Dec 31, 2025

Dec 31, 2025

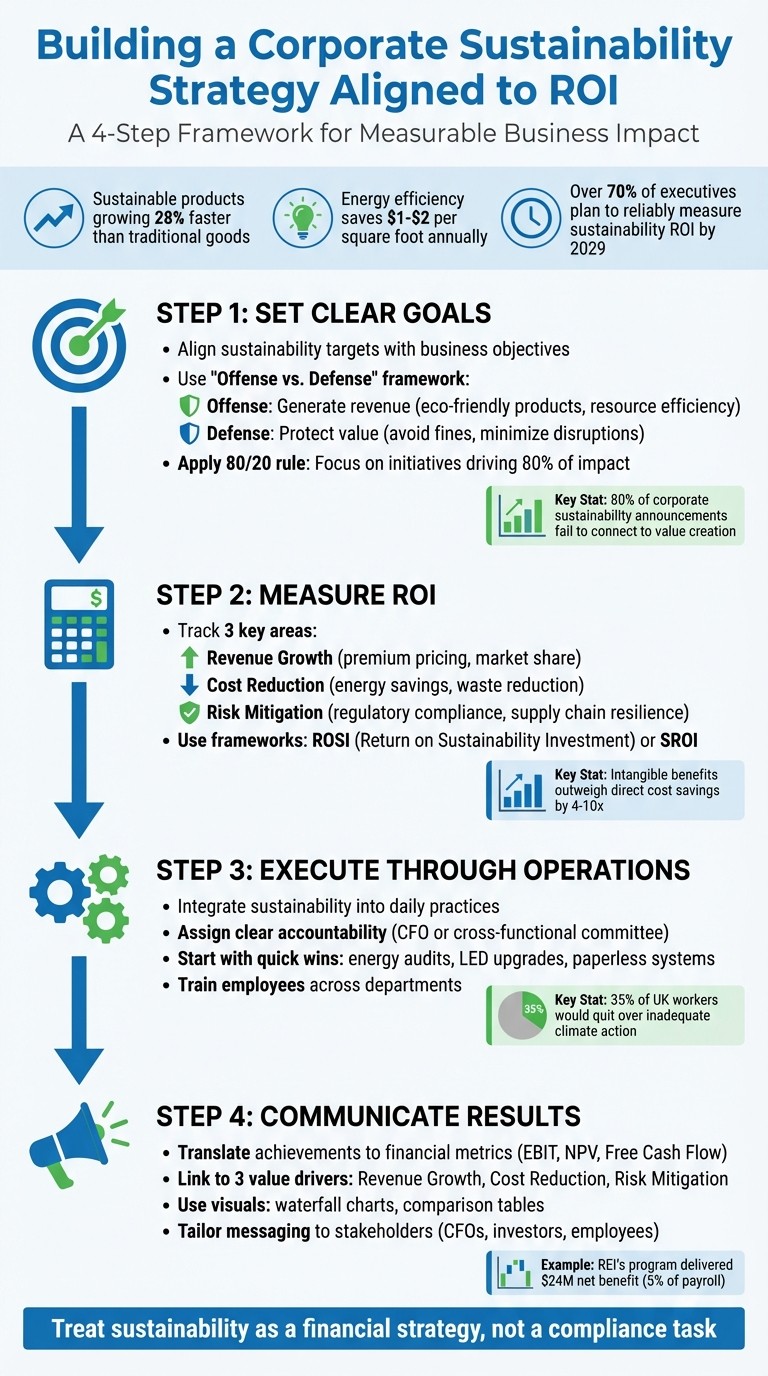

How to Build a Corporate Sustainability Strategy Aligned to ROI for Corporations

Sustainability Strategy

Sustainability Strategy

In This Article

Link sustainability to financial outcomes: set business-aligned goals, prioritize initiatives by ROI, quantify benefits, embed into operations, and report results.

