Dec 29, 2025

Dec 29, 2025

How to Integrate Climate Risk into Infrastructure Planning for Corporations

Sustainability Strategy

Sustainability Strategy

In This Article

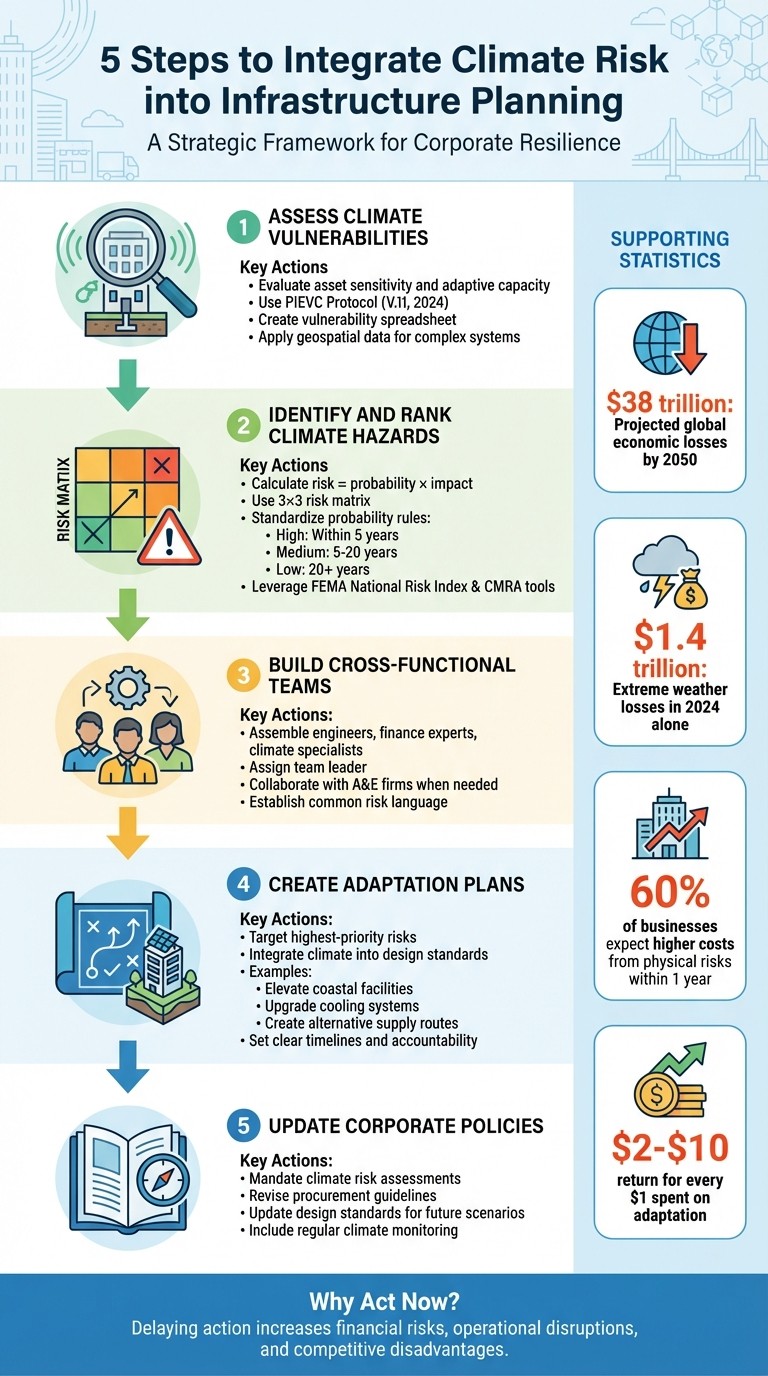

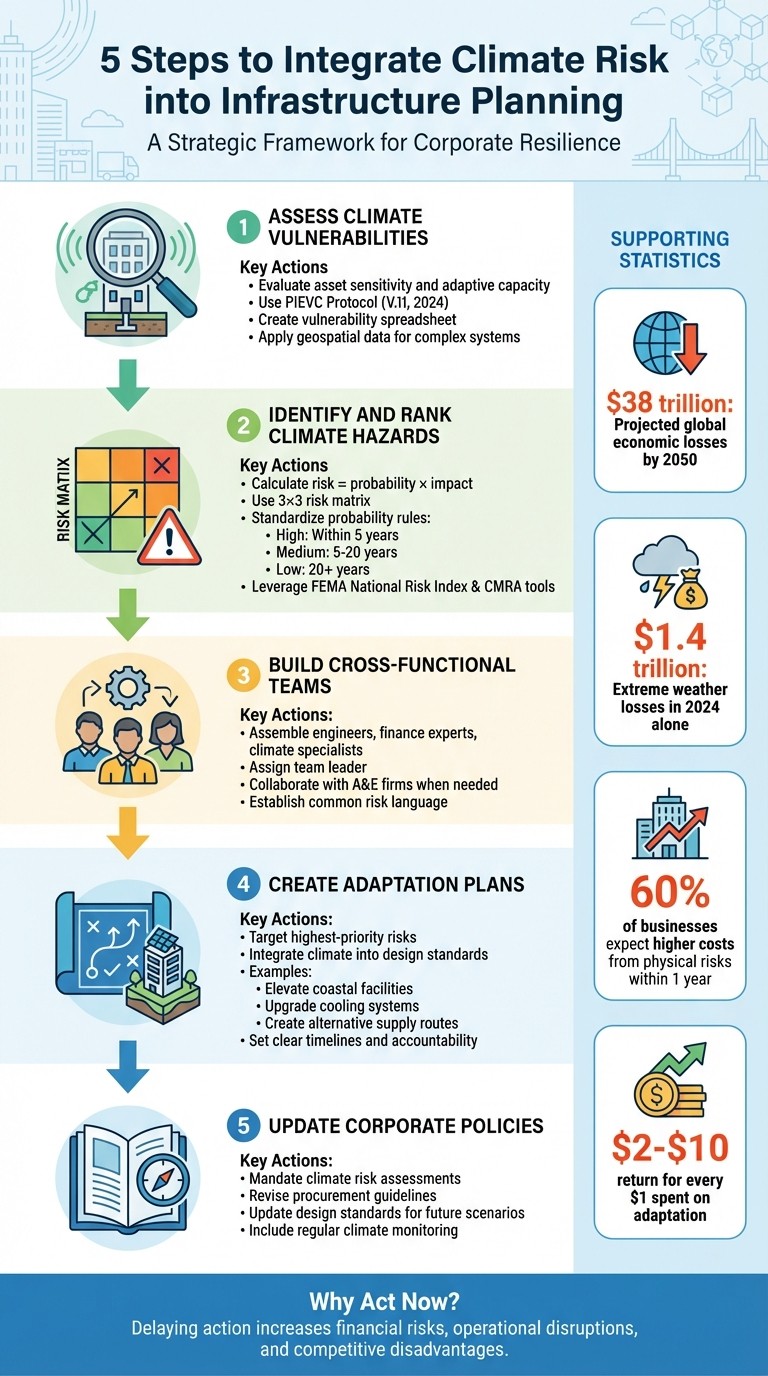

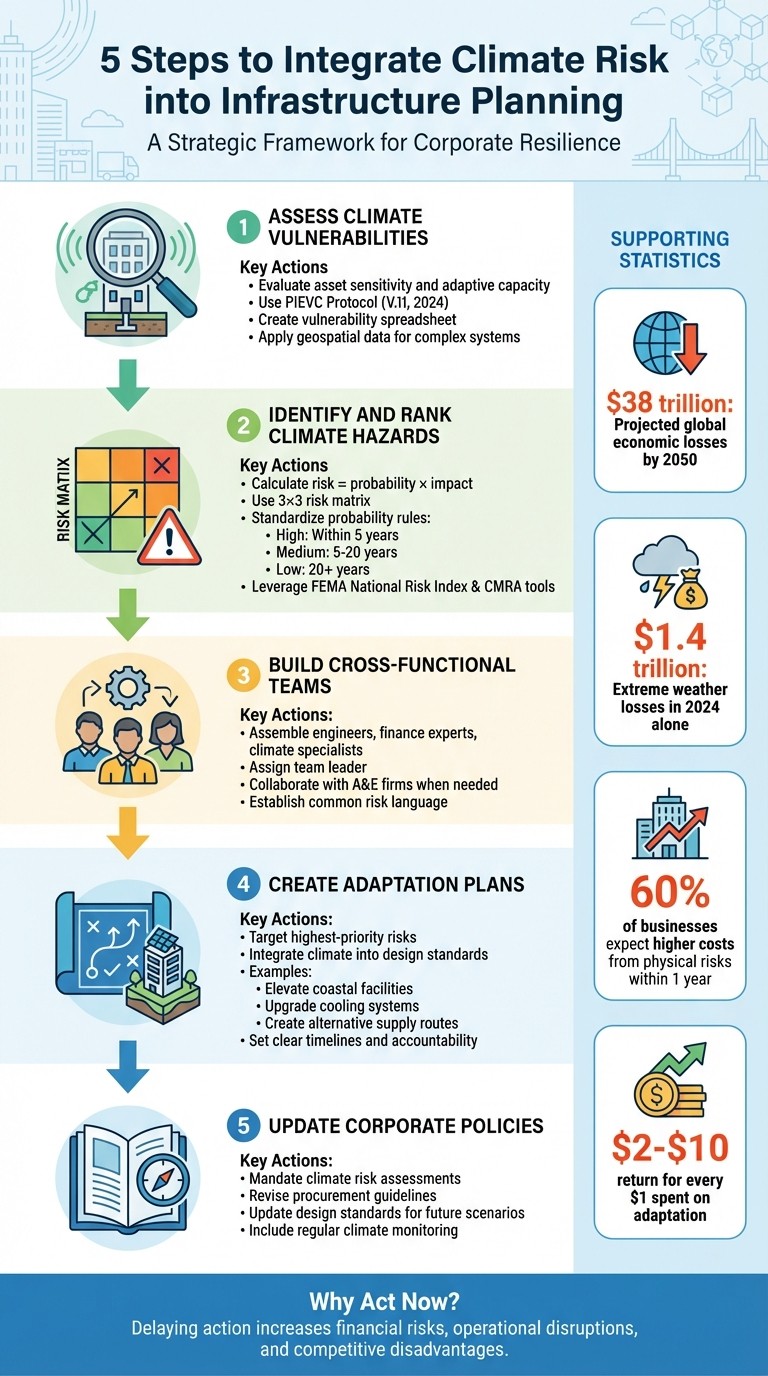

Practical five-step guide to assess vulnerabilities, rank hazards, build cross-functional teams, and embed climate resilience into corporate infrastructure and supply chains.

How to Integrate Climate Risk into Infrastructure Planning for Corporations

Climate risks are no longer hypothetical - they're reshaping infrastructure planning for corporations. With extreme weather events causing billions in damages annually and global economic losses projected to reach $38 trillion by 2050, businesses face mounting pressure to adapt. Ignoring these risks leads to asset devaluation, supply chain disruptions, and rising costs, while proactive measures can safeguard operations and financial stability.

Key Takeaways:

Types of Climate Risks:

Physical: Includes acute events (floods, hurricanes) and chronic changes (rising sea levels, temperature shifts).

Transitional: Regulatory changes, carbon pricing, and market shifts toward low-carbon models.

Systemic: Chain reactions from disruptions, like supply chain breakdowns or power grid failures.

Five-Step Integration Process:

Assess vulnerabilities using tools like PIEVC Protocol and geospatial data.

Identify and rank hazards via risk matrices and standardized probability rules.

Form cross-functional teams with engineers, finance, and climate experts.

Develop targeted adaptation plans for high-priority risks.

Update corporate policies to embed climate considerations into investments and operations.

Tools and Methods:

GIS mapping for risk visualization.

Climate scenario planning to project future conditions.

PIEVC Protocol for structured vulnerability assessments.

Corporate Examples:

Coastal protection using natural barriers.

Urban heat management with green roofs and advanced cooling systems.

Strengthened supply chains through risk mapping and updated infrastructure.

Why Act Now?

Delaying action increases financial risks, operational disruptions, and competitive disadvantages. Immediate steps - like prioritizing vulnerable assets, leveraging data-driven tools, and assembling expert teams - help businesses build resilience and ensure long-term success.

5-Step Process for Integrating Climate Risk into Corporate Infrastructure Planning

Modeling climate risks to infrastructure and supply chains

What Climate Risk Means for Corporations

For corporations, climate risk refers to the potential hazards and their effects on operations, assets, and financial stability. This framing allows businesses to move beyond abstract concerns and take actionable steps. Addressing these risks requires tailored strategies for each category.

