Dec 22, 2025

Dec 22, 2025

Case Studies: Conflict of Interest in Impact Investments

ESG Strategy

ESG Strategy

In This Article

Unchecked conflicts of interest in impact investing erode returns and mission — real cases show fines, fraud and how governance, disclosure, and automated controls restore trust.

Case Studies: Conflict of Interest in Impact Investments

Conflicts of interest in impact investing arise when personal or organizational priorities interfere with delivering both financial returns and social outcomes. These conflicts, if unchecked, can harm investors, stakeholders, and the credibility of the entire sector. Key challenges include:

Side-by-Side Management: Favoring funds with higher performance fees at the expense of others.

Cross-Trades: Undisclosed asset trades between clients, leading to financial losses.

Material Affiliations: Decision-makers with ties to entities they oversee, risking biased decisions.

Benchmark Mismatch: Using financial benchmarks that dilute impact goals.

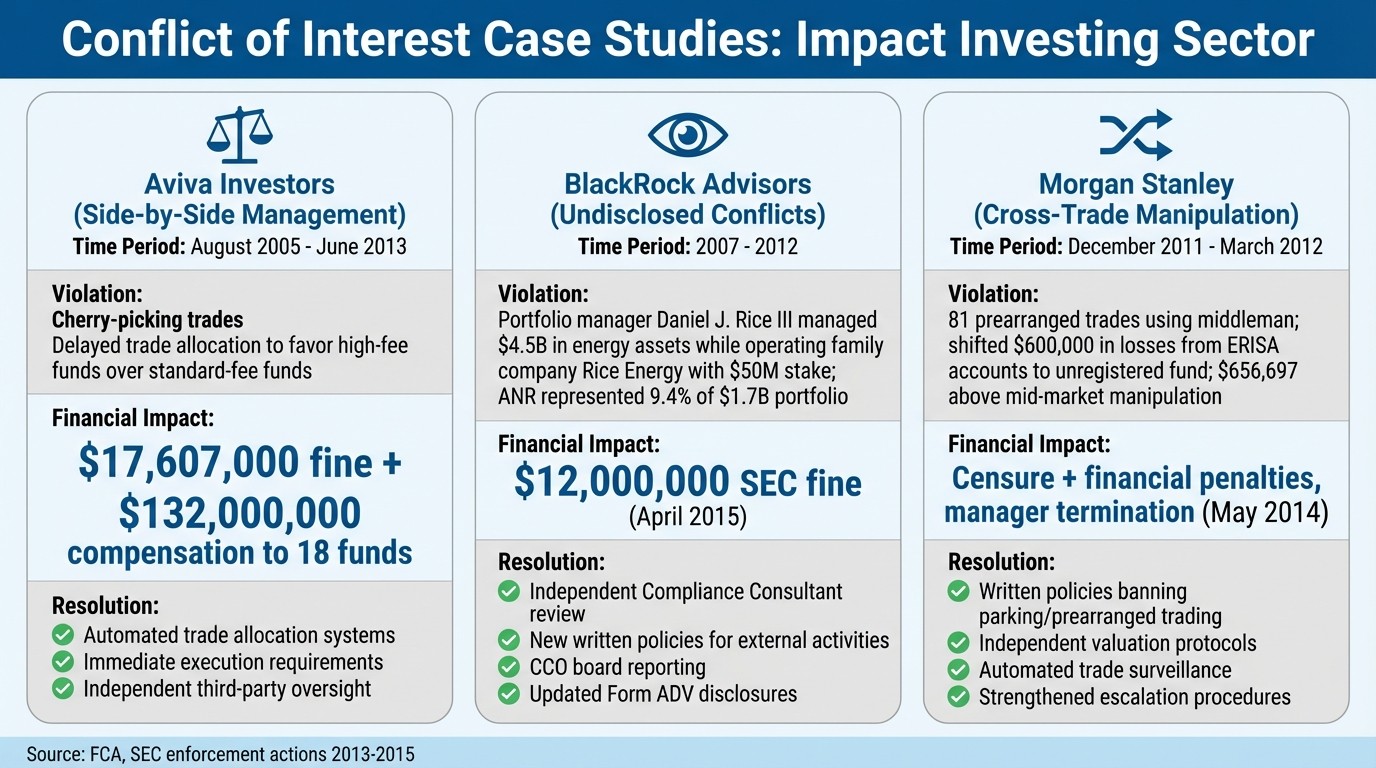

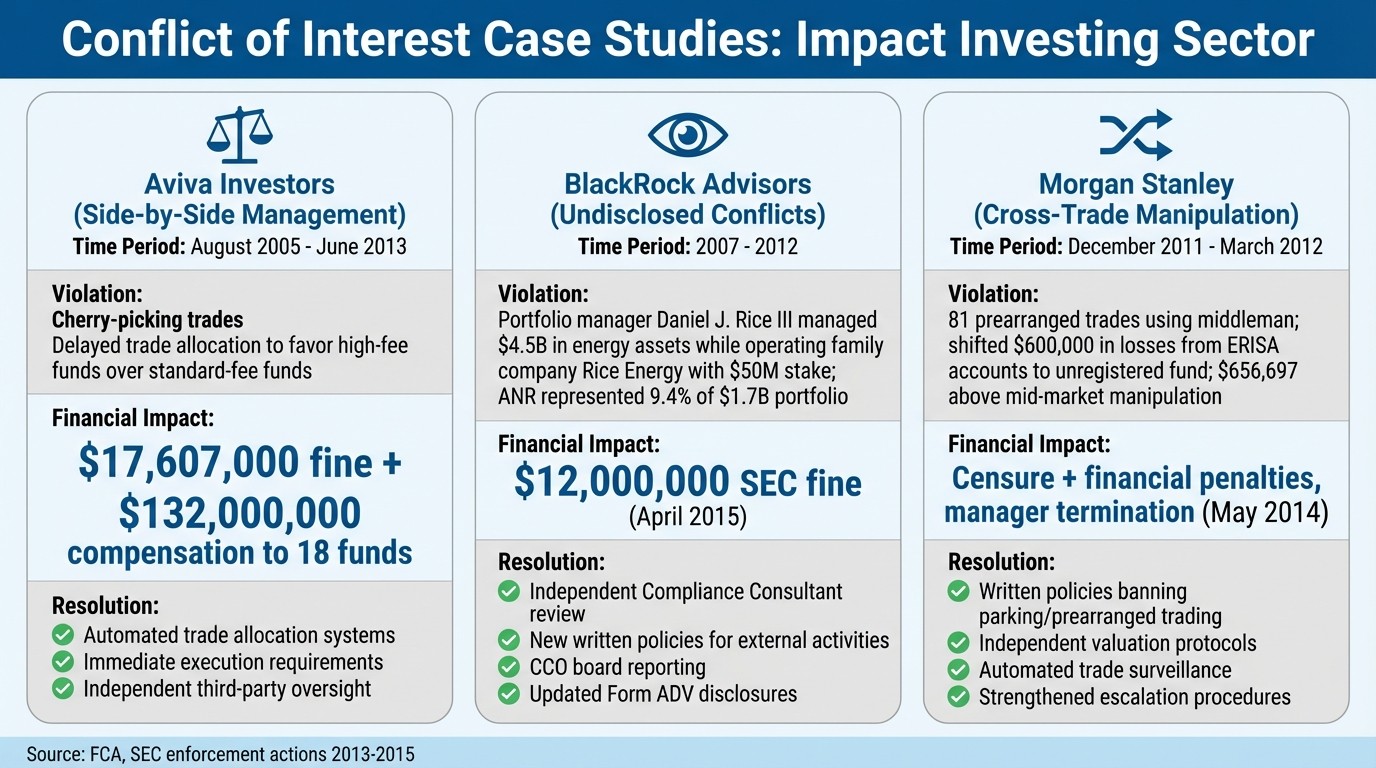

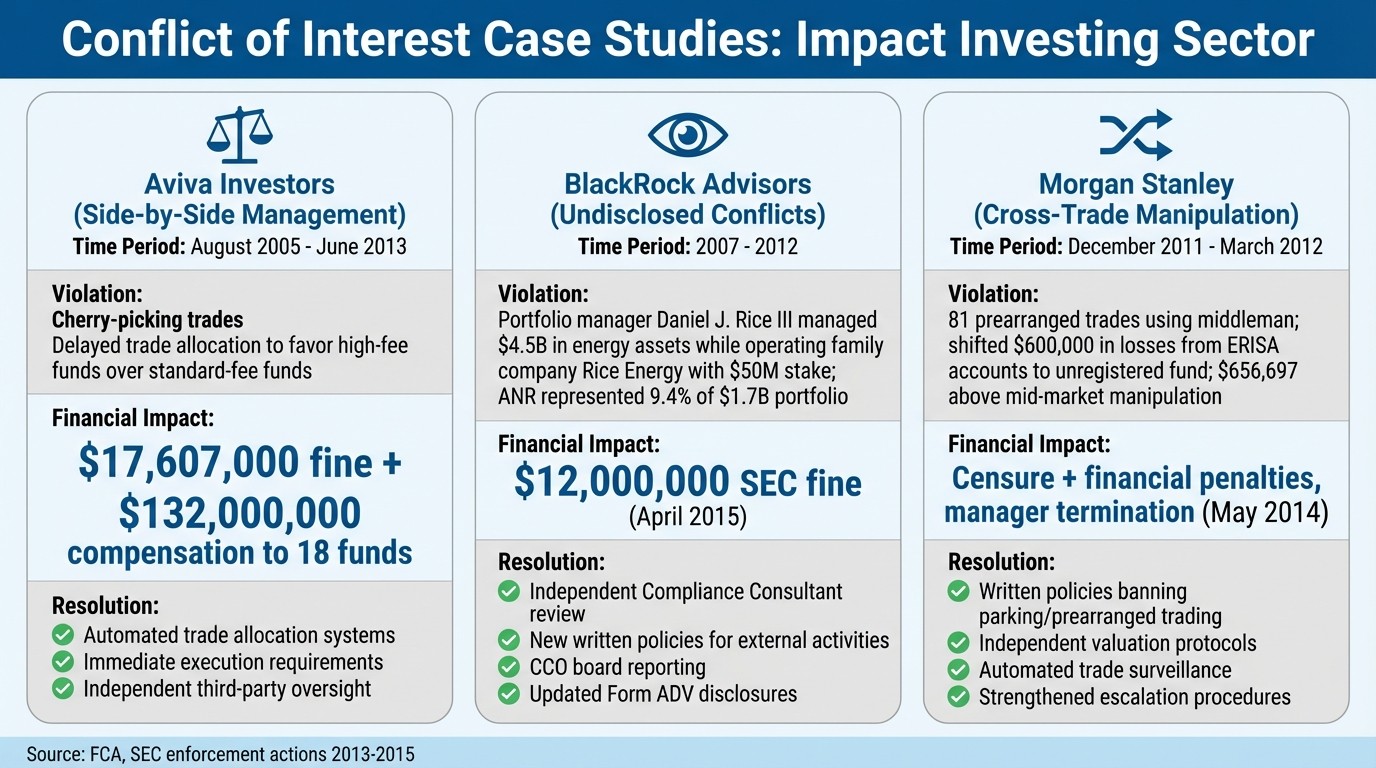

Regulatory penalties, reputational harm, and stakeholder trust erosion are common consequences. Examples like Aviva, BlackRock, and Morgan Stanley highlight how poor management of conflicts can lead to fines and loss of credibility. Solutions include automated systems, independent oversight, clear disclosure policies, and robust governance frameworks. Transparency, accountability, and proactive conflict management are essential to preserving the integrity of impact investing.

Three Major Conflict of Interest Cases in Impact Investing: Violations, Fines, and Resolutions

Case Study 1: Side-by-Side Management Favoring Performance Fees

Problems Identified

From August 2005 to June 2013, Aviva Investors Global Services Limited (AIGSL) managed various funds simultaneously, some of which included performance fees while others did not. This setup created a conflict of interest, as portfolio managers were incentivized to prioritize high-fee funds over standard-fee ones due to compensation structures tied to advisory fees [3]. Although AIGSL recognized and documented this conflict in its conflict register, the controls in place failed to prevent misuse [2].

The core issue revolved around the timing of trade allocation. While company policy required trades to be allocated promptly, portfolio managers delayed recording allocations for several hours after executing trades. This delay allowed them to monitor intraday performance and assign profitable trades to high-fee funds, disadvantaging standard-fee investments - a practice referred to as "cherry picking" [2].

In February 2015, the UK Financial Conduct Authority (FCA) imposed a $17,607,000 fine on AIGSL. Additionally, the firm compensated approximately $132,000,000 to 18 impacted funds [2]. As highlighted by Daniela Strebel and Paul Fraser from Deloitte:

"The firm identified this and recorded it in its conflict register." [2]

These findings prompted the need for substantial corrective actions.

How the Issue Was Resolved