How to Build a Corporate Sustainability Strategy Aligned to ROI for Corporations

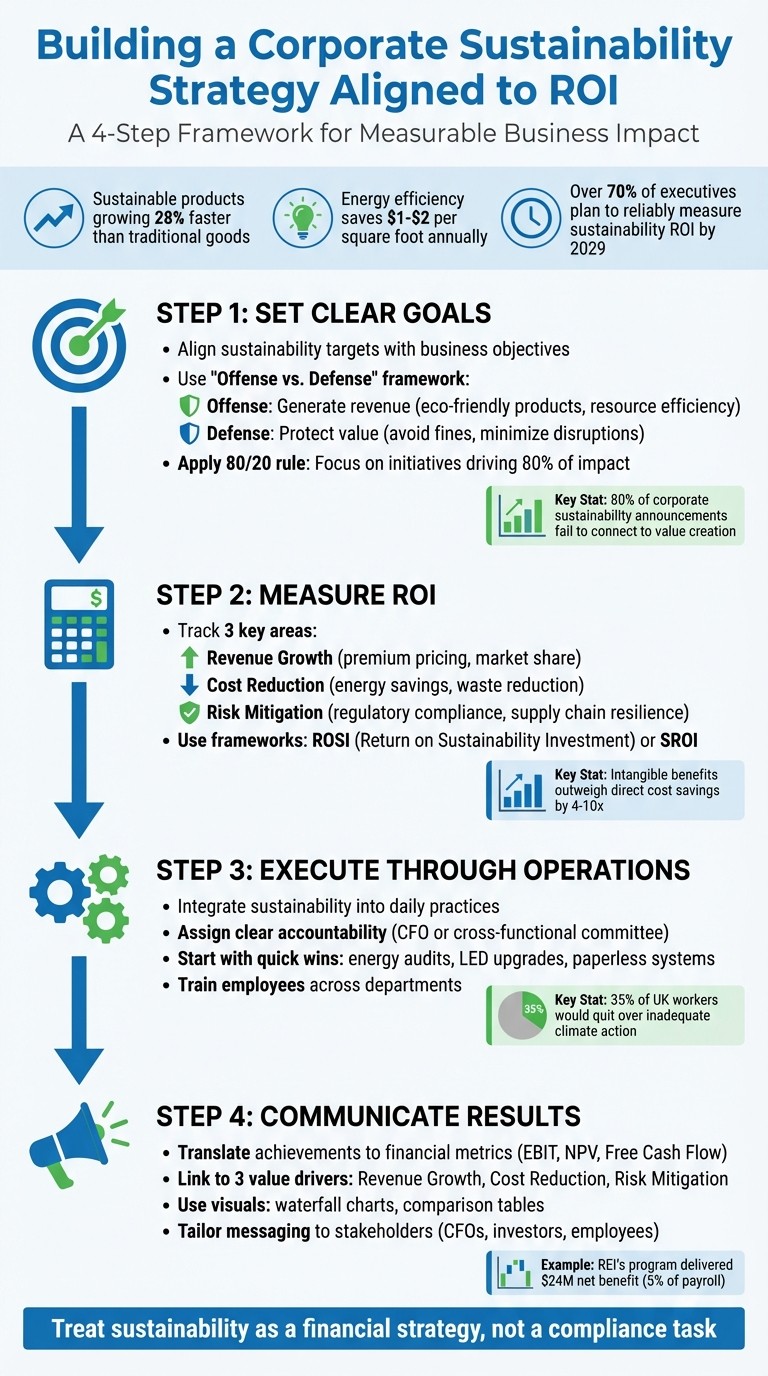

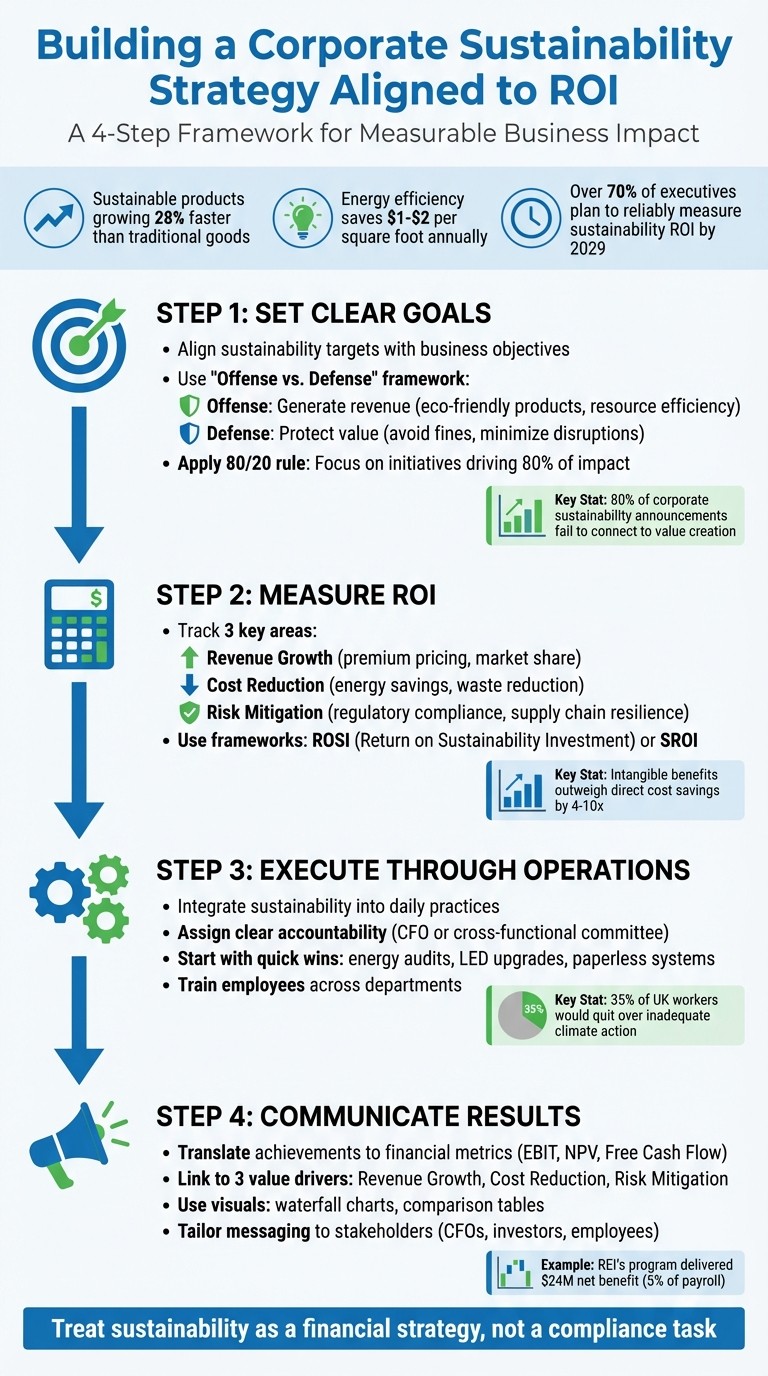

Sustainability is no longer just a moral obligation - it's a financial opportunity. Companies are now linking environmental and social efforts to measurable financial returns, making sustainability a core business investment. Here's how businesses are driving revenue, cutting costs, and reducing risks through focused strategies:

Revenue Growth: Sustainable products are growing 28% faster than traditional goods, with companies like Indorama Ventures investing $1.5 billion in recycled materials to command price premiums.

Cost Savings: Energy efficiency initiatives, like Gundersen Health System’s retrofits, save $1–$2 per square foot annually.

Risk Reduction: Companies like Antofagasta are mitigating regulatory and supply chain risks with proactive investments, such as desalination plants.

To achieve measurable ROI, businesses must:

Set Clear Goals: Align sustainability targets with business objectives, focusing on revenue drivers or risk management.

Prioritize Initiatives: Rank projects based on financial impact, using tools like materiality assessments.

Measure ROI: Use frameworks like ROSI to quantify benefits, including cost savings, productivity gains, and risk mitigation.

Integrate into Operations: Embed sustainability into daily practices and assign clear accountability.

Communicate Results: Present outcomes in financial terms to stakeholders, linking achievements to metrics like EBIT or free cash flow.

Companies that treat sustainability as a financial strategy, not a compliance task, are reaping both environmental and economic rewards.

4-Step Framework for Building ROI-Driven Corporate Sustainability Strategy

How to Demonstrate ROI of Sustainability Initiatives - Recording May 2025

Step 1: Set Clear Sustainability and Business Goals

Building a sustainability strategy that delivers measurable ROI begins with setting clear, business-aligned goals. Surprisingly, over 80% of corporate sustainability announcements fail to connect their initiatives to value creation [2]. This disconnect might explain why 41% of executives struggle to evaluate sustainability ROI [9]. The solution lies in treating sustainability goals with the same strategic rigor as any other key business objective. Doing so provides a foundation for identifying and prioritizing initiatives based on their ROI potential.

Link Sustainability Goals to Core Business Objectives

For sustainability goals to make an impact, they need to align with how your company generates revenue. This involves pinpointing sustainability issues that are critical to your industry and operations and linking them to cash flow drivers. In simpler terms, initiatives should either boost revenue or reduce risks [2].

An effective way to structure your goals is by using an "Offense vs. Defense" framework. Offensive goals aim to generate new revenue streams, such as launching eco-friendly product lines that attract premium pricing or improving resource efficiency to reduce operational costs. Defensive goals, on the other hand, focus on protecting current value - whether by avoiding regulatory fines, minimizing supply chain disruptions, or safeguarding your reputation [3]. For instance, in 2023, Nestlé adopted a defensive strategy by ensuring that all its crude palm oil purchases were certified as deforestation-free [2].

It’s also essential to consider the broader value your initiatives bring to shareholders, employees, customers, and the environment. Long-term financial performance often hinges on environmental and social stability [6]. Trane Technologies provides a great example of embedding sustainability into its culture. CFO Chris Kuehn highlighted that every employee at the company has sustainability goals tied to their performance objectives [10].

Rank Initiatives by ROI Potential

Once your goals are set, prioritize initiatives based on their financial impact. Begin with a materiality assessment to identify key metrics such as CO2 emissions, water usage, employee retention, or supply chain resilience [3]. Each initiative can be evaluated under three categories: Regulatory (compliance-related), Sustaining (operational improvements), and Growth (market expansion opportunities) [10].

Goal Category | Focus Area | ROI Potential |

|---|---|---|

Regulatory | Compliance, transitions (e.g., refrigerant changes) | Mitigating risks and avoiding penalties |

Sustaining | Maintenance, equipment upgrades | Boosting operational efficiency and cutting costs |

Growth | New products, market share, digital connectivity | Driving revenue and capturing new markets |

Applying the 80/20 rule can help you concentrate efforts where they matter most. Focus on the select few initiatives - specific materials, suppliers, or processes - that account for 80% of your sustainability risks or opportunities [12]. For example, General Motors prioritized securing lithium supplies to support its electric vehicle (EV) transition. The company strategically invested in two U.S.-based lithium projects - Hell's Kitchen in California and Thacker Pass in Nevada. GM even secured first rights on Phase 1 production at Thacker Pass, which is expected to support the production of 1 million EVs annually [2].

Don’t overlook intangible benefits like improved employee retention, enhanced brand reputation, and reduced risks. By using methodologies such as Return on Sustainability Investment (ROSI), you can quantify these less visible advantages, which often outweigh direct cost savings by a factor of 4 to 10 [9]. These carefully prioritized initiatives will serve as the backbone for measuring ROI and executing your sustainability strategy effectively.

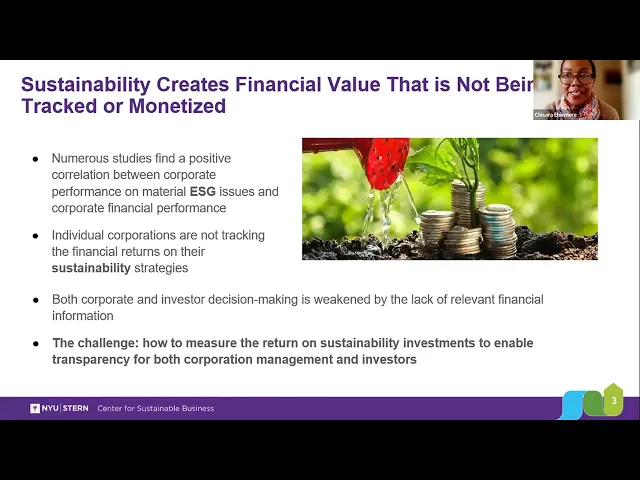

Step 2: Measure and Quantify Sustainability ROI

Once sustainability initiatives are prioritized, the next step is proving their financial value. This shifts sustainability reporting from being a compliance exercise to a strategic advantage. By 2029, over 70% of executives plan to reliably measure sustainability ROI, signaling a growing recognition of these efforts as investments rather than costs [5].

