Dec 18, 2025

Dec 18, 2025

Blended Finance Models for Off-Grid Energy

Sustainability Strategy

Sustainability Strategy

In This Article

Explains concessional debt, results-based financing, guarantees, and integrated models that reduce investor risk and mobilize private capital for off-grid renewables.

Blended Finance Models for Off-Grid Energy

Over 1 billion people globally lack electricity, with demand in non-OECD nations projected to rise 63% by 2030. Off-grid renewable energy offers a faster solution to underserved areas compared to traditional grids, but financing such projects remains a challenge. Blended finance - a mix of public, philanthropic, and private funding - helps address risks like currency volatility or policy instability, making these ventures more attractive to investors.

Key approaches include concessional debt, results-based financing, risk-sharing facilities, and integrated programmatic models. Each method balances risk, scalability, and policy alignment differently, enabling the expansion of clean energy access while contributing to global climate goals.

Key Insights:

Concessional Debt: Reduces risk for private investors but struggles with scalability.

Results-Based Financing: Ties funding to measurable outcomes but requires upfront capital.

Risk-Sharing Facilities: Mitigate risks like currency or policy uncertainty, unlocking private investment.

Integrated Models: Bundle smaller projects into portfolios, addressing liquidity and scale challenges.

These models, when aligned with strong policy frameworks, can mobilize private capital, expand clean energy access, and address climate challenges effectively.

1. Concessional Debt and First-Loss Capital Structures

Capital Structure and Risk Allocation

Concessional debt and first-loss capital structures play a significant role in reshaping project risk by leveraging public funds to absorb initial losses. This approach makes investments in off-grid energy projects more appealing to commercial investors [6]. Under these arrangements, concessional capital is repaid only after senior debt holders have been satisfied [7]. This setup acts as a safety net, encouraging commercial investors to participate in projects that might otherwise seem too risky. If a project underperforms, the first-loss capital absorbs the initial losses, reducing the financial exposure of other investors. This risk-sharing mechanism is particularly beneficial for off-grid energy projects, which often come with high upfront costs and extended timelines for returns. By addressing these risks, these structures pave the way for tackling the challenges of scaling such projects, as discussed in the following section.

Scalability and Transaction Costs

While concessional debt and first-loss structures effectively attract investment, they face hurdles when it comes to scalability. Off-grid energy companies often operate with small ticket sizes, which fall below the investment thresholds preferred by traditional infrastructure investors. Additionally, these projects typically require more patient capital than what private equity firms are accustomed to providing. Another challenge lies in the administrative complexity of managing multiple investors, each with different loan terms, which increases operational costs.

For example, in September 2019, USAID's INVEST initiative successfully mobilized $63.25 million in private capital for off-grid energy companies in Kenya. This funding is projected to enable 440,000 new energy connections [8].

Currency mismatches further complicate financial risks, especially when revenue is generated in local currency while loans are denominated in foreign currency. USAID INVEST highlights the value of syndicated loans in addressing this issue:

A syndicated loan aligns the terms and conditions of the loan across all investors, which improves the efficiency of, and reduces operational cost for, the company [8].

To overcome these operational challenges, robust policy support is essential, as explored in the next section.

Alignment with Policy and Regulatory Frameworks

The effectiveness of concessional debt and first-loss capital structures is closely tied to the policy environment in which they operate. U.S. initiatives like Energy for Peace demonstrate how these structures can close the viability gap for off-grid energy projects [2][3].

However, policy uncertainty and regulatory barriers continue to discourage private investment in decentralized electricity markets [4]. Investors frequently point to the lack of risk mitigation tools - such as guarantees and insurance - as a major obstacle [1]. Bridging this gap will require stronger coordination between financial structuring and policymaking to create a more supportive environment for investment.

Impact on Energy Access and Climate Goals

When implemented effectively, these capital structures can deliver tangible results. For instance, in 2018, Uganda-based Aptech Africa secured a $250,000 concessional loan from UNCDF, which helped attract an additional $800,000 from Stanbic Bank to expand rural energy access [9].

Blended finance for climate-focused initiatives surged by 107%, growing from $5.6 billion in 2022 to $11.6 billion in 2023 [9]. While mini-grids generally connect fewer people per dollar invested compared to solar home systems, they provide higher wattage, enabling productive uses like irrigation and refrigeration. This makes mini-grids a critical tool for driving sustainable development [8].

These examples highlight how targeted financial strategies can transform policy frameworks into actionable pathways for scaling off-grid energy investments and advancing both energy access and climate goals.

2. Results-Based Financing and Output-Linked Subsidy Models

Capital Structure and Risk Allocation

Results-based financing (RBF) and output-linked subsidies shift the burden of performance risk from public funders to private developers. In this setup, private companies secure the initial capital needed to build and run off-grid energy projects, while public sector entities or donor organizations provide financial support only after specific outcomes - like verified energy connections or installed capacity - are achieved [3]. This approach enhances the appeal of projects to investors by offering grant payments that cover the gap between project costs and what commercial investors consider viable, particularly in underserved regions [3]. By tying funding to measurable results, these models complement traditional risk mitigation strategies, ensuring funds are disbursed only when tangible milestones are met.

Scalability and Transaction Costs

While RBF models can prove market viability and attract private investment without fostering reliance on continuous grants, they do come with administrative hurdles. Verifying results requires robust monitoring and evaluation systems, which can drive up transaction costs [3]. Off-grid developers often face elevated costs per connection due to fragmented customer bases, weak regulatory environments, and the lack of standardized documentation required by local financiers [6][9].

To tackle these inefficiencies, efforts are focusing on semi-standardized project preparation activities, transaction documents, and risk mitigation tools to lower legal and administrative barriers. Streamlining approval processes and bundling smaller projects into larger, more appealing portfolios for investors can also enhance efficiency [1]. These challenges highlight the need for streamlined policy frameworks to simplify verification and reduce administrative burdens.

Alignment with Policy and Regulatory Frameworks

For these financing models to be effective, they must align with national energy policies and goals. Output-linked models perform best when integrated into broader energy strategies. For instance, feed-in tariffs (FITs) are used to offer price incentives for small-scale renewable projects, helping to bridge the cost gap between renewables and fossil fuels [10]. In 2014, Mozambique implemented a FIT policy targeting biomass, small hydro, solar, and wind projects to encourage private sector involvement in its energy initiatives. Similarly, India’s 30% capital subsidy for rooftop solar PV aims to support 4.2 GW of new capacity, contributing to its 40 GW rooftop solar target [10].

The World Bank Group's Scaling Mini-Grid initiative demonstrates how platform approaches can work closely with governments to address regulatory gaps. In May 2022, the IFC announced a blended finance guarantee for the Democratic Republic of Congo, projected to mobilize US$400 million in capital investment. This initiative is expected to develop 180 MW of installed solar PV capacity, delivering renewable energy to over 1.5 million new users [6]. As Linda Munyengeterwa, IFC Regional Industry Director, explained:

"Efforts by the World Bank Group, including those implemented under the Scaling Mini-Grid initiative, are helping to improve strategic clarity and increase focus on delivering mini-grids at scale." [6]

Impact on Energy Access and Climate Goals

These financing models are instrumental in bridging the funding gap for universal electricity access. Meeting this goal in Africa by 2030 is estimated to require US$200 billion annually, with approximately 67% allocated to clean energy [9]. Currently, around 570 million people in Sub-Saharan Africa lack electricity, accounting for three-quarters of the global population without power [6].

In October 2022, the U.S. International Development Finance Corporation (DFC) pledged US$40 million to the Energy Entrepreneurs Growth Fund, aiming to benefit over 5 million people while significantly reducing greenhouse gas emissions [11]. Triple Jump CEO Steven Evers emphasized:

"The fund ultimately aims to reach in excess of 5 million beneficiaries, including over 240 female-led businesses, and avoiding 4.5 million tons of greenhouse gas emissions." [11]

3. Guarantee, Insurance, and Risk-Sharing Facilities

Capital Structure and Risk Allocation

Effective risk allocation plays a critical role in scaling investments in off-grid energy projects, just as it does with concessional debt and results-based financing models. Guarantee and insurance mechanisms step in by transferring risks - such as off-taker, currency, and policy risks - from private investors to public or donor-backed entities. This shift enhances the risk–return profile for commercial investors, making these projects more appealing. In distributed generation markets, such mechanisms are particularly important, as they support corporate finance structures and pave the way for securitization. The Climate Policy Initiative highlights how these tools help close the gap between clean energy and fossil fuels, pushing forward sustainable development efforts [1].