Physical risks directly affect corporate infrastructure through extreme weather events and environmental changes. These risks fall into two categories: acute and chronic. Acute physical risks include sudden, destructive events like hurricanes, floods, and wildfires. In contrast, chronic physical risks develop gradually, such as rising sea levels, sustained temperature increases, or shifting precipitation patterns. These long-term changes can threaten coastal facilities, overburden cooling systems, or disrupt water-reliant operations. In 2024 alone, extreme weather caused an estimated $1.4 trillion in global economic losses[4].

Transitional risks emerge as economies shift toward low-carbon models. New carbon pricing mechanisms, stricter environmental regulations, and updated building codes can render existing infrastructure outdated. Advancements in technology add to the pressure, as fossil fuel-dependent systems may become obsolete in favor of cleaner alternatives. Market forces also contribute - companies that fail to align with the growing demand for low-carbon products risk losing their competitive edge.

Rob Bradley, Managing Director of Climate Change and Sustainability Services at Ernst & Young LLP, emphasizes: "The significance of understanding these risks and opportunities is no less crucial than addressing personal safety risks at work, process safety risks in complex manufacturing facilities, cybersecurity risks in technology, or liquidity risks in investment and financial transactions."[2]

Systemic risks compound the effects of physical and transitional risks through interconnected networks. These risks arise when disruptions in one area trigger a chain reaction across broader systems. For instance, a flood at a single supplier’s facility can halt production lines thousands of miles away. Similarly, regional power grid failures caused by extreme heat can simultaneously disrupt multiple facilities. Such cascading failures highlight the need for geographic diversification and robust supply chain planning. Currently, 60% of businesses expect higher costs from physical risks, including extreme weather and supply chain interruptions, within the next year[3].

Recognizing these risks is a critical first step in developing effective strategies to mitigate their impact, as explored in the following sections.

How to Integrate Climate Risk into Infrastructure Planning

Incorporating climate risk into infrastructure decisions is a critical step toward building resilience and ensuring long-term sustainability. A structured five-step approach can help embed climate considerations at every stage, from assessing vulnerabilities to updating corporate policies. Here's how to make climate risk a core part of infrastructure planning.

Step 1: Assess Climate Vulnerabilities

The first step involves evaluating how vulnerable your assets are to climate impacts. Vulnerability depends on two key factors: sensitivity (how likely an asset is to sustain damage) and adaptive capacity (its ability to adjust or recover) [1]. A simple vulnerability spreadsheet can help map out each asset's potential impact, sensitivity, and adaptive capacity. This tool makes it easier to identify high-priority asset–hazard pairs that require immediate focus.

