Dec 18, 2025

Dec 18, 2025

Cross-Border ESG Rules: What Businesses Need to Know

ESG Strategy

ESG Strategy

In This Article

Cross-border ESG rules shape market access; companies must map obligations, align reporting standards, and tighten data, governance, and supply-chain controls.

Cross-Border ESG Rules: What Businesses Need to Know

Navigating cross-border ESG (Environmental, Social, and Governance) regulations is becoming more complex as jurisdictions enforce varying standards. Businesses must comply with rules like the EU's Corporate Sustainability Reporting Directive (CSRD) and California’s climate laws, which often apply to multinational companies based on revenue or operations. Non-compliance risks include fines, reputational damage, and restricted market access. Here's what you need to know:

Key Differences in ESG Standards: The EU focuses on "double materiality" (financial and societal impacts), while U.S. rules prioritize financial materiality.

Who Must Comply: EU CSRD applies to companies with €450M+ in revenue and 1,000+ employees, while California’s SB 253 targets companies with $1B+ in revenue operating in the state.

Global Reporting Standards: ISSB, GHG Protocol, and TCFD are widely used frameworks to align disclosures across regions.

Challenges: Tracking evolving regulations, managing supply chain due diligence, and ensuring accurate data collection are critical hurdles.

Benefits of Early Action: Companies adopting robust ESG strategies gain better access to capital, stronger supply chains, and improved risk management.

To succeed, businesses must map regulatory exposure, align with global standards, and establish governance structures. ESG compliance is no longer optional - it’s a critical factor in maintaining competitiveness and trust.