Scalability and Transaction Costs

One of the biggest hurdles in off-grid energy investments is the lack of aggregation vehicles to bundle smaller projects into larger, more manageable portfolios. Without these, transaction costs rise, making investments less appealing. Many blended finance initiatives struggle to scale due to complicated approval processes and a scarcity of local financing options, both of which drive up costs and discourage participation. To address this, stakeholders must simplify these processes and focus on expanding beyond initial pilot projects. As the Climate Policy Initiative points out:

Achieving scale will require, among others: supporting initiatives that are ripe for expansion, as risks can remain even after a successful pilot; building sustainability through technical advisory services and supporting networks that generate new ideas and partnerships; and improving efficiency by streamlining approval processes [1].

These insights underscore the need for clear regulatory guidance, a topic explored further in the next section.

Alignment with Policy and Regulatory Frameworks

Tackling the challenges of high transaction costs and limited scalability, U.S. agencies have introduced guarantee facilities that align with broader development priorities. A compelling example is USAID Colombia’s Energy for Peace (E4P) initiative, launched in August 2024. This blended finance model was created to attract private investments in renewable energy for off-grid communities impacted by conflict. The program addressed key issues like low income potential and diminished productive capacity. As USAID Colombia explained:

This experience demonstrates to energy companies, investors, and donors the transformative effects of leveraging private investment to reach common development goals [2].

Strong regulatory frameworks are also essential for encouraging private sector engagement. Beyond traditional utility regulations, policies must include specific measures for decentralized electricity products and services to reduce policy uncertainty and remove barriers to investment [4].

Impact on Energy Access and Climate Goals

Enhanced risk-sharing facilities have a unique role in bridging the gap between energy access and climate objectives. They unlock private capital in high-risk markets where conventional financing often falls short. For instance, in October 2023, the World Bank's Multilateral Investment Guarantee Agency (MIGA) issued a $150 million guarantee for renewable energy projects in Sub-Saharan Africa. This guarantee is expected to mobilize an additional $600 million in private investment, with a focus on mini-grid development [1]. By concentrating efforts in regions like Southeast Asia, Sub-Saharan Africa, and South Asia, these facilities address the dual challenge of expanding energy access and advancing climate goals. The Climate Policy Initiative underscores the urgency of this mission:

The objective is clear: mobilize investment to meet the goal of limiting global warming to, at most, 2 degrees Celsius while also bringing electricity to the more than 1 billion people globally who do not yet have access to it [1].

4. Integrated Facility and Programmatic Models Anchored in Policy

Capital Structure and Risk Allocation

Integrated facilities offer a way to scale off-grid renewable energy projects by bundling smaller initiatives into larger portfolios. This approach addresses common hurdles like liquidity and scale, which often discourage investors. Instead of assessing projects one by one, programmatic models spread investments across regional or global portfolios. This diversification balances renewable energy sources - such as solar, wind, hydro, and geothermal - helping to reduce risks tied to specific locations or technologies. In regions with critical energy access challenges, corporate finance structures and securitized assets are becoming vital tools for achieving the level of scale needed to make these projects commercially viable [1]. By redistributing risk across multiple projects, these models pave the way for broader deployment.

Scalability and Transaction Costs

Scaling pilot projects into full-scale deployments often faces obstacles due to lingering risks. Integrated models tackle these issues by incorporating technical advisory services and fostering partnerships that ensure long-term project stability. This approach helps reduce operational risks while building a foundation for sustainable growth. Simplifying approval processes is another critical element, as high transaction costs can hinder large-scale implementation of blended finance solutions. For instance, the World Bank's Global Facility on Mini Grids provides practical guidance and tested strategies to help decision-makers expand deployment within specific national contexts [12]. These streamlined processes, combined with supportive policy measures, are essential for achieving efficiency at scale.

Alignment with Policy and Regulatory Frameworks

Strong and consistent policy frameworks are essential for attracting private investment in renewable energy. When integrated facilities are designed to operate within established policy environments, they reduce regulatory uncertainty, making them more appealing to commercial investors. Programs like USAID Colombia's Energy for Peace illustrate how aligning programmatic models with policy can successfully mobilize private capital [2]. These frameworks not only provide clarity but also create a stable environment for investment.

Impact on Energy Access and Climate Goals

By addressing key risks and diversifying investments across technologies, integrated facilities help unlock private capital in regions with significant energy needs, such as Southeast Asia, Sub-Saharan Africa, and South Asia. Together, these areas represent more than $360 billion in clean energy investment opportunities [1]. These models tackle challenges like off-taker risk, currency fluctuations, and policy uncertainties, bridging the gap between clean energy and fossil fuels. In doing so, they open up financing options in markets where traditional methods often fall short, contributing to both energy access and climate goals.