Sustainability ROI goes beyond traditional profit metrics. It encompasses long-term economic, environmental, and social benefits. For instance, Gundersen Health System's energy retrofits delivered $1 per square foot annually in existing facilities and $2 per square foot in new net-zero buildings [4]. This phase focuses on quantifying the impact of your initiatives, laying the groundwork for effective implementation.

Key Metrics for ROI Measurement

To measure ROI effectively, focus on three main areas: revenue growth, cost reduction, and risk mitigation. Each area requires specific key performance indicators (KPIs) that tie directly to financial outcomes.

Environmental metrics: Track carbon emissions (measured in tons of CO₂e), water usage, and waste reduction percentages. These metrics often translate into savings on utility and waste disposal costs.

Social metrics: Monitor employee satisfaction (eNPS), retention rates, and community engagement hours. These indicators highlight workforce stability and productivity gains.

Governance metrics: Include board diversity and ethics policy compliance, which are increasingly valued by investors for demonstrating leadership accountability.

The true impact lies in monetizing these metrics. For example, in November 2024, chocolate manufacturer Natra partnered with NYU Stern Center for Sustainable Business to assess the value of achieving full traceability in their cocoa supply chain. By transforming cocoa from a commodity to a specialty item, they estimated a present value of €2.4 million over 1–4 years [4][14].

Additionally, it's essential to account for intangible benefits. Improved brand reputation, stronger supplier relationships, and reduced regulatory risks can add significant value beyond direct cost savings. The challenge is making these "soft" benefits clear to stakeholders who influence budget decisions.

Tools and Frameworks for ROI Analysis

Once metrics are identified, advanced frameworks can help validate and monetize sustainability outcomes.

Two widely used approaches - ROSI (Return on Sustainability Investment) and SROI (Social Return on Investment) - quantify value by measuring operational efficiency, employee engagement, innovation, and social outcomes [4][14][13]. ROSI, for instance, involves five steps: assessing material opportunities and risks, identifying strategies, determining expected benefits, quantifying results, and monetizing those benefits.

"To properly embed sustainability and make it a source of competitive advantage, companies need to incorporate sustainability into their strategy and, ultimately, target the material issues."

– Tensie Whelan, Founding Director, NYU Stern Center for Sustainable Business [14]

A practical example comes from Owens Corning, which applied the ROSI framework in March 2025 to its "Zero Waste to Landfill" goal for its fiberglass insulation business. The analysis revealed substantial savings in processing and procurement costs while also cutting carbon emissions through internal material recycling [14].

Start small. Focus on a single initiative, apply a framework step by step, and document the results. This creates a repeatable process that builds trust with finance teams and decision-makers responsible for sustainability budgets.

Step 3: Execute Sustainability Through Operations

With ROI metrics in place, the next step is to bring those figures to life through daily operations. This means weaving sustainability into everyday practices, starting with small, actionable changes that yield immediate savings while laying the groundwork for more significant transformations.

Interestingly, while over 33% of S&P 500 companies tie leader compensation to emissions targets, only 33% of executives at the C-level report linking pay to environmental performance [7][8]. To ensure sustainability initiatives are managed with the same rigor as financial reporting, it’s critical to assign clear ownership. This responsibility could rest with the CFO or a dedicated cross-functional committee.

Build Internal Sustainability Capacity

Once measurable ROI goals are set, successful execution depends on breaking down barriers between departments. Finance, operations, and sustainability teams must work as one. By involving finance teams from the outset and providing training on how to align budget priorities with environmental goals, organizations can create a more cohesive approach [9][17].

"Aligning sustainability ROI with the CFO's definition of financial ROI is essential to enable effective communication... and ensure consistent and informed decision-making across the organization."

– Matteo Tonello, The Conference Board [9]

Start with straightforward initiatives that deliver quick results, such as energy audits, upgrading to LED lighting, and implementing paperless systems. These "no-regret" actions immediately reduce waste and cut costs, proving that sustainability can drive profitability. For instance, Alembic Pharmaceuticals reported a 48% year-over-year increase in profit after tax for Q3 in February 2024, attributing much of this growth to lower material costs and improved supply chain efficiency [3].

Employee involvement is just as crucial as leadership support. A third of workers aged 18–24 have turned down job offers from companies with weak sustainability practices [16], and 35% of UK office workers surveyed indicated they’d quit over inadequate climate action [11]. Workforce training, whether through internal programs or external partnerships, helps employees see how their roles contribute to sustainability goals and empowers them to identify new efficiency opportunities.

Partner with Council Fire for Execution Support

For organizations seeking additional expertise, partnering with firms like Council Fire can accelerate progress. Council Fire provides consulting services, data-driven insights, and stakeholder engagement strategies to align sustainability with operational objectives [15].

The real challenge for many corporations isn’t setting sustainability targets - it’s converting those targets into actionable steps that deliver measurable ROI. Council Fire helps businesses prioritize impactful initiatives, establish governance structures that integrate sustainability into financial decision-making, and leverage tools like geospatial analytics and dashboards to provide clear visibility into decarbonization efforts [17]. This approach turns sustainability into a competitive advantage rather than a compliance obligation.

"Businesses that embed sustainability into their core operations often discover untapped revenue streams and cost efficiencies that dramatically improve their net present value over time."

– Julien Denormandie, Chief Impact Officer, Sweep [16]

Step 4: Communicate ROI Results to Stakeholders

After achieving measurable outcomes from sustainability initiatives, the next step is to present these results in a way that resonates with various stakeholders. CFOs might prioritize metrics like Free Cash Flow or NPV, while investors often focus on market protection and risk mitigation. The key lies in transforming raw data into a narrative that speaks to everyone.

Build a Clear Business Case

Once sustainability initiatives are implemented, clearly presenting their financial impact is essential. This involves translating sustainability achievements into tangible financial outcomes. Instead of merely reporting reductions in carbon emissions or water usage, link these results to metrics like EBIT savings, cost avoidance, or revenue growth. Take, for example, REI’s 2024 report: the company’s employee sustainability program not only reduced turnover and hiring costs but also boosted productivity, resulting in a net benefit of $24 million - around 5% of total payroll expenses[4].

Focus on three primary value drivers to build your case: revenue growth (such as premium pricing for sustainable products), cost reduction (like energy savings from LED upgrades), and risk mitigation (such as avoiding regulatory fines or supply chain disruptions)[1]. Products marketed as sustainable have shown 28% cumulative growth over five years, compared to 20% for non-sustainable products[3]. Additionally, emphasize the risks of inaction, such as losing market share to competitors who are quicker to adapt.

"Embedding sustainability into business strategy is good management and creates financial value through operational efficiency, innovation, sales & marketing and other benefits."

– NYU Stern Center for Sustainable Business[4]

Simple and relatable examples can make a big difference. Gundersen Health System, for instance, used energy retrofits to illustrate how clear metrics can highlight financial benefits. Similarly, an automotive company working with NYU Stern showed that recycling materials from end-of-life vehicles could result in $100 million in annual EBIT savings by cutting virgin material costs and disposal fees[4].

Use Visuals to Simplify Complex Data

ROI calculations can often feel overwhelming, but visual tools can make them more digestible. Waterfall charts, for instance, can demonstrate how individual sustainability efforts - like energy efficiency, waste reduction, and supply chain improvements - combine to create overall value for the company[3].

A concise table can also clarify how different strategies drive financial benefits:

Sustainability Strategy | Financial Value Drivers |

|---|---|

Decarbonization | Energy cost savings, avoidance of carbon fees, lower cost of capital |

Circularity | Operational efficiency, reduced waste disposal costs, increased market share |

Sustainable Sourcing | Supply chain resilience, reduced reputational risk, community license to operate |

Employee Well-being | Higher productivity, lower recruitment costs, reduced insurance expenses |

To further engage stakeholders, consider framing your presentation using an "offense versus defense" approach. Offense emphasizes opportunities like launching eco-friendly products or leveraging price premiums, while defense focuses on protecting existing value by mitigating risks such as regulatory fines or market decline[3]. For example, Natra’s investment in full traceability for cocoa products transformed the commodity into a specialty item, delivering an estimated present value of $2.6 million within 1–4 years[4].