ESG Through a Legal Lens with Christian Perez-Font

Map Your Regulatory Exposure Across Jurisdictions

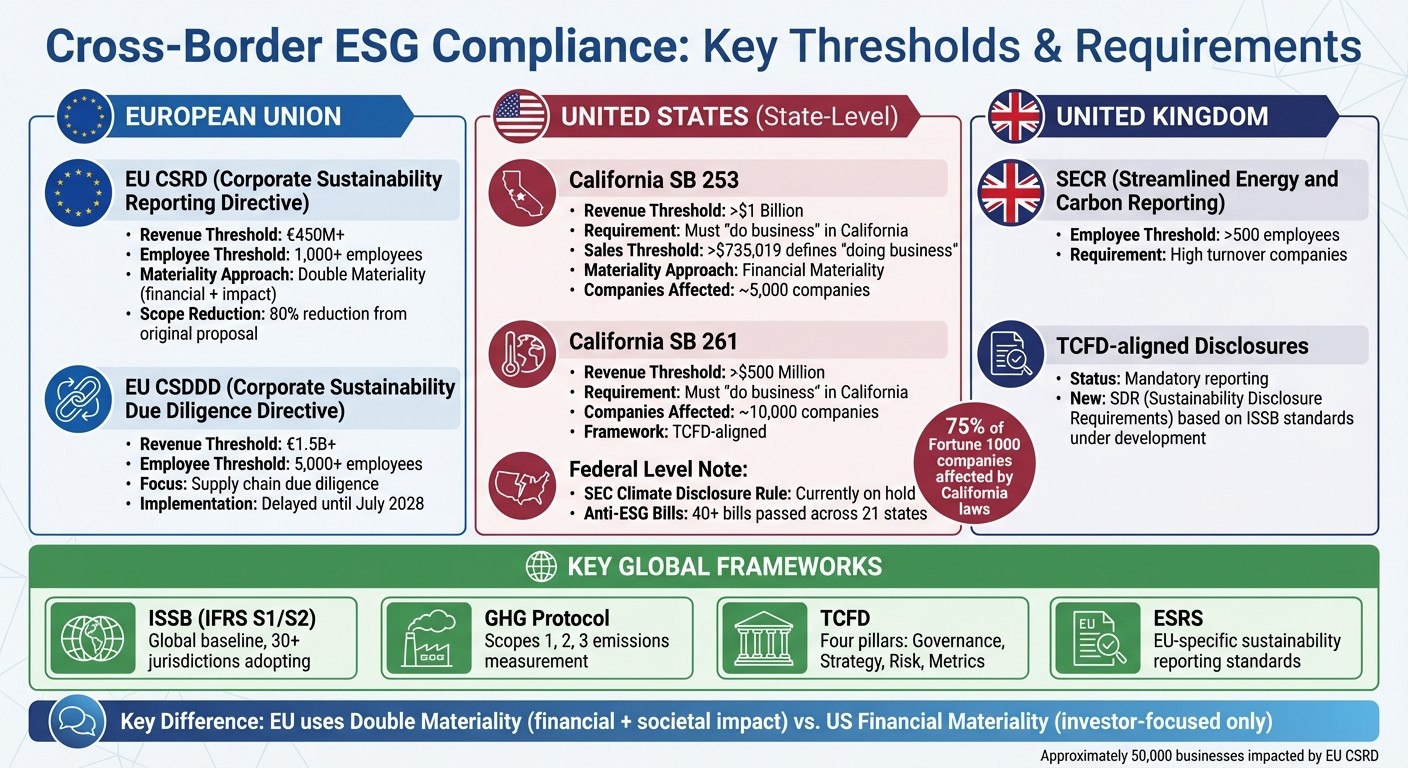

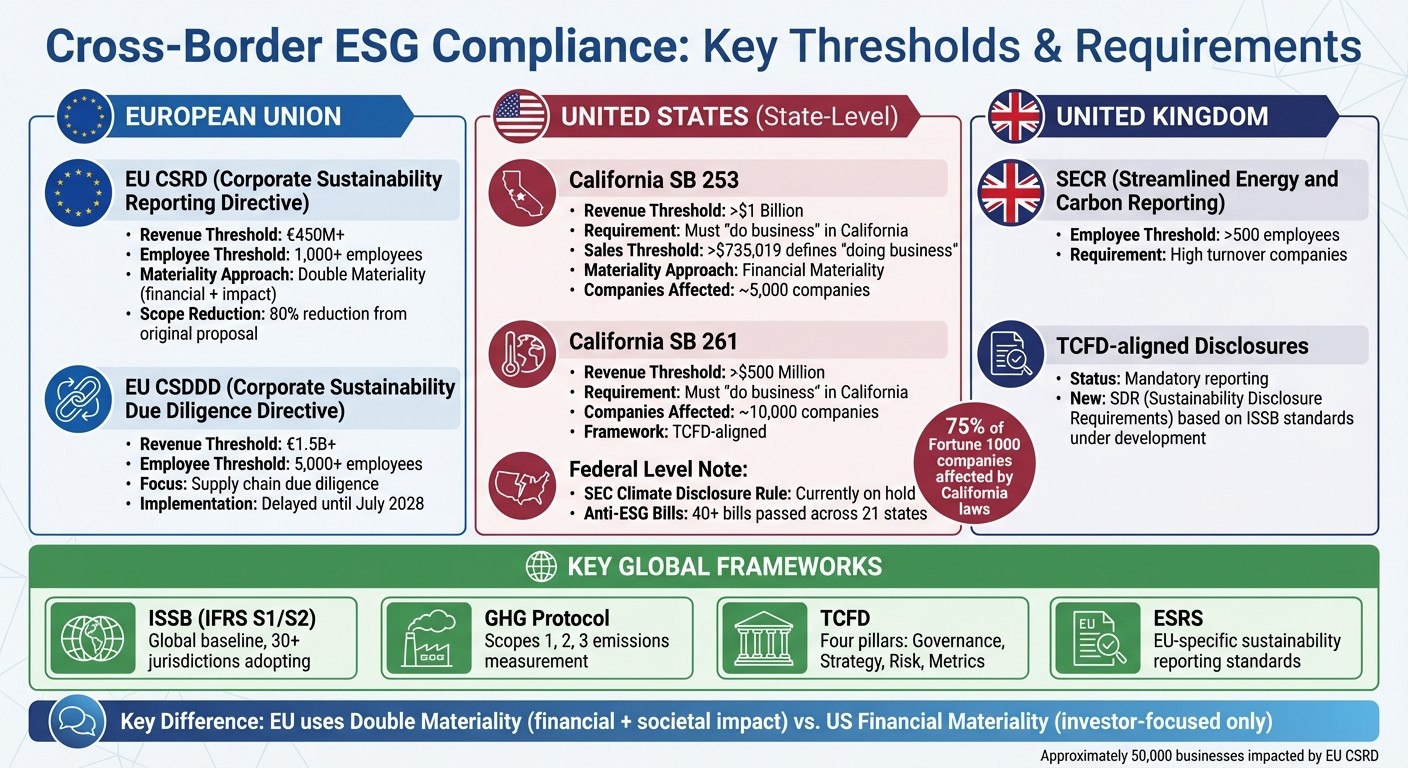

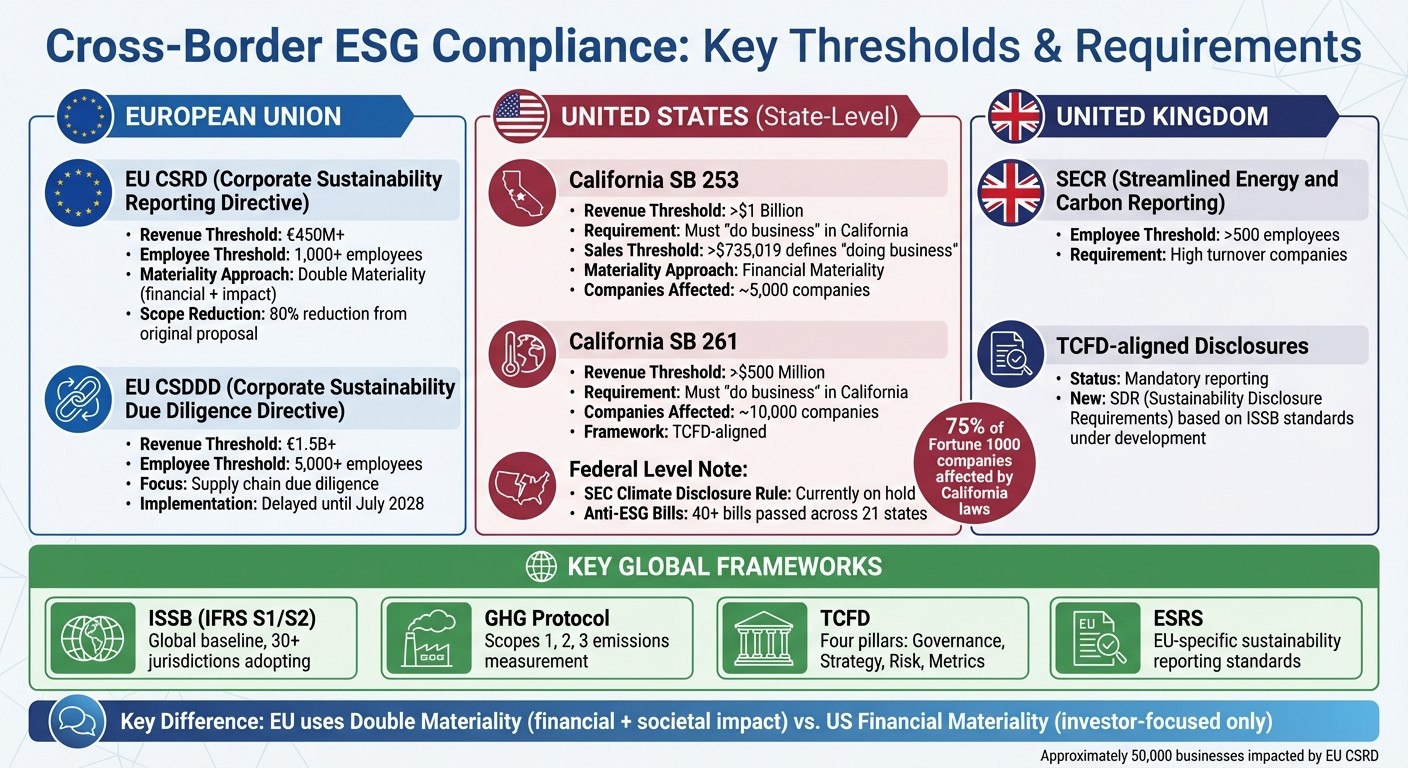

Cross-Border ESG Compliance Thresholds and Requirements by Jurisdiction

Identify Which Regulations Apply to Your Business

To begin, you need to pinpoint which ESG regulations are relevant to your operations. The rules you must follow depend on factors such as where your business operates, the locations of your subsidiaries, and where you generate revenue. Different regions approach ESG compliance in varying ways.

In the European Union, two directives play a central role. The Corporate Sustainability Reporting Directive (CSRD) demands detailed sustainability disclosures, while the Corporate Sustainability Due Diligence Directive (CSDDD) requires businesses to assess human rights and environmental risks throughout their supply chains. Recently, the EU introduced changes through the revised Omnibus proposal, significantly raising compliance thresholds to bolster European competitiveness.

In the United States, federal ESG regulation has slowed, with the SEC Climate Disclosure Rule currently on hold. Instead, state-level initiatives are taking the lead. California's SB 253 and SB 261 climate laws have become benchmarks for large companies. Other states, such as New York and Vermont, are also rolling out climate liability laws targeting specific industries [2][3].

The United Kingdom enforces mandatory reporting through frameworks like Streamlined Energy and Carbon Reporting (SECR) and TCFD-aligned disclosures. Additionally, new Sustainability Disclosure Requirements (SDR) based on ISSB standards are under development [1].

One major challenge businesses face is the difference in materiality standards across regions. The EU employs "double materiality", which considers both the financial impact of sustainability issues on businesses and their broader societal and environmental effects. In contrast, U.S. regulations focus solely on "financial materiality" [1][2]. This divergence may require businesses to prepare separate disclosures for different markets.

Once you’ve identified which regulations apply, assess whether your operations meet the thresholds that trigger compliance.

Check If You Meet Compliance Thresholds

After identifying your regulatory obligations, the next step is determining whether your company meets the thresholds that require compliance. These thresholds often depend on factors like revenue, employee numbers, or specific operational metrics.

For California’s climate regulations, SB 253 applies to U.S. companies with annual revenues exceeding $1 billion that conduct business in California. SB 261 has a lower threshold of $500 million in revenue [9]. According to the California Franchise Tax Board, "doing business" includes companies organized in California or those with sales surpassing $735,019 [9]. Approximately 10,000 companies are subject to SB 261, with half of those also meeting SB 253 requirements [3].

In the European Union, the revised Omnibus proposal has narrowed the scope of the CSRD, which now applies only to companies with more than 1,000 employees and €450 million in revenue [8][10]. This represents an 80% reduction in scope compared to the original plan [3]. The CSDDD applies to companies with at least 5,000 employees and €1.5 billion in revenue [8][10].

"The commission's proposal would reduce the scope of the CSRD by 80%, only applying to companies with more than 1,000 employees" [3].

Regulation | Revenue Threshold | Employee/Other Threshold | Market |

|---|---|---|---|

CA SB 253 | > $1 Billion | Must "do business" in California | U.S. (State) |

CA SB 261 | > $500 Million | Must "do business" in California | U.S. (State) |

EU CSRD (2025) | €450M+ | > 1,000 employees | European Union |

EU CSDDD | €1.5B+ | > 5,000 employees | European Union |

UK SECR | High turnover | > 500 employees | United Kingdom |

You should also evaluate whether your subsidiaries can rely on consolidated parent-level reporting to meet compliance. Both California and EU regulations allow this under certain conditions [9]. For instance, U.S. multinationals operating in the EU may qualify for the "sister company" exemption, which permits large EU subsidiaries of non-EU parents to report on a consolidated basis until fiscal year 2029 [2].

Track Policy Changes and Trade Developments

Once your compliance obligations are clear, it’s crucial to stay updated as regulations and policies evolve. ESG requirements are constantly shifting, and keeping up with these changes helps avoid compliance gaps or unnecessary reporting efforts.

The EU’s Omnibus package aims to reduce CSRD and CSDDD reporting requirements by at least 25% [10]. By February 2025, 20 EU countries had integrated the CSRD into national law, while 10 others had not [3]. Additionally, the initial application of the CSDDD for the first group of companies has been delayed until July 2028 [3]. These updates mean businesses should reassess whether their EU subsidiaries meet the revised thresholds before committing to extensive reporting frameworks [8].

In the U.S., while federal ESG mandates are deprioritized, state-level initiatives are gaining momentum. Over 40 anti-ESG bills have been passed across 21 states, primarily affecting financial institutions and state contractors [3]. This has created a divide between states like California, New York, and Illinois, which support ESG initiatives, and others that actively restrict the use of non-financial factors in investment and contracting decisions [3].

To manage these complexities, consider forming a cross-functional ESG steering committee. This team, including representatives from finance, legal, risk, compliance, and supply chain departments, can monitor regulatory updates, engage with trade associations, and maintain open communication with regulators. Additionally, working with external consultants or legal experts specializing in ESG compliance can help you navigate fragmented requirements across jurisdictions [3].

Set Up Your Cross-Border ESG Reporting Framework

Align With Global Reporting Standards

After understanding your regulatory requirements, the next step is to create a reporting framework that works across different jurisdictions. Since regions follow varying standards, it's essential to identify where these standards align and where they differ.

The ISSB (IFRS S1 and S2) has become the global benchmark for sustainability disclosures. S1 addresses general sustainability-related financial information, while S2 focuses on climate-related disclosures [11]. Over 30 jurisdictions have already adopted or are in the process of adopting ISSB standards into their local regulations [12]. Countries like the UK, Japan, and Brazil are also aligning their national frameworks with ISSB for better global compatibility [4].

In the European Union, companies must adhere to the European Sustainability Reporting Standards (ESRS) under the CSRD. These standards emphasize "double materiality", requiring businesses to disclose both the financial impact of sustainability issues and their broader societal and environmental effects [5].