Addressing the issue required both immediate compensation for affected investors and significant structural reforms. AIGSL ensured full financial restitution to the impacted investors, eliminating any adverse effects [2].

To prevent future occurrences, the firm introduced automated trade allocation systems, which removed the possibility of allocation delays. Under the new system, trades had to be allocated immediately upon execution, closing the window for any potential favoritism. Additionally, an independent third party was brought in to oversee the remediation process and confirm the effectiveness of the new controls [2]. This approach reflects a broader regulatory trend:

"In most cases, the regulator would not take the costly, lengthy and resource heavy approach of public enforcement or legal action but instead require the firms... to undertake lengthy and expensive internal remediation actions" [2].

This case underscores a critical takeaway: identifying conflicts of interest is not sufficient. Firms must implement robust controls that eliminate opportunities for personal incentives to compromise fiduciary responsibilities, especially when managing funds where both financial returns and broader social outcomes are at stake.

Case Study 2: Internal vs. External Impact Funds

Disclosure and Oversight Problems

Between 2007 and 2012, BlackRock Advisors, LLC found itself embroiled in a significant conflict of interest involving portfolio manager Daniel J. Rice III. While managing $4.5 billion in energy assets for external clients, Rice simultaneously operated his family-owned company, Rice Energy, which held a $50 million stake. The situation intensified in February 2010 when Rice Energy entered a joint venture with Alpha Natural Resources (ANR). By June 2011, ANR represented 9.4% of the $1.7 billion BlackRock Energy & Resources Portfolio under Rice's management.

BlackRock's Legal and Compliance Department initially flagged this conflict in 2010 when Rice sought approval to join the joint venture's board. However, due to poor record-keeping, the firm mistakenly believed it was addressing the issue for the first time, even though the activity had already been underway. The absence of written policies for monitoring, assessing, and disclosing employees' external activities compounded the problem, as the company relied entirely on Rice's self-reporting.

The U.S. Securities and Exchange Commission (SEC) highlighted the gravity of the oversight failure, emphasizing that:

"It is the client, not the investment adviser, who is entitled to determine whether a conflict of interest might cause a portfolio manager consciously or unconsciously to render advice that is not disinterested." [3]

When media reports in June 2012 brought Rice's dual roles to light, it led to a $12 million SEC fine in April 2015 for non-disclosure and broader compliance shortcomings. [3]

Actions Taken to Fix the Problem

Following these compliance failures, BlackRock implemented sweeping reforms under the SEC's direction. The firm was required to hire an Independent Compliance Consultant to conduct a thorough 120-day review of its policies on outside business activities. BlackRock was then obligated to adopt all of the consultant’s recommendations within 90 days.