For a more standardized approach, consider using the Public Infrastructure Engineering Vulnerability Committee (PIEVC) Protocol, with its latest version (V.11) released in June 2024 [5]. While qualitative ratings (high, medium, or low) can quickly flag less vulnerable assets, more complex systems or larger portfolios may benefit from quantitative analyses using geospatial data. This helps reduce uncertainty and ensures resources are directed where they’re needed most [1].

Step 2: Identify and Rank Climate Hazards

Once vulnerabilities are clear, the next step is identifying the specific climate hazards your infrastructure faces. Risk is calculated as the product of a hazard's probability and the magnitude of its impact [1]. To maintain consistency, create standardized probability rules. For example, categorize hazards expected within 5 years as "high probability", those likely every 5 to 20 years as "medium", and events occurring less frequently than once in 20 years as "low."

A 3×3 risk matrix can be a helpful visual tool, plotting probability on one axis and impact magnitude on the other. This allows teams to quickly pinpoint "High–High" or "High–Medium" risks that demand urgent action. Federal resources like FEMA's National Risk Index and the Climate Mapping for Resilience and Adaptation (CMRA) tool provide valuable data on various natural hazards [1][6]. Additionally, prioritize systemic assets - such as critical bridges, telecommunications hubs, or logistics centers - because their failure could lead to cascading disruptions.

Step 3: Build Cross-Functional Teams

Addressing climate risk requires input from a variety of experts. Assemble a team that includes engineers, finance professionals, and climate specialists. Engineers bring technical insights, finance experts assess cost implications, and climate professionals contribute expertise on environmental risks. Assign a leader to guide the team, ensuring efforts stay focused on the most vulnerable assets.

For more complex analyses, consider collaborating with external experts, such as Architecture and Engineering (A&E) firms or climate adaptation specialists. Pairing internal staff with outside expertise strengthens the process, especially when advanced climate modeling is required. To keep everyone aligned, establish a common risk language with simple, standardized rule sets [1][7].

Step 4: Create Adaptation Plans

With your team in place, the next step is to develop adaptation strategies tailored to the highest-priority risks. After ranking risks and identifying key assets, integrate climate considerations into design standards. This ensures new infrastructure is built to withstand future conditions rather than relying solely on historical data.

Practical interventions could include elevating coastal facilities to address sea level rise, upgrading cooling systems to handle extreme heat, or creating alternative supply routes to reduce dependency on a single corridor. Use a combination of geospatial data and community or operational needs to guide these decisions. Document the strategies with clear timelines and accountability to ensure follow-through [1][7].

Step 5: Update Corporate Policies

Finally, embed climate resilience into your organization by updating corporate policies. Make climate risk assessments a standard part of infrastructure investments. This could involve revising procurement guidelines to mandate climate risk reviews for projects exceeding a certain budget, updating design standards to reflect future climate scenarios, or adjusting operating procedures to include regular climate monitoring and timely adaptation measures.

Tools and Methods for Climate Risk Assessment

Incorporating climate risk into strategic planning requires not only a clear process but also the right tools and methods to refine and implement these strategies effectively. By utilizing structured frameworks and advanced technologies, corporations can better identify vulnerabilities, anticipate hazards, and prepare for future scenarios. Here, we explore three key approaches that bring focus and precision to climate risk planning.

PIEVC Protocol for Infrastructure Assessments

The PIEVC Protocol (Public Infrastructure Engineering Vulnerability Committee) provides a systematic approach to evaluating the vulnerability of infrastructure to climate-related threats. This method helps teams assess asset–hazard combinations by considering two critical factors: sensitivity (how easily an asset could sustain damage) and adaptive capacity (how effectively it can recover or adjust) [1].

This framework is particularly beneficial for organizations managing a range of infrastructure assets. It ensures consistency and reliability in identifying vulnerabilities. Starting with a basic spreadsheet to rate assets against potential hazards can establish a foundation for understanding risks. For more intricate systems, the protocol incorporates quantitative analysis using geospatial data, which helps reduce uncertainty and supports decisions for large-scale investments [1].

Spatial analysis complements this method by identifying areas where risks overlap, offering deeper insights into potential vulnerabilities.

GIS Mapping and Data Analysis

Geographic Information Systems (GIS) serve as a powerful tool for mapping and analyzing the relationship between assets and climate-related hazards. By overlaying asset locations with data such as flood zones, wildfire-prone areas, sea level rise projections, and heat maps, corporations can quickly identify facilities at the highest risk [8]. GIS goes beyond simple visualization by enabling techniques like proximity analysis, overlay analysis, and density mapping to detect "hotspots" where multiple risks intersect [9].

For instance, a company might use GIS to combine elevation data, historical flood records, and future sea level rise projections to identify coastal sites at risk. These tools also allow for scenario testing, so decision-makers can evaluate different mitigation strategies before committing resources [9]. Accessible government tools, such as the NOAA Sea Level Rise Viewer, FEMA Flood Mapping Products, and the National Risk Index, provide excellent starting points for initial assessments [1][8].

Climate Scenario Planning

While GIS and the PIEVC Protocol focus on current vulnerabilities, climate scenario planning looks ahead. This approach uses climate models and risk scenarios to project future conditions, categorized by likelihood: Routine (occurring every 5 years), Design (every 50 years), and Extreme (every 200+ years) [8]. These scenarios help organizations define performance goals and allocate resources effectively.

The NIST Community Resilience Planning Guide introduces a performance-based framework to evaluate how infrastructure operates under stress. It defines recovery benchmarks at 30%, 60%, and 90% operational capacity [8]. For example:

30% capacity: The minimum level needed to initiate response and recovery efforts.

60% capacity: Sufficient for scaled-down daily operations.

90% capacity: Full restoration to normal operations.

Corporate Examples of Climate Risk Integration

Corporations are taking proactive steps to address climate risks, using innovative strategies to protect their assets and maintain operational resilience. These examples highlight how businesses are adapting to environmental challenges through targeted measures.

Coastal Protection Through Nature-Based Solutions

Companies with operations in coastal areas are turning to nature-based solutions to shield their facilities. For instance, coral reefs are being utilized as natural barriers to reduce wave impact [11]. Some firms have adopted a "Reef2Resilience" trust fund model, where local businesses contribute to a shared fund aimed at restoring coastal ecosystems and securing catastrophe insurance for faster disaster recovery [11]. Additionally, many organizations are forming internal climate science teams to incorporate cutting-edge meteorological data into their risk assessments and infrastructure planning [10]. These steps not only bolster coastal defenses but also pave the way for similar strategies in urban and supply chain settings.

Urban Heat Management Strategies

In cities, where extreme heat poses a different set of challenges, corporations are redesigning facilities to address the risks. With potential annual fixed asset losses from heat risks estimated at $560–610 billion by 2035 [12], businesses are investing in solutions like reflective materials, green roofs, rain gardens, and upgraded HVAC systems [2][13]. These measures not only reduce heat impacts but also deliver economic benefits, with every $1 spent on adaptation yielding returns between $2 and $10 [14]. Companies are also implementing heat stress management programs and adjusting work schedules to protect employee productivity during peak heat hours [2][12].

Supply Chain Resilience Frameworks

Climate risk integration isn't limited to physical infrastructure - it also extends to supply chain operations. Many corporations are using the "Steps to Resilience" framework, which helps them identify vulnerabilities, assess risks, explore options, and implement action plans [6]. To strengthen supply chain resilience, companies are modernizing key infrastructure, such as border entry points, and incorporating Life Cycle Assessments into procurement processes [15]. Tools like the Climate Explorer and Sea Level Rise Viewer are also being deployed to map geographical hazards along supply routes [6][15]. By embedding climate risk considerations into capital maintenance and investment decisions, businesses are ensuring their supply chains remain robust and adaptive to future challenges.

These examples demonstrate how strategic measures not only safeguard assets but also enhance corporate resilience in the face of evolving climate risks.