The GHG Protocol serves as the primary standard for measuring greenhouse gas emissions across Scopes 1, 2, and 3, and it is a key element in most mandatory reporting frameworks [4]. For example, California’s SB 253 mandates compliance with the GHG Protocol for emissions reporting [13].

"Understanding where the frameworks align and diverge will help companies develop the requisite reporting strategy, data gathering processes, and related controls, providing for a streamlined process and effective deployment of resources." - PwC [13]

To streamline efforts, map the overlaps between standards. For instance, both GRI and ESRS share common elements, enabling businesses to structure data collection to meet both frameworks simultaneously [6]. Conducting a gap analysis against frameworks like TCFD or ISSB can help identify missing metrics early [6].

Standard | Focus | Materiality Approach | Key Application |

|---|---|---|---|

ISSB (IFRS S1/S2) | General sustainability & climate | Financial (investor-focused) | Global baseline |

EU ESRS | Full ESG (environment, social, governance) | Double (financial + impact) | EU mandatory |

GHG Protocol | Greenhouse gas emissions (Scopes 1, 2, 3) | N/A | Embedded in most rules |

TCFD | Climate-related risks | Financial | Widely adopted; ISSB monitoring since 2024 |

These global standards serve as the foundation for consistent cross-border ESG reporting. Once aligned, the next step is to focus on establishing reliable data controls.

Build Data Collection and Control Systems

Accurate and reliable data is the cornerstone of effective ESG reporting. To meet regulatory requirements and avoid compliance issues, it's crucial to develop robust systems for data collection and control.

For EU CSRD compliance, businesses must track both "impact materiality" (how operations affect society and the environment) and "financial materiality" (how sustainability issues impact the business itself) [12]. The key to effective reporting lies in accuracy, automation, and auditability. A staggering 96% of financial leaders report challenges with ESG data, citing inaccuracies, inconsistencies, and unclear definitions as major hurdles [16]. Specialized ESG reporting software can address these issues by providing a centralized and auditable data source [4].

Since ISSB standards require sustainability disclosures to be integrated with financial statements, it's important to align ESG and financial data controls [12]. Leveraging existing frameworks, like the Committee of Sponsoring Organizations (COSO) framework, can bring the same level of rigor to sustainability data [4].

For businesses adopting ISSB standards, climate-related risks should be prioritized in the first year, with full reporting on other sustainability topics expected in the second year. Using the TCFD's four pillars - Governance, Strategy, Risk Management, and Metrics/Targets - as a foundational structure for data controls is particularly effective. This framework is widely used by the SEC, ISSB, and California SB 261 [13].

Prepare for Assurance and Verification

As ESG reporting transitions from voluntary to mandatory, third-party verification is becoming the standard to ensure transparency and combat greenwashing [14]. Once your data systems are reliable and integrated, the next step is to plan for independent verification.

Start by identifying the assurance standards applicable to your jurisdiction. In the U.S., SSAEs (Standards for Attestation Engagements) are commonly used, while internationally, ISAE 3000 and ISAE 3410 apply to non-financial and greenhouse gas-related statements [14]. The emerging ISSA 5000 standard is also gaining traction as a global benchmark for sustainability engagements [15].

Limited assurance provides a basic level of confidence, while reasonable assurance involves more extensive testing. Under the CSRD, companies are required to start with limited assurance and transition to reasonable assurance over time [15].

"Strong documentation and controls are vital for CSRD compliance and assurance." - RSM US [14]

To support assurance efforts, establish internal control frameworks at three levels: entity-level (governance), process-level (data collection), and system-level (IT) [16]. Maintain detailed documentation of data sources, estimation methods, and judgments made during processing to ensure clear audit trails [16]. Conduct mock audits or "dry runs" to identify and address any gaps before formal assurance engagements begin [16].

Engage qualified assurance providers early, ensuring they have expertise in both sustainability and the legal frameworks of your region. Adopting digital reporting formats, like the IFRS Sustainability Disclosure Taxonomy or XBRL, can further streamline audits with automated validation checks [15].

Establish Governance and Risk Management for ESG Compliance

Once your reporting systems are firmly in place, the next step is to ensure that your ESG governance and risk management processes are just as robust.

Strengthen ESG Oversight

Building governance structures to oversee ESG reporting is critical. Begin by establishing mandatory board-level oversight. Typically, the Audit Committee handles ESG disclosure processes and attestation, while the Nominating and Corporate Governance Committee addresses broader topics like board diversity [7].

At the management level, nearly two-thirds of companies have formed cross-functional ESG committees that include members from the C-suite to mid-management [3]. These committees should bring together representatives from legal, finance, risk, compliance, sustainability, human resources, and supply chain teams to ensure consistency in data protocols and adherence to compliance timelines [7][3].

Clearly document these oversight structures with specific charters that outline membership, meeting schedules, and risk-assessment responsibilities [7]. ESG data management should be fully integrated into your existing Enterprise Risk Management (ERM) frameworks to ensure sustainability risks are treated with the same diligence as financial risks [7]. Implementing a sub-certification process for ESG data, similar to financial reporting practices, can help identify and prevent potential fraud [7].

"In a recent Workiva survey, 97% of C-Suite and other executives agreed that sustainability reporting creates value beyond compliance." - The Conference Board [3]

Embed ESG Due Diligence in Supply Chains

Under the EU Corporate Sustainability Due Diligence Directive (CSDDD), companies must identify, prevent, mitigate, and account for human rights and environmental risks throughout their entire value chain [17][3]. Similar global thresholds apply when managing risks tied to third parties.

Start by mapping all suppliers, subcontractors, and partners. Prioritize risks based on their severity and likelihood, then implement corrective actions as needed [1]. Independent verification is key to addressing common data inaccuracies. Conduct regular monitoring of supplier performance and trends, and consider requesting independence statements or direct access to supplier systems to validate ESG claims [16]. For example, 78% of S&P 500 companies disclosed Scope 3 emissions in 2024, up from 64% in 2021, underscoring the growing focus on supply chain transparency [3].

Effective supply chain due diligence not only strengthens compliance but also reduces exposure to broader trade and investment risks.

Evaluate Trade and Investment Risks

Beyond internal controls and supplier oversight, it’s essential to address external trade and investment challenges. ESG non-compliance can disrupt trade flows, hinder supply chain operations, and influence capital allocation decisions. A double materiality assessment can help measure both financial impacts and broader societal or environmental consequences [1][2][3].

Pay attention to the evolving regulatory landscape. While the EU and UK have unified ESG mandates, the U.S. remains fragmented. For instance, California’s climate disclosure laws are estimated to affect approximately 10,000 companies, including 75% of the Fortune 1000 [3]. At the same time, 21 U.S. states have enacted "anti-ESG" laws, primarily targeting financial institutions and state contractors [3].

Engage independent auditors early to secure third-party assurance and mitigate risks of greenwashing [16][2][3][14]. It’s crucial to ensure ESG information remains consistent across all platforms - SEC filings, corporate websites, and sustainability reports - to avoid claims of greenwashing and regulatory scrutiny [7].

Framework | Jurisdiction | Primary Focus | Materiality Standard |

|---|---|---|---|

CSRD | European Union | Broad ESG (Environment, Social, Governance) | Double Materiality |

CSDDD | European Union | Supply Chain Due Diligence | Impact-based |

SB 253/261 | California (U.S.) | Climate Risks & Emissions | Extensive |

SEC Climate Rule | United States | Climate-related Risks | Financial Materiality |

ISSB Standards | Global Baseline | Investor-focused Sustainability | Financial Materiality |

Implement and Improve Your Compliance Program

Once you've established solid governance and data systems, the next step is to put a well-defined compliance program into action.

Create a Compliance Program

Start by adopting a unified compliance framework based on COSO principles that can be applied across all jurisdictions. Instead of tackling each regulation individually, this overarching framework ensures consistency, transparency, and audit readiness [4]. This approach not only saves time but also reduces the risk of missing critical regulatory requirements.

Clearly define the scope of your program by outlining which business units, facilities, and regions it will cover. Assign dedicated teams to oversee each area, ensuring clear accountability [16][6]. Your control framework should function on multiple levels: entity-level controls for governance, process-level controls for data management, system-level controls for IT integrity, and monitoring controls to facilitate regular audits [16].

Standardize your data collection process by using automated and integrated systems. Automated validation tools can help consolidate ESG metrics, monitor key performance indicators, and produce reports from a single, reliable source [4][11][16]. Whenever possible, leverage your existing financial reporting systems to streamline ESG reporting, taking advantage of already established IT controls [16].

Conduct a gap analysis against global ESG frameworks like GRI, SASB, and TCFD to pinpoint missing metrics or unverified data [6]. It's important to note that failing to comply with regulations can result in steep penalties - up to 4% of global turnover or $20 million [11].

Link ESG Compliance With Business Strategy

Integrate ESG compliance into your core business strategy to maximize its impact. Use insights from regulatory exposure mapping and reporting protocols to shape strategic initiatives. Results from a double materiality assessment can guide the development of your ESG framework and help set measurable, goal-oriented targets [16]. Tie climate, social, and governance risks directly to operational controls and business continuity plans [6]. This approach not only ensures compliance but also opens doors to initiatives like decarbonization, circular economy programs, and stronger stakeholder engagement.