In January 2013, BlackRock introduced new written policies designed to prevent similar issues in the future. These policies provided clear guidelines for evaluating employees' external activities and established who held the authority to approve them. Additionally, the Chief Compliance Officer (CCO) was tasked with reporting all significant compliance matters directly to the boards of the affected funds. To boost transparency, BlackRock also updated its Form ADV to disclose the SEC's findings and the corrective actions taken.

These changes marked a shift from relying solely on employee self-reporting to a more robust system that included independent verification and formal board oversight. This overhaul addressed the governance lapses that had allowed the conflict of interest to go unnoticed for years. [3]

Case Study 3: Cross-Trades Between Impact-Focused Clients

Where Conflict Management Failed

Between December 2011 and March 2012, Sheila Huang, who served as Head of Mortgages at Morgan Stanley Investment Management (MSIM), exploited weaknesses in cross-trade oversight by using SG Americas Securities (SGAS) as a middleman to carry out 81 prearranged trades. In a particularly egregious move in March 2012, Huang shifted $600,000 in unrealized losses from five ERISA-governed accounts to an unregistered fund. This was accomplished by selling 29 non-investment grade bonds to SGAS at inflated prices while simultaneously selling two bonds from the unregistered fund at steep discounts. The unregistered fund then repurchased all the positions the following day, effectively absorbing $656,697 above mid-market prices. This deliberate manipulation eventually triggered regulatory scrutiny. [4]

"The prearranged nature of the six sets of buyback trades meant that risk never truly passed to SGAS. In practice, Huang was simply interposing SGAS to effect cross trades and avoid MSIM and regulatory requirements governing cross trades." (U.S. Securities and Exchange Commission) [4]

To hide the scheme, Huang instructed her team to falsify dealer quotes in MSIM's recordkeeping systems. This created a misleading paper trail that appeared to demonstrate competitive bidding, aiming to meet best execution standards. Although MSIM's pricing team flagged trades that deviated more than 5% from vendor prices, an initial legal review labeled the trades as "questionable but not problematic." This allowed Huang to continue overseeing funds for another two years until the SEC stepped in. [4]

Changes Made to Prevent Future Issues

In light of these findings, MSIM made sweeping changes to its compliance framework. The firm implemented written policies explicitly banning "parking" and prearranged trading. Independent valuation protocols were introduced, requiring cross-trades to be executed at the midpoint between the highest current independent bid and the lowest current independent offer. Trade surveillance systems were upgraded to automatically detect buyback patterns, and escalation procedures were strengthened to ensure investigations considered fiduciary duties and client impact alongside legal compliance.

Sheila Huang was ultimately terminated in May 2014, and MSIM faced censure and financial penalties for its compliance shortcomings. These reforms aimed to restore trust and prevent similar issues from occurring in the future. [4]

Best Practices for Managing Conflicts of Interest

Governance and Oversight Methods

Case studies reveal that conflicts often escalate when oversight is weak or inconsistent. For organizations managing impact investments, it’s essential to establish structured systems that identify and address issues early, avoiding the need for regulatory intervention.

A strong starting point is implementing annual disclosure requirements. For example, the MacArthur Foundation mandates annual disclosures to maintain a clear record of material interests. Additionally, it operates a Gift Registry for items valued at $100 or more. The Vice President/General Counsel submits an annual report to the Audit Committee, outlining transactions involving conflicts and the steps taken to resolve them [1].

Carnegie Mellon University takes a different approach with its Investment Committee policy, which prohibits investments where a Trustee holds a management position. To override this restriction, a five-member special committee - composed of three independent members along with the Chairs of the Investment Committee and Board - must confirm that the investment is "fair and reasonable." This ensures that decisions involving potential conflicts are reviewed by impartial parties [6].

"The philosophy behind the procedures is to promote disclosure and transparency, rather than to impose categorical prohibitions, and to provide for a flexible approach to deal with actual or perceived conflicts."

– Carnegie Mellon University [6]

Another key tool is third-party audits, which validate that internal controls are functioning effectively. As of 2025, over $400 billion in assets are managed under the Operating Principles for Impact Management, which require annual disclosures and periodic external verification. More than 140 funds and institutions have adopted these principles. For instance, the International Finance Corporation released an independent verifier's limited assurance report in October 2025 to confirm the integrity of its impact management systems [7].

Governance Method | Primary Function | Key Benefit |

|---|---|---|

Conflict Register | Tracks known affiliations | Provides a historical record of managed conflicts [1] |

Third-Party Audit | Verifies internal controls externally | Builds trust and enhances market credibility [7] |

Recusal Policy | Removes biased decision-makers | Ensures decisions are made objectively [6] |

Gift Registry | Monitors external influences | Mitigates perceptions of favoritism or undue influence [1] |

These governance practices establish a foundation for greater transparency, which is essential for building trust with stakeholders.

Building Transparency and Stakeholder Trust

Transparency hinges on openly disclosing conflicts and providing stakeholders with real-time visibility. Organizations should clearly define what qualifies as a "material interest" - such as ownership exceeding 5% or income constituting more than 5% of total annual income - to eliminate any ambiguity in disclosures [1].

Despite the rapid growth of the impact investing market, which reached approximately $2.3 trillion in assets by 2025, only $636 billion of these assets are tied to well-defined impact management and measurement processes [7]. This highlights the urgent need for standardized frameworks. By adopting harmonized tools like the Joint Impact Indicators, aligned with IRIS+ and HIPSO, organizations can present transparent and comparable impact data to their stakeholders [7].

"The Foundation encourages a culture of transparency in which Covered Persons fully and promptly disclose all affiliations, interests, and gifts of which they are aware that might present a conflict..."

– MacArthur Foundation [1]

To foster a culture of openness, organizations should encourage individuals to disclose potential conflicts even when unsure of their relevance. Regular training that emphasizes open-ended questioning and effective communication among oversight teams can help identify and address issues before they develop into major problems [5].

How Council Fire Supports Conflict Management in Impact Investments

Using Data to Map Conflicts

Council Fire employs a data-driven strategy to identify potential conflicts within impact investment portfolios. By using quantitative scoring, the firm compares key metrics against industry benchmarks to uncover areas of concern. For instance, they analyze revenue exposure to determine how much of a company's income is tied to activities that might be vulnerable to specific risks. This step is crucial in assessing whether financial priorities could potentially overshadow impact commitments.

Their approach also involves risk modeling to simulate scenarios like governance breakdowns or supply chain interruptions. These simulations help investment managers predict how such events could influence portfolio performance and highlight areas where conflicts might emerge. Even when data is incomplete, Council Fire leverages proxy information from similar companies or industry averages, ensuring decision-making remains informed. This meticulous use of data forms the foundation for creating tailored governance frameworks.

Creating Custom Governance Frameworks

Council Fire designs governance frameworks that are specifically tailored to address the unique risks of each portfolio. These frameworks are built around materiality-based factors, focusing on the most financially impactful elements - such as data privacy concerns in tech investments or carbon emissions in energy holdings. By zeroing in on the most pressing vulnerabilities, their conflict management strategies remain highly targeted and effective.

A key feature of their method is dynamic rebalancing, which continuously monitors trends and adjusts to evolving risk profiles. Unlike static ratings, this real-time approach provides actionable insights into emerging conflicts, ensuring accountability throughout the entire investment process.

Improving Stakeholder Communication

In addition to data analysis and customized frameworks, Council Fire prioritizes effective stakeholder communication. By working closely with client teams, they foster trust through direct collaboration. Their communication strategies are designed to showcase sustainability achievements and deliver measurable, transparent solutions. This gives stakeholders clear evidence of progress, addressing the growing demand for transparency from both investors and regulators.