Masterclass: Structuring Blended Finance for Energy

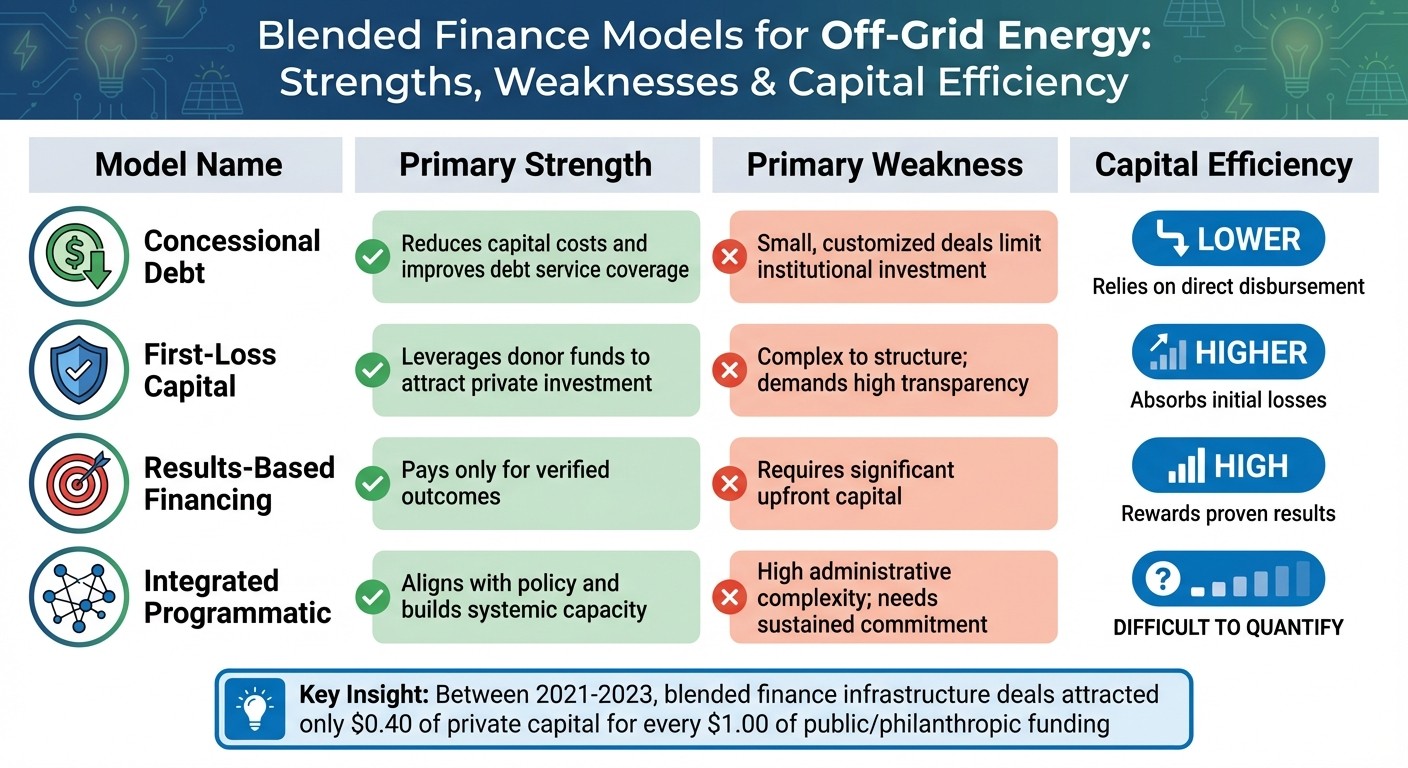

Advantages and Disadvantages

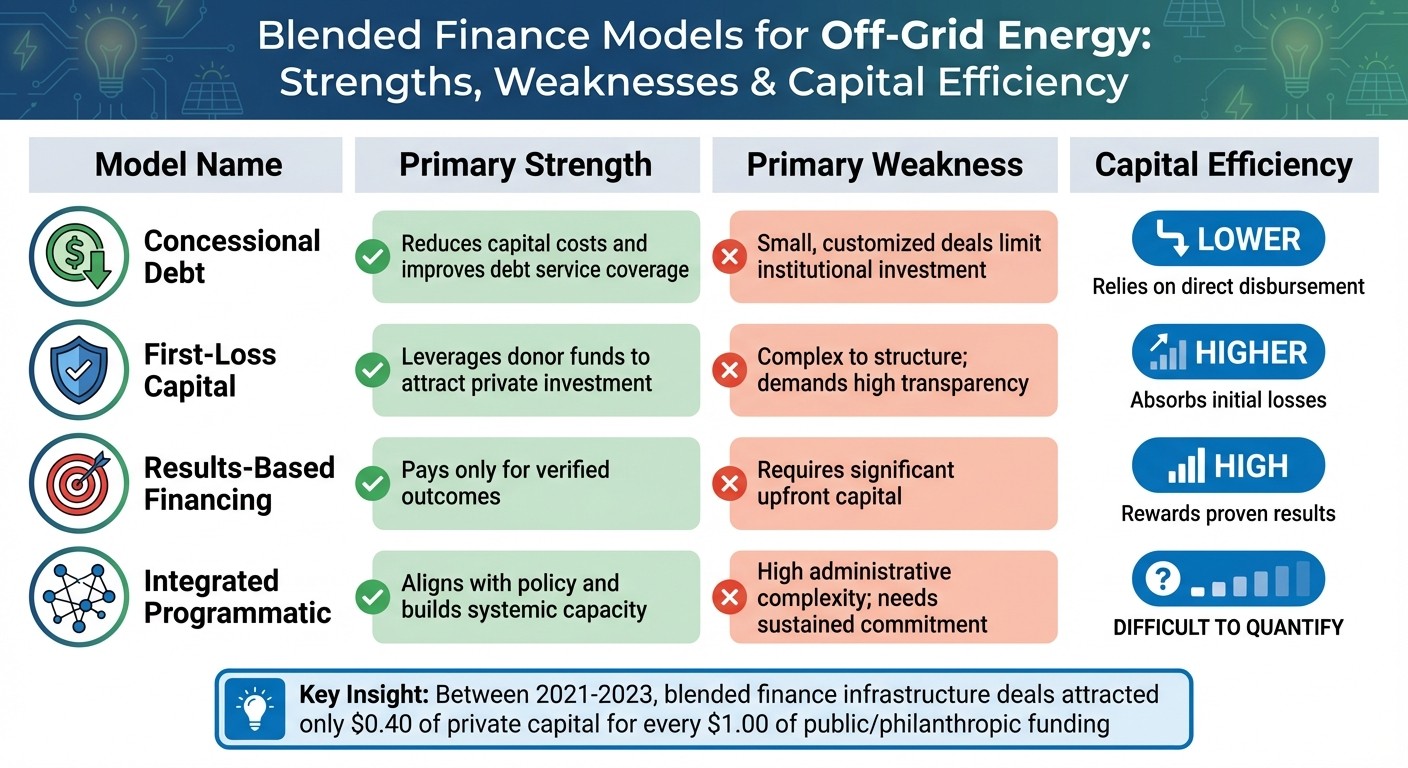

Comparison of Four Blended Finance Models for Off-Grid Energy Projects

This section provides a concise overview of the strengths and weaknesses of various blended finance models, particularly in their application to off-grid energy projects. Understanding these trade-offs is essential for aligning financial strategies with policy goals in the energy sector.

Blended finance models bring distinct benefits and challenges to off-grid energy initiatives. For instance, concessional debt helps reduce capital costs, making projects more financially viable. However, these deals are often small-scale and highly customized, discouraging institutional investors from participating. As Lasse Møller, Senior Economist at the OECD Development Cooperation Directorate, explains:

Blended finance has remained pretty much a cottage industry. It has been focused on relatively small transactions and bespoke deals, which has meant that we have not seen the kind of scale-up with standardisation... that we had wanted [14].

First-loss capital structures represent another approach, using smaller donor contributions to absorb initial losses and shield private investors from risks, particularly in emerging mini-grid markets. While this method effectively mitigates demand risk, its complexity cannot be overlooked. Crafting these agreements requires advanced risk-sharing mechanisms and robust governance systems [6] [13].

Moving on to results-based financing, this model ties payments to measurable outcomes, such as new household connections or unit sales. This approach works well in off-grid contexts, where results are easier to quantify compared to large-scale grid projects. However, developers face a significant hurdle: they must secure substantial upfront funding to execute projects before receiving performance-based payments [5].

Lastly, integrated programmatic models aim to address systemic challenges by combining finance, policy, and capacity-building efforts. This comprehensive approach aligns with national energy goals and fosters a stable investment climate. Yet, it comes with its own set of challenges, including high administrative demands and the need for long-term, multi-stakeholder commitment. Between 2021 and 2023, blended finance infrastructure deals managed to attract only $0.40 of private capital for every $1.00 of public or philanthropic funding, underscoring the difficulty in mobilizing private investments effectively [13].

Model | Primary Strength | Primary Weakness | Capital Efficiency |

|---|---|---|---|

Concessional Debt | Reduces capital costs and improves debt service coverage | Small, customized deals limit institutional investment | Lower; relies on direct disbursement |

First-Loss Capital | Leverages donor funds to attract private investment | Complex to structure; demands high transparency | Higher; absorbs initial losses |

Results-Based Financing | Pays only for verified outcomes | Requires significant upfront capital | High; rewards proven results |

Integrated Programmatic | Aligns with policy and builds systemic capacity | High administrative complexity; needs sustained commitment | Difficult to quantify |

Each model offers unique opportunities and challenges, making it essential to carefully match the approach to the specific needs and goals of off-grid energy projects.

Conclusion

The success of blended finance depends heavily on the maturity of the market and the associated risk profiles. In regions like Sub-Saharan Africa - where around 570 million people still lack access to electricity - concessional subordinated debt has proven to be an effective tool for reducing risks and attracting commercial senior debt investments [6]. For pilot projects with untested business models, concessional funds are essential to pave the way for commercial investors [15]. On the other hand, transitioning economies such as Indonesia, which faces a $47 billion infrastructure funding gap between 2025 and 2029, benefit from blended models that combine concessional and commercial capital. These approaches are particularly effective in accelerating the early retirement of coal plants [15]. These examples highlight the importance of tailoring financial strategies to the specific needs of each market.

In light of these trends, decisive action is needed from U.S. policymakers. Strengthening the Power Africa initiative through multiyear congressional authorization would provide the program with the stability to operate effectively across administrations [16]. Additionally, reforms to the U.S. Development Finance Corporation (DFC) could enable direct equity investments and allow it to retain profits, which would help catalyze private capital. For investors, mature markets such as India and South Africa offer opportunities, while regional vehicles can help spread risks in smaller or less developed markets [1]. Development agencies, on the other hand, should focus on tools like guarantees, insurance, and local currency financing to mitigate risks [1].

To transition projects from the planning phase to financial close, standardized documentation, robust risk-sharing mechanisms, and expanded grant funding for feasibility studies are critical [15]. As Tom Bishop, Senior Climate Finance Advisor at RTI, aptly states:

The key lies in alignment and trust, ensuring that each partner plays the right role [15].

This alignment of risk-sharing and policy frameworks supports earlier findings on scaling sustainable projects effectively.

Drawing on these insights, Council Fire specializes in creating actionable strategies for financing off-grid energy solutions. By aligning development goals with commercial returns, Council Fire helps stakeholders design and execute blended finance models. Through its expertise in risk mitigation, stakeholder collaboration, and policy alignment, the organization assists policymakers, investors, and development agencies in structuring deals that attract private capital while advancing sustainability objectives. Whether navigating regulatory complexities or fostering technical partnerships, Council Fire turns ambitious energy access goals into practical, measurable outcomes that balance financial returns with environmental and social benefits.

FAQs

What are the benefits and challenges of using blended finance for off-grid renewable energy projects?

Blended finance weaves together public funds, grants, or concessional loans with private capital to drive off-grid renewable energy projects. By lowering the initial risks for private investors, it opens the door to funding for initiatives like mini-grids and solar home systems, which are essential for bringing electricity to underserved communities. This method not only boosts the financial appeal of projects but also aligns investments with broader goals, such as cutting emissions, while enabling risk-sharing structures that help make projects economically sustainable.

That said, structuring blended finance arrangements is no simple task. It demands expertise across legal, financial, and technical domains. Misjudged public contributions can skew markets or lead to subsidies that can’t be sustained long-term. Additional hurdles include regulatory challenges, policy instability, and high transaction expenses. Overcoming these obstacles requires thoughtful planning, robust institutional capabilities, and well-defined policy frameworks. Council Fire plays a key role in this space, offering expert guidance to navigate these complexities and achieve successful project outcomes.

How do concessional debt and first-loss capital reduce risks for private investors in off-grid energy projects?