Conclusion

Climate risks have transitioned from abstract concerns to pressing challenges that are reshaping corporate approaches to infrastructure planning. The reliability of past weather patterns as predictive tools has diminished, given the increasing frequency and intensity of hazards [1]. Delaying proactive measures comes with the risk of steep financial losses and significant operational disruptions.

As discussed earlier, systematic screening and the use of risk matrices are essential for prioritizing assets [1]. These methods ensure resources are concentrated on critical infrastructure, where failures could lead to widespread disruptions across operations and supply chains.

Integrating climate risk strategies not only safeguards assets but also strengthens financial stability. Beyond mitigating disaster-related costs, these assessments extend asset lifespans, lower insurance premiums, and can even improve access to favorable financing terms. Transitioning from qualitative evaluations to data-driven, quantitative geospatial analyses minimizes uncertainty and supports more precise capital allocation [1].

Effective climate planning requires flexibility and continuous reassessment. The "Steps to Resilience" framework offers a structured approach for evaluating exposure, exploring adaptive strategies, and refining plans as conditions shift [1]. Incorporating safety margins - such as exceeding current flood elevation standards by four feet or ensuring infrastructure can operate independently for 72 hours - helps prepare for future uncertainties [16].

The measures outlined throughout this discussion provide a strong foundation for building resilient infrastructure. The urgency to act cannot be overstated. Postponing the integration of climate risk strategies leads to higher costs, greater disruptions, and a diminished competitive position. Taking immediate steps - focusing on vulnerable assets, assembling multidisciplinary teams, and leveraging advanced quantitative tools - ensures operational security for the long term.

FAQs

What steps should corporations take to integrate climate risks into infrastructure planning?

To address climate risks in infrastructure planning, begin by identifying your assets and evaluating their vulnerability to threats like extreme heat, flooding, or rising sea levels. Focus on the assets most at risk, considering both their sensitivity to climate hazards and their capacity to adjust to these challenges.

Leverage climate assessment tools to analyze current risks and anticipate future conditions. Factor in projections that highlight potential changes over time, such as more frequent storms or temperature fluctuations. Choose climate scenarios that align with your organization's objectives, and ensure your evaluation includes other stressors like population growth or increasing resource demands.

Put your analysis into action by integrating the findings into your decision-making process. Test strategies using scenario analysis, adopt design standards that prioritize resilience, and establish a system for continuous monitoring and updates. This approach ensures your infrastructure remains flexible and prepared to adapt as new climate data becomes available.

What are the differences between physical, transition, and systemic climate risks?

Physical climate risks refer to the immediate and tangible effects of climate change on a company’s assets, operations, and supply chains. These risks manifest through events like hurricanes, floods, and wildfires, as well as more gradual changes such as rising sea levels and altered rainfall patterns. Such factors can lead to infrastructure damage, operational disruptions, and increased expenses.

Transition climate risks emerge as the world moves toward a low-carbon economy. This shift involves changes in policies, such as the introduction of carbon taxes, evolving market demands like declining reliance on fossil fuels, and advancements in renewable energy technologies. These changes can impact revenue streams, raise compliance expenses, or reduce the value of certain assets.

Systemic climate risks encompass widespread economic and financial disruptions triggered by climate-related events. These risks can ripple across industries and markets, posing threats to economic stability. For instance, extensive physical damage or abrupt policy shifts can strain credit systems and public finances, creating far-reaching consequences.

By understanding these categories of climate risks, businesses can pinpoint vulnerabilities and design infrastructure strategies that withstand both immediate threats and long-term challenges.

Why should corporations prioritize climate risk in their infrastructure planning now?

The effects of climate change are already taking a toll on infrastructure across the U.S., with rising temperatures, intense storms, floods, and wildfires inflicting costly damage and disruptions. These events place immense pressure on essential systems like the power grid, transportation networks, and water supplies, which in turn disrupt business operations. On top of that, regulatory demands to meet net-zero targets are intensifying. Companies that fail to adapt risk falling behind on compliance, losing access to key markets, and facing steeper financing costs.

Acting now isn’t just about staying prepared - it’s also a smart financial decision. Research indicates that incorporating climate resilience into infrastructure adds only around 3% to initial costs but offers substantial long-term benefits. Waiting to act increases vulnerability to physical damage, supply chain interruptions, and financial instability. On the other hand, proactive measures not only reduce these risks but also enhance competitiveness and secure a more stable future.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 29, 2025

How to Integrate Climate Risk into Infrastructure Planning for Corporations

Sustainability Strategy

In This Article

Practical five-step guide to assess vulnerabilities, rank hazards, build cross-functional teams, and embed climate resilience into corporate infrastructure and supply chains.

How to Integrate Climate Risk into Infrastructure Planning for Corporations

Climate risks are no longer hypothetical - they're reshaping infrastructure planning for corporations. With extreme weather events causing billions in damages annually and global economic losses projected to reach $38 trillion by 2050, businesses face mounting pressure to adapt. Ignoring these risks leads to asset devaluation, supply chain disruptions, and rising costs, while proactive measures can safeguard operations and financial stability.

Key Takeaways:

Types of Climate Risks:

Physical: Includes acute events (floods, hurricanes) and chronic changes (rising sea levels, temperature shifts).

Transitional: Regulatory changes, carbon pricing, and market shifts toward low-carbon models.

Systemic: Chain reactions from disruptions, like supply chain breakdowns or power grid failures.

Five-Step Integration Process:

Assess vulnerabilities using tools like PIEVC Protocol and geospatial data.

Identify and rank hazards via risk matrices and standardized probability rules.

Form cross-functional teams with engineers, finance, and climate experts.

Develop targeted adaptation plans for high-priority risks.

Update corporate policies to embed climate considerations into investments and operations.

Tools and Methods:

GIS mapping for risk visualization.

Climate scenario planning to project future conditions.

PIEVC Protocol for structured vulnerability assessments.

Corporate Examples:

Coastal protection using natural barriers.

Urban heat management with green roofs and advanced cooling systems.

Strengthened supply chains through risk mapping and updated infrastructure.

Why Act Now?

Delaying action increases financial risks, operational disruptions, and competitive disadvantages. Immediate steps - like prioritizing vulnerable assets, leveraging data-driven tools, and assembling expert teams - help businesses build resilience and ensure long-term success.

5-Step Process for Integrating Climate Risk into Corporate Infrastructure Planning

Modeling climate risks to infrastructure and supply chains

What Climate Risk Means for Corporations

For corporations, climate risk refers to the potential hazards and their effects on operations, assets, and financial stability. This framing allows businesses to move beyond abstract concerns and take actionable steps. Addressing these risks requires tailored strategies for each category.

Physical risks directly affect corporate infrastructure through extreme weather events and environmental changes. These risks fall into two categories: acute and chronic. Acute physical risks include sudden, destructive events like hurricanes, floods, and wildfires. In contrast, chronic physical risks develop gradually, such as rising sea levels, sustained temperature increases, or shifting precipitation patterns. These long-term changes can threaten coastal facilities, overburden cooling systems, or disrupt water-reliant operations. In 2024 alone, extreme weather caused an estimated $1.4 trillion in global economic losses[4].

Transitional risks emerge as economies shift toward low-carbon models. New carbon pricing mechanisms, stricter environmental regulations, and updated building codes can render existing infrastructure outdated. Advancements in technology add to the pressure, as fossil fuel-dependent systems may become obsolete in favor of cleaner alternatives. Market forces also contribute - companies that fail to align with the growing demand for low-carbon products risk losing their competitive edge.