Council Fire combines quantitative insights with human expertise to interpret data and account for company-specific actions and broader economic conditions. This balance of data and judgment helps build accountability and reduces skepticism among stakeholders who might doubt whether impact goals are genuinely prioritized over financial returns. By providing clarity and measurable outcomes, Council Fire ensures that conflict management efforts resonate with all parties involved.

Impact Washing: The Great Risk to Growing the Impact Investing Industry

Conclusion

Effectively managing conflicts of interest is essential to safeguarding both financial returns and the integrity of an organization’s mission. The Russell Family Foundation's journey - expanding its impact-aligned investments from 7% to an impressive 94% between 2014 and 2024 - highlights the transformative role of transparency and structured decision-making in achieving aligned goals [8].

Establishing clear guidelines for disclosure, such as the MacArthur Foundation's 5% rule, is a critical step. Organizations should ensure that individuals with conflicts not only abstain from voting but also avoid participating in informal discussions. Thorough documentation of these processes is equally important [1]. These practices build trust among stakeholders, as they are pivotal to preserving both financial and mission-driven performance.

"Addressing conflicts of interest in a nonprofit is essential for success. It directly impacts the credibility, public trust, and overall effectiveness of the nonprofit in achieving its mission." - The Charity CFO [9]

This insight underscores how strong conflict management systems protect an organization’s credibility and foster trust.

By implementing measures like annual disclosures, centralized oversight, and gift registries, organizations can maintain accountability even as their portfolios grow and evolve.

Impact investing demands a balance of financial discipline and ethical responsibility. When organizations consolidate formal protocols, recusal standards, and transparent oversight into cohesive governance strategies, they can achieve measurable social and environmental outcomes without compromising their values. Looking ahead, transparency, decisive action, and ongoing monitoring will remain indispensable tools for ensuring success.

FAQs

What are the typical conflicts of interest in impact investing?

Conflicts of interest in impact investing often emerge when financial objectives clash with the mission to achieve meaningful social or environmental change. One of the most frequent challenges is balancing profit with purpose. The pressure to deliver high financial returns can sometimes take precedence over the commitment to measurable impact, particularly when performance rewards are tied exclusively to financial outcomes rather than impact-driven achievements.

Another source of tension comes from personal or organizational affiliations. For instance, board memberships or ownership stakes in portfolio companies can lead to decisions that favor private interests over the broader impact goals. Similarly, incentive structures - like commission-based pay - can push individuals to prioritize short-term financial gains, potentially at the expense of long-term alignment with impact objectives.

To navigate these challenges, organizations need to establish robust governance frameworks, enforce transparent policies, and ensure that financial and impact goals are clearly aligned. These steps are crucial for maintaining trust and achieving meaningful, lasting results.

How can organizations address and prevent conflicts of interest in impact investing?

To address potential conflicts of interest in impact investing, organizations should implement a strong governance framework that emphasizes transparency and accountability. A key component of this framework is a written conflict-of-interest policy. Such a policy requires all individuals involved - whether board members, staff, or investment committee participants - to disclose any personal or financial connections that might affect their decision-making. Additionally, it mandates that individuals recuse themselves from decisions where conflicts arise. Regular disclosures and fostering a culture of openness are critical steps in reducing these risks.

Adding independent oversight can further safeguard impartiality. Leveraging third-party impact measurement standards like IRIS+ or establishing an external advisory board ensures investment decisions align with the organization’s mission. This approach helps to minimize personal biases while maintaining focus on the broader goals. Separating responsibilities and adhering to strict ethical guidelines also reinforce this alignment.

For additional support, organizations might consider collaborating with sustainability-focused consultancies such as Council Fire. These partnerships provide strategic insights and customized solutions to incorporate conflict management into impact investment strategies. This ensures that financial objectives and positive social or environmental outcomes are achieved without compromising integrity.

What happens if conflicts of interest in impact investing are not properly managed?

When conflicts of interest arise in impact investing and are not handled properly, the fallout can be severe. Organizations might face regulatory scrutiny, including hefty fines or legal actions, which can disrupt operations and tarnish their credibility. Beyond the financial and legal ramifications, mishandling these situations can damage trust and reputation among key stakeholders - investors, partners, and the broader public.

The most troubling consequence, however, is the potential misallocation of funds. When conflicts are left unresolved, capital intended to drive positive social and environmental change may end up being misused, ultimately compromising the mission at its core. Addressing these challenges head-on is crucial for upholding transparency, ensuring accountability, and staying aligned with the goals of impact investing.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 22, 2025

Case Studies: Conflict of Interest in Impact Investments

ESG Strategy

In This Article

Unchecked conflicts of interest in impact investing erode returns and mission — real cases show fines, fraud and how governance, disclosure, and automated controls restore trust.

Case Studies: Conflict of Interest in Impact Investments

Conflicts of interest in impact investing arise when personal or organizational priorities interfere with delivering both financial returns and social outcomes. These conflicts, if unchecked, can harm investors, stakeholders, and the credibility of the entire sector. Key challenges include:

Side-by-Side Management: Favoring funds with higher performance fees at the expense of others.

Cross-Trades: Undisclosed asset trades between clients, leading to financial losses.

Material Affiliations: Decision-makers with ties to entities they oversee, risking biased decisions.

Benchmark Mismatch: Using financial benchmarks that dilute impact goals.

Regulatory penalties, reputational harm, and stakeholder trust erosion are common consequences. Examples like Aviva, BlackRock, and Morgan Stanley highlight how poor management of conflicts can lead to fines and loss of credibility. Solutions include automated systems, independent oversight, clear disclosure policies, and robust governance frameworks. Transparency, accountability, and proactive conflict management are essential to preserving the integrity of impact investing.

Three Major Conflict of Interest Cases in Impact Investing: Violations, Fines, and Resolutions

Case Study 1: Side-by-Side Management Favoring Performance Fees

Problems Identified

From August 2005 to June 2013, Aviva Investors Global Services Limited (AIGSL) managed various funds simultaneously, some of which included performance fees while others did not. This setup created a conflict of interest, as portfolio managers were incentivized to prioritize high-fee funds over standard-fee ones due to compensation structures tied to advisory fees [3]. Although AIGSL recognized and documented this conflict in its conflict register, the controls in place failed to prevent misuse [2].

The core issue revolved around the timing of trade allocation. While company policy required trades to be allocated promptly, portfolio managers delayed recording allocations for several hours after executing trades. This delay allowed them to monitor intraday performance and assign profitable trades to high-fee funds, disadvantaging standard-fee investments - a practice referred to as "cherry picking" [2].

In February 2015, the UK Financial Conduct Authority (FCA) imposed a $17,607,000 fine on AIGSL. Additionally, the firm compensated approximately $132,000,000 to 18 impacted funds [2]. As highlighted by Daniela Strebel and Paul Fraser from Deloitte:

"The firm identified this and recorded it in its conflict register." [2]

These findings prompted the need for substantial corrective actions.

How the Issue Was Resolved

Addressing the issue required both immediate compensation for affected investors and significant structural reforms. AIGSL ensured full financial restitution to the impacted investors, eliminating any adverse effects [2].

To prevent future occurrences, the firm introduced automated trade allocation systems, which removed the possibility of allocation delays. Under the new system, trades had to be allocated immediately upon execution, closing the window for any potential favoritism. Additionally, an independent third party was brought in to oversee the remediation process and confirm the effectiveness of the new controls [2]. This approach reflects a broader regulatory trend:

"In most cases, the regulator would not take the costly, lengthy and resource heavy approach of public enforcement or legal action but instead require the firms... to undertake lengthy and expensive internal remediation actions" [2].

This case underscores a critical takeaway: identifying conflicts of interest is not sufficient. Firms must implement robust controls that eliminate opportunities for personal incentives to compromise fiduciary responsibilities, especially when managing funds where both financial returns and broader social outcomes are at stake.