Tailor visuals to suit your audience. Board members might prefer scenario planning visuals that account for fluctuating market conditions, while employees may connect better with infographics that show how their efforts contribute to measurable outcomes. These visual elements not only reinforce the strategic narrative but also foster ongoing engagement. By demonstrating transparency and aligning sustainability with business priorities, you can solidify its role as a sound investment.

Conclusion: Sustainability as a Business Investment

Positioning sustainability as a core business investment not only safeguards but also enhances your bottom line. By following a focused four-step approach - establishing clear, business-driven goals, using concrete metrics to measure financial outcomes, integrating sustainability into daily operations, and effectively communicating results - companies can unlock measurable value.

The numbers tell a compelling story. Products marketed as sustainable have achieved an average of 28% cumulative growth over a recent five-year period, significantly outpacing the 20% growth seen in conventional products [3].

"Embedding sustainability into business strategy is good management and creates financial value through operational efficiency, innovation, sales and marketing and other benefits."

– NYU Stern Center for Sustainable Business [4]

The business landscape is shifting. Sustainability is no longer just about compliance - it’s an opportunity to innovate, capture new revenue streams, and mitigate risks. Companies that fail to adapt risk falling behind competitors who are successfully weaving sustainability into their strategies and product lines [1]. This evolution highlights the importance of expert guidance to transform sustainability goals into tangible, measurable outcomes.

Council Fire is here to help businesses take the next step. By moving beyond ESG compliance, we provide strategic planning and execution support designed to deliver impactful, system-wide results. The time to act is now - embrace sustainability as a competitive edge that drives long-term growth.

FAQs

How can companies measure the ROI of sustainability initiatives effectively?

To gauge the return on investment (ROI) of sustainability efforts, businesses need to connect their environmental and social actions to tangible financial outcomes. Begin by cataloging all associated costs, including capital expenditures, operational expenses, and employee training. Next, outline the benefits - such as energy savings, lower carbon fees, enhanced brand reputation, and improved employee morale. Assigning monetary values to these elements allows companies to use tools like net present value (NPV) or internal rate of return (IRR) to evaluate the financial impact over time.

Here’s a straightforward process to get started:

Set a baseline for metrics like energy consumption, emissions, or waste production.

Identify key performance indicators (KPIs) that directly link to financial results, such as dollars saved per megawatt-hour or avoided penalties.

Regularly gather and integrate data into financial reports for a clearer picture of progress.

When applied consistently, this approach not only uncovers measurable financial gains - like higher revenue or reduced costs - but also builds investor trust and supports long-term profitability.

What are some easy sustainability actions businesses can take to see quick financial benefits?

Businesses can take straightforward steps toward sustainability that also bring immediate cost savings and operational advantages. For instance, switching to energy-efficient LED lighting, fine-tuning HVAC schedules, and using building automation systems can lower energy expenses by 10–30%, while also reducing vulnerability to fluctuating energy prices. Similarly, performing a waste audit, improving recycling efforts, and cutting back on excessive packaging can decrease disposal costs and even create new revenue streams from recyclable materials.

Making water efficiency upgrades - like repairing leaks, installing low-flow fixtures, and leveraging water monitoring tools - can lead to noticeable reductions in water bills and ensure compliance with regulatory standards. Short-term renewable energy options, such as installing on-site solar panels or entering into power purchase agreements (PPAs), can help secure lower electricity rates and sidestep potential carbon-related charges. Additionally, revisiting supplier contracts to prioritize eco-friendly vendors can cut material waste, streamline logistics, and boost your company’s ESG standing - all while trimming expenses.

How can businesses align their sustainability goals with financial success?

To align sustainability goals with financial objectives, businesses should weave sustainability into their core strategies rather than treating it as a standalone effort. Start by examining how environmental and social factors influence critical financial elements like revenue, costs, risks, and brand reputation. Tools like materiality analysis can help pinpoint which sustainability initiatives are most likely to yield measurable business benefits.

Once priorities are identified, convert them into clear, measurable KPIs. These might include metrics like energy cost reductions, lower carbon-related expenses, or increased revenue from eco-friendly products. To emphasize their importance, integrate these KPIs into performance reviews and compensation plans. Many forward-thinking companies already tie executive incentives to sustainability achievements, ensuring these goals stay at the forefront of decision-making.

Equally important is consistent tracking and reporting. By monitoring sustainability metrics alongside traditional financial data, businesses can showcase ROI, fine-tune their strategies, and effectively communicate progress to stakeholders. When sustainability is seamlessly incorporated into governance, budgeting, and performance systems, it becomes a natural part of driving overall business success.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 31, 2025

How to Build a Corporate Sustainability Strategy Aligned to ROI for Corporations

Sustainability Strategy

In This Article

Link sustainability to financial outcomes: set business-aligned goals, prioritize initiatives by ROI, quantify benefits, embed into operations, and report results.

How to Build a Corporate Sustainability Strategy Aligned to ROI for Corporations

Sustainability is no longer just a moral obligation - it's a financial opportunity. Companies are now linking environmental and social efforts to measurable financial returns, making sustainability a core business investment. Here's how businesses are driving revenue, cutting costs, and reducing risks through focused strategies:

Revenue Growth: Sustainable products are growing 28% faster than traditional goods, with companies like Indorama Ventures investing $1.5 billion in recycled materials to command price premiums.

Cost Savings: Energy efficiency initiatives, like Gundersen Health System’s retrofits, save $1–$2 per square foot annually.

Risk Reduction: Companies like Antofagasta are mitigating regulatory and supply chain risks with proactive investments, such as desalination plants.

To achieve measurable ROI, businesses must:

Set Clear Goals: Align sustainability targets with business objectives, focusing on revenue drivers or risk management.

Prioritize Initiatives: Rank projects based on financial impact, using tools like materiality assessments.

Measure ROI: Use frameworks like ROSI to quantify benefits, including cost savings, productivity gains, and risk mitigation.

Integrate into Operations: Embed sustainability into daily practices and assign clear accountability.

Communicate Results: Present outcomes in financial terms to stakeholders, linking achievements to metrics like EBIT or free cash flow.

Companies that treat sustainability as a financial strategy, not a compliance task, are reaping both environmental and economic rewards.

4-Step Framework for Building ROI-Driven Corporate Sustainability Strategy

How to Demonstrate ROI of Sustainability Initiatives - Recording May 2025

Step 1: Set Clear Sustainability and Business Goals

Building a sustainability strategy that delivers measurable ROI begins with setting clear, business-aligned goals. Surprisingly, over 80% of corporate sustainability announcements fail to connect their initiatives to value creation [2]. This disconnect might explain why 41% of executives struggle to evaluate sustainability ROI [9]. The solution lies in treating sustainability goals with the same strategic rigor as any other key business objective. Doing so provides a foundation for identifying and prioritizing initiatives based on their ROI potential.

Link Sustainability Goals to Core Business Objectives

For sustainability goals to make an impact, they need to align with how your company generates revenue. This involves pinpointing sustainability issues that are critical to your industry and operations and linking them to cash flow drivers. In simpler terms, initiatives should either boost revenue or reduce risks [2].

An effective way to structure your goals is by using an "Offense vs. Defense" framework. Offensive goals aim to generate new revenue streams, such as launching eco-friendly product lines that attract premium pricing or improving resource efficiency to reduce operational costs. Defensive goals, on the other hand, focus on protecting current value - whether by avoiding regulatory fines, minimizing supply chain disruptions, or safeguarding your reputation [3]. For instance, in 2023, Nestlé adopted a defensive strategy by ensuring that all its crude palm oil purchases were certified as deforestation-free [2].

It’s also essential to consider the broader value your initiatives bring to shareholders, employees, customers, and the environment. Long-term financial performance often hinges on environmental and social stability [6]. Trane Technologies provides a great example of embedding sustainability into its culture. CFO Chris Kuehn highlighted that every employee at the company has sustainability goals tied to their performance objectives [10].