Rob Bradley, Managing Director of Climate Change and Sustainability Services at Ernst & Young LLP, emphasizes: "The significance of understanding these risks and opportunities is no less crucial than addressing personal safety risks at work, process safety risks in complex manufacturing facilities, cybersecurity risks in technology, or liquidity risks in investment and financial transactions."[2]

Systemic risks compound the effects of physical and transitional risks through interconnected networks. These risks arise when disruptions in one area trigger a chain reaction across broader systems. For instance, a flood at a single supplier’s facility can halt production lines thousands of miles away. Similarly, regional power grid failures caused by extreme heat can simultaneously disrupt multiple facilities. Such cascading failures highlight the need for geographic diversification and robust supply chain planning. Currently, 60% of businesses expect higher costs from physical risks, including extreme weather and supply chain interruptions, within the next year[3].

Recognizing these risks is a critical first step in developing effective strategies to mitigate their impact, as explored in the following sections.

How to Integrate Climate Risk into Infrastructure Planning

Incorporating climate risk into infrastructure decisions is a critical step toward building resilience and ensuring long-term sustainability. A structured five-step approach can help embed climate considerations at every stage, from assessing vulnerabilities to updating corporate policies. Here's how to make climate risk a core part of infrastructure planning.

Step 1: Assess Climate Vulnerabilities

The first step involves evaluating how vulnerable your assets are to climate impacts. Vulnerability depends on two key factors: sensitivity (how likely an asset is to sustain damage) and adaptive capacity (its ability to adjust or recover) [1]. A simple vulnerability spreadsheet can help map out each asset's potential impact, sensitivity, and adaptive capacity. This tool makes it easier to identify high-priority asset–hazard pairs that require immediate focus.

For a more standardized approach, consider using the Public Infrastructure Engineering Vulnerability Committee (PIEVC) Protocol, with its latest version (V.11) released in June 2024 [5]. While qualitative ratings (high, medium, or low) can quickly flag less vulnerable assets, more complex systems or larger portfolios may benefit from quantitative analyses using geospatial data. This helps reduce uncertainty and ensures resources are directed where they’re needed most [1].

Step 2: Identify and Rank Climate Hazards

Once vulnerabilities are clear, the next step is identifying the specific climate hazards your infrastructure faces. Risk is calculated as the product of a hazard's probability and the magnitude of its impact [1]. To maintain consistency, create standardized probability rules. For example, categorize hazards expected within 5 years as "high probability", those likely every 5 to 20 years as "medium", and events occurring less frequently than once in 20 years as "low."

A 3×3 risk matrix can be a helpful visual tool, plotting probability on one axis and impact magnitude on the other. This allows teams to quickly pinpoint "High–High" or "High–Medium" risks that demand urgent action. Federal resources like FEMA's National Risk Index and the Climate Mapping for Resilience and Adaptation (CMRA) tool provide valuable data on various natural hazards [1][6]. Additionally, prioritize systemic assets - such as critical bridges, telecommunications hubs, or logistics centers - because their failure could lead to cascading disruptions.

Step 3: Build Cross-Functional Teams

Addressing climate risk requires input from a variety of experts. Assemble a team that includes engineers, finance professionals, and climate specialists. Engineers bring technical insights, finance experts assess cost implications, and climate professionals contribute expertise on environmental risks. Assign a leader to guide the team, ensuring efforts stay focused on the most vulnerable assets.

For more complex analyses, consider collaborating with external experts, such as Architecture and Engineering (A&E) firms or climate adaptation specialists. Pairing internal staff with outside expertise strengthens the process, especially when advanced climate modeling is required. To keep everyone aligned, establish a common risk language with simple, standardized rule sets [1][7].

Step 4: Create Adaptation Plans

With your team in place, the next step is to develop adaptation strategies tailored to the highest-priority risks. After ranking risks and identifying key assets, integrate climate considerations into design standards. This ensures new infrastructure is built to withstand future conditions rather than relying solely on historical data.

Practical interventions could include elevating coastal facilities to address sea level rise, upgrading cooling systems to handle extreme heat, or creating alternative supply routes to reduce dependency on a single corridor. Use a combination of geospatial data and community or operational needs to guide these decisions. Document the strategies with clear timelines and accountability to ensure follow-through [1][7].

Step 5: Update Corporate Policies

Finally, embed climate resilience into your organization by updating corporate policies. Make climate risk assessments a standard part of infrastructure investments. This could involve revising procurement guidelines to mandate climate risk reviews for projects exceeding a certain budget, updating design standards to reflect future climate scenarios, or adjusting operating procedures to include regular climate monitoring and timely adaptation measures.

Tools and Methods for Climate Risk Assessment

Incorporating climate risk into strategic planning requires not only a clear process but also the right tools and methods to refine and implement these strategies effectively. By utilizing structured frameworks and advanced technologies, corporations can better identify vulnerabilities, anticipate hazards, and prepare for future scenarios. Here, we explore three key approaches that bring focus and precision to climate risk planning.

PIEVC Protocol for Infrastructure Assessments

The PIEVC Protocol (Public Infrastructure Engineering Vulnerability Committee) provides a systematic approach to evaluating the vulnerability of infrastructure to climate-related threats. This method helps teams assess asset–hazard combinations by considering two critical factors: sensitivity (how easily an asset could sustain damage) and adaptive capacity (how effectively it can recover or adjust) [1].

This framework is particularly beneficial for organizations managing a range of infrastructure assets. It ensures consistency and reliability in identifying vulnerabilities. Starting with a basic spreadsheet to rate assets against potential hazards can establish a foundation for understanding risks. For more intricate systems, the protocol incorporates quantitative analysis using geospatial data, which helps reduce uncertainty and supports decisions for large-scale investments [1].

Spatial analysis complements this method by identifying areas where risks overlap, offering deeper insights into potential vulnerabilities.

GIS Mapping and Data Analysis

Geographic Information Systems (GIS) serve as a powerful tool for mapping and analyzing the relationship between assets and climate-related hazards. By overlaying asset locations with data such as flood zones, wildfire-prone areas, sea level rise projections, and heat maps, corporations can quickly identify facilities at the highest risk [8]. GIS goes beyond simple visualization by enabling techniques like proximity analysis, overlay analysis, and density mapping to detect "hotspots" where multiple risks intersect [9].

For instance, a company might use GIS to combine elevation data, historical flood records, and future sea level rise projections to identify coastal sites at risk. These tools also allow for scenario testing, so decision-makers can evaluate different mitigation strategies before committing resources [9]. Accessible government tools, such as the NOAA Sea Level Rise Viewer, FEMA Flood Mapping Products, and the National Risk Index, provide excellent starting points for initial assessments [1][8].

Climate Scenario Planning

While GIS and the PIEVC Protocol focus on current vulnerabilities, climate scenario planning looks ahead. This approach uses climate models and risk scenarios to project future conditions, categorized by likelihood: Routine (occurring every 5 years), Design (every 50 years), and Extreme (every 200+ years) [8]. These scenarios help organizations define performance goals and allocate resources effectively.

The NIST Community Resilience Planning Guide introduces a performance-based framework to evaluate how infrastructure operates under stress. It defines recovery benchmarks at 30%, 60%, and 90% operational capacity [8]. For example:

30% capacity: The minimum level needed to initiate response and recovery efforts.

60% capacity: Sufficient for scaled-down daily operations.

90% capacity: Full restoration to normal operations.

Corporate Examples of Climate Risk Integration

Corporations are taking proactive steps to address climate risks, using innovative strategies to protect their assets and maintain operational resilience. These examples highlight how businesses are adapting to environmental challenges through targeted measures.

Coastal Protection Through Nature-Based Solutions

Companies with operations in coastal areas are turning to nature-based solutions to shield their facilities. For instance, coral reefs are being utilized as natural barriers to reduce wave impact [11]. Some firms have adopted a "Reef2Resilience" trust fund model, where local businesses contribute to a shared fund aimed at restoring coastal ecosystems and securing catastrophe insurance for faster disaster recovery [11]. Additionally, many organizations are forming internal climate science teams to incorporate cutting-edge meteorological data into their risk assessments and infrastructure planning [10]. These steps not only bolster coastal defenses but also pave the way for similar strategies in urban and supply chain settings.

