints are as critical as carbon footprints for ensuring long-term operations [2]. This evolving landscape is paving the way for more integrated and collaborative approaches.

Scaling Impact Through Partnerships

Expanding on hybrid models, achieving scale requires both financial resources and strategic partnerships. Organizations like Council Fire play a pivotal role in this space, merging profitability with sustainability. Their expertise in water infrastructure and resource management helps public and private entities implement sustainability initiatives and form effective partnerships.

The future lies in blended financing approaches, which combine public funds, grants, and loan guarantees to reduce risks for private investors in underserved areas [5]. Success also hinges on engaging proactively with regulators to foster an environment that encourages innovation and collaboration.

Technology is another critical piece of the puzzle. Over 60% of respondents identify artificial intelligence as a key driver of transformation, enabling water systems to operate more efficiently [2]. With 92% of stakeholders acknowledging the potential of technology [2], partnerships that integrate both capital and cutting-edge solutions are poised to drive significant advancements in the sector.

Public and Private Finance for Rethinking Water Infrastructure - Rethinking Water West 2025 at ASU

Conclusion

The global water infrastructure crisis, with funding gaps running into trillions of dollars, cannot rely solely on public funding to bridge the divide [1]. Private capital is stepping in as a critical force for progress. In 2024, infrastructure funds are expected to deploy an average of $1.3 billion each - an amount that rivals public sector contributions [3]. This shift highlights the growing importance of collaborative models that unite public oversight with the efficiency of private investment.

The solution lies not in choosing between public or private approaches but in blending their strengths. Joanne Emerson Taqi, Partner at White & Case, emphasizes this balanced perspective:

"Closing the water investment gap will require something other than full privatization or exclusively public funding. It will require thoughtful collaboration that leverages the strengths of both sectors." [1]

As market conditions change, hybrid partnerships are becoming indispensable. Achieving success requires embracing these models, working with regulators to eliminate barriers, and fostering partnerships that balance financial stability with fair access to water resources. This is especially vital for small, decentralized systems, which often face the greatest challenges in securing funding.

With mounting water scarcity and the intensifying effects of climate change, the need for integrated investment solutions is urgent. Organizations like Council Fire play a key role in guiding both public and private sectors to develop water infrastructure projects that benefit communities while delivering returns for investors. The future of decentralized water systems depends on building balanced partnerships and making smart investments today.

FAQs

What advantages do decentralized water systems offer compared to traditional municipal models?

Decentralized water systems process water or wastewater near the source, bypassing the need for extensive pipelines to centralized treatment plants. By treating water locally, these systems significantly cut down infrastructure expenses, use less energy, and reduce water loss. This makes them an efficient and practical option, especially for rural or remote areas where building large-scale plants may not be feasible.

Beyond cost efficiency, decentralized systems bring added flexibility and resilience. They enable communities to respond more effectively to climate-related challenges or shifts in population, as maintenance and upgrades are confined to smaller, localized units. Their modular design encourages regional collaboration and can draw private investment through public-private partnerships, opening doors for sustained development. Organizations like Council Fire play a key role in guiding stakeholders to align financial objectives with environmental and social priorities in decentralized water projects.

How do public-private partnerships improve decentralized water infrastructure?

Public-private partnerships (PPPs) bring together government oversight with private-sector resources, expertise, and shared risk to tackle the immense investment demands of U.S. water systems. These collaborations are particularly beneficial for rural and small-community utilities, which often face challenges in maintaining outdated infrastructure. Through PPPs, these utilities can modernize decentralized treatment and distribution systems without imposing heavy financial burdens on local residents.

One of the key advantages of PPPs is their ability to provide upfront funding, which allows construction to move forward more quickly and minimizes delays between project planning and implementation. Private-sector partners also bring specialized capabilities, such as advanced engineering solutions and digital monitoring technologies, that boost efficiency and help extend the lifespan of water infrastructure. Furthermore, these partnerships balance risks - like construction challenges or fluctuating demand - by assigning them to the parties best equipped to handle them, ensuring projects remain both financially stable and operationally effective.

Council Fire, a consultancy focused on sustainability, plays a vital role in shaping these partnerships. By encouraging collaboration, developing clear financing models, and emphasizing the lasting importance of resilient water systems, Council Fire helps communities secure private investment while safeguarding public health and preserving ecosystems.

How does technology enhance decentralized water systems?

Technology plays a pivotal role in enhancing the efficiency and scalability of decentralized water systems. Modern on-site treatment solutions, such as advanced filtration systems and membrane bioreactor technologies, can be deployed in a matter of months, providing safe and clean water exactly where it’s needed. These systems are often equipped with digital monitoring tools that deliver real-time data on water quality, flow rates, and energy consumption. This data helps operators fine-tune performance, anticipate maintenance needs, and comply with regulatory standards.

Cutting-edge advancements like compact reverse osmosis, AI-powered controls, and electrocoagulation broaden the range of contaminants that can be effectively treated. These technologies also support water reuse and closed-loop systems, making them ideal for schools, small communities, and businesses. By lowering initial costs and accelerating implementation timelines, these innovations make decentralized water systems an attractive option for private investors. Council Fire works with organizations to integrate these technologies, ensuring projects deliver both financial returns and positive environmental impacts.

Related Blog Posts

FAQ

What does it really mean to “redefine profit”?

What makes Council Fire different?

Who does Council Fire you work with?

What does working with Council Fire actually look like?

How does Council Fire help organizations turn big goals into action?

How does Council Fire define and measure success?