Concessional debt plays a crucial role in making off-grid energy projects more appealing to private investors. By offering lower interest rates and extending repayment periods, it eases the cash flow burden during the critical early stages of a project. This approach helps improve the financial feasibility of such investments, encouraging greater participation.

First-loss capital adds another layer of protection for investors by taking on the initial losses within the investment structure. Positioned at the bottom of the capital stack, it acts as a financial cushion. This setup ensures that private investors face risks only after this buffer is exhausted, boosting their confidence in the project's overall financial resilience.

Why is aligning policies important for blended finance models in off-grid energy projects?

Policy alignment plays a pivotal role in the success of blended finance models, particularly when it comes to off-grid energy projects. A stable policy environment - one that clearly defines tariffs, streamlines permitting processes, and ensures access to public subsidies - reduces regulatory uncertainty and makes these projects more attractive to private investors. When governments actively prioritize renewable energy and universal electricity access, they create the conditions needed to make these initiatives financially feasible and scalable.

Blended finance relies on a mix of public-sector funds and private capital. Without clear and cohesive policies, investors may hesitate, and progress can falter. Robust policy frameworks are essential to ensure public funds are effectively used to mitigate risks, while also providing the predictability private investors require to commit to these ventures. Organizations like Council Fire play a critical role in bridging policy and financial mechanisms, helping off-grid energy projects achieve both economic growth and environmental progress.

Related Blog Posts

Latest Articles

©2025

FAQ

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 18, 2025

Blended Finance Models for Off-Grid Energy

Sustainability Strategy

In This Article

Explains concessional debt, results-based financing, guarantees, and integrated models that reduce investor risk and mobilize private capital for off-grid renewables.

Blended Finance Models for Off-Grid Energy

Over 1 billion people globally lack electricity, with demand in non-OECD nations projected to rise 63% by 2030. Off-grid renewable energy offers a faster solution to underserved areas compared to traditional grids, but financing such projects remains a challenge. Blended finance - a mix of public, philanthropic, and private funding - helps address risks like currency volatility or policy instability, making these ventures more attractive to investors.

Key approaches include concessional debt, results-based financing, risk-sharing facilities, and integrated programmatic models. Each method balances risk, scalability, and policy alignment differently, enabling the expansion of clean energy access while contributing to global climate goals.

Key Insights:

Concessional Debt: Reduces risk for private investors but struggles with scalability.

Results-Based Financing: Ties funding to measurable outcomes but requires upfront capital.

Risk-Sharing Facilities: Mitigate risks like currency or policy uncertainty, unlocking private investment.

Integrated Models: Bundle smaller projects into portfolios, addressing liquidity and scale challenges.

These models, when aligned with strong policy frameworks, can mobilize private capital, expand clean energy access, and address climate challenges effectively.

1. Concessional Debt and First-Loss Capital Structures

Capital Structure and Risk Allocation

Concessional debt and first-loss capital structures play a significant role in reshaping project risk by leveraging public funds to absorb initial losses. This approach makes investments in off-grid energy projects more appealing to commercial investors [6]. Under these arrangements, concessional capital is repaid only after senior debt holders have been satisfied [7]. This setup acts as a safety net, encouraging commercial investors to participate in projects that might otherwise seem too risky. If a project underperforms, the first-loss capital absorbs the initial losses, reducing the financial exposure of other investors. This risk-sharing mechanism is particularly beneficial for off-grid energy projects, which often come with high upfront costs and extended timelines for returns. By addressing these risks, these structures pave the way for tackling the challenges of scaling such projects, as discussed in the following section.

Scalability and Transaction Costs

While concessional debt and first-loss structures effectively attract investment, they face hurdles when it comes to scalability. Off-grid energy companies often operate with small ticket sizes, which fall below the investment thresholds preferred by traditional infrastructure investors. Additionally, these projects typically require more patient capital than what private equity firms are accustomed to providing. Another challenge lies in the administrative complexity of managing multiple investors, each with different loan terms, which increases operational costs.

For example, in September 2019, USAID's INVEST initiative successfully mobilized $63.25 million in private capital for off-grid energy companies in Kenya. This funding is projected to enable 440,000 new energy connections [8].

Currency mismatches further complicate financial risks, especially when revenue is generated in local currency while loans are denominated in foreign currency. USAID INVEST highlights the value of syndicated loans in addressing this issue:

A syndicated loan aligns the terms and conditions of the loan across all investors, which improves the efficiency of, and reduces operational cost for, the company [8].

To overcome these operational challenges, robust policy support is essential, as explored in the next section.

Alignment with Policy and Regulatory Frameworks

The effectiveness of concessional debt and first-loss capital structures is closely tied to the policy environment in which they operate. U.S. initiatives like Energy for Peace demonstrate how these structures can close the viability gap for off-grid energy projects [2][3].

However, policy uncertainty and regulatory barriers continue to discourage private investment in decentralized electricity markets [4]. Investors frequently point to the lack of risk mitigation tools - such as guarantees and insurance - as a major obstacle [1]. Bridging this gap will require stronger coordination between financial structuring and policymaking to create a more supportive environment for investment.

Impact on Energy Access and Climate Goals

When implemented effectively, these capital structures can deliver tangible results. For instance, in 2018, Uganda-based Aptech Africa secured a $250,000 concessional loan from UNCDF, which helped attract an additional $800,000 from Stanbic Bank to expand rural energy access [9].

Blended finance for climate-focused initiatives surged by 107%, growing from $5.6 billion in 2022 to $11.6 billion in 2023 [9]. While mini-grids generally connect fewer people per dollar invested compared to solar home systems, they provide higher wattage, enabling productive uses like irrigation and refrigeration. This makes mini-grids a critical tool for driving sustainable development [8].

These examples highlight how targeted financial strategies can transform policy frameworks into actionable pathways for scaling off-grid energy investments and advancing both energy access and climate goals.

2. Results-Based Financing and Output-Linked Subsidy Models

Capital Structure and Risk Allocation

Results-based financing (RBF) and output-linked subsidies shift the burden of performance risk from public funders to private developers. In this setup, private companies secure the initial capital needed to build and run off-grid energy projects, while public sector entities or donor organizations provide financial support only after specific outcomes - like verified energy connections or installed capacity - are achieved [3]. This approach enhances the appeal of projects to investors by offering grant payments that cover the gap between project costs and what commercial investors consider viable, particularly in underserved regions [3]. By tying funding to measurable results, these models complement traditional risk mitigation strategies, ensuring funds are disbursed only when tangible milestones are met.

Scalability and Transaction Costs

While RBF models can prove market viability and attract private investment without fostering reliance on continuous grants, they do come with administrative hurdles. Verifying results requires robust monitoring and evaluation systems, which can drive up transaction costs [3]. Off-grid developers often face elevated costs per connection due to fragmented customer bases, weak regulatory environments, and the lack of standardized documentation required by local financiers [6][9].

To tackle these inefficiencies, efforts are focusing on semi-standardized project preparation activities, transaction documents, and risk mitigation tools to lower legal and administrative barriers. Streamlining approval processes and bundling smaller projects into larger, more appealing portfolios for investors can also enhance efficiency [1]. These challenges highlight the need for streamlined policy frameworks to simplify verification and reduce administrative burdens.

Alignment with Policy and Regulatory Frameworks

For these financing models to be effective, they must align with national energy policies and goals. Output-linked models perform best when integrated into broader energy strategies. For instance, feed-in tariffs (FITs) are used to offer price incentives for small-scale renewable projects, helping to bridge the cost gap between renewables and fossil fuels [10]. In 2014, Mozambique implemented a FIT policy targeting biomass, small hydro, solar, and wind projects to encourage private sector involvement in its energy initiatives. Similarly, India’s 30% capital subsidy for rooftop solar PV aims to support 4.2 GW of new capacity, contributing to its 40 GW rooftop solar target [10].

The World Bank Group's Scaling Mini-Grid initiative demonstrates how platform approaches can work closely with governments to address regulatory gaps. In May 2022, the IFC announced a blended finance guarantee for the Democratic Republic of Congo, projected to mobilize US$400 million in capital investment. This initiative is expected to develop 180 MW of installed solar PV capacity, delivering renewable energy to over 1.5 million new users [6]. As Linda Munyengeterwa, IFC Regional Industry Director, explained:

"Efforts by the World Bank Group, including those implemented under the Scaling Mini-Grid initiative, are helping to improve strategic clarity and increase focus on delivering mini-grids at scale." [6]

Impact on Energy Access and Climate Goals

These financing models are instrumental in bridging the funding gap for universal electricity access. Meeting this goal in Africa by 2030 is estimated to require US$200 billion annually, with approximately 67% allocated to clean energy [9]. Currently, around 570 million people in Sub-Saharan Africa lack electricity, accounting for three-quarters of the global population without power [6].