Urban Heat Management Strategies

In cities, where extreme heat poses a different set of challenges, corporations are redesigning facilities to address the risks. With potential annual fixed asset losses from heat risks estimated at $560–610 billion by 2035 [12], businesses are investing in solutions like reflective materials, green roofs, rain gardens, and upgraded HVAC systems [2][13]. These measures not only reduce heat impacts but also deliver economic benefits, with every $1 spent on adaptation yielding returns between $2 and $10 [14]. Companies are also implementing heat stress management programs and adjusting work schedules to protect employee productivity during peak heat hours [2][12].

Supply Chain Resilience Frameworks

Climate risk integration isn't limited to physical infrastructure - it also extends to supply chain operations. Many corporations are using the "Steps to Resilience" framework, which helps them identify vulnerabilities, assess risks, explore options, and implement action plans [6]. To strengthen supply chain resilience, companies are modernizing key infrastructure, such as border entry points, and incorporating Life Cycle Assessments into procurement processes [15]. Tools like the Climate Explorer and Sea Level Rise Viewer are also being deployed to map geographical hazards along supply routes [6][15]. By embedding climate risk considerations into capital maintenance and investment decisions, businesses are ensuring their supply chains remain robust and adaptive to future challenges.

These examples demonstrate how strategic measures not only safeguard assets but also enhance corporate resilience in the face of evolving climate risks.

Conclusion

Climate risks have transitioned from abstract concerns to pressing challenges that are reshaping corporate approaches to infrastructure planning. The reliability of past weather patterns as predictive tools has diminished, given the increasing frequency and intensity of hazards [1]. Delaying proactive measures comes with the risk of steep financial losses and significant operational disruptions.

As discussed earlier, systematic screening and the use of risk matrices are essential for prioritizing assets [1]. These methods ensure resources are concentrated on critical infrastructure, where failures could lead to widespread disruptions across operations and supply chains.

Integrating climate risk strategies not only safeguards assets but also strengthens financial stability. Beyond mitigating disaster-related costs, these assessments extend asset lifespans, lower insurance premiums, and can even improve access to favorable financing terms. Transitioning from qualitative evaluations to data-driven, quantitative geospatial analyses minimizes uncertainty and supports more precise capital allocation [1].

Effective climate planning requires flexibility and continuous reassessment. The "Steps to Resilience" framework offers a structured approach for evaluating exposure, exploring adaptive strategies, and refining plans as conditions shift [1]. Incorporating safety margins - such as exceeding current flood elevation standards by four feet or ensuring infrastructure can operate independently for 72 hours - helps prepare for future uncertainties [16].

The measures outlined throughout this discussion provide a strong foundation for building resilient infrastructure. The urgency to act cannot be overstated. Postponing the integration of climate risk strategies leads to higher costs, greater disruptions, and a diminished competitive position. Taking immediate steps - focusing on vulnerable assets, assembling multidisciplinary teams, and leveraging advanced quantitative tools - ensures operational security for the long term.

FAQs

What steps should corporations take to integrate climate risks into infrastructure planning?

To address climate risks in infrastructure planning, begin by identifying your assets and evaluating their vulnerability to threats like extreme heat, flooding, or rising sea levels. Focus on the assets most at risk, considering both their sensitivity to climate hazards and their capacity to adjust to these challenges.

Leverage climate assessment tools to analyze current risks and anticipate future conditions. Factor in projections that highlight potential changes over time, such as more frequent storms or temperature fluctuations. Choose climate scenarios that align with your organization's objectives, and ensure your evaluation includes other stressors like population growth or increasing resource demands.

Put your analysis into action by integrating the findings into your decision-making process. Test strategies using scenario analysis, adopt design standards that prioritize resilience, and establish a system for continuous monitoring and updates. This approach ensures your infrastructure remains flexible and prepared to adapt as new climate data becomes available.

What are the differences between physical, transition, and systemic climate risks?

Physical climate risks refer to the immediate and tangible effects of climate change on a company’s assets, operations, and supply chains. These risks manifest through events like hurricanes, floods, and wildfires, as well as more gradual changes such as rising sea levels and altered rainfall patterns. Such factors can lead to infrastructure damage, operational disruptions, and increased expenses.

Transition climate risks emerge as the world moves toward a low-carbon economy. This shift involves changes in policies, such as the introduction of carbon taxes, evolving market demands like declining reliance on fossil fuels, and advancements in renewable energy technologies. These changes can impact revenue streams, raise compliance expenses, or reduce the value of certain assets.

Systemic climate risks encompass widespread economic and financial disruptions triggered by climate-related events. These risks can ripple across industries and markets, posing threats to economic stability. For instance, extensive physical damage or abrupt policy shifts can strain credit systems and public finances, creating far-reaching consequences.

By understanding these categories of climate risks, businesses can pinpoint vulnerabilities and design infrastructure strategies that withstand both immediate threats and long-term challenges.

Why should corporations prioritize climate risk in their infrastructure planning now?

The effects of climate change are already taking a toll on infrastructure across the U.S., with rising temperatures, intense storms, floods, and wildfires inflicting costly damage and disruptions. These events place immense pressure on essential systems like the power grid, transportation networks, and water supplies, which in turn disrupt business operations. On top of that, regulatory demands to meet net-zero targets are intensifying. Companies that fail to adapt risk falling behind on compliance, losing access to key markets, and facing steeper financing costs.

Acting now isn’t just about staying prepared - it’s also a smart financial decision. Research indicates that incorporating climate resilience into infrastructure adds only around 3% to initial costs but offers substantial long-term benefits. Waiting to act increases vulnerability to physical damage, supply chain interruptions, and financial instability. On the other hand, proactive measures not only reduce these risks but also enhance competitiveness and secure a more stable future.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 29, 2025

How to Integrate Climate Risk into Infrastructure Planning for Corporations

Sustainability Strategy

In This Article

Practical five-step guide to assess vulnerabilities, rank hazards, build cross-functional teams, and embed climate resilience into corporate infrastructure and supply chains.

How to Integrate Climate Risk into Infrastructure Planning for Corporations

Climate risks are no longer hypothetical - they're reshaping infrastructure planning for corporations. With extreme weather events causing billions in damages annually and global economic losses projected to reach $38 trillion by 2050, businesses face mounting pressure to adapt. Ignoring these risks leads to asset devaluation, supply chain disruptions, and rising costs, while proactive measures can safeguard operations and financial stability.

Key Takeaways:

Types of Climate Risks:

Physical: Includes acute events (floods, hurricanes) and chronic changes (rising sea levels, temperature shifts).

Transitional: Regulatory changes, carbon pricing, and market shifts toward low-carbon models.

Systemic: Chain reactions from disruptions, like supply chain breakdowns or power grid failures.

Five-Step Integration Process:

Assess vulnerabilities using tools like PIEVC Protocol and geospatial data.

Identify and rank hazards via risk matrices and standardized probability rules.

Form cross-functional teams with engineers, finance, and climate experts.

Develop targeted adaptation plans for high-priority risks.

Update corporate policies to embed climate considerations into investments and operations.

Tools and Methods:

GIS mapping for risk visualization.

Climate scenario planning to project future conditions.

PIEVC Protocol for structured vulnerability assessments.

Corporate Examples:

Coastal protection using natural barriers.

Urban heat management with green roofs and advanced cooling systems.

Strengthened supply chains through risk mapping and updated infrastructure.

Why Act Now?

Delaying action increases financial risks, operational disruptions, and competitive disadvantages. Immediate steps - like prioritizing vulnerable assets, leveraging data-driven tools, and assembling expert teams - help businesses build resilience and ensure long-term success.