Rank Initiatives by ROI Potential

Once your goals are set, prioritize initiatives based on their financial impact. Begin with a materiality assessment to identify key metrics such as CO2 emissions, water usage, employee retention, or supply chain resilience [3]. Each initiative can be evaluated under three categories: Regulatory (compliance-related), Sustaining (operational improvements), and Growth (market expansion opportunities) [10].

Goal Category | Focus Area | ROI Potential |

|---|---|---|

Regulatory | Compliance, transitions (e.g., refrigerant changes) | Mitigating risks and avoiding penalties |

Sustaining | Maintenance, equipment upgrades | Boosting operational efficiency and cutting costs |

Growth | New products, market share, digital connectivity | Driving revenue and capturing new markets |

Applying the 80/20 rule can help you concentrate efforts where they matter most. Focus on the select few initiatives - specific materials, suppliers, or processes - that account for 80% of your sustainability risks or opportunities [12]. For example, General Motors prioritized securing lithium supplies to support its electric vehicle (EV) transition. The company strategically invested in two U.S.-based lithium projects - Hell's Kitchen in California and Thacker Pass in Nevada. GM even secured first rights on Phase 1 production at Thacker Pass, which is expected to support the production of 1 million EVs annually [2].

Don’t overlook intangible benefits like improved employee retention, enhanced brand reputation, and reduced risks. By using methodologies such as Return on Sustainability Investment (ROSI), you can quantify these less visible advantages, which often outweigh direct cost savings by a factor of 4 to 10 [9]. These carefully prioritized initiatives will serve as the backbone for measuring ROI and executing your sustainability strategy effectively.

Step 2: Measure and Quantify Sustainability ROI

Once sustainability initiatives are prioritized, the next step is proving their financial value. This shifts sustainability reporting from being a compliance exercise to a strategic advantage. By 2029, over 70% of executives plan to reliably measure sustainability ROI, signaling a growing recognition of these efforts as investments rather than costs [5].

Sustainability ROI goes beyond traditional profit metrics. It encompasses long-term economic, environmental, and social benefits. For instance, Gundersen Health System's energy retrofits delivered $1 per square foot annually in existing facilities and $2 per square foot in new net-zero buildings [4]. This phase focuses on quantifying the impact of your initiatives, laying the groundwork for effective implementation.

Key Metrics for ROI Measurement

To measure ROI effectively, focus on three main areas: revenue growth, cost reduction, and risk mitigation. Each area requires specific key performance indicators (KPIs) that tie directly to financial outcomes.

Environmental metrics: Track carbon emissions (measured in tons of CO₂e), water usage, and waste reduction percentages. These metrics often translate into savings on utility and waste disposal costs.

Social metrics: Monitor employee satisfaction (eNPS), retention rates, and community engagement hours. These indicators highlight workforce stability and productivity gains.

Governance metrics: Include board diversity and ethics policy compliance, which are increasingly valued by investors for demonstrating leadership accountability.

The true impact lies in monetizing these metrics. For example, in November 2024, chocolate manufacturer Natra partnered with NYU Stern Center for Sustainable Business to assess the value of achieving full traceability in their cocoa supply chain. By transforming cocoa from a commodity to a specialty item, they estimated a present value of €2.4 million over 1–4 years [4][14].

Additionally, it's essential to account for intangible benefits. Improved brand reputation, stronger supplier relationships, and reduced regulatory risks can add significant value beyond direct cost savings. The challenge is making these "soft" benefits clear to stakeholders who influence budget decisions.

Tools and Frameworks for ROI Analysis

Once metrics are identified, advanced frameworks can help validate and monetize sustainability outcomes.

Two widely used approaches - ROSI (Return on Sustainability Investment) and SROI (Social Return on Investment) - quantify value by measuring operational efficiency, employee engagement, innovation, and social outcomes [4][14][13]. ROSI, for instance, involves five steps: assessing material opportunities and risks, identifying strategies, determining expected benefits, quantifying results, and monetizing those benefits.

"To properly embed sustainability and make it a source of competitive advantage, companies need to incorporate sustainability into their strategy and, ultimately, target the material issues."

– Tensie Whelan, Founding Director, NYU Stern Center for Sustainable Business [14]

A practical example comes from Owens Corning, which applied the ROSI framework in March 2025 to its "Zero Waste to Landfill" goal for its fiberglass insulation business. The analysis revealed substantial savings in processing and procurement costs while also cutting carbon emissions through internal material recycling [14].

Start small. Focus on a single initiative, apply a framework step by step, and document the results. This creates a repeatable process that builds trust with finance teams and decision-makers responsible for sustainability budgets.

Step 3: Execute Sustainability Through Operations

With ROI metrics in place, the next step is to bring those figures to life through daily operations. This means weaving sustainability into everyday practices, starting with small, actionable changes that yield immediate savings while laying the groundwork for more significant transformations.

Interestingly, while over 33% of S&P 500 companies tie leader compensation to emissions targets, only 33% of executives at the C-level report linking pay to environmental performance [7][8]. To ensure sustainability initiatives are managed with the same rigor as financial reporting, it’s critical to assign clear ownership. This responsibility could rest with the CFO or a dedicated cross-functional committee.

Build Internal Sustainability Capacity

Once measurable ROI goals are set, successful execution depends on breaking down barriers between departments. Finance, operations, and sustainability teams must work as one. By involving finance teams from the outset and providing training on how to align budget priorities with environmental goals, organizations can create a more cohesive approach [9][17].

"Aligning sustainability ROI with the CFO's definition of financial ROI is essential to enable effective communication... and ensure consistent and informed decision-making across the organization."

– Matteo Tonello, The Conference Board [9]

Start with straightforward initiatives that deliver quick results, such as energy audits, upgrading to LED lighting, and implementing paperless systems. These "no-regret" actions immediately reduce waste and cut costs, proving that sustainability can drive profitability. For instance, Alembic Pharmaceuticals reported a 48% year-over-year increase in profit after tax for Q3 in February 2024, attributing much of this growth to lower material costs and improved supply chain efficiency [3].

Employee involvement is just as crucial as leadership support. A third of workers aged 18–24 have turned down job offers from companies with weak sustainability practices [16], and 35% of UK office workers surveyed indicated they’d quit over inadequate climate action [11]. Workforce training, whether through internal programs or external partnerships, helps employees see how their roles contribute to sustainability goals and empowers them to identify new efficiency opportunities.

Partner with Council Fire for Execution Support

For organizations seeking additional expertise, partnering with firms like Council Fire can accelerate progress. Council Fire provides consulting services, data-driven insights, and stakeholder engagement strategies to align sustainability with operational objectives [15].

The real challenge for many corporations isn’t setting sustainability targets - it’s converting those targets into actionable steps that deliver measurable ROI. Council Fire helps businesses prioritize impactful initiatives, establish governance structures that integrate sustainability into financial decision-making, and leverage tools like geospatial analytics and dashboards to provide clear visibility into decarbonization efforts [17]. This approach turns sustainability into a competitive advantage rather than a compliance obligation.

"Businesses that embed sustainability into their core operations often discover untapped revenue streams and cost efficiencies that dramatically improve their net present value over time."

– Julien Denormandie, Chief Impact Officer, Sweep [16]

Step 4: Communicate ROI Results to Stakeholders

After achieving measurable outcomes from sustainability initiatives, the next step is to present these results in a way that resonates with various stakeholders. CFOs might prioritize metrics like Free Cash Flow or NPV, while investors often focus on market protection and risk mitigation. The key lies in transforming raw data into a narrative that speaks to everyone.

Build a Clear Business Case

Once sustainability initiatives are implemented, clearly presenting their financial impact is essential. This involves translating sustainability achievements into tangible financial outcomes. Instead of merely reporting reductions in carbon emissions or water usage, link these results to metrics like EBIT savings, cost avoidance, or revenue growth. Take, for example, REI’s 2024 report: the company’s employee sustainability program not only reduced turnover and hiring costs but also boosted productivity, resulting in a net benefit of $24 million - around 5% of total payroll expenses[4].