In October 2022, the U.S. International Development Finance Corporation (DFC) pledged US$40 million to the Energy Entrepreneurs Growth Fund, aiming to benefit over 5 million people while significantly reducing greenhouse gas emissions [11]. Triple Jump CEO Steven Evers emphasized:

"The fund ultimately aims to reach in excess of 5 million beneficiaries, including over 240 female-led businesses, and avoiding 4.5 million tons of greenhouse gas emissions." [11]

3. Guarantee, Insurance, and Risk-Sharing Facilities

Capital Structure and Risk Allocation

Effective risk allocation plays a critical role in scaling investments in off-grid energy projects, just as it does with concessional debt and results-based financing models. Guarantee and insurance mechanisms step in by transferring risks - such as off-taker, currency, and policy risks - from private investors to public or donor-backed entities. This shift enhances the risk–return profile for commercial investors, making these projects more appealing. In distributed generation markets, such mechanisms are particularly important, as they support corporate finance structures and pave the way for securitization. The Climate Policy Initiative highlights how these tools help close the gap between clean energy and fossil fuels, pushing forward sustainable development efforts [1].

Scalability and Transaction Costs

One of the biggest hurdles in off-grid energy investments is the lack of aggregation vehicles to bundle smaller projects into larger, more manageable portfolios. Without these, transaction costs rise, making investments less appealing. Many blended finance initiatives struggle to scale due to complicated approval processes and a scarcity of local financing options, both of which drive up costs and discourage participation. To address this, stakeholders must simplify these processes and focus on expanding beyond initial pilot projects. As the Climate Policy Initiative points out:

Achieving scale will require, among others: supporting initiatives that are ripe for expansion, as risks can remain even after a successful pilot; building sustainability through technical advisory services and supporting networks that generate new ideas and partnerships; and improving efficiency by streamlining approval processes [1].

These insights underscore the need for clear regulatory guidance, a topic explored further in the next section.

Alignment with Policy and Regulatory Frameworks

Tackling the challenges of high transaction costs and limited scalability, U.S. agencies have introduced guarantee facilities that align with broader development priorities. A compelling example is USAID Colombia’s Energy for Peace (E4P) initiative, launched in August 2024. This blended finance model was created to attract private investments in renewable energy for off-grid communities impacted by conflict. The program addressed key issues like low income potential and diminished productive capacity. As USAID Colombia explained:

This experience demonstrates to energy companies, investors, and donors the transformative effects of leveraging private investment to reach common development goals [2].

Strong regulatory frameworks are also essential for encouraging private sector engagement. Beyond traditional utility regulations, policies must include specific measures for decentralized electricity products and services to reduce policy uncertainty and remove barriers to investment [4].

Impact on Energy Access and Climate Goals

Enhanced risk-sharing facilities have a unique role in bridging the gap between energy access and climate objectives. They unlock private capital in high-risk markets where conventional financing often falls short. For instance, in October 2023, the World Bank's Multilateral Investment Guarantee Agency (MIGA) issued a $150 million guarantee for renewable energy projects in Sub-Saharan Africa. This guarantee is expected to mobilize an additional $600 million in private investment, with a focus on mini-grid development [1]. By concentrating efforts in regions like Southeast Asia, Sub-Saharan Africa, and South Asia, these facilities address the dual challenge of expanding energy access and advancing climate goals. The Climate Policy Initiative underscores the urgency of this mission:

The objective is clear: mobilize investment to meet the goal of limiting global warming to, at most, 2 degrees Celsius while also bringing electricity to the more than 1 billion people globally who do not yet have access to it [1].

4. Integrated Facility and Programmatic Models Anchored in Policy

Capital Structure and Risk Allocation

Integrated facilities offer a way to scale off-grid renewable energy projects by bundling smaller initiatives into larger portfolios. This approach addresses common hurdles like liquidity and scale, which often discourage investors. Instead of assessing projects one by one, programmatic models spread investments across regional or global portfolios. This diversification balances renewable energy sources - such as solar, wind, hydro, and geothermal - helping to reduce risks tied to specific locations or technologies. In regions with critical energy access challenges, corporate finance structures and securitized assets are becoming vital tools for achieving the level of scale needed to make these projects commercially viable [1]. By redistributing risk across multiple projects, these models pave the way for broader deployment.

Scalability and Transaction Costs

Scaling pilot projects into full-scale deployments often faces obstacles due to lingering risks. Integrated models tackle these issues by incorporating technical advisory services and fostering partnerships that ensure long-term project stability. This approach helps reduce operational risks while building a foundation for sustainable growth. Simplifying approval processes is another critical element, as high transaction costs can hinder large-scale implementation of blended finance solutions. For instance, the World Bank's Global Facility on Mini Grids provides practical guidance and tested strategies to help decision-makers expand deployment within specific national contexts [12]. These streamlined processes, combined with supportive policy measures, are essential for achieving efficiency at scale.

Alignment with Policy and Regulatory Frameworks

Strong and consistent policy frameworks are essential for attracting private investment in renewable energy. When integrated facilities are designed to operate within established policy environments, they reduce regulatory uncertainty, making them more appealing to commercial investors. Programs like USAID Colombia's Energy for Peace illustrate how aligning programmatic models with policy can successfully mobilize private capital [2]. These frameworks not only provide clarity but also create a stable environment for investment.

Impact on Energy Access and Climate Goals

By addressing key risks and diversifying investments across technologies, integrated facilities help unlock private capital in regions with significant energy needs, such as Southeast Asia, Sub-Saharan Africa, and South Asia. Together, these areas represent more than $360 billion in clean energy investment opportunities [1]. These models tackle challenges like off-taker risk, currency fluctuations, and policy uncertainties, bridging the gap between clean energy and fossil fuels. In doing so, they open up financing options in markets where traditional methods often fall short, contributing to both energy access and climate goals.

Masterclass: Structuring Blended Finance for Energy

Advantages and Disadvantages

Comparison of Four Blended Finance Models for Off-Grid Energy Projects

This section provides a concise overview of the strengths and weaknesses of various blended finance models, particularly in their application to off-grid energy projects. Understanding these trade-offs is essential for aligning financial strategies with policy goals in the energy sector.

Blended finance models bring distinct benefits and challenges to off-grid energy initiatives. For instance, concessional debt helps reduce capital costs, making projects more financially viable. However, these deals are often small-scale and highly customized, discouraging institutional investors from participating. As Lasse Møller, Senior Economist at the OECD Development Cooperation Directorate, explains:

Blended finance has remained pretty much a cottage industry. It has been focused on relatively small transactions and bespoke deals, which has meant that we have not seen the kind of scale-up with standardisation... that we had wanted [14].

First-loss capital structures represent another approach, using smaller donor contributions to absorb initial losses and shield private investors from risks, particularly in emerging mini-grid markets. While this method effectively mitigates demand risk, its complexity cannot be overlooked. Crafting these agreements requires advanced risk-sharing mechanisms and robust governance systems [6] [13].

Moving on to results-based financing, this model ties payments to measurable outcomes, such as new household connections or unit sales. This approach works well in off-grid contexts, where results are easier to quantify compared to large-scale grid projects. However, developers face a significant hurdle: they must secure substantial upfront funding to execute projects before receiving performance-based payments [5].

Lastly, integrated programmatic models aim to address systemic challenges by combining finance, policy, and capacity-building efforts. This comprehensive approach aligns with national energy goals and fosters a stable investment climate. Yet, it comes with its own set of challenges, including high administrative demands and the need for long-term, multi-stakeholder commitment. Between 2021 and 2023, blended finance infrastructure deals managed to attract only $0.40 of private capital for every $1.00 of public or philanthropic funding, underscoring the difficulty in mobilizing private investments effectively [13].

Model | Primary Strength | Primary Weakness | Capital Efficiency |

|---|---|---|---|

Concessional Debt | Reduces capital costs and improves debt service coverage | Small, customized deals limit institutional investment | Lower; relies on direct disbursement |

First-Loss Capital | Leverages donor funds to attract private investment | Complex to structure; demands high transparency | Higher; absorbs initial losses |

Results-Based Financing | Pays only for verified outcomes | Requires significant upfront capital | High; rewards proven results |

Integrated Programmatic | Aligns with policy and builds systemic capacity | High administrative complexity; needs sustained commitment | Difficult to quantify |

Each model offers unique opportunities and challenges, making it essential to carefully match the approach to the specific needs and goals of off-grid energy projects.

