Dec 26, 2025

Dec 26, 2025

How to Draft ESG Clauses to Avoid Disputes

ESG Strategy

ESG Strategy

In This Article

Use SMART goals, measurable KPIs, verification and clear remedies to draft enforceable ESG clauses that reduce disputes, greenwashing and legal risk.

How to Draft ESG Clauses to Avoid Disputes

Clear ESG clauses are essential to prevent disputes and ensure accountability in contracts. Vague commitments like "sustainable practices" often lead to greenwashing accusations and enforcement challenges. By drafting measurable, enforceable terms, you can strengthen compliance and reduce legal risks.

Key Takeaways:

Use the SMART Framework: Define goals that are Specific, Measurable, Achievable, Relevant, and Time-bound.

Clarify Obligations: Differentiate between "obligations of means" (effort-focused) and "obligations of result" (outcome-focused).

Set Measurable KPIs: Examples include reducing emissions by a specific percentage or ensuring a living wage for workers.

Include Remedies: Specify penalties, service credits, or corrective actions for non-compliance.

Plan for Termination: Designate critical ESG terms as "essential clauses" to allow contract termination for severe breaches.

Account for Jurisdictional Differences: Tailor clauses to local and international ESG laws and standards.

Contracts with precise ESG terms not only align with growing regulatory demands but also protect against reputational and legal risks. This guide provides actionable steps to draft effective clauses that reduce ambiguity and ensure compliance.

Drafting ESG Compliant Clauses in Contracts - A Guide for Commercial Contract Lawyers - Webinar

Core Principles for Drafting Enforceable ESG Clauses

To create effective ESG clauses, it’s crucial to shift from broad, aspirational language to precise and enforceable terms. This approach ensures that commitments are not just promises but measurable obligations that both parties can understand and monitor throughout the contract’s duration.

Two frameworks - the SMART approach and the SME checklist - provide practical guidance for turning vague goals into actionable and enforceable contract terms.

The SMART Approach

The SMART framework helps refine ESG goals into specific, actionable obligations by applying five essential criteria:

Specific: Clearly define requirements instead of using vague terms like "environmentally conscious." For instance, specify a target such as "reduce water usage by 30%."

Measurable: Use objective metrics or recognized standards to track progress, ensuring obligations can be verified.

Achievable: Set targets that are realistic and commercially feasible based on the counterparty’s resources and capabilities.

Relevant: Tailor clauses to the industry, geography, and specific supply chain risks involved.

Time-bound: Establish clear deadlines and reporting intervals, such as quarterly emissions reports or annual diversity audits, to maintain accountability.

"Organisations should try to include specific and measurable obligations, eg through targets or metrics that can be monitored and verified objectively." – Allens [1]

This framework strengthens the legal foundation of ESG clauses, reducing ambiguity and potential disputes over interpretation.

The SME Checklist

The SME checklist complements the SMART approach by focusing on enforceability. It emphasizes the distinction between two types of obligations:

Obligation of Means: Requires best efforts but does not guarantee results.

Obligation of Result: Guarantees specific outcomes, making a breach clear if targets are unmet, regardless of effort.

For obligations of result, remedies such as liquidated damages, service credits, or mandatory corrective actions can be included to address non-compliance. Additionally, designating ESG commitments as "essential clauses" provides a strong legal basis for unilateral termination in case of significant breaches.

Audit rights, paired with provisions for third-party verification and access to relevant documentation, further enhance enforceability by ensuring transparency and accountability.

Framework Element | Key Application | Legal Impact |

|---|---|---|

SMART: Specific | Define exact targets (e.g., "reduce water usage by 30%") | Reduces interpretation disputes |

SMART: Measurable | Use verifiable KPIs tied to industry standards | Enables objective performance tracking |

SMART: Achievable | Align targets with counterparty capabilities | Prevents immediate breach risks |

SME: Enforceable | Specify remedies like liquidated damages or audits | Ensures clear legal recourse for violations |

SME: Essential Designation | Mark critical ESG terms as "essential clauses" | Justifies unilateral termination for breaches |