Focus on three primary value drivers to build your case: revenue growth (such as premium pricing for sustainable products), cost reduction (like energy savings from LED upgrades), and risk mitigation (such as avoiding regulatory fines or supply chain disruptions)[1]. Products marketed as sustainable have shown 28% cumulative growth over five years, compared to 20% for non-sustainable products[3]. Additionally, emphasize the risks of inaction, such as losing market share to competitors who are quicker to adapt.

"Embedding sustainability into business strategy is good management and creates financial value through operational efficiency, innovation, sales & marketing and other benefits."

– NYU Stern Center for Sustainable Business[4]

Simple and relatable examples can make a big difference. Gundersen Health System, for instance, used energy retrofits to illustrate how clear metrics can highlight financial benefits. Similarly, an automotive company working with NYU Stern showed that recycling materials from end-of-life vehicles could result in $100 million in annual EBIT savings by cutting virgin material costs and disposal fees[4].

Use Visuals to Simplify Complex Data

ROI calculations can often feel overwhelming, but visual tools can make them more digestible. Waterfall charts, for instance, can demonstrate how individual sustainability efforts - like energy efficiency, waste reduction, and supply chain improvements - combine to create overall value for the company[3].

A concise table can also clarify how different strategies drive financial benefits:

Sustainability Strategy | Financial Value Drivers |

|---|---|

Decarbonization | Energy cost savings, avoidance of carbon fees, lower cost of capital |

Circularity | Operational efficiency, reduced waste disposal costs, increased market share |

Sustainable Sourcing | Supply chain resilience, reduced reputational risk, community license to operate |

Employee Well-being | Higher productivity, lower recruitment costs, reduced insurance expenses |

To further engage stakeholders, consider framing your presentation using an "offense versus defense" approach. Offense emphasizes opportunities like launching eco-friendly products or leveraging price premiums, while defense focuses on protecting existing value by mitigating risks such as regulatory fines or market decline[3]. For example, Natra’s investment in full traceability for cocoa products transformed the commodity into a specialty item, delivering an estimated present value of $2.6 million within 1–4 years[4].

Tailor visuals to suit your audience. Board members might prefer scenario planning visuals that account for fluctuating market conditions, while employees may connect better with infographics that show how their efforts contribute to measurable outcomes. These visual elements not only reinforce the strategic narrative but also foster ongoing engagement. By demonstrating transparency and aligning sustainability with business priorities, you can solidify its role as a sound investment.

Conclusion: Sustainability as a Business Investment

Positioning sustainability as a core business investment not only safeguards but also enhances your bottom line. By following a focused four-step approach - establishing clear, business-driven goals, using concrete metrics to measure financial outcomes, integrating sustainability into daily operations, and effectively communicating results - companies can unlock measurable value.

The numbers tell a compelling story. Products marketed as sustainable have achieved an average of 28% cumulative growth over a recent five-year period, significantly outpacing the 20% growth seen in conventional products [3].

"Embedding sustainability into business strategy is good management and creates financial value through operational efficiency, innovation, sales and marketing and other benefits."

– NYU Stern Center for Sustainable Business [4]

The business landscape is shifting. Sustainability is no longer just about compliance - it’s an opportunity to innovate, capture new revenue streams, and mitigate risks. Companies that fail to adapt risk falling behind competitors who are successfully weaving sustainability into their strategies and product lines [1]. This evolution highlights the importance of expert guidance to transform sustainability goals into tangible, measurable outcomes.

Council Fire is here to help businesses take the next step. By moving beyond ESG compliance, we provide strategic planning and execution support designed to deliver impactful, system-wide results. The time to act is now - embrace sustainability as a competitive edge that drives long-term growth.

FAQs

How can companies measure the ROI of sustainability initiatives effectively?

To gauge the return on investment (ROI) of sustainability efforts, businesses need to connect their environmental and social actions to tangible financial outcomes. Begin by cataloging all associated costs, including capital expenditures, operational expenses, and employee training. Next, outline the benefits - such as energy savings, lower carbon fees, enhanced brand reputation, and improved employee morale. Assigning monetary values to these elements allows companies to use tools like net present value (NPV) or internal rate of return (IRR) to evaluate the financial impact over time.

Here’s a straightforward process to get started:

Set a baseline for metrics like energy consumption, emissions, or waste production.

Identify key performance indicators (KPIs) that directly link to financial results, such as dollars saved per megawatt-hour or avoided penalties.

Regularly gather and integrate data into financial reports for a clearer picture of progress.

When applied consistently, this approach not only uncovers measurable financial gains - like higher revenue or reduced costs - but also builds investor trust and supports long-term profitability.

What are some easy sustainability actions businesses can take to see quick financial benefits?

Businesses can take straightforward steps toward sustainability that also bring immediate cost savings and operational advantages. For instance, switching to energy-efficient LED lighting, fine-tuning HVAC schedules, and using building automation systems can lower energy expenses by 10–30%, while also reducing vulnerability to fluctuating energy prices. Similarly, performing a waste audit, improving recycling efforts, and cutting back on excessive packaging can decrease disposal costs and even create new revenue streams from recyclable materials.

Making water efficiency upgrades - like repairing leaks, installing low-flow fixtures, and leveraging water monitoring tools - can lead to noticeable reductions in water bills and ensure compliance with regulatory standards. Short-term renewable energy options, such as installing on-site solar panels or entering into power purchase agreements (PPAs), can help secure lower electricity rates and sidestep potential carbon-related charges. Additionally, revisiting supplier contracts to prioritize eco-friendly vendors can cut material waste, streamline logistics, and boost your company’s ESG standing - all while trimming expenses.

How can businesses align their sustainability goals with financial success?

To align sustainability goals with financial objectives, businesses should weave sustainability into their core strategies rather than treating it as a standalone effort. Start by examining how environmental and social factors influence critical financial elements like revenue, costs, risks, and brand reputation. Tools like materiality analysis can help pinpoint which sustainability initiatives are most likely to yield measurable business benefits.

Once priorities are identified, convert them into clear, measurable KPIs. These might include metrics like energy cost reductions, lower carbon-related expenses, or increased revenue from eco-friendly products. To emphasize their importance, integrate these KPIs into performance reviews and compensation plans. Many forward-thinking companies already tie executive incentives to sustainability achievements, ensuring these goals stay at the forefront of decision-making.

Equally important is consistent tracking and reporting. By monitoring sustainability metrics alongside traditional financial data, businesses can showcase ROI, fine-tune their strategies, and effectively communicate progress to stakeholders. When sustainability is seamlessly incorporated into governance, budgeting, and performance systems, it becomes a natural part of driving overall business success.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 31, 2025

How to Build a Corporate Sustainability Strategy Aligned to ROI for Corporations

Sustainability Strategy

In This Article

Link sustainability to financial outcomes: set business-aligned goals, prioritize initiatives by ROI, quantify benefits, embed into operations, and report results.

How to Build a Corporate Sustainability Strategy Aligned to ROI for Corporations

Sustainability is no longer just a moral obligation - it's a financial opportunity. Companies are now linking environmental and social efforts to measurable financial returns, making sustainability a core business investment. Here's how businesses are driving revenue, cutting costs, and reducing risks through focused strategies:

Revenue Growth: Sustainable products are growing 28% faster than traditional goods, with companies like Indorama Ventures investing $1.5 billion in recycled materials to command price premiums.

Cost Savings: Energy efficiency initiatives, like Gundersen Health System’s retrofits, save $1–$2 per square foot annually.

Risk Reduction: Companies like Antofagasta are mitigating regulatory and supply chain risks with proactive investments, such as desalination plants.

To achieve measurable ROI, businesses must:

Set Clear Goals: Align sustainability targets with business objectives, focusing on revenue drivers or risk management.

Prioritize Initiatives: Rank projects based on financial impact, using tools like materiality assessments.

Measure ROI: Use frameworks like ROSI to quantify benefits, including cost savings, productivity gains, and risk mitigation.

Integrate into Operations: Embed sustainability into daily practices and assign clear accountability.

Communicate Results: Present outcomes in financial terms to stakeholders, linking achievements to metrics like EBIT or free cash flow.

Companies that treat sustainability as a financial strategy, not a compliance task, are reaping both environmental and economic rewards.