Conclusion

The success of blended finance depends heavily on the maturity of the market and the associated risk profiles. In regions like Sub-Saharan Africa - where around 570 million people still lack access to electricity - concessional subordinated debt has proven to be an effective tool for reducing risks and attracting commercial senior debt investments [6]. For pilot projects with untested business models, concessional funds are essential to pave the way for commercial investors [15]. On the other hand, transitioning economies such as Indonesia, which faces a $47 billion infrastructure funding gap between 2025 and 2029, benefit from blended models that combine concessional and commercial capital. These approaches are particularly effective in accelerating the early retirement of coal plants [15]. These examples highlight the importance of tailoring financial strategies to the specific needs of each market.

In light of these trends, decisive action is needed from U.S. policymakers. Strengthening the Power Africa initiative through multiyear congressional authorization would provide the program with the stability to operate effectively across administrations [16]. Additionally, reforms to the U.S. Development Finance Corporation (DFC) could enable direct equity investments and allow it to retain profits, which would help catalyze private capital. For investors, mature markets such as India and South Africa offer opportunities, while regional vehicles can help spread risks in smaller or less developed markets [1]. Development agencies, on the other hand, should focus on tools like guarantees, insurance, and local currency financing to mitigate risks [1].

To transition projects from the planning phase to financial close, standardized documentation, robust risk-sharing mechanisms, and expanded grant funding for feasibility studies are critical [15]. As Tom Bishop, Senior Climate Finance Advisor at RTI, aptly states:

The key lies in alignment and trust, ensuring that each partner plays the right role [15].

This alignment of risk-sharing and policy frameworks supports earlier findings on scaling sustainable projects effectively.

Drawing on these insights, Council Fire specializes in creating actionable strategies for financing off-grid energy solutions. By aligning development goals with commercial returns, Council Fire helps stakeholders design and execute blended finance models. Through its expertise in risk mitigation, stakeholder collaboration, and policy alignment, the organization assists policymakers, investors, and development agencies in structuring deals that attract private capital while advancing sustainability objectives. Whether navigating regulatory complexities or fostering technical partnerships, Council Fire turns ambitious energy access goals into practical, measurable outcomes that balance financial returns with environmental and social benefits.

FAQs

What are the benefits and challenges of using blended finance for off-grid renewable energy projects?

Blended finance weaves together public funds, grants, or concessional loans with private capital to drive off-grid renewable energy projects. By lowering the initial risks for private investors, it opens the door to funding for initiatives like mini-grids and solar home systems, which are essential for bringing electricity to underserved communities. This method not only boosts the financial appeal of projects but also aligns investments with broader goals, such as cutting emissions, while enabling risk-sharing structures that help make projects economically sustainable.

That said, structuring blended finance arrangements is no simple task. It demands expertise across legal, financial, and technical domains. Misjudged public contributions can skew markets or lead to subsidies that can’t be sustained long-term. Additional hurdles include regulatory challenges, policy instability, and high transaction expenses. Overcoming these obstacles requires thoughtful planning, robust institutional capabilities, and well-defined policy frameworks. Council Fire plays a key role in this space, offering expert guidance to navigate these complexities and achieve successful project outcomes.

How do concessional debt and first-loss capital reduce risks for private investors in off-grid energy projects?

Concessional debt plays a crucial role in making off-grid energy projects more appealing to private investors. By offering lower interest rates and extending repayment periods, it eases the cash flow burden during the critical early stages of a project. This approach helps improve the financial feasibility of such investments, encouraging greater participation.

First-loss capital adds another layer of protection for investors by taking on the initial losses within the investment structure. Positioned at the bottom of the capital stack, it acts as a financial cushion. This setup ensures that private investors face risks only after this buffer is exhausted, boosting their confidence in the project's overall financial resilience.

Why is aligning policies important for blended finance models in off-grid energy projects?

Policy alignment plays a pivotal role in the success of blended finance models, particularly when it comes to off-grid energy projects. A stable policy environment - one that clearly defines tariffs, streamlines permitting processes, and ensures access to public subsidies - reduces regulatory uncertainty and makes these projects more attractive to private investors. When governments actively prioritize renewable energy and universal electricity access, they create the conditions needed to make these initiatives financially feasible and scalable.

Blended finance relies on a mix of public-sector funds and private capital. Without clear and cohesive policies, investors may hesitate, and progress can falter. Robust policy frameworks are essential to ensure public funds are effectively used to mitigate risks, while also providing the predictability private investors require to commit to these ventures. Organizations like Council Fire play a critical role in bridging policy and financial mechanisms, helping off-grid energy projects achieve both economic growth and environmental progress.

Related Blog Posts

FAQ

01

What does it really mean to “redefine profit”?

02

What makes Council Fire different?

03

Who does Council Fire you work with?

04

What does working with Council Fire actually look like?

05

How does Council Fire help organizations turn big goals into action?

06

How does Council Fire define and measure success?

Dec 18, 2025

Blended Finance Models for Off-Grid Energy

Sustainability Strategy

In This Article

Explains concessional debt, results-based financing, guarantees, and integrated models that reduce investor risk and mobilize private capital for off-grid renewables.

Blended Finance Models for Off-Grid Energy

Over 1 billion people globally lack electricity, with demand in non-OECD nations projected to rise 63% by 2030. Off-grid renewable energy offers a faster solution to underserved areas compared to traditional grids, but financing such projects remains a challenge. Blended finance - a mix of public, philanthropic, and private funding - helps address risks like currency volatility or policy instability, making these ventures more attractive to investors.

Key approaches include concessional debt, results-based financing, risk-sharing facilities, and integrated programmatic models. Each method balances risk, scalability, and policy alignment differently, enabling the expansion of clean energy access while contributing to global climate goals.

Key Insights:

Concessional Debt: Reduces risk for private investors but struggles with scalability.

Results-Based Financing: Ties funding to measurable outcomes but requires upfront capital.

Risk-Sharing Facilities: Mitigate risks like currency or policy uncertainty, unlocking private investment.

Integrated Models: Bundle smaller projects into portfolios, addressing liquidity and scale challenges.

These models, when aligned with strong policy frameworks, can mobilize private capital, expand clean energy access, and address climate challenges effectively.

1. Concessional Debt and First-Loss Capital Structures

Capital Structure and Risk Allocation

Concessional debt and first-loss capital structures play a significant role in reshaping project risk by leveraging public funds to absorb initial losses. This approach makes investments in off-grid energy projects more appealing to commercial investors [6]. Under these arrangements, concessional capital is repaid only after senior debt holders have been satisfied [7]. This setup acts as a safety net, encouraging commercial investors to participate in projects that might otherwise seem too risky. If a project underperforms, the first-loss capital absorbs the initial losses, reducing the financial exposure of other investors. This risk-sharing mechanism is particularly beneficial for off-grid energy projects, which often come with high upfront costs and extended timelines for returns. By addressing these risks, these structures pave the way for tackling the challenges of scaling such projects, as discussed in the following section.

Scalability and Transaction Costs

While concessional debt and first-loss structures effectively attract investment, they face hurdles when it comes to scalability. Off-grid energy companies often operate with small ticket sizes, which fall below the investment thresholds preferred by traditional infrastructure investors. Additionally, these projects typically require more patient capital than what private equity firms are accustomed to providing. Another challenge lies in the administrative complexity of managing multiple investors, each with different loan terms, which increases operational costs.

For example, in September 2019, USAID's INVEST initiative successfully mobilized $63.25 million in private capital for off-grid energy companies in Kenya. This funding is projected to enable 440,000 new energy connections [8].

Currency mismatches further complicate financial risks, especially when revenue is generated in local currency while loans are denominated in foreign currency. USAID INVEST highlights the value of syndicated loans in addressing this issue:

A syndicated loan aligns the terms and conditions of the loan across all investors, which improves the efficiency of, and reduces operational cost for, the company [8].

To overcome these operational challenges, robust policy support is essential, as explored in the next section.

Alignment with Policy and Regulatory Frameworks

The effectiveness of concessional debt and first-loss capital structures is closely tied to the policy environment in which they operate. U.S. initiatives like Energy for Peace demonstrate how these structures can close the viability gap for off-grid energy projects [2][3].

However, policy uncertainty and regulatory barriers continue to discourage private investment in decentralized electricity markets [4]. Investors frequently point to the lack of risk mitigation tools - such as guarantees and insurance - as a major obstacle [1]. Bridging this gap will require stronger coordination between financial structuring and policymaking to create a more supportive environment for investment.

Impact on Energy Access and Climate Goals

When implemented effectively, these capital structures can deliver tangible results. For instance, in 2018, Uganda-based Aptech Africa secured a $250,000 concessional loan from UNCDF, which helped attract an additional $800,000 from Stanbic Bank to expand rural energy access [9].

Blended finance for climate-focused initiatives surged by 107%, growing from $5.6 billion in 2022 to $11.6 billion in 2023 [9]. While mini-grids generally connect fewer people per dollar invested compared to solar home systems, they provide higher wattage, enabling productive uses like irrigation and refrigeration. This makes mini-grids a critical tool for driving sustainable development [8].