Notably, 61% of companies have established ESG steering committees at the C-Suite level, ensuring that sustainability goals align with broader business objectives [3]. These cross-functional teams are instrumental in embedding ESG considerations into daily operations, from procurement to product design. With ESG-focused institutional investments expected to reach approximately $33.9 trillion by 2026 [11], strong ESG performance is becoming a key factor in securing capital and investor trust.

Monitor Enforcement and Reputational Risks

The regulatory landscape is changing quickly, making it crucial to stay informed. Resources like the "Carrots & Sticks" database, which tracks nearly 2,500 global ESG disclosure policies, can help you monitor requirements across different jurisdictions [18].

Moving away from manual processes is equally critical. A study revealed that 77% of French respondents still rely on manual ESG compliance systems, which significantly increases the likelihood of oversight and breaches [19]. Automating monitoring systems can track over 1,600 data points, including carbon metrics and alignment with the EU Taxonomy, to ensure compliance [19].

Ensure that all ESG communications are backed by verified performance data to minimize the risk of litigation and reputational harm from inaccurate claims [19]. Additionally, prepare for third-party assessments by conducting readiness exercises to confirm the transparency and authenticity of your sustainability disclosures [16]. Regular benchmarking against industry peers can also help you adopt emerging best practices and identify areas where you can improve [16].

Conclusion

Cross-border ESG compliance has evolved from being a voluntary effort to a critical legal and financial requirement, directly influencing market access and investment strategies. With California's climate disclosure laws now covering an estimated 75% of Fortune 1000 companies and the EU's CSRD impacting roughly 50,000 businesses, the urgency to act is undeniable [3][4]. Viewing ESG as a strategic opportunity rather than a mere obligation is key to staying ahead.

The frameworks and governance models discussed earlier provide a solid foundation for tackling these challenges. Whether you're addressing double materiality assessments, managing Scope 3 emissions disclosures, or preparing for mandatory third-party assurance, the most important step is to start now. Delaying action only increases risks and missed opportunities.

"ESG reporting is no longer a compliance checkbox. It's a strategic tool for identifying risk, making informed decisions, building trust, and future-proofing the business." - Pulsora [20]

As regulatory landscapes continue to evolve, staying adaptable is crucial. For instance, the EU's proposed Omnibus package could reduce the CSRD scope by 80%, while U.S. state-level laws are stepping up in response to federal delays [3]. A compliance program that can adjust to these changes without requiring a complete overhaul will save significant resources. Centralized data systems, cross-functional governance teams, and alignment across multiple frameworks can streamline efforts and improve efficiency.

To make these efforts truly impactful, strategic partnerships can play a transformative role. Expert guidance can help translate ambitious ESG goals into actionable and measurable results. Council Fire specializes in turning sustainability visions into practical outcomes, offering support in areas like climate resilience planning, stakeholder engagement, and data-driven ESG strategies. Their approach goes beyond meeting reporting requirements, aiming to build systems that deliver meaningful and lasting change across environmental, social, and economic dimensions.

FAQs

What’s the best way for businesses to manage evolving ESG regulations across different countries?

To navigate the complexities of ESG regulations across various regions, businesses should establish a centralized monitoring system. This system would track real-time updates from regulators, standard-setting organizations, and industry groups. By doing so, companies can stay informed about changes in disclosure requirements, taxonomies, and enforcement trends from frameworks like the EU’s CSRD, the SEC’s climate-related rules, and ISSB standards. Consolidating all this information in one platform allows businesses to assign tasks, align requirements with the appropriate teams, and set deadline alerts.

It’s equally important for legal, finance, sustainability, and operations teams to collaborate regularly. These teams can work together to review updates, identify priorities, and weave new requirements into company policies and reporting processes. Leadership must view ESG compliance as a strategic initiative, ensuring consistent oversight and engagement with stakeholders. For businesses seeking tailored solutions, Council Fire offers expertise in designing frameworks that simplify regulatory complexities and drive meaningful ESG progress.

What are the advantages of following global ESG standards like ISSB and the GHG Protocol?

Aligning with global ESG frameworks like the International Sustainability Standards Board (ISSB) and the Greenhouse Gas (GHG) Protocol allows businesses to streamline their sustainability reporting while meeting regulatory demands across different regions. These frameworks provide a consistent structure, making compliance less complicated and costly, while enhancing the clarity and comparability of climate-related data.

By adhering to the emissions accounting standards set by the ISSB, companies can simplify their data collection processes, eliminate redundant efforts, and strengthen investor trust. This alignment not only aids in managing risks and setting more effective targets but also improves access to funding opportunities. For organizations based in the U.S., Council Fire offers customized support to help integrate these global standards into practical strategies that align with both U.S. financial systems and international ESG expectations.

What steps can businesses take to ensure their ESG data is accurate and reliable?

To guarantee the accuracy and reliability of ESG data, businesses should establish a solid governance structure and implement controls akin to those used in financial reporting. Begin by aligning ESG metrics with established frameworks such as the EU CSRD, ISSB standards, or GRI. This alignment ensures the data meets double materiality requirements, satisfies cross-border disclosure needs, and is prepared for assurance processes. Assigning clear accountability is essential - an ESG steering committee can oversee tasks like defining metrics, identifying data sources, and setting collection schedules.

Strong data-quality controls are a must. Automated tools, like IoT sensors for tracking emissions or HR systems for monitoring diversity, can reduce errors significantly. Regular cross-checks - such as comparing reported emissions against utility bills or using third-party verifications - help identify and address discrepancies. A structured ESG control framework ensures that processes are thoroughly documented, consistently monitored, and assessed for potential risks, bolstering accuracy.

Continuous improvement is equally important. Periodic audits, updated materiality assessments, and staff training on evolving reporting standards help keep systems effective and relevant. For businesses navigating U.S. regulations and global expectations, Council Fire offers customized ESG systems that enhance data reliability and build trust with stakeholders.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 18, 2025

Cross-Border ESG Rules: What Businesses Need to Know

ESG Strategy

In This Article

Cross-border ESG rules shape market access; companies must map obligations, align reporting standards, and tighten data, governance, and supply-chain controls.

Cross-Border ESG Rules: What Businesses Need to Know

Navigating cross-border ESG (Environmental, Social, and Governance) regulations is becoming more complex as jurisdictions enforce varying standards. Businesses must comply with rules like the EU's Corporate Sustainability Reporting Directive (CSRD) and California’s climate laws, which often apply to multinational companies based on revenue or operations. Non-compliance risks include fines, reputational damage, and restricted market access. Here's what you need to know:

Key Differences in ESG Standards: The EU focuses on "double materiality" (financial and societal impacts), while U.S. rules prioritize financial materiality.

Who Must Comply: EU CSRD applies to companies with €450M+ in revenue and 1,000+ employees, while California’s SB 253 targets companies with $1B+ in revenue operating in the state.

Global Reporting Standards: ISSB, GHG Protocol, and TCFD are widely used frameworks to align disclosures across regions.

Challenges: Tracking evolving regulations, managing supply chain due diligence, and ensuring accurate data collection are critical hurdles.

Benefits of Early Action: Companies adopting robust ESG strategies gain better access to capital, stronger supply chains, and improved risk management.

To succeed, businesses must map regulatory exposure, align with global standards, and establish governance structures. ESG compliance is no longer optional - it’s a critical factor in maintaining competitiveness and trust.

ESG Through a Legal Lens with Christian Perez-Font

Map Your Regulatory Exposure Across Jurisdictions

Cross-Border ESG Compliance Thresholds and Requirements by Jurisdiction

Identify Which Regulations Apply to Your Business

To begin, you need to pinpoint which ESG regulations are relevant to your operations. The rules you must follow depend on factors such as where your business operates, the locations of your subsidiaries, and where you generate revenue. Different regions approach ESG compliance in varying ways.

In the European Union, two directives play a central role. The Corporate Sustainability Reporting Directive (CSRD) demands detailed sustainability disclosures, while the Corporate Sustainability Due Diligence Directive (CSDDD) requires businesses to assess human rights and environmental risks throughout their supply chains. Recently, the EU introduced changes through the revised Omnibus proposal, significantly raising compliance thresholds to bolster European competitiveness.

In the United States, federal ESG regulation has slowed, with the SEC Climate Disclosure Rule currently on hold. Instead, state-level initiatives are taking the lead. California's SB 253 and SB 261 climate laws have become benchmarks for large companies. Other states, such as New York and Vermont, are also rolling out climate liability laws targeting specific industries [2][3].

The United Kingdom enforces mandatory reporting through frameworks like Streamlined Energy and Carbon Reporting (SECR) and TCFD-aligned disclosures. Additionally, new Sustainability Disclosure Requirements (SDR) based on ISSB standards are under development [1].

One major challenge businesses face is the difference in materiality standards across regions. The EU employs "double materiality", which considers both the financial impact of sustainability issues on businesses and their broader societal and environmental effects. In contrast, U.S. regulations focus solely on "financial materiality" [1][2]. This divergence may require businesses to prepare separate disclosures for different markets.