5-Step Process for Integrating Climate Risk into Corporate Infrastructure Planning

Modeling climate risks to infrastructure and supply chains

What Climate Risk Means for Corporations

For corporations, climate risk refers to the potential hazards and their effects on operations, assets, and financial stability. This framing allows businesses to move beyond abstract concerns and take actionable steps. Addressing these risks requires tailored strategies for each category.

Physical risks directly affect corporate infrastructure through extreme weather events and environmental changes. These risks fall into two categories: acute and chronic. Acute physical risks include sudden, destructive events like hurricanes, floods, and wildfires. In contrast, chronic physical risks develop gradually, such as rising sea levels, sustained temperature increases, or shifting precipitation patterns. These long-term changes can threaten coastal facilities, overburden cooling systems, or disrupt water-reliant operations. In 2024 alone, extreme weather caused an estimated $1.4 trillion in global economic losses[4].

Transitional risks emerge as economies shift toward low-carbon models. New carbon pricing mechanisms, stricter environmental regulations, and updated building codes can render existing infrastructure outdated. Advancements in technology add to the pressure, as fossil fuel-dependent systems may become obsolete in favor of cleaner alternatives. Market forces also contribute - companies that fail to align with the growing demand for low-carbon products risk losing their competitive edge.

Rob Bradley, Managing Director of Climate Change and Sustainability Services at Ernst & Young LLP, emphasizes: "The significance of understanding these risks and opportunities is no less crucial than addressing personal safety risks at work, process safety risks in complex manufacturing facilities, cybersecurity risks in technology, or liquidity risks in investment and financial transactions."[2]

Systemic risks compound the effects of physical and transitional risks through interconnected networks. These risks arise when disruptions in one area trigger a chain reaction across broader systems. For instance, a flood at a single supplier’s facility can halt production lines thousands of miles away. Similarly, regional power grid failures caused by extreme heat can simultaneously disrupt multiple facilities. Such cascading failures highlight the need for geographic diversification and robust supply chain planning. Currently, 60% of businesses expect higher costs from physical risks, including extreme weather and supply chain interruptions, within the next year[3].

Recognizing these risks is a critical first step in developing effective strategies to mitigate their impact, as explored in the following sections.

How to Integrate Climate Risk into Infrastructure Planning

Incorporating climate risk into infrastructure decisions is a critical step toward building resilience and ensuring long-term sustainability. A structured five-step approach can help embed climate considerations at every stage, from assessing vulnerabilities to updating corporate policies. Here's how to make climate risk a core part of infrastructure planning.

Step 1: Assess Climate Vulnerabilities

The first step involves evaluating how vulnerable your assets are to climate impacts. Vulnerability depends on two key factors: sensitivity (how likely an asset is to sustain damage) and adaptive capacity (its ability to adjust or recover) [1]. A simple vulnerability spreadsheet can help map out each asset's potential impact, sensitivity, and adaptive capacity. This tool makes it easier to identify high-priority asset–hazard pairs that require immediate focus.

For a more standardized approach, consider using the Public Infrastructure Engineering Vulnerability Committee (PIEVC) Protocol, with its latest version (V.11) released in June 2024 [5]. While qualitative ratings (high, medium, or low) can quickly flag less vulnerable assets, more complex systems or larger portfolios may benefit from quantitative analyses using geospatial data. This helps reduce uncertainty and ensures resources are directed where they’re needed most [1].

Step 2: Identify and Rank Climate Hazards

Once vulnerabilities are clear, the next step is identifying the specific climate hazards your infrastructure faces. Risk is calculated as the product of a hazard's probability and the magnitude of its impact [1]. To maintain consistency, create standardized probability rules. For example, categorize hazards expected within 5 years as "high probability", those likely every 5 to 20 years as "medium", and events occurring less frequently than once in 20 years as "low."

A 3×3 risk matrix can be a helpful visual tool, plotting probability on one axis and impact magnitude on the other. This allows teams to quickly pinpoint "High–High" or "High–Medium" risks that demand urgent action. Federal resources like FEMA's National Risk Index and the Climate Mapping for Resilience and Adaptation (CMRA) tool provide valuable data on various natural hazards [1][6]. Additionally, prioritize systemic assets - such as critical bridges, telecommunications hubs, or logistics centers - because their failure could lead to cascading disruptions.

Step 3: Build Cross-Functional Teams

Addressing climate risk requires input from a variety of experts. Assemble a team that includes engineers, finance professionals, and climate specialists. Engineers bring technical insights, finance experts assess cost implications, and climate professionals contribute expertise on environmental risks. Assign a leader to guide the team, ensuring efforts stay focused on the most vulnerable assets.

For more complex analyses, consider collaborating with external experts, such as Architecture and Engineering (A&E) firms or climate adaptation specialists. Pairing internal staff with outside expertise strengthens the process, especially when advanced climate modeling is required. To keep everyone aligned, establish a common risk language with simple, standardized rule sets [1][7].

Step 4: Create Adaptation Plans

With your team in place, the next step is to develop adaptation strategies tailored to the highest-priority risks. After ranking risks and identifying key assets, integrate climate considerations into design standards. This ensures new infrastructure is built to withstand future conditions rather than relying solely on historical data.

Practical interventions could include elevating coastal facilities to address sea level rise, upgrading cooling systems to handle extreme heat, or creating alternative supply routes to reduce dependency on a single corridor. Use a combination of geospatial data and community or operational needs to guide these decisions. Document the strategies with clear timelines and accountability to ensure follow-through [1][7].

Step 5: Update Corporate Policies

Finally, embed climate resilience into your organization by updating corporate policies. Make climate risk assessments a standard part of infrastructure investments. This could involve revising procurement guidelines to mandate climate risk reviews for projects exceeding a certain budget, updating design standards to reflect future climate scenarios, or adjusting operating procedures to include regular climate monitoring and timely adaptation measures.

Tools and Methods for Climate Risk Assessment

Incorporating climate risk into strategic planning requires not only a clear process but also the right tools and methods to refine and implement these strategies effectively. By utilizing structured frameworks and advanced technologies, corporations can better identify vulnerabilities, anticipate hazards, and prepare for future scenarios. Here, we explore three key approaches that bring focus and precision to climate risk planning.

PIEVC Protocol for Infrastructure Assessments

The PIEVC Protocol (Public Infrastructure Engineering Vulnerability Committee) provides a systematic approach to evaluating the vulnerability of infrastructure to climate-related threats. This method helps teams assess asset–hazard combinations by considering two critical factors: sensitivity (how easily an asset could sustain damage) and adaptive capacity (how effectively it can recover or adjust) [1].

This framework is particularly beneficial for organizations managing a range of infrastructure assets. It ensures consistency and reliability in identifying vulnerabilities. Starting with a basic spreadsheet to rate assets against potential hazards can establish a foundation for understanding risks. For more intricate systems, the protocol incorporates quantitative analysis using geospatial data, which helps reduce uncertainty and supports decisions for large-scale investments [1].

Spatial analysis complements this method by identifying areas where risks overlap, offering deeper insights into potential vulnerabilities.

GIS Mapping and Data Analysis

Geographic Information Systems (GIS) serve as a powerful tool for mapping and analyzing the relationship between assets and climate-related hazards. By overlaying asset locations with data such as flood zones, wildfire-prone areas, sea level rise projections, and heat maps, corporations can quickly identify facilities at the highest risk [8]. GIS goes beyond simple visualization by enabling techniques like proximity analysis, overlay analysis, and density mapping to detect "hotspots" where multiple risks intersect [9].