Case Study 2: Internal vs. External Impact Funds

Disclosure and Oversight Problems

Between 2007 and 2012, BlackRock Advisors, LLC found itself embroiled in a significant conflict of interest involving portfolio manager Daniel J. Rice III. While managing $4.5 billion in energy assets for external clients, Rice simultaneously operated his family-owned company, Rice Energy, which held a $50 million stake. The situation intensified in February 2010 when Rice Energy entered a joint venture with Alpha Natural Resources (ANR). By June 2011, ANR represented 9.4% of the $1.7 billion BlackRock Energy & Resources Portfolio under Rice's management.

BlackRock's Legal and Compliance Department initially flagged this conflict in 2010 when Rice sought approval to join the joint venture's board. However, due to poor record-keeping, the firm mistakenly believed it was addressing the issue for the first time, even though the activity had already been underway. The absence of written policies for monitoring, assessing, and disclosing employees' external activities compounded the problem, as the company relied entirely on Rice's self-reporting.

The U.S. Securities and Exchange Commission (SEC) highlighted the gravity of the oversight failure, emphasizing that:

"It is the client, not the investment adviser, who is entitled to determine whether a conflict of interest might cause a portfolio manager consciously or unconsciously to render advice that is not disinterested." [3]

When media reports in June 2012 brought Rice's dual roles to light, it led to a $12 million SEC fine in April 2015 for non-disclosure and broader compliance shortcomings. [3]

Actions Taken to Fix the Problem

Following these compliance failures, BlackRock implemented sweeping reforms under the SEC's direction. The firm was required to hire an Independent Compliance Consultant to conduct a thorough 120-day review of its policies on outside business activities. BlackRock was then obligated to adopt all of the consultant’s recommendations within 90 days.

In January 2013, BlackRock introduced new written policies designed to prevent similar issues in the future. These policies provided clear guidelines for evaluating employees' external activities and established who held the authority to approve them. Additionally, the Chief Compliance Officer (CCO) was tasked with reporting all significant compliance matters directly to the boards of the affected funds. To boost transparency, BlackRock also updated its Form ADV to disclose the SEC's findings and the corrective actions taken.

These changes marked a shift from relying solely on employee self-reporting to a more robust system that included independent verification and formal board oversight. This overhaul addressed the governance lapses that had allowed the conflict of interest to go unnoticed for years. [3]

Case Study 3: Cross-Trades Between Impact-Focused Clients

Where Conflict Management Failed

Between December 2011 and March 2012, Sheila Huang, who served as Head of Mortgages at Morgan Stanley Investment Management (MSIM), exploited weaknesses in cross-trade oversight by using SG Americas Securities (SGAS) as a middleman to carry out 81 prearranged trades. In a particularly egregious move in March 2012, Huang shifted $600,000 in unrealized losses from five ERISA-governed accounts to an unregistered fund. This was accomplished by selling 29 non-investment grade bonds to SGAS at inflated prices while simultaneously selling two bonds from the unregistered fund at steep discounts. The unregistered fund then repurchased all the positions the following day, effectively absorbing $656,697 above mid-market prices. This deliberate manipulation eventually triggered regulatory scrutiny. [4]

"The prearranged nature of the six sets of buyback trades meant that risk never truly passed to SGAS. In practice, Huang was simply interposing SGAS to effect cross trades and avoid MSIM and regulatory requirements governing cross trades." (U.S. Securities and Exchange Commission) [4]

To hide the scheme, Huang instructed her team to falsify dealer quotes in MSIM's recordkeeping systems. This created a misleading paper trail that appeared to demonstrate competitive bidding, aiming to meet best execution standards. Although MSIM's pricing team flagged trades that deviated more than 5% from vendor prices, an initial legal review labeled the trades as "questionable but not problematic." This allowed Huang to continue overseeing funds for another two years until the SEC stepped in. [4]

Changes Made to Prevent Future Issues

In light of these findings, MSIM made sweeping changes to its compliance framework. The firm implemented written policies explicitly banning "parking" and prearranged trading. Independent valuation protocols were introduced, requiring cross-trades to be executed at the midpoint between the highest current independent bid and the lowest current independent offer. Trade surveillance systems were upgraded to automatically detect buyback patterns, and escalation procedures were strengthened to ensure investigations considered fiduciary duties and client impact alongside legal compliance.

Sheila Huang was ultimately terminated in May 2014, and MSIM faced censure and financial penalties for its compliance shortcomings. These reforms aimed to restore trust and prevent similar issues from occurring in the future. [4]

Best Practices for Managing Conflicts of Interest

Governance and Oversight Methods

Case studies reveal that conflicts often escalate when oversight is weak or inconsistent. For organizations managing impact investments, it’s essential to establish structured systems that identify and address issues early, avoiding the need for regulatory intervention.

A strong starting point is implementing annual disclosure requirements. For example, the MacArthur Foundation mandates annual disclosures to maintain a clear record of material interests. Additionally, it operates a Gift Registry for items valued at $100 or more. The Vice President/General Counsel submits an annual report to the Audit Committee, outlining transactions involving conflicts and the steps taken to resolve them [1].

Carnegie Mellon University takes a different approach with its Investment Committee policy, which prohibits investments where a Trustee holds a management position. To override this restriction, a five-member special committee - composed of three independent members along with the Chairs of the Investment Committee and Board - must confirm that the investment is "fair and reasonable." This ensures that decisions involving potential conflicts are reviewed by impartial parties [6].

"The philosophy behind the procedures is to promote disclosure and transparency, rather than to impose categorical prohibitions, and to provide for a flexible approach to deal with actual or perceived conflicts."

– Carnegie Mellon University [6]

Another key tool is third-party audits, which validate that internal controls are functioning effectively. As of 2025, over $400 billion in assets are managed under the Operating Principles for Impact Management, which require annual disclosures and periodic external verification. More than 140 funds and institutions have adopted these principles. For instance, the International Finance Corporation released an independent verifier's limited assurance report in October 2025 to confirm the integrity of its impact management systems [7].

Governance Method | Primary Function | Key Benefit |

|---|---|---|

Conflict Register | Tracks known affiliations | Provides a historical record of managed conflicts [1] |

Third-Party Audit | Verifies internal controls externally | Builds trust and enhances market credibility [7] |

Recusal Policy | Removes biased decision-makers | Ensures decisions are made objectively [6] |

Gift Registry | Monitors external influences | Mitigates perceptions of favoritism or undue influence [1] |

These governance practices establish a foundation for greater transparency, which is essential for building trust with stakeholders.

Building Transparency and Stakeholder Trust

Transparency hinges on openly disclosing conflicts and providing stakeholders with real-time visibility. Organizations should clearly define what qualifies as a "material interest" - such as ownership exceeding 5% or income constituting more than 5% of total annual income - to eliminate any ambiguity in disclosures [1].

Despite the rapid growth of the impact investing market, which reached approximately $2.3 trillion in assets by 2025, only $636 billion of these assets are tied to well-defined impact management and measurement processes [7]. This highlights the urgent need for standardized frameworks. By adopting harmonized tools like the Joint Impact Indicators, aligned with IRIS+ and HIPSO, organizations can present transparent and comparable impact data to their stakeholders [7].

"The Foundation encourages a culture of transparency in which Covered Persons fully and promptly disclose all affiliations, interests, and gifts of which they are aware that might present a conflict..."

– MacArthur Foundation [1]

To foster a culture of openness, organizations should encourage individuals to disclose potential conflicts even when unsure of their relevance. Regular training that emphasizes open-ended questioning and effective communication among oversight teams can help identify and address issues before they develop into major problems [5].

How Council Fire Supports Conflict Management in Impact Investments

Using Data to Map Conflicts

Council Fire employs a data-driven strategy to identify potential conflicts within impact investment portfolios. By using quantitative scoring, the firm compares key metrics against industry benchmarks to uncover areas of concern. For instance, they analyze revenue exposure to determine how much of a company's income is tied to activities that might be vulnerable to specific risks. This step is crucial in assessing whether financial priorities could potentially overshadow impact commitments.