Once you’ve identified which regulations apply, assess whether your operations meet the thresholds that trigger compliance.

Check If You Meet Compliance Thresholds

After identifying your regulatory obligations, the next step is determining whether your company meets the thresholds that require compliance. These thresholds often depend on factors like revenue, employee numbers, or specific operational metrics.

For California’s climate regulations, SB 253 applies to U.S. companies with annual revenues exceeding $1 billion that conduct business in California. SB 261 has a lower threshold of $500 million in revenue [9]. According to the California Franchise Tax Board, "doing business" includes companies organized in California or those with sales surpassing $735,019 [9]. Approximately 10,000 companies are subject to SB 261, with half of those also meeting SB 253 requirements [3].

In the European Union, the revised Omnibus proposal has narrowed the scope of the CSRD, which now applies only to companies with more than 1,000 employees and €450 million in revenue [8][10]. This represents an 80% reduction in scope compared to the original plan [3]. The CSDDD applies to companies with at least 5,000 employees and €1.5 billion in revenue [8][10].

"The commission's proposal would reduce the scope of the CSRD by 80%, only applying to companies with more than 1,000 employees" [3].

Regulation | Revenue Threshold | Employee/Other Threshold | Market |

|---|---|---|---|

CA SB 253 | > $1 Billion | Must "do business" in California | U.S. (State) |

CA SB 261 | > $500 Million | Must "do business" in California | U.S. (State) |

EU CSRD (2025) | €450M+ | > 1,000 employees | European Union |

EU CSDDD | €1.5B+ | > 5,000 employees | European Union |

UK SECR | High turnover | > 500 employees | United Kingdom |

You should also evaluate whether your subsidiaries can rely on consolidated parent-level reporting to meet compliance. Both California and EU regulations allow this under certain conditions [9]. For instance, U.S. multinationals operating in the EU may qualify for the "sister company" exemption, which permits large EU subsidiaries of non-EU parents to report on a consolidated basis until fiscal year 2029 [2].

Track Policy Changes and Trade Developments

Once your compliance obligations are clear, it’s crucial to stay updated as regulations and policies evolve. ESG requirements are constantly shifting, and keeping up with these changes helps avoid compliance gaps or unnecessary reporting efforts.

The EU’s Omnibus package aims to reduce CSRD and CSDDD reporting requirements by at least 25% [10]. By February 2025, 20 EU countries had integrated the CSRD into national law, while 10 others had not [3]. Additionally, the initial application of the CSDDD for the first group of companies has been delayed until July 2028 [3]. These updates mean businesses should reassess whether their EU subsidiaries meet the revised thresholds before committing to extensive reporting frameworks [8].

In the U.S., while federal ESG mandates are deprioritized, state-level initiatives are gaining momentum. Over 40 anti-ESG bills have been passed across 21 states, primarily affecting financial institutions and state contractors [3]. This has created a divide between states like California, New York, and Illinois, which support ESG initiatives, and others that actively restrict the use of non-financial factors in investment and contracting decisions [3].

To manage these complexities, consider forming a cross-functional ESG steering committee. This team, including representatives from finance, legal, risk, compliance, and supply chain departments, can monitor regulatory updates, engage with trade associations, and maintain open communication with regulators. Additionally, working with external consultants or legal experts specializing in ESG compliance can help you navigate fragmented requirements across jurisdictions [3].

Set Up Your Cross-Border ESG Reporting Framework

Align With Global Reporting Standards

After understanding your regulatory requirements, the next step is to create a reporting framework that works across different jurisdictions. Since regions follow varying standards, it's essential to identify where these standards align and where they differ.

The ISSB (IFRS S1 and S2) has become the global benchmark for sustainability disclosures. S1 addresses general sustainability-related financial information, while S2 focuses on climate-related disclosures [11]. Over 30 jurisdictions have already adopted or are in the process of adopting ISSB standards into their local regulations [12]. Countries like the UK, Japan, and Brazil are also aligning their national frameworks with ISSB for better global compatibility [4].

In the European Union, companies must adhere to the European Sustainability Reporting Standards (ESRS) under the CSRD. These standards emphasize "double materiality", requiring businesses to disclose both the financial impact of sustainability issues and their broader societal and environmental effects [5].

The GHG Protocol serves as the primary standard for measuring greenhouse gas emissions across Scopes 1, 2, and 3, and it is a key element in most mandatory reporting frameworks [4]. For example, California’s SB 253 mandates compliance with the GHG Protocol for emissions reporting [13].

"Understanding where the frameworks align and diverge will help companies develop the requisite reporting strategy, data gathering processes, and related controls, providing for a streamlined process and effective deployment of resources." - PwC [13]

To streamline efforts, map the overlaps between standards. For instance, both GRI and ESRS share common elements, enabling businesses to structure data collection to meet both frameworks simultaneously [6]. Conducting a gap analysis against frameworks like TCFD or ISSB can help identify missing metrics early [6].

Standard | Focus | Materiality Approach | Key Application |

|---|---|---|---|

ISSB (IFRS S1/S2) | General sustainability & climate | Financial (investor-focused) | Global baseline |

EU ESRS | Full ESG (environment, social, governance) | Double (financial + impact) | EU mandatory |

GHG Protocol | Greenhouse gas emissions (Scopes 1, 2, 3) | N/A | Embedded in most rules |

TCFD | Climate-related risks | Financial | Widely adopted; ISSB monitoring since 2024 |

These global standards serve as the foundation for consistent cross-border ESG reporting. Once aligned, the next step is to focus on establishing reliable data controls.

Build Data Collection and Control Systems

Accurate and reliable data is the cornerstone of effective ESG reporting. To meet regulatory requirements and avoid compliance issues, it's crucial to develop robust systems for data collection and control.

For EU CSRD compliance, businesses must track both "impact materiality" (how operations affect society and the environment) and "financial materiality" (how sustainability issues impact the business itself) [12]. The key to effective reporting lies in accuracy, automation, and auditability. A staggering 96% of financial leaders report challenges with ESG data, citing inaccuracies, inconsistencies, and unclear definitions as major hurdles [16]. Specialized ESG reporting software can address these issues by providing a centralized and auditable data source [4].

Since ISSB standards require sustainability disclosures to be integrated with financial statements, it's important to align ESG and financial data controls [12]. Leveraging existing frameworks, like the Committee of Sponsoring Organizations (COSO) framework, can bring the same level of rigor to sustainability data [4].

For businesses adopting ISSB standards, climate-related risks should be prioritized in the first year, with full reporting on other sustainability topics expected in the second year. Using the TCFD's four pillars - Governance, Strategy, Risk Management, and Metrics/Targets - as a foundational structure for data controls is particularly effective. This framework is widely used by the SEC, ISSB, and California SB 261 [13].

Prepare for Assurance and Verification

As ESG reporting transitions from voluntary to mandatory, third-party verification is becoming the standard to ensure transparency and combat greenwashing [14]. Once your data systems are reliable and integrated, the next step is to plan for independent verification.

Start by identifying the assurance standards applicable to your jurisdiction. In the U.S., SSAEs (Standards for Attestation Engagements) are commonly used, while internationally, ISAE 3000 and ISAE 3410 apply to non-financial and greenhouse gas-related statements [14]. The emerging ISSA 5000 standard is also gaining traction as a global benchmark for sustainability engagements [15].

Limited assurance provides a basic level of confidence, while reasonable assurance involves more extensive testing. Under the CSRD, companies are required to start with limited assurance and transition to reasonable assurance over time [15].

"Strong documentation and controls are vital for CSRD compliance and assurance." - RSM US [14]

To support assurance efforts, establish internal control frameworks at three levels: entity-level (governance), process-level (data collection), and system-level (IT) [16]. Maintain detailed documentation of data sources, estimation methods, and judgments made during processing to ensure clear audit trails [16]. Conduct mock audits or "dry runs" to identify and address any gaps before formal assurance engagements begin [16].

Engage qualified assurance providers early, ensuring they have expertise in both sustainability and the legal frameworks of your region. Adopting digital reporting formats, like the IFRS Sustainability Disclosure Taxonomy or XBRL, can further streamline audits with automated validation checks [15].

Establish Governance and Risk Management for ESG Compliance

Once your reporting systems are firmly in place, the next step is to ensure that your ESG governance and risk management processes are just as robust.

Strengthen ESG Oversight

Building governance structures to oversee ESG reporting is critical. Begin by establishing mandatory board-level oversight. Typically, the Audit Committee handles ESG disclosure processes and attestation, while the Nominating and Corporate Governance Committee addresses broader topics like board diversity [7].

At the management level, nearly two-thirds of companies have formed cross-functional ESG committees that include members from the C-suite to mid-management [3]. These committees should bring together representatives from legal, finance, risk, compliance, sustainability, human resources, and supply chain teams to ensure consistency in data protocols and adherence to compliance timelines [7][3].

Clearly document these oversight structures with specific charters that outline membership, meeting schedules, and risk-assessment responsibilities [7]. ESG data management should be fully integrated into your existing Enterprise Risk Management (ERM) frameworks to ensure sustainability risks are treated with the same diligence as financial risks [7]. Implementing a sub-certification process for ESG data, similar to financial reporting practices, can help identify and prevent potential fraud [7].