These examples highlight how targeted financial strategies can transform policy frameworks into actionable pathways for scaling off-grid energy investments and advancing both energy access and climate goals.

2. Results-Based Financing and Output-Linked Subsidy Models

Capital Structure and Risk Allocation

Results-based financing (RBF) and output-linked subsidies shift the burden of performance risk from public funders to private developers. In this setup, private companies secure the initial capital needed to build and run off-grid energy projects, while public sector entities or donor organizations provide financial support only after specific outcomes - like verified energy connections or installed capacity - are achieved [3]. This approach enhances the appeal of projects to investors by offering grant payments that cover the gap between project costs and what commercial investors consider viable, particularly in underserved regions [3]. By tying funding to measurable results, these models complement traditional risk mitigation strategies, ensuring funds are disbursed only when tangible milestones are met.

Scalability and Transaction Costs

While RBF models can prove market viability and attract private investment without fostering reliance on continuous grants, they do come with administrative hurdles. Verifying results requires robust monitoring and evaluation systems, which can drive up transaction costs [3]. Off-grid developers often face elevated costs per connection due to fragmented customer bases, weak regulatory environments, and the lack of standardized documentation required by local financiers [6][9].

To tackle these inefficiencies, efforts are focusing on semi-standardized project preparation activities, transaction documents, and risk mitigation tools to lower legal and administrative barriers. Streamlining approval processes and bundling smaller projects into larger, more appealing portfolios for investors can also enhance efficiency [1]. These challenges highlight the need for streamlined policy frameworks to simplify verification and reduce administrative burdens.

Alignment with Policy and Regulatory Frameworks

For these financing models to be effective, they must align with national energy policies and goals. Output-linked models perform best when integrated into broader energy strategies. For instance, feed-in tariffs (FITs) are used to offer price incentives for small-scale renewable projects, helping to bridge the cost gap between renewables and fossil fuels [10]. In 2014, Mozambique implemented a FIT policy targeting biomass, small hydro, solar, and wind projects to encourage private sector involvement in its energy initiatives. Similarly, India’s 30% capital subsidy for rooftop solar PV aims to support 4.2 GW of new capacity, contributing to its 40 GW rooftop solar target [10].

The World Bank Group's Scaling Mini-Grid initiative demonstrates how platform approaches can work closely with governments to address regulatory gaps. In May 2022, the IFC announced a blended finance guarantee for the Democratic Republic of Congo, projected to mobilize US$400 million in capital investment. This initiative is expected to develop 180 MW of installed solar PV capacity, delivering renewable energy to over 1.5 million new users [6]. As Linda Munyengeterwa, IFC Regional Industry Director, explained:

"Efforts by the World Bank Group, including those implemented under the Scaling Mini-Grid initiative, are helping to improve strategic clarity and increase focus on delivering mini-grids at scale." [6]

Impact on Energy Access and Climate Goals

These financing models are instrumental in bridging the funding gap for universal electricity access. Meeting this goal in Africa by 2030 is estimated to require US$200 billion annually, with approximately 67% allocated to clean energy [9]. Currently, around 570 million people in Sub-Saharan Africa lack electricity, accounting for three-quarters of the global population without power [6].

In October 2022, the U.S. International Development Finance Corporation (DFC) pledged US$40 million to the Energy Entrepreneurs Growth Fund, aiming to benefit over 5 million people while significantly reducing greenhouse gas emissions [11]. Triple Jump CEO Steven Evers emphasized:

"The fund ultimately aims to reach in excess of 5 million beneficiaries, including over 240 female-led businesses, and avoiding 4.5 million tons of greenhouse gas emissions." [11]

3. Guarantee, Insurance, and Risk-Sharing Facilities

Capital Structure and Risk Allocation

Effective risk allocation plays a critical role in scaling investments in off-grid energy projects, just as it does with concessional debt and results-based financing models. Guarantee and insurance mechanisms step in by transferring risks - such as off-taker, currency, and policy risks - from private investors to public or donor-backed entities. This shift enhances the risk–return profile for commercial investors, making these projects more appealing. In distributed generation markets, such mechanisms are particularly important, as they support corporate finance structures and pave the way for securitization. The Climate Policy Initiative highlights how these tools help close the gap between clean energy and fossil fuels, pushing forward sustainable development efforts [1].

Scalability and Transaction Costs

One of the biggest hurdles in off-grid energy investments is the lack of aggregation vehicles to bundle smaller projects into larger, more manageable portfolios. Without these, transaction costs rise, making investments less appealing. Many blended finance initiatives struggle to scale due to complicated approval processes and a scarcity of local financing options, both of which drive up costs and discourage participation. To address this, stakeholders must simplify these processes and focus on expanding beyond initial pilot projects. As the Climate Policy Initiative points out:

Achieving scale will require, among others: supporting initiatives that are ripe for expansion, as risks can remain even after a successful pilot; building sustainability through technical advisory services and supporting networks that generate new ideas and partnerships; and improving efficiency by streamlining approval processes [1].

These insights underscore the need for clear regulatory guidance, a topic explored further in the next section.

Alignment with Policy and Regulatory Frameworks

Tackling the challenges of high transaction costs and limited scalability, U.S. agencies have introduced guarantee facilities that align with broader development priorities. A compelling example is USAID Colombia’s Energy for Peace (E4P) initiative, launched in August 2024. This blended finance model was created to attract private investments in renewable energy for off-grid communities impacted by conflict. The program addressed key issues like low income potential and diminished productive capacity. As USAID Colombia explained:

This experience demonstrates to energy companies, investors, and donors the transformative effects of leveraging private investment to reach common development goals [2].

Strong regulatory frameworks are also essential for encouraging private sector engagement. Beyond traditional utility regulations, policies must include specific measures for decentralized electricity products and services to reduce policy uncertainty and remove barriers to investment [4].

Impact on Energy Access and Climate Goals

Enhanced risk-sharing facilities have a unique role in bridging the gap between energy access and climate objectives. They unlock private capital in high-risk markets where conventional financing often falls short. For instance, in October 2023, the World Bank's Multilateral Investment Guarantee Agency (MIGA) issued a $150 million guarantee for renewable energy projects in Sub-Saharan Africa. This guarantee is expected to mobilize an additional $600 million in private investment, with a focus on mini-grid development [1]. By concentrating efforts in regions like Southeast Asia, Sub-Saharan Africa, and South Asia, these facilities address the dual challenge of expanding energy access and advancing climate goals. The Climate Policy Initiative underscores the urgency of this mission:

The objective is clear: mobilize investment to meet the goal of limiting global warming to, at most, 2 degrees Celsius while also bringing electricity to the more than 1 billion people globally who do not yet have access to it [1].

4. Integrated Facility and Programmatic Models Anchored in Policy

Capital Structure and Risk Allocation

Integrated facilities offer a way to scale off-grid renewable energy projects by bundling smaller initiatives into larger portfolios. This approach addresses common hurdles like liquidity and scale, which often discourage investors. Instead of assessing projects one by one, programmatic models spread investments across regional or global portfolios. This diversification balances renewable energy sources - such as solar, wind, hydro, and geothermal - helping to reduce risks tied to specific locations or technologies. In regions with critical energy access challenges, corporate finance structures and securitized assets are becoming vital tools for achieving the level of scale needed to make these projects commercially viable [1]. By redistributing risk across multiple projects, these models pave the way for broader deployment.

Scalability and Transaction Costs

Scaling pilot projects into full-scale deployments often faces obstacles due to lingering risks. Integrated models tackle these issues by incorporating technical advisory services and fostering partnerships that ensure long-term project stability. This approach helps reduce operational risks while building a foundation for sustainable growth. Simplifying approval processes is another critical element, as high transaction costs can hinder large-scale implementation of blended finance solutions. For instance, the World Bank's Global Facility on Mini Grids provides practical guidance and tested strategies to help decision-makers expand deployment within specific national contexts [12]. These streamlined processes, combined with supportive policy measures, are essential for achieving efficiency at scale.

Alignment with Policy and Regulatory Frameworks

Strong and consistent policy frameworks are essential for attracting private investment in renewable energy. When integrated facilities are designed to operate within established policy environments, they reduce regulatory uncertainty, making them more appealing to commercial investors. Programs like USAID Colombia's Energy for Peace illustrate how aligning programmatic models with policy can successfully mobilize private capital [2]. These frameworks not only provide clarity but also create a stable environment for investment.