Their approach also involves risk modeling to simulate scenarios like governance breakdowns or supply chain interruptions. These simulations help investment managers predict how such events could influence portfolio performance and highlight areas where conflicts might emerge. Even when data is incomplete, Council Fire leverages proxy information from similar companies or industry averages, ensuring decision-making remains informed. This meticulous use of data forms the foundation for creating tailored governance frameworks.

Creating Custom Governance Frameworks

Council Fire designs governance frameworks that are specifically tailored to address the unique risks of each portfolio. These frameworks are built around materiality-based factors, focusing on the most financially impactful elements - such as data privacy concerns in tech investments or carbon emissions in energy holdings. By zeroing in on the most pressing vulnerabilities, their conflict management strategies remain highly targeted and effective.

A key feature of their method is dynamic rebalancing, which continuously monitors trends and adjusts to evolving risk profiles. Unlike static ratings, this real-time approach provides actionable insights into emerging conflicts, ensuring accountability throughout the entire investment process.

Improving Stakeholder Communication

In addition to data analysis and customized frameworks, Council Fire prioritizes effective stakeholder communication. By working closely with client teams, they foster trust through direct collaboration. Their communication strategies are designed to showcase sustainability achievements and deliver measurable, transparent solutions. This gives stakeholders clear evidence of progress, addressing the growing demand for transparency from both investors and regulators.

Council Fire combines quantitative insights with human expertise to interpret data and account for company-specific actions and broader economic conditions. This balance of data and judgment helps build accountability and reduces skepticism among stakeholders who might doubt whether impact goals are genuinely prioritized over financial returns. By providing clarity and measurable outcomes, Council Fire ensures that conflict management efforts resonate with all parties involved.

Impact Washing: The Great Risk to Growing the Impact Investing Industry

Conclusion

Effectively managing conflicts of interest is essential to safeguarding both financial returns and the integrity of an organization’s mission. The Russell Family Foundation's journey - expanding its impact-aligned investments from 7% to an impressive 94% between 2014 and 2024 - highlights the transformative role of transparency and structured decision-making in achieving aligned goals [8].

Establishing clear guidelines for disclosure, such as the MacArthur Foundation's 5% rule, is a critical step. Organizations should ensure that individuals with conflicts not only abstain from voting but also avoid participating in informal discussions. Thorough documentation of these processes is equally important [1]. These practices build trust among stakeholders, as they are pivotal to preserving both financial and mission-driven performance.

"Addressing conflicts of interest in a nonprofit is essential for success. It directly impacts the credibility, public trust, and overall effectiveness of the nonprofit in achieving its mission." - The Charity CFO [9]

This insight underscores how strong conflict management systems protect an organization’s credibility and foster trust.

By implementing measures like annual disclosures, centralized oversight, and gift registries, organizations can maintain accountability even as their portfolios grow and evolve.

Impact investing demands a balance of financial discipline and ethical responsibility. When organizations consolidate formal protocols, recusal standards, and transparent oversight into cohesive governance strategies, they can achieve measurable social and environmental outcomes without compromising their values. Looking ahead, transparency, decisive action, and ongoing monitoring will remain indispensable tools for ensuring success.

FAQs

What are the typical conflicts of interest in impact investing?

Conflicts of interest in impact investing often emerge when financial objectives clash with the mission to achieve meaningful social or environmental change. One of the most frequent challenges is balancing profit with purpose. The pressure to deliver high financial returns can sometimes take precedence over the commitment to measurable impact, particularly when performance rewards are tied exclusively to financial outcomes rather than impact-driven achievements.

Another source of tension comes from personal or organizational affiliations. For instance, board memberships or ownership stakes in portfolio companies can lead to decisions that favor private interests over the broader impact goals. Similarly, incentive structures - like commission-based pay - can push individuals to prioritize short-term financial gains, potentially at the expense of long-term alignment with impact objectives.

To navigate these challenges, organizations need to establish robust governance frameworks, enforce transparent policies, and ensure that financial and impact goals are clearly aligned. These steps are crucial for maintaining trust and achieving meaningful, lasting results.

How can organizations address and prevent conflicts of interest in impact investing?

To address potential conflicts of interest in impact investing, organizations should implement a strong governance framework that emphasizes transparency and accountability. A key component of this framework is a written conflict-of-interest policy. Such a policy requires all individuals involved - whether board members, staff, or investment committee participants - to disclose any personal or financial connections that might affect their decision-making. Additionally, it mandates that individuals recuse themselves from decisions where conflicts arise. Regular disclosures and fostering a culture of openness are critical steps in reducing these risks.

Adding independent oversight can further safeguard impartiality. Leveraging third-party impact measurement standards like IRIS+ or establishing an external advisory board ensures investment decisions align with the organization’s mission. This approach helps to minimize personal biases while maintaining focus on the broader goals. Separating responsibilities and adhering to strict ethical guidelines also reinforce this alignment.

For additional support, organizations might consider collaborating with sustainability-focused consultancies such as Council Fire. These partnerships provide strategic insights and customized solutions to incorporate conflict management into impact investment strategies. This ensures that financial objectives and positive social or environmental outcomes are achieved without compromising integrity.

What happens if conflicts of interest in impact investing are not properly managed?

When conflicts of interest arise in impact investing and are not handled properly, the fallout can be severe. Organizations might face regulatory scrutiny, including hefty fines or legal actions, which can disrupt operations and tarnish their credibility. Beyond the financial and legal ramifications, mishandling these situations can damage trust and reputation among key stakeholders - investors, partners, and the broader public.

The most troubling consequence, however, is the potential misallocation of funds. When conflicts are left unresolved, capital intended to drive positive social and environmental change may end up being misused, ultimately compromising the mission at its core. Addressing these challenges head-on is crucial for upholding transparency, ensuring accountability, and staying aligned with the goals of impact investing.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 22, 2025

Case Studies: Conflict of Interest in Impact Investments

ESG Strategy

In This Article

Unchecked conflicts of interest in impact investing erode returns and mission — real cases show fines, fraud and how governance, disclosure, and automated controls restore trust.

Case Studies: Conflict of Interest in Impact Investments

Conflicts of interest in impact investing arise when personal or organizational priorities interfere with delivering both financial returns and social outcomes. These conflicts, if unchecked, can harm investors, stakeholders, and the credibility of the entire sector. Key challenges include:

Side-by-Side Management: Favoring funds with higher performance fees at the expense of others.

Cross-Trades: Undisclosed asset trades between clients, leading to financial losses.

Material Affiliations: Decision-makers with ties to entities they oversee, risking biased decisions.

Benchmark Mismatch: Using financial benchmarks that dilute impact goals.

Regulatory penalties, reputational harm, and stakeholder trust erosion are common consequences. Examples like Aviva, BlackRock, and Morgan Stanley highlight how poor management of conflicts can lead to fines and loss of credibility. Solutions include automated systems, independent oversight, clear disclosure policies, and robust governance frameworks. Transparency, accountability, and proactive conflict management are essential to preserving the integrity of impact investing.

Three Major Conflict of Interest Cases in Impact Investing: Violations, Fines, and Resolutions

Case Study 1: Side-by-Side Management Favoring Performance Fees

Problems Identified

From August 2005 to June 2013, Aviva Investors Global Services Limited (AIGSL) managed various funds simultaneously, some of which included performance fees while others did not. This setup created a conflict of interest, as portfolio managers were incentivized to prioritize high-fee funds over standard-fee ones due to compensation structures tied to advisory fees [3]. Although AIGSL recognized and documented this conflict in its conflict register, the controls in place failed to prevent misuse [2].