"In a recent Workiva survey, 97% of C-Suite and other executives agreed that sustainability reporting creates value beyond compliance." - The Conference Board [3]

Embed ESG Due Diligence in Supply Chains

Under the EU Corporate Sustainability Due Diligence Directive (CSDDD), companies must identify, prevent, mitigate, and account for human rights and environmental risks throughout their entire value chain [17][3]. Similar global thresholds apply when managing risks tied to third parties.

Start by mapping all suppliers, subcontractors, and partners. Prioritize risks based on their severity and likelihood, then implement corrective actions as needed [1]. Independent verification is key to addressing common data inaccuracies. Conduct regular monitoring of supplier performance and trends, and consider requesting independence statements or direct access to supplier systems to validate ESG claims [16]. For example, 78% of S&P 500 companies disclosed Scope 3 emissions in 2024, up from 64% in 2021, underscoring the growing focus on supply chain transparency [3].

Effective supply chain due diligence not only strengthens compliance but also reduces exposure to broader trade and investment risks.

Evaluate Trade and Investment Risks

Beyond internal controls and supplier oversight, it’s essential to address external trade and investment challenges. ESG non-compliance can disrupt trade flows, hinder supply chain operations, and influence capital allocation decisions. A double materiality assessment can help measure both financial impacts and broader societal or environmental consequences [1][2][3].

Pay attention to the evolving regulatory landscape. While the EU and UK have unified ESG mandates, the U.S. remains fragmented. For instance, California’s climate disclosure laws are estimated to affect approximately 10,000 companies, including 75% of the Fortune 1000 [3]. At the same time, 21 U.S. states have enacted "anti-ESG" laws, primarily targeting financial institutions and state contractors [3].

Engage independent auditors early to secure third-party assurance and mitigate risks of greenwashing [16][2][3][14]. It’s crucial to ensure ESG information remains consistent across all platforms - SEC filings, corporate websites, and sustainability reports - to avoid claims of greenwashing and regulatory scrutiny [7].

Framework | Jurisdiction | Primary Focus | Materiality Standard |

|---|---|---|---|

CSRD | European Union | Broad ESG (Environment, Social, Governance) | Double Materiality |

CSDDD | European Union | Supply Chain Due Diligence | Impact-based |

SB 253/261 | California (U.S.) | Climate Risks & Emissions | Extensive |

SEC Climate Rule | United States | Climate-related Risks | Financial Materiality |

ISSB Standards | Global Baseline | Investor-focused Sustainability | Financial Materiality |

Implement and Improve Your Compliance Program

Once you've established solid governance and data systems, the next step is to put a well-defined compliance program into action.

Create a Compliance Program

Start by adopting a unified compliance framework based on COSO principles that can be applied across all jurisdictions. Instead of tackling each regulation individually, this overarching framework ensures consistency, transparency, and audit readiness [4]. This approach not only saves time but also reduces the risk of missing critical regulatory requirements.

Clearly define the scope of your program by outlining which business units, facilities, and regions it will cover. Assign dedicated teams to oversee each area, ensuring clear accountability [16][6]. Your control framework should function on multiple levels: entity-level controls for governance, process-level controls for data management, system-level controls for IT integrity, and monitoring controls to facilitate regular audits [16].

Standardize your data collection process by using automated and integrated systems. Automated validation tools can help consolidate ESG metrics, monitor key performance indicators, and produce reports from a single, reliable source [4][11][16]. Whenever possible, leverage your existing financial reporting systems to streamline ESG reporting, taking advantage of already established IT controls [16].

Conduct a gap analysis against global ESG frameworks like GRI, SASB, and TCFD to pinpoint missing metrics or unverified data [6]. It's important to note that failing to comply with regulations can result in steep penalties - up to 4% of global turnover or $20 million [11].

Link ESG Compliance With Business Strategy

Integrate ESG compliance into your core business strategy to maximize its impact. Use insights from regulatory exposure mapping and reporting protocols to shape strategic initiatives. Results from a double materiality assessment can guide the development of your ESG framework and help set measurable, goal-oriented targets [16]. Tie climate, social, and governance risks directly to operational controls and business continuity plans [6]. This approach not only ensures compliance but also opens doors to initiatives like decarbonization, circular economy programs, and stronger stakeholder engagement.

Notably, 61% of companies have established ESG steering committees at the C-Suite level, ensuring that sustainability goals align with broader business objectives [3]. These cross-functional teams are instrumental in embedding ESG considerations into daily operations, from procurement to product design. With ESG-focused institutional investments expected to reach approximately $33.9 trillion by 2026 [11], strong ESG performance is becoming a key factor in securing capital and investor trust.

Monitor Enforcement and Reputational Risks

The regulatory landscape is changing quickly, making it crucial to stay informed. Resources like the "Carrots & Sticks" database, which tracks nearly 2,500 global ESG disclosure policies, can help you monitor requirements across different jurisdictions [18].

Moving away from manual processes is equally critical. A study revealed that 77% of French respondents still rely on manual ESG compliance systems, which significantly increases the likelihood of oversight and breaches [19]. Automating monitoring systems can track over 1,600 data points, including carbon metrics and alignment with the EU Taxonomy, to ensure compliance [19].

Ensure that all ESG communications are backed by verified performance data to minimize the risk of litigation and reputational harm from inaccurate claims [19]. Additionally, prepare for third-party assessments by conducting readiness exercises to confirm the transparency and authenticity of your sustainability disclosures [16]. Regular benchmarking against industry peers can also help you adopt emerging best practices and identify areas where you can improve [16].

Conclusion

Cross-border ESG compliance has evolved from being a voluntary effort to a critical legal and financial requirement, directly influencing market access and investment strategies. With California's climate disclosure laws now covering an estimated 75% of Fortune 1000 companies and the EU's CSRD impacting roughly 50,000 businesses, the urgency to act is undeniable [3][4]. Viewing ESG as a strategic opportunity rather than a mere obligation is key to staying ahead.

The frameworks and governance models discussed earlier provide a solid foundation for tackling these challenges. Whether you're addressing double materiality assessments, managing Scope 3 emissions disclosures, or preparing for mandatory third-party assurance, the most important step is to start now. Delaying action only increases risks and missed opportunities.

"ESG reporting is no longer a compliance checkbox. It's a strategic tool for identifying risk, making informed decisions, building trust, and future-proofing the business." - Pulsora [20]

As regulatory landscapes continue to evolve, staying adaptable is crucial. For instance, the EU's proposed Omnibus package could reduce the CSRD scope by 80%, while U.S. state-level laws are stepping up in response to federal delays [3]. A compliance program that can adjust to these changes without requiring a complete overhaul will save significant resources. Centralized data systems, cross-functional governance teams, and alignment across multiple frameworks can streamline efforts and improve efficiency.

To make these efforts truly impactful, strategic partnerships can play a transformative role. Expert guidance can help translate ambitious ESG goals into actionable and measurable results. Council Fire specializes in turning sustainability visions into practical outcomes, offering support in areas like climate resilience planning, stakeholder engagement, and data-driven ESG strategies. Their approach goes beyond meeting reporting requirements, aiming to build systems that deliver meaningful and lasting change across environmental, social, and economic dimensions.

FAQs

What’s the best way for businesses to manage evolving ESG regulations across different countries?

To navigate the complexities of ESG regulations across various regions, businesses should establish a centralized monitoring system. This system would track real-time updates from regulators, standard-setting organizations, and industry groups. By doing so, companies can stay informed about changes in disclosure requirements, taxonomies, and enforcement trends from frameworks like the EU’s CSRD, the SEC’s climate-related rules, and ISSB standards. Consolidating all this information in one platform allows businesses to assign tasks, align requirements with the appropriate teams, and set deadline alerts.

It’s equally important for legal, finance, sustainability, and operations teams to collaborate regularly. These teams can work together to review updates, identify priorities, and weave new requirements into company policies and reporting processes. Leadership must view ESG compliance as a strategic initiative, ensuring consistent oversight and engagement with stakeholders. For businesses seeking tailored solutions, Council Fire offers expertise in designing frameworks that simplify regulatory complexities and drive meaningful ESG progress.

What are the advantages of following global ESG standards like ISSB and the GHG Protocol?

Aligning with global ESG frameworks like the International Sustainability Standards Board (ISSB) and the Greenhouse Gas (GHG) Protocol allows businesses to streamline their sustainability reporting while meeting regulatory demands across different regions. These frameworks provide a consistent structure, making compliance less complicated and costly, while enhancing the clarity and comparability of climate-related data.

By adhering to the emissions accounting standards set by the ISSB, companies can simplify their data collection processes, eliminate redundant efforts, and strengthen investor trust. This alignment not only aids in managing risks and setting more effective targets but also improves access to funding opportunities. For organizations based in the U.S., Council Fire offers customized support to help integrate these global standards into practical strategies that align with both U.S. financial systems and international ESG expectations.

What steps can businesses take to ensure their ESG data is accurate and reliable?