4-Step Framework for Building ROI-Driven Corporate Sustainability Strategy

How to Demonstrate ROI of Sustainability Initiatives - Recording May 2025

Step 1: Set Clear Sustainability and Business Goals

Building a sustainability strategy that delivers measurable ROI begins with setting clear, business-aligned goals. Surprisingly, over 80% of corporate sustainability announcements fail to connect their initiatives to value creation [2]. This disconnect might explain why 41% of executives struggle to evaluate sustainability ROI [9]. The solution lies in treating sustainability goals with the same strategic rigor as any other key business objective. Doing so provides a foundation for identifying and prioritizing initiatives based on their ROI potential.

Link Sustainability Goals to Core Business Objectives

For sustainability goals to make an impact, they need to align with how your company generates revenue. This involves pinpointing sustainability issues that are critical to your industry and operations and linking them to cash flow drivers. In simpler terms, initiatives should either boost revenue or reduce risks [2].

An effective way to structure your goals is by using an "Offense vs. Defense" framework. Offensive goals aim to generate new revenue streams, such as launching eco-friendly product lines that attract premium pricing or improving resource efficiency to reduce operational costs. Defensive goals, on the other hand, focus on protecting current value - whether by avoiding regulatory fines, minimizing supply chain disruptions, or safeguarding your reputation [3]. For instance, in 2023, Nestlé adopted a defensive strategy by ensuring that all its crude palm oil purchases were certified as deforestation-free [2].

It’s also essential to consider the broader value your initiatives bring to shareholders, employees, customers, and the environment. Long-term financial performance often hinges on environmental and social stability [6]. Trane Technologies provides a great example of embedding sustainability into its culture. CFO Chris Kuehn highlighted that every employee at the company has sustainability goals tied to their performance objectives [10].

Rank Initiatives by ROI Potential

Once your goals are set, prioritize initiatives based on their financial impact. Begin with a materiality assessment to identify key metrics such as CO2 emissions, water usage, employee retention, or supply chain resilience [3]. Each initiative can be evaluated under three categories: Regulatory (compliance-related), Sustaining (operational improvements), and Growth (market expansion opportunities) [10].

Goal Category | Focus Area | ROI Potential |

|---|---|---|

Regulatory | Compliance, transitions (e.g., refrigerant changes) | Mitigating risks and avoiding penalties |

Sustaining | Maintenance, equipment upgrades | Boosting operational efficiency and cutting costs |

Growth | New products, market share, digital connectivity | Driving revenue and capturing new markets |

Applying the 80/20 rule can help you concentrate efforts where they matter most. Focus on the select few initiatives - specific materials, suppliers, or processes - that account for 80% of your sustainability risks or opportunities [12]. For example, General Motors prioritized securing lithium supplies to support its electric vehicle (EV) transition. The company strategically invested in two U.S.-based lithium projects - Hell's Kitchen in California and Thacker Pass in Nevada. GM even secured first rights on Phase 1 production at Thacker Pass, which is expected to support the production of 1 million EVs annually [2].

Don’t overlook intangible benefits like improved employee retention, enhanced brand reputation, and reduced risks. By using methodologies such as Return on Sustainability Investment (ROSI), you can quantify these less visible advantages, which often outweigh direct cost savings by a factor of 4 to 10 [9]. These carefully prioritized initiatives will serve as the backbone for measuring ROI and executing your sustainability strategy effectively.

Step 2: Measure and Quantify Sustainability ROI

Once sustainability initiatives are prioritized, the next step is proving their financial value. This shifts sustainability reporting from being a compliance exercise to a strategic advantage. By 2029, over 70% of executives plan to reliably measure sustainability ROI, signaling a growing recognition of these efforts as investments rather than costs [5].

Sustainability ROI goes beyond traditional profit metrics. It encompasses long-term economic, environmental, and social benefits. For instance, Gundersen Health System's energy retrofits delivered $1 per square foot annually in existing facilities and $2 per square foot in new net-zero buildings [4]. This phase focuses on quantifying the impact of your initiatives, laying the groundwork for effective implementation.

Key Metrics for ROI Measurement

To measure ROI effectively, focus on three main areas: revenue growth, cost reduction, and risk mitigation. Each area requires specific key performance indicators (KPIs) that tie directly to financial outcomes.

Environmental metrics: Track carbon emissions (measured in tons of CO₂e), water usage, and waste reduction percentages. These metrics often translate into savings on utility and waste disposal costs.

Social metrics: Monitor employee satisfaction (eNPS), retention rates, and community engagement hours. These indicators highlight workforce stability and productivity gains.

Governance metrics: Include board diversity and ethics policy compliance, which are increasingly valued by investors for demonstrating leadership accountability.

The true impact lies in monetizing these metrics. For example, in November 2024, chocolate manufacturer Natra partnered with NYU Stern Center for Sustainable Business to assess the value of achieving full traceability in their cocoa supply chain. By transforming cocoa from a commodity to a specialty item, they estimated a present value of €2.4 million over 1–4 years [4][14].

Additionally, it's essential to account for intangible benefits. Improved brand reputation, stronger supplier relationships, and reduced regulatory risks can add significant value beyond direct cost savings. The challenge is making these "soft" benefits clear to stakeholders who influence budget decisions.

Tools and Frameworks for ROI Analysis

Once metrics are identified, advanced frameworks can help validate and monetize sustainability outcomes.

Two widely used approaches - ROSI (Return on Sustainability Investment) and SROI (Social Return on Investment) - quantify value by measuring operational efficiency, employee engagement, innovation, and social outcomes [4][14][13]. ROSI, for instance, involves five steps: assessing material opportunities and risks, identifying strategies, determining expected benefits, quantifying results, and monetizing those benefits.

"To properly embed sustainability and make it a source of competitive advantage, companies need to incorporate sustainability into their strategy and, ultimately, target the material issues."

– Tensie Whelan, Founding Director, NYU Stern Center for Sustainable Business [14]

A practical example comes from Owens Corning, which applied the ROSI framework in March 2025 to its "Zero Waste to Landfill" goal for its fiberglass insulation business. The analysis revealed substantial savings in processing and procurement costs while also cutting carbon emissions through internal material recycling [14].

Start small. Focus on a single initiative, apply a framework step by step, and document the results. This creates a repeatable process that builds trust with finance teams and decision-makers responsible for sustainability budgets.

Step 3: Execute Sustainability Through Operations

With ROI metrics in place, the next step is to bring those figures to life through daily operations. This means weaving sustainability into everyday practices, starting with small, actionable changes that yield immediate savings while laying the groundwork for more significant transformations.

Interestingly, while over 33% of S&P 500 companies tie leader compensation to emissions targets, only 33% of executives at the C-level report linking pay to environmental performance [7][8]. To ensure sustainability initiatives are managed with the same rigor as financial reporting, it’s critical to assign clear ownership. This responsibility could rest with the CFO or a dedicated cross-functional committee.

Build Internal Sustainability Capacity

Once measurable ROI goals are set, successful execution depends on breaking down barriers between departments. Finance, operations, and sustainability teams must work as one. By involving finance teams from the outset and providing training on how to align budget priorities with environmental goals, organizations can create a more cohesive approach [9][17].

"Aligning sustainability ROI with the CFO's definition of financial ROI is essential to enable effective communication... and ensure consistent and informed decision-making across the organization."

– Matteo Tonello, The Conference Board [9]

Start with straightforward initiatives that deliver quick results, such as energy audits, upgrading to LED lighting, and implementing paperless systems. These "no-regret" actions immediately reduce waste and cut costs, proving that sustainability can drive profitability. For instance, Alembic Pharmaceuticals reported a 48% year-over-year increase in profit after tax for Q3 in February 2024, attributing much of this growth to lower material costs and improved supply chain efficiency [3].

Employee involvement is just as crucial as leadership support. A third of workers aged 18–24 have turned down job offers from companies with weak sustainability practices [16], and 35% of UK office workers surveyed indicated they’d quit over inadequate climate action [11]. Workforce training, whether through internal programs or external partnerships, helps employees see how their roles contribute to sustainability goals and empowers them to identify new efficiency opportunities.

Partner with Council Fire for Execution Support

For organizations seeking additional expertise, partnering with firms like Council Fire can accelerate progress. Council Fire provides consulting services, data-driven insights, and stakeholder engagement strategies to align sustainability with operational objectives [15].