Impact on Energy Access and Climate Goals

By addressing key risks and diversifying investments across technologies, integrated facilities help unlock private capital in regions with significant energy needs, such as Southeast Asia, Sub-Saharan Africa, and South Asia. Together, these areas represent more than $360 billion in clean energy investment opportunities [1]. These models tackle challenges like off-taker risk, currency fluctuations, and policy uncertainties, bridging the gap between clean energy and fossil fuels. In doing so, they open up financing options in markets where traditional methods often fall short, contributing to both energy access and climate goals.

Masterclass: Structuring Blended Finance for Energy

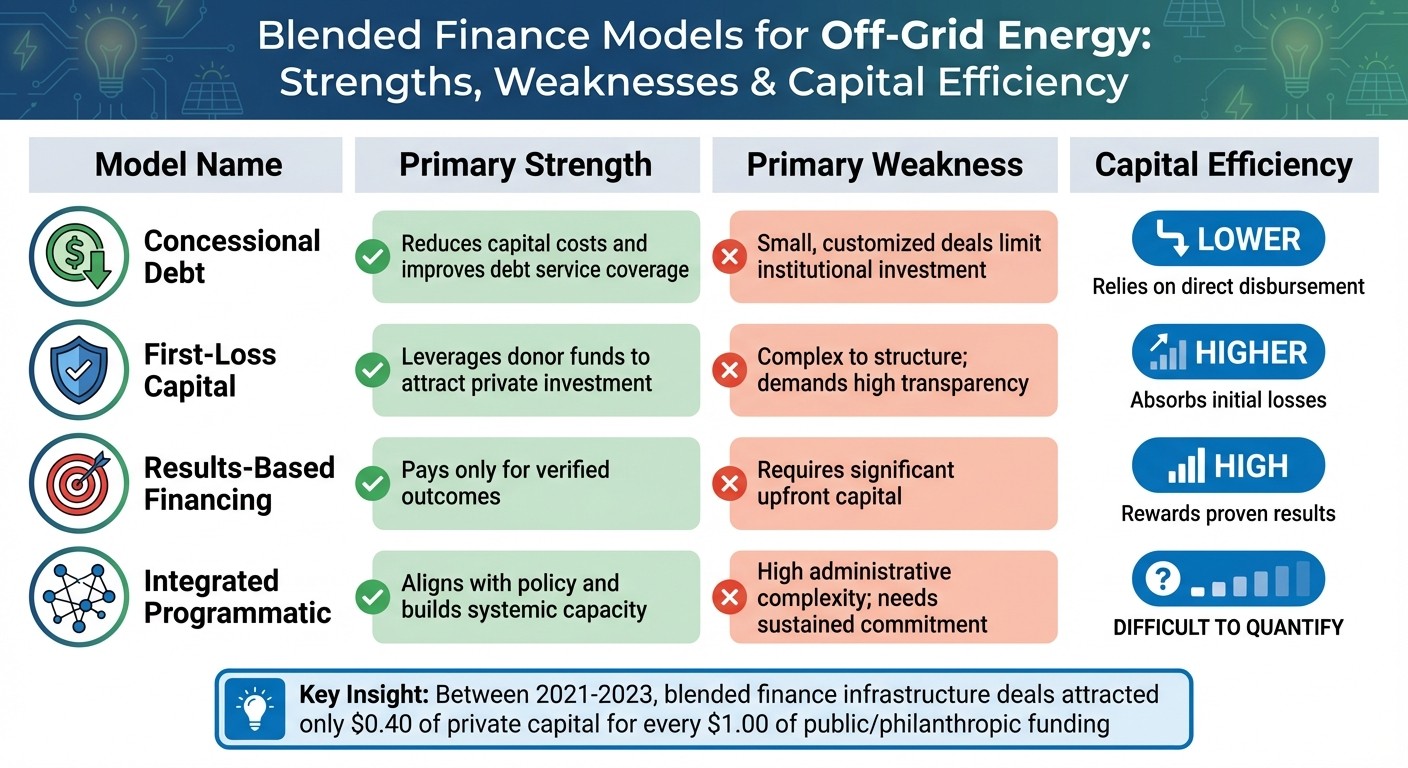

Advantages and Disadvantages

Comparison of Four Blended Finance Models for Off-Grid Energy Projects

This section provides a concise overview of the strengths and weaknesses of various blended finance models, particularly in their application to off-grid energy projects. Understanding these trade-offs is essential for aligning financial strategies with policy goals in the energy sector.

Blended finance models bring distinct benefits and challenges to off-grid energy initiatives. For instance, concessional debt helps reduce capital costs, making projects more financially viable. However, these deals are often small-scale and highly customized, discouraging institutional investors from participating. As Lasse Møller, Senior Economist at the OECD Development Cooperation Directorate, explains:

Blended finance has remained pretty much a cottage industry. It has been focused on relatively small transactions and bespoke deals, which has meant that we have not seen the kind of scale-up with standardisation... that we had wanted [14].

First-loss capital structures represent another approach, using smaller donor contributions to absorb initial losses and shield private investors from risks, particularly in emerging mini-grid markets. While this method effectively mitigates demand risk, its complexity cannot be overlooked. Crafting these agreements requires advanced risk-sharing mechanisms and robust governance systems [6] [13].

Moving on to results-based financing, this model ties payments to measurable outcomes, such as new household connections or unit sales. This approach works well in off-grid contexts, where results are easier to quantify compared to large-scale grid projects. However, developers face a significant hurdle: they must secure substantial upfront funding to execute projects before receiving performance-based payments [5].

Lastly, integrated programmatic models aim to address systemic challenges by combining finance, policy, and capacity-building efforts. This comprehensive approach aligns with national energy goals and fosters a stable investment climate. Yet, it comes with its own set of challenges, including high administrative demands and the need for long-term, multi-stakeholder commitment. Between 2021 and 2023, blended finance infrastructure deals managed to attract only $0.40 of private capital for every $1.00 of public or philanthropic funding, underscoring the difficulty in mobilizing private investments effectively [13].

Model | Primary Strength | Primary Weakness | Capital Efficiency |

|---|---|---|---|

Concessional Debt | Reduces capital costs and improves debt service coverage | Small, customized deals limit institutional investment | Lower; relies on direct disbursement |

First-Loss Capital | Leverages donor funds to attract private investment | Complex to structure; demands high transparency | Higher; absorbs initial losses |

Results-Based Financing | Pays only for verified outcomes | Requires significant upfront capital | High; rewards proven results |

Integrated Programmatic | Aligns with policy and builds systemic capacity | High administrative complexity; needs sustained commitment | Difficult to quantify |

Each model offers unique opportunities and challenges, making it essential to carefully match the approach to the specific needs and goals of off-grid energy projects.

Conclusion

The success of blended finance depends heavily on the maturity of the market and the associated risk profiles. In regions like Sub-Saharan Africa - where around 570 million people still lack access to electricity - concessional subordinated debt has proven to be an effective tool for reducing risks and attracting commercial senior debt investments [6]. For pilot projects with untested business models, concessional funds are essential to pave the way for commercial investors [15]. On the other hand, transitioning economies such as Indonesia, which faces a $47 billion infrastructure funding gap between 2025 and 2029, benefit from blended models that combine concessional and commercial capital. These approaches are particularly effective in accelerating the early retirement of coal plants [15]. These examples highlight the importance of tailoring financial strategies to the specific needs of each market.

In light of these trends, decisive action is needed from U.S. policymakers. Strengthening the Power Africa initiative through multiyear congressional authorization would provide the program with the stability to operate effectively across administrations [16]. Additionally, reforms to the U.S. Development Finance Corporation (DFC) could enable direct equity investments and allow it to retain profits, which would help catalyze private capital. For investors, mature markets such as India and South Africa offer opportunities, while regional vehicles can help spread risks in smaller or less developed markets [1]. Development agencies, on the other hand, should focus on tools like guarantees, insurance, and local currency financing to mitigate risks [1].

To transition projects from the planning phase to financial close, standardized documentation, robust risk-sharing mechanisms, and expanded grant funding for feasibility studies are critical [15]. As Tom Bishop, Senior Climate Finance Advisor at RTI, aptly states:

The key lies in alignment and trust, ensuring that each partner plays the right role [15].

This alignment of risk-sharing and policy frameworks supports earlier findings on scaling sustainable projects effectively.

Drawing on these insights, Council Fire specializes in creating actionable strategies for financing off-grid energy solutions. By aligning development goals with commercial returns, Council Fire helps stakeholders design and execute blended finance models. Through its expertise in risk mitigation, stakeholder collaboration, and policy alignment, the organization assists policymakers, investors, and development agencies in structuring deals that attract private capital while advancing sustainability objectives. Whether navigating regulatory complexities or fostering technical partnerships, Council Fire turns ambitious energy access goals into practical, measurable outcomes that balance financial returns with environmental and social benefits.

FAQs

What are the benefits and challenges of using blended finance for off-grid renewable energy projects?