To guarantee the accuracy and reliability of ESG data, businesses should establish a solid governance structure and implement controls akin to those used in financial reporting. Begin by aligning ESG metrics with established frameworks such as the EU CSRD, ISSB standards, or GRI. This alignment ensures the data meets double materiality requirements, satisfies cross-border disclosure needs, and is prepared for assurance processes. Assigning clear accountability is essential - an ESG steering committee can oversee tasks like defining metrics, identifying data sources, and setting collection schedules.

Strong data-quality controls are a must. Automated tools, like IoT sensors for tracking emissions or HR systems for monitoring diversity, can reduce errors significantly. Regular cross-checks - such as comparing reported emissions against utility bills or using third-party verifications - help identify and address discrepancies. A structured ESG control framework ensures that processes are thoroughly documented, consistently monitored, and assessed for potential risks, bolstering accuracy.

Continuous improvement is equally important. Periodic audits, updated materiality assessments, and staff training on evolving reporting standards help keep systems effective and relevant. For businesses navigating U.S. regulations and global expectations, Council Fire offers customized ESG systems that enhance data reliability and build trust with stakeholders.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 18, 2025

Cross-Border ESG Rules: What Businesses Need to Know

ESG Strategy

In This Article

Cross-border ESG rules shape market access; companies must map obligations, align reporting standards, and tighten data, governance, and supply-chain controls.

Cross-Border ESG Rules: What Businesses Need to Know

Navigating cross-border ESG (Environmental, Social, and Governance) regulations is becoming more complex as jurisdictions enforce varying standards. Businesses must comply with rules like the EU's Corporate Sustainability Reporting Directive (CSRD) and California’s climate laws, which often apply to multinational companies based on revenue or operations. Non-compliance risks include fines, reputational damage, and restricted market access. Here's what you need to know:

Key Differences in ESG Standards: The EU focuses on "double materiality" (financial and societal impacts), while U.S. rules prioritize financial materiality.

Who Must Comply: EU CSRD applies to companies with €450M+ in revenue and 1,000+ employees, while California’s SB 253 targets companies with $1B+ in revenue operating in the state.

Global Reporting Standards: ISSB, GHG Protocol, and TCFD are widely used frameworks to align disclosures across regions.

Challenges: Tracking evolving regulations, managing supply chain due diligence, and ensuring accurate data collection are critical hurdles.

Benefits of Early Action: Companies adopting robust ESG strategies gain better access to capital, stronger supply chains, and improved risk management.

To succeed, businesses must map regulatory exposure, align with global standards, and establish governance structures. ESG compliance is no longer optional - it’s a critical factor in maintaining competitiveness and trust.

ESG Through a Legal Lens with Christian Perez-Font

Map Your Regulatory Exposure Across Jurisdictions

Cross-Border ESG Compliance Thresholds and Requirements by Jurisdiction

Identify Which Regulations Apply to Your Business

To begin, you need to pinpoint which ESG regulations are relevant to your operations. The rules you must follow depend on factors such as where your business operates, the locations of your subsidiaries, and where you generate revenue. Different regions approach ESG compliance in varying ways.

In the European Union, two directives play a central role. The Corporate Sustainability Reporting Directive (CSRD) demands detailed sustainability disclosures, while the Corporate Sustainability Due Diligence Directive (CSDDD) requires businesses to assess human rights and environmental risks throughout their supply chains. Recently, the EU introduced changes through the revised Omnibus proposal, significantly raising compliance thresholds to bolster European competitiveness.

In the United States, federal ESG regulation has slowed, with the SEC Climate Disclosure Rule currently on hold. Instead, state-level initiatives are taking the lead. California's SB 253 and SB 261 climate laws have become benchmarks for large companies. Other states, such as New York and Vermont, are also rolling out climate liability laws targeting specific industries [2][3].

The United Kingdom enforces mandatory reporting through frameworks like Streamlined Energy and Carbon Reporting (SECR) and TCFD-aligned disclosures. Additionally, new Sustainability Disclosure Requirements (SDR) based on ISSB standards are under development [1].

One major challenge businesses face is the difference in materiality standards across regions. The EU employs "double materiality", which considers both the financial impact of sustainability issues on businesses and their broader societal and environmental effects. In contrast, U.S. regulations focus solely on "financial materiality" [1][2]. This divergence may require businesses to prepare separate disclosures for different markets.

Once you’ve identified which regulations apply, assess whether your operations meet the thresholds that trigger compliance.

Check If You Meet Compliance Thresholds

After identifying your regulatory obligations, the next step is determining whether your company meets the thresholds that require compliance. These thresholds often depend on factors like revenue, employee numbers, or specific operational metrics.

For California’s climate regulations, SB 253 applies to U.S. companies with annual revenues exceeding $1 billion that conduct business in California. SB 261 has a lower threshold of $500 million in revenue [9]. According to the California Franchise Tax Board, "doing business" includes companies organized in California or those with sales surpassing $735,019 [9]. Approximately 10,000 companies are subject to SB 261, with half of those also meeting SB 253 requirements [3].

In the European Union, the revised Omnibus proposal has narrowed the scope of the CSRD, which now applies only to companies with more than 1,000 employees and €450 million in revenue [8][10]. This represents an 80% reduction in scope compared to the original plan [3]. The CSDDD applies to companies with at least 5,000 employees and €1.5 billion in revenue [8][10].

"The commission's proposal would reduce the scope of the CSRD by 80%, only applying to companies with more than 1,000 employees" [3].

Regulation | Revenue Threshold | Employee/Other Threshold | Market |

|---|---|---|---|

CA SB 253 | > $1 Billion | Must "do business" in California | U.S. (State) |

CA SB 261 | > $500 Million | Must "do business" in California | U.S. (State) |

EU CSRD (2025) | €450M+ | > 1,000 employees | European Union |

EU CSDDD | €1.5B+ | > 5,000 employees | European Union |

UK SECR | High turnover | > 500 employees | United Kingdom |

You should also evaluate whether your subsidiaries can rely on consolidated parent-level reporting to meet compliance. Both California and EU regulations allow this under certain conditions [9]. For instance, U.S. multinationals operating in the EU may qualify for the "sister company" exemption, which permits large EU subsidiaries of non-EU parents to report on a consolidated basis until fiscal year 2029 [2].

Track Policy Changes and Trade Developments

Once your compliance obligations are clear, it’s crucial to stay updated as regulations and policies evolve. ESG requirements are constantly shifting, and keeping up with these changes helps avoid compliance gaps or unnecessary reporting efforts.

The EU’s Omnibus package aims to reduce CSRD and CSDDD reporting requirements by at least 25% [10]. By February 2025, 20 EU countries had integrated the CSRD into national law, while 10 others had not [3]. Additionally, the initial application of the CSDDD for the first group of companies has been delayed until July 2028 [3]. These updates mean businesses should reassess whether their EU subsidiaries meet the revised thresholds before committing to extensive reporting frameworks [8].

In the U.S., while federal ESG mandates are deprioritized, state-level initiatives are gaining momentum. Over 40 anti-ESG bills have been passed across 21 states, primarily affecting financial institutions and state contractors [3]. This has created a divide between states like California, New York, and Illinois, which support ESG initiatives, and others that actively restrict the use of non-financial factors in investment and contracting decisions [3].

To manage these complexities, consider forming a cross-functional ESG steering committee. This team, including representatives from finance, legal, risk, compliance, and supply chain departments, can monitor regulatory updates, engage with trade associations, and maintain open communication with regulators. Additionally, working with external consultants or legal experts specializing in ESG compliance can help you navigate fragmented requirements across jurisdictions [3].

Set Up Your Cross-Border ESG Reporting Framework

Align With Global Reporting Standards

After understanding your regulatory requirements, the next step is to create a reporting framework that works across different jurisdictions. Since regions follow varying standards, it's essential to identify where these standards align and where they differ.

The ISSB (IFRS S1 and S2) has become the global benchmark for sustainability disclosures. S1 addresses general sustainability-related financial information, while S2 focuses on climate-related disclosures [11]. Over 30 jurisdictions have already adopted or are in the process of adopting ISSB standards into their local regulations [12]. Countries like the UK, Japan, and Brazil are also aligning their national frameworks with ISSB for better global compatibility [4].

In the European Union, companies must adhere to the European Sustainability Reporting Standards (ESRS) under the CSRD. These standards emphasize "double materiality", requiring businesses to disclose both the financial impact of sustainability issues and their broader societal and environmental effects [5].

The GHG Protocol serves as the primary standard for measuring greenhouse gas emissions across Scopes 1, 2, and 3, and it is a key element in most mandatory reporting frameworks [4]. For example, California’s SB 253 mandates compliance with the GHG Protocol for emissions reporting [13].

"Understanding where the frameworks align and diverge will help companies develop the requisite reporting strategy, data gathering processes, and related controls, providing for a streamlined process and effective deployment of resources." - PwC [13]

To streamline efforts, map the overlaps between standards. For instance, both GRI and ESRS share common elements, enabling businesses to structure data collection to meet both frameworks simultaneously [6]. Conducting a gap analysis against frameworks like TCFD or ISSB can help identify missing metrics early [6].