The real challenge for many corporations isn’t setting sustainability targets - it’s converting those targets into actionable steps that deliver measurable ROI. Council Fire helps businesses prioritize impactful initiatives, establish governance structures that integrate sustainability into financial decision-making, and leverage tools like geospatial analytics and dashboards to provide clear visibility into decarbonization efforts [17]. This approach turns sustainability into a competitive advantage rather than a compliance obligation.

"Businesses that embed sustainability into their core operations often discover untapped revenue streams and cost efficiencies that dramatically improve their net present value over time."

– Julien Denormandie, Chief Impact Officer, Sweep [16]

Step 4: Communicate ROI Results to Stakeholders

After achieving measurable outcomes from sustainability initiatives, the next step is to present these results in a way that resonates with various stakeholders. CFOs might prioritize metrics like Free Cash Flow or NPV, while investors often focus on market protection and risk mitigation. The key lies in transforming raw data into a narrative that speaks to everyone.

Build a Clear Business Case

Once sustainability initiatives are implemented, clearly presenting their financial impact is essential. This involves translating sustainability achievements into tangible financial outcomes. Instead of merely reporting reductions in carbon emissions or water usage, link these results to metrics like EBIT savings, cost avoidance, or revenue growth. Take, for example, REI’s 2024 report: the company’s employee sustainability program not only reduced turnover and hiring costs but also boosted productivity, resulting in a net benefit of $24 million - around 5% of total payroll expenses[4].

Focus on three primary value drivers to build your case: revenue growth (such as premium pricing for sustainable products), cost reduction (like energy savings from LED upgrades), and risk mitigation (such as avoiding regulatory fines or supply chain disruptions)[1]. Products marketed as sustainable have shown 28% cumulative growth over five years, compared to 20% for non-sustainable products[3]. Additionally, emphasize the risks of inaction, such as losing market share to competitors who are quicker to adapt.

"Embedding sustainability into business strategy is good management and creates financial value through operational efficiency, innovation, sales & marketing and other benefits."

– NYU Stern Center for Sustainable Business[4]

Simple and relatable examples can make a big difference. Gundersen Health System, for instance, used energy retrofits to illustrate how clear metrics can highlight financial benefits. Similarly, an automotive company working with NYU Stern showed that recycling materials from end-of-life vehicles could result in $100 million in annual EBIT savings by cutting virgin material costs and disposal fees[4].

Use Visuals to Simplify Complex Data

ROI calculations can often feel overwhelming, but visual tools can make them more digestible. Waterfall charts, for instance, can demonstrate how individual sustainability efforts - like energy efficiency, waste reduction, and supply chain improvements - combine to create overall value for the company[3].

A concise table can also clarify how different strategies drive financial benefits:

Sustainability Strategy | Financial Value Drivers |

|---|---|

Decarbonization | Energy cost savings, avoidance of carbon fees, lower cost of capital |

Circularity | Operational efficiency, reduced waste disposal costs, increased market share |

Sustainable Sourcing | Supply chain resilience, reduced reputational risk, community license to operate |

Employee Well-being | Higher productivity, lower recruitment costs, reduced insurance expenses |

To further engage stakeholders, consider framing your presentation using an "offense versus defense" approach. Offense emphasizes opportunities like launching eco-friendly products or leveraging price premiums, while defense focuses on protecting existing value by mitigating risks such as regulatory fines or market decline[3]. For example, Natra’s investment in full traceability for cocoa products transformed the commodity into a specialty item, delivering an estimated present value of $2.6 million within 1–4 years[4].

Tailor visuals to suit your audience. Board members might prefer scenario planning visuals that account for fluctuating market conditions, while employees may connect better with infographics that show how their efforts contribute to measurable outcomes. These visual elements not only reinforce the strategic narrative but also foster ongoing engagement. By demonstrating transparency and aligning sustainability with business priorities, you can solidify its role as a sound investment.

Conclusion: Sustainability as a Business Investment

Positioning sustainability as a core business investment not only safeguards but also enhances your bottom line. By following a focused four-step approach - establishing clear, business-driven goals, using concrete metrics to measure financial outcomes, integrating sustainability into daily operations, and effectively communicating results - companies can unlock measurable value.

The numbers tell a compelling story. Products marketed as sustainable have achieved an average of 28% cumulative growth over a recent five-year period, significantly outpacing the 20% growth seen in conventional products [3].

"Embedding sustainability into business strategy is good management and creates financial value through operational efficiency, innovation, sales and marketing and other benefits."

– NYU Stern Center for Sustainable Business [4]

The business landscape is shifting. Sustainability is no longer just about compliance - it’s an opportunity to innovate, capture new revenue streams, and mitigate risks. Companies that fail to adapt risk falling behind competitors who are successfully weaving sustainability into their strategies and product lines [1]. This evolution highlights the importance of expert guidance to transform sustainability goals into tangible, measurable outcomes.

Council Fire is here to help businesses take the next step. By moving beyond ESG compliance, we provide strategic planning and execution support designed to deliver impactful, system-wide results. The time to act is now - embrace sustainability as a competitive edge that drives long-term growth.

FAQs

How can companies measure the ROI of sustainability initiatives effectively?

To gauge the return on investment (ROI) of sustainability efforts, businesses need to connect their environmental and social actions to tangible financial outcomes. Begin by cataloging all associated costs, including capital expenditures, operational expenses, and employee training. Next, outline the benefits - such as energy savings, lower carbon fees, enhanced brand reputation, and improved employee morale. Assigning monetary values to these elements allows companies to use tools like net present value (NPV) or internal rate of return (IRR) to evaluate the financial impact over time.

Here’s a straightforward process to get started:

Set a baseline for metrics like energy consumption, emissions, or waste production.

Identify key performance indicators (KPIs) that directly link to financial results, such as dollars saved per megawatt-hour or avoided penalties.

Regularly gather and integrate data into financial reports for a clearer picture of progress.

When applied consistently, this approach not only uncovers measurable financial gains - like higher revenue or reduced costs - but also builds investor trust and supports long-term profitability.

What are some easy sustainability actions businesses can take to see quick financial benefits?

Businesses can take straightforward steps toward sustainability that also bring immediate cost savings and operational advantages. For instance, switching to energy-efficient LED lighting, fine-tuning HVAC schedules, and using building automation systems can lower energy expenses by 10–30%, while also reducing vulnerability to fluctuating energy prices. Similarly, performing a waste audit, improving recycling efforts, and cutting back on excessive packaging can decrease disposal costs and even create new revenue streams from recyclable materials.

Making water efficiency upgrades - like repairing leaks, installing low-flow fixtures, and leveraging water monitoring tools - can lead to noticeable reductions in water bills and ensure compliance with regulatory standards. Short-term renewable energy options, such as installing on-site solar panels or entering into power purchase agreements (PPAs), can help secure lower electricity rates and sidestep potential carbon-related charges. Additionally, revisiting supplier contracts to prioritize eco-friendly vendors can cut material waste, streamline logistics, and boost your company’s ESG standing - all while trimming expenses.

How can businesses align their sustainability goals with financial success?

To align sustainability goals with financial objectives, businesses should weave sustainability into their core strategies rather than treating it as a standalone effort. Start by examining how environmental and social factors influence critical financial elements like revenue, costs, risks, and brand reputation. Tools like materiality analysis can help pinpoint which sustainability initiatives are most likely to yield measurable business benefits.

Once priorities are identified, convert them into clear, measurable KPIs. These might include metrics like energy cost reductions, lower carbon-related expenses, or increased revenue from eco-friendly products. To emphasize their importance, integrate these KPIs into performance reviews and compensation plans. Many forward-thinking companies already tie executive incentives to sustainability achievements, ensuring these goals stay at the forefront of decision-making.

Equally important is consistent tracking and reporting. By monitoring sustainability metrics alongside traditional financial data, businesses can showcase ROI, fine-tune their strategies, and effectively communicate progress to stakeholders. When sustainability is seamlessly incorporated into governance, budgeting, and performance systems, it becomes a natural part of driving overall business success.

Related Blog Posts

FAQ

What does it really mean to “redefine profit”?

What makes Council Fire different?

Who does Council Fire you work with?

What does working with Council Fire actually look like?

How does Council Fire help organizations turn big goals into action?

How does Council Fire define and measure success?