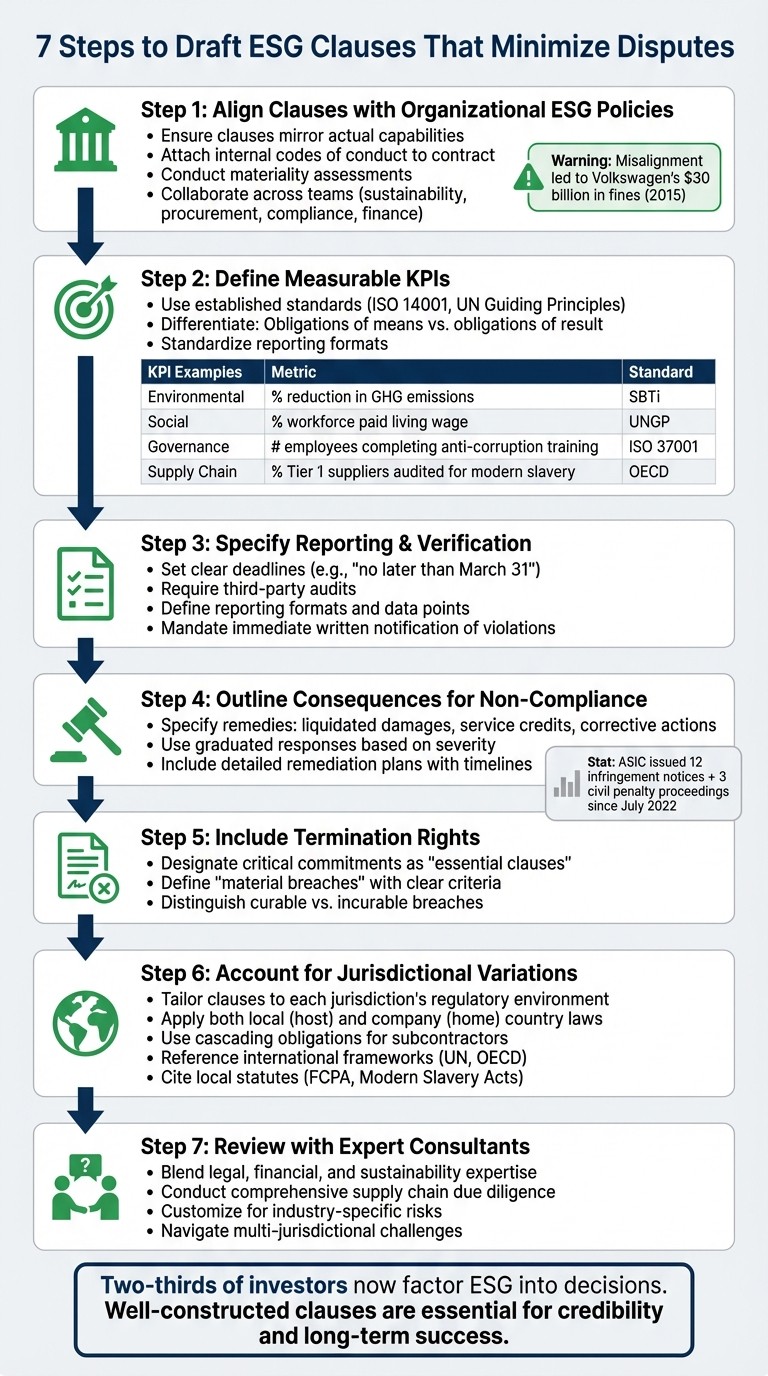

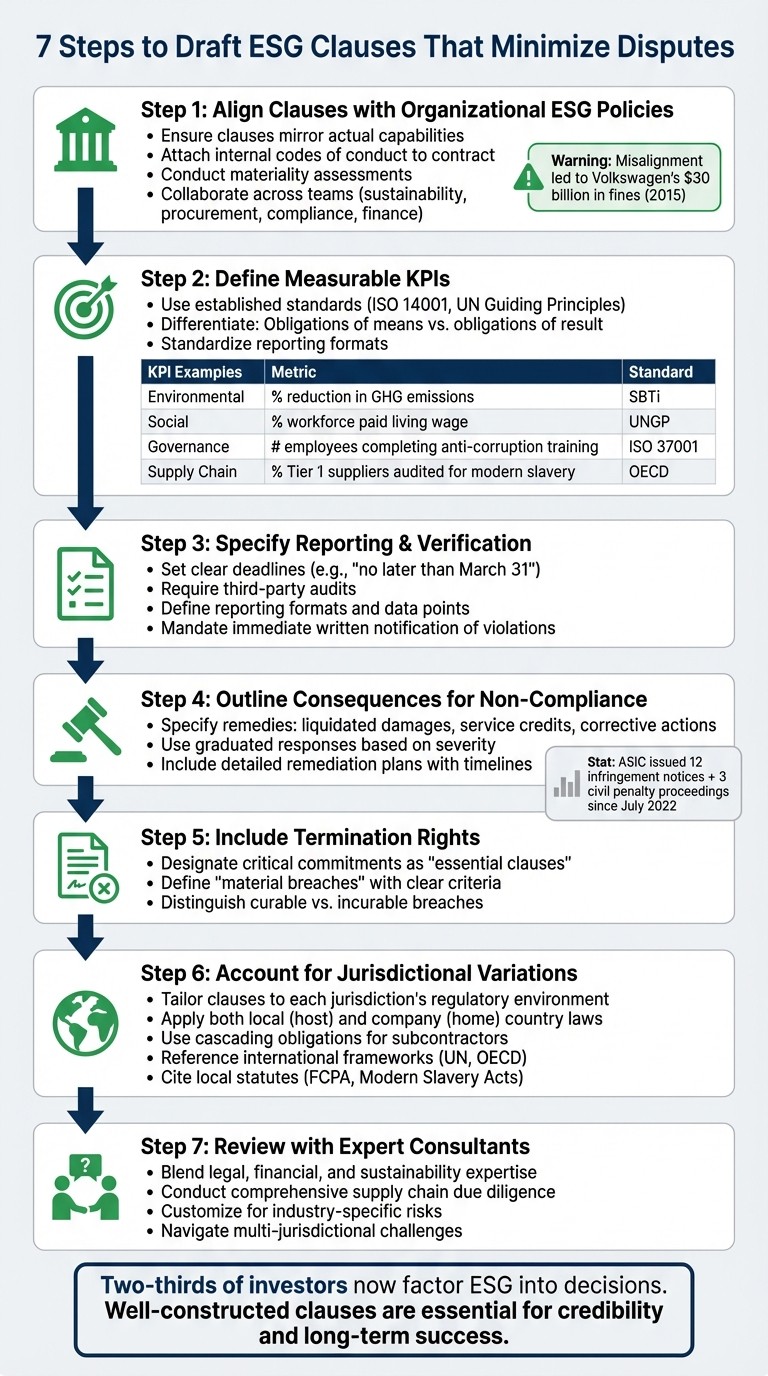

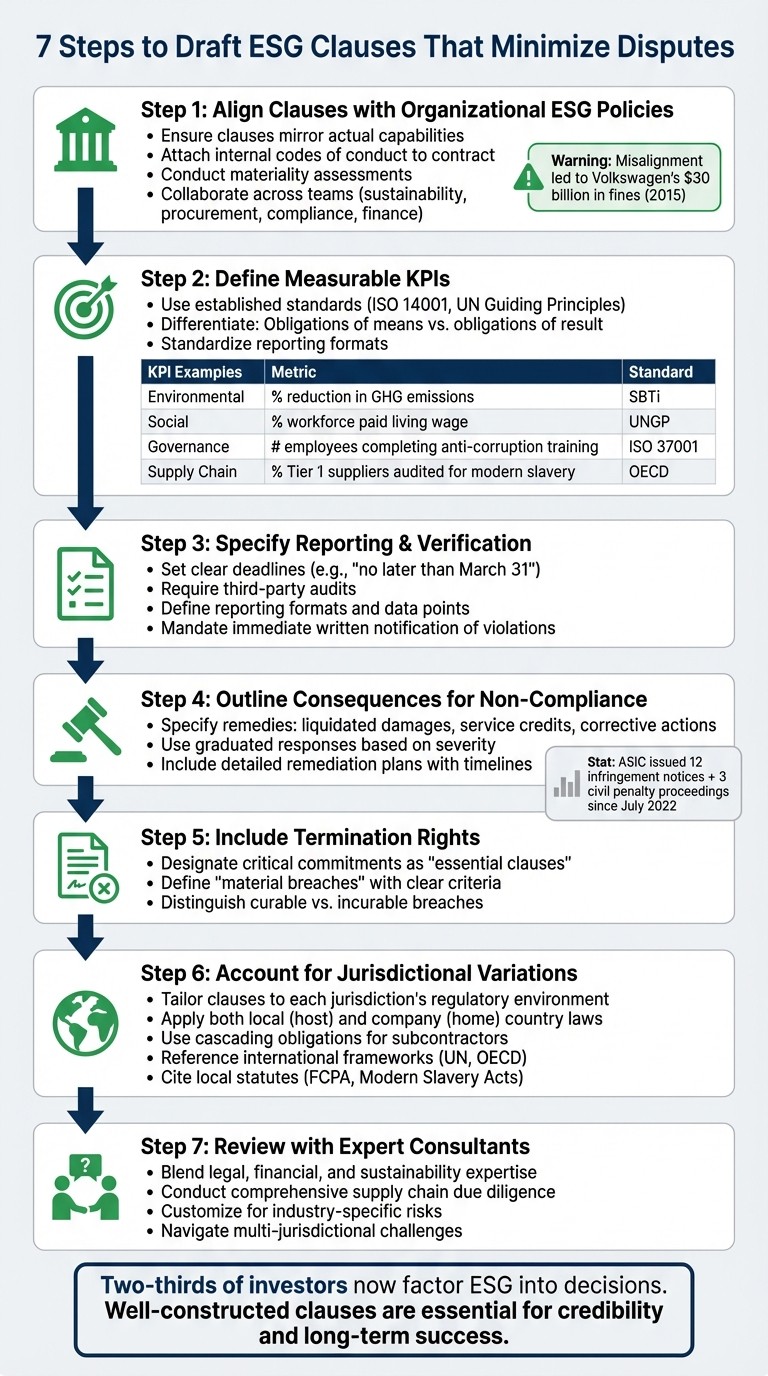

7 Steps to Draft ESG Clauses That Minimize Disputes

7-Step Process for Drafting Dispute-Free ESG Clauses

Drafting ESG clauses that avoid disputes requires a thoughtful approach that combines clear legal language with practical implementation. Here’s a step-by-step guide to help create effective clauses that reduce ambiguity and prevent conflicts.

Step 1: Align Clauses with Organizational ESG Policies

Start by ensuring that ESG clauses mirror your organization's actual capabilities and public commitments. Misalignment can lead to both legal risks and reputational damage.

"Contracting parties should ensure that ESG provisions in their agreements align with their internal policies and operational capabilities, as misalignment may lead to legal exposure or reputational harm." – RDS Law Partners [7]

To strengthen alignment, attach internal codes of conduct or ESG policies to the contract and require signed acknowledgment. Simply linking to a website is insufficient. For example, Volkswagen's 2015 emissions scandal, where software was manipulated to appear more eco-friendly, resulted in fines and settlements amounting to $30 billion [8]. Conduct materiality assessments to pinpoint the most critical ESG issues for your business and stakeholders. Collaboration among sustainability, procurement, compliance, and finance teams ensures that commitments are realistic and enforceable. Consider a tiered approach for clauses, ranging from encouragement to obligations or incentives, and define measurable targets to reinforce commitments.

Step 2: Define Measurable Key Performance Indicators (KPIs)

Set clear, quantifiable goals using established standards like ISO 14001 for environmental objectives or the UN Guiding Principles for social commitments.

"Organisations should try to include specific and measurable obligations, eg through targets or metrics that can be monitored and verified objectively." – Elyse Adams, Partner, Allens [1]

Differentiate between obligations of means (best efforts) and obligations of result (guaranteed outcomes), as some legal systems assume fault if specific results aren't achieved [6]. Standardize reporting formats to ensure consistency and transparency across the supply chain. Below are examples of measurable KPIs:

KPI Category | Example Metric | Reference Standard |

|---|---|---|

Environmental | Percentage reduction in Scope 1 and 2 GHG emissions | |

Social | Percentage of workforce paid a living wage | UN Guiding Principles (UNGP) |

Governance | Number of employees completing anti-corruption training | ISO 37001 (Anti-bribery) |

Supply Chain | Percentage of Tier 1 suppliers audited for modern slavery |

Step 3: Specify Reporting and Verification Requirements

Clearly define timelines and mechanisms for reporting and verification. For instance, set deadlines like "no later than March 31" to align with corporate reporting cycles and avoid confusion [7]. Require third-party audits and detailed documentation to verify compliance. Suppliers should report any violations or failures to meet KPIs immediately in writing [3]. Define reporting formats, including the required data points and calculation methods, to ensure clarity. Additionally, include procedures for disclosing ESG-related incidents or risks as they occur, enabling proactive management.

Step 4: Outline Consequences for Non-Compliance

Without consequences, ESG clauses remain aspirational. Specify remedies like liquidated damages, service credits, or mandatory corrective actions for unmet commitments [1][6].

Recent enforcement highlights the importance of this step. Since July 1, 2022, the Australian Securities and Investments Commission (ASIC) has issued 12 infringement notices and initiated three civil penalty proceedings related to ESG misconduct [1]. Tie KPI failures to graduated responses based on severity. Minor breaches might trigger remediation plans with set timelines, while major or repeated violations could lead to financial penalties or contract termination. Include detailed remediation plans that outline corrective steps and deadlines to maintain accountability.