Standard | Focus | Materiality Approach | Key Application |

|---|---|---|---|

ISSB (IFRS S1/S2) | General sustainability & climate | Financial (investor-focused) | Global baseline |

EU ESRS | Full ESG (environment, social, governance) | Double (financial + impact) | EU mandatory |

GHG Protocol | Greenhouse gas emissions (Scopes 1, 2, 3) | N/A | Embedded in most rules |

TCFD | Climate-related risks | Financial | Widely adopted; ISSB monitoring since 2024 |

These global standards serve as the foundation for consistent cross-border ESG reporting. Once aligned, the next step is to focus on establishing reliable data controls.

Build Data Collection and Control Systems

Accurate and reliable data is the cornerstone of effective ESG reporting. To meet regulatory requirements and avoid compliance issues, it's crucial to develop robust systems for data collection and control.

For EU CSRD compliance, businesses must track both "impact materiality" (how operations affect society and the environment) and "financial materiality" (how sustainability issues impact the business itself) [12]. The key to effective reporting lies in accuracy, automation, and auditability. A staggering 96% of financial leaders report challenges with ESG data, citing inaccuracies, inconsistencies, and unclear definitions as major hurdles [16]. Specialized ESG reporting software can address these issues by providing a centralized and auditable data source [4].

Since ISSB standards require sustainability disclosures to be integrated with financial statements, it's important to align ESG and financial data controls [12]. Leveraging existing frameworks, like the Committee of Sponsoring Organizations (COSO) framework, can bring the same level of rigor to sustainability data [4].

For businesses adopting ISSB standards, climate-related risks should be prioritized in the first year, with full reporting on other sustainability topics expected in the second year. Using the TCFD's four pillars - Governance, Strategy, Risk Management, and Metrics/Targets - as a foundational structure for data controls is particularly effective. This framework is widely used by the SEC, ISSB, and California SB 261 [13].

Prepare for Assurance and Verification

As ESG reporting transitions from voluntary to mandatory, third-party verification is becoming the standard to ensure transparency and combat greenwashing [14]. Once your data systems are reliable and integrated, the next step is to plan for independent verification.

Start by identifying the assurance standards applicable to your jurisdiction. In the U.S., SSAEs (Standards for Attestation Engagements) are commonly used, while internationally, ISAE 3000 and ISAE 3410 apply to non-financial and greenhouse gas-related statements [14]. The emerging ISSA 5000 standard is also gaining traction as a global benchmark for sustainability engagements [15].

Limited assurance provides a basic level of confidence, while reasonable assurance involves more extensive testing. Under the CSRD, companies are required to start with limited assurance and transition to reasonable assurance over time [15].

"Strong documentation and controls are vital for CSRD compliance and assurance." - RSM US [14]

To support assurance efforts, establish internal control frameworks at three levels: entity-level (governance), process-level (data collection), and system-level (IT) [16]. Maintain detailed documentation of data sources, estimation methods, and judgments made during processing to ensure clear audit trails [16]. Conduct mock audits or "dry runs" to identify and address any gaps before formal assurance engagements begin [16].

Engage qualified assurance providers early, ensuring they have expertise in both sustainability and the legal frameworks of your region. Adopting digital reporting formats, like the IFRS Sustainability Disclosure Taxonomy or XBRL, can further streamline audits with automated validation checks [15].

Establish Governance and Risk Management for ESG Compliance

Once your reporting systems are firmly in place, the next step is to ensure that your ESG governance and risk management processes are just as robust.

Strengthen ESG Oversight

Building governance structures to oversee ESG reporting is critical. Begin by establishing mandatory board-level oversight. Typically, the Audit Committee handles ESG disclosure processes and attestation, while the Nominating and Corporate Governance Committee addresses broader topics like board diversity [7].

At the management level, nearly two-thirds of companies have formed cross-functional ESG committees that include members from the C-suite to mid-management [3]. These committees should bring together representatives from legal, finance, risk, compliance, sustainability, human resources, and supply chain teams to ensure consistency in data protocols and adherence to compliance timelines [7][3].

Clearly document these oversight structures with specific charters that outline membership, meeting schedules, and risk-assessment responsibilities [7]. ESG data management should be fully integrated into your existing Enterprise Risk Management (ERM) frameworks to ensure sustainability risks are treated with the same diligence as financial risks [7]. Implementing a sub-certification process for ESG data, similar to financial reporting practices, can help identify and prevent potential fraud [7].

"In a recent Workiva survey, 97% of C-Suite and other executives agreed that sustainability reporting creates value beyond compliance." - The Conference Board [3]

Embed ESG Due Diligence in Supply Chains

Under the EU Corporate Sustainability Due Diligence Directive (CSDDD), companies must identify, prevent, mitigate, and account for human rights and environmental risks throughout their entire value chain [17][3]. Similar global thresholds apply when managing risks tied to third parties.

Start by mapping all suppliers, subcontractors, and partners. Prioritize risks based on their severity and likelihood, then implement corrective actions as needed [1]. Independent verification is key to addressing common data inaccuracies. Conduct regular monitoring of supplier performance and trends, and consider requesting independence statements or direct access to supplier systems to validate ESG claims [16]. For example, 78% of S&P 500 companies disclosed Scope 3 emissions in 2024, up from 64% in 2021, underscoring the growing focus on supply chain transparency [3].

Effective supply chain due diligence not only strengthens compliance but also reduces exposure to broader trade and investment risks.

Evaluate Trade and Investment Risks

Beyond internal controls and supplier oversight, it’s essential to address external trade and investment challenges. ESG non-compliance can disrupt trade flows, hinder supply chain operations, and influence capital allocation decisions. A double materiality assessment can help measure both financial impacts and broader societal or environmental consequences [1][2][3].

Pay attention to the evolving regulatory landscape. While the EU and UK have unified ESG mandates, the U.S. remains fragmented. For instance, California’s climate disclosure laws are estimated to affect approximately 10,000 companies, including 75% of the Fortune 1000 [3]. At the same time, 21 U.S. states have enacted "anti-ESG" laws, primarily targeting financial institutions and state contractors [3].

Engage independent auditors early to secure third-party assurance and mitigate risks of greenwashing [16][2][3][14]. It’s crucial to ensure ESG information remains consistent across all platforms - SEC filings, corporate websites, and sustainability reports - to avoid claims of greenwashing and regulatory scrutiny [7].

Framework | Jurisdiction | Primary Focus | Materiality Standard |

|---|---|---|---|

CSRD | European Union | Broad ESG (Environment, Social, Governance) | Double Materiality |

CSDDD | European Union | Supply Chain Due Diligence | Impact-based |

SB 253/261 | California (U.S.) | Climate Risks & Emissions | Extensive |

SEC Climate Rule | United States | Climate-related Risks | Financial Materiality |

ISSB Standards | Global Baseline | Investor-focused Sustainability | Financial Materiality |

Implement and Improve Your Compliance Program

Once you've established solid governance and data systems, the next step is to put a well-defined compliance program into action.

Create a Compliance Program

Start by adopting a unified compliance framework based on COSO principles that can be applied across all jurisdictions. Instead of tackling each regulation individually, this overarching framework ensures consistency, transparency, and audit readiness [4]. This approach not only saves time but also reduces the risk of missing critical regulatory requirements.

Clearly define the scope of your program by outlining which business units, facilities, and regions it will cover. Assign dedicated teams to oversee each area, ensuring clear accountability [16][6]. Your control framework should function on multiple levels: entity-level controls for governance, process-level controls for data management, system-level controls for IT integrity, and monitoring controls to facilitate regular audits [16].

Standardize your data collection process by using automated and integrated systems. Automated validation tools can help consolidate ESG metrics, monitor key performance indicators, and produce reports from a single, reliable source [4][11][16]. Whenever possible, leverage your existing financial reporting systems to streamline ESG reporting, taking advantage of already established IT controls [16].

Conduct a gap analysis against global ESG frameworks like GRI, SASB, and TCFD to pinpoint missing metrics or unverified data [6]. It's important to note that failing to comply with regulations can result in steep penalties - up to 4% of global turnover or $20 million [11].

Link ESG Compliance With Business Strategy

Integrate ESG compliance into your core business strategy to maximize its impact. Use insights from regulatory exposure mapping and reporting protocols to shape strategic initiatives. Results from a double materiality assessment can guide the development of your ESG framework and help set measurable, goal-oriented targets [16]. Tie climate, social, and governance risks directly to operational controls and business continuity plans [6]. This approach not only ensures compliance but also opens doors to initiatives like decarbonization, circular economy programs, and stronger stakeholder engagement.

Notably, 61% of companies have established ESG steering committees at the C-Suite level, ensuring that sustainability goals align with broader business objectives [3]. These cross-functional teams are instrumental in embedding ESG considerations into daily operations, from procurement to product design. With ESG-focused institutional investments expected to reach approximately $33.9 trillion by 2026 [11], strong ESG performance is becoming a key factor in securing capital and investor trust.

Monitor Enforcement and Reputational Risks