For instance, a company might use GIS to combine elevation data, historical flood records, and future sea level rise projections to identify coastal sites at risk. These tools also allow for scenario testing, so decision-makers can evaluate different mitigation strategies before committing resources [9]. Accessible government tools, such as the NOAA Sea Level Rise Viewer, FEMA Flood Mapping Products, and the National Risk Index, provide excellent starting points for initial assessments [1][8].

Climate Scenario Planning

While GIS and the PIEVC Protocol focus on current vulnerabilities, climate scenario planning looks ahead. This approach uses climate models and risk scenarios to project future conditions, categorized by likelihood: Routine (occurring every 5 years), Design (every 50 years), and Extreme (every 200+ years) [8]. These scenarios help organizations define performance goals and allocate resources effectively.

The NIST Community Resilience Planning Guide introduces a performance-based framework to evaluate how infrastructure operates under stress. It defines recovery benchmarks at 30%, 60%, and 90% operational capacity [8]. For example:

30% capacity: The minimum level needed to initiate response and recovery efforts.

60% capacity: Sufficient for scaled-down daily operations.

90% capacity: Full restoration to normal operations.

Corporate Examples of Climate Risk Integration

Corporations are taking proactive steps to address climate risks, using innovative strategies to protect their assets and maintain operational resilience. These examples highlight how businesses are adapting to environmental challenges through targeted measures.

Coastal Protection Through Nature-Based Solutions

Companies with operations in coastal areas are turning to nature-based solutions to shield their facilities. For instance, coral reefs are being utilized as natural barriers to reduce wave impact [11]. Some firms have adopted a "Reef2Resilience" trust fund model, where local businesses contribute to a shared fund aimed at restoring coastal ecosystems and securing catastrophe insurance for faster disaster recovery [11]. Additionally, many organizations are forming internal climate science teams to incorporate cutting-edge meteorological data into their risk assessments and infrastructure planning [10]. These steps not only bolster coastal defenses but also pave the way for similar strategies in urban and supply chain settings.

Urban Heat Management Strategies

In cities, where extreme heat poses a different set of challenges, corporations are redesigning facilities to address the risks. With potential annual fixed asset losses from heat risks estimated at $560–610 billion by 2035 [12], businesses are investing in solutions like reflective materials, green roofs, rain gardens, and upgraded HVAC systems [2][13]. These measures not only reduce heat impacts but also deliver economic benefits, with every $1 spent on adaptation yielding returns between $2 and $10 [14]. Companies are also implementing heat stress management programs and adjusting work schedules to protect employee productivity during peak heat hours [2][12].

Supply Chain Resilience Frameworks

Climate risk integration isn't limited to physical infrastructure - it also extends to supply chain operations. Many corporations are using the "Steps to Resilience" framework, which helps them identify vulnerabilities, assess risks, explore options, and implement action plans [6]. To strengthen supply chain resilience, companies are modernizing key infrastructure, such as border entry points, and incorporating Life Cycle Assessments into procurement processes [15]. Tools like the Climate Explorer and Sea Level Rise Viewer are also being deployed to map geographical hazards along supply routes [6][15]. By embedding climate risk considerations into capital maintenance and investment decisions, businesses are ensuring their supply chains remain robust and adaptive to future challenges.

These examples demonstrate how strategic measures not only safeguard assets but also enhance corporate resilience in the face of evolving climate risks.

Conclusion

Climate risks have transitioned from abstract concerns to pressing challenges that are reshaping corporate approaches to infrastructure planning. The reliability of past weather patterns as predictive tools has diminished, given the increasing frequency and intensity of hazards [1]. Delaying proactive measures comes with the risk of steep financial losses and significant operational disruptions.

As discussed earlier, systematic screening and the use of risk matrices are essential for prioritizing assets [1]. These methods ensure resources are concentrated on critical infrastructure, where failures could lead to widespread disruptions across operations and supply chains.

Integrating climate risk strategies not only safeguards assets but also strengthens financial stability. Beyond mitigating disaster-related costs, these assessments extend asset lifespans, lower insurance premiums, and can even improve access to favorable financing terms. Transitioning from qualitative evaluations to data-driven, quantitative geospatial analyses minimizes uncertainty and supports more precise capital allocation [1].

Effective climate planning requires flexibility and continuous reassessment. The "Steps to Resilience" framework offers a structured approach for evaluating exposure, exploring adaptive strategies, and refining plans as conditions shift [1]. Incorporating safety margins - such as exceeding current flood elevation standards by four feet or ensuring infrastructure can operate independently for 72 hours - helps prepare for future uncertainties [16].

The measures outlined throughout this discussion provide a strong foundation for building resilient infrastructure. The urgency to act cannot be overstated. Postponing the integration of climate risk strategies leads to higher costs, greater disruptions, and a diminished competitive position. Taking immediate steps - focusing on vulnerable assets, assembling multidisciplinary teams, and leveraging advanced quantitative tools - ensures operational security for the long term.

FAQs

What steps should corporations take to integrate climate risks into infrastructure planning?

To address climate risks in infrastructure planning, begin by identifying your assets and evaluating their vulnerability to threats like extreme heat, flooding, or rising sea levels. Focus on the assets most at risk, considering both their sensitivity to climate hazards and their capacity to adjust to these challenges.

Leverage climate assessment tools to analyze current risks and anticipate future conditions. Factor in projections that highlight potential changes over time, such as more frequent storms or temperature fluctuations. Choose climate scenarios that align with your organization's objectives, and ensure your evaluation includes other stressors like population growth or increasing resource demands.

Put your analysis into action by integrating the findings into your decision-making process. Test strategies using scenario analysis, adopt design standards that prioritize resilience, and establish a system for continuous monitoring and updates. This approach ensures your infrastructure remains flexible and prepared to adapt as new climate data becomes available.

What are the differences between physical, transition, and systemic climate risks?

Physical climate risks refer to the immediate and tangible effects of climate change on a company’s assets, operations, and supply chains. These risks manifest through events like hurricanes, floods, and wildfires, as well as more gradual changes such as rising sea levels and altered rainfall patterns. Such factors can lead to infrastructure damage, operational disruptions, and increased expenses.

Transition climate risks emerge as the world moves toward a low-carbon economy. This shift involves changes in policies, such as the introduction of carbon taxes, evolving market demands like declining reliance on fossil fuels, and advancements in renewable energy technologies. These changes can impact revenue streams, raise compliance expenses, or reduce the value of certain assets.

Systemic climate risks encompass widespread economic and financial disruptions triggered by climate-related events. These risks can ripple across industries and markets, posing threats to economic stability. For instance, extensive physical damage or abrupt policy shifts can strain credit systems and public finances, creating far-reaching consequences.

By understanding these categories of climate risks, businesses can pinpoint vulnerabilities and design infrastructure strategies that withstand both immediate threats and long-term challenges.

Why should corporations prioritize climate risk in their infrastructure planning now?

The effects of climate change are already taking a toll on infrastructure across the U.S., with rising temperatures, intense storms, floods, and wildfires inflicting costly damage and disruptions. These events place immense pressure on essential systems like the power grid, transportation networks, and water supplies, which in turn disrupt business operations. On top of that, regulatory demands to meet net-zero targets are intensifying. Companies that fail to adapt risk falling behind on compliance, losing access to key markets, and facing steeper financing costs.

Acting now isn’t just about staying prepared - it’s also a smart financial decision. Research indicates that incorporating climate resilience into infrastructure adds only around 3% to initial costs but offers substantial long-term benefits. Waiting to act increases vulnerability to physical damage, supply chain interruptions, and financial instability. On the other hand, proactive measures not only reduce these risks but also enhance competitiveness and secure a more stable future.

Related Blog Posts

FAQ

What does it really mean to “redefine profit”?

What makes Council Fire different?

Who does Council Fire you work with?

What does working with Council Fire actually look like?

How does Council Fire help organizations turn big goals into action?

How does Council Fire define and measure success?