The core issue revolved around the timing of trade allocation. While company policy required trades to be allocated promptly, portfolio managers delayed recording allocations for several hours after executing trades. This delay allowed them to monitor intraday performance and assign profitable trades to high-fee funds, disadvantaging standard-fee investments - a practice referred to as "cherry picking" [2].

In February 2015, the UK Financial Conduct Authority (FCA) imposed a $17,607,000 fine on AIGSL. Additionally, the firm compensated approximately $132,000,000 to 18 impacted funds [2]. As highlighted by Daniela Strebel and Paul Fraser from Deloitte:

"The firm identified this and recorded it in its conflict register." [2]

These findings prompted the need for substantial corrective actions.

How the Issue Was Resolved

Addressing the issue required both immediate compensation for affected investors and significant structural reforms. AIGSL ensured full financial restitution to the impacted investors, eliminating any adverse effects [2].

To prevent future occurrences, the firm introduced automated trade allocation systems, which removed the possibility of allocation delays. Under the new system, trades had to be allocated immediately upon execution, closing the window for any potential favoritism. Additionally, an independent third party was brought in to oversee the remediation process and confirm the effectiveness of the new controls [2]. This approach reflects a broader regulatory trend:

"In most cases, the regulator would not take the costly, lengthy and resource heavy approach of public enforcement or legal action but instead require the firms... to undertake lengthy and expensive internal remediation actions" [2].

This case underscores a critical takeaway: identifying conflicts of interest is not sufficient. Firms must implement robust controls that eliminate opportunities for personal incentives to compromise fiduciary responsibilities, especially when managing funds where both financial returns and broader social outcomes are at stake.

Case Study 2: Internal vs. External Impact Funds

Disclosure and Oversight Problems

Between 2007 and 2012, BlackRock Advisors, LLC found itself embroiled in a significant conflict of interest involving portfolio manager Daniel J. Rice III. While managing $4.5 billion in energy assets for external clients, Rice simultaneously operated his family-owned company, Rice Energy, which held a $50 million stake. The situation intensified in February 2010 when Rice Energy entered a joint venture with Alpha Natural Resources (ANR). By June 2011, ANR represented 9.4% of the $1.7 billion BlackRock Energy & Resources Portfolio under Rice's management.

BlackRock's Legal and Compliance Department initially flagged this conflict in 2010 when Rice sought approval to join the joint venture's board. However, due to poor record-keeping, the firm mistakenly believed it was addressing the issue for the first time, even though the activity had already been underway. The absence of written policies for monitoring, assessing, and disclosing employees' external activities compounded the problem, as the company relied entirely on Rice's self-reporting.

The U.S. Securities and Exchange Commission (SEC) highlighted the gravity of the oversight failure, emphasizing that:

"It is the client, not the investment adviser, who is entitled to determine whether a conflict of interest might cause a portfolio manager consciously or unconsciously to render advice that is not disinterested." [3]

When media reports in June 2012 brought Rice's dual roles to light, it led to a $12 million SEC fine in April 2015 for non-disclosure and broader compliance shortcomings. [3]

Actions Taken to Fix the Problem

Following these compliance failures, BlackRock implemented sweeping reforms under the SEC's direction. The firm was required to hire an Independent Compliance Consultant to conduct a thorough 120-day review of its policies on outside business activities. BlackRock was then obligated to adopt all of the consultant’s recommendations within 90 days.

In January 2013, BlackRock introduced new written policies designed to prevent similar issues in the future. These policies provided clear guidelines for evaluating employees' external activities and established who held the authority to approve them. Additionally, the Chief Compliance Officer (CCO) was tasked with reporting all significant compliance matters directly to the boards of the affected funds. To boost transparency, BlackRock also updated its Form ADV to disclose the SEC's findings and the corrective actions taken.

These changes marked a shift from relying solely on employee self-reporting to a more robust system that included independent verification and formal board oversight. This overhaul addressed the governance lapses that had allowed the conflict of interest to go unnoticed for years. [3]

Case Study 3: Cross-Trades Between Impact-Focused Clients

Where Conflict Management Failed

Between December 2011 and March 2012, Sheila Huang, who served as Head of Mortgages at Morgan Stanley Investment Management (MSIM), exploited weaknesses in cross-trade oversight by using SG Americas Securities (SGAS) as a middleman to carry out 81 prearranged trades. In a particularly egregious move in March 2012, Huang shifted $600,000 in unrealized losses from five ERISA-governed accounts to an unregistered fund. This was accomplished by selling 29 non-investment grade bonds to SGAS at inflated prices while simultaneously selling two bonds from the unregistered fund at steep discounts. The unregistered fund then repurchased all the positions the following day, effectively absorbing $656,697 above mid-market prices. This deliberate manipulation eventually triggered regulatory scrutiny. [4]

"The prearranged nature of the six sets of buyback trades meant that risk never truly passed to SGAS. In practice, Huang was simply interposing SGAS to effect cross trades and avoid MSIM and regulatory requirements governing cross trades." (U.S. Securities and Exchange Commission) [4]

To hide the scheme, Huang instructed her team to falsify dealer quotes in MSIM's recordkeeping systems. This created a misleading paper trail that appeared to demonstrate competitive bidding, aiming to meet best execution standards. Although MSIM's pricing team flagged trades that deviated more than 5% from vendor prices, an initial legal review labeled the trades as "questionable but not problematic." This allowed Huang to continue overseeing funds for another two years until the SEC stepped in. [4]

Changes Made to Prevent Future Issues

In light of these findings, MSIM made sweeping changes to its compliance framework. The firm implemented written policies explicitly banning "parking" and prearranged trading. Independent valuation protocols were introduced, requiring cross-trades to be executed at the midpoint between the highest current independent bid and the lowest current independent offer. Trade surveillance systems were upgraded to automatically detect buyback patterns, and escalation procedures were strengthened to ensure investigations considered fiduciary duties and client impact alongside legal compliance.

Sheila Huang was ultimately terminated in May 2014, and MSIM faced censure and financial penalties for its compliance shortcomings. These reforms aimed to restore trust and prevent similar issues from occurring in the future. [4]

Best Practices for Managing Conflicts of Interest

Governance and Oversight Methods

Case studies reveal that conflicts often escalate when oversight is weak or inconsistent. For organizations managing impact investments, it’s essential to establish structured systems that identify and address issues early, avoiding the need for regulatory intervention.

A strong starting point is implementing annual disclosure requirements. For example, the MacArthur Foundation mandates annual disclosures to maintain a clear record of material interests. Additionally, it operates a Gift Registry for items valued at $100 or more. The Vice President/General Counsel submits an annual report to the Audit Committee, outlining transactions involving conflicts and the steps taken to resolve them [1].

Carnegie Mellon University takes a different approach with its Investment Committee policy, which prohibits investments where a Trustee holds a management position. To override this restriction, a five-member special committee - composed of three independent members along with the Chairs of the Investment Committee and Board - must confirm that the investment is "fair and reasonable." This ensures that decisions involving potential conflicts are reviewed by impartial parties [6].

"The philosophy behind the procedures is to promote disclosure and transparency, rather than to impose categorical prohibitions, and to provide for a flexible approach to deal with actual or perceived conflicts."

– Carnegie Mellon University [6]

Another key tool is third-party audits, which validate that internal controls are functioning effectively. As of 2025, over $400 billion in assets are managed under the Operating Principles for Impact Management, which require annual disclosures and periodic external verification. More than 140 funds and institutions have adopted these principles. For instance, the International Finance Corporation released an independent verifier's limited assurance report in October 2025 to confirm the integrity of its impact management systems [7].

Governance Method | Primary Function | Key Benefit |

|---|---|---|

Conflict Register | Tracks known affiliations | Provides a historical record of managed conflicts [1] |

Third-Party Audit | Verifies internal controls externally | Builds trust and enhances market credibility [7] |

Recusal Policy | Removes biased decision-makers | Ensures decisions are made objectively [6] |

Gift Registry | Monitors external influences | Mitigates perceptions of favoritism or undue influence [1] |

These governance practices establish a foundation for greater transparency, which is essential for building trust with stakeholders.