Step 5: Include Termination Rights for Material Breaches

Address termination rights for significant ESG violations by designating critical commitments as "essential clauses." This provides a strong legal foundation for unilateral termination in cases of serious breaches [1]. Define "material breaches" with clear criteria, such as repeated failure to meet emissions targets, evidence of forced labor, or falsified ESG reports. Structure these rights to distinguish between curable breaches (allowing a notice period for remedy) and incurable breaches (permitting immediate termination for severe violations).

Step 6: Account for Jurisdictional Variations

ESG standards and regulations vary widely across countries, especially in global supply chains [4]. For example, the European Union's Corporate Sustainability Due Diligence Directive (CSDDD) significantly influences how ESG clauses are framed in cross-border agreements [7].

"ESG contractual provisions will be particularly key where there are different standards, laws or regulations, and levels of transparency, between various countries along the supply chain." – Norton Rose Fulbright [4]

Tailor clauses to the regulatory environment of each jurisdiction. Apply both local ("host") and company ("home") country laws to ensure commitments are practical. Use cascading obligations that require direct suppliers to pass ESG requirements down to their subcontractors. Reference international frameworks like the UN Guiding Principles or OECD Guidelines to establish a shared baseline. When relevant, cite local statutes such as the Foreign Corrupt Practices Act (US) or Modern Slavery Acts (UK/Australia) to ensure clarity and enforceability.

Common Pitfalls in ESG Clause Drafting and How to Avoid Them

Drafting effective ESG clauses requires precision and foresight. Missteps in this process can lead to disputes, regulatory scrutiny, or unenforceable agreements. Identifying and addressing common pitfalls ensures that clauses are both practical and enforceable.

Using Ambiguous Language

Vague terms like "environmentally conscious" or "perform activities ethically" often lead to disputes because they lack clear, objective standards. Similarly, phrases such as "best efforts" or "endeavor to" fail to establish measurable compliance benchmarks, leaving room for interpretation.

To avoid these issues, replace ambiguous language with precise, quantifiable terms tied to recognized standards. For example, instead of "best efforts" or "environmentally conscious", specify obligations such as achieving a defined emissions reduction verified by an established framework. Clearly distinguish between obligations of means - committing to reasonable efforts - and obligations of result, where failing to meet a specific outcome constitutes a breach [6].

Mitigating Greenwashing Risks

Exaggerated claims in ESG clauses can lead to accusations of greenwashing, exposing parties to regulatory penalties and reputational damage. The rise in companies referencing terms like "net zero" or "carbon neutral" has drawn increased scrutiny, with regulators responding aggressively. For instance, between July 1, 2022, and early 2025, ASIC issued 12 infringement notices and initiated three civil penalty proceedings related to ESG misconduct [1].

Notable cases include the Federal Court's $10.5 million penalty against Active Super in March 2025 for misrepresenting its ESG practices and Clorox's $8.25 million penalty in April 2025 for misleading claims about products made with recycled ocean plastic [9].

To mitigate greenwashing risks, align ESG commitments with your operational realities and internal policies. Set achievable targets based on realistic timelines and resources. A tiered approach - ranging from encouraging performance to rewarding or mandating it - can provide flexibility while avoiding overpromises. Including materiality qualifiers helps limit liability for minor technical breaches while emphasizing accountability for significant violations [1][3].

Ensuring Quantifiable Targets

Measurable targets are essential for enforceable ESG clauses. Vague aspirations lack the clarity needed for compliance and monitoring. Instead, define commitments in concrete terms, such as requiring that 100% of raw materials come from certified suppliers. Use external standards like the Science Based Targets initiative (SBTi) to establish clear benchmarks understood by all parties.

To strengthen enforceability, standardize reporting formats across your supply chain and mandate third-party audits to verify compliance data [3][6]. Clearly outline whether each commitment is an obligation of means or result, ensuring that critical goals are specific and actionable. By setting precise targets, ESG clauses move from aspirational language to enforceable obligations, creating a solid foundation for monitoring and accountability.

Enforcement and Monitoring Mechanisms for ESG Clauses

Having clear ESG clauses is just the first step - ensuring compliance and addressing breaches effectively is where the real work begins. Without proper monitoring and enforcement, even the most well-crafted clauses risk becoming empty promises.

Tracking Obligations and Performance

Enforcement begins by shifting from one-time verifications to covenants that ensure ongoing compliance throughout the contract's duration [3]. This approach keeps all parties accountable over time, rather than relying on a single snapshot of adherence.

To ensure effective tracking, set clear and specific requirements. For instance, suppliers might be required to submit quarterly ESG performance reports [10]. Additionally, define the frequency of audits, such as bi-annual unannounced inspections, and clarify who bears the cost of these audits. Establishing upfront roles for third-party verification can also reduce ambiguity [3][6].

While automated monitoring tools can streamline compliance tracking, human oversight remains critical. A human review step ensures that any automated remediation notices are legally enforceable and appropriately applied [10].

Cascading obligations are another key element. By including clauses that require direct suppliers to impose equivalent ESG standards on their subcontractors, you strengthen compliance throughout the supply chain. As Stéphanie De Smedt, Partner at Loyens & Loeff, aptly puts it:

"The chain is of course only as strong as its weakest link" [6].

When breaches occur, immediate notification and corrective action plans should be mandatory. Allowing suppliers to address violations before triggering termination can resolve issues without prematurely ending the relationship [3][1]. Alternative remedies, such as service credits for failing to meet KPIs or mandatory contributions to rehabilitation efforts, can often be more constructive than outright termination [1][6].

These monitoring strategies naturally tie into broader risk mitigation efforts, which are further bolstered by strong ESG clauses.

Risk Mitigation Through Strong Clauses

Once monitoring systems are in place, the strength of your ESG clauses becomes your next line of defense against disputes. The clarity and specificity of these clauses directly impact your ability to avoid and resolve conflicts.

Clause Type | Vague Clause Example | Strong ESG Clause Example | Impact on Dispute Mitigation |

|---|---|---|---|

Environmental | "Supplier shall act in an environmentally conscious manner." | "Supplier shall reduce Scope 1 GHG emissions by 20% by December 31, 2026, against a 2024 baseline, verified by [Specific Standard]." | Strong clauses provide measurable benchmarks, reducing ambiguity about compliance. |

Social/Labor | "Supplier will perform its activities ethically." | "Supplier shall provide evidence of a valid [Specific Certification] and permit bi-annual unannounced audits of labor conditions." | Clear verification rights and evidence-based compliance minimize room for disputes. |

Governance | "Supplier agrees to comply with all applicable ESG laws." | "Supplier shall implement a whistleblowing policy with anonymous reporting and notify Buyer of any violations within 48 hours." | Proactive monitoring and immediate notification requirements strengthen accountability. |

Designating critical ESG commitments as "essential clauses" in contracts can further strengthen enforcement. This designation makes it easier to justify unilateral termination in cases of material breaches [6].

For situations involving non-quantifiable losses, consider including provisions for liquidated damages or lump-sum indemnities. These should be compensatory rather than punitive, ensuring fairness while addressing breaches [3][6].

Finally, whether you choose an obligation of means (requiring reasonable efforts) or an obligation of result (requiring specific outcomes) can significantly influence enforcement. Opting for obligations of result shifts the burden to the supplier, enhancing your legal position in cases of non-compliance [6].

The Role of Expert Consulting in ESG Clause Drafting

Why Partner with Experts

Expert consulting plays a pivotal role in refining ESG clause drafting by blending technical precision with strategic goals. This collaboration ensures that clauses are not only enforceable but also aligned with broader organizational objectives.

Drafting effective ESG clauses requires a combination of legal, financial, and sustainability expertise [12]. Expert consultants fill the gaps that standard legal teams might overlook [6]. They conduct comprehensive supply chain due diligence, transforming vague commitments into specific, measurable targets that can be tracked objectively [1][6]. Such precision is essential, especially considering enforcement actions against greenwashing doubled between 2022 and 2024 [12].

Consultancies like Council Fire specialize in integrating profitability with measurable ESG outcomes. Their systems-based approach ensures that ESG clauses align with an organization’s overarching goals while remaining enforceable across varying regulatory frameworks.

This level of expertise is particularly beneficial for tailoring clauses to address risks unique to specific industries.

Tailoring ESG Clauses to Minimize Disputes

Customizing ESG clauses to suit your industry and regulatory environment enhances enforceability and reduces the likelihood of disputes.

Generic clauses often fail to address the specific risks associated with particular industries, regions, or transaction types. Expert consultants help refine these provisions by clearly defining ESG-related terms - such as "Net Zero" or "Supply Chain Visibility" - to ensure both parties share a common understanding, thereby minimizing potential conflicts [13].

For global supply chains, consultants bring essential expertise in navigating multi-jurisdictional challenges. As Norton Rose Fulbright highlights:

"ESG contractual provisions will be particularly key where there are different standards, laws or regulations, and levels of transparency, between various countries along the supply chain" [4].

Consultants also implement tiered compliance strategies, requiring stricter standards for high-risk suppliers while applying less stringent measures for low-risk providers [11]. This approach not only avoids immediate breaches of contract but also fosters long-term commercial relationships [1][2]. Daniel Barnes from Gatekeeper underscores the importance of this:

"If your contract doesn't ensure you're getting the correct behaviours from your vendors to be compliant with ESG requirements, then you'll be the one dealing with the consequences" [13].

Conclusion

This guide highlights the importance of crafting precise and measurable ESG clauses to avoid disputes and ensure compliance. When contracts rely on vague or aspirational language, they create enforcement hurdles and increase the risk of legal challenges and reputational harm. The solution lies in specificity - incorporating concrete KPIs, standardized reporting mechanisms, and well-defined audit rights allows for objective compliance verification.

With regulatory scrutiny intensifying, the risks of unclear ESG commitments have grown. Effective clauses strike a balance between enforceability and commercial practicality, employing tools like climate remediation fees or corrective action plans as gradated remedies. Shifting from static, point-in-time representations to ongoing compliance covenants adds another layer of reliability. Additionally, cascading obligations that extend ESG standards throughout the supply chain can further bolster contractual integrity.

Navigating the complexities of varying jurisdictions and evolving regulations requires expert advice. Professionals can help differentiate between obligations of means and obligations of results, tailor clauses to address specific industry risks, and adapt contracts to accommodate changing regulatory landscapes. These strategies underscore the critical role of expertise in embedding strong ESG measures into contractual agreements.

"Your contracts need to support your ESG values, not quietly undermine them" – Sarah Gunton, Harper James [5]

With two-thirds of investors now factoring ESG considerations into their decisions [5], well-constructed clauses are no longer optional - they are essential for maintaining credibility and achieving long-term success.

FAQs

What’s the difference between obligations of means and obligations of result in ESG clauses?

Obligations of means and obligations of result represent two distinct levels of commitment often found in ESG clauses. An obligation of means requires parties to make reasonable efforts toward achieving a goal but does not promise a specific outcome. For instance, a company might pledge to work toward lowering emissions by adopting certain practices. On the other hand, an obligation of result demands accountability for meeting a defined, measurable target, such as cutting carbon emissions by 20% within a specified period.

When drafting ESG clauses, it’s essential to specify whether the commitment falls under an obligation of means or result. This distinction plays a crucial role in enforcement and can influence the likelihood of disputes. Using clear language and establishing measurable criteria ensures all parties have a shared understanding of their roles and expectations.

How can companies draft ESG clauses that comply with both U.S. and international regulations?

To ensure that ESG clauses align with both U.S. and international regulations, companies must begin by identifying the relevant legal and regulatory frameworks. Within the U.S., this involves referencing guidelines such as the SEC’s climate-related disclosure requirements and state-specific supply chain laws. On the international stage, organizations should account for regulations like the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) and follow guidance from bodies like the OECD and United Nations. Explicitly naming these regulations within contracts eliminates confusion and establishes clear expectations for compliance.

Practical measures for ensuring compliance should also be embedded in contracts. This can include requiring periodic ESG reporting that adheres to recognized standards like GRI or SASB, granting audit rights to verify adherence, and outlining specific consequences for non-compliance. Defining terms such as "material ESG breach" with precision can minimize misunderstandings and reduce the likelihood of disputes.

Finally, staying proactive is crucial. Contracts should include provisions that allow ESG commitments to evolve in response to changing regulations. Partnering with experts, such as Council Fire, can further support companies in navigating compliance while advancing broader sustainability efforts.

How can I draft ESG clauses to avoid greenwashing claims?

To ensure ESG commitments are taken seriously and not dismissed as greenwashing, it’s essential to draft contract clauses that are specific, measurable, and enforceable. Use clear, quantifiable terms like "reduce Scope 1 CO₂ emissions by 15% by December 31, 2026", instead of ambiguous phrases such as "reasonable efforts." Contracts should outline performance metrics, require regular progress reporting (e.g., quarterly updates), and include independent third-party verification to maintain accountability. Additionally, include enforceable consequences for non-compliance, such as financial penalties or the option to terminate the agreement.

Make sure the ESG language in contracts aligns with your organization’s internal policies and addresses the unique risks tied to the transaction. Regularly reviewing and updating targets ensures they stay relevant as standards evolve. Transparent communication and collaboration with stakeholders are also key to building trust and credibility. Council Fire offers guidance in crafting precise ESG terms, setting up verification processes, and reinforcing trust through well-defined, transparent commitments.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 26, 2025

How to Draft ESG Clauses to Avoid Disputes

ESG Strategy

In This Article

Use SMART goals, measurable KPIs, verification and clear remedies to draft enforceable ESG clauses that reduce disputes, greenwashing and legal risk.

How to Draft ESG Clauses to Avoid Disputes

Clear ESG clauses are essential to prevent disputes and ensure accountability in contracts. Vague commitments like "sustainable practices" often lead to greenwashing accusations and enforcement challenges. By drafting measurable, enforceable terms, you can strengthen compliance and reduce legal risks.

Key Takeaways:

Use the SMART Framework: Define goals that are Specific, Measurable, Achievable, Relevant, and Time-bound.

Clarify Obligations: Differentiate between "obligations of means" (effort-focused) and "obligations of result" (outcome-focused).

Set Measurable KPIs: Examples include reducing emissions by a specific percentage or ensuring a living wage for workers.

Include Remedies: Specify penalties, service credits, or corrective actions for non-compliance.

Plan for Termination: Designate critical ESG terms as "essential clauses" to allow contract termination for severe breaches.

Account for Jurisdictional Differences: Tailor clauses to local and international ESG laws and standards.

Contracts with precise ESG terms not only align with growing regulatory demands but also protect against reputational and legal risks. This guide provides actionable steps to draft effective clauses that reduce ambiguity and ensure compliance.

Drafting ESG Compliant Clauses in Contracts - A Guide for Commercial Contract Lawyers - Webinar

Core Principles for Drafting Enforceable ESG Clauses

To create effective ESG clauses, it’s crucial to shift from broad, aspirational language to precise and enforceable terms. This approach ensures that commitments are not just promises but measurable obligations that both parties can understand and monitor throughout the contract’s duration.

Two frameworks - the SMART approach and the SME checklist - provide practical guidance for turning vague goals into actionable and enforceable contract terms.

The SMART Approach

The SMART framework helps refine ESG goals into specific, actionable obligations by applying five essential criteria:

Specific: Clearly define requirements instead of using vague terms like "environmentally conscious." For instance, specify a target such as "reduce water usage by 30%."

Measurable: Use objective metrics or recognized standards to track progress, ensuring obligations can be verified.

Achievable: Set targets that are realistic and commercially feasible based on the counterparty’s resources and capabilities.

Relevant: Tailor clauses to the industry, geography, and specific supply chain risks involved.

Time-bound: Establish clear deadlines and reporting intervals, such as quarterly emissions reports or annual diversity audits, to maintain accountability.

"Organisations should try to include specific and measurable obligations, eg through targets or metrics that can be monitored and verified objectively." – Allens [1]

This framework strengthens the legal foundation of ESG clauses, reducing ambiguity and potential disputes over interpretation.

The SME Checklist

The SME checklist complements the SMART approach by focusing on enforceability. It emphasizes the distinction between two types of obligations:

Obligation of Means: Requires best efforts but does not guarantee results.

Obligation of Result: Guarantees specific outcomes, making a breach clear if targets are unmet, regardless of effort.

For obligations of result, remedies such as liquidated damages, service credits, or mandatory corrective actions can be included to address non-compliance. Additionally, designating ESG commitments as "essential clauses" provides a strong legal basis for unilateral termination in case of significant breaches.

Audit rights, paired with provisions for third-party verification and access to relevant documentation, further enhance enforceability by ensuring transparency and accountability.

Framework Element | Key Application | Legal Impact |

|---|---|---|

SMART: Specific | Define exact targets (e.g., "reduce water usage by 30%") | Reduces interpretation disputes |

SMART: Measurable | Use verifiable KPIs tied to industry standards | Enables objective performance tracking |

SMART: Achievable | Align targets with counterparty capabilities | Prevents immediate breach risks |

SME: Enforceable | Specify remedies like liquidated damages or audits | Ensures clear legal recourse for violations |

SME: Essential Designation | Mark critical ESG terms as "essential clauses" | Justifies unilateral termination for breaches |

7 Steps to Draft ESG Clauses That Minimize Disputes

7-Step Process for Drafting Dispute-Free ESG Clauses

Drafting ESG clauses that avoid disputes requires a thoughtful approach that combines clear legal language with practical implementation. Here’s a step-by-step guide to help create effective clauses that reduce ambiguity and prevent conflicts.

Step 1: Align Clauses with Organizational ESG Policies

Start by ensuring that ESG clauses mirror your organization's actual capabilities and public commitments. Misalignment can lead to both legal risks and reputational damage.

"Contracting parties should ensure that ESG provisions in their agreements align with their internal policies and operational capabilities, as misalignment may lead to legal exposure or reputational harm." – RDS Law Partners [7]

To strengthen alignment, attach internal codes of conduct or ESG policies to the contract and require signed acknowledgment. Simply linking to a website is insufficient. For example, Volkswagen's 2015 emissions scandal, where software was manipulated to appear more eco-friendly, resulted in fines and settlements amounting to $30 billion [8]. Conduct materiality assessments to pinpoint the most critical ESG issues for your business and stakeholders. Collaboration among sustainability, procurement, compliance, and finance teams ensures that commitments are realistic and enforceable. Consider a tiered approach for clauses, ranging from encouragement to obligations or incentives, and define measurable targets to reinforce commitments.

Step 2: Define Measurable Key Performance Indicators (KPIs)

Set clear, quantifiable goals using established standards like ISO 14001 for environmental objectives or the UN Guiding Principles for social commitments.

"Organisations should try to include specific and measurable obligations, eg through targets or metrics that can be monitored and verified objectively." – Elyse Adams, Partner, Allens [1]

Differentiate between obligations of means (best efforts) and obligations of result (guaranteed outcomes), as some legal systems assume fault if specific results aren't achieved [6]. Standardize reporting formats to ensure consistency and transparency across the supply chain. Below are examples of measurable KPIs:

KPI Category | Example Metric | Reference Standard |

|---|---|---|

Environmental | Percentage reduction in Scope 1 and 2 GHG emissions | |

Social | Percentage of workforce paid a living wage | UN Guiding Principles (UNGP) |

Governance | Number of employees completing anti-corruption training | ISO 37001 (Anti-bribery) |

Supply Chain | Percentage of Tier 1 suppliers audited for modern slavery |

Step 3: Specify Reporting and Verification Requirements

Clearly define timelines and mechanisms for reporting and verification. For instance, set deadlines like "no later than March 31" to align with corporate reporting cycles and avoid confusion [7]. Require third-party audits and detailed documentation to verify compliance. Suppliers should report any violations or failures to meet KPIs immediately in writing [3]. Define reporting formats, including the required data points and calculation methods, to ensure clarity. Additionally, include procedures for disclosing ESG-related incidents or risks as they occur, enabling proactive management.

Step 4: Outline Consequences for Non-Compliance

Without consequences, ESG clauses remain aspirational. Specify remedies like liquidated damages, service credits, or mandatory corrective actions for unmet commitments [1][6].

Recent enforcement highlights the importance of this step. Since July 1, 2022, the Australian Securities and Investments Commission (ASIC) has issued 12 infringement notices and initiated three civil penalty proceedings related to ESG misconduct [1]. Tie KPI failures to graduated responses based on severity. Minor breaches might trigger remediation plans with set timelines, while major or repeated violations could lead to financial penalties or contract termination. Include detailed remediation plans that outline corrective steps and deadlines to maintain accountability.

Step 5: Include Termination Rights for Material Breaches

Address termination rights for significant ESG violations by designating critical commitments as "essential clauses." This provides a strong legal foundation for unilateral termination in cases of serious breaches [1]. Define "material breaches" with clear criteria, such as repeated failure to meet emissions targets, evidence of forced labor, or falsified ESG reports. Structure these rights to distinguish between curable breaches (allowing a notice period for remedy) and incurable breaches (permitting immediate termination for severe violations).

Step 6: Account for Jurisdictional Variations

ESG standards and regulations vary widely across countries, especially in global supply chains [4]. For example, the European Union's Corporate Sustainability Due Diligence Directive (CSDDD) significantly influences how ESG clauses are framed in cross-border agreements [7].

"ESG contractual provisions will be particularly key where there are different standards, laws or regulations, and levels of transparency, between various countries along the supply chain." – Norton Rose Fulbright [4]

Tailor clauses to the regulatory environment of each jurisdiction. Apply both local ("host") and company ("home") country laws to ensure commitments are practical. Use cascading obligations that require direct suppliers to pass ESG requirements down to their subcontractors. Reference international frameworks like the UN Guiding Principles or OECD Guidelines to establish a shared baseline. When relevant, cite local statutes such as the Foreign Corrupt Practices Act (US) or Modern Slavery Acts (UK/Australia) to ensure clarity and enforceability.

Common Pitfalls in ESG Clause Drafting and How to Avoid Them

Drafting effective ESG clauses requires precision and foresight. Missteps in this process can lead to disputes, regulatory scrutiny, or unenforceable agreements. Identifying and addressing common pitfalls ensures that clauses are both practical and enforceable.

Using Ambiguous Language

Vague terms like "environmentally conscious" or "perform activities ethically" often lead to disputes because they lack clear, objective standards. Similarly, phrases such as "best efforts" or "endeavor to" fail to establish measurable compliance benchmarks, leaving room for interpretation.

To avoid these issues, replace ambiguous language with precise, quantifiable terms tied to recognized standards. For example, instead of "best efforts" or "environmentally conscious", specify obligations such as achieving a defined emissions reduction verified by an established framework. Clearly distinguish between obligations of means - committing to reasonable efforts - and obligations of result, where failing to meet a specific outcome constitutes a breach [6].

Mitigating Greenwashing Risks

Exaggerated claims in ESG clauses can lead to accusations of greenwashing, exposing parties to regulatory penalties and reputational damage. The rise in companies referencing terms like "net zero" or "carbon neutral" has drawn increased scrutiny, with regulators responding aggressively. For instance, between July 1, 2022, and early 2025, ASIC issued 12 infringement notices and initiated three civil penalty proceedings related to ESG misconduct [1].

Notable cases include the Federal Court's $10.5 million penalty against Active Super in March 2025 for misrepresenting its ESG practices and Clorox's $8.25 million penalty in April 2025 for misleading claims about products made with recycled ocean plastic [9].

To mitigate greenwashing risks, align ESG commitments with your operational realities and internal policies. Set achievable targets based on realistic timelines and resources. A tiered approach - ranging from encouraging performance to rewarding or mandating it - can provide flexibility while avoiding overpromises. Including materiality qualifiers helps limit liability for minor technical breaches while emphasizing accountability for significant violations [1][3].

Ensuring Quantifiable Targets

Measurable targets are essential for enforceable ESG clauses. Vague aspirations lack the clarity needed for compliance and monitoring. Instead, define commitments in concrete terms, such as requiring that 100% of raw materials come from certified suppliers. Use external standards like the Science Based Targets initiative (SBTi) to establish clear benchmarks understood by all parties.

To strengthen enforceability, standardize reporting formats across your supply chain and mandate third-party audits to verify compliance data [3][6]. Clearly outline whether each commitment is an obligation of means or result, ensuring that critical goals are specific and actionable. By setting precise targets, ESG clauses move from aspirational language to enforceable obligations, creating a solid foundation for monitoring and accountability.

Enforcement and Monitoring Mechanisms for ESG Clauses

Having clear ESG clauses is just the first step - ensuring compliance and addressing breaches effectively is where the real work begins. Without proper monitoring and enforcement, even the most well-crafted clauses risk becoming empty promises.

Tracking Obligations and Performance

Enforcement begins by shifting from one-time verifications to covenants that ensure ongoing compliance throughout the contract's duration [3]. This approach keeps all parties accountable over time, rather than relying on a single snapshot of adherence.

To ensure effective tracking, set clear and specific requirements. For instance, suppliers might be required to submit quarterly ESG performance reports [10]. Additionally, define the frequency of audits, such as bi-annual unannounced inspections, and clarify who bears the cost of these audits. Establishing upfront roles for third-party verification can also reduce ambiguity [3][6].

While automated monitoring tools can streamline compliance tracking, human oversight remains critical. A human review step ensures that any automated remediation notices are legally enforceable and appropriately applied [10].

Cascading obligations are another key element. By including clauses that require direct suppliers to impose equivalent ESG standards on their subcontractors, you strengthen compliance throughout the supply chain. As Stéphanie De Smedt, Partner at Loyens & Loeff, aptly puts it:

"The chain is of course only as strong as its weakest link" [6].

When breaches occur, immediate notification and corrective action plans should be mandatory. Allowing suppliers to address violations before triggering termination can resolve issues without prematurely ending the relationship [3][1]. Alternative remedies, such as service credits for failing to meet KPIs or mandatory contributions to rehabilitation efforts, can often be more constructive than outright termination [1][6].

These monitoring strategies naturally tie into broader risk mitigation efforts, which are further bolstered by strong ESG clauses.

Risk Mitigation Through Strong Clauses

Once monitoring systems are in place, the strength of your ESG clauses becomes your next line of defense against disputes. The clarity and specificity of these clauses directly impact your ability to avoid and resolve conflicts.

Clause Type | Vague Clause Example | Strong ESG Clause Example | Impact on Dispute Mitigation |

|---|---|---|---|

Environmental | "Supplier shall act in an environmentally conscious manner." | "Supplier shall reduce Scope 1 GHG emissions by 20% by December 31, 2026, against a 2024 baseline, verified by [Specific Standard]." | Strong clauses provide measurable benchmarks, reducing ambiguity about compliance. |

Social/Labor | "Supplier will perform its activities ethically." | "Supplier shall provide evidence of a valid [Specific Certification] and permit bi-annual unannounced audits of labor conditions." | Clear verification rights and evidence-based compliance minimize room for disputes. |

Governance | "Supplier agrees to comply with all applicable ESG laws." | "Supplier shall implement a whistleblowing policy with anonymous reporting and notify Buyer of any violations within 48 hours." | Proactive monitoring and immediate notification requirements strengthen accountability. |

Designating critical ESG commitments as "essential clauses" in contracts can further strengthen enforcement. This designation makes it easier to justify unilateral termination in cases of material breaches [6].

For situations involving non-quantifiable losses, consider including provisions for liquidated damages or lump-sum indemnities. These should be compensatory rather than punitive, ensuring fairness while addressing breaches [3][6].

Finally, whether you choose an obligation of means (requiring reasonable efforts) or an obligation of result (requiring specific outcomes) can significantly influence enforcement. Opting for obligations of result shifts the burden to the supplier, enhancing your legal position in cases of non-compliance [6].

The Role of Expert Consulting in ESG Clause Drafting

Why Partner with Experts

Expert consulting plays a pivotal role in refining ESG clause drafting by blending technical precision with strategic goals. This collaboration ensures that clauses are not only enforceable but also aligned with broader organizational objectives.

Drafting effective ESG clauses requires a combination of legal, financial, and sustainability expertise [12]. Expert consultants fill the gaps that standard legal teams might overlook [6]. They conduct comprehensive supply chain due diligence, transforming vague commitments into specific, measurable targets that can be tracked objectively [1][6]. Such precision is essential, especially considering enforcement actions against greenwashing doubled between 2022 and 2024 [12].

Consultancies like Council Fire specialize in integrating profitability with measurable ESG outcomes. Their systems-based approach ensures that ESG clauses align with an organization’s overarching goals while remaining enforceable across varying regulatory frameworks.

This level of expertise is particularly beneficial for tailoring clauses to address risks unique to specific industries.

Tailoring ESG Clauses to Minimize Disputes

Customizing ESG clauses to suit your industry and regulatory environment enhances enforceability and reduces the likelihood of disputes.

Generic clauses often fail to address the specific risks associated with particular industries, regions, or transaction types. Expert consultants help refine these provisions by clearly defining ESG-related terms - such as "Net Zero" or "Supply Chain Visibility" - to ensure both parties share a common understanding, thereby minimizing potential conflicts [13].

For global supply chains, consultants bring essential expertise in navigating multi-jurisdictional challenges. As Norton Rose Fulbright highlights:

"ESG contractual provisions will be particularly key where there are different standards, laws or regulations, and levels of transparency, between various countries along the supply chain" [4].

Consultants also implement tiered compliance strategies, requiring stricter standards for high-risk suppliers while applying less stringent measures for low-risk providers [11]. This approach not only avoids immediate breaches of contract but also fosters long-term commercial relationships [1][2]. Daniel Barnes from Gatekeeper underscores the importance of this:

"If your contract doesn't ensure you're getting the correct behaviours from your vendors to be compliant with ESG requirements, then you'll be the one dealing with the consequences" [13].

Conclusion

This guide highlights the importance of crafting precise and measurable ESG clauses to avoid disputes and ensure compliance. When contracts rely on vague or aspirational language, they create enforcement hurdles and increase the risk of legal challenges and reputational harm. The solution lies in specificity - incorporating concrete KPIs, standardized reporting mechanisms, and well-defined audit rights allows for objective compliance verification.

With regulatory scrutiny intensifying, the risks of unclear ESG commitments have grown. Effective clauses strike a balance between enforceability and commercial practicality, employing tools like climate remediation fees or corrective action plans as gradated remedies. Shifting from static, point-in-time representations to ongoing compliance covenants adds another layer of reliability. Additionally, cascading obligations that extend ESG standards throughout the supply chain can further bolster contractual integrity.

Navigating the complexities of varying jurisdictions and evolving regulations requires expert advice. Professionals can help differentiate between obligations of means and obligations of results, tailor clauses to address specific industry risks, and adapt contracts to accommodate changing regulatory landscapes. These strategies underscore the critical role of expertise in embedding strong ESG measures into contractual agreements.

"Your contracts need to support your ESG values, not quietly undermine them" – Sarah Gunton, Harper James [5]

With two-thirds of investors now factoring ESG considerations into their decisions [5], well-constructed clauses are no longer optional - they are essential for maintaining credibility and achieving long-term success.

FAQs

What’s the difference between obligations of means and obligations of result in ESG clauses?

Obligations of means and obligations of result represent two distinct levels of commitment often found in ESG clauses. An obligation of means requires parties to make reasonable efforts toward achieving a goal but does not promise a specific outcome. For instance, a company might pledge to work toward lowering emissions by adopting certain practices. On the other hand, an obligation of result demands accountability for meeting a defined, measurable target, such as cutting carbon emissions by 20% within a specified period.

When drafting ESG clauses, it’s essential to specify whether the commitment falls under an obligation of means or result. This distinction plays a crucial role in enforcement and can influence the likelihood of disputes. Using clear language and establishing measurable criteria ensures all parties have a shared understanding of their roles and expectations.

How can companies draft ESG clauses that comply with both U.S. and international regulations?

To ensure that ESG clauses align with both U.S. and international regulations, companies must begin by identifying the relevant legal and regulatory frameworks. Within the U.S., this involves referencing guidelines such as the SEC’s climate-related disclosure requirements and state-specific supply chain laws. On the international stage, organizations should account for regulations like the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) and follow guidance from bodies like the OECD and United Nations. Explicitly naming these regulations within contracts eliminates confusion and establishes clear expectations for compliance.

Practical measures for ensuring compliance should also be embedded in contracts. This can include requiring periodic ESG reporting that adheres to recognized standards like GRI or SASB, granting audit rights to verify adherence, and outlining specific consequences for non-compliance. Defining terms such as "material ESG breach" with precision can minimize misunderstandings and reduce the likelihood of disputes.

Finally, staying proactive is crucial. Contracts should include provisions that allow ESG commitments to evolve in response to changing regulations. Partnering with experts, such as Council Fire, can further support companies in navigating compliance while advancing broader sustainability efforts.

How can I draft ESG clauses to avoid greenwashing claims?

To ensure ESG commitments are taken seriously and not dismissed as greenwashing, it’s essential to draft contract clauses that are specific, measurable, and enforceable. Use clear, quantifiable terms like "reduce Scope 1 CO₂ emissions by 15% by December 31, 2026", instead of ambiguous phrases such as "reasonable efforts." Contracts should outline performance metrics, require regular progress reporting (e.g., quarterly updates), and include independent third-party verification to maintain accountability. Additionally, include enforceable consequences for non-compliance, such as financial penalties or the option to terminate the agreement.

Make sure the ESG language in contracts aligns with your organization’s internal policies and addresses the unique risks tied to the transaction. Regularly reviewing and updating targets ensures they stay relevant as standards evolve. Transparent communication and collaboration with stakeholders are also key to building trust and credibility. Council Fire offers guidance in crafting precise ESG terms, setting up verification processes, and reinforcing trust through well-defined, transparent commitments.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 26, 2025

How to Draft ESG Clauses to Avoid Disputes

ESG Strategy

In This Article

Use SMART goals, measurable KPIs, verification and clear remedies to draft enforceable ESG clauses that reduce disputes, greenwashing and legal risk.

How to Draft ESG Clauses to Avoid Disputes

Clear ESG clauses are essential to prevent disputes and ensure accountability in contracts. Vague commitments like "sustainable practices" often lead to greenwashing accusations and enforcement challenges. By drafting measurable, enforceable terms, you can strengthen compliance and reduce legal risks.

Key Takeaways:

Use the SMART Framework: Define goals that are Specific, Measurable, Achievable, Relevant, and Time-bound.

Clarify Obligations: Differentiate between "obligations of means" (effort-focused) and "obligations of result" (outcome-focused).

Set Measurable KPIs: Examples include reducing emissions by a specific percentage or ensuring a living wage for workers.

Include Remedies: Specify penalties, service credits, or corrective actions for non-compliance.

Plan for Termination: Designate critical ESG terms as "essential clauses" to allow contract termination for severe breaches.

Account for Jurisdictional Differences: Tailor clauses to local and international ESG laws and standards.

Contracts with precise ESG terms not only align with growing regulatory demands but also protect against reputational and legal risks. This guide provides actionable steps to draft effective clauses that reduce ambiguity and ensure compliance.

Drafting ESG Compliant Clauses in Contracts - A Guide for Commercial Contract Lawyers - Webinar

Core Principles for Drafting Enforceable ESG Clauses

To create effective ESG clauses, it’s crucial to shift from broad, aspirational language to precise and enforceable terms. This approach ensures that commitments are not just promises but measurable obligations that both parties can understand and monitor throughout the contract’s duration.

Two frameworks - the SMART approach and the SME checklist - provide practical guidance for turning vague goals into actionable and enforceable contract terms.

The SMART Approach

The SMART framework helps refine ESG goals into specific, actionable obligations by applying five essential criteria:

Specific: Clearly define requirements instead of using vague terms like "environmentally conscious." For instance, specify a target such as "reduce water usage by 30%."

Measurable: Use objective metrics or recognized standards to track progress, ensuring obligations can be verified.

Achievable: Set targets that are realistic and commercially feasible based on the counterparty’s resources and capabilities.

Relevant: Tailor clauses to the industry, geography, and specific supply chain risks involved.

Time-bound: Establish clear deadlines and reporting intervals, such as quarterly emissions reports or annual diversity audits, to maintain accountability.

"Organisations should try to include specific and measurable obligations, eg through targets or metrics that can be monitored and verified objectively." – Allens [1]

This framework strengthens the legal foundation of ESG clauses, reducing ambiguity and potential disputes over interpretation.

The SME Checklist

The SME checklist complements the SMART approach by focusing on enforceability. It emphasizes the distinction between two types of obligations:

Obligation of Means: Requires best efforts but does not guarantee results.

Obligation of Result: Guarantees specific outcomes, making a breach clear if targets are unmet, regardless of effort.

For obligations of result, remedies such as liquidated damages, service credits, or mandatory corrective actions can be included to address non-compliance. Additionally, designating ESG commitments as "essential clauses" provides a strong legal basis for unilateral termination in case of significant breaches.

Audit rights, paired with provisions for third-party verification and access to relevant documentation, further enhance enforceability by ensuring transparency and accountability.

Framework Element | Key Application | Legal Impact |

|---|---|---|

SMART: Specific | Define exact targets (e.g., "reduce water usage by 30%") | Reduces interpretation disputes |

SMART: Measurable | Use verifiable KPIs tied to industry standards | Enables objective performance tracking |

SMART: Achievable | Align targets with counterparty capabilities | Prevents immediate breach risks |

SME: Enforceable | Specify remedies like liquidated damages or audits | Ensures clear legal recourse for violations |

SME: Essential Designation | Mark critical ESG terms as "essential clauses" | Justifies unilateral termination for breaches |

7 Steps to Draft ESG Clauses That Minimize Disputes

7-Step Process for Drafting Dispute-Free ESG Clauses

Drafting ESG clauses that avoid disputes requires a thoughtful approach that combines clear legal language with practical implementation. Here’s a step-by-step guide to help create effective clauses that reduce ambiguity and prevent conflicts.

Step 1: Align Clauses with Organizational ESG Policies

Start by ensuring that ESG clauses mirror your organization's actual capabilities and public commitments. Misalignment can lead to both legal risks and reputational damage.

"Contracting parties should ensure that ESG provisions in their agreements align with their internal policies and operational capabilities, as misalignment may lead to legal exposure or reputational harm." – RDS Law Partners [7]

To strengthen alignment, attach internal codes of conduct or ESG policies to the contract and require signed acknowledgment. Simply linking to a website is insufficient. For example, Volkswagen's 2015 emissions scandal, where software was manipulated to appear more eco-friendly, resulted in fines and settlements amounting to $30 billion [8]. Conduct materiality assessments to pinpoint the most critical ESG issues for your business and stakeholders. Collaboration among sustainability, procurement, compliance, and finance teams ensures that commitments are realistic and enforceable. Consider a tiered approach for clauses, ranging from encouragement to obligations or incentives, and define measurable targets to reinforce commitments.

Step 2: Define Measurable Key Performance Indicators (KPIs)

Set clear, quantifiable goals using established standards like ISO 14001 for environmental objectives or the UN Guiding Principles for social commitments.

"Organisations should try to include specific and measurable obligations, eg through targets or metrics that can be monitored and verified objectively." – Elyse Adams, Partner, Allens [1]

Differentiate between obligations of means (best efforts) and obligations of result (guaranteed outcomes), as some legal systems assume fault if specific results aren't achieved [6]. Standardize reporting formats to ensure consistency and transparency across the supply chain. Below are examples of measurable KPIs:

KPI Category | Example Metric | Reference Standard |

|---|---|---|

Environmental | Percentage reduction in Scope 1 and 2 GHG emissions | |

Social | Percentage of workforce paid a living wage | UN Guiding Principles (UNGP) |

Governance | Number of employees completing anti-corruption training | ISO 37001 (Anti-bribery) |

Supply Chain | Percentage of Tier 1 suppliers audited for modern slavery |

Step 3: Specify Reporting and Verification Requirements

Clearly define timelines and mechanisms for reporting and verification. For instance, set deadlines like "no later than March 31" to align with corporate reporting cycles and avoid confusion [7]. Require third-party audits and detailed documentation to verify compliance. Suppliers should report any violations or failures to meet KPIs immediately in writing [3]. Define reporting formats, including the required data points and calculation methods, to ensure clarity. Additionally, include procedures for disclosing ESG-related incidents or risks as they occur, enabling proactive management.

Step 4: Outline Consequences for Non-Compliance

Without consequences, ESG clauses remain aspirational. Specify remedies like liquidated damages, service credits, or mandatory corrective actions for unmet commitments [1][6].

Recent enforcement highlights the importance of this step. Since July 1, 2022, the Australian Securities and Investments Commission (ASIC) has issued 12 infringement notices and initiated three civil penalty proceedings related to ESG misconduct [1]. Tie KPI failures to graduated responses based on severity. Minor breaches might trigger remediation plans with set timelines, while major or repeated violations could lead to financial penalties or contract termination. Include detailed remediation plans that outline corrective steps and deadlines to maintain accountability.

Step 5: Include Termination Rights for Material Breaches

Address termination rights for significant ESG violations by designating critical commitments as "essential clauses." This provides a strong legal foundation for unilateral termination in cases of serious breaches [1]. Define "material breaches" with clear criteria, such as repeated failure to meet emissions targets, evidence of forced labor, or falsified ESG reports. Structure these rights to distinguish between curable breaches (allowing a notice period for remedy) and incurable breaches (permitting immediate termination for severe violations).

Step 6: Account for Jurisdictional Variations

ESG standards and regulations vary widely across countries, especially in global supply chains [4]. For example, the European Union's Corporate Sustainability Due Diligence Directive (CSDDD) significantly influences how ESG clauses are framed in cross-border agreements [7].

"ESG contractual provisions will be particularly key where there are different standards, laws or regulations, and levels of transparency, between various countries along the supply chain." – Norton Rose Fulbright [4]

Tailor clauses to the regulatory environment of each jurisdiction. Apply both local ("host") and company ("home") country laws to ensure commitments are practical. Use cascading obligations that require direct suppliers to pass ESG requirements down to their subcontractors. Reference international frameworks like the UN Guiding Principles or OECD Guidelines to establish a shared baseline. When relevant, cite local statutes such as the Foreign Corrupt Practices Act (US) or Modern Slavery Acts (UK/Australia) to ensure clarity and enforceability.

Common Pitfalls in ESG Clause Drafting and How to Avoid Them

Drafting effective ESG clauses requires precision and foresight. Missteps in this process can lead to disputes, regulatory scrutiny, or unenforceable agreements. Identifying and addressing common pitfalls ensures that clauses are both practical and enforceable.

Using Ambiguous Language

Vague terms like "environmentally conscious" or "perform activities ethically" often lead to disputes because they lack clear, objective standards. Similarly, phrases such as "best efforts" or "endeavor to" fail to establish measurable compliance benchmarks, leaving room for interpretation.

To avoid these issues, replace ambiguous language with precise, quantifiable terms tied to recognized standards. For example, instead of "best efforts" or "environmentally conscious", specify obligations such as achieving a defined emissions reduction verified by an established framework. Clearly distinguish between obligations of means - committing to reasonable efforts - and obligations of result, where failing to meet a specific outcome constitutes a breach [6].

Mitigating Greenwashing Risks

Exaggerated claims in ESG clauses can lead to accusations of greenwashing, exposing parties to regulatory penalties and reputational damage. The rise in companies referencing terms like "net zero" or "carbon neutral" has drawn increased scrutiny, with regulators responding aggressively. For instance, between July 1, 2022, and early 2025, ASIC issued 12 infringement notices and initiated three civil penalty proceedings related to ESG misconduct [1].

Notable cases include the Federal Court's $10.5 million penalty against Active Super in March 2025 for misrepresenting its ESG practices and Clorox's $8.25 million penalty in April 2025 for misleading claims about products made with recycled ocean plastic [9].

To mitigate greenwashing risks, align ESG commitments with your operational realities and internal policies. Set achievable targets based on realistic timelines and resources. A tiered approach - ranging from encouraging performance to rewarding or mandating it - can provide flexibility while avoiding overpromises. Including materiality qualifiers helps limit liability for minor technical breaches while emphasizing accountability for significant violations [1][3].

Ensuring Quantifiable Targets

Measurable targets are essential for enforceable ESG clauses. Vague aspirations lack the clarity needed for compliance and monitoring. Instead, define commitments in concrete terms, such as requiring that 100% of raw materials come from certified suppliers. Use external standards like the Science Based Targets initiative (SBTi) to establish clear benchmarks understood by all parties.

To strengthen enforceability, standardize reporting formats across your supply chain and mandate third-party audits to verify compliance data [3][6]. Clearly outline whether each commitment is an obligation of means or result, ensuring that critical goals are specific and actionable. By setting precise targets, ESG clauses move from aspirational language to enforceable obligations, creating a solid foundation for monitoring and accountability.

Enforcement and Monitoring Mechanisms for ESG Clauses

Having clear ESG clauses is just the first step - ensuring compliance and addressing breaches effectively is where the real work begins. Without proper monitoring and enforcement, even the most well-crafted clauses risk becoming empty promises.

Tracking Obligations and Performance

Enforcement begins by shifting from one-time verifications to covenants that ensure ongoing compliance throughout the contract's duration [3]. This approach keeps all parties accountable over time, rather than relying on a single snapshot of adherence.

To ensure effective tracking, set clear and specific requirements. For instance, suppliers might be required to submit quarterly ESG performance reports [10]. Additionally, define the frequency of audits, such as bi-annual unannounced inspections, and clarify who bears the cost of these audits. Establishing upfront roles for third-party verification can also reduce ambiguity [3][6].

While automated monitoring tools can streamline compliance tracking, human oversight remains critical. A human review step ensures that any automated remediation notices are legally enforceable and appropriately applied [10].

Cascading obligations are another key element. By including clauses that require direct suppliers to impose equivalent ESG standards on their subcontractors, you strengthen compliance throughout the supply chain. As Stéphanie De Smedt, Partner at Loyens & Loeff, aptly puts it:

"The chain is of course only as strong as its weakest link" [6].

When breaches occur, immediate notification and corrective action plans should be mandatory. Allowing suppliers to address violations before triggering termination can resolve issues without prematurely ending the relationship [3][1]. Alternative remedies, such as service credits for failing to meet KPIs or mandatory contributions to rehabilitation efforts, can often be more constructive than outright termination [1][6].

These monitoring strategies naturally tie into broader risk mitigation efforts, which are further bolstered by strong ESG clauses.

Risk Mitigation Through Strong Clauses

Once monitoring systems are in place, the strength of your ESG clauses becomes your next line of defense against disputes. The clarity and specificity of these clauses directly impact your ability to avoid and resolve conflicts.

Clause Type | Vague Clause Example | Strong ESG Clause Example | Impact on Dispute Mitigation |

|---|---|---|---|

Environmental | "Supplier shall act in an environmentally conscious manner." | "Supplier shall reduce Scope 1 GHG emissions by 20% by December 31, 2026, against a 2024 baseline, verified by [Specific Standard]." | Strong clauses provide measurable benchmarks, reducing ambiguity about compliance. |

Social/Labor | "Supplier will perform its activities ethically." | "Supplier shall provide evidence of a valid [Specific Certification] and permit bi-annual unannounced audits of labor conditions." | Clear verification rights and evidence-based compliance minimize room for disputes. |

Governance | "Supplier agrees to comply with all applicable ESG laws." | "Supplier shall implement a whistleblowing policy with anonymous reporting and notify Buyer of any violations within 48 hours." | Proactive monitoring and immediate notification requirements strengthen accountability. |

Designating critical ESG commitments as "essential clauses" in contracts can further strengthen enforcement. This designation makes it easier to justify unilateral termination in cases of material breaches [6].

For situations involving non-quantifiable losses, consider including provisions for liquidated damages or lump-sum indemnities. These should be compensatory rather than punitive, ensuring fairness while addressing breaches [3][6].

Finally, whether you choose an obligation of means (requiring reasonable efforts) or an obligation of result (requiring specific outcomes) can significantly influence enforcement. Opting for obligations of result shifts the burden to the supplier, enhancing your legal position in cases of non-compliance [6].

The Role of Expert Consulting in ESG Clause Drafting

Why Partner with Experts

Expert consulting plays a pivotal role in refining ESG clause drafting by blending technical precision with strategic goals. This collaboration ensures that clauses are not only enforceable but also aligned with broader organizational objectives.

Drafting effective ESG clauses requires a combination of legal, financial, and sustainability expertise [12]. Expert consultants fill the gaps that standard legal teams might overlook [6]. They conduct comprehensive supply chain due diligence, transforming vague commitments into specific, measurable targets that can be tracked objectively [1][6]. Such precision is essential, especially considering enforcement actions against greenwashing doubled between 2022 and 2024 [12].

Consultancies like Council Fire specialize in integrating profitability with measurable ESG outcomes. Their systems-based approach ensures that ESG clauses align with an organization’s overarching goals while remaining enforceable across varying regulatory frameworks.

This level of expertise is particularly beneficial for tailoring clauses to address risks unique to specific industries.

Tailoring ESG Clauses to Minimize Disputes

Customizing ESG clauses to suit your industry and regulatory environment enhances enforceability and reduces the likelihood of disputes.

Generic clauses often fail to address the specific risks associated with particular industries, regions, or transaction types. Expert consultants help refine these provisions by clearly defining ESG-related terms - such as "Net Zero" or "Supply Chain Visibility" - to ensure both parties share a common understanding, thereby minimizing potential conflicts [13].

For global supply chains, consultants bring essential expertise in navigating multi-jurisdictional challenges. As Norton Rose Fulbright highlights:

"ESG contractual provisions will be particularly key where there are different standards, laws or regulations, and levels of transparency, between various countries along the supply chain" [4].

Consultants also implement tiered compliance strategies, requiring stricter standards for high-risk suppliers while applying less stringent measures for low-risk providers [11]. This approach not only avoids immediate breaches of contract but also fosters long-term commercial relationships [1][2]. Daniel Barnes from Gatekeeper underscores the importance of this:

"If your contract doesn't ensure you're getting the correct behaviours from your vendors to be compliant with ESG requirements, then you'll be the one dealing with the consequences" [13].

Conclusion

This guide highlights the importance of crafting precise and measurable ESG clauses to avoid disputes and ensure compliance. When contracts rely on vague or aspirational language, they create enforcement hurdles and increase the risk of legal challenges and reputational harm. The solution lies in specificity - incorporating concrete KPIs, standardized reporting mechanisms, and well-defined audit rights allows for objective compliance verification.

With regulatory scrutiny intensifying, the risks of unclear ESG commitments have grown. Effective clauses strike a balance between enforceability and commercial practicality, employing tools like climate remediation fees or corrective action plans as gradated remedies. Shifting from static, point-in-time representations to ongoing compliance covenants adds another layer of reliability. Additionally, cascading obligations that extend ESG standards throughout the supply chain can further bolster contractual integrity.

Navigating the complexities of varying jurisdictions and evolving regulations requires expert advice. Professionals can help differentiate between obligations of means and obligations of results, tailor clauses to address specific industry risks, and adapt contracts to accommodate changing regulatory landscapes. These strategies underscore the critical role of expertise in embedding strong ESG measures into contractual agreements.

"Your contracts need to support your ESG values, not quietly undermine them" – Sarah Gunton, Harper James [5]

With two-thirds of investors now factoring ESG considerations into their decisions [5], well-constructed clauses are no longer optional - they are essential for maintaining credibility and achieving long-term success.

FAQs

What’s the difference between obligations of means and obligations of result in ESG clauses?

Obligations of means and obligations of result represent two distinct levels of commitment often found in ESG clauses. An obligation of means requires parties to make reasonable efforts toward achieving a goal but does not promise a specific outcome. For instance, a company might pledge to work toward lowering emissions by adopting certain practices. On the other hand, an obligation of result demands accountability for meeting a defined, measurable target, such as cutting carbon emissions by 20% within a specified period.

When drafting ESG clauses, it’s essential to specify whether the commitment falls under an obligation of means or result. This distinction plays a crucial role in enforcement and can influence the likelihood of disputes. Using clear language and establishing measurable criteria ensures all parties have a shared understanding of their roles and expectations.

How can companies draft ESG clauses that comply with both U.S. and international regulations?

To ensure that ESG clauses align with both U.S. and international regulations, companies must begin by identifying the relevant legal and regulatory frameworks. Within the U.S., this involves referencing guidelines such as the SEC’s climate-related disclosure requirements and state-specific supply chain laws. On the international stage, organizations should account for regulations like the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) and follow guidance from bodies like the OECD and United Nations. Explicitly naming these regulations within contracts eliminates confusion and establishes clear expectations for compliance.

Practical measures for ensuring compliance should also be embedded in contracts. This can include requiring periodic ESG reporting that adheres to recognized standards like GRI or SASB, granting audit rights to verify adherence, and outlining specific consequences for non-compliance. Defining terms such as "material ESG breach" with precision can minimize misunderstandings and reduce the likelihood of disputes.

Finally, staying proactive is crucial. Contracts should include provisions that allow ESG commitments to evolve in response to changing regulations. Partnering with experts, such as Council Fire, can further support companies in navigating compliance while advancing broader sustainability efforts.

How can I draft ESG clauses to avoid greenwashing claims?