Building Transparency and Stakeholder Trust

Transparency hinges on openly disclosing conflicts and providing stakeholders with real-time visibility. Organizations should clearly define what qualifies as a "material interest" - such as ownership exceeding 5% or income constituting more than 5% of total annual income - to eliminate any ambiguity in disclosures [1].

Despite the rapid growth of the impact investing market, which reached approximately $2.3 trillion in assets by 2025, only $636 billion of these assets are tied to well-defined impact management and measurement processes [7]. This highlights the urgent need for standardized frameworks. By adopting harmonized tools like the Joint Impact Indicators, aligned with IRIS+ and HIPSO, organizations can present transparent and comparable impact data to their stakeholders [7].

"The Foundation encourages a culture of transparency in which Covered Persons fully and promptly disclose all affiliations, interests, and gifts of which they are aware that might present a conflict..."

– MacArthur Foundation [1]

To foster a culture of openness, organizations should encourage individuals to disclose potential conflicts even when unsure of their relevance. Regular training that emphasizes open-ended questioning and effective communication among oversight teams can help identify and address issues before they develop into major problems [5].

How Council Fire Supports Conflict Management in Impact Investments

Using Data to Map Conflicts

Council Fire employs a data-driven strategy to identify potential conflicts within impact investment portfolios. By using quantitative scoring, the firm compares key metrics against industry benchmarks to uncover areas of concern. For instance, they analyze revenue exposure to determine how much of a company's income is tied to activities that might be vulnerable to specific risks. This step is crucial in assessing whether financial priorities could potentially overshadow impact commitments.

Their approach also involves risk modeling to simulate scenarios like governance breakdowns or supply chain interruptions. These simulations help investment managers predict how such events could influence portfolio performance and highlight areas where conflicts might emerge. Even when data is incomplete, Council Fire leverages proxy information from similar companies or industry averages, ensuring decision-making remains informed. This meticulous use of data forms the foundation for creating tailored governance frameworks.

Creating Custom Governance Frameworks

Council Fire designs governance frameworks that are specifically tailored to address the unique risks of each portfolio. These frameworks are built around materiality-based factors, focusing on the most financially impactful elements - such as data privacy concerns in tech investments or carbon emissions in energy holdings. By zeroing in on the most pressing vulnerabilities, their conflict management strategies remain highly targeted and effective.

A key feature of their method is dynamic rebalancing, which continuously monitors trends and adjusts to evolving risk profiles. Unlike static ratings, this real-time approach provides actionable insights into emerging conflicts, ensuring accountability throughout the entire investment process.

Improving Stakeholder Communication

In addition to data analysis and customized frameworks, Council Fire prioritizes effective stakeholder communication. By working closely with client teams, they foster trust through direct collaboration. Their communication strategies are designed to showcase sustainability achievements and deliver measurable, transparent solutions. This gives stakeholders clear evidence of progress, addressing the growing demand for transparency from both investors and regulators.

Council Fire combines quantitative insights with human expertise to interpret data and account for company-specific actions and broader economic conditions. This balance of data and judgment helps build accountability and reduces skepticism among stakeholders who might doubt whether impact goals are genuinely prioritized over financial returns. By providing clarity and measurable outcomes, Council Fire ensures that conflict management efforts resonate with all parties involved.

Impact Washing: The Great Risk to Growing the Impact Investing Industry

Conclusion

Effectively managing conflicts of interest is essential to safeguarding both financial returns and the integrity of an organization’s mission. The Russell Family Foundation's journey - expanding its impact-aligned investments from 7% to an impressive 94% between 2014 and 2024 - highlights the transformative role of transparency and structured decision-making in achieving aligned goals [8].

Establishing clear guidelines for disclosure, such as the MacArthur Foundation's 5% rule, is a critical step. Organizations should ensure that individuals with conflicts not only abstain from voting but also avoid participating in informal discussions. Thorough documentation of these processes is equally important [1]. These practices build trust among stakeholders, as they are pivotal to preserving both financial and mission-driven performance.

"Addressing conflicts of interest in a nonprofit is essential for success. It directly impacts the credibility, public trust, and overall effectiveness of the nonprofit in achieving its mission." - The Charity CFO [9]

This insight underscores how strong conflict management systems protect an organization’s credibility and foster trust.

By implementing measures like annual disclosures, centralized oversight, and gift registries, organizations can maintain accountability even as their portfolios grow and evolve.

Impact investing demands a balance of financial discipline and ethical responsibility. When organizations consolidate formal protocols, recusal standards, and transparent oversight into cohesive governance strategies, they can achieve measurable social and environmental outcomes without compromising their values. Looking ahead, transparency, decisive action, and ongoing monitoring will remain indispensable tools for ensuring success.

FAQs

What are the typical conflicts of interest in impact investing?

Conflicts of interest in impact investing often emerge when financial objectives clash with the mission to achieve meaningful social or environmental change. One of the most frequent challenges is balancing profit with purpose. The pressure to deliver high financial returns can sometimes take precedence over the commitment to measurable impact, particularly when performance rewards are tied exclusively to financial outcomes rather than impact-driven achievements.

Another source of tension comes from personal or organizational affiliations. For instance, board memberships or ownership stakes in portfolio companies can lead to decisions that favor private interests over the broader impact goals. Similarly, incentive structures - like commission-based pay - can push individuals to prioritize short-term financial gains, potentially at the expense of long-term alignment with impact objectives.

To navigate these challenges, organizations need to establish robust governance frameworks, enforce transparent policies, and ensure that financial and impact goals are clearly aligned. These steps are crucial for maintaining trust and achieving meaningful, lasting results.

How can organizations address and prevent conflicts of interest in impact investing?

To address potential conflicts of interest in impact investing, organizations should implement a strong governance framework that emphasizes transparency and accountability. A key component of this framework is a written conflict-of-interest policy. Such a policy requires all individuals involved - whether board members, staff, or investment committee participants - to disclose any personal or financial connections that might affect their decision-making. Additionally, it mandates that individuals recuse themselves from decisions where conflicts arise. Regular disclosures and fostering a culture of openness are critical steps in reducing these risks.

Adding independent oversight can further safeguard impartiality. Leveraging third-party impact measurement standards like IRIS+ or establishing an external advisory board ensures investment decisions align with the organization’s mission. This approach helps to minimize personal biases while maintaining focus on the broader goals. Separating responsibilities and adhering to strict ethical guidelines also reinforce this alignment.

For additional support, organizations might consider collaborating with sustainability-focused consultancies such as Council Fire. These partnerships provide strategic insights and customized solutions to incorporate conflict management into impact investment strategies. This ensures that financial objectives and positive social or environmental outcomes are achieved without compromising integrity.

What happens if conflicts of interest in impact investing are not properly managed?

When conflicts of interest arise in impact investing and are not handled properly, the fallout can be severe. Organizations might face regulatory scrutiny, including hefty fines or legal actions, which can disrupt operations and tarnish their credibility. Beyond the financial and legal ramifications, mishandling these situations can damage trust and reputation among key stakeholders - investors, partners, and the broader public.

The most troubling consequence, however, is the potential misallocation of funds. When conflicts are left unresolved, capital intended to drive positive social and environmental change may end up being misused, ultimately compromising the mission at its core. Addressing these challenges head-on is crucial for upholding transparency, ensuring accountability, and staying aligned with the goals of impact investing.

Related Blog Posts

FAQ

What does it really mean to “redefine profit”?

What makes Council Fire different?

Who does Council Fire you work with?

What does working with Council Fire actually look like?

How does Council Fire help organizations turn big goals into action?

How does Council Fire